4 minute read

MARKETS

Studies highlight Jerseys’ profitability.

PGS. 20 & 21

A sustainable transformation. PGS. 22 & 23

Eye cancers — blink and you’ll miss them.

PG. 34

MARKETS ...................................................3 NEWS .....................................................4-23 PASTURE IMPROVEMENT ..... 24-33 ANIMAL HEALTH ..........................34-35

MACHINERY AND

PRODUCTS ......................................36-39

Market cause for optimism

SOFIA OMSTEDT Senior Industry Analyst

THE START of 2022 has been anything but smooth. Surging COVID-19 ‘Omicron’ cases have forced thousands into isolation around the globe, resulting in considerable supply chain roadblocks. Whilst some countries have reintroduced restrictions, others are hoping the current infection wave will bring an end to the pandemic. Mounting case numbers have created several challenges for Australia’s dairy industry, however, many factors remain supportive heading into the new year.

With more than 100,000 daily COVID-19 cases in Australia this January and rapid antigen tests in short supply, many people are stuck in isolation. According to industry estimates, some have been forced to operate with up to a 40 per cent reduction in staff numbers, putting signifi cant strain on the dairy supply chain. A similar trend is playing out across most sectors and combined with higher fuel, energy and ingredient prices, pressures are intensifying. Several businesses are now contemplating introducing a COVID-19 surcharge and as such, costs are likely to remain elevated.

In light of this cost infl ation, the global dairy market continues to provide cause for optimism. Less milk is being produced globally and the availability of uncommitted product has begun to dry up. In Australia, milk production has continued to decrease, down 0.8 per cent this November. The same is true across the ‘ditch’ and with Oceania’s peak months in the rear-view mirror, seasonality is starting to constrain global product availability. In Europe, milk production is also lagging. Surging feed and energy costs are hurting margins and impeding growth in several countries. Similar input pressures have prompted substantial cuts to the US national herd. This has resulted in declining milk production during the last months of 2021.

While milk fl ows slow, logistical challenges continue to make accessing products even more fraught. Shipping congestion, a lack of containers (especially reefers), delayed departures and staffi ng shortages are a constant source of headache. This has made many buyers willing to switch between suppliers and pay premiums for supply chain security.

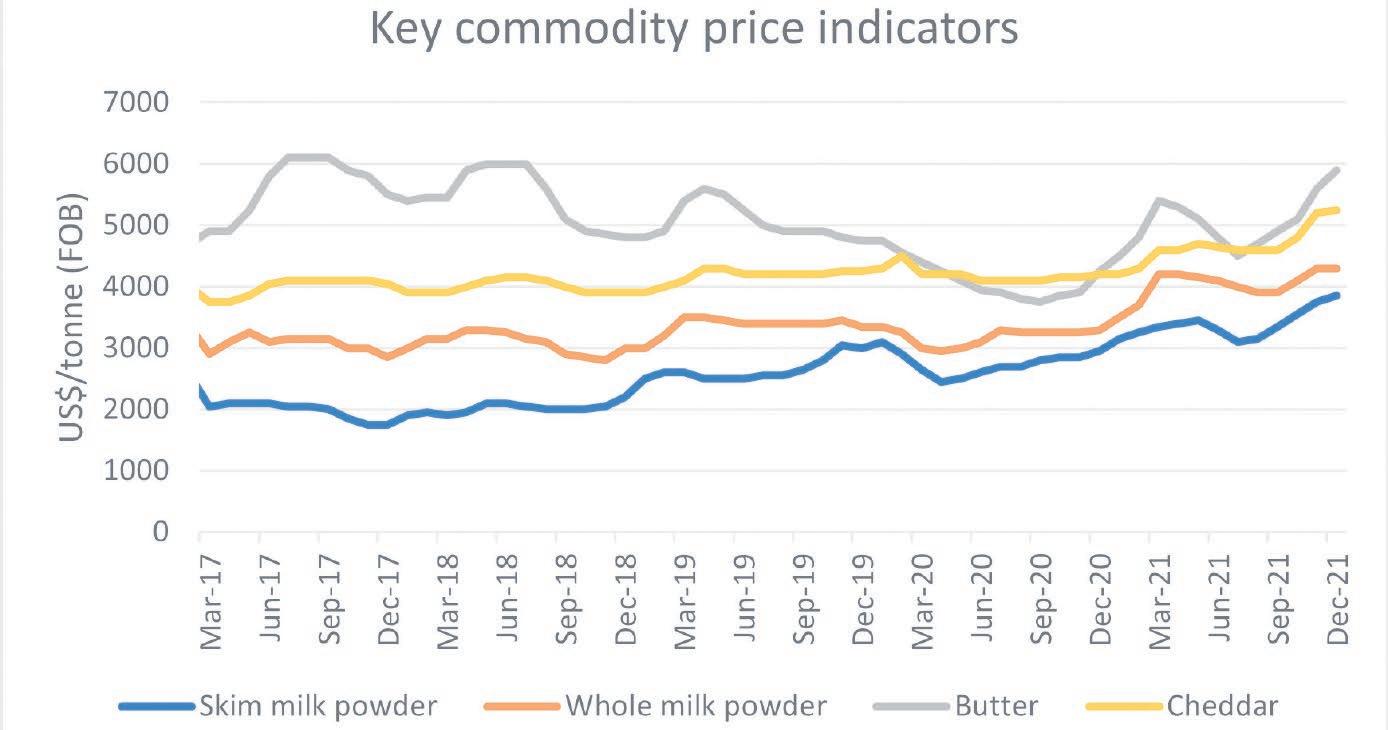

Meanwhile, demand for dairy is fi rm, with southeast Asian buyers particularly active at the moment. Some buyers that hoped for a market correction and held off procuring products appear to have accepted that commodity values are unlikely to drop any time soon. This created a slightly panicked rush to secure supply which helped drive prices higher. As a result, commodity prices for most dairy products are now trading above fi ve-year averages.

From a product perspective, demand for Oceania whole milk powder (WMP) remains strong following a jump in European prices. Availability is limited and as other products continue to off er attractive returns, supply is likely to remain tight going forward. Skim milk powder has quickly emerged as the frontrunner this season and prices continue to surge. Strong demand from southeast Asia has especially contributed to this value growth, as many buyers actively look to boost inventories. Cheese prices are also fi rmer than usual; delays in getting products to our shores have seen some Australian buyers usually reliant on dairy imports turn to domestic producers. Finally, milkfat and particularly butter prices continue to soar as demand remains fi rm and there is little supply available.

Looking ahead, supply chain pressures are unlikely to abate anytime soon. Staffi ng shortages and increasing production costs will continue to strain operations and new challenges are also likely to take shape as the pandemic unfolds. On the other hand, as input costs have risen at the farmgate, in Australia and other key exporting regions, milk supply is expected to remain tight well into 2022. Combined with growing global demand, this is likely to underpin elevated commodity prices. While we can expect further COVID-19 induced bumps along the way, strong market fundamentals will help to cushion the impact for the road ahead.

Get more with less this calving season

Spend up to 90%

With calving season just around the corner, an automatic DeLaval Calf Feeder CF1000S can help you deliver more with less. Unlock up to 8% more milk from your cows at first lactation** and spend more time on other activities with up to 90% less time spent mixing, feeding and cleaning equipment. A DeLaval Calf Feeder CF1000S can feed up to 4 calves at once (and up to 120 calves in total), all while automatically identifying and adapting portions to each calf’s individual feeding plan.