6 minute read

SEE PROJECT

school and I was giving a presentation and both of my breasts were leaking and my teacher had to tap me on the shoulder to let me know,” Omenai said. “I was so confused because no one told me that after — because I was 17 weeks — no one said that afterwards my body would respond as if I delivered a child.”

Her personal experience is the main reason she joined the board of directors for the Colorado Doula Project, a nonprofi t that helps guide people from all over the country to safe abortion access in the state of Colorado.

“We provide abortion transportation to and from procedures, when there is fi nancial assistance needed with procedures, and food and lodging for when people are here in Colorado to receive those services and medical support,” Omenai explained. “Most of the people we serve are people of color.”

The organization also helps provide support for people after abortions.

“There are nuances that women need to know. When you’re nonbinary there are things you need to be prepared for when you don’t navigate the world in a cis [gendered] way,” Omenai said. “There are ways to protect yourself that should be loving and comforting and gentle.”

After Politico published a leaked draft opinion from the United States Supreme Court that showed the court’s conservative justices are prepared to overturn Roe v. Wade, Omenai wants to get the word out about the Colorado Doula Project.

“We are constantly saying, ‘If you need help, we know where the [abortion] bans are.’ We are making phone calls, calling our friends, and posting all over social media. We are using every platform and every method at our disposal to get the word out,” she says.

The draft opinion obtained by Politico would not make abortion illegal nationwide, but by overturning Roe the court would be allowing states to dramatically restrict, or outright ban, access to abortions. This would not be the case in Colorado, where Democratic lawmakers recently passed a law codifying abortion access in the state. As Kaiser Health News recently reported, Colorado is one of the few states without any restrictions on when in pregnancy an abortion can occur and is one of the few states in the region without a mandatory waiting period of up to 72 hours after required abortion counseling.

Omenai feels that no matter what, no one should have to go through it alone.

“A lot of people don’t discuss that sometimes you need grief counseling. Some people experience grief, and some don’t. Even when you’re perfectly happy with your choice and the choice was right for you, you might still experience grief and you might need to know how to handle that,” Omenai said.

She says the Colorado Doula Project will continue to fi ght to ensure access to safe abortions, especially for the most vulnerable.

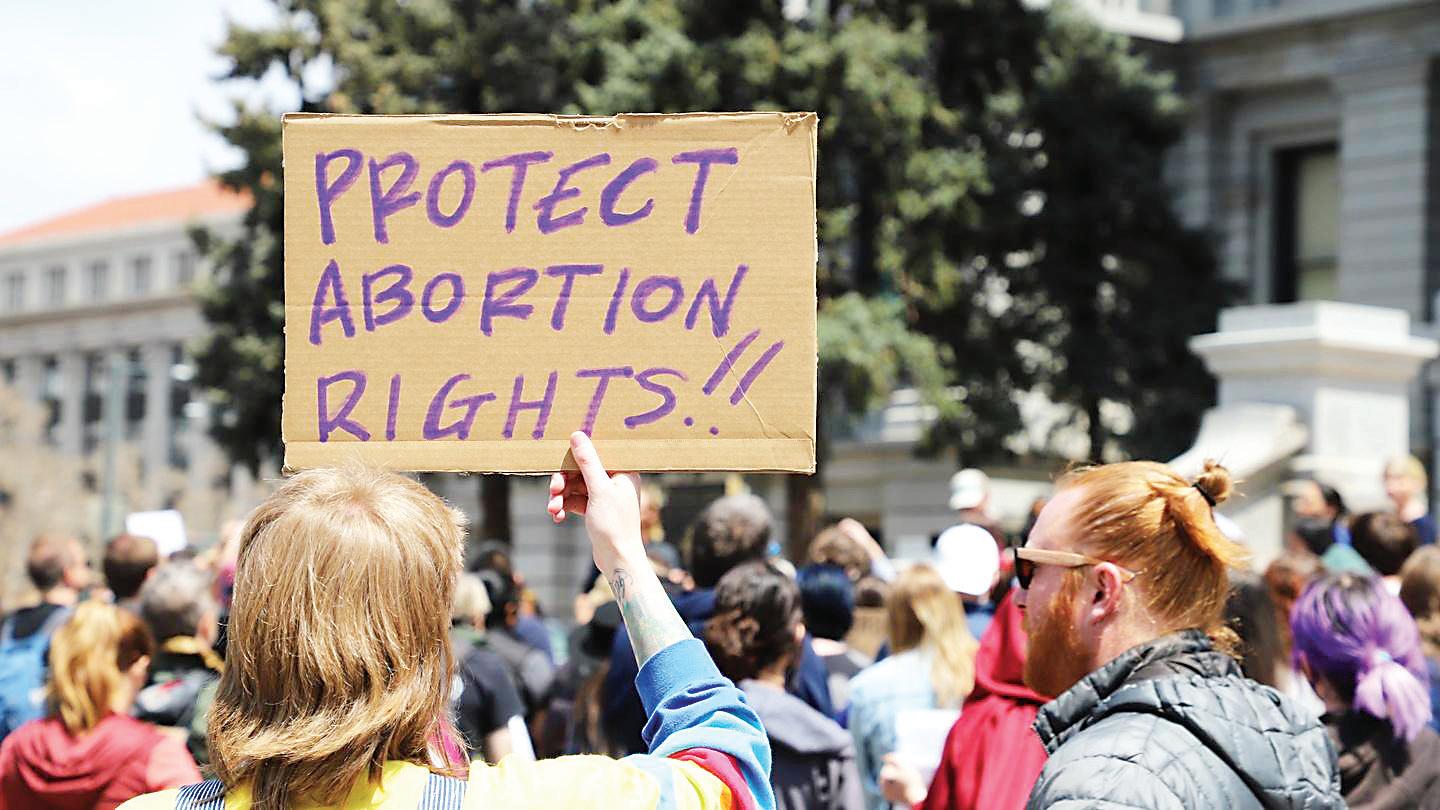

Coloradans gathered at the State Capitol Tuesday, May 3 in support of safe, accessible and legal abortions. COURTESY OF ROCKY MOUNTAIN PBS

This story is from Rocky Mountain PBS, a nonprofi t public broadcaster providing community stories across Colorado over the air and online. Used by permission. For more, and to support Rocky Mountain PBS, visit rmpbs.org.

Your Financial Assistance Use a Reverse Mortgage to Fund Retirement

by Matt Witt

Are you a homeowner 62 or older? Have you ever found yourself having to choose between buying food or medicine? How about having to put o a medical or dental procedure due to limited funds? If you have been faced with having to make a tough nancial decision of any kind stop reading and call 720-458-4034 to speak to the local reverse mortgage experts at Silver Leaf Mortgage right now. Did you know the proceeds from a reverse mortgage are tax-free money that may be used in any way you choose? For some it’s the instant, lifesaving help needed today. For others, it’s the safety net for your future or the unplanned life events like medical emergencies that may arise. Qualifying for a reverse mortgage, it’s simple and easy. Quali cation is based on these important factors: • You (the borrower) must own the home. • You must be 62+. (A non-borrowing spouse may be under 62.) • e home must be your primary residence (you live there at least six months and one day per year).

According According to author Wade Pfau, PhD, CFA, nancial planning research shows retirement planning should include a reverse mortgage; for most people, their home represents 70% of their assets. A reverse mortgage is a retirement tool that can be incorporated as part of an overall retirement cash ow plan. Coordinating retirement spending from a reverse Even if you have bad credit, have had a bankruptcy, or a foreclosure, you are not disquali ed. In most cases there is a remedy for past credit problems. So, don’t mortgage reduces strain on the investment think you can’t get the help you need. portfolio. is helps manage the risk of Let us help you navigate these di cult having to sell assets at a loss during market nancial times, call your local experts downturns. at Silver Leaf Mortgage today at Reverse mortgages can actually sidestep 720-458-4034 to see if a Reverse this risk by providing an alternate source of Mortgage is right for you. cash during market declines, creating more opportunity for the portfolio to recover. Additionally, opening a reverse mortgage early—especially when interest rates are low—ensures the principal limit (loan balance plus remaining line of credit) will continue to grow throughout retirement. To qualify for a government-insured reverse mortgage, at least one borrower must be 62, the home must be your primary residence, and you should have 40–60% equity. Most types of properties are acceptable. A Reverse Mortgage is also a non-recourse loan, meaning even if your home loses value due to a market downturn, you or your heirs can never be “under water.” And just to clarify—because I hear this a lot—you are the only one who owns your home and its equity. e bank does not. e reverse mortgage is not repaid until the last borrower leaves the home. You owe it to yourself to get the facts. Call me today to see if a Reverse Mortgage can help you fund your retirement. I promise we will never pressure you or guide towards a product that won’t meet your needs. We’ll simply answer your questions and help you determine if a Reverse Mortgage is right for you. Matt Witt, NMLS #1638881, President at Silver Leaf Mortgage in Centennial.

* e homeowner is still responsible for applicable property taxes and homeowner’s insurance, as well as maintaining the property.

Colorado’s #1 Reverse Mortgage Broker Colorado’s#1 Reverse Mortgage Broker

Mortgage Company Reverse Mortgage Company Mortgage Agent Call within the next 30 days and choose one of these great offers: choose one of these great offers:

• A Free Appraisal • A Free Home Inspection • $1,000 Paid Towards Closing Costs

Offer Code 0101CCM

Matt Witt Matt Witt

NMLS #1638881 President and Sr. Lending O cer Reverse Mortgage Specialist Silver Leaf Mortgage, Inc. 720-458-4034 2154 E. Commons Avenue, Suite 342 MattW@SilverLeafMortgage.com Centennial, CO 80122 O ce 720-458-4023 • Fax 303-362-7812 Matt Witt: Reverse Mortgage Expert! Listen to: The Reverse Mortgage Show Hosted by Matt Witt Legends 810 and 94.3FM, 670 KLTT, 100.7FM KLZ and 560 KLZ or see us live on Cell Phone 303-888-4531 Colorado’s Best KWGN CW2 & Fox-31, or Colorado & Company KUSA 9News mattw@silverleafmortgage.com • www.SilverLeafMortgage.com