3 minute read

Update from across the ditch: Cost of living impacting Kiwi households

By Monika Lacey MICM*

The beginning of 2023 has been challenging for many households in New Zealand as the increased cost of living continues to squeeze wallets nationwide.

Advertisement

In February, the Reserve Bank made the tenth consecutive increase to the Official Cash Rate – up an additional 50 basis points to 4.75%.

Furthermore, New Zealand’s GDP fell 0.6% in the last three months of 2022. Despite coming off several quarters of consistent upward growth, this fall fuels ongoing concern the country is heading towards an engineered recession this year.

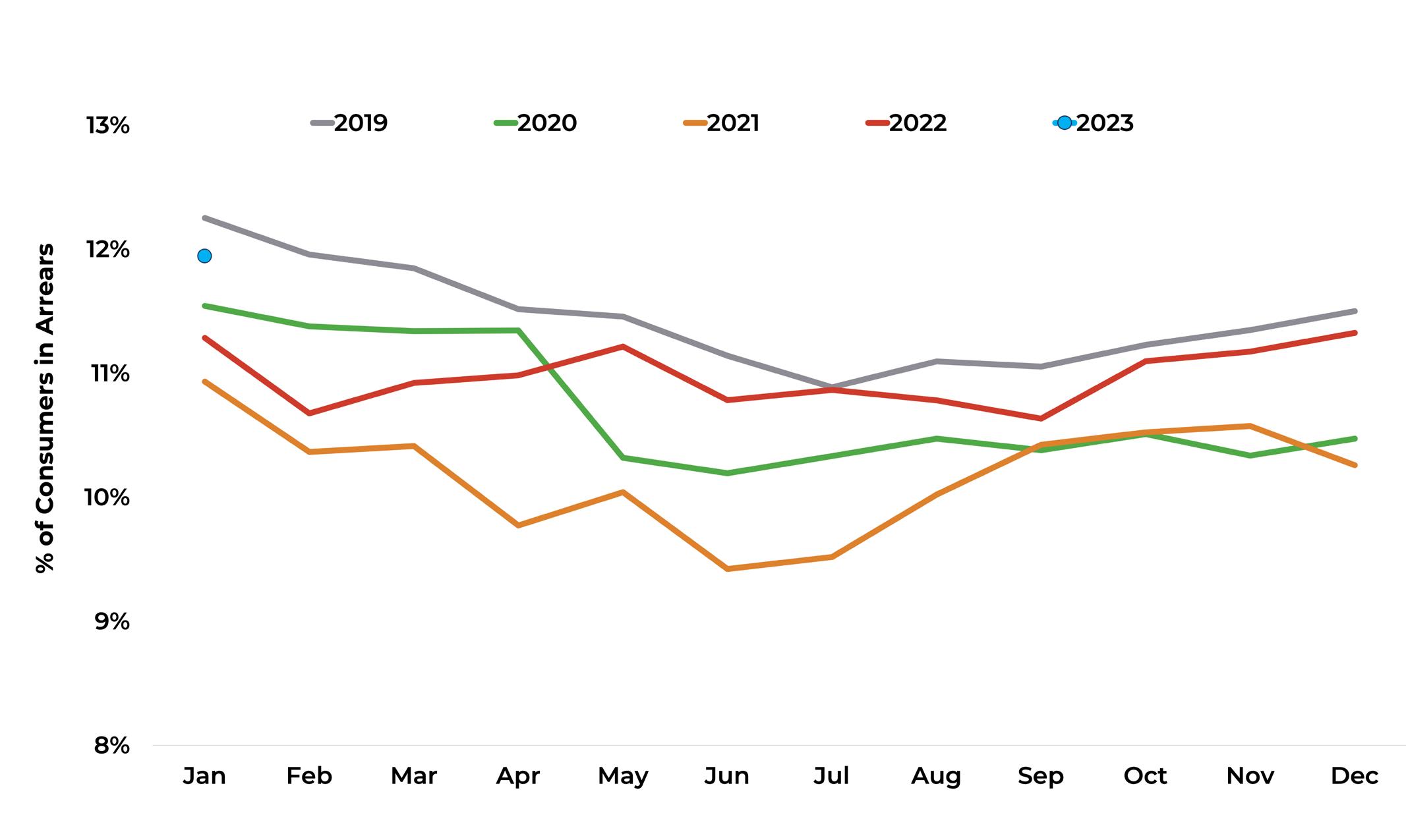

Climbing arrears highlight financial squeeze

Movements in credit behaviour are a good reflection of consumer confidence. For example, the current arrears trends in NZ point towards a rising difficulty for households to meet their credit repayment commitments.

In January 2023, consumer arrears rose to 11.9% of the active credit population, with approximately 430,000 Kiwis behind on their repayments. This was a 20,000 increase from December 2022, with 4.8% of credit active consumers currently 30+ days past due (up from 4.4% in January 2022).

While the arrears cycle tends to peak post-Christmas, the current arrears level is 6% higher compared to the same time last year, as economic conditions continue to deteriorate.

Although the increasing arrears rates are concerning and something to keep a close eye on, it is important to point out that we are still below prepandemic levels.

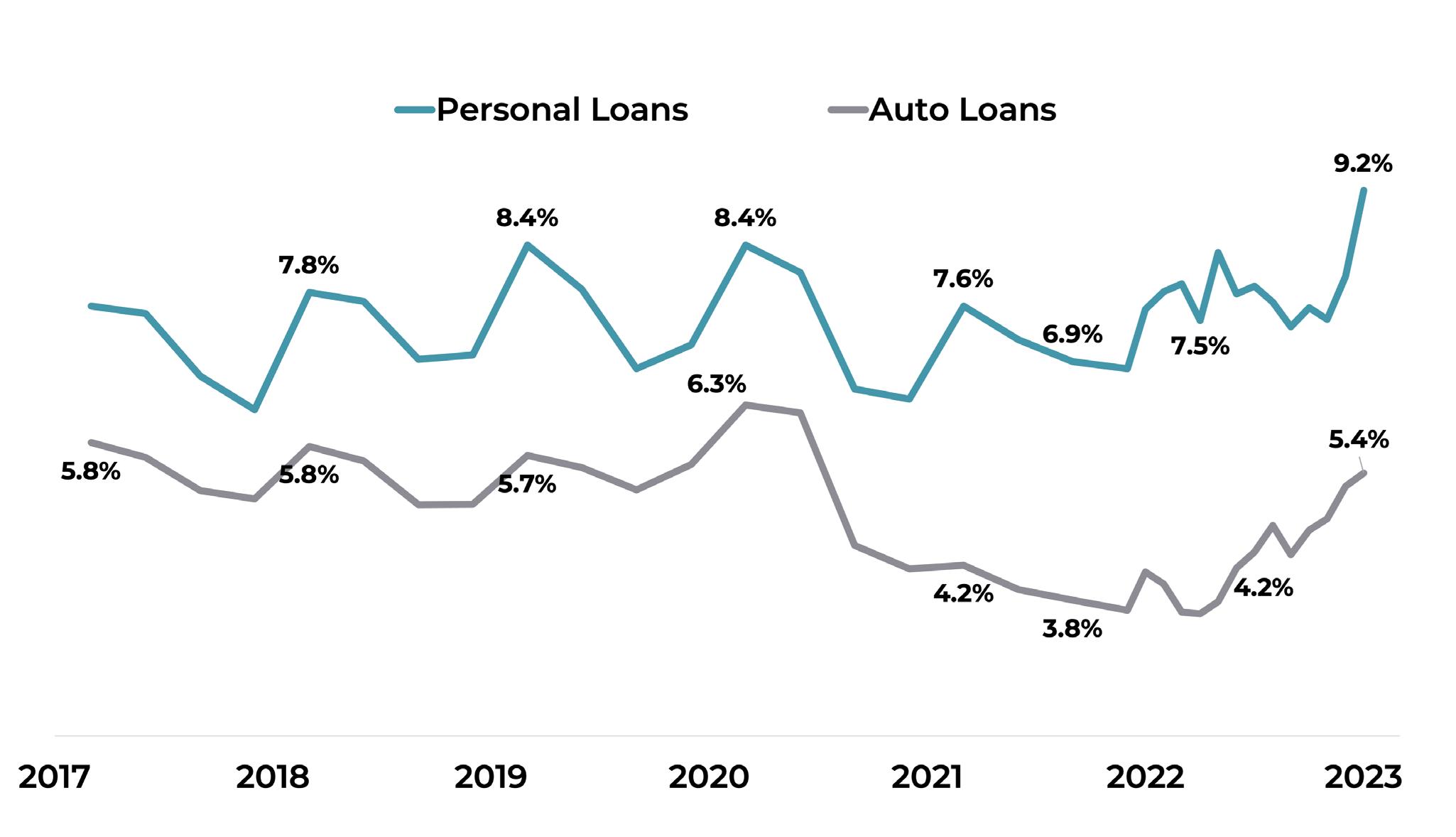

Unsecured personal loan

Consumer Arrears Trend

Consumer Loan Arrears

arrears jumped to 9.2% in January 2023 – the highest percentage on record since 2017.

Vehicle arrears continued to climb to 5.5% in January 2023 (up from 4.9% year-on-year).

Alongside consumer arrears, the number of Kiwis falling behind on their mortgage repayments is also beginning to climb back up from record lows recorded at the end of 2022.

The number of households behind on mortgage repayments in January 2023 has risen to the largest number since April

Home Loan Arrears

2020, with approximately 18,400 mortgage accounts past due – or 1.26% of all mortgages.

This is a 22% year-onyear increase, which could be

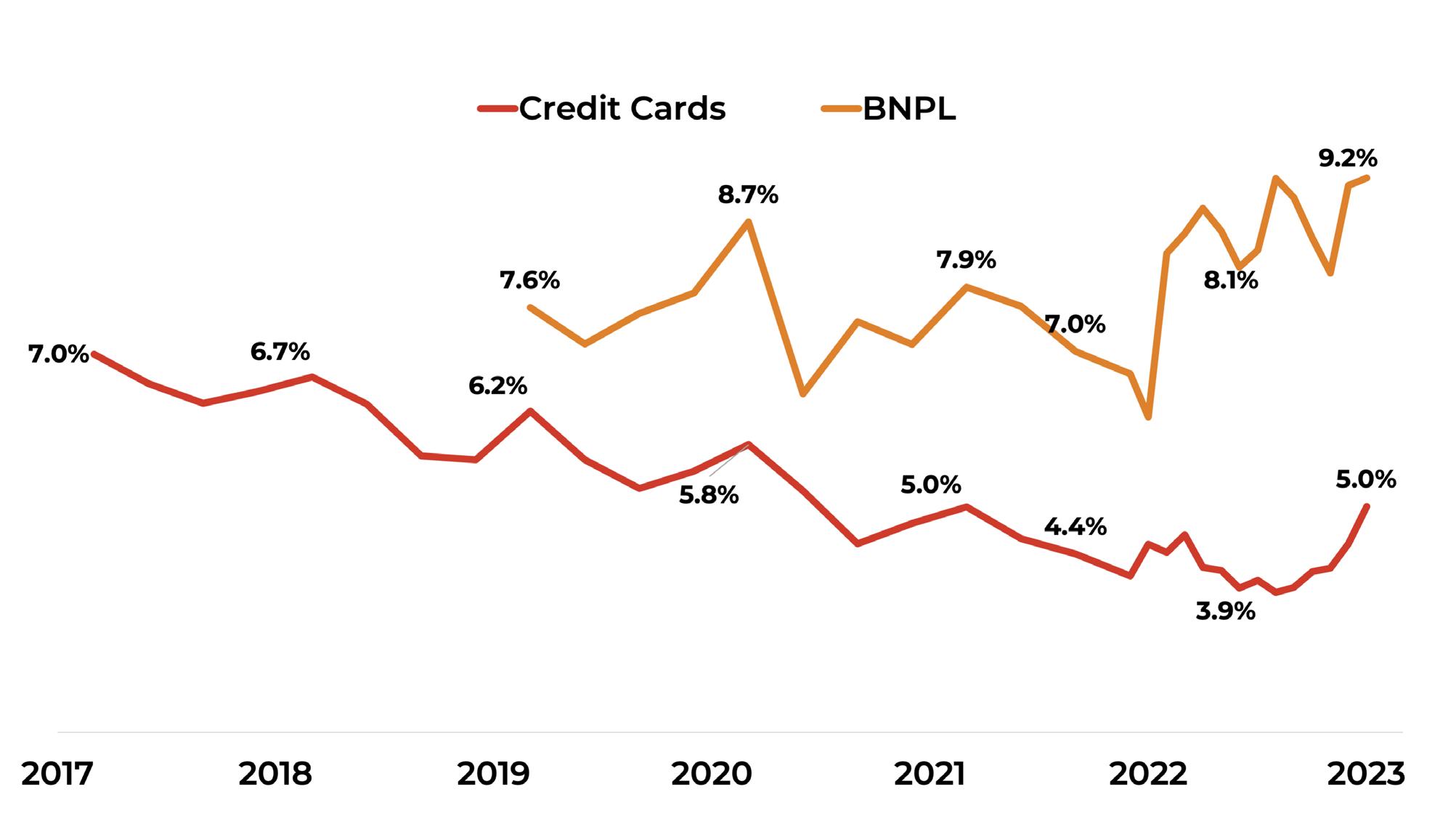

Credit Card & BNPL Arrears

attributed to Kiwi households rolling off fixed home loans and onto higher interest rates as the Official Cash Rate continues to climb.

Arrears on discretionary spending have also risen, with both credit card and Buy Now Pay Later repayments slipping in early 2023.

Credit card arrears have climbed to 5% of active accounts in January 2023, the highest level recorded since January 2021.

Buy Now Pay Later arrears have also climbed to the highest level recorded (9.3%), which is similar to arrears rates seen in unsecured personal loans.

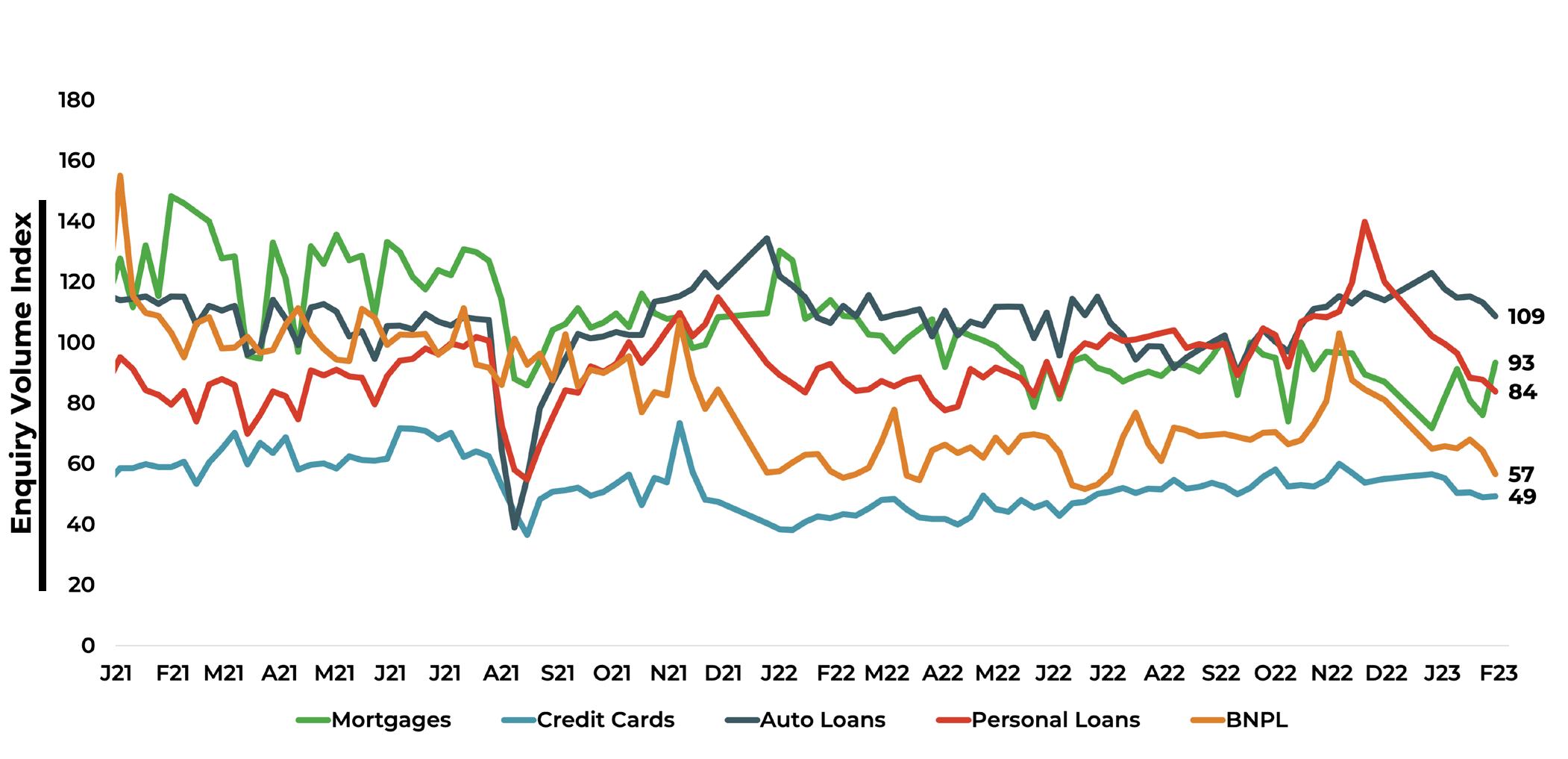

Fluctuating credit demand recorded

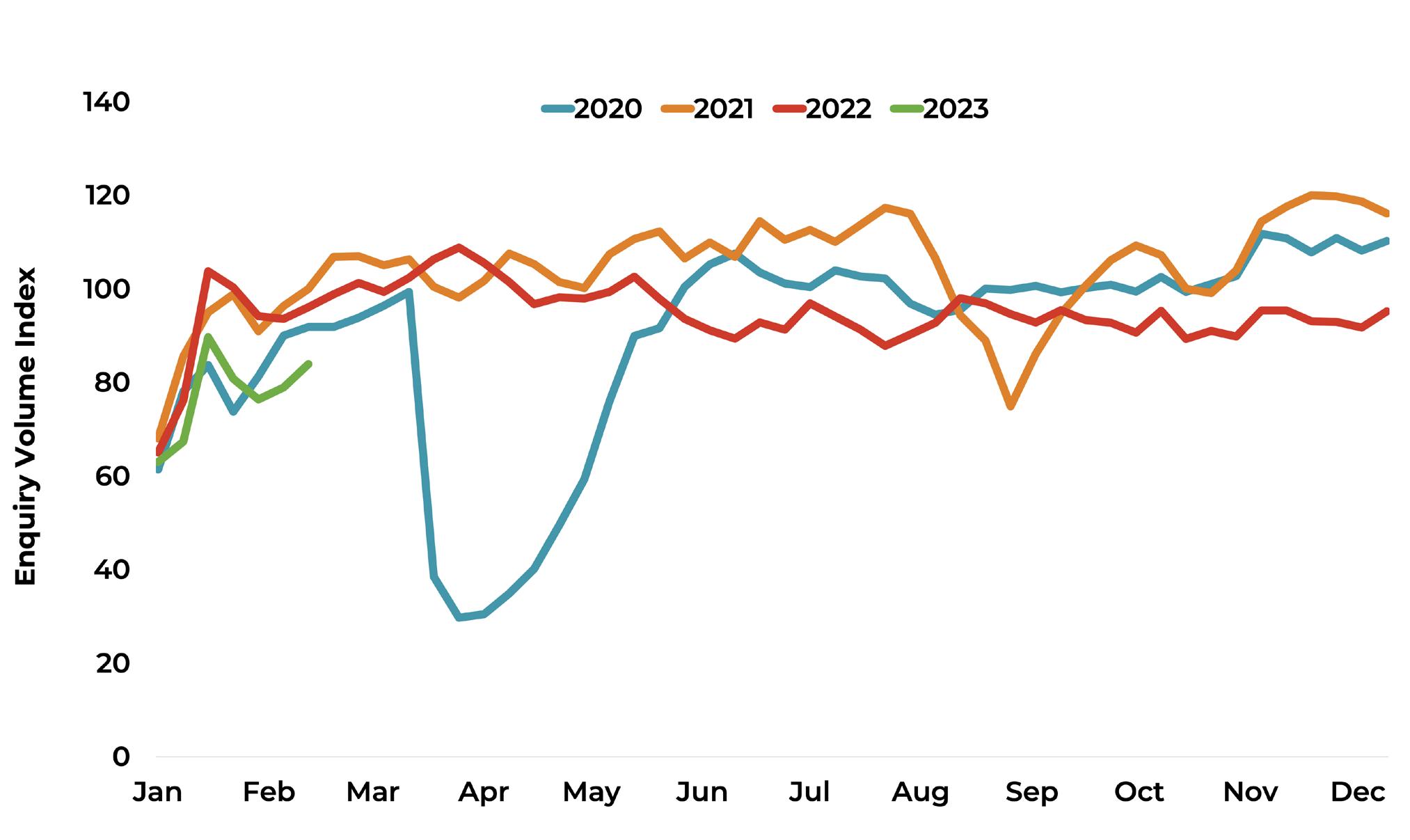

Alongside arrears, the demand for new credit is also a good measure of how consumers are feeling financially.

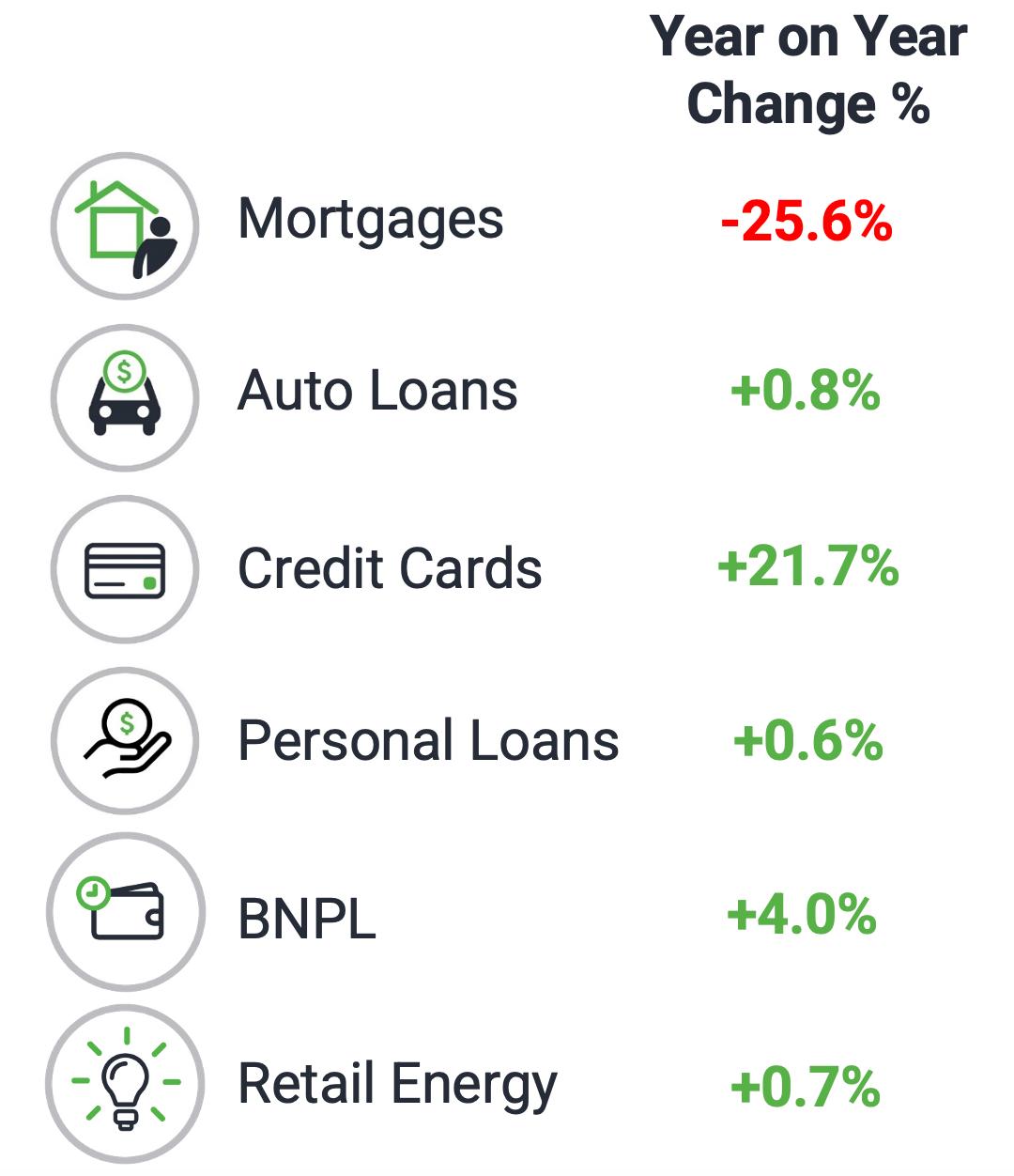

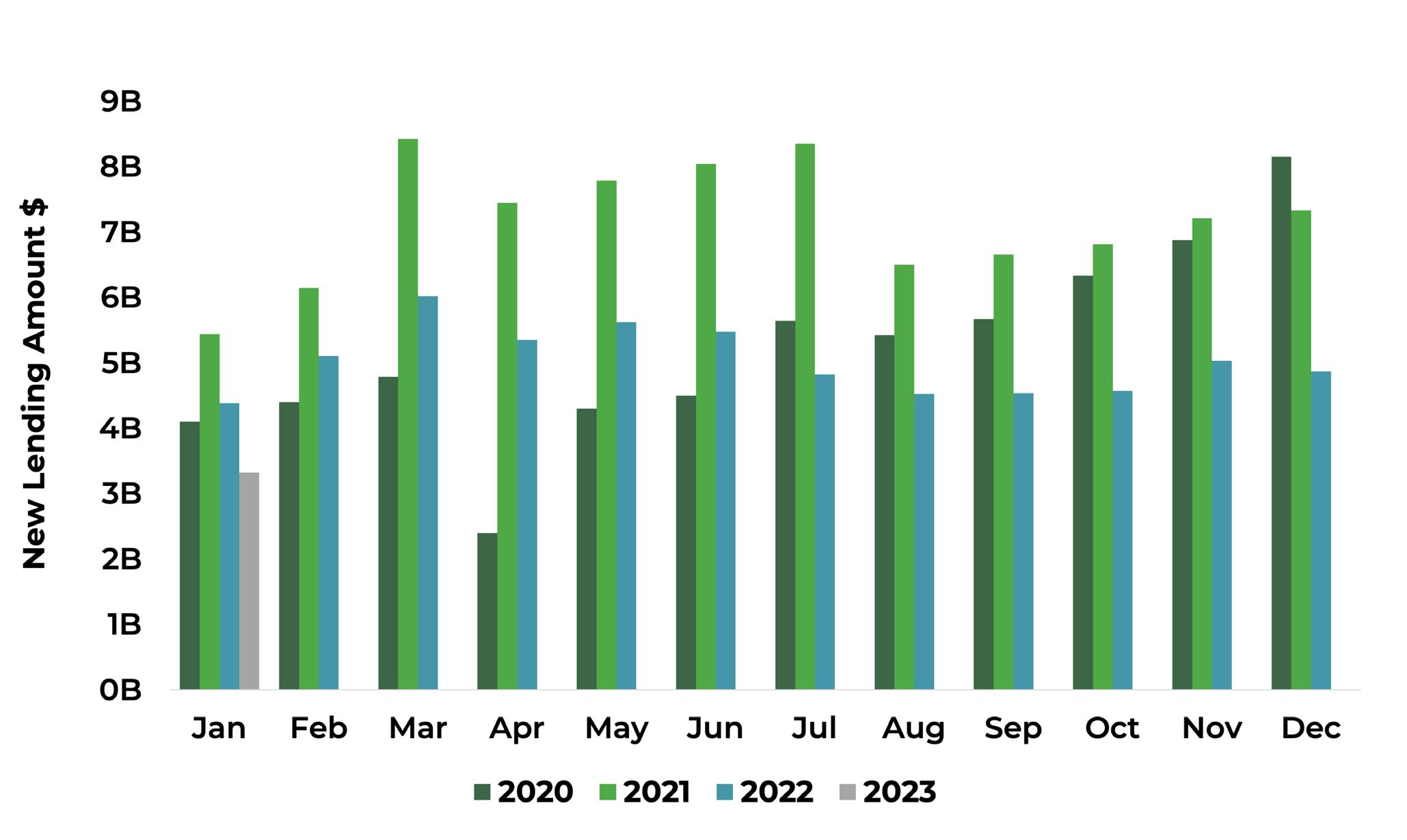

In February 2023, the demand for credit cards has climbed 21.7% year-on-year, while new mortgage applications are down 25.6% year-on-year in February 2023.

In terms of new lending, new mortgage borrowing was 24% down year-on-year as the NZ housing market downturn persists.

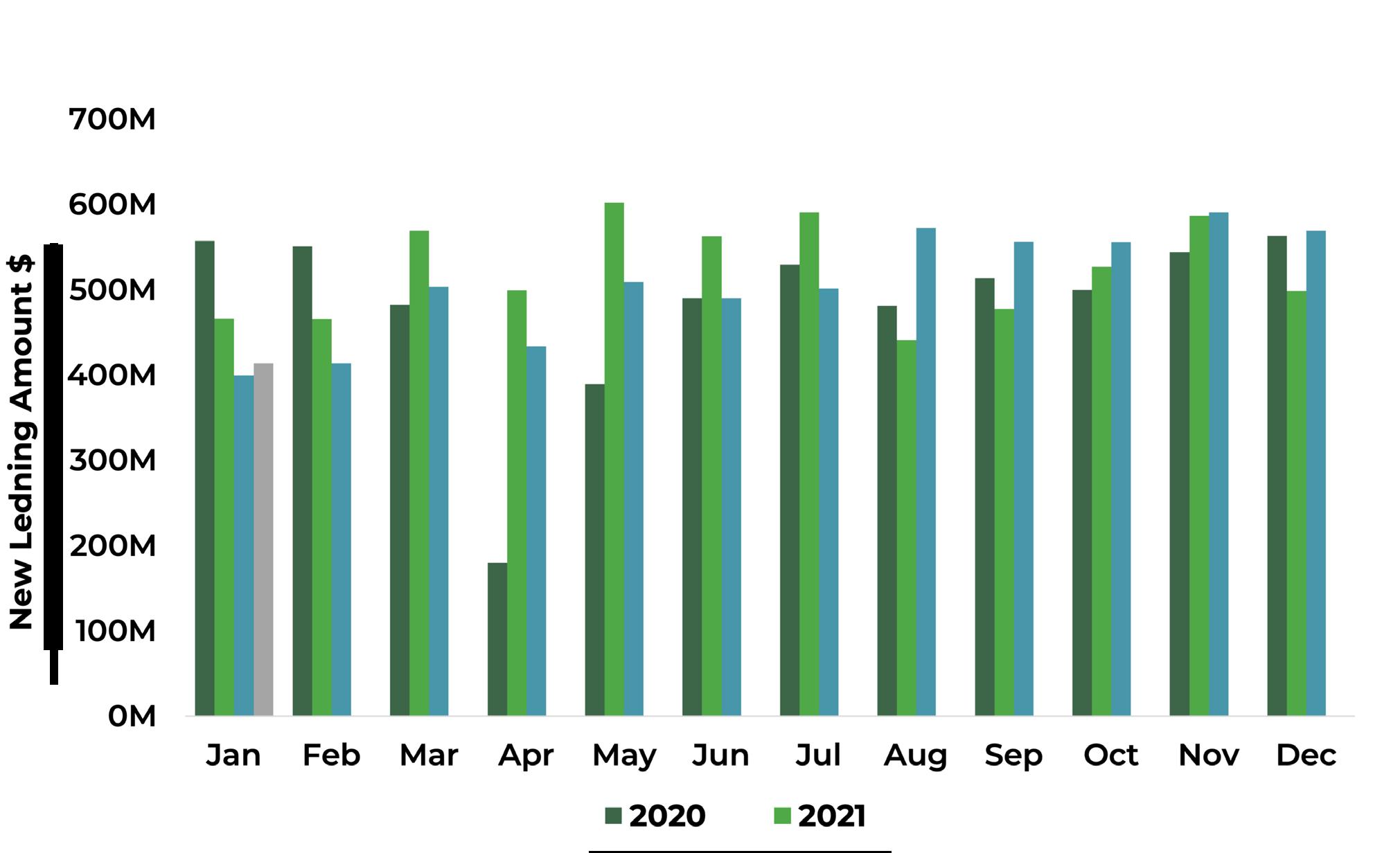

However, new lending for consumer loans –while down from December 2022 – was up 3% year-on-year in January 2023. This could be due to households taking on more credit to get through the holiday season or maintain lifestyles.

Credit Demand by Product Type

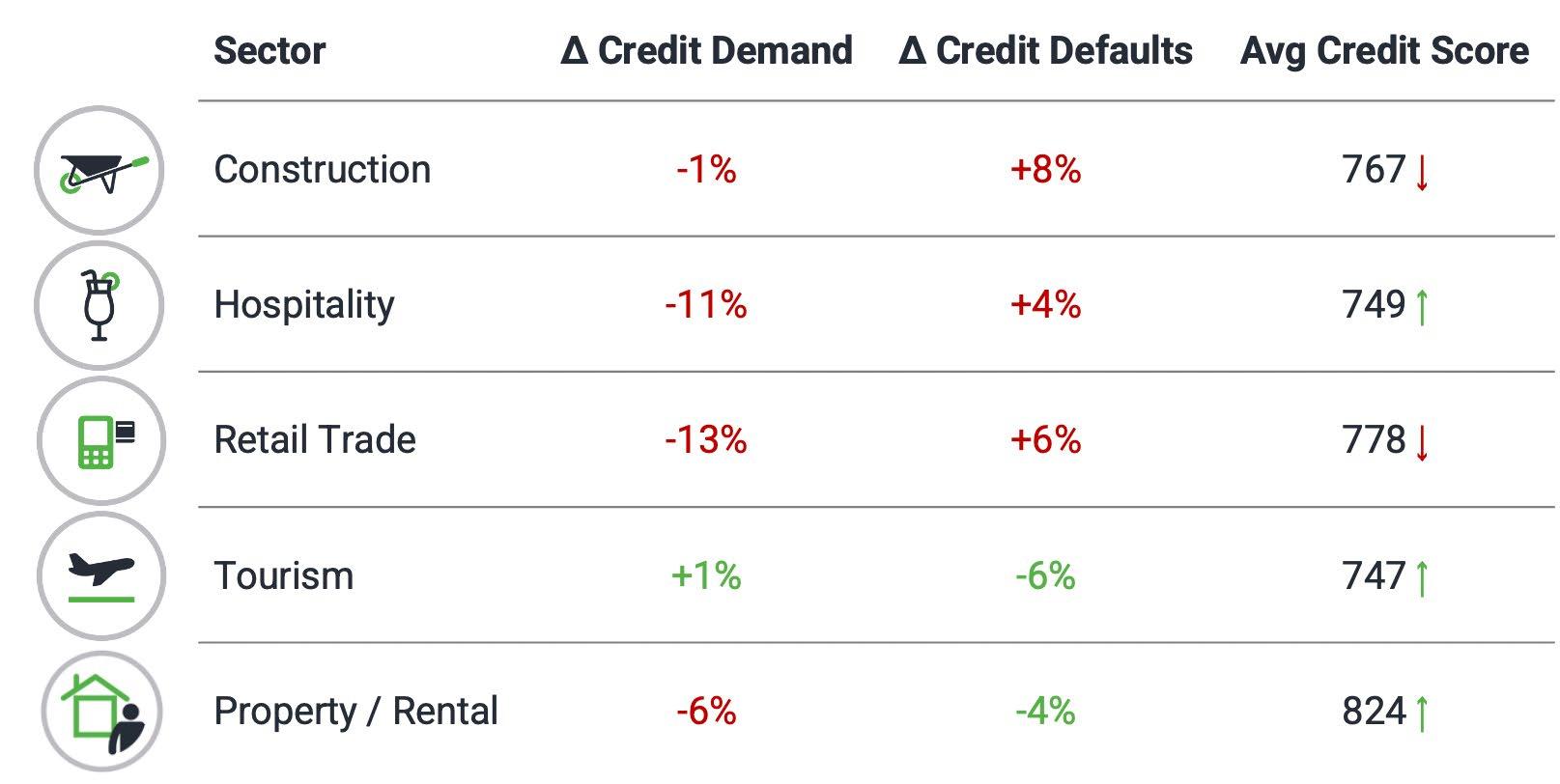

Ongoing pain for business sectors

Overall business credit demand is down 13% year-on-year in February 2023, impacted largely by the retail trade and hospitality sectors, as discretionary spending slows and consumer confidence falls.

Additionally, credit defaults in the construction sector climbed 8% in February.

However, tourism continues to improve compared to 2022 as the impact of open borders and

New Lending Amount: Mortgages

New Lending Amount: Consumer Loans

renewed foreign tourists helps to reignite the sector.

With further changes to the Official Cash Rate expected to try to rein in inflation, the challenging economic landscape is well and truly impacting Kiwi households.

Only time will tell if the next quarter brings another fall in GDP and the beginning of recessionary times, which is likely to be front and centre as campaigning begins ahead of the election in October 2023.

For those who are struggling with meeting their repayments, now’s the time to get in touch with creditors. It’s better to come to a repayment agreement than to slip into arrears and further financial strife.

*Monika Lacey MICM Chief Operating Officer Centrix Credit Bureau of New Zealand www.centrix.co.nz

Business Credit Demand: 2020 to 2023