12 minute read

Colorado may force new homes in wildfire-prone areas

Bill would create new board

BY MICHAEL BOOTH THE COLORADO SUN

Fire chiefs fearing disaster from wild res where open space meets urban areas are joining lawmakers to push for a statewide board with power to de ne so-called wildlandurban interface danger zones and impose preventive building codes on local governments.

A bill for the mandatory codes board is set to be introduced this week by Sen. Lisa Cutter, a Littleton Democrat, but is already raising opposition from local-control advocates who are battling potential statewide impositions on multiple fronts, including a ordable housing. Democratic supporters abandoned a similar idea introduced late in the 2022 legislative session after Republican opponents to the policy threatened to block other measures in protest.

Fire o cials from Colorado Springs to Fairplay are lobbying hard for the uniform codes, citing the 2021 Marshall re in Boulder County, the East Troublesome re that swept through Grand County in 2020, and the 2012 Waldo Canyon re in Colorado Springs as dire wake-up calls to fast-growing communities on the edge of wild re-

Dear Davis Schilken, prone landscape.

“Fires aren’t jurisdictional. ey cross borders,” said Colorado Springs Fire Chief Randy Royal, who is also an o cer in the Colorado State Fire Chiefs.

Recent wild res destroying hundreds of homes in suburban and exurban areas of Colorado have spread through embers blowing o wooden shake roofs, or down into excessive roof venting, Royal

I just recently proposed to my girlfriend (now fiancée) and now her parents insist the two of us sign a prenup before we get married. How can I appease my in-laws while still protecting my rights?

Sincerely, Perplexed by a Prenup

Dear Perplexed by a Prenup,

First off, let us congratulate your fiancée and you on your pending marriage. We hope your wedding day is as amazing as your life together will be!! Now, let’s get down to the business of nuptial agreements, which can either be done prior to or after marriage.

Marital agreements, both prenuptial and postnuptial, are a written contract executed between a couple to specify what will happen to the couple’s assets in the event of divorce or death.

Even if you build a happy, healthy marriage, one spouse will likely outlive the other. Marital agreements can give partners peace of mind about the financial future.

When you’re about to get married, divorce is the last thing on your mind. However, the reality is that between 40 and 50 percent of first marriages end in divorce. If you bring significant assets to your marriage or if your fiancée has significant debts, a pre-nuptial agreement is an important way to protect yourself financially. The attorneys at Davis Schilken, PC can draft a prenuptial agreement that details the assets and debts of both parties to be married and explain how property will be divided and support handled in the event of death or divorce. The agreement can encompass children’s and grandparents’ rights, if desired.

There are a few requirements that a nuptial agreement must meet before it becomes valid. These include the following conditions -

• The nuptial agreement must be written, signed, and notarized.

• The agreement must include valid disclosure of assets and financial obligations between both parties.

• Threats, force, or emotional duress must not have influenced the creation of the agreement.

• Terms of the agreement must not appear unethical or lacking fairness.

If nuptial agreements aren’t drafted correctly, they may do nothing but complicate things further. Unfortunately, just because you have created an agreement in writing doesn’t mean that it is presumed to be valid or enforceable. Therefore, it’s crucial that you have a nuptial agreement reviewed by a qualified lawyer to ensure everything is executed properly.

Contact the Davis Schilken, PC team with any of your Estate Planning needs (303) 670-9855. We offer no obligation in person or virtual meetings. We make estate planning simple!

Visit our comprehensive website for more tools www.dslawcolorado.com said. Uniform preventive building codes could outlaw shake roofs and limit vents, protecting re ghters, residents and property from blazes that explode on high winds.

“Wild res are a huge problem, and we have to come at them with every tool we have. I’m taking all my cues from the re chiefs,” said Cutter, lead sponsor of the bill that would create the “Wild re Resiliency Code Board.”

“We can harden our homes,” Cutter said. “We obviously continue to build in the WUI, and we need to be responsible about that.”

Local governments who want to retain control over building code decisions will lobby hard against the bill, already registering their opposition and at the very least looking to soften the draft language.

“We have a number of concerns with what’s being proposed,” said Heather Stau er, legislative advocacy manager for the Colorado Municipal League, which lobbies at the Capitol for towns and cities.

“ e needs of a community on the Front Range may not be the needs of another community in the mountains,” Stau er said. “It’s appropriate for local governments to have input on these decisions.”

Gov. Jared Polis’ o ce indicated he could support the idea with some changes.

“ e Governor’s team is working with the sponsors and stakeholders to ensure legislation ts with his goals of making Colorado safer and reducing home prices,” Polis’ o ce said, in a statement on the draft language.

Local governments also worry statewide codes would create expensive standards for homeowners and homebuilders, exacerbating housing shortages. ey also complain the building code would represent an unfunded mandate on local authorities, who would have to inspect and enforce the rules.

Local o cials might consider supporting a statewide board creating model codes that cities and counties could choose to adopt, Stau er said. Negotiations have also oated the idea of a code board de ning a “menu” of tighter codes that local governments could mix and match to suit their condiCutter rejects that idea out of

“ e menu idea won’t y,” she said. “ is is long overdue, to get on the same page.” e other lead sponsors for the mandatory codes bill include Sen. Tony Exum, D-Colorado Springs, and Rep. Elizabeth Velasco, DGlenwood Springs. e code board legislation would: e codes would apply to new residential buildings; how much renovation of an existing home would trigger a mandatory code update is still to be negotiated. e re chiefs’ association says members are ready to push back against local o cials’ arguments that they understand the wild re threat and will make changes.

First require the appointed board to set the geographic boundaries of wildland-urban interface zones across the state where new codes would apply.

Adopt minimum building and landscaping codes for local governments to pass, though cities and towns could make them tougher than the state minimum.

Establish a petition process for local governments to appeal and modify the codes.

Allow the governor to appoint 10 members of the board, the legislature to appoint 10 more members, and name three subject matter expert board members participating ex-o cio.

“ en why haven’t you done something already? Really simple question,” said Garry Briese, executive director of the Colorado State Fire Chiefs. “As a result of the inaction of local jurisdictions we have a statewide problem that doesn’t respect political boundaries, that is incredibly destructive, and something has to be done.” e Marshall re at the end of 2021 burned nearly 1,100 homes and caused more than $2 billion in damage as it swept east from Marshall Mesa through Superior and Louisville. ough a report on the re’s origins is still pending, the wild re was fanned by 100 mph winds that pushed embers across grassland and into subdivisions bordering open space. e Waldo Canyon re destroyed about 350 homes and forced thousands to evacuate from western Colorado Springs, Woodland Park and Manitou Springs, causing $450 million in damage. It was followed the next year by the Black Forest re in more wildland-urban terrain northeast of Colorado Springs, resulting in nearly 500 lost homes. said what I had was the best thing I could have had when you’re losing your sight.”

East Troublesome in the fall of 2020 burned close to 200,000 acres and 366 houses, with $543 million in damage. Winds whipped embers over the Continental Divide, burning large portions of Rocky Mountain National Park and forcing evacuation of Estes Park before it was stopped in Beaver Meadows.

Closed-circuit TV has been another helpful tool. Its camera enlarges things, making them easier to see and read.

“It also has OCR — Optical Character Recognition — that can scan a printed-out page and read it to you,” Weinberg said.

Weinberg is a fan of the Colorado Talking Books Library at 180 Sheridan Blvd. in Denver’s Barnum West neighborhood. He downloads books to a ash drive and listens to the narrative.

“Which is wonderful,” he said.

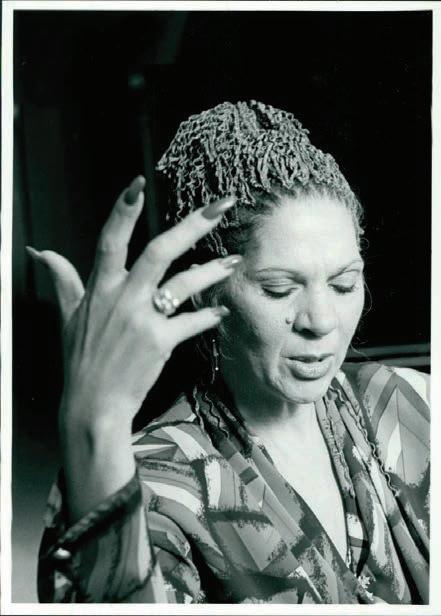

Weinberg was drawn to photography in 1965 when he took his rst photo course at George Washington High School, using a pinhole camera.

“You’d work with printed-out paper, make an image work in the dark, x it and then you’d have a print without having had a negative,” he said.

He’s still taking photos — and gave himself an assignment to shoot a large project of workers replacing all the elevators in a residential building.

“So I documented all the cranes that were there,” Weinberg said.

He gave prints of his work to some of the workers.

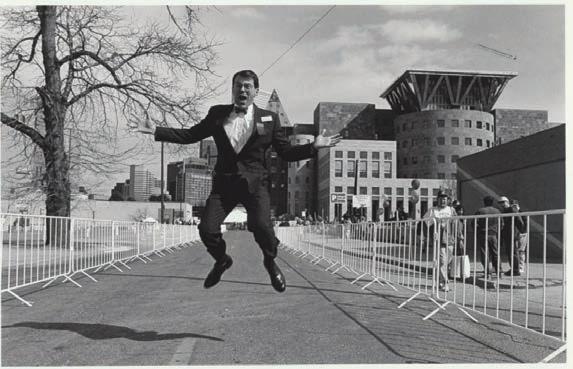

Jeremy Morton, public engagement manager at History Colorado, praised Weinberg’s innate photogra- phy skills.

“He has this ability to take closeup portraits of people in a way that intrigues them and highlights their humanity, and see into the person, even if you don’t know the back story,” Morton said. “He’s considered one of the preeminent photographers in Denver in the 1980s and 1990s. e work he produced during that time is considered (to be) like the documentation of Denver.” enough places for everyone to live.

“The World in Denver: The Photography of Robert Weinberg” exhibit is now on display at the History Colorado Center, 1200 Broadway, in Denver. The exhibit will be up until January 2024. To learn more, visit historycolorado.org.

To view more of Weinberg’s photos online, visit weinbergphotographics.com.

A look at the data e majority of households in America are homeowners, with ownership rates at about 65%, according to the U.S. census. Colorado’s not far o from the national numbers, with homeownership rates inching up in recent years to 65.9% in 2021. A recent low was 62.4% in 2016 while the high of 71.3% was in 2003. e 30-year xed mortgage rate was 6.45% on ursday, after hitting a high of 7.2% in October, according to Mortgage News Daily.

A trend happening nationwide and in Colorado for several years has been that fewer houses are being built each year. e National Association of Realtors’ data guru Nadia Evangelou calls it a housing market slump with the number of new housing starts o by 1.5 million a year. She expects that atness to continue in 2023 as the industry deals with ongoing material bottlenecks.

But another thing limiting potential homeowners from buying a house is interest rates. When they shot up last year, homebuyers had to spend a lot more to buy a lot less.

In other words, at 3% (where mortgage rates were in January 2022), the monthly mortgage payment on a mid-priced home was $1,410, according to the National Association of Realtors.

At 6%, the payment jumped to $2,010.

At 8%, it would be $2,460.

Most renters can’t a ord a starter home, which NAR de nes as houses priced at 25% less than the median sales price. at puts the median price of a starter home at $321,600 in the U.S.

Evangelou, NAR’s senior economist and director of real estate research, broke it down into a chart. Keep in mind, these are national gures:

National stats on how many renters can buy a median-priced starter home right now put the number at 36%. e data comes from the National Association of Realtors.

To a ord a starter home, with a 10% down payment at a 6.1% interest rate, a buyer’s income must be $86,360 if they don’t want to spend more than one-third of their income on housing. Only 36% of renters met that income level.

In Colorado, it looks worse for renters hoping to become homeowners. NAR pulled up the similar numbers for the Denver metro area and that translated to only 14% of local renters being able to a ord to buy a “starter home,” currently at a median price of $480,000. As for a mid-priced home? e number of renters who can a ord one drops to 6%, as seen in this updated chart below:

Housing costs a lot more in the Denver metro area, compared to the U.S. e National Association of Realtors provided Denver data to e Colorado Sun so we edited the chart to re ect local numbers. While Denver incomes are higher too, fewer residents can a ord a medianpriced starter home — a mere 14%.

“It’s a double pain because they have to deal with rent prices as well as saving up for the down payment,” Evangelou said. “We’ve talked about low a ordability and low availability of homes, but when we put these two factors together, we can see what is the real impact and what challenges buyers face out there.” e number may be rising though. Leprino said he was surprised there were even that many available. “I would’ve guessed that number was below 10% last summer,” he said.

And if renters can a ord Denver’s starter home, there aren’t many available, according to data from REColorado. Currently, about 32% of the 1,015 condo or single-family home for-sale listings in Denver were below $480,000. Only 89 are for single-family homes, and only 21 are listed at less than $400,000, said Matt Leprino, a Denver-area Realtor with Remingo, who tracks the data.

On a hopeful note, the real estate industry is counting on interest rates to drop. at may not come until next year, but in ation eased a bit in December, and the Federal Reserve raised interest rates a quarter of a point in January, compared to three-quarters of a point for several months last year.

“In 2022, home sales activity dropped about 15% per month,” Evangelou said. “In 2023, we expect home sales to continue to drop but slower, like around 7% drop. And 2024 is when the housing market will rebound and we expect to have about 10% more home sales than 2023.”

Where are the workers? Not “on the couch” e pandemic put hundreds of thousands of Coloradans out of work. e state’s labor department estimates the loss at 374,500 jobs during March and April 2020. But since then, Colorado added them all back and more — approximately 466,400 jobs have been added since spring 2020 for a 124% recovery rate, according to the most recent state jobs report.

Had the pandemic not happened and Colorado’s job growth continued as forecasted years earlier, the state would have added 124,000 more jobs by now, said Patty Silverstein, president of Development Research Partners in Littleton.

But the job growth momentum we had before the pandemic is gone, Silverstein said.

“I will suggest to you that we are not going back to that pace, given the demographics, given changes in what we’re seeing in the employment base,” Silverstein said during her economic overview at the event. “I don’t think that 124,000 — our perfect pace of growth — is even going to be possible.”

However, employers say they’re still struggling to stay fully sta ed. And that shows up in a data point that ranks Colorado as the second highest state for how many available people are in the labor force. Out of all Coloradans 16 years and older, 69% are working or looking for work (the rest are retired or not looking for work). at’s 3.2 million people, which is twice as large as Nebraska’s workforce. Nebraska had the nation’s highest labor force participation rate at 69.8%, according to the Bureau of Labor Statistics.

“It’s incredibly, incredibly tight out there. And I know many of you are thinking, ‘Well, we just need to get those people to get back out and work.’ Maybe,” Silverstein said. “ ere are some of those folks across the country but they’re not here in Colorado. … People are not hanging out on the couch here in Colorado. ey are out working or actively looking for a job.” e BLS, through its job openings report, estimated that Colorado had 231,000 job openings in November. At the same time, there were roughly 113,447 unemployed Coloradans. at’s two job openings for every person looking for work.

And according to Aspen Tech Labs, an Aspen-based company that tracks job openings, three of the top four industries with job openings were among the lower-wage occupations of health care, food service and retail.

Whether renters have vacated the state for cheaper housing is a little more di cult to research beyond anecdotal evidence.

Silverstein doesn’t blame the higher cost of living for chasing away lower-income earners. It’s more so about our demographics. With a shrinking number of younger workers entering the workforce, the average age of a worker continues to get older. When the Baby Boomers retire — and all Baby Boomers will be over 65 by 2030 — that will leave a big hole in Colorado’s labor force. Even the real estate industry must gure out how to maintain productivity, she said.

“ ere’s a company coming out of Buena Vista making homes in a matter of weeks. ey’re assembling them, a factory line. We need to get creative rather than putting in however many people it takes to build a home on site, they’re doing it much quicker, much faster and at a more a ordable cost by doing it in a factory,” she said, referring to Fading West modular home factory. “We need to gure out how we can use automation moving forward to do some of that and provide productivity.” is story is from e Colorado Sun, a journalist-owned news outlet based in Denver and covering the state. For more, and to support e Colorado Sun, visit coloradosun. com. e Colorado Sun is a partner in the Colorado News Conservancy, owner of Colorado Community Media.

Here’s a year-old chart showing how Colorado’s population has changed and is forecast to change through 2050. ose 65 and over are the fastest growing segment of our population.