2 minute read

Global situation led to a fall in overall May 2023 exports : FIEO

NEW DELHI: Responding to the May exports figures, Dr A Sakthivel, President, FIEO said that the sharp decline in the international demand situation has led to the fall in overall exports. With major economies including US and China showing downward trend in exports, along with the Eurozone entering into technical recession after the region shrank by 0.1% in Q1 2023, marking two consecutive quarters of contracting GDP. The slowdown comes in wake of higher energy prices contributing to curbing demand in Europe's largest economy and surging inflation, added Dr Sakthivel. One of the reasons for moderating pace of growth in merchandise exports significantly in 2023 has been because of persistent geopolitical tensions, monetary tightening and recessionary fears which has continuously led to a fall in consumer spendings across the globe especially in advanced economies, reiteratedFIEOPresident.

FIEO Chief added that we hope that exports will start showing better growth numbers starting July, 2023, as things are expected to improve from Q3 of the Calendar year, with fresh orders or order bookings for festival and New Year season beginning to come. Some of the key sectors which have shown positive growth during the month of May 2023, include electronic goods, ceramic products & glassware, drugs & pharmaceuticals, iron ore, fruits & vegetables, oil meals, oil seeds, cashew, spices, tobacco, other cereals, rice, tea and coffee. FIEO Chief said that though the decline in imports is a good sign for the country, however, that has also led to degrowth in our key export sectors like petroleum products, gems & jewellery, organic & inorganic chemicalsetc.

Advertisement

FIEOPresidentfurtherreiterated that the need of the hour is to provide further momentum to the economy through easy and low cost of credit to the MSMEs, a very-long pending demand of the exporting community of marketing support for further promoting Brand India products and services globally and GST exemption on Freight on exports. Besides, the interest equalisation support across all sectors of export and 3-6 months transition period may be provided, whenever a major change is notified in the Foreign Trade policy, which will provide much needed cushion during suchtoughandchallengingtimes.

India's merchandise import jump in May signals stable local economy: Economists

MUMBAI: A sequential increase in merchandise imports in May that led to the trade deficit widening to a five-month high signalled a stable localeconomy,economistssaid.

Merchandise imports advanced 14.5%overthepreviousmonthto$57.1 billion, while exports inched up 0.7% to$35billion.

The merchandise trade deficit widened to $22.1 billion in May from $15.1 billion in the previous month. "The recovery in imports points to domestic demand resilience," said Madhavi Arora, lead economist at EmkayGlobal.Aroraalsopointedtoa seasonal trend, citing a typical increase in imports in May after a slumpinthepreviousmonth.

Gold imports more than tripled to $3.7 billion - the highest level since October. Oil imports climbed 3%, while core imports, barring oil and gold,advanced12.1%.

Imports of industrial goods such asmachinetoolsandconsumergoods like electronics grew at a robust pace, indicating resilience in domestic demand, said Rahul Bajoria, Chief IndiaEconomistatBarclays.

Fertilizer imports also jumped significantly ahead of the kharif sowingseason,Bajoriaadded.

Economists, however, do not see thewidermerchandisetradedeficitin May swaying expectations of a manageable current account deficit inthisfinancialyear.

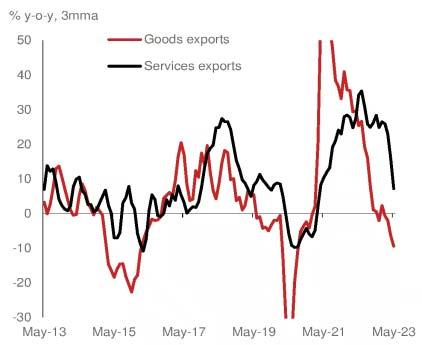

"Falling commodity prices, an expandingservicestradesurplusand rising remittances have supported the improvement in external metrics so far," said Bajoria. "This year, a slowing global economy implies commodity prices will trend lower on average compared with the previous year."

Arora sees the current account deficit settling at 1.9% of the gross domestic product in this fiscal year endingMarch31.