4 minute read

Arabica Prices Drop as 2025 Kicks Off

by Buna Pulse

Arabica Prices Drop as 2025 Kicks Off: What’s Driving the Decline and Its Impact on Exporting Regions?

As the new year begins, the global coffee market is seeing a notable dip in Arabica coffee prices. Currently trading at 318.50 c/lb as of January 10, 2025, prices have fallen from December's peak of 350 c/lb. This correction comes as several market forces converge, creating ripples across the coffee value chain. While the decline may offer short-term relief for buyers, it poses significant challenges for Arabica coffee-exporting regions, particularly those in Africa and Latin America, where coffee is a cornerstone of the economy.

Key Factors Behind the Price Drop

Index Fund Rebalancing

A key driver of the price drop is the annual rebalancing of index funds. Around 15,000 lots of Arabica futures are being sold as part of this process, creating a temporary oversupply in the market and dragging prices downward.

Seasonal Adjustments

The market is naturally correcting after December’s dramatic highs, driven by strong production from major exporters like Brazil and Colombia.

Increased Certified Stocks

Certified Arabica stock levels have rebounded to 980,000 bags, providing some buffer to the supply chain. While this may stabilize prices in the long term, it is currently adding downward pressure.

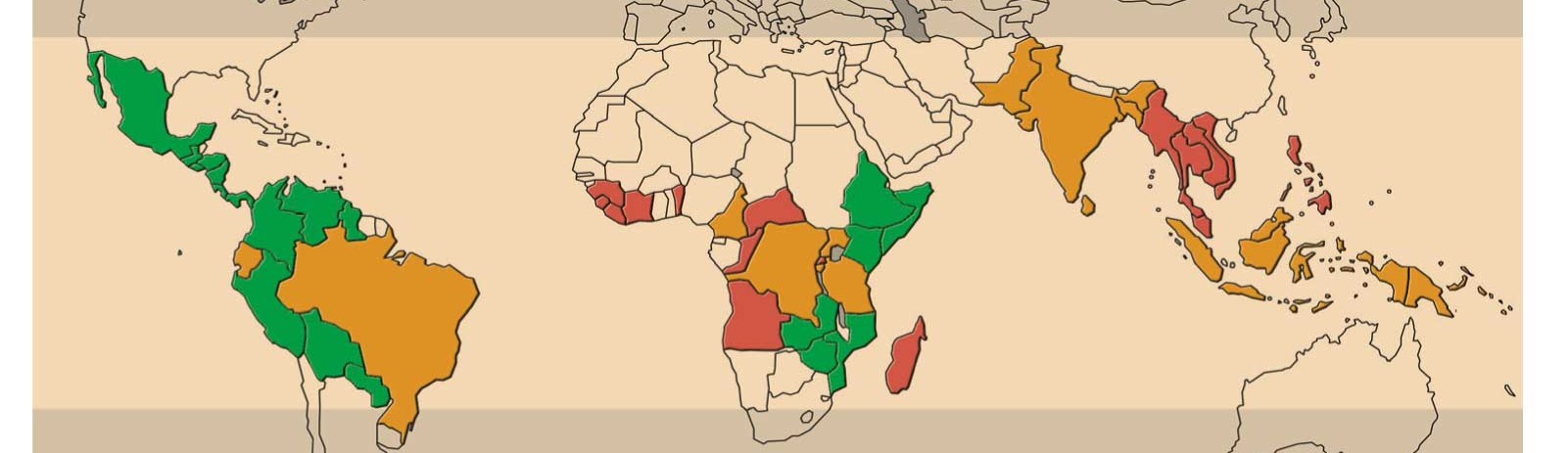

Impact on Key Exporting Regions

Latin America

Brazil

Economic Strain: As the world’s largest Arabica producer, Brazil faces a double-edged sword. While local prices have seen an uptick due to strong differentials (10+ cents higher than last month), the global price drop reduces profit margins for exporters.

Currency Pressure: The strength of the Brazilian real against the dollar exacerbates the situation for exporters, as it makes Brazilian coffee less competitive internationally.

Farmers’ Woes: Many Brazilian farmers who were counting on higher prices to offset rising production costs—such as fertilizers and labor—are now facing economic challenges.

Colombia

Increased Supply, Lower Prices: Colombia's Arabica production surged by 47.37% in December 2024. While this growth is a positive indicator of recovery from past production challenges, it also contributes to the price dip.

Smallholder Impact: Colombia's smallholder farmers, who make up the bulk of the coffee sector, are particularly vulnerable to price volatility, as their margins are already thin.

Africa

Ethiopia

Export Revenues at Risk: As the birthplace of Arabica coffee, Ethiopia relies heavily on coffee exports for foreign exchange earnings. A prolonged price dip could significantly reduce export revenues, impacting the national economy.

Smallholder Farmers: Ethiopian coffee farmers, especially those producing specialty coffee like Yirgacheffe, may struggle to cover production costs, potentially affecting their ability to invest in quality improvements.

Market Competitiveness: With Brazil and Colombia flooding the market with lower-priced coffee, Ethiopia’s higher production costs could make its exports less competitive.

Kenya

Reduced Earnings: Kenya, known for its high-quality Arabica, is also facing challenges as lower global prices threaten the profitability of its coffee auctions.

Risk of Crop Abandonment: Prolonged low prices could discourage farmers from investing in coffee production, leading to a potential decline in output.

Asia

Vietnam

Robusta Focus: While Vietnam primarily exports Robusta, its growing Arabica production could face hurdles as the global Arabica price drops. This may dampen efforts to expand its Arabica market share.

Broader Economic and Social Impacts

Foreign Exchange Declines: Major Arabica-exporting countries like Ethiopia, Colombia, and Brazil rely heavily on coffee exports for foreign exchange. Lower prices could widen trade deficits and strain economic stability.

Social Implications: Coffee farming supports millions of livelihoods, particularly in rural areas. A prolonged price decline may lead to reduced income for smallholder farmers, increasing poverty levels and pushing some to abandon coffee farming altogether.

Production Quality: Farmers struggling to make ends meet may cut back on investments in quality improvements, which could impact the premium segments of the coffee market.

Arabica Price Outlook

As Arabica prices stabilize at 318.50 c/lb, the coming months will be critical for exporters:

Short-Term Challenges: Exporting regions will need to navigate shrinking margins and economic pressures.

Long-Term Adjustments: Governments and coffee cooperatives may need to invest in strategies like diversification, cost-cutting measures, or value-added processing to weather the storm.

A Quick Look at Market Stats

Commodity Price (9.1.2025)Change (Vs. 19.12.2024)

-ICE Arabica (Mar 25) $318.50 c/lb-5.25

-ICE Robusta(Mar 25) $4,979/mt-67

-Arbitrage (Arabica/Robusta) $92.65 c/lb -2.20

Conclusion

The current drop in Arabica prices is more than just a market correction—it has significant ramifications for exporting regions. While some producers may see this as a short-term challenge, others will need to adapt quickly to prevent long-term economic and social repercussions.

For exporters in Africa and Latin America, the focus must shift toward resilience: embracing sustainability, improving efficiencies, and exploring value-added coffee products that can fetch higher prices in the global market.

Published by:Buna Pulse – Kerchanshe Coffee’s News Magazine