8 minute read

Time and permeability: meeting others on common ground

In my last column, I talked about complexity, the second in my ve-part series on our relationship with time, and how we respond to it.

is month let’s look at what happens when you move from complexity into permeability. When you become permeable, you’re heavily in uenced by the ideas of others, the world around you, and demands being made on you. You’re so saturated with what’s going on outside yourself you lose your sense of inner balance, become detached from your core, and your sense of wellbeing. You can feel isolated and likely have trouble discerning what’s working and not working in your life, which can lend to your feeling of a lack of con dence.

When it comes to decision-making, con dence isn’t something you acquire or make yourself do. It’s the result of knowing your self, having grace with limiting factors and setting strong boundaries.

Having too many projects, attending to everyone else’s needs, reading every social media meme about how to be the best, can contribute to your feelings confusion and defeat.

Here are a few ways I work with my clients so they are able to redirect their feelings of overwhelm:

Re-name confusion and call it “my options.” Confusion keeps you stuck and helpless, while having options just means there is more than one way to see your situation.

Relax and let yourself see the circumstances are unclear, not YOU.

Notice where and when your

About Letters To The Editor

Unlearn It

sense of self returns as you reframe confusion and turn it into understanding your options.

Christine Kahane

Next, bring on your decision-making power by asking yourself some questions to help you discern what is most important to you now:

Which options serve your needs now and what can be moved to the mid-and long term?

What results are you seeking?

What will you achieve if you can bundle your options?

Which options are you ready to release for good?

What boundaries will you set in order to implement them?

Answering even some of these questions will begin to set you free from the information tsunami coming toward you.

Something marvelous will start to happen — you will feel more grounded and able to tackle what’s in front of you. Your sense of self will return — you’ll feel more sure of your direction. Now, you’re inhabiting your con dence.

Coach, and owner of KAHANE COACHING (www.kahanecoaching. com), located at 30792 Southview Drive/Suite 206 in Evergreen, CO. For more information about coaching, or to write-in a question for UNlearn it! send your inquiries to christine@ kahanecoaching.com.

Colorado Community Media welcomes letters to the editor. Please note the following rules:

• Email your letter to kfiore@coloradocommunitymedia.com. Do not send via postal mail. Put the words “letter to the editor” in the email subject line.

• Submit your letter by 5 p.m. on Wednesday in order to have it considered for publication in the following week’s newspaper.

• Letters must be no longer than 400 words.

• Letters should be exclusively submitted to Colorado Community Media and should not be submitted to other outlets or previously posted on websites or social media. Submitted letters become the property of CCM and should not be republished elsewhere.

School District has faced similar pressures. Superintendent Alan Kaylor said the annual salary for a rst-year teacher in the district is about $41,000.

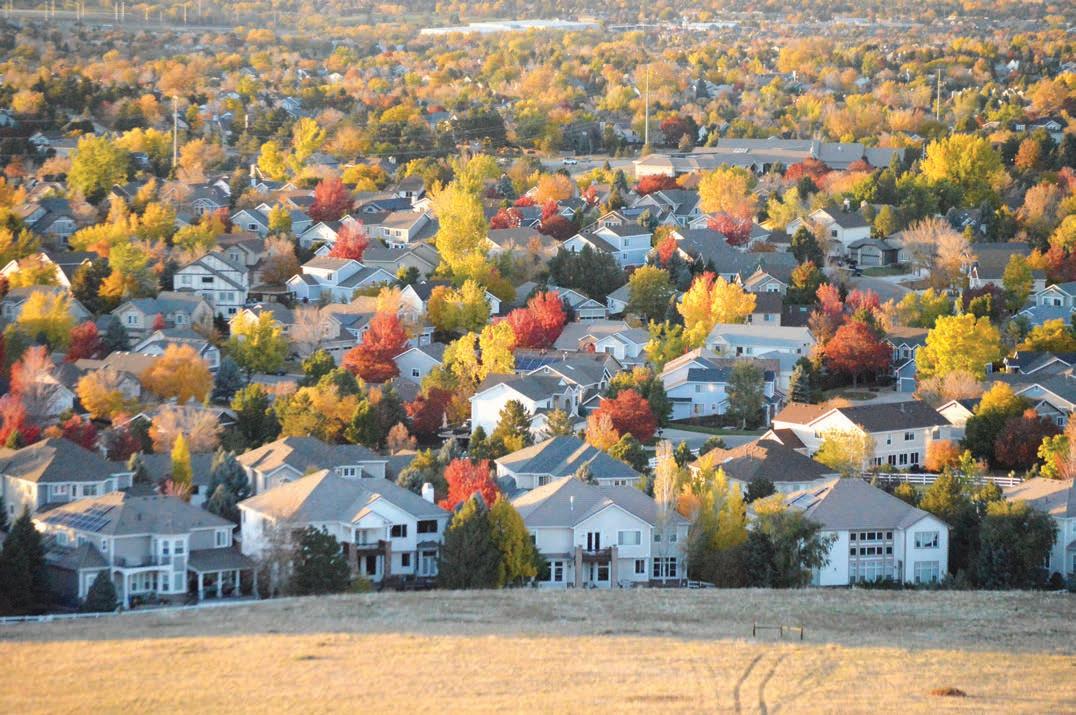

Kaylor bought his home in 1995 for $72,000. He said a home across the street from his was recently listed at $685,000. e price of that house across the street rose more than four times faster than the pace of in ation, according to the U.S. Bureau of Labor Statistics’ in ation calculator.

“How can any family a ord that?” he asked. “Something has to give. After a while, you have to wonder how long people will tolerate living on teachers’ wages.”

Even for some residents making a larger income, housing remains elusive.

West of Denver, in Evergreen, husband and wife Bill and Charm Connelly bring in a combined sixgure salary.

Bill Connelly is an insurance agent and blackjack dealer for a Black Hawk casino. Charm is the front-house general manager for Cactus Jack’s, a bar and restaurant in Evergreen. e two rent a three-bedroom home and are struggling to save for a house. Even downsizing to something smaller, they said, would likely increase their spending by roughly $400 a month. e two currently pay $2,200 per month on rent.

“I feel like a failure. I nally get a good full-time job making great money, and eight years ago, 10 years ago, we could easily have gotten something,” Bill Connelly said.

“Between the two of us, I see what we make,” Charm said. “We are making decent money, but I want to be able to save money and not blow it all on rent.”

For Adam Galbraith, a Cactus Jack’s bartender, the only way to keep his rent a ordable is to live with others.

“ e only reason I’m able to save money is because it’s a 1,100-square-foot place and we crammed four people in it,” Galbraith said, adding monthly rent is about $1,500. “If you’ve got roommates, that’s the only way you’re going to save money.”

A housing ‘limbo’

Near the end of 2019, Laney, the Littleton bartender, was beginning to feel more con dent about reaching his goal for a down payment. He’d paid o his car and credit-card debt and said he “worked hard to keep it that way.”

His savings account was beginning to bulk up. en came COVID-19.

Years of careful saving and unyielding restraint on spending evaporated in months. Laney was forced to drain his savings account during the beginning of the pandemic amid lockdowns. He received nothing from the federal government’s Paycheck Protection Program, though he would gain $3,200 from stimulus checks in the months to come. Still, he was hanging on.

It was “the community around Jake’s, our regulars, who kept us alive,” Laney said.

“I was there every single day, for damn near a year,” he said, with the bar able to do curbside orders even as its indoors remained shuttered.

Before the pandemic, Laney estimates he brought in about $4,000 each month before taxes. By the end of the month, after paying for rent, utilities, groceries and gas, he would be left with just $200 to $300, which usually went into his savings.

Living that way was “terrifying,” said Laney, who always felt he could be on the edge of losing his housing should he have a bad month. e pandemic only exacerbated the uncertainty.

As his savings depleted, Laney’s dream of owning a home never seemed further away.

But his resolve didn’t waver and he used what federal relief he had to rebuild his savings because, as he put it, “I had a goal: I wanted a house. When I came out of the tunnel I knew what I wanted.”

By 2021, he started looking again. A townhome might come up on the market — far from perfect, but within Laney’s means — and he would ready himself to put down an o er. It never was enough.

“Someone comes in and puts 20k cash on the o er, or 30k or 40k,” Laney said. “I went through about a year and a half of that and I knew in my head I was not going to be able to get a house.”

A real-estate agent who came into his bar told Laney to apply for a $300,000 bank loan. He had good credit, the agent told him, and would be a shoo-in for the money.

“ ree hundred thousand dollars does not get you a townhome,” Laney thought to himself.

He was frustrated. More than frustrated. He felt depressed.

“I’d done everything right, everything I was supposed to do and it still didn’t matter,” he said. “I’m just stuck, like the hundreds of thousands of other people, in limbo.” at did not come with the guarantee of a home. Laney was in a line of people just like him and demand far outweighed supply. Number 10 was his position. Who knew how many more were behind him, he thought. en it happened. Laney was made an o er, a 1,275-square-foot detached home near Ketring Park in central Littleton valued at $285,000, roughly a third of what similar properties sold for.

Laney’s luck began to turn near the end of 2021 when he heard there were about to be dozens of single-family homes for sale in Littleton for less than $300,000. He thought it was too good to be true.

‘We can’t all win the lottery’ at year, South Metro Housing Options, which manages a ordable properties throughout Littleton, sold 59 of its single-family homes to Habitat for Humanity of Metro Denver, which pledged to renovate the units and sell them at a belowmarket price.

Laney’s hourly wage had slightly increased since the pandemic from $8 to $10, though 90% of his income still came from tips, he said. Still, Laney believed he met the nancial requirements for a Habitat home, which would only sell to people who earn no more than 80% of the area’s median income.

But when Laney applied to be on a waitlist at the beginning of 2022, he was quickly denied. He was told his income, roughly $56,000 when he applied, exceeded the cap by less than $1,000.

Laney said he was actually making less than that, about $54,000, but because Habitat counted his “unrealized interest gains,” such as money held in stocks, Laney was over the threshold.

Habitat was also only looking at the income of recent months, Laney said, rather than his income over the past year. is made it look like he made more than he did because his monthto-month income would uctuate dramatically based on tips.

He applied again and was denied again, this time for making just $300 more than the cut-o . But, a slow month at work turned out to be a good thing. His income dipped just enough that by the third time he applied he made it on the waitlist.

“I can’t even express how happy I was,” Laney said. “I’ve been living and serving this community for 10 years and I want to live here.”

Still, the program has some drawbacks compared to traditional homeownership. Laney cannot build as much equity as many of his neighbors because he does not own the property the home sits on. Instead, it is owned by something called a land trust — a collection of entities.

“ e beauty of the land trust is it removes the cost of the land from the equation from the cost of the home,” said Kate Hilberg, director of real estate development for Habitat for Humanity. “It allows the homeowners to pay on that mortgage for that home and improvements to that home but not the land.”

Land trusts are crucial tools organizations like Habitat use to lock in the a ordability of homes even as property values rise elsewhere. e owners of these units will see some equity from their homes, Hilberg said, about 2% each year. But it won’t be enough to match the likes of homeowners who have used their growing property values to build decades of generational wealth.

“A lot of families use this as a starter home option and they do gain enough equity and stability to turn that into a down payment on a home in the open market,” Hilberg said of homes under land trusts.

But fathoming a concept like equity is a luxury for those who still can’t buy a house on the market, Laney said.

While he’s thankful for what Habitat did for him, he fears the few dozen homes it manages in Littleton can only go so far to meet the demand of hundreds, if not thousands, of residents who have struggled as he has.

“ ere isn’t enough income-based housing for people … the people who live and work in this community can’t a ord a house,” Laney said. “We can’t all win the lottery.”

Colorado Community Reporters Andrew Fraieli, Steve Smith, Tayler Shaw and Ellis Arnold contributed reporting to this story.