24 minute read

MENA'S CONTENT KING

MENA’S

One of the biggest MENA production houses has remained resilient in the face of the lockdown that crippled the production industry worldwide last year. Cedars Art Production (Sabbah Brothers) CEO Sadek Sabbah tells Vijaya Cherian how the company has continuously adapted since the early 50s, and discusses its Ramadan 2021 drama rollout

Advertisement

Cedars Art Production (CAP) has released five 30-episode Ramadan productions this year, four of which will feature exclusively on MBC platforms, with its SVOD service Shahid VIP enjoying first window status in some cases: Moroccan series Slamat Abu Al Banat and Wlad El Amm, Egyptian productions Molook Al Gadaana and Lahm Ghazal, and a Levant series titled 2020.

The latter, starring Nadine Nassib Njeim, will launch exclusively on MBC in the GCC, on MTV in Lebanon, on Ro’ya TV in Jordan and on ART in Egypt. Although CAP usually produces around 14 TV series and a couple of movies a year, five is considered remarkable in an ecosystem that is still under partial lockdown and riddled by other recent regional challenges.

Heading the family-owned business started by his grandfather in 1954 is Sadek Sabbah, who joined the entity in 1978 and has run the show since 1981, along with his brother and partner Ali Sabbah and the new Sabbah generation.

Since the Sabbah brothers took over, Cedars Art Production has become a strong contender in the Arabic production market and in recent years has worked with the likes of Banijay, The Walt Disney Company, Netflix and Shahid. But the production house’s forte lies in creating Arabic productions and developing stories that cater to each of the Arab markets.

It all began with his grandfather, who “loved filmmaking and the theatrical aspect of the business but wanted to expand”, Sabbah says. “He sent one of his sons to Egypt for inspiration and they ended up investing in Egyptian cinemas first, and later in Lebanese cinema. My uncle was dubbed the King of Egyptian Cinema.”

“I came into the business in 1978 during the video cassette era. My brother is the CFO, while I oversee the rest of the business; we have 125 people working in the group. Our children are mostly producers – we have four producers in the company. One for the Egyptian part, two working to serve the pan-Arab market and one focusing on the Moroccan area. Today we are innovating with our productions, serials, TV game shows, animation, theatrical plays adapted for TV and so on.”

Cedar Art Productions made headlines in 2018 when its hit Al Hayba was picked up by Netflix. CAP also produced the Lebanese series Dollar as another original for Netflix, which released it in August 2019. More recently, the production house collaborated with The Walt Disney Company – a first – to produce Sukkar Ziada, the Egyptian adaptation of American show Golden Girls. Also on the cards is Anbar12 – Untold Stories behind the Beirut Port Explosion.

Asked how it feels to work with international companies, Sabbah sums it up in one word – “complicated”.

“There are a lot more limitations and protocol to follow with international productions, but fortunately the restrictions were a lot less with Golden Girls, because it is a relatively older format. The idea was to bring back two Arabic divas from Egyptian cinema to the smaller screen. The challenge in this specific case was that we were working with older celebrities, which meant we could only work a few hours a day.”

CAP had the original 13-season Golden Girls run condensed into a 30-episode package. A new set was created in Lebanon for the purpose, with Arabic flavour and culture integrated into the series. The team also toned down the raciness, making it more palatable to an Arab audience.

Asked why CAP was chosen over other production houses,

Sabbah speculates that, high quality aside, it has the ability to invest time and money in getting the work done, and “has the experience, the access and exclusive stars”.

“We spent 90% more time on these productions than we would on a normal Arabic production. The hundreds of hours invested in meetings and emails was significantly different from our normal classical way of operating. But having gone through the first one, we now know the ropes and are confident future productions will require less time.”

He points out that Arab audiences have a certain expectation of storylines, one that is perhaps not the current priority for international platforms looking to add Arabic productions to their portfolio.

“A trend we have noticed among international platforms is that they seem to be looking to create a catalogue of productions in different languages and genres, rather than focusing on specific storylines for the region as we do. So they are not necessarily competing with regional producers who want to infuse our productions with a local flavour and have the finer nuances that appeal to our world. They are competing on a worldwide level, and perhaps their priorities are different,” he speculates.

As a result, he thinks interest from the Turkish market.

“We have the opportunity to have our productions dubbed for other markets, as we see huge opportunities there to work with international broadcasters. Al Hayba was the first Arabic content in 2018 from our portfolio to be dubbed and subtitled into many languages for Netflix, and we are in season five now. There’s a lot of potential to do the same with a lot of our other productions, and we are exploring that opportunity in greater detail now.”

While there is huge demand for Arabic productions, Sabbah rues how Covid-19 spoiled the party last year by affecting “where to shoot and how to shoot”. But Cedars has now got its act together and has a good strategy in place, says the 60-year-old chairman proudly.

“Last year, it was quite hard. But now we are back because we know more. Our groups are vaccinated and by the end of May, everyone will be vaccinated. This includes not just the people who have always worked for the company, but also freelancers who are part of our projects. In Lebanon and Morocco, everyone has been vaccinated. In Saudi Arabia, not yet. In Egypt,

Sadek Sabbah, CEO, Cedars Art Production

regional platforms with their finger on the pulse of the Arab audience will always have room to grow.

Cedars has its own priorities. Apart from wanting to focus on making high-quality Arabic content, it is also keen to help its productions travel. In fact, it has recently had considerable

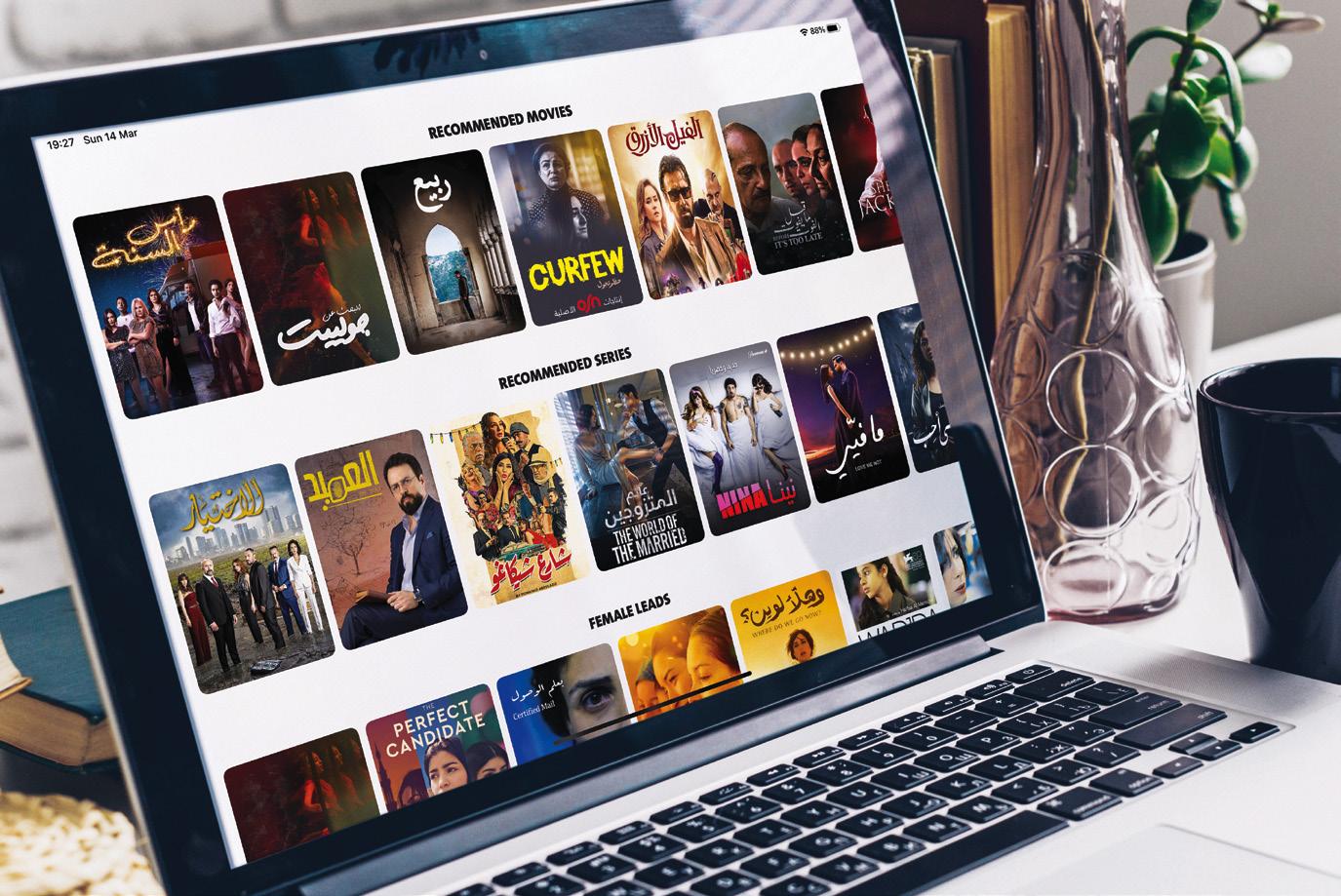

Posters of 2020 (l), which will premiere on a number of channels during Ramadan, and The Blue Eye (r), which debuted on OSN last month.

Eghleb El Sakka is the regional avatar of the international format Beat the Star, a game show with Egyptian action movie megastar Ahmad El Sakka.

Sadek Sabbah says CAP's biggest advantages are its understanding of Arab audiences, its willingness to invest and its access to celebrities.

there is no corona,” he jokes.

After a few weeks of being completely locked down, Cedars secured special permissions to continue indoor shooting. It hired a few beds in one of the central hospitals for its staff, bought medicine and oxygen from Dubai and Cairo and “followed the corona protocol”.

“We took all the precautionary measures and surrounded ourselves with the medical support we would require to protect our staff and continue doing our business. This is important, because last year we were under lockdown. This problem may continue for years; we have to adapt and survive.”

Asked how Cedars circumvented the production challenges that have cropped up in Egypt in recent years, with several production houses having to shut down and one production house favoured to produce most Egyptian shows, Sabbah says he strategically moved his Egyptian productions to Lebanon.

“We only operate a bureau now in Egypt. Instead, we expanded our studios in Lebanon. Our studios are in the suburbs, around 15km away from Beirut. We have brought all the accessories needed to build Egyptian sets, with a complete replica of Egyptian urban neighbourhoods in Lebanon, and built everything there. We flew everyone, from the stars and the technical artistic production team to those required for the Egyptian productions, to Lebanon and they stayed there for the duration of the shoot. The government supports us because they know production helps boost the country’s economy on so many levels: economy, tourism and media. They are giving us many facilities.”

One reason CAP productions are sought-after is its work with celebrities, some of whom are exclusive to the production house. Nadine Njeim, for example, has worked exclusively with Cedars Art for the last seven to eight years.

“We have signed exclusive deals with many A-list stars like Nadine Njeim (2020, Five Thirty, Al Hayba, Cello, Samra, The Way, What If), Taim Hasan (Al Hayba, Ana, Hajj Nohman Family, Cello, Half Day), Kosay El Khawli (Not Guilty, 2020, Five Thirty), and we work on two projects at least annually with each of them – usually one for Ramadan and one outside Ramadan. While there are celebrities who work exclusively with us as part of a deal, there are others who haven’t

Sadek Sabbah, CEO, Cedars Art Production

Taim Hasan in Al Hayba season 4 – a Levant action series that went beyond Arab borders and was translated into at least 34 languages.

signed deals but are also working in a similar way. It’s a win-win.

“I think the reason they do it, especially high-level celebrities, is because they don’t want to fail. It’s not just about money for them; they also want to have safe projects, and most of our productions have been very successful.”

As a result, these drama series are in big demand. Cedars has a collaboration with MBC Group that gives the broadcast network a first look at its programmes. MBC often acquires the bulk of them, but some do run on other platforms – for instance, a telenovela titled Aka Kharzeh Zarka (The Blue Eye) launched exclusively on OSN last month.

But not everyone can afford a Cedars production. Sabbah explains that all good things come at a price.

“I admit that our productions are a little bit more expensive. But in any project, if you put a lot of expertise behind it in terms of directors, DOPs and big celebrities, ipso facto it brings up the production costs.”

The production house is not just spending on high-quality productions, it is equally invested in entering new markets and developing talent there. A good example is Saudi Arabia, where Cedars Art is gearing up for a big launch. With a strong existing presence in Lebanon, Egypt, Syria, Tunisia, Morocco, Kuwait and the UAE, Cedars first entered the Saudi market in 2019 with the first season of Masrah Al-Saudia.

Sabbah’s passion for cinema and TV production is said to have spurred this theatre performance project, specifically designed for television. It also helped the company explore the Saudi market, scout for talent and check the feasibility of setting up a base there.

“I believe that live performance and theatre serve as a rich platform for future generations to experience the magic of stage performances. Masrah Al-Saudia itself has gradually evolved into a real-life academy that is now managed by top actors, scriptwriters and directors who are now fully engaged in developing and allocating new talents to work first on this project. Then they will be able to expand their career in the TV industry with that experience.

“Today, Cedars Art has established three branches of this live academy – one in Egypt (Masrah Massr), one in Casablanca (Masrah El Maghreb) and the newest in Saudi (Masrah Saudia). It makes me happy to help bring up new talents in different sections of our industry by transferring our team knowledge to them and train them and upskill them so it can reflect in turn in the media.”

Cedars Art was meant to open a facility in Saudi Arabia last year, but the global pandemic put the brake on that. Now

Sadek Sabbah, CEO, Cedars Art Production

A scene from Al Hayba Season 4, currently streaming on Shahid.

Cedars has revived the project, investing initial capital of $10m in partnership with RITIX, with the aim of developing that market.

“We will apply our expertise to Saudi content and Gulf content. We want to train Saudi talent and bring them up to the levels that have been achieved in more mature markets like Lebanon, Morocco or Egypt. We started that process with Masrah Al-Saudia.

“Sometimes postponing a project also gives you an opportunity to plan and evaluate things better. Now we know how to enter this market in a smarter way. In Saudi Arabia especially, you have three different dialects, and you have to work on it. We are now more familiar with the type of stories that the audience there like, the stars that appeal to them, and we have identified some of the new generation of Saudi stars that will be right for our projects,” Sabbah explains.

In fact, Cedars is already working on two Saudi productions – a historical film and a 15-episode TV series. Their names are both under wraps.

“Our aim is to make a hit with a couple of Saudi projects. If we succeed on one or two of our first projects there, it will boost their confidence in us and we will be able to build a whole production market there, like we have done in other Arab markets. We are known to be successful with introducing new concepts, and now, in this part of the region, we need to concentrate more and allocate more time and resources.”

Sabbah’s plans for Saudi Arabia are all theatrical releases, but he knows the situation means they may be on other platforms prior to that.

“Even if it is not released in theatres, we want to continue making grand productions. This is a new concept. We are talking to platforms who are willing to pay us to exclude the theatrical and the traditional windows, and this is up to them. We make big productions even if we will not be able to put it in theatres. But we will make the same kind of buzz around it.”

Cedars is also looking at other new ventures. For instance, it is eying a new set of talent, namely influencers. Another element it is exploring is the adaptation of well-known Arabic novels for the big and small screens.

“We think there are some bloggers and influencers out there who have the potential to become acting talent if we train them well. They already have a large fan following. We have also bought the rights to some successful novels like those of well-known Egyptian novelist Naguib Mahfouz, and we are starting to pick out the stories that we can best adapt either for the traditional screen or for newer platforms.”

Sabbah believes this is a great period for content, when one is no longer limited to the markets one operates in but has the potential to reach audiences beyond the Arabic territory.

“There’s so much more opportunity now. Before, we were limited by geographies. Now with the expansion of digital platforms, our market has become global, which is why we are looking to take our regional productions to

Sadek Sabbah, CEO, Cedars Art Production

Not Guilty is currently streaming on Shahid.

Kings of Chivalry is a 2021 release from CAP.

international markets and have invested in dubbing a number of our Levant series in Mexico to be specifically offered to the LATAM market and so on. We are exploring new formats and constantly innovating.”

Sabbah cites a new Moroccan cooking programme hosted by famous chef Rim Chami.

“We are in the last stages of finalising this production. I think we will shoot by the summer. She flies to different countries to pick up her ingredients. Sometimes she has to take a flight, but she will do what it takes to get the right flavour, because it’s not just important to see the ingredients on the table but where she goes to bring them. She will then cook each time with a new family. It’s a new format, but it is integrating traditional cooking and it will appeal to everyone.”

With five different widely-spoken dialects of Arabic, Cedars will stick to white Arabic for this production. “The most commonly understood dialects are maybe Levant, Iraqi, Egyptian, Sudanese and Maghreb. White is understood by everyone.”

Apart from the Western platforms, one other key market taking notice of Cedars Art is Turkey. Sabbah calls this a milestone.

“For years, the Arab market has bought Turkish productions, and I don’t think an Arabic drama format has ever travelled to Turkey. So it’s great that they are now looking to acquire some of our productions. We are in talks with an important Turkish studio to make a Turkish version of Al Hayba. It’s a big market and a big competitor, and so we are really happy.”

At 60, Sabbah is still replete with new ideas to ensure Cedars Art remains a powerhouse; but in our conversation, he seems to hint that old age is creeping up on him. Perhaps the mantle will one day need to be passed on to someone younger. But for now, he appears to thoroughly enjoy what he does, travelling across different parts of the Arab world, negotiating deals and ensuring that his company continues leading the way in the Arab media Industry.

Sadek Sabbah, CEO, Cedars Art Production

Introducing 4K-12G solutions from Canare

12G cable-CUHD Series 12G Video Patch panel - 32MCK-ST

12G Micro BNC - HBCP-D25HD Pre-Loaded A/V Connector - 161U-JRUK

Canare Middle East FZCO

DAFZA Industrial Park, Dubai Airport Free Zone, Al Qusais, Dubai, United Arab Emirates Gopalakrishnan - General Manager Tel. 00971 50 421 2692 | Email: gopal@canare.co.ae

The Industry Professionals’ Choice

CONTENT PRODUCTION IN MENA: DIGGING DEEPER INTO THE DYNAMICS

The Arabic content market is a complex labyrinth that requires a fair degree of expertise to navigate, and the entry of new platforms has added to this complexity. Content expert Heba Korayem takes us through some of the twists and turns of the industry's production scene

Eight years ago, the Arabic content industry was fairly straightforward when it came to the monetisation life cycle of a video asset, like an Arabic drama series or a movie. A tight-knit TV industry thriving on personal relationships meant that a limited selection of production houses produced content for TV/ theatre, with a simple windowing process that normally only involved theatre (for movies), followed by pay TV, then free TV.

Finally, almost everything landed on YouTube for residual revenues, a convenient and cheap catch-up solution. In most cases, the monetisation cycle only went through the last two stages, especially during the month of Ramadan.

This lasted until roughly 2017, when OTT platforms started popping up in MENA at almost the same rate as linear channels on satellite back in 1997. Fresh demand was created by these new buyers coming into the Arabic content marketplace.

However, in an industry still almost fully funded by ad spend rather than subscription revenues, the acquisition budgets of the digital newcomers were too small to justify ramping up production, leaving the monetisation life cycle of a video asset in limbo. While content distributors had a bit of fun splitting the rights of video assets even further to cater to the small budgets of OTT platforms, YouTube had an abrupt 92% decline in video assets uploaded, as witnessed in Ramadan 2019.

To cut a long story short, this is how many OTTs started off in the MENA region – catch-up services for linear channels, slightly more monetisable YouTube replacements. However, this only lasted a year or so, as OTT platforms struggled to figure out a monetisation strategy in a region used to receiving free Arabic content. Needless to say, OTTs decided to gain a competitive edge by going into production, aka Originals.

Shifting trends If you recall, Netflix announced its expansion into MENA back in 2016. That was probably bad news for pay-TV networks in the region, but for regional production houses, it meant new commissioning opportunities and new money.

Netflix started investing in Arabic content a year later, releasing Emirati drama Justice in 2017. Interestingly, the first regional OTT platform to release its own Original production in the region was ICFlix in 2014, with Egyptian movies HIV and Al Makida, titles and genres that were a perfect fit for an OTT platform.

However, the concept of SVOD back then was too premature to gain traction. Fast forward to 2021 – in just seven years, the MENA region has witnessed the rise and fall of three OTT platforms, the birth of some more, and more than seven telcos

Investment in Arabic content by OTTs does not translate to significant ROI in the form of ad spend or subscription money, says Heba Korayem.

acquiring content for their own IPTV and OTT solutions. Recent content market studies released by Dubai-based companies such as DICM, vynd and mena.TV all point to the good news that OTT is indeed flourishing in the region, implying new money in the marketplace.

We should then all celebrate the digital content revolution, because subscription revenues will finally save the industry from being fully dependent on ad spend, right?

Wrong.

The industry is still fine-tuning the balance between SVOD models and ad-supported monetisation, whether digital or linear, but one thing is clear: both international and regional OTTs are now setting aside budgets for exclusive Arabic Originals. That’s music to every producer’s ears, because it means content is privately funded for the purpose of increasing the valuation of an OTT platform, not necessarily immediate profitability.

Investment in Arabic content by OTTs does not translate to significant ROI in the form of ad spend or subscription money, not for the next couple of years. However, the fact that MENA viewers are finally starting to open up to the concept of paying for content is to be celebrated.

Where’s the money? A market scan reveals three international OTTs already investing in the region, and at least three more trying to properly expand into MENA within the next year. By ‘properly’, I mean investing in Arabic content, not just having a payment gateway or a small free zone office in Dubai. There are five regional OTTs investing in Arabic content and at least two more scheduled to launch in 2021, boasting about doubling or tripling investment in Arabic productions for OTT.

Now, before international format distributors and regional production houses start rolling up their sleeves, they need to understand what to start pitching, to whom. In other words, what content is going to sell, and what do audiences want to see?

In a unique region where the source of audience data is a controversial topic that is frequently debated, and with digital platforms not releasing audience share or ratings data, this is a million-dollar question. However, I’m going to run some simple non-algorithmic AI (Actual Intelligence) to analyse the production trends of platforms over the past few years, drawing conclusions to help understand what sort of Arabic content these OTTs are demanding.

We all know drama sells in MENA. That’s why a whopping 56% of OTT releases are drama series, 40% of them portraying societal stories/relationships – OTTs have chosen a conservative ‘if it’s not broken, don’t fix it’ approach.

However, since the start of OTT production releases in 2014, new genres that Arabic viewers were not used to seeing on linear EPGs have been successful on OTT platforms: thrillers, suspense, crime, mystery.

From 2014 to 2019, 12% of OTT releases were in these genres. 2020 alone saw a 19% YOY increase.

This tells me two things. First, it took three years for OTTs to realise that what works on linear TV does not work on a solo digital watching platform. Second, you can be a lot more creative and experiment with different genres if you’re pitching to an OTT platform.

While the second point is good news for the creative crew, I wouldn’t get too creative, because censorship rules in the region remain vague – as witnessed with Dahaya Halal, or Halal Victims, with which Shahid boldly announced it was ready to take on Netflix. Despite hundreds of thousands of dollars spent on this production, it didn’t make it past the fourth episode. It was ordered to be taken off the platform immediately.

Now that we know what genres are trendy, we’ll look at who and how. Who is the target audience, and how many episodes? In 2020, 36% of all OTT releases were in Egyptian dialect – as expected, since it‘s the most widely understood and familiar dialect in the Arab world. No surprises here. 26% were in Gulf dialects, mainly those of Saudi Arabia, Kuwait and the UAE. 13% of releases were in Levant dialects, mainly those of Lebanon and Syria.

These are all expected trends. We already know that Egyptian content sells and Khaleeji content pays. Not rocket science.

The unusual trend is in the part of the pie chart labelled ‘other’. 15% of 2020 releases were “mixed dialects” – a new trend rarely seen on linear TV but adopted by OTTs positioning themselves as pan-Arab, mainly Shahid and OSN. Why is this a cool trend? Because it implies collaboration, co-production and cohabitation. (Maybe not the last one, but you get the idea.)

In a nutshell, it doesn’t require too much content market intelligence to figure out that the entities currently spending on Arabic content are no longer the linear channels, but the OTT platforms. The key difference is that OTTs have access to their own real-time viewership data; they will never publicly reveal it, but a quick scan of their libraries is enough to get a general understanding of acquisition trends and production preferences. Now is the time to try new genres in MENA. Shorter episodes and mixed dialects (Lebanese, Saudi, Egyptian) seem to work for Shahid, the region’s biggest platform.

The content industry is currently experimenting, so it’s a good time to go in with fresh ideas. Whether this subtle risk-taker approach will become a new norm is up for debate, but the good news is that right now, unlike any time before, we can confidently say that the MENA content industry has potential money in two places instead of one: ads and subs.

I believe there’s actually money in three places – but that’s for a different article.

Dantelle is a Lebanese romantic drama produced by Eagle Films. Dahaya Halal was touted as a bold Saudi production but was pulled off air after it sparked outrage among more conservative viewers.