14 minute read

The CPA Supply: What’s Behind the Downward Trend?

BY NATALIE ROONEY

In June 2021, the Illinois CPA Society (ICPAS) released the findings of its groundbreaking research about the decreasing supply of new CPAs. The report, Decoding the Decline, took a deep dive into the responses from more than 3,100 accounting students, graduates, and professionals to reveal the top challenges, perceptions, and who impacts an individual’s decision to pursue the CPA designation. Now that we have the results, where do we go from here?

DIGGING INTO THE DATA

The fact that the number of accounting students is declining isn’t new information. The most recent AICPA Trends Report from 2019, showed projected bachelor’s, master’s, and Ph.D. accounting enrollments were down 4 percent, 6 percent, and 23 percent in 2018, respectively. And the number of new CPA Exam candidates hit a 10-year low. At the time, the AICPA suggested the continued declines were being driven by “both economic conditions and an expansion of the alternatives available” to potential accounting students who are “opting to enter or remain in the workforce in lieu of pursuing an advanced accounting degree or to pursue other avenues for advanced education.”

What is new information, however, comes from the ICPAS report that reveals the underlying reason behind the declining trends: young professionals who do not plan on becoming CPAs said they aren’t doing so because “they feel they can be successful in their anticipated or chosen careers without it and ultimately believe any value the CPA credential holds is outweighed by its lack of relevance to their personal endeavors and the time commitment necessary to obtain it.”

Additional key findings from the ICPAS report: • The costs associated either with obtaining the additional credit hours to meet the educational/licensing requirements or preparing for and taking the CPA exam were not the top barriers cited by any respondent category. • The likelihood of becoming a CPA drops dramatically after age 22. • Many respondents do not have an interest in pursuing a credential at all. • Accounting, auditing, and tax preparation are the words most associated with the CPA credential, further narrowing the credential’s scope and attractiveness. • Respondents do not see their employers or prospective employers supporting or requiring the CPA designation.

YEARS IN THE MAKING

ICPAS President and CEO Todd Shapiro says the profession’s pipeline has been a topic of discussion for a good part of the last decade. “If you look at the AICPA Trends report over the past seven or eight years, we see an increasing number of accounting majors but a flattening in the number of first-time exam takers. That is a leading indicator of what the pipeline will look like. That flattening means you have a lower percentage of your accounting graduates sitting for the exam. That piqued our interest.” In 2016, it was announced that there would be significant changes made to the CPA exam for 2017. The number of first-time exam takers spiked. “That spike was 100 percent driven by the change coming for the 2017 exam,” Shapiro says. The spike lulled some into a false sense of security, but when the numbers dropped again in 2018, it got everyone’s attention. Shapiro says two successive drops had not occurred in at least the last fifteen years. “It really got us thinking about what was going on. Why is this number continuing to fall?”

2021 SPECIAL FEATURE

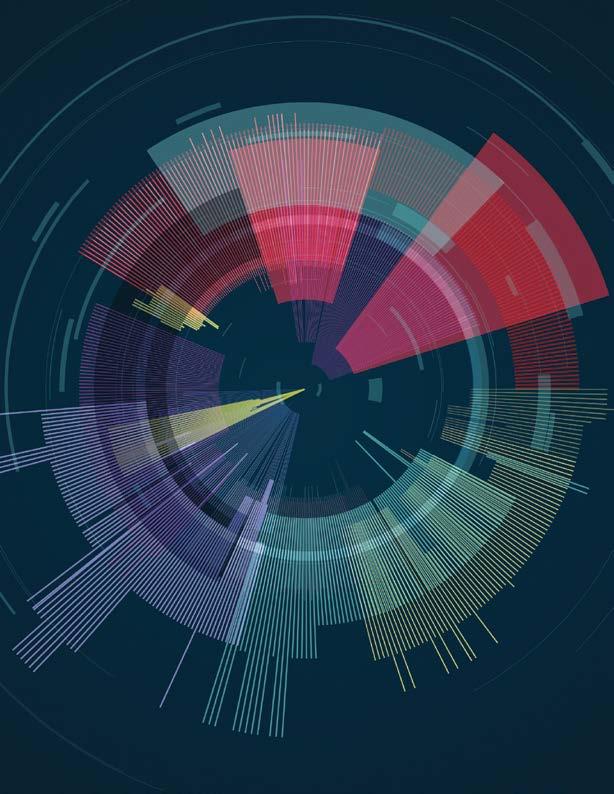

Decoding the Decline A CPA Pipeline Report

Data details the challenges in attracting accounting students and young professionals to the CPA credential.

Kari Natale, CAE, ICPAS senior director of planning and governance, led the survey team, and set out to answer that question. “We saw a gap in terms of the knowledge, and we wanted to learn from it. We knew if we wanted to do something, we had to uncover what young accounting professionals were thinking so we could change our strategies. We wanted to hear from those young professionals themselves.”

THE POWER OF ME

Natale says when the ICPAS team began sharing the report’s data with educators and practitioners, they received a surprising amount of pushback. Historically, there has been a rote answer to the declining number of CPA exam takers: the 150-hour requirement. It turns out, that reason didn’t rise to the top at all. Natale says one of the biggest surprises in the results came from asking who influences an individual’s decision to pursue the CPA. It wasn’t employers or educators, which would have been true in prior years. “They said those opinions were helpful, but it was just one factor.” Who is the number one influencer? Respondents said: Myself, and if I don’t personally see the value to me, I’ll walk away. “So, we can no longer tell them they need the designation to get a promotion,” Natale

says. “That’s why it’s now so important to make someone see the value in the CPA. More money isn’t the only deciding factor. They have to care. This changes our strategies and message on campus. We need to show people why they would want to get their CPA and help them find that direction on their own.”

Shapiro says he found it fascinating to hear individuals talk about how “myself” was the number one influencer. “The 2018 data showed us that people are done with something just because you tell them they have to do it. Our CPA Profession 2027 project is looking at the future and how compliance isn’t viewed as exciting work. If we want to attract the best and the brightest, we need to understand that they want to do strategic work. The report confirmed a lot of these things.”

SOLVING THE BRANDING ISSUE

Another key datapoint the survey revealed is how much respondents value their work life balance. “How they want to invest their time isn’t necessarily in credentialing and work,” Natale says. “The time commitment has always been a factor in pursuing a CPA, but people are saying this is just a test rather than evidence that makes them better. We need to change the messaging to connect with them.” Shapiro emphasizes, “When you see a declining number of CPAs at large accounting firms because activities are being offshored or completed by bots, we need to show the long-term value in becoming a CPA. They’ll put the time in if they think there’s value in doing it. That’s the major challenge – communicating the importance and making it worth their time.”

Aligning the CPA designation value proposition with what people see is important is key, Natale says. “We need to show that an exam like this helps you be more rounded and gives you knowledge beyond others at your level regardless of the career path you take. Respondents said they see the CPA designation as a public accounting thing, and they’ve also said they don’t see themselves spending most of their careers in public accounting. That’s where we need to demonstrate that the CPA license is more than auditing and tax. It gives you the foundation you need to help you perform your job better anywhere you work.”

A recent Korn Ferry study showed only 36 percent of CFOs at the 1,000 largest U.S.

Decoding the Decline Top-Level Highlights

Challenges

By and large, the most faced or anticipated barrier to becoming a CPA cited by respondents is the time commitment needed to study for and pass the CPA exam. In fact, workload time commitment was by far the top reason for deciding not to complete the CPA exam by those who started the process but did not complete the exam. Importantly, when breaking out responses from the individuals who do not plan to become CPAs, we gained the invaluable insight that their top reasons for not pursuing the CPA credential included not seeing value or relevance to their careers, not seeing the return on investment, their employers or prospective employers do not require it, and other credentials or specialties are more valuable to their careers. Contrary to popular belief, the costs associated either with obtaining the additional credit hours to meet the educational/licensing requirements or preparing for and taking the CPA exam were not the top barriers cited among any respondent category.

Perceptions

A key goal of this survey was to understand how accounting students, graduates, and young professionals value the CPA credential itself and if it is perceived to provide personal value to them. As expected, we clearly validated that the CPA credential’s perceived value directly aligns with one’s interest in becoming a CPA. More than 95 percent of respondents who are CPAs, are in the process of becoming CPAs, and are planning on becoming CPAs rate the credential as valuable or very valuable. Encouragingly, 86 percent of respondents who are still unsure about becoming CPAs view the credential as valuable or very valuable. And, surprisingly, the CPA credential is even acknowledged as being valuable or very valuable among those who started but did not complete the CPA exam (65 percent) and those who do not plan on becoming CPAs (68 percent). Respondents who see little or no value in the CPA credential feel they can be successful in their anticipated or chosen careers without it and ultimately perceive that any value the CPA credential holds is outweighed by its lack of relevance to their personal endeavors and the time and costs required to obtain it. Of further concern is the finding that 51 percent of all respondents have not obtained nor plan on pursuing other credentials—this was equally measured among respondents who do not plan on becoming CPAs (50 percent).

Influencers

Contrary to the common belief that an employer or prospective employer is the leading influencer on an accounting student’s or young professional’s decision to pursue the CPA credential, most respondents (53 percent) cited “self” as their primary influencer. As suspected, employer/prospective employer (39 percent) was validated as a significant influencer, which was closely followed by college professor (33 percent). It is worth noting that educators did outrank employers among respondents who plan on becoming CPAs and who are still unsure about becoming CPAs. Also challenging common belief was the fact that a higher-than-average salary was not identified as a top factor in deciding whether to become a CPA. Instead, career advancement opportunities earned the largest response, which was followed by greater marketability. In addition, we found a clear correlation between respondents either working or preferring to work in public accounting and deciding to pursue the CPA credential. Interestingly, though, just 27 percent of all respondents see themselves spending most of their careers in public accounting.

CONTINUED FROM PAGE 15

public companies are CPAs - a six-year low. “We saw the same decline of first-time exam takers in the 1990s,” Shapiro says. “What saved the credential back then was a major financial meltdown resulting in a change to the regulatory structure through the Sarbanes-Oxley Act of 2002. We’d better not hope for that kind of crisis to save us. Let’s learn from that. How do we make the CPA more relevant when technology is taking the place of people in compliance? It’s a branding issue. Let’s solve that.”

A CATALYST FOR CHANGE

A conversation with the ICPAS board sparked the research leading to Decoding the Decline. Now the results are leading to more in-depth conversations about the future. “Professional organizations try to enhance the value of their designations,” Natale says. “If there are fewer and fewer CPAs, we need to decide if we’re going to shrink the number of CPAs and be OK with that, or do we help more people see the value in it?” For ICPAS and other state CPA societies, the answer is clear. “We think this is a valuable, respected credential,” Shapiro says. “We know this is a credential that can change people’s lives, especially for diverse populations. The more you make a credential relevant, the more people will want to pursue it, and that will help your pipeline.” Shapiro says there are no easy solutions, but just getting people to talk about the issues facing the CPA designation is the right first step. “What has excited us is that the study is really the catalyst for conversation,” he says. “People are talking about it, and now we’re using real data, not just anecdotal information. We’re finally talking openly and honestly about the problem.” Read and download the full report from the ICPAS website at www.icpas.org/information/professional-issues/decoding-the-decline. Read and download the newly released AICPA 2021 Trends report at www.aicpa.org/professional-insights/download/2021-trends-report.

Respondents

The survey—which was deployed on Sept. 29, 2020 throughout Illinois and with national stakeholders—was targeted toward accounting students, graduates, and professionals under the age of 35, including CPAs and non-CPAs, and attracted 3,102 respondents and achieved an 81.5 percent complete response rate (2,527 completions). Respondents revealed unique perspectives across demographics, including age, gender, race, employment, education, and commitment to the credential. Although 88 percent of respondents identified themselves as either being a CPA, in the process of becoming a CPA, or planning on becoming a CPA, valuable insights were also gathered from the groups of those who started the process but decided not to complete the CPA exam, who do not plan on becoming a CPA, and who are unsure about becoming a CPA. A strong student response was also received, with 600 students participating in the survey.

The 2021 AICPA Trends Report: Key Insights

The AICPA Trends report has been published since 1971 and biennially since 2009. It identifies key trends in U.S. accounting enrollments and graduates, as well as hiring in the public accounting sector, along with select information about CPA Examination candidates. This year’s report provides statistical projections and respondent expectations based on university responses for the 2019-2020 academic year and firm responses for the 2020 calendar year. To read the full report, go to www.aicpa.org/profes-

sional-insights/download/2021-trends-report.

ACCOUNTING GRADUATES AND ENROLLMENT EXPECTATIONS

Accounting graduates trended downward in the 2019–2020 academic year, with decreases of 2.8% and 8.4% at the bachelor’s and master’s levels, respectively. Accounting programs are optimistic about enrollments for the 2021–2022 academic year — 58% of both bachelor’s and master’s programs respondents reported that they expected enrollment for that academic year to be the same or higher than the 2020–2021 academic year. (Note: IPEDS data for 2020–2021 had not yet been released at the time of this publication).

HIRING AND HIRING EXPECTATIONS

Total hiring of new accounting graduates in 2020 has decreased by 10%, however there was a 2% increase in master’s graduate new hires. New non-accounting graduates hired into accounting and finance functions increased by 10 percentage points. The hiring mix continues to shift, with 57.3% of new graduate new hires being accounting graduates and 42.7% being non-accounting graduates. New accounting graduate new hires are increasingly being assigned to audit — a shift of 11.5 percentage points from 2018. Of firms that hired one or more accounting graduates in 2020, 74% expect to hire the same number or more in 2022 as compared with 2021. Eighty-nine percent of all U.S. CPA firms expect to have the same number or more CPAs on staff in 2022 in comparison with 2021.

DIVERSE HIRING

In 2020, diverse hiring of new bachelor’s and master’s of accounting graduates into accounting/finance functions of U.S. CPA firms increased by almost five percentage points (includes multiethnic hires). Asian or Pacific Islander, Black or African American, and Hispanic or Latino new graduate new hires in accounting have all increased by near one or more percentage points (1.9, 0.6, 1.6 percentage points, respectively). These three groups comprise their highest (or very near their highest) percentage of the whole of new graduate new hires in the history of Trends’ data collection.

CPA EXAMINATION

The number of new CPA Exam candidates entering the CPA pipeline decreased anomalously in 2020 due to short-term closings and the various restrictions at Prometric® test centers, with overall COVID concerns carrying forward into 2021. As such, while new CPA Examination candidates decreased less than 0.5% between 2018 and 2019, there was a 17% decrease between 2019 and 2020. A 6% increase occurred between 2020 and 2021. The number of CPA Exam candidates who passed their fourth section of the exam decreased 11% between 2019 and 2020 after a 2% decline between 2018 and 2019. The number of successful candidates decreased 5.5% between 2020 and 2021.

Undergraduate population down over 1M students (down 6.6%) (2019-2021)

Major Factors Impacting the Pipeline

700K+ fewer students in community colleges (down 13%) (2019-2021) Decreasing accounting graduates; fewer CPA Exam candidates ~40% of accounting graduates sit for the CPA Exam

Decline in the US CPA Exam volumes offset by growth in international

Firms hiring fewer accounting and more non-accounting graduates

Student/accounting decision points and stakeholder influence in easing unnecessary obstacles