4 minute read

Opportunity Zones

Opportunity Zones

An Introduction to

Qualified Opportunity Zone Investments

Introduction

A famous quote by founding father Benjamin Franklin comes to mind when we think of Opportunity Zones: “Do well by doing good.”

It is in this spirit that the US Government and the IRS have created a unique and timely opportunity for investors to embrace this long-standing American value today—namely, Opportunity Zones (OZ). Opportunity Zones were enacted into law by the Tax Cuts and Jobs Act on December 22, 2017, with the final Treasury Department regulations being published as late as the Spring of 2019. Consequently, the Opportunity Zone tax provisions are not widely known and understood by most taxpayers and their advisors.

The Opportunity Zone tax law (IRC §1400Z) is one of those rare and unique opportunities in tax legislative history where both sides of the political spectrum have come together on a bipartisan basis to present investors with both a significant tax advantage (tax break) and an opportunity to reinvigorate targeted highimpact markets throughout the United States. The initial bill that found its way onto the Tax Cuts and Jobs Act was originally coauthored by Congressmen Tim Scott (R-SC) and Cory Booker (D-NJ) and championed in the White House by Ivanka Trump.

With values in the stock and real estate markets at all-time highs, Opportunity Zone investments present investors with a timely and tremendous opportunity to realize builtup capital gains, defer and even eliminate capital gains tax, and redeploy the full untaxed gain into uncorrelated investments in undervalued assets with significant upside potential. Thus, OZ provide diversification, potential income, and significant tax advantages, all while helping society reinvigorate targeted communities throughout the country.

However, time is of the essence for the investor to “do well by doing good” and take full advantage of opportunity zones, as the tax regulations have certain sunset provisions. In the pages to follow, we present the limited time window for this opportunity as well as discuss the key tax advantages, outline OZ investment offerings, define investor eligibility, and reference possible risks.

A Limited Time Window of Opportunity

Unless Congress extends the program, investors have until December 31, 2019, to roll over capital gains and enjoy a 1 5% capital gain exclusion if investments are held in OZ at least 7 years. Investments after 2019 and before December 31, 2021 , would be able to exclude 10% of the invested capital gain if investments are held in OZ at least 5 years. As discussed in more detail below, the remaining net capital gain that is rolled into the OZ is deferred until December 31, 2026 or the sale of the OZ, whichever is earlier.

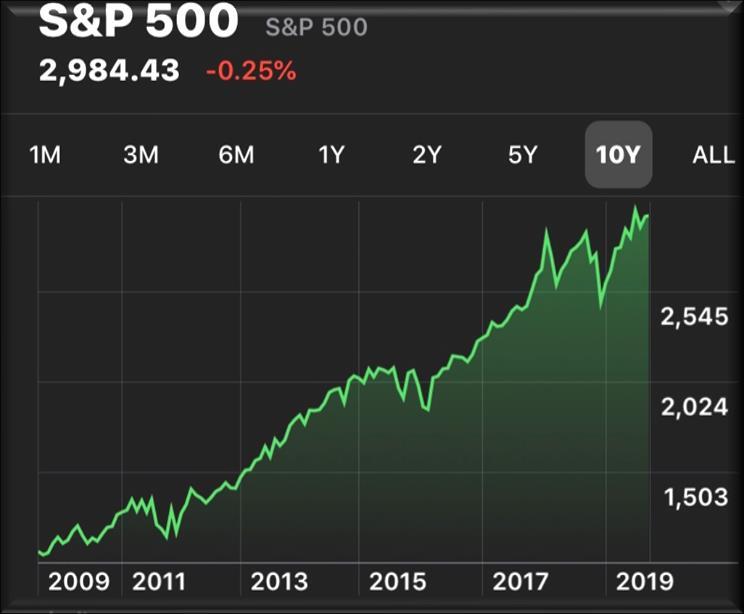

US equity market investors have enjoyed a bull market for stocks over the last decade following the 2008 Financial Crisis and Great Recession.

Source: Standard and Poor’s Indices

However, these gains may be threatened by recent severe market volatility, global trade wars, and the political and economic risks of future elections. These factors may point to a short window of opportunity to lock in gains through asset liquidation or reallocation.

Many investors may be hesitant to liquidate (sell) or reallocate (sell and buy) their portfolios due to the fact that capital gains taxation will eat into their earnings. For most investors with the long-term capital gain tax rate of 20 percent plus the Affordable Care Act tax rate of 3.8 percent, and the state and local tax rate of around 7 percent, the total

tax bill for a liquidation could be as high as 30 percent! They are also faced with limited investment options that would be classified as discounted with significant upside potential.

Reallocation without Taxation!

Opportunity Zones present accredited investors who have significant capital gains in their portfolios with the ability to defer taxation for up to 7 years—until December 31, 2026—by re-investing their capital gains into a Qualified Opportunity Zone Fund (QOZF). In should be noted that the original principal from the down leg sale does not need to be invested in order to protect the capital gain portion of the sale from immediate taxation and that investors are allowed up to 6 months (180 days) to diversify their portfolios and invest in an asset class which has not yet seen significant appreciation by reinvesting capital gains in an OZ.

Another powerful feature of the QOZF is the tax-free nature of future capital gains on appreciation of the QOZ investments. If the investment is held in the OZ for a full 10 years, then the gain on the QOZ investment may be liquidated tax-free (i.e., a full exclusion of the capital gain on the QOZ investment). This benefit cannot be overstated for long-term growth-oriented investors. However, please note that gain or appreciation are not guaranteed and your investment may lose value.

Most stock market investors have no idea that this option exists, nor are their WallStreet financial advisors likely to suggest something to their clients that will effectively reduce the advisors income by reducing their assets under management (AUM), even if their firm does offer Qualified Opportunity Zone Funds.

It is our mission as Cornerstone Real Estate Investment Services to reach out to CPA’s and estate planning attorneys to help them make their clients aware of this extremely valuable new investment option.