1 minute read

SIMPLIFIED EXAMPLE OF 1ST-YEAR

TAX DEDUCTION FOR OIL & GAS

Advertisement

TAX CONSIDERATIONS OF OIL & GAS INVESTING – THE BASICS

CONGRESSIONAL INCENTIVES

INTANGIBLE DRILLING COST (IDC) TAX DEDUCTION

DEPRECIATION TAX DEDUCTION

SMALL PRODUCER’S TAX EXEMPTION- DEPLETION ALLOWANCE

ACTIVE, OR NON-PASSIVE VS. PASSIVE INCOME

ALTERNATIVE MINIMUM TAX (AMT)

Tax Benefits for the Small Producer

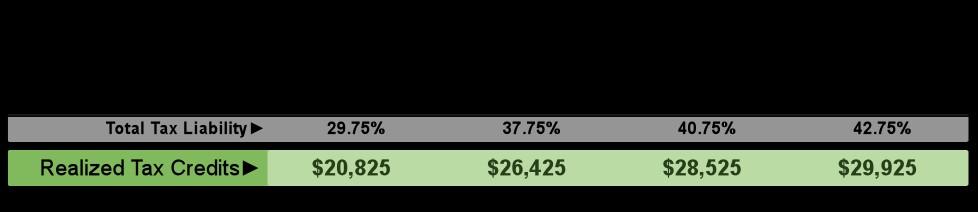

In the case of a successful oil and gas investment, the IRS allows for a tax write-off from one’s taxable earned income of approximately 65% – 80% of the investment amount in the year of investment. The remaining amount of the investment is depreciated over a period of seven years.

Even in the case of an unsuccessful oil and gas investment, the IRS allows almost 100% of the investment to be written off against one’s taxable earned income unlike stock investments where the investor may only writeoff a small portion of the loss (subject to certain limitations).

The IRS currently allows 15% of one’s gross Working Interest income from the sale of oil and/or gas to be derived “tax free” (this is referred to as a “depletion allowance”).