2 minute read

to

fall across all sectors, including Manufacturing & Engineering

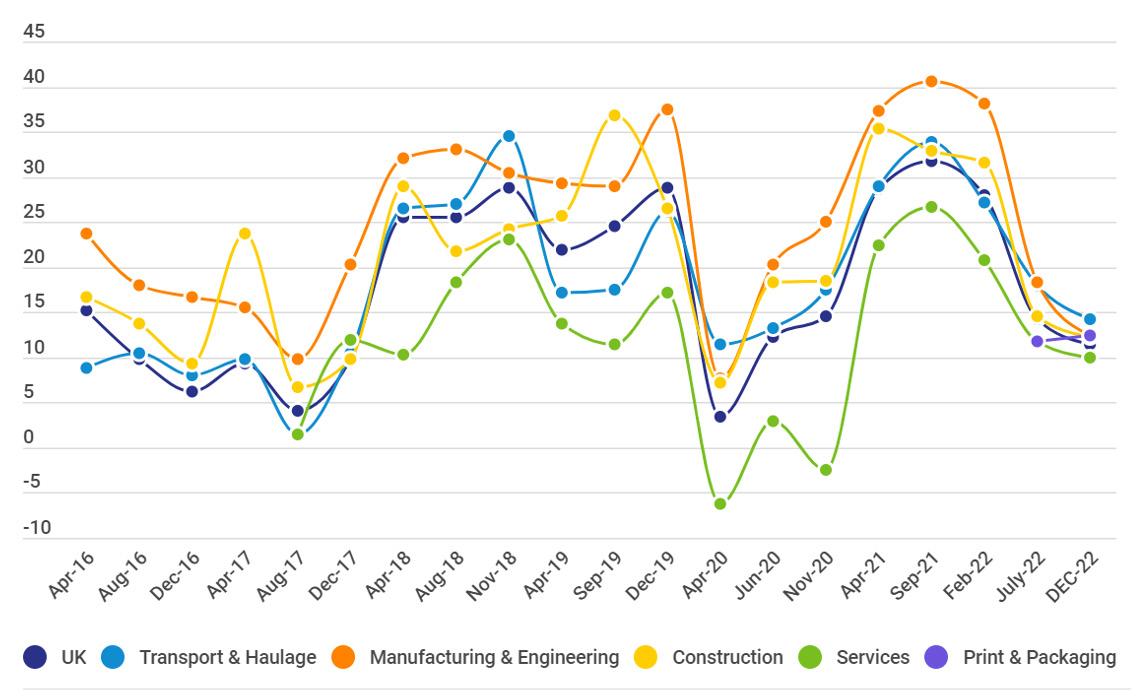

Business sentiment across all key sectors has continued to subside – although not as dramatically as was seen between March and April last year.

Our data reveals that over the past year, positivity has fallen significantly from record highs to levels not seen since the first lockdown – and what we are seeing for the first time is the sectors aligning around a smaller spread of figures than we usually see; it’s clear the pain of the rising cost of doing business, recession, interest rate rises, energy prices and inflation is being felt across all industries, not only Manufacturing & Engineering.

According to our research, Manufacturing & Engineering business owners’ top five concerns were:

1: Energy costs

2: Inflation

3: Interest rates

4: Materials supply

5: Cash flow

Business sentiment index – December 2022

How the sectors have fared

After the highs of 12 months ago, the Manufacturing & Engineering sector – as in July 2022 - again saw the most significant fall in sentiment and is now at a lower level than Transport and Haulage for the first time since April 2020, just a month after the first lockdowns were announced.

Appetite for investment

The one positive is that, overall, over four in every five Manufacturing & Engineering firms are still looking to seek funding for investment in the next 12 months, up from July’s 78%. This is reflected across all key sectors, with the most notable rise coming in Services, where the number of firms planning to seek funding has risen by 32%.

Q Does your business plan to seek funding for business investment in the next 12 months?

Missed opportunities

The number of Manufacturing & Engineering companies missing business opportunities due to a lack of available finance continues to rise, with nearly half (45%) admitting to having lost out.

With pressure on cash flow, most ambitious businesses rely on additional finance to enable them to invest in growth.

Q Have you missed a business opportunity in the last 12 months, due to lack of available finance?

Economic outlook

Business owners are, unsurprisingly, more negative than positive about the macro-economic outlook and it’s this indicator that has contributed most to the decline in the BSI; for example, in November 2021 83% of Manufacturing & Engineering respondents were positive about the economy – by December 2022 this has fallen to 38%.

Confident that the economy will grow

Concerned that the economy will slow down

I don't think there will be a significant change in the economy

Predicted business performance

Predictions about future business performance in the Manufacturing & Engineering sector – perhaps surprisingly – were more positive than six months prior.

QIn general, how do you expect your business to perform over the next 12 months?

Score calculation

The BSI is based on the views of 900 business owners and senior members of the UK’s business community and calculated from data charting their:

• Appetite for investment in their business in the coming 12 months

• Access to finance and whether they’ve missed a business opportunity through lack of available finance

• Views about the UK’s economic outlook

• Thoughts on their likely performance in the coming 12 months