1 minute read

Demand rebound slows in April : Sea-Intelligence

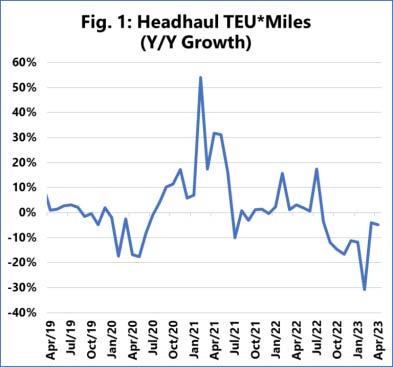

COPENHAGEN: According to recent analysis from Sea-Intelligence, there was a sharp six-month growth decline that reverted to a minor level of growth decline in March and April 2023.

Sea-Intelligence observes that when comparing the year-on-year (YoY) demand growth in April 2023 with the share of global TEU*Miles in global trades, it becomes evident that theFarEasttoNorthAmericaandFar East to Europe trades are considerably larger than other trade routes.

Advertisement

However,thedeclineingrowthcan beattributedtothediminishedimportsinNorthAmerica.

This is supported by the evidence that the TEU*Miles growth, excluding the Far East to North America trade, experienced a recovery with positive growth in March 2023, and this growth continued throughoutAprilaswell.

However, Sea-Intelligence affirms it is the strength of the head-haul markets which is the true measure of whethertheshipsarefullornotdue tothetradeimbalances.

“Onceagain,this[deterioration] is to a large degree driven by the aforementioned continued decline in Far East to North America volume,” said Alan Murphy, CEO, Sea-Intelligence.

“This very poor performance should furthermore be seen in the context of the inventory developments in the US. Therein, it was clear that despite the drop in imports, inventory sizes were still not declining, which remains problematic.

“In essence, we see a picture where global demand is indeed recovering in terms of growth rates, but with the trade to North America as well as key intra-regional trades, not being a part of this recovery.”

This month, Sea-Intelligence also presented data that indicated weakness in the market in the second half of 2022,whichmanifestedfullyinQ12023.