5 minute read

Street Maintenance Fund

Overview

Advertisement

The Pavement Management - Street Maintenance Fund accounts for costs associated with street maintenance, repair and replacement planned by the Pavement Management Program including: ADA curb ramp compliance, concrete replacement, crack sealing, hot chip, cape and slurry sealing, reconstruction, milling and overlay. Revenues are derived from the City’s General Fund and the Highway Users Tax Fund which is the City’s share of state-collected gas tax revenue.

Revenue Highlights

• Revenues consist of a transfer from the General Fund and street degradation fees.

Expenditure Highlights

• The 2023 Pavement Management Program map includes proposed areas to be addressed is attached hereto and incorporated herein by reference. The map identifies areas proposed to be addressed in 2023 with compliant ADA curb ramps, concrete replacement, mill and overlay, hot chip seal, slurry seal, cape seal and crack seal.

Overview:

The Pavement Management - Street Maintenance Fund accounts for costs associated with street maintenance, repair and replacement planned by the Pavement Management Program including: ADA curb ramp compliance, concrete replacement, crack sealing, hot chip, cape and slurry sealing, reconstruction, milling and overlay. Revenues are derived from the City’s General Fund and the Highway Users Tax Fund which is the City’s share of state-collected gas tax revenue.

The 2023 Pavement Management Program (PMP) had three active contracts in the second quarter. See summaries below:

ADA Curb Ramp and Concrete Replacement Program

Summary:

• One (1) concrete contract

• Contractors – Triple M Construction

• Percent Complete – 46%

Pavement Maintenance 2023 Mill and Overlay

Summary:

• Two (2) Asphalt Contracts

• One Asphalt Contractor(2 Contracts) – Asphalt Specialties

• Percent Complete – 49%

Pavement Maintenance 2023 Hot Chip, Slurry Seal and Crack Seal

Summary:

• One (1) Contract - Hot Chip, Chip Seal, Slurry Seal, Mastic and Crack Seal

• One (1) Contractor – A-1 Chipseal

• Percent Complete – 26%

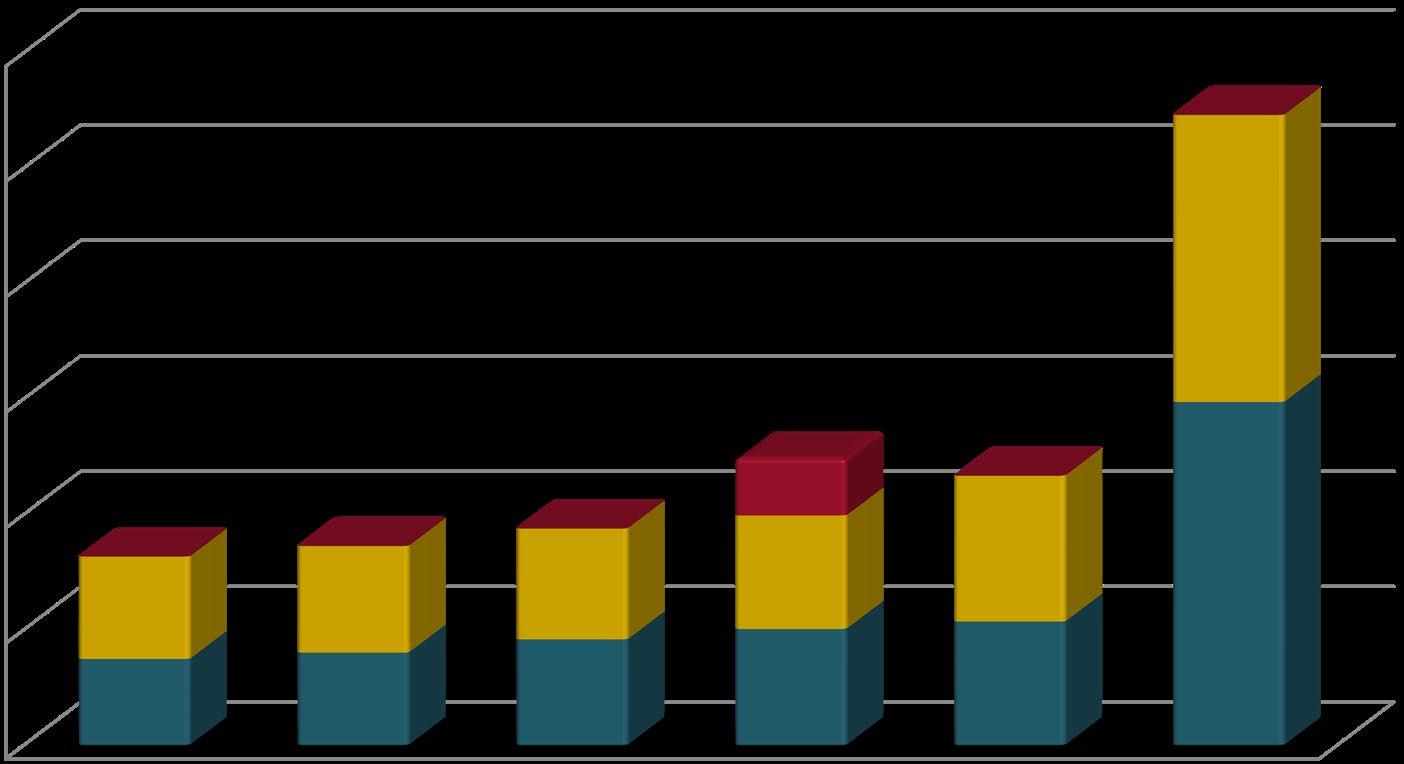

Pavement Management Program Financi

Current Contracts:

04.705013.55005 – Concrete Contracts

• Budget Amount – 3,653,425.00

• Billing to date – 1,688,301.39

• Budget Balance Remaining- 1,965,123.61

04.705014.55009 - Asphalt - Mill and Overlay

• Budget Amount – 5,096,949.00

• Billing to date – 3,007,074.13

• Budget Balance Remaining- 2,089,874.90

04.705014.53032 - Chip, Crack and Slurry Seal

• Budget Amount – 1,500,000

• Billed to Date - 390,471.54

• Budget Balance Remaining – 1,109,528.50

Note: Financial Summary includes active contracts as of the end of the Second Quarter. It does not include costs for material testing/materials or other expenses. 04 - Pavement Maintenance Fund

Total Completed

• $5,085,847.10

Budget Balance Remaining

• $5,164,526.94

Note: 04 – Pavement Maintenance Fund Summary includes costs and balance as it relates to active contracts as of the end of the Second Quarter.

Challenges

• Poor subgrade conditions found during repaving

• Unforeseen additional costs were incurred. However, by addressing and correcting before repaving, the result will significantly extend the service life of the streets.

• The Impact of additional unforeseen costs affects the ability to complete areas proposed to be completed in 2023 as it relates to available funding.

• Unstable weather conditions

• ADA Curb Ramp Removal and Replacement

• Additional unforeseen removal and replacement of concrete in order to meet ADA curb ramp compliance. This triggers additional costs which impacts the funding needed to complete the ADA curb ramps scheduled for completion in 2023 in preparation for future pavement maintenance applications.

Conclusion

The Pavement Management Team is committed to improving pavement quality throughout the City. In addition to managing the 2023 contracts, the Pavement Management Team has been working to improve policies, processes, and procedures. Second quarter examples include:

• Concrete Replacement

• ADA compliance

• Collaborating with internal teams to develop and implement a standardized process when addressing non-compliant curb ramps which are included in the 2023 Pavement Maintenance Program.

• Proposed Changes to Pavement Management Concrete Policy

• Communication

• Continuous collaboration with internal teams to review, update and implement standardized communication internally and externally

• In an effort to research best practices and promote networking, other cities were engaged in discussion around Pavement Management. Among these were Denver, Colorado Springs, Aurora, Lakewood, and Longmont.

• RoadMatrix

• Utilizing software to assist with determining pavement maintenance applications and priorities

• Annual data captured by Stantec

Parks Fund

Overview

The Parks Fund accounts for costs associated with the acquisition, design, development, maintenance and beatification of parks, open space and trails within the City. Revenues are derived from the City’s General Fund, Grants Fund, Jefferson County Open Space Funds and Adams County Open Space Funds

Revenue Highlights

• Overall revenues increased by $137,248, or 2.4% over 2022.

• Jefferson County Open Space funds increased $127,544 or 6.4%.

• In 2022, the City transitioned athletic field programming from the APEX Recreation District to the Parks Department. At this time last year, the City received over a million dollars for reimbursement from APEX. Although the City no longer receives APEX money, revenues are still up from last year due to the receipt of field programming revenues.

Expenditure Highlights

• Overall expenditures increased in second quarter from 2022 by $121,150 or 2.2%.

• A high number of expenses are associated with running the new athletic field program and the new employees added for Parks safety and maintenance

Special Revenue Funds Overview

Special Revenue Funds account for revenues that are to be used for specific purposes. The following funds are considered special revenue funds:

• Tax Increment Funds

• Community Development

• Housing

Tax Increment Funds

Overview

There are two tax increment funds which account for the voter-approved sales tax increases to fund expanded police services. The first accounts for the .21 cent sales and use tax and the second accounts for the .25 cent sales and use tax. Sources include sales tax, general use tax, auto use tax, building use and interest income. Since the tax increment is in addition to the City’s 3% sales tax, revenue trends in the tax increment fund will closely follow those in the general fund.

Revenue Highlights

• Sales Tax and Audit revenue increased due to inflation. The price of goods and services has increased over the last year which is directly related to the sales tax increase.

• The increase in other revenue is due to a larger accounting adjustment entry for daily interest made in 2023 than the same entry made in 2022.

Expenditure Highlights

• Ongoing expenditures slightly increased due to more police officers onboard in 2023 than in 2022.

Community Development

The Community Development Fund accounts for all entitlements, revenues and expenditures of the Community Development Block Grants (CDBG) program and the Home Rehabilitation program and Essential Home Repairs program.

Revenue Highlights

• Overall revenues decreased by $24,653 or 5.9% from 2022.

• A third party is now managing the Essential Home Repair Program under the CDBG so the grant reimbursements have slowed down due to the new program needing time to establish. On the other hand, interest income has increased compared to the previous year.

Expenditure Highlights

• Overall expenditures increased $27,376 which is a 6.4% increase over 2022.

• Although our CDBG Program has been restructured and program spending is down $158,426 or 91.5% compared to the previous year, the City made a $200,000 grant to the local nonprofit for an affordable housing project in 2023 compared to no such grant in 2022. The net effect of this activity is a small increase in spending between the years. The Essential Home Repair Program has a few projects under way; none have been completed as of 6/30/23. The wait list for essential home repairs is at 58 as of June 30 2023.

Arvada Housing Authority

The Authority administers funds received for rent subsidy to low/moderate income households under Section 8 of the U.S. Housing Assistance Payment Program.

Revenue Highlights

• Overall revenues increased $208,265 or 6.2% over 2022.

• Grants revenue increased $193,523 or 5.8% from 2022 due to rising rental costs in the Arvada area and increased leasing in both Section 8 and Mainstream Programs.

• For the first half of 2023 there have not been transfers from the General Fund or Community Development fund due to staffing changes.

Expenditure Highlights

• Overall expenditures increased $667,111 or 21.9% over 2022.

• Rent expenditures increased by $617,413 or 21.5% due to the increased number of tenants on the program and higher overall rental costs.

• The Arvada Housing Authority served 496 families during 2023 while 433 were served during the same period in 2022. The Housing Authority also served 46 families with disabled family members through the Mainstream voucher program, 11 more than last year. The waitlist has 198 people on it.