4 minute read

Tax season is a win-win

You wouldn’t normally describe tax season as a time of joy, but for Davenport and its accounting students, it is a season not only about accountability but also about community service.

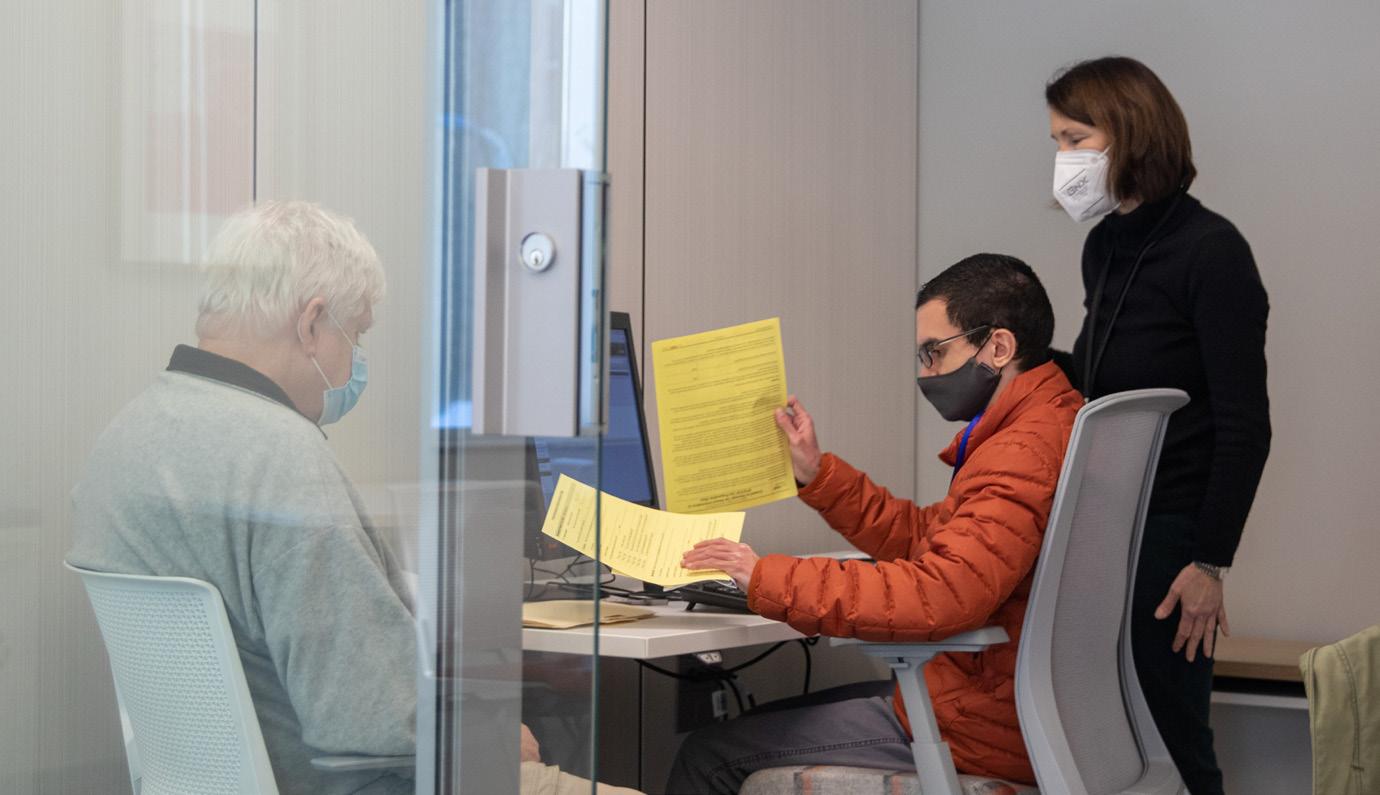

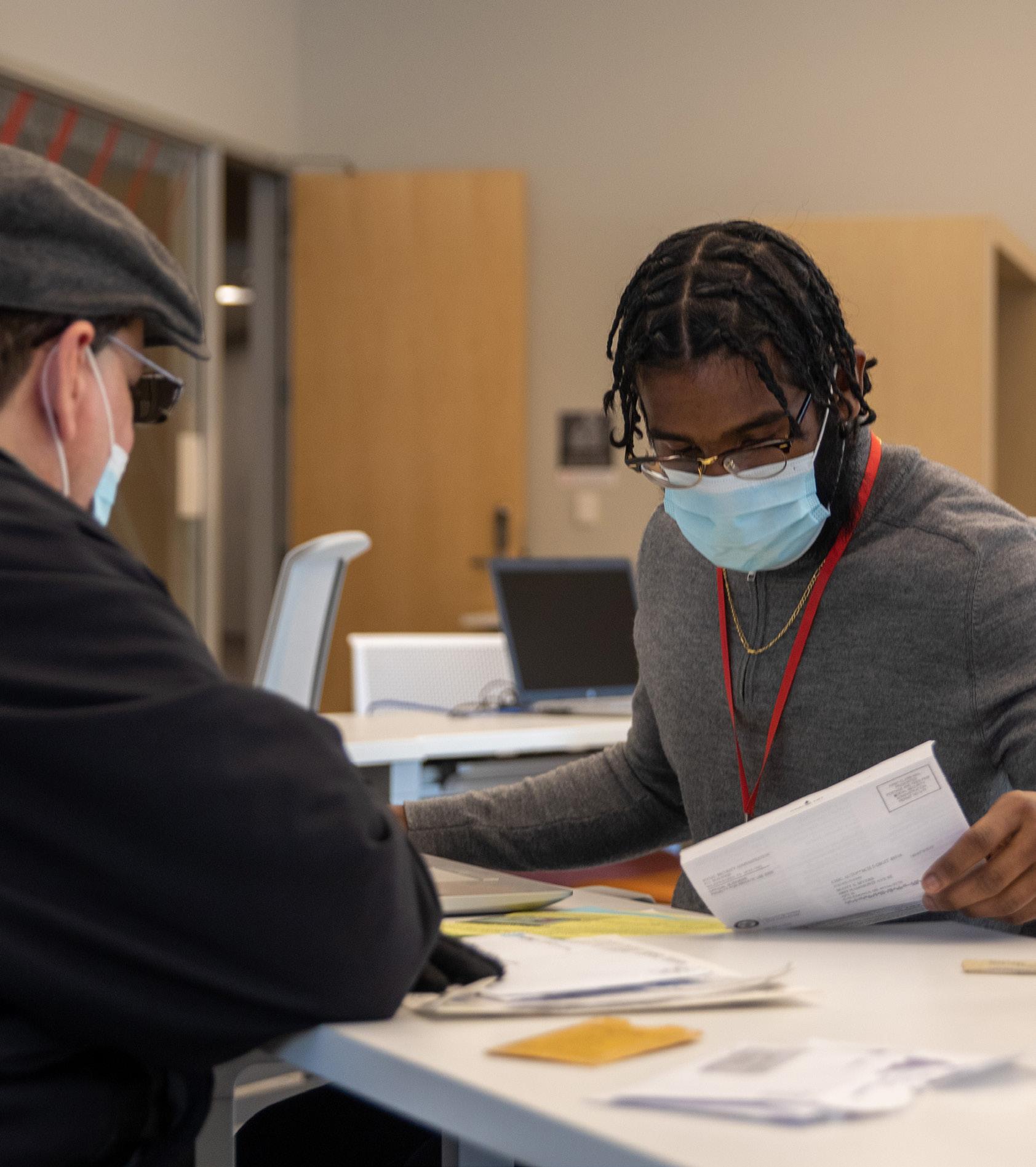

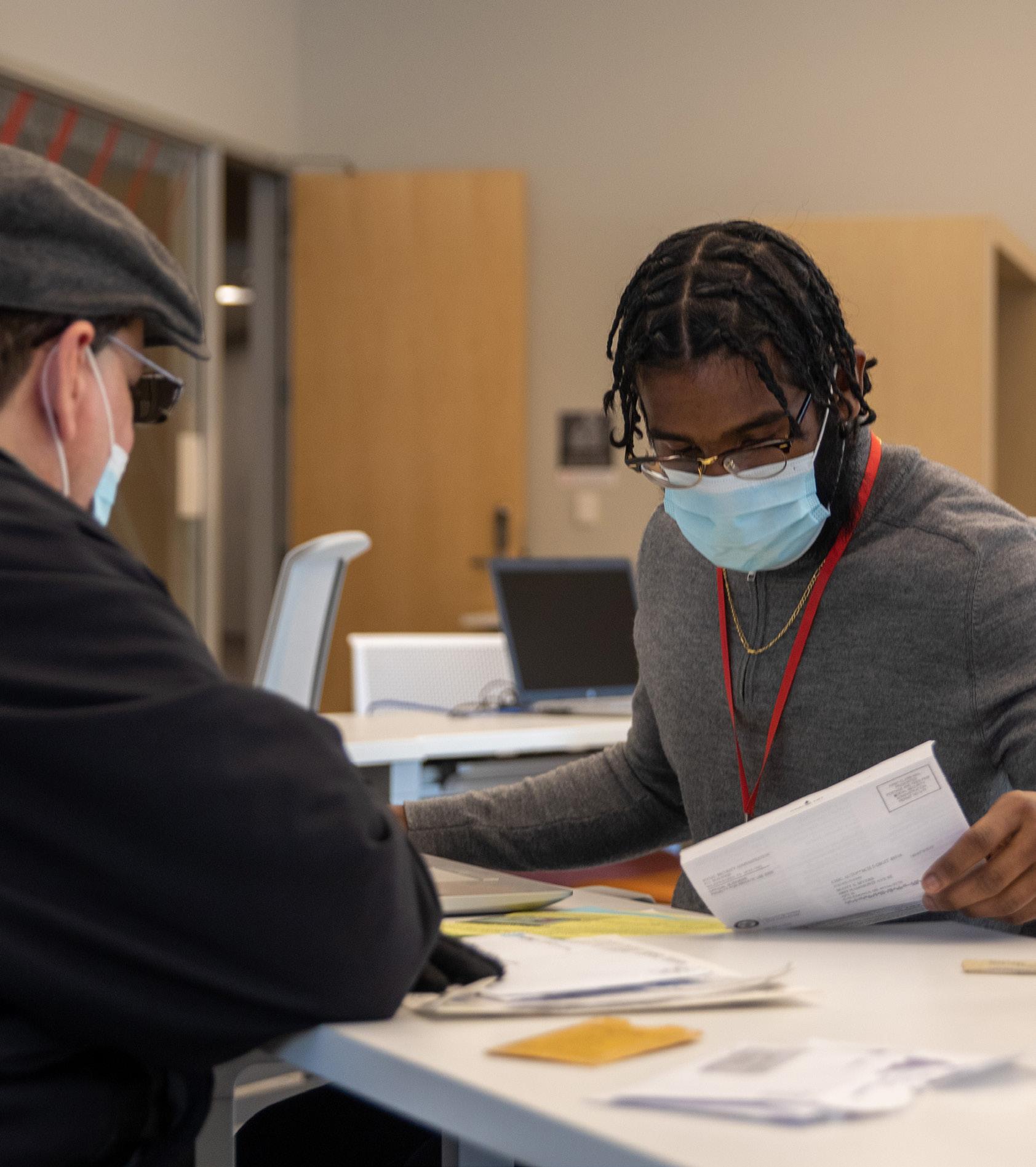

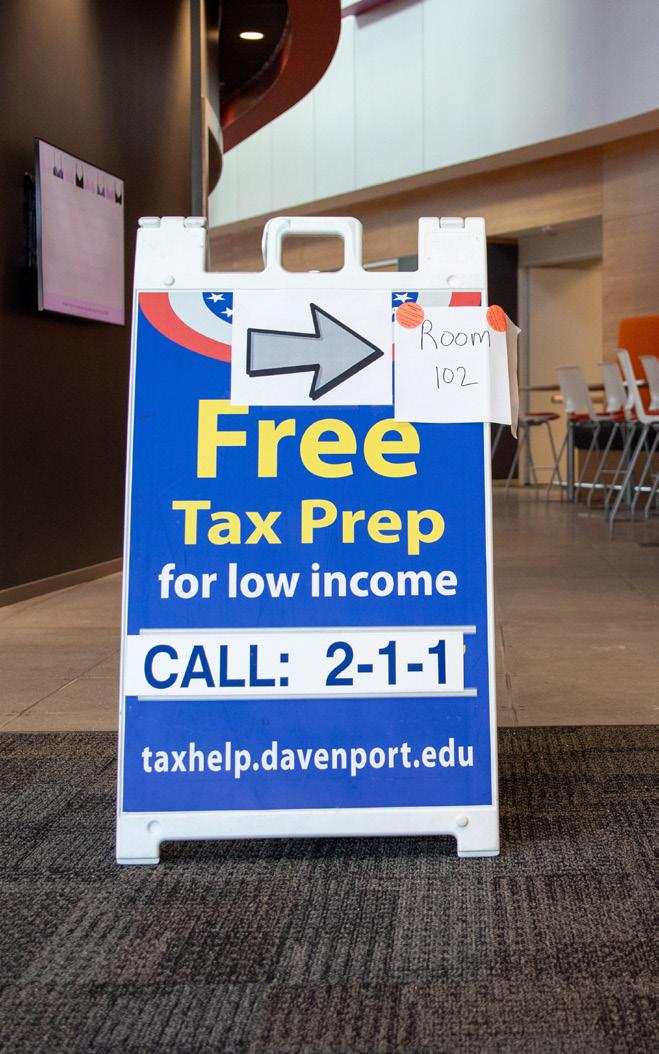

Each year, Davenport University, the West Michigan VITA Collegiate Partnership and the IRS-sponsored Volunteer Income Tax Assistance (VITA) program partner with community groups to help families, seniors and people with disabilities fi le their tax returns, returning tax refunds and credits to those who need them most.

Advertisement

Last year, the VITA program helped more than 6,500 people receive nearly $8 million in tax returns and credits.

“This program is a win-win,” said Dr. Richard J. Pappas, president of Davenport University. “It’s an opportunity for our students to provide community service while also learning valuable skills that align with their career goals.”

Scott Gumieny, professor at Davenport University and the Davenport VITA program site coordinator, is extremely proud of the students and faculty who run this program each year.

“Through this program, we can help individuals and families navigate what can be a very stressful event in their lives,” said Gumieny. “And there is nothing more powerful for students than to see that the knowledge and skills they are learning in the classroom have practical implications in the real world.”

Davenport University opened 10 tax assistance centers in February in Kent and Ottawa counties, with students and faculty providing low-income families and individuals assistance with their 2021 tax returns. This service is open to individuals and families earning $60,000 or less.

Gumieny anticipated needing to support more individuals this year, as many will have to fi le tax returns even if they haven’t had to in the past.

He added, “Those with low income are required to fi le to claim a Recovery Rebate Credit to receive the tax credit from the 2021 stimulus payments or reconcile advance payments of the child tax credit.”

Gumieny and his students often provide advice through this program, and this year poses some unique challenges.

“We are hearing consistent questions from folks as they fi le their taxes this year,” said Gumieny. “Unemployment and taxes around the child tax credits are among the top concerns.”

Darryle Peiff er, a sophomore in the Davenport University and GRCC 3 plus 1 accounting transfer program, is one of the volunteers assisting families. He credits the program for giving him practical experience that he can use to enhance his resume and take to his next role.

“I’ve learned through my classes and working with tutors that making sure to get real work experience is an important way to build your resume and prepare for the workforce,” Peiff er shared. “It’s also a great way to provide community service.”

Lien Nguyen, a sophomore accounting student at Davenport, shared that she loves to participate in the program because she fi nds the changing tax laws and rules interesting.

“Taxes are never boring,” she said. “I learn something new in this program each year I participate.”

For John*, this program has been a blessing. He has worked for local Grand Rapids automotive companies and construction for most of his life.

MEET SCOTT GUMIENY

Scott Gumieny is a professor at Davenport University and a fi fth-year Davenport VITA program site coordinator. He has been with the university for nearly 10 years and has served as an accounting instructor for several key courses, including accounting foundations, accounting for government and not-for-profi ts, and computerized auditing. His professional experience spans nearly seven years, where he worked as a fi nancial manager for Davenport University as well as an accountant for H&S Companies.

A few years ago he sustained an injury that required him to go on disability, and he has been taking advantage of this free program ever since. He found the service by calling 211, which directs those who need tax assistance to this free program.

“Having to fi le my taxes is always so daunting each year,” said John. “I appreciate having this resource available to get my questions answered and to get my information fi led on time. These students are smart and really know their stuff .”

The Volunteer Income Tax Assistance (VITA) program is funded by the Internal Revenue Service.

*Names of participants have been altered to protect their identity.

CURRENT TAX ASSISTANCE SITES

ALLENDALE

• Love Inc.

GRAND HAVEN

• Four Pointes Center

GRAND RAPIDS

• Davenport University • Kent County Community

Action Center • St. Alphonsus Parish • The Source • Trinity Reformed Church

HOLLAND

• Community Action House • Davenport University

WYOMING

• Wyoming Public Library

— SCOTT GUMIENY