1 minute read

Prepare Your Child for their Financial Future

Budgeting and learning how to manage money is a skill that adults use on a daily basis so it is important to teach children and teens good spending habits. First Credit Union has a solution to this! Mad City Money is a way for teens to learn the importance of budgeting - all while having FUN! This immersive financial education experience is designed for junior high and high school students and it's free! Each teen receives a future identity complete with an occupation, salary, kids, and perhaps some debt. Students then make decisions about housing, transportation, food, and more. Just like adults!

Before leaving Mad City Money the teens discuss and review what they learned about budgeting. Did everyone stick to their spending plan? What choices put them over budget?

Advertisement

Mad City Money will be held at the First Credit Union Chandler Corporate Plaza (25 S Arizona Place, Chandler, AZ 85225) on Thursday June 22 from 10:00 am to 12:30 m and lunch will be provided. Open to junior high and high school students. Sign up your child today to prepare your child for their financial future.

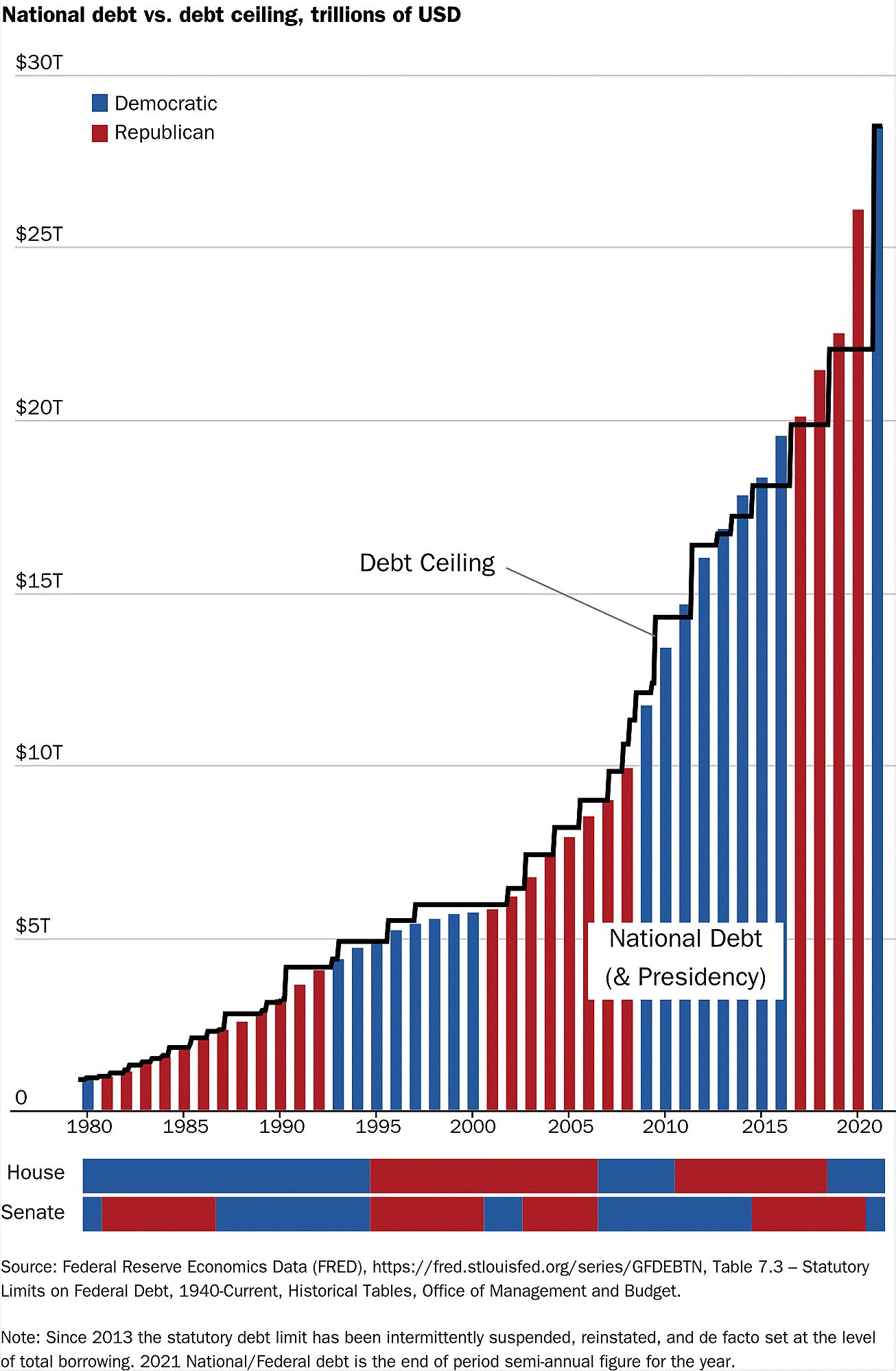

Debt Ceiling

The Debt Ceiling Bill has passed the House and Senate. As the graph shows this is the normal trend within the last 40 years. Key provisions include:

• Two-year increase in the debt ceiling

• Caps on non-defense spending in 2024, with a 1% increase in 2025

• Full funding for veterans' health care and increased support for toxic exposure fund

• Broadened work requirements for food stamp recipients

• Rescinding unspent COVID-19 relief funds

• Cutting IRS funding for new agents

• Restarting student loan repayments

• Promoting domestic energy production by easing permitting restrictions.