2 minute read

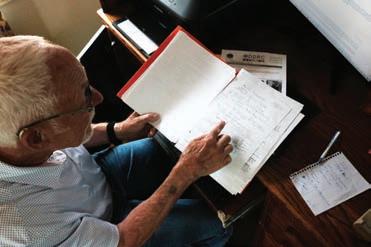

George Vonesh shows handwritten math problems calculating payment standards, income levels and his grandson’s voucher subsidy — complex calculations required to find his grandson a home. PHOTO BY NINA JOSS

people with vouchers, there’s no clarity about whether a minimum income requirement applies to the whole rent, or just the portion of rent a voucher holder is paying out of pocket. is legal blurriness has created a situation where landlords can reject a voucher holder for not making three or more times the full rent amount in income.

A new law rough months of lobbying and testifying, the Colo- rado Coalition for the Homeless and the Colorado Poverty Law Project worked with legislators on a new law this year, Senate Bill 23-184, that addresses income requirement barrier for voucher holders. It will go into e ect in August. e Colorado Apartment Association, a leading state group for landlords, was a vocal opponent of the bill. Spokesperson Drew Hamrick said the income requirement cap — which will allow people to spend 50% of their income on rent — will set tenants up for failure.

“It caps the minimum income requirement at two times the cost of rent,” Wilde said.

“Anyone signing a contract that they’re promising to pay that much of their income in rent is going to default under it,” he said. “No one can afford to do that.”

Hamrick said landlords do not care about the source of a tenant’s money — but they care that they get paid.

In landlords’ eyes, he said, the housing voucher program adds the risk of additional expenses they might not be compensated for. ese potential expenses include rent lost while o cials inspect a unit to see if it meets federal standards. He added there are other risks, like the chance that a tenant might not be able to pay for repairing property damage.

Instead of mandating that landlords accept vouchers, Hamrick said, legislators should work to make the program more nancially attractive for landlords.

He said the new cap is not a sustainable decision for rental housing providers, who will have to accept tenants more likely to default on rent. He added that more defaults would likely make rents rise across the market over time.

“ e Colorado legislature has substituted their own business judgment for the judgment of the entire market and made a bad business decision here,” he said.

Regenbogen, however, said he thinks people paying half their income on rent will still be able to make ends meet. Low-income people, he said, have always had to be resourceful — and housing is a necessity they deserve the opportunity to have. requirement, been holders Hope is income generally of vast

“(Paying half of one’s income on rent is) not ideal, but what’s worse was the previous status quo where if people weren’t earning an arbitrary multiplier of what rent is, then they could very possibly nd themselves either in the homeless shelter or on the street,” he said.

He added that the new number re ects a reality in Colorado — where more than half of households are rentburdened, meaning they are paying more than the recommended 30% of their income on rent, according to recent U.S. Census Bureau data.

For people with vouchers, the new law also clari es that minimum income requirements must only apply to the portion of rent the tenant pays out of their own pocket.