28 minute read

CEO INTERVIEW BEHIND AVAADA ENERGY’S RAPID EXPANSION IN INDIA

The company clinched repeat investments from institutions such as ADB, DEG, FMO and Proparco.

Established just in 2017, Avaada Energy has grown to be amongst the fastest growing renewable energy companies in India, with 1GW of capacity under operation and another 3GW under implementation. They are also implementing 1GW capacity solar plants under open access across the country.

Asian Power spoke with Avaada Group’s chairperson Vineet Mittal about his experiences on establishing the business, the strategies that drove its rapid growth, and opportunities they are looking to grab in the future.

“An inherent risk-taker, I started out with a dot com company then ventured into the BPO sector. It was during my time at the IT sector that I started exploring avenues which were aligned to my core value system. In my opinion, we have an inherent responsibility towards nature and the communities that have given us the environment to grow,” Mittal said.

What strategies have you employed to drive Avaada Energy to become amongst the biggest suppliers of solar energy in India?

We are one of the fastest-growing renewable energy companies in India. At Avaada, we believe in working in tandem with nature whether it is our renewable energy projects or our community development initiatives. Our philosophy is inspired by the 3 Ps— Promise, Progress and Partnership. The projects we commission, the initiatives we undertake and the results we produce are all aligned to this philosophy, something that defines who we are.

Our unique strategy interweaves business goals with environmental sustainability and social responsibility, producing mutually beneficial results. By contributing to community’s socioeconomic development in the short-term, we foresee delivery of continual value to our shareholders. Through our community engagement initiatives, we are contributing to uplift the lifestyle of communities we work with.

At Avaada, we know that a company is only as strong as the people who make it. We believe in nurturing a family culture in the organisation—thus every member of the organisation believes in a shared ethos and value system which is being practiced earnestly. This has been one of the basic reasons that a highly competent and experienced team has been working together for the last 10 years. There has been negligible attrition over so many years. We strongly believe in 3 principles: what gets measured, gets managed, gets delivered, inspect what you expect and what gets rewarded gets repeated.

We are adept at leveraging people, process, and technology framework for ensuring continuous improvement. With a strong foundation of family culture, strict adherence to governance principles, and dynamic framework for evaluation for performance improvement we have managed to build a strong organisation which has exceptional expertise in engineering, procurement, construction and O&M.

After winning the 320MW solar project in the state-owned NHPC’s auction last April, what are you working on for the rest of 2020 and 2021?

At Avaada we believe that if you think big, bigger things will happen to you and your organization. Avaada Energy has scaled up rapidly and within two years of establishment, it has 1000MW of capacity under operation.

The firm created a solid pipeline of another 3,000+MW which shall be implemented over next few years. We plan to have installed base of 5GW by 2022 and 11GW by 2025.

"We endeavour to optimise costs and increase efficiency with the help of our inherent ability to innovate" Since 2017, Avaada has crossed quite a few milestones. Please tell us more about the key developments in your company. Which achievements are you particularly proud of?

We have always strived to do something innovative, and could be a path-breaking thing for my country and for the clean energy industry. We have been one of the largest suppliers of green energy to several government agencies like NTPC, SECI and DISCOMS, which constitute 60-70% of the total business.

At Avaada Energy, we endeavour to optimise costs and increase efficiency with the help of our inherent ability to innovate. Aided by technology upgrading and decline in prices of components, we have managed to reduce capital costs from Rs. 15 crores/MW to Rs. 4 crores / MW in the last seven to eight years.

Furthermore, because of our strong project execution capabilities, impeccable debt servicing record, and professional leadership team, Avaada has managed to bag repeat investments from reputed institutional investors like ADB, DEG, FMO and Proparco. The company has marquee clientele which includes office complexes, global IT companies, hotels etc.

What are the biggest challenges and risks regarding supplying power to India?

As a relatively new industry, the renewable energy sector in India has already emerged as the fastest growing sector. However, there are some issues that have to be addressed to further cement Avaada’s position as an important player of clean energy on the global front.

There is an urgent need for a stable policy regime wherein once a policy has been framed, it remains in place for at least five years without any change. Any modification / amendment must be brought in under extreme circumstances and it should be ensured that its implementation is prospective. Retrospective implementation must be done away with completely. Another issue is dispute resolution between contracting parties. Risk associated with land acquisition, financing, transmission evacuation infrastructure etc. end up hurting us as developers. This can be eased through an appropriate redressal mechanism within the contract itself.

What valuable lessons have you learned whilst operating in a market as huge and diverse as India? What opportunities do you see for the renewable energy sector?

From the beginning of time, Indian culture has respected and worshipped wind, water, earth, fire and sky. One of the most important lessons I have learned is to always look at the renewable energy business as an opportunity to live this great Indian legacy. With clean energy in constant state of innovation and with our nation’s green energy revolution led by Hon’ble PM Shri Narendra Modi, India will continue its exponential growth in the renewable energy sector.

With the government committed to its environment sustainability and clean energy targets, these are exciting times for adoption and implementation of clean energy innovations.

Additionally, India is continuously exploring power projects coupled with storage capabilities. There is also a rising demand from large industrial and manufacturing facilities for sourcing solar energy to meet their energy needs.

Further, industrial heating solutions powered by solar energy have made a small advent in the Indian market but over time that should grow as well.

COUNTRY REPORT: JAPAN Lobbying hampers Japan's energy transition

Many utilities providers have been turning away from coal generation in favor of renewables.

Amongst G7 nations, Japan seems to be distinctive in a way that it is adding to its domestic coal power generation capacity counter to the global coal phase out trend, according to a report from London-based InfluenceMap. The country is said to have roughly 45 new coal plants in the pipeline. In parallel with this, its public finance assistance of power projects overseas is primarily directed at coal-power with a pipeline of 30GWs of coal projects, mostly in Southeast Asia.

Even as Japan’s power sector is striving to move away from coal, a business lobby group has hampered the country’s efforts to align its clean energy transition consistent with the Paris Agreement targets. In spite of this issue, new renewable sources are gradually emerging, with large-scale offshore wind projects in particular gaining ground.

The research also finds that the Japanese government's pursuit of coal power generation over more accelerated renewable power is misaligned with the business interests of the majority of large Japanese companies. More than half of the Nikkei top 100 companies (53%), representing almost JP¥140t of market value and employing over 3.5 million, have business models that would prefer proliferation of renewable electricity generation, both in Japan and globally, compared to coal.

InfluenceMap’s report says that “very few” have any preference for the coal value chain with a range of Japanese companies having interests in renewable electricity related markets. Construction and real estate firms have interests in construction and operation of wind, biomass and solar facilities as well as 'zero carbon' buildings that integrate renewable generation.

Japanese materials and technology firms such as Asahi Kasei, Toray, Panasonic, have global strengths in lithium-ion batteries, materials for solar cells, and carbon fiber products for use in wind turbines. Japanese automotive makers are global leaders

Large-scale offshore wind projects have been gaining ground within Japan’s energy mix.

in EV technologies that may benefit in many markets where convergence with renewable electricity becomes apparent. Conversely there are very few leading Japanese companies with the coal value chain key to their business models.

METI-Keidanren-Cabinet’s policy

In March, Japan announced its updated Nationally Determined Contribution (NDC), which laid out its commitment to the Paris Agreement, as part of the United Nations Framework Convention on Climate Change (UNFCCC) process. Its submission targeted 22-24% renewables, with less than 2% of this being wind power, and 26% coal in the electric power generation mix by 2030.

This drew sharp criticism from the Japan Climate Initiative (JCI)—a coalition which includes many blue-chip corporations from retail, finance, construction and homebuilding and technology—commenting that the government "did not listen to these voices at all," added InfluenceMap. Another crosssector group, the Japan Climate Leaders' Partnership (JCLP) representing corporations including AEON, Fujitsu, Ricoh and Mitsubishi Real Estate, has called to aim for a 50% renewables target by 2030.

InfluenceMap’s research found that the energy and climate policy in Japan is formulated mainly by the Japan Business Federation (Keidanren), the Ministry of Economics, Trade and Industry (METI) and the Cabinet Office of the ruling LDP party. Keidanren is a federation with over 200 staff and over 100 key industry associations across the economy as members. All three of them are said to be in support for the development of large-coal power generation by the existing regional power companies over rapid scaling up of solar and wind power in a more liberalized electricity generation market place.

Country policies weakened by lobbying

Source: InfluenceMap

On climate change, Keidanren argued for a voluntary, sectorspecific approach. However, InfluenceMap found that only seven sectors showed intensive policy engagement on climate and energy issues through their respective industry association, namely: iron/steel, electric power, automotive production, cement, electrical machinery, oil/petrochemicals and the coal value chain. These only represent 10% of the nation’s GDP.

Thus, the report recommended that reforms in transparency and governance will likely be needed in how industry associations interact with the government on policy issues, along with greater engagement in climate-motivated policy by non-fossil fuel sectors.

“Importantly, industry associations representing key economic sectors like healthcare, retail, financial services, logistics, construction, and real estate should be more actively engaged on a range of climate-related policy streams to express their positions and climate goals more clearly,” the report stated.

Utilities ditch coal

However, with the potential of greener energy in Japan, as well as the pandemic, utilities have turned their attention from coalbased generation to renewables. According to a statement from GlobalData, Japan has been using this opportunity through decade-long plans to terminate about 90% of the nation’s 114 coalfired power generation units noted to show poor performance and low efficiency. This is said to assist the nation to reduce its carbon emissions and shift towards renewable energy, says data and analytics company GlobalData.

Japan is considered to be a resource-scarce country that relies on coal for about a third of its energy needs, with almost 30-33% of its electricity generation coming from the fuel in the past two years, according to GlobalData’s senior power analyst Somik Das.

As the country plans to continue using its high-efficiency coal plants, 100 low-efficiency plants are being planned to be phased out. Furthermore, Japan’s latest Strategic Energy Plan aimed to ramp up the share of renewables and nuclear in electricity generation to 22-24% and 20-22%, respectively, over the decade.

The country also aims to support other developing nations with its coal power technologies. With the country’s inability to build up clean nuclear-based generation, Japan has maintained a target to scale down emission by 26% over the decade, compared to 2013, which might be seen by global environmental authorities as less ambitious.

Meanwhile, nuclear-based generation has been struggling following the 2011 Fukushima crisis, and in 2019 it formed just 2.1% of the total generation. It is expected to only take up 2.5% of the total generation by 2020. “The inability to fully generate from its nuclear sources and the renewables forming an expected 15-20% of the generation for the following few years, the nation is likely to have gone more conservative on its emission reduction target,” Das said.

Somik Das

In this backdrop, the pandemic has compelled the nation to focus on renewables. Das noted that the total solar and wind capacity in the country is expected to grow by over 8%. “The country is eagerly looking into developing utility-scale Solar PV, Floating renewable projects, and energy storage to further develop the renewable landscape,” he said.

Offshore wind boost

The offshore wind sector is also kicking off in Japan. According to data from the Mizuho Bank revealed in a conference during the World Smart Energy Week, the installed offshore wind capacity is around 65MW as of 2017, and no large-scale projects have yet to be installed. However, there has been a dramatic rise in offshore wind projects undergoing environmental impact assessment (EIA), which is at 15.41GW as of 24 January.

Government support has contributed to this growth. In April 2019, a bidding system was introduced for offshore wind power provision in designated areas, which offers support for offshore wind projects outside port areas. The government has set the key performance indicator (KPI) of having these projects start operation in five areas by 2030.

Mizuho Bank’s senior manager Tae Tamura noted that the potential of offshore wind generation in Japan is much bigger than that of onshore wind, which is estimated at around 613GW vs. 169GW, given its geography as a small island country. Of these, the potential for floating offshore wind, which is better suited for deep sea areas, is about 519GW.

However, Japanese companies struggle to enter the original equipment manufacturer (OEM) market on their own, which are primarily engaged in designing the turbine, component procurement, turbine assembly, testing and shipping. Just in Japan, over 70% of wind turbines installed are made by overseas players, and there are local firms who have either withdrawn from manufacturing or stopped receiving orders.

With this, Tamura found it necessary for global wind turbine OEMs to promote local production from the viewpoint of cost reduction. But with the large number of procured parts, a supply chain will have to be constructed that includes assembly, manufacture, test, transport and installation.

“In order to expand the use of floating offshore wind power generation in Japan, it is important for foreign companies and Japanese companies to establish a win-win cooperative structure at an early stage to enjoy the advantages of being the first mover in Japan,” Tamura said.

Furthermore, Japanese companies would also be required to respond to the needs for cost reduction and performance improvement for wind turbine OEMs in order for them to enter the supply chain. Tamura is counting for a possibility that global OEMs and Japanese firms will be able to jointly develop wind turbine components.

Heavy industry sectors dominate policy engagement

TW JERA turbine

Taiwan’s offshore wind sector stays afloat

Investors with neither experience nor capacity in the sector seek new opportunities to buy into existing projects.

Despite the reduction of feed-in The offshore be “unreasonable” and failing to “reflect Ministry said that developers have yet to tariff (FiT) rates and the supply wind sector the true costs of building offshore wind provide “convincing” evidence to support chain disruptions caused by has witnessed farms in Taiwan.” their claims of high costs, Yeap added, the pandemic, Taiwan’s offshore wind an increase “[The FiT cuts] received some saying that the new tariff is the result of sector continues to remain attractive to of investors opposition from developers, although consulting experts on the matter and that investors as it witnessed more local and competing for globally FiT does decline given increasing last year’s rates cannot be maintained. international investors competing for a a share in the economies of scale and localisation in the Backing this, Fitch noted that the share in the market through acquiring a market sector,” Yeap said. final decision came after three rounds stake in one or more of the projects under Yuni was also said to have commented of public hearings in Taipei, Taichung construction or development. that wpd might have to renegotiate and Kaohsiung respectively, which may

The Ministry of Economic Affairs’ contracts with their local and foreign suggest an adequate consultation and (MOEA) announced FiT rates for suppliers due to the new rate, adding decision-making process. In contrast in offshore wind in 2020 fell by an average that this might lead to a delay in the 2019, the unexpectedly steep cuts caused of 7.64% to $0.17 (NT$5.0946) per development of the wpd’s projects. major developers and investors, including kWh. According to Pinsent Masons On the other hand, the ministry has Ørsted, to suspend their projects. The consultant John Yeap, this has received said in an interview that wind energy government later compromised on the some opposition from developers—wpd developers have yet to provide convincing 2019 rates following the backlash. Taiwan Energy chair Yuni Wang was evidence to support their claims of high Furthermore, Fitch believes that the reported to have criticised the FiT rate to costs, and claims that the new tariff is new prices remain relatively attractive the result of consulting experts on the to investors, noting that Taiwan’s first

Top markets with offshore wind project pipeline matter and that last year’s rates cannot be offshore wind capacity auction registered maintained. winning bids of $0.076 (NT$2.2245) to A note from Fitch Solutions explained $0.087 (NT$2.548) per kWh, far lower this decline jeopardised the economic than the FiTs offered. The fall in tariffs will feasibility of some existing projects in the be countered by rapidly falling technology pipeline and worsened the risk of delays. and development costs for offshore wind. “Whilst we acknowledge that the new FiT In particular, the development of its first rates might pose some downside risks batch of offshore wind projects—such as to our wind forecasts for the market, we Ørsted's Formosa 1, or Changua 1 and maintain our bullish outlook and will 2a—is expected to help put in place an continue to monitor the market closely,” equipment supply chain, enabling greater Fitch added. cost reduction on future projects.

Source: Fitch Solutions Key Projects Database In response to such criticisms, the “Whilst higher FiT rates are needed to

Feed-in-Tariff rates in Taiwan

Source: Ministry of Economic Affairs

support the substantial upfront supply chain investment required, future projects will become much more cost-competitive, as project developers can tap into a then established domestic supply chain, and also from synergies from existing projects,” the report stated.

Also driving down costs throughout the wind power supply chain and making wind projects more cost-competitive is the development of more powerful offshore wind turbines will reduce the required number of turbines required on new projects. “Wind turbine manufacturers continue to make advancements towards the commercial deployment of larger, more powerful offshore wind turbines that are equal to or exceed 10MW in size,” the report stated.

Pandemic headwinds

Amongst the markets that showed to be most effective in fending off the COVID-19 pandemic, Taiwan’s economy never needed to shut down like many other countries across the globe, and everything is still operating as usual. However, there was no way to avoid interruptions off its offshore wind supply chain, as a large part of it is still based in badly-hit Europe.

“Given that a large part of the offshore wind supply chain is still based in Europe, which is badly affected by the pandemic, the production of various components and the assembling of the wind turbines have been affected. Also, Taiwan's border was shut to foreigners until recently, so some technical experts were unable to travel to Taiwan to carry out their work,” Yeap said.

Although the supply chain slowed, the determination and enthusiasm of the sector did not. Yeap noted a Reuters report of Ørsted Asia-Pacific president Matthias Bausenwein saying that their investment decisions and general confidence in the offshore wind sector will not be influenced by the pandemic, even though it could delay the timeline of their projects.

However, aside from the pandemic, challenges for Taiwan's growing offshore wind energy market such as unique geographical features, local content requirements, insurance market capacity and gaps in local infrastructure and skilled labour still remain. Yeap notes that whether these challenges can be overcome in time to comply with the schedule is yet to be seen.

Appeal to investors remains strong

The outlook for the sector remains bright for the next six or twelve months, as offshore wind is still in its nascent stage in Taiwan and wider Asia, it remains a sector with huge potential. The market is still expected to attract more local and international investors, as more projects approach completion and investors without experience and financial investors without capacity in the sector look for opportunities to buy into an existing project, Yeap said.

It is already seeing more players enter the market, as evidenced by acquisitions of a majority stake in Yushan Energy by Stonepeak Oceanview, and a stake in Zhangfang and Xidao Wind Farms by Taiwan Life Insurance and Transglobe Life Insurance. Also, the Yunlin Off shore Wind Farm by EGCO Group was acquired by a consortium comprising Sojitz, JXTG Nippon Oil & Energy, Chugoku Electric Power, Chudenko, and Shikoku Electric Power.

German investors have also been gravitating towards Taiwan’s offshore wind market, seeing it as a nascent market with abundant opportunities and an important gateway into Asia. Yeap expects to see growing interest from European investors in the future.

WPD was amongst the first international investors to be allocated with capacity in Taiwan, and now has one project under construction—Yunlin Offshore Wind Farm with a capacity of 640MW. Another project will commence construction in 2021, namely the Liwei Offshore Wind Farm with a capacity

John Yeap

of 350MW, whilst two others are under development. Furthermore, it has been reported recently that wpd will work with a local Taiwanese developer the Lealea Group to develop an offshore wind farm in Changhua that has passed the EIA but yet to be allocated with capacity.

Energie Baden-Württemberg AG (EnBW) also picked Taiwan as its first offshore wind markets outside of Europe, pushing with the development of the 2GW Formosa III in Taiwan along with Macquarie and JERA. Furthermore, RWE Renewables has also established a presence in the market, joining with Asia Cement Corporation in Taiwan to further develop the up-to-448MW Chu Feng offshore wind project.

“With the exception of Mainland China, Taiwan is leading the region in terms of government policy, legal framework, projects under construction, projects in development, and future plans. It already has 5.5GW in the pipeline from 2020 to 2025, and has plans for more generation capacity coming online from 2026 to 2035,” Yeap added. Furthermore, the demand for green energy in Taiwan is growing rapidly, which offers an alternative to selling electricity to Taipower and could, in fact, potentially be more lucrative.

Whilst investors will always want to have higher tariffs and greater flexibility around procurement requirements such as the extent of local content requirement, such concessions are unlikely to happen as the Taiwanese government is under pressure from the public to keep the cost of establishing a supply chain in Taiwan and the cost of electricity for consumers as low as possible. Instead, the government can enhance investor interest through ensuring regulatory certainty so as to reduce risks for investors, as well as providing a steady pipeline for growth.

Fitch Solutions projected Taiwan to add a net wind capacity of approximately 5.8 gigawatts (GW) over the coming decade, and account for 7.9% of total electricity generation by 2029. In the long term, capacity for both onshore and offshore is projected to grow by an annual average of 23% between end-2019 and 2029 to reach under 6.7GW by the end of the decade.

COUNTRY REPORT: MALAYSIA Bright future ahead for Malaysia’s solar sector

Unhindered by current economic uncertainties, total solar capacity could more than double by 2029.

With Malaysia’s solar tenders being successful and with floating solar technology gaining ground across Southeast Asia, analysts are bullish that the country’s solar sector is in for a robust growth spurt, even amidst pandemic headwinds.

To kickstart the economic recovery, the Ministry of Energy and Natural Resources (KeTSA) launched a 1GW tender in 2016 under the Large Scale Solar (LSS) programme. On 31 May, it launched a new round of solar auctions with a targeted capacity of 1GW, its solar auction to date. The maximum bidding capacity has however been lowered to only 50MW, with a maximum of three bids per developer, to attract more investors. The submission deadline is within three months, and the projects are expected to begin implementation before 2020, with COD latest by 31 December 2023.

With both auctions, the government hoped to revitalise the economy with the auction amidst the COVID-19 outbreak. They have expressed high hopes from the fourth round, especially considering the current scenario and its impacts on the economy, a GlobalData report noted.

Analysts are also optimistic about the tenders—despite the uncertain economic and financing environment. Fitch Solutions noted the country's significant oversubscription in previous solar auctions, citing the previous round in September 2019, which had a target of 500MW but attracted more than 112 bids for a total of more than 6.7GW of generation capacity.

Bid prices went to a record low of $0.0416 (RM0.1777) per kWh, falling lower than the price for gas-fired power.

Local bidders are also likely to greatly benefit from a drop in the levelised cost of electricity (LCOE) from $88/MWh, GlobalData’s senior power analyst Somik Das said. He noted that

Malaysia’s cumulative solar PV capacity is expected grow 8% to about 1.1GW in 2020.

the LCOE for renewables remains significantly higher compared to coal power plants, but this is expected to decrease if not vanish in the next eight to nine years.

“Besides, the LSS 4 provides the opportunity of creating almost 12,000 employment opportunities. This is expected to stimulate the economy and help the nation propel through the existent stagnancy,” he added.

Malaysia's solar capacity surged 64% to an estimated 882MW in 2019. Fitch projects for the country to add a net capacity of around 800MW from end-2019 to 2029. Considering the effects of the pandemic, Das expects Malaysia’s cumulative solar PV capacity to grow 8% to about 1.1GW in 2020, which would serve as a growth shot to an ailing economy to fight the crisis.

“Whilst we expect some near-term project delays to weigh on growth in 2020 due to the Covid-19 outbreak and ongoing political uncertainties, we have revised our longer term growth forecasts up slightly given the rising traction and investor interests in the sector,” Fitch Solutions said in its report.

In the first round of the LSS in 2016, the government allocated 250MW in the country. In the second tender in 2017, 360MW was allocated in the peninsula and 100MW across Sabah and the islands of Labuan.The third tender went undersubscribed by 10MW, where bids for 490MW were lodged.

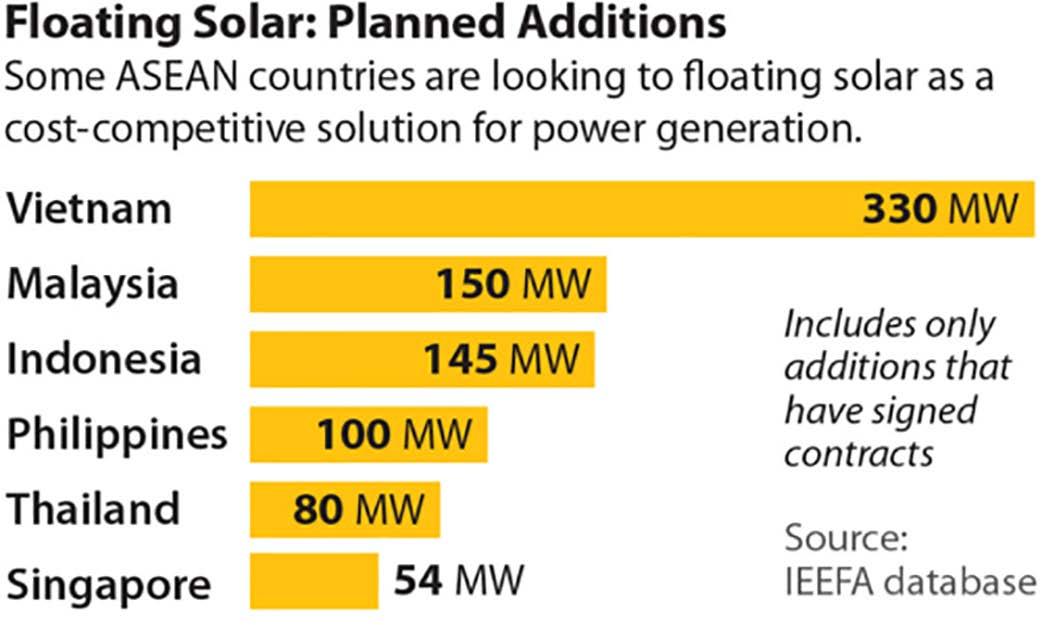

Floating solar emerges

The development of floating solar technology has also been taking off across Southeast Asia, according to a report from the Institute for Energy Economics and Financial Analysis (IEEFA). Up to 2019, total installed capacity of FPVs amongst ASEAN countries was mostly below 1MW. This has changed drastically with at least five countries, including Malaysia, recently

Large-scale floating solar plans of ASEAN countries

Source: IEEFA database

announcing large-scale floating solar plans.

In August 2019, a local engineering firm entered a partnership with a Chinese inverter maker to jointly develop such solutions, whilst in October 2019 a Chinese solar manufacturer secured a contract to supply 150MW of PV modules to fully power a floating PV park.

Energy finance analysts Sara Jane Ahmed and Elrika Hamdi noted that power demand in the Philippines and Malaysia has dropped by as much as 16% during the lockdown, causing extreme stress to electricity grids due to excess power.

“If the COVID-19 outbreak is to teach one lesson, it would be that utility companies need agile operations, not outdated power stations that burn coal 24/7 and cannot respond quickly to sudden changes or outages,” Ahmed said.

IEEFA’s research revealed that more ASEAN countries are building solar farms that float on rivers, dams, lakes and reservoirs, and even on sea, to produce clean electricity at prices that could compete with power from polluting coal-fired plants.

Further, the report found that solar farms are best installed near hydropower facilities and piggyback existing connections to electricity grids.

Floating solar power could also balance out the peaks and troughs of consumer demand in complex electricity systems. “The combination of floating solar and hydro on existing dams and reservoirs trumps the economics of adding new baseload coalfired power plants on grid systems such as the Java-Bali network that already have generation overcapacity,” Hamdi said.

Floating solar installations have also proved that they can withstand typhoons, powerful waves, and winds gusting up to 170 kilometres an hour, with offshore FPV now being tested by manufacturers. For Southeast Asian countries, the decision to install FPVs is based primarily on the economics of existing grid infrastructure and the issue of land scarcity.

“Focusing on the economics of generation assets in isolation does not make sense because of the need to invest in transmission lines. A grid-level solution, considering the cost of generation plus transmission requirements, is key,” says Ahmed. It also helps with energy security, avoiding the cost of coal imports, which is often still preferred in the far east where new plants continue to be planned and built.

It is also possible to get competitively priced generation through technology-specific auctions of power, and Southeast Asian countries stand to benefit.

“Further, water-borne solar installations are much quicker to build than fossil-fuelled power stations and can be ready in a matter of months, while coal, gas, hydro generators take up to three years to build, and nuclear plants take much longer (still),” says Hamdi.

The report also adds that clean energy sources, such as floating solar power, can also help insulate coal-importing ASEAN

Sara Jane Ahmed

Elrika Hamdi

Somik Das

countries from the risk of volatile fuel prices and the expensive supply logistics of the global fossil fuels market.

“The geography and demographics of ASEAN present a distinctive opportunity for floating solar,” added Hamdi.

Local manufacturing sector boost

On top of these, Malaysia's solar sector is also particularly well poised for more growth, according to Fitch Solutions. Besides having relatively high irradiation levels in the country, Malaysia already has an established solar manufacturing sector, although most of the solar equipment is exported at present. Fitch notes that the continuation and success of solar tenders present a sizeable upside risk in the market

Although most of the solar equipment is currently being exported, the expanding domestic manufacturing base for renewables components will be able to ensure that there is a reliable and low-cost supply chain for project developers, enabling them to capitalise on falling technology costs.

“We believe that this will be a key supportive factor to the Malaysian solar industry over the coming years, as greater numbers of manufacturers set up in the country,” the Fitch Solutions report stated.

One of these for example is PV firm LONGi Green Energy Technology announced in 2019 that it plans to build a new 1GW monocrystalline solar cell manufacturing facility in Malaysia, in the Shama Jaya Free Industrial Park, Kuching City. It later announced that it will invest an additional $117m (RM500m) into the plant in late 2019.

Fitch also noted that the Malaysian government's commitment to the domestic renewables sector has strengthened of late, and a number of regulations have been put in place to entice investments into the sector.

In particular, the government is looking to introduce more financing incentives into the sector, such as those similar to the Green Investment Tax Allowance and Green Technology Financing Scheme 2.0, which has already attracted many private investors. It also plans to launch a Renewable Energy Transition Roadmap 2035, which aims to boost the country’s share of renewables in the power mix to 20% by 2025.

Fitch believes that the roadmap will have provisions and more specific actions to accelerate renewables growth, and may include strategies such as peer-to-peer electricity trading or transitioning towards a mandatory renewable energy certificate market system.

“Whilst we now expect some delays and uncertainties to policy making given the domestic political crisis in the country, alongside headwinds from the COVID-19 outbreak, we believe that this is largely in the near term and the government is likely to retain an ongoing commitment to boosting the sector, particularly as it has highlighted 'Green Growth and Energy' as one of their economic diversification efforts over the longer term,” the report added.

Total installed solar capacity in Malaysia