17 minute read

SEE 40 YEARS

Jerry Flannery is the president of the Highlands Ranch Communication Association.

PHOTOS BY THELMA GRIMES

Highlands Ranch Metro District General Manager Mike Renshaw.

40 YEARS

“Proper planning prevents poor performance,” he said. “Highland Ranch got it right.”

Going back in time, Renshaw said the idea of creating an unincorporated master-planned community, fi rst introduced in the 1970s, was not met with open arms.

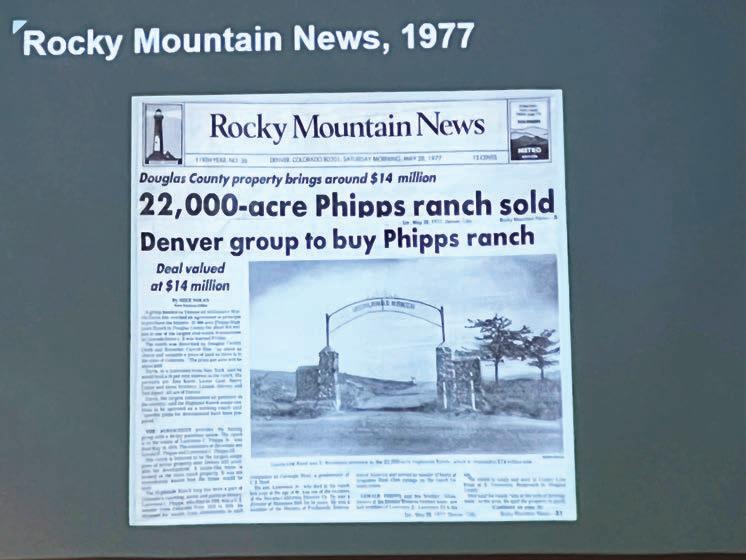

Renshaw showed pictures of newspaper headlines questioning the idea, with residents, neighboring communities and Douglas County offi cials expressing concern over how the community would be managed, if water supplies would be depleted and whether it was sustainable.

Moving the project forward, the site of more than 22,000 acres currently known as Highlands Ranch was sold to housing developer Shea Homes. At the time, Renshaw said the sale of the property was the biggest in state history.

The project was owned by Mission Viejo, which later sold to Shea Homes as construction continued. In the 1980s, the population was was under 3,000. Today, Highlands Ranch has nearly 100,000 residents.

How did the early planning become a successful reality? Renshaw said the answer involves the installation of system development fees, otherwise known as impact fees.

For Highlands Ranch, Renshaw said, smart use of the funds alleviated growing pains, giving the community the ability to build without added pressure.

Highlands Ranch thrives, Renshaw said, because the community falls under Douglas County jurisdiction, which maintains roadways. The Douglas County Sheriff’s Offi ce provides police services. The South Metro Fire District provides fi re services, he said.

For water, Renshaw said, Highlands Ranch has a sustainable future thanks to services provided by Centennial Water.

With just under 100 employees on the metro district staff, Renshaw said the continued mission in Highlands Ranch is to provide “innovative, quality services.”

Renshaw bragged about the community’s dedication to family and services. Highlands Ranch is home to 26 parks, 70 miles of trails and 2,600 acres of open space, he said.

In looking at the community side of Highlands Ranch, Jerry Flannery, president of the HRCA, told the more than 30 people in attendance, that there is plenty to be proud of.

As part of the original planning, all Highlands Ranch homeowners are required to be members of the HRCA.

“(Highlands Ranch) was designed as an unincorporated community on purpose,” he said. “There is no need to incorporate because we already get great service from the county.”

Growing steadily over the years, HRCA currently has 110 full and part-time staff members and more than 750 volunteers.

As the community and HRCA has grown, so have the amenities and services in Highlands Ranch, Flannery said. The community has multiple recreation centers, a town center and the coveted back-country wilderness area.

As the community continues to age, Flannery was asked how HRCA deals with aging buildings, paint upgrades and improvements.

Flannery said maintaining high standards in the community is a constant challenge, while noting that customers forced to be a part of a homeowners association (HOA) is like “yin and yang.”

“Some people love being a part of it. Others hate it,” he said.

Per year, Flannery said the HRCA hands out about 30,000 notices to keep up with standards and needs.

The Historical Society fi lmed all of the 40th year historical presentations. To access the monthly presentations, visit the website at highlandsranchhistoricalsociety.org.

LEADING EDGETM

START-UP ESSENTIAL SERIES

Create a short flexible plan to grow your business. Offered in English and Spanish

Register for the online series today! www.Aurora-SouthMetroSBDC.com/training

Free Virtual Consulting

AuroraSouth Metro SBDC

Helping existing and new businesses grow and prosper

Virtual appointments only

SBDC Host:

CITY OF AURORA

Aurora Municipal Center CONFIDENTIAL ONE-ON-ONE Request an appointment today! www.Aurora-SouthMetroSBDC.com/consulting

Funding and Resources

Invaluable assistance, support and information

VISIT THE WEBSITE BELOW TODAY!

of policy implementation because as we got into actually reviewing what districts were using, you realize that not everything fi ts into a neat bucket.”

Reviewers of ReadyGEN said the program met key standards for science-based reading instruction, but they noted it doesn’t thoroughly cover all foundational skills. They recommended teachers compensate for these shortcomings by using the company’s intervention lessons, a supplement designed for struggling readers, for all students.

Education department offi cials said the intervention lessons must be purchased separately and that while the state can encourage schools to buy and use those lessons, they can’t require it. ReadyGEN also fell short on the state’s review in the “usability” category because reviewers said it was hard to navigate. Become a Chalkbeat sponsor

In Denver, the state’s largest district, many schools use staterejected curriculum, with the most common ones being the 2018 version of Benchmark Advance and Benchmark Adelante, the program’s Spanish version.

Meredith Stolte, the district’s director of humanities, said during Thursday’s literacy event that she’s seen a big difference in reading instruction in the pilot classrooms.

“When children engage in the explicit and systematic way of learning to read, the light in them is completely different because ... they can understand and it’s not a guessing game,” she said, “which, to be honest, is some of what exists in older curriculum like Benchmark.”

Parent Priscila Ramirez, who also spoke at the literacy event, described the frustration she felt about the reading instruction her son, now a fourth-grader, received in Denver.

“Unfortunately, after many years and different schools we saw that he wasn’t learning,” she said. “He wasn’t learning because the learning system or the curriculum that is followed in most schools is not functional for children with dyslexia.”

If districts don’t submit a plan to switch from subpar reading curriculum by the state’s Jan. 17 deadline, Colsman said the department will send reminders. If that doesn’t

A fi le photo of students reading.

PHOTO BY KAREN PULFER FOCHT/CHALKBEAT

work, the department could lower districts’ accreditation rating.

“We want to avoid that as as much as possible because ... it’s a blunt instrument,” she said.

This story is from Chalkbeat Colorado, a nonprofi t news site covering educational change in public schools. Used by permission. For more, and to support Chalkbeat, visit co.chalkbeat.org.

Your Financial Assistance Use a Reverse Mortgage to Fund Retirement

by Matt Witt

Are you a homeowner 62 or older? Have you ever found yourself having to choose between buying food or medicine? How about having to put o a medical or dental procedure due to limited funds? If you have been faced with having to make a tough nancial decision of any kind stop reading and call 720-458-4034 to speak to the local reverse mortgage experts at Silver Leaf Mortgage right now. Did you know the proceeds from a reverse mortgage are tax-free money that may be used in any way you choose? For some it’s the instant, lifesaving help needed today. For others, it’s the safety net for your future or the unplanned life events like medical emergencies that may arise. Qualifying for a reverse mortgage, it’s simple and easy. Quali cation is based on these important factors: • You (the borrower) must own the home. • You must be 62+. (A non-borrowing spouse may be under 62.) • e home must be your primary residence (you live there at least six months and one day per year).

According According to author Wade Pfau, PhD, CFA, nancial planning research has shown that coordinated use of a reverse mortgage early in retirement outperforms a “last resort” reverse mortgage. A reverse mortgage is a retirement tool that can be incorporated as part of an overall retirement cash ow plan. Coordinating retirement spending from a reverse Even if you have bad credit, have had a bankruptcy, or a foreclosure, you are not disquali ed. In most cases there is a remedy for past credit problems. So, don’t mortgage reduces strain on the investment think you can’t get the help you need. portfolio. is helps manage the risk of Let us help you navigate these di cult having to sell assets at a loss during market nancial times, call your local experts downturns. at Silver Leaf Mortgage today at Reverse mortgages can actually sidestep 720-458-4034 to see if a Reverse this risk by providing an alternate source of Mortgage is right for you. cash during market declines, creating more opportunity for the portfolio to recover. Additionally, opening a reverse mortgage early—especially when interest rates are low—ensures the principal limit (loan balance plus remaining line of credit) will continue to grow throughout retirement. To qualify for a government-insured reverse mortgage, at least one borrower must be 62, the home must be your primary residence, and you should have 40–60% equity. Most types of properties are acceptable. A Reverse Mortgage is also a non-recourse loan, meaning even if your home loses value due to a market downturn, you or your heirs can never be “under water.” And just to clarify—because I hear this a lot—you are the only one who owns your home and its equity. e bank does not. e reverse mortgage is not repaid until the last borrower leaves the home. You owe it to yourself to get the facts. Call me today to see if a Reverse Mortgage can help you fund your retirement. I promise we will never pressure you or guide towards a product that won’t meet your needs. We’ll simply answer your questions and help you determine if a Reverse Mortgage is right for you. Matt Witt, NMLS #1638881, President at Silver Leaf Mortgage in Centennial.

* e homeowner is still responsible for applicable property taxes and homeowner’s insurance, as well as maintaining the property.

Colorado’s #1 Reverse Mortgage Broker Colorado’s#1 Reverse Mortgage Broker

Mortgage Company Reverse Mortgage Company Mortgage Agent Call within the next 30 days and choose one of these great offers: choose one of these great offers:

• A Free Appraisal • A Free Home Inspection • $1,000 Paid Towards Closing Costs

Offer Code 0101CCM

Matt Witt

NMLS #1638881 Reverse Mortgage Specialist

720-458-4034

MattW@SilverLeafMortgage.com

Matt Witt: Reverse Mortgage Expert! Listen to: The Reverse Mortgage Show Hosted by Matt Witt Legends 810 and 94.3FM, 670 KLTT, 100.7FM KLZ and 560 KLZ or see us live on Colorado’s Best KWGN CW2 & Fox-31, or Colorado & Company KUSA 9News

Hospital’s high-tech surgery program expanding

BY THELMA GRIMES TGRIMES@COLORADOCOMMUNITYMEDIA.COM

Already serving as one of the state’s leaders in robot-assisted surgery, Sky Ridge Medical Center in Lone Tree is making a major investment in the future by building a special robotics unit.

Construction in the Lone Tree hospital’s Evergreen building is currently underway for an outpatient robotic surgery center covering more than 26,000 square feet, slated to open in 2022.

Sky Ridge CEO Kirk McCarty said robot-assisted surgery allows doctors to perform a variety of procedures with more precision, fl exibility and control than is possible with conventional techniques. Robotic surgery is usually associated with minimally invasive surgery, which can be performed through tiny incisions.

In a robot-assisted procedure, surgeons operate on patients using a camera arm and mechanical arms that have surgical instruments attached to them. The surgeon controls the arms while seated at a computer console near the operating table. Through the technology, the surgeon has a view through a high defi nition, magnifi ed, 3D lens.

Sky Ridge Vice President of Operation Will Bertram said the $20 million expansion will have four operating rooms, eight pre-op rooms and six recovery rooms.

In the new department, surgeons will focus on specialty procedures in gynecology, bariatrics and urology.

Bertram said the new department is being built directly next to the gynecology department because of the number of procedures being done for women. Robotic technology has emerged in the last decade to treat issues with the female reproductive system, Bertram said. The robots are able to more precisely remove tumors and address issues with less complications, he said.

Jeff James, a gynecological oncologist at Sky Ridge, said robotics in surgery has continually evolved over the last decade, noting that the ease of use, decrease of set-up time and patient success are all good reasons for the hospital to expand the program.

“Currently, one of the problems is availability,” James said. “With the equipment we have now, we have to schedule surgeons and patients and make sure the robots are available. That is because they create the ability for far more effi ciency and better-quality services for the patient.”

In the past, James said preparing for a robotic-assisted surgery could take more than an hour to put the machine together. Now, with the equipment currently used at Sky Ridge and the future expansion, surgery prep takes around 10 minutes.

In gynecological procedures, James said the advanced robots allow easier access for specialized procedures and with the smart technology on the computer, the robot can correct a surgeon’s hand movements quickly, rotating from left to right or right to left as needed, James said.

McCarty said in looking at where healthcare is headed, it makes sense to expand an area where technology allows surgeons to be more precise, cuts down on recovery time, allows patients to be sent home sooner and has less risk of complications.

“It allows us to take on a special niche to drive the positive outcome for patients,” McCarty said. “Sky Ridge is quickly becoming one of the busiest hospitals for robotic procedures in Colorado. We want to become a regional service center offering these procedures. This expansion will allow us to have the largest fl eet of robots in the Rocky Mountain region.”

The need for robot-assisted procedures has steadily increased at Sky Ridge, Bertram said. After using one robot for several years, he said, the hospital invested in six more machines in 2015.

As information about robotics has become more readily available, Bertram said people are seeking out facilities that offer the technologically advanced services. Sky Ridge has not only treated patients from across the entire Front Range, but also statewide and from neighboring states, he said.

When robot-assisted surgeries started in 2013, Bertram said, Sky Ridge surgeons performed 250 procedures. In 2021, Sky Ridge will do 1,300 robot-assisted procedures, he said.

McCarty said Sky Ridge administrators would never have started discussing the expansion concepts and designs of the new center in 2018 if it were not for the “exceptional” surgeons working at the hospital.

“All the robots and pretty space would mean nothing without the great surgeons we have here,” he said. “We have a rock star staff taking care of our patients.”

Sky Ridge Medical Center Vice President of Operations Will Berton and Linda Watson Kolstad, the hospital’s vice president of marketing and public relations, discuss the equipment and technology required to build a new robotics surgery center.

PHOTO BY THELMA GRIMES

A return to authentic.

The Schweiger Ranch Austrian Christmas.

Saturday, December 4th, 11-5 pm.

Welcome all to this free event, celebrating Austrian food and drink, holiday lights, Santa Claus and real reindeer. Inspired by the genuine holiday traditions of the Austrian immigrants who settled Schweiger Ranch. “Frohe Weihnachten!”

10822 S. Havana Street, Lone Tree. Just east of I-25, south of RidgeGate Parkway.

Weekly Carrier Routes Available

Ask about our sign on bonus! Castle Rock, Parker & Highlands Ranch Area

• Part-time hours •Adaptable route sizes • No suit & tie required!

Previous carrier experience encouraged; reliable vehicle and email access, required.

PROGRAM

75% 75%

Your contribution helps our journalists cover your community. We can’t do it without YOU.

“Thank you for your newspaper, it’s the only paper I get and it’s got most everything I need in it. The voting info is always helpful.” “News is so important now, especially local news. You folks are doing such a vital job for our community and democracy. Your quality of reporting and excellence in writing is the bulwark against misinformation and conspiracy that has invaded our need to know. You are the light of fi ght in the darkness.”

“Thank you for your commitment to our community through reporting on local topics.”

SCAN TO CONTRIBUTE!

Reliable, local news is not free.

We need your support to keep you informed about Highlands Ranch, and provide this necessary public service. Help us reach our fundraising goal with our four convenient contribution options, mail, phone call, online or scan the QR code. Those who contribute $40 or more will receive unlimited digital access for the year. Visit us online at HighlandsRanchHerald.net to create your account. As always, thank you for being a loyal reader and we wish you well this holiday season.

Linda Shapley is the publisher of Colorado Community Media and can be reached at lshapley@coloradocommunitymedia.com.

34%

50% 50%

25% 25%

To contribute online: coloradocommunitymedia.com/ReadersCare To contribute by phone: Please call 303-566-4100 • Monday-Friday 9am-4pm Please call 303-566-4100 • Monday-Friday 9am-4pm

Should you choose not to contribute, you will still receive a free copy of the Highlands Ranch Herald. But, for those who do contribute, you will be contributing toward quality, trusted journalism in your hometown. To contribute by mail please detach the form below and return with your contribution: Highlands Ranch Herald, Attn: VC, 750 W. Hampden Ave., Ste. 225 Englewood, CO 80110

Name: ______________________________________________________________________

Address: _____________________________________________________________________

City, State, Zip: _______________________________________________________________

Email: ________________________________________Phone:_______________________

We do not sell or share your email or personal information.

Check to receive Newsletters, Breaking News, Exclusive O ers, & Events/Subscriber Services

Check

Please make payable to the Highlands Ranch Herald

Credit Card/Check Number: __________________________________________________

Contribution & Carrier Tip:

Enclosed is my one-time voluntary contribution of $______ Also please tip my carrier $______ Total Amount Enclosed $______