37 minute read

FINANCIAL & NEWS

BLOOMBERG

Bloomberg readers are the people who manage and control the world’s money – they are ultra-affluent and influential. Bloomberg readers are professional, global citizens who live the ultimate luxury lifestyle, driven by their discerning tastes and exclusive experiences.

AUDIENCE DEMOGRAPHICS

Circulation 382,473

Total Affluent Adults 11.4M Male/Female Skew 78% / 22%

Average HHI $190,310 Median age 46.6

Median Net Worth $1,191,200

BLOOMBERG

Evening Briefing e-Newsletter

• Price per Week With Five Deployments: $11,775

Subscribers 640,000

SOTHEBY’S INTERNATIONAL REALTY

BLOOMBERG MARKETS E-NEWSLETTER

5 THINGS NEWSLETTERS Five Things to Start Your Day. Get up to speed with the most important business & markets news each morning in our Five Things roundup.

BLOOMBERG

5 Things e-Newsletter

Place your listing next to the most important business and markets news each morning in the 5 Things roundup.

• America, 5 Deployments: $8,850 per week • Asia, 5 Deployments: $3,750 per week • Europe, 5 Deployments: $3,750 per week

America Subscribers 346,000

Asia Subscribers 90,000

Europe Subscribers 90,000

BLOOMBERG

FULLY CHARGED E-Newsletter

• Price per Week, 5 Deployments: $6,500

Subscribers 148,000

Pursuits E-Newsletter

Bloomberg’s exclusive luxury lifestyle component.

• Price per Week: $4,250

Subscribers 60,000

BLOOMBERG

Open/Close e-Newsletter

A recap of important topics at the start and finish of the trading day.

• America, 2 per Day for a Total of 10 per Week: $6,500 • Europe, 2 per Day for a Total of 10 per Week: $1,500 • Asia, 2 per Day for a Total of 10 per Week: $1,500

America Subscribers 377,000

Asia Subscribers 46,000

Europe Subscribers 46,000

FINANCIAL TIMES

The Financial Times showcases the finest residential properties on the market and provides sage advice to a discerning audience of high-end private owners, as well as investors, every Saturday in its stand-alone FT Weekend “House & Home” section.

House & Home Rates

• Gallery Box: $1,240 • Gallery Strip: $6,510 • Front Page Strip: $14,725 • Quarter Page: $8,100 • Half Page : $16,125 • Full Page: $32,250

CIRCULATION AND DEMOGRAPHICS

Saturday 6 November / Sunday 7 November 2021

USA $3.00 Canada C$3.50

Stone poses Rock-solid additions to your decor — INTERIORS PAGE 10

Follow us on Instagram @ft_houseandhome

INTERNATIONAL NEWSPAPER OF THE YEAR USedition

SATURDAY 11 DECEMBER / SUNDAY 12 DECEMBER 2021

Disney’s new boss on talent and the past Netflix,

LIFE &ARTS

How the super-rich buy their homes

Hugo Cox ventures inside a world of private banks, billionaires ’ trade fairs, zero deposit mortgages and multiple loans that extend to hundreds of millions

Earlier this year, mortgage broker Paul Welch arranged the financing for a Singaporean client who was buying a home in London for £7m — andputtingdownnomoneywhatsoever asadeposit.

“We used existing assets such as individualsharesinadditiontotheproperty itself,” says Welch, who runs largemortgageloans.com and arranged the mortgage with a 1 per cent interest rate — terms that most UK homeowners would considertoogoodtobetrue.

For years the super-rich, advised by a suite of lawyers, accountants and bankers have taken mortgages — often reaching up to 100 per cent of the value of the property — on the world’s priciest homes. The majority of loans are interest-only; most are never paid off unless the home is sold; increasingly, when the home is inherited, the next generation will take out a comparable loan. The money saved can then be shuffled around the world in search of the best tax deal and the biggest investmentgains.

With annual net income over £300,000 or net assets over £3m, Welch’s clients enjoy a wider range of options than other UK mortgage customers. Borrowing the money — and buying in London — brings benefits. Many are resident non-doms (RNDs), meaning they live in the UK but declare their domicile elsewhere so are not taxed on money earned outside the country,solongastheydon’tbringitin.

“It’s a no-brainer,” says Mark Davies, aLondontaxadvisertothesuper-rich— most of them non-doms. “[Borrowing] means your money is working in two different places to generate wealth. You own the house in London [which may increase in value] and you also invest themoneyoffshore.”

For a super-rich individual, the combined value of multiple home loans can extend to the hundreds of millions, with international private banks typically lending the money. Often they clear the borrowing quicker than a high street bank would, helping clients snap up abargain.

“If you find something you like, you may want to buy it in a hurry, whether it’s in the south of France, the Caribbean or Miami,” says Roddy Boulton, a private banker for Deutsche Bank in London.

Those who offer home finance, or arrange it, pursue potential clients at trade fairs, where the very wealthy shop forsuperyachtsorprivatejets, orevents where they enjoy their pastimes. Welch, who also arranges finance for yachts and jet purchases, reckons he has received £500m of leads through giving out branded sunglasses cleaning cloths fromhisstallattheMonacoYachtShow.

He is also a regular at Geneva’s

‘It’s a no-brainer. Borrowing means you own the house in London and you also invest the money offshore’

European Business Aviation Convention and Exhibition. Classic and supercar events such as the UK’s Salon Privé at Blenheim Palace and the Goodwood Revival are also popular mixing grounds, as is the Paddock Club VIP accessattheworld’sFormula1races.

Private banks may host events at the WorldEconomicForumatDavos,luring current and prospective clients with celebrity speakers. Financiers make sure they keep advisers to the superrich — including lawyers, accountants and tax advisers — up to date with what they can offer. Staff of the super-rich visit ultra-high net worth conventions tostakeouttheservicesonoffer.

“And people talk,” says Davies. “One billionaire might introduce another: ‘These guys are good [for arranging a mortgage], try them’; ‘Credit Suisse

Nick Lowndes were fantastic for this; I used UBS for thatandtheywereallright.’”

Mortgages for the super-rich typically cost banks more to administer than those for normal customers — partly because their incomes are rarely all from typical sources such as a salary, so take time and effort to fathom. But if they spy lucrative business down the line — such as managing share and bond portfolios or selling clients new shares as part of initial public offerings — bankers may offer them at knockdown prices.

“Lending can often be a dooropener, ” saysBoulton.

A private banker at the Monaco office of a big global bank, who asked not to be named, says he would lend money at a loss if this was outweighed by revenue from other services. Recently he sought to lure a client worth $3bn from a competitor bank, offering him a loan on a €60m home purchase at a rate so low that he knew it would be rejected by his lending department. The prospect still refused because — ‘Everyone wants as much LTV as they can get. The attitude is: why wouldn’t you andyou’redumbifyoudon’t’ the banker believes — the terms from the existing bank were better.

Earlier this year, Welch secured a £45m mortgage from a private bank on a £50m London home for a client. “On day one [there was] nothing but a gentleman’s agreement that they would develop a wider relationship. Banks will dowhatevertheywanttodoiftheywant theclient,”hesays.

Melissa Cohn, a specialist US mortgage broker who covers New York, Florida and the Hamptons for William Raveis Mortgage, has arranged $400m worth of home loans this year, for sums of between $3m and $19m. She says typical rates for these — most of which are interest only, with 30-year terms — are now between 2.5 and 2.9 per cent. Recently, falling interest rates have led her clients to increase the amount of borrowing on their homes, releasing equity to invest in their own businesses or the stock market, where they believe theywillgetreturnsthatarehigherthan thecostoftheloans.

“At the beginning of 2020, when rates were at 3.5 per cent or 3.75 per cent, my clients would [borrow] 50 per cent to 75 per cent loan to value. Now, everyone wants to get as much as they can get. The attitude is: why wouldn’t you and you’redumbifyoudon’t.”

Private bankers say that while most clientsstillfavourvariablerateloans,an increasing number are considering fixed-rate mortgages in anticipation of futureinterestraterises.

Several UK high street banks will currently lend mortgages of up to £10m — NatWest’s was the best rate at this level in late October — but borrowers must be able to demonstrate clear historical income to show they can afford OWEN WALKER — LONDONDANIEL DOMBEY — MADRIDSILVIA SCIORILLI BORRELLI — MILAN therepayments. “The high street banks are criteria led —theyhavethelowestratesandfeesbut no negotiating of the terms and lowerflexibility,”saysWelch. Spanish bank Santander must payAndrea Orcel €68m in compensationafter losing a legal battle over its ran-corous 2018 U-turn on hiring the Ital-ianbankeraschiefexecutive. Continuedonpage2 TheMadridcourt rulingcappeda long-running dispute between Orcel, one ofEurope’s best-known investment bankers and now head of UniCredit, andSpanish lender Santander, his formerclientwhenheworkedatUBSandMer-rillLynch. BroughtbyOrcel, thecase centredonSantander’s decision to withdraw anofferitmadetohimin2018whenhewasrunningUBS’sinvestmentbank.The ruling was a significant blow forAna Botín, executive chair of the Spanishlender,whosetenuresincesucceed-ing her father Emilio Botín has beenmarked by the decision first to hireOrcel, a family confidant, and then todrophim,withtheresultinglegalfight.The court ruled that both sides hadsigned a “valid” contract, which hadbeen broken in a “unilateralandunjus-tified” manner by the bank and thattherefore it had to pay compensation.Santandersaiditwouldappeal.Thepayment the court ordered fromSantander included €10m “for moraland reputational damages” to Orcel, aswell as contractual items including€5.8m for two years of salary, a €17msign-on bonus and€35mcompensationforlossoflong-termincentivesatUBS.“I think it’s unfortunate that we arewhere we are, but ifpeople look only atthefactsandwhathasemergedincourtthe conclusions are clear,” Orcel said in

COLBY SMITH — NEW YORK

US consumer prices rose at the fastestpace in nearly 40 years in November,piling more political pressure on JoeBiden’s administration as it seeks sup-portforamassivespendingplan.Theconsumerprice index,publishedbytheBureauofLaborStatisticsyester-day, rose 6.8per cent lastmonthfrom ayearago — thefastestannualpace since1982 and a significant pick-up from the6.2percentrateinOctober.Inflation has become a thorny politi-cal issue for the White House, weighingon the president’s approval ratings aswell as the electoral prospects for his Santanderorderedtoincompensationover payOrcel€68m U-turnonjoboffer Europe’s winter skiing season has gotoff to a faltering start as memories ofspring 2020 loom large. Some Alpineresorts became notorious as virus superspreader spots after stayingopen even though the pandemic wasravaging neighbouring Italy. This year authorities are acting with caution. Austria has been in lockdownsince late November. In France andItaly, where jab rates are higher,nervousness about curbs is palpable.Europe’s reopened resorts i PAGE 3 Ski resorts take tentativefirst steps amid Covid fears an interview with the Financial Timesbeforeheknewthatthecourt’sdecisionwascomingyesterday.Santandersaid:“Wedisagreestronglywiththeruling.TheboardofSantanderis confident we will be successful onappeal as we were in the two criminalcomplaints already considered by thecourtsinrelationtothismatter.”The bank claimed Orcel’s offer letterdid not amount to a contract underSpanish law. The court quoted what itdescribed as “ particularly eloquent”tweets by Botín, in which she enthusedabout Orcel’s appointment “effectivefromthebeginningof2019”, aswellasapromotional video and interviews inwhichshegavethesamemessage.Orcel became chief executive ofUniCredit, Italy’ssecond-biggestlender,inApril.Hesaidthathehopedthedeci-sionwouldbetheendofthematter.

Democratic partymidtermelections. during next year’s In a sign of his concern, Bidensoughtto play down the relevance of the latestdata both ahead of the announcementand afterwards, stressing that priceshave fallen in recent weeks formany ofthesectorsdrivingtheincrease.“Developments in the weeks afterthese data were collected last monthshow that price and cost increases areslowing,althoughnotasquicklyaswe’dlike,”hesaidyesterday. At riskfortheWhiteHouse islegisla-tiontoinvest$1.75tninAmerica’ssocialsafety net, which Biden is seeking topass throughCongress this month.Last month Biden signed into law another$1.2tnbipartisaninfrastructurebill.Republicans and some moderateDemocrats have argued that additionalspendingwilladdfueltorisingprices.Following yesterday’s numbers, theFederal Reserve is likely to press aheadwithplanstoscalebackmorequicklyitsasset-purchase programme at its meet-ing next week. Jay Powell, chair of thecentral bank, earlier this month sig-nalled his support for a quicker exit,acknowledgingthattherisksofinflationbecomingentrenchedhadrisen.Economists now predict that thatpacewillbedoubledsothatthestimulusprogramme ends in March, which

InflationrisepilespressureonBiden3 Pace of surge hits 40-year high 3 Midterm prospects threatened 3 Spending bill under fire

Finalcorner Joe Biden, the US president, tried to play down the latest data, pointing out that prices had fallen in recent weeks would give the Fed more flexibility toraiseinterestratessoonernextyear.Prices between October and Novem-ber jumped 0.8 per cent, slightly downfrom the previous month-on-monthrise of 0.9 per cent. “Broad increases inmost component indices” fuelled therise, the BLS said, with petrol and food“amongthelargercontributors”.Core CPI climbed 0.5 per cent fromOctober, pushingup the annualpace to4.9 per cent. Last month, it was 4.6 percent.“Inflationwillbemorepersistent,”said Anna Stupnytska, global macroeconomist at Fidelity International. “Itis very likely to stay well above [theFed’s2percent]targetthrough2022.”

Rivalssetfor

F1titledecider Formula1worldchampionLewisHam-iltonleadshisMercedesfromRedBull’sMaxVerstappenduringpracticeyester-day for tomorrow’s Abu Dhabi GrandPrix. The showdown will decide whichofthepairwilltakethisyear’stitleintheclimacticraceofanailbitingseason.The intense battle between BritishdriverHamilton,seventimesthecham-pion, and the young Dutchman hasenthralledfansandfuelledhopesatLib-erty Media that its $8bn takeover of F1in2017isstartingtopayoff. A tie-up with Netflix for the behind-the-scenesDrivetoSurvivedocumentaryhashelpedthesporttowoonewfans.Gripping showdown page 14 Guiseppe Cacace/AFP via Getty Images

Subscribe In print www.ft.com/subsusa and online Tel: 1 800 628 8088

STOCK MARKETS World Markets

CURRENCIES Sustainable Christmas How green is your tree?

HOUSE & HOME

Putin’s mind games Will Russia invade Ukraine?

BIG READ

Festive wines Jancis Robinson’s best reds

LIFE & ARTS

For the latest www.ft.com news go to

© THE FINANCIAL No: 40,888 ★† TIMES LTD 2021

Printed in Frankfurt, Francisco, Dubai London, Liverpool, Milan, Madrid, New Tokyo, Hong Kong, Glasgow, Dublin, York, Chicago, San Singapore, Seoul,

S&P 500

Nasdaq Composite

Dow Jones Ind

FTSEurofirst 300 Euro Stoxx 50 FTSE 100 FTSE All-Share CAC 40 Xetra Dax Nikkei

Dec 10 prev %chg 4691.34 4667.45 0.51 15565.95 15517.37 0.31 35821.51 35754.69 0.19 1845.29 1849.96 -0.25 4200.60 4208.30 -0.18 7291.78 7321.26 -0.40 4146.90 4167.39 -0.49 6991.68 7008.23 -0.24 Dec 10 prev $ per € 1.131 1.129 $ per £ 1.323 1.321 £ per € 0.855 0.855 ¥ per $ 113.425 113.445 ¥ per £ 150.049 149.832 SFr per € 1.042 1.044 € per $ 0.885 0.886 Dec 10 prev £ per $ 0.756 0.757 € per £ 1.170 1.170 ¥ per € 128.222 128.029 £ index 81.001 80.813 SFr per £ 1.219 1.222 INTEREST RATES

US Gov 10 yr UK Gov 10 yr Ger Gov 10 yr Jpn Gov 10 yr US Gov 30 yr Ger Gov 2 yr

15623.31 15639.26 -0.10 Hang MSCI MSCI MSCI 28437.77 Seng 23995.72 World $ 3172.49 EM $ 1247.71 ACWI $ 743.61 28725.47 24254.86 3196.39 1241.01 748.11 -1.00 -1.07 -0.75 0.54 -0.60 COMMODITIES

Dec 10 Oil WTI $ 71.21

prev %chg Oil Brent $ 74.63 Gold $ 1776.15 70.94 74.42 1783.80 0.38 0.28 -0.43 Fed Funds Eff US 3m Bills Euro Libor 3m UK 3m

Prices are latest for edition

price yield chg 147.71 1.46 -0.02 0.66 -0.02 -0.35 0.01 112.81 0.05 0.01 121.80 1.86 0.00 104.71 -0.70 0.01

price prev chg 0.08 0.08 0.00 0.06 0.07 -0.01 -0.61 -0.60 -0.01 0.09 0.09 0.00

Data provided by Morningstar

Weekend Circulation 208,930 Readership 1,629,654 Male/Female Skew 82% / 18%

Average HHI $357,000 Average Hhi $190,310 Median Age 50

THE DAILY TELEGRAPH

The Daily Telegraph is the UK’s leading quality daily newspaper. Its readers are among the wealthiest in the UK and for whom property is just one category of luxury products they consume.

The Property Pages

The Property pages are part of the “Money” section, which attracts vast numbers of home buyers and home sellers.

• 3 inches x 5 inches: Prices starting at $1,825 • 6 inches x 5 inches: $3,715 • Quarter Page $6,325 • Other Sizes Available Upon Request

CIRCULATION

Saturday Circulation 401,000

Saturday 11 September 2021 *** telegraph.co.uk Republic of Ireland €3.50 No 51,732 £3.00

Schoolgirl to superstar in 73 days

INSIDE

John Lydon ‘The Sex Pistols have ceased to exist’

Review

Mary Churchill’s diaries ‘My love for Papa is almost a religion’

The Telegraph Magazine

Character homes Discover the most viewed properties on Rightmove

Saturday

‘Gold’ rush Is Cornwall sitting on a mining fortune?

The Telegraph Magazine

NEWS BRIEFING

Comment 19 Obituaries 29 Business 33 Weather 36

ISSN-0307-1235 9 *ujöeöu#yxccn,* ÊÃËÆ

How Emma Raducanu made sporting history

7-page US Open final special, Sport

BRITAIN’S BEST QUALITY NEWSPAPER

PLUS EXTRA PROPERTY INSIDE

Council tax rise to pay for social care

Duke of York served with sex assault lawsuit

MONEY MAKEOVER ‘Where should I invest my £600,000 buy-to-let profits?’

P.9

SOARING SALES British cities are bouncing back – but a new threat awaits

P.4

‘Double whammy’ for families as town halls search for funds before extra NI cash kicks in

By Christopher Hope, Dominic Penna and Maighna Nanu COUNCIL tax bills will have to rise for millions of households next year to pay for social care despite Boris Johnson’s tax raid, ministers fear.

This would mean families facing a “double whammy” of tax rises as the 1.25 percentage point increase in National Insurance is due to come into force at the same time as council tax goes up in April next year.

Town halls are likely to need extra cash as most of the money raised by the NI increase will go to the NHS in the next three years before being diverted to social care in 2024. Experts privately believe council tax will need to rise by an average of at least 5 or 6 per cent next year to help meet the shortfall.

A poll of 10,000 voters by Electoral Calculus and Find Out Now for The Daily Telegraph found that the tax rises have sent the Conservative Party’s performance in the polls into a nosedive, down eight percentage points to 37 per cent. Labour is unchanged at 33 per cent, with the Greens up 5 per cent.

If the results were repeated at a general election, Mr Johnson’s majority would be wiped out and 54 Tory MPs would lose their seats, including 21 in “red wall” constituencies won in 2019.

There are now growing concerns among Cabinet ministers that the NI increase is the first in a series of tax rises in the coming years which will harm the Tories’ electoral chances.

One senior minister admitted that the prospect of soaring council tax bills was “a worry”, but added: “At the end of it all, people are going to ask themselves do they want the Government to level with them and be honest, or do they want a government that wrings its hands and does nothing?” Clive Betts, the Labour chairman of the Commons housing, communities and local government committee, said: “Council tax bills will have to rise because there is no other way for councils to be able to pay for social care.

“The people who are going to be hit hardest by the council tax increases are the very people hit hardest by National Insurance increases. It is a double whammy in April.”

Local authorities that provide social care to adults are able to charge an extra 3 per cent on top of council tax bills under legislation brought in five years ago. However, figures show that a third of the councils that can charge the precept – 52 out of 152 – has not so far levied the full amount.

The Government’s NHS and social care plan, published on Tuesday, hinted that the council tax precept would have to increase because of a delay in the £5.4 billion earmarked for social care filtering through to local authorities.

The small print of the plan suggested that the cap on the precept could be increased above 3 per cent in the Budget at the end of next month.

A survey of councils by The Telegraph found that many in “red wall” seats were considering increasing the social care precept next year.

Andy Morgan, executive cabinet member for adult social care at Bolton council, where the social care precept is 2.5 per cent, said: “Yes, we would absolutely be looking to increase the precept next year.”

A government spokesman said last night: “We will ensure every council has the resources they need to deliver these reforms with extra money invested next year and £5.4 billion by 2024-25.”

A government source added: “Details of core local government funding, including flexibility for local authorities to set council tax, will be set out at the Spending Review, in the usual way.”

CHRIS JACKSON/GETTY

Reports: Pages 4-6 Camilla Tominey: Page 19 Editorial Comment: Page 21

Covid variant throws festive travel plans into chaos

No insurer will pay out if Christmas plans to head abroad are derailed by another lockdown or a ban on foreign holidays. Jessica Beard reports

Tech giants hinder terror fight, says Met chief Face masks will be back if virus cases surge in autumn By Ben Riley-Smith Political Editor TENS of millions of adults in England will be told to wear face masks in indoor settings if Covid-19 cases surge this autumn, The Daily Telegraph understands.

Boris Johnson is understood to be “adamant” that a nationwide lockdown will not be reimposed given that so many adults have been vaccinated, but mask mandates will be one of the first levers pulled by the Government if there are concerns the virus is spreading at an alarming rate. The move is seen in Downing Street as preferable to reimposing social distancing rules because it has less of a direct impact on the economy. Covid restriction laws are being extended until next spring, meaning that fines could return for people who ignore orders to wear masks in certain settings. No 10 would have to decide whether to make such orders compulsory or advisory. In recent months there has been an emphasis on “personal responsibility”, suggesting the latter. Mr Johnson plans to announce his approach next week, making clear that the Government is ready for a wave of cases as the weather cools. The Prime Minister is expected to approve vaccine boosters – though for how many remains a point of internal debate – and announce the biggest flu jab rollout in history. Vaccine passports for nightclubs and other settings are also expected to be

By Martin Evans crimE corrEsPondEnt TECH giants are making it impossible to identify and stop terrorists carrying out deadly attacks, Dame Cressida Dick warns today on the 20th anniversary of 9/11.

The Metropolitan Police commissioner – who was yesterday granted a two-year extension on her contract – said the introduction of end-to-end encryption, which allows users to message one another in secrecy, was giving terrorists an advantage over law enforcement agencies. Companies such confirmed, with Mr Johnson stressing that the country faces an “uncertain” few months with Covid.

No decisions have been made about when any measures should be imposed, but there is an emerging consensus in Downing Street about how to approach the coming months. Reports: Pages 10-11

as Facebook have argued that introducing encryption will improve privacy for its customers.

Writing in The Daily Telegraph, Dame Cressida warns that terrorists are exploiting such technological advances to radicalise people and direct attacks around the world.

She describes the Sept 11 attacks as a “watershed moment, confirming that terrorism was a truly global threat that required a global response”.

Dame Cressida said that the terrorist landscape had shifted since the atrocity in New York in 2001, with relatively sophisticated plots giving way to much

The Duke of York has been served with a civil lawsuit at the Royal Lodge in Windsor by lawyers acting for Virginia Roberts Giuffre. Ms Giuffre, 38, accuses the Duke of raping her as a teenager, which he denies. The affidavit states he has until Sept 17 to respond Page 3 more rudimentary attacks that required very little planning or preparation. She writes: “That global shift has only gathered pace in recent years with advances in communications technology. Terrorist groups have exploited this to reach and recruit anyone, anywhere and at any time.” But she warns: “The current focus on encryption by many big tech companies is only serving to make our job to identify Continued on Page 2 Dame Cressida Dick: Page 17 Douglas Murray: Page 20 Editorial Comment: Page 21 Calais mayor inflames Channel migrants row

US judge rules against Apple on app fees Anger at India after fifth Test is cancelled The mayor of Calais has questioned whether Britain will begin shooting at migrant boats, as the Border Force prepares to turn back vessels in the Channel. Natacha Bouchart further soured relations between London and Paris yesterday as she urged British authorities to pick up migrants at sea. “Are they going to shoot at the boats and at the passengers in the small boats?” she asked her local newspaper. Home Office sources said the suggestion was “offensive”. Page 2

Apple faces losing billions of dollars in sales after an American judge ruled that the firm must allow developers to bypass fees on its App Store. Apple was told to lift a rule that forces apps to use its own payments system, which charges fees of up to 30 per cent, amid growing opposition from iPhone software creators. In a case brought by Epic Games, which makes the video game Fortnite, Judge Yvonne Gonzalez Rogers declared that Apple was “engaging in anti-competitive conduct”. Page 33

news business sport The Indian cricket team was last night preparing to fly out of Manchester for the IPL, leaving English cricket facing a £40 million financial black hole after the fifth Test was cancelled 90 minutes before the toss. The India players sealed the Test’s fate when they sent a letter to their board just before midnight on Thursday saying they would not play the game over concerns about Covid ‘She’s exactly what this spreading through the touring party. country needs. I wonder if The IPL starts on Sept 19 and they were she has an HGV licence?’ worried about getting stuck in Britain. Sport, page 1

world Lionel Shriver The lessons of 9/11 were wasted on us Page 16 Insurers will leave Britons unpro-tected and out of pocket this Christmas as they fail to offer cover against the tightened travel restrictions. Fears of the new omicron variant have thrown travel into chaos, with new border rules coming into force across France, Spain, Portugal and other popular destinations this week. The red list is back and testing requirements have been beefed up. Many people heading home for Christmas or visiting friends or relatives abroad now face losing their money if plans fall through, or paying hundreds of pounds for extra tests. Anyone entering Britain must now take a PCR test, which ranges in price from around £50 to £217. At an average cost of £80, more than £300 could be added to the travel bill for families of four looking to get away over the festive season, and double that if a test is needed to enter the destination country. Test prices are expected to rise in the coming weeks as private companies respond to this higher demand. Anna-Marie Duthie of Defaqto, a financial data firm, said travellers should only book trips they know to be 100pc cancellable or refundable, because of the uncertainty around rules changing at short notice. “Travellers may encounter increased costs from having to pay for PCR tests, having to stay beyond the planned return date or having to pay to quaran-tine in a government hotel,” she said. Switzerland has introduced a 10-day quarantine on all arrivals from Britain, meaning that skiers may decide to ditch their plans. Searches for winter travel to Geneva rose by 300pc last month, according to Skyscanner, a price com-parison service. But one in five passengers failed to turn up to some flights leaving the UK on Monday. Britons who continue with Christmas travel plans could find themselves footing the whole bill if there are any government-enforced restrictions. No insurer will pay out if a trip is cancelled because of further lockdowns, and only 3pc will cover disruptions caused by a change in the official advice, according to Defaqto.

Just 1pc of insurers would cover the cost of quarantining abroad or travellers denied boarding a flight because they displayed symptoms.Only half of policies will cover anyone who can no longer make their trip because they must self-isolate. However, nearly all policies will pay up for any medical costs related to contracting coronavirus, or a cancellation due to a positive test. Anyone who chooses not to travel because of the increased risk or cost will have no protection if their flight or train is still running, Ms Duthie said. Travellers have been given a “false impression” about what insurers will and will not cover, the consumer group Which? has previously warned. Insurers have used confusing policy names, such as “Covid cover” or “enhanced Covid cover”, to reassure customers despite policies containing harmful exclusions, Which?’s report found.Demand for travel insurance has risen in the past week. One company, Cover-ForYou, reported a 40pc rise in insurance policy sales on Sunday and Monday following changes to travel rules. Increased uncertainty and last-minute changes to government policies will be a big blow to people’s confidence, warned Ian Bell of RSM, a consultancy. He called for more support for the struggling travel industry, such as bearing the cost of PCR tests for all inbound travellers. GEORGE HANNAFORD/GETTY/ALAMY Flight companies must offer a cash refund for a cancelled flight. Some air-lines have kept flexible travel policies in place for all passengers, which means those who are unable to travel or choose not to could change their flight or request a voucher. British Airways and easyJet flights can be rebooked without charge, but passengers will have to pay the difference in the fare if the new tickets are more expensive. Ryanair flights booked between Nov 20 and Dec 11 2021 will also be covered under a zero-change fee policy. However, passengers are unlikely to receive any cash refunds for flights that are still running and they choose not to take. telegraph.co.uk/money

*** Saturday 4 December 2021

FTSE FORTRESS Is a market crash coming? These fund managers are betting on it

P.7

HIDDEN CRISIS ‘I took on a £10,000 loan just to pay for childcare and get back to work’

P.3

THE NEW YORK TIMES

The New York Times is widely recognized as the most influential news source for many of the world’s most sophisticated and loyal readers.

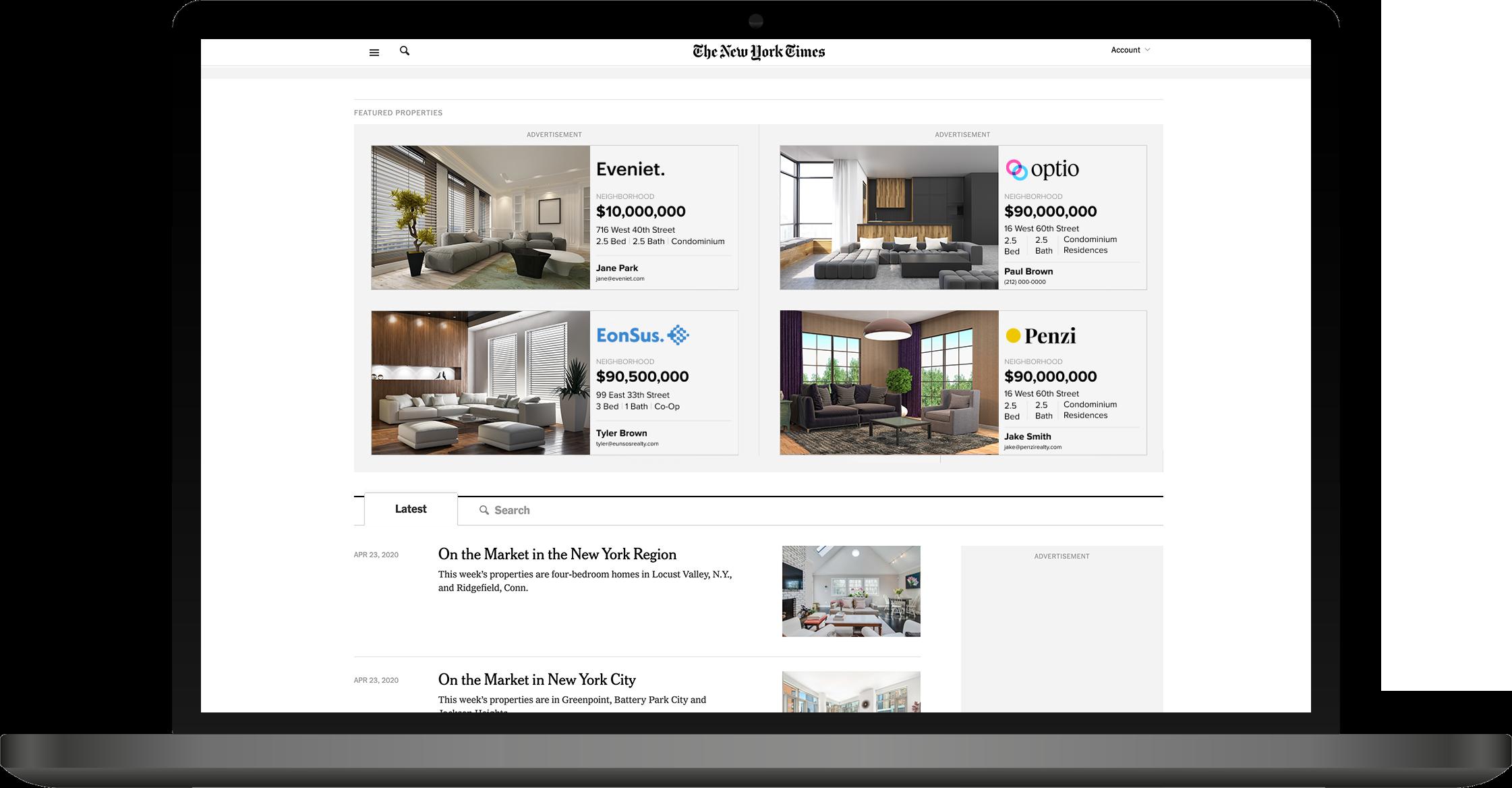

NYTimes.com Featured Property Module

Appear right below the fold on the real estate section front page.

• Four Spots Available • Price per Week: $3,000

CIRCULATION AND DEMOGRAPHICS

Global Reach 164.2M Gen Z and Millennial readers 58%

Total Buying Power $1.4T Average CLICK-THROUGH RATE 0.36-0.55%

THE NEW YORK TIMES SUNDAY REAL ESTATE SECTION

Sunday Real Estate Featured Listings

The New York Times Sunday Real Estate Section features the latest developments in the housing market. This section educates, enriches and inspires readers in the quest for their forever home or future investment property.

2 inches x 3.5 inches:

• 1-time run: $1,475 • 2-time run: $1,180 each • 3-time run: $1,000 each

AUDIENCE DEMOGRAPHICS

Circulation 381,268 Male/Female Skew 48% / 52% Median age 51

Average HHI $149,000

THE WALL STREET JOURNAL AND MANSION GLOBAL

Whether it’s searching for a summer home or a condo in the city, 18 million affluent readers are dedicated to seeking out the most sumptuous and luxurious real estate. And in their journey to the perfect place, The Wall Street Journal and Mansion Global brands are their inspiration – their guide home.

WSJ.com & MansionGlobal.com

45% of readers plan to make a real estate purchase in the next five years

DEMOGRAPHICS

YOUR MESSAGE HERE

Average HHI $337,499 Average HHNW $1,986,537

YOUR MESSAGE HERE

THE WALL STREET JOURNAL AND MANSION GLOBAL

Featured Property Upgrades

Place your listings at the beginning of the search results in the town where the property is located for extra visible positioning.

• 10 30-Day Upgrades: $1,110 • 25 30-Day Upgrades: $1,950 • 100 30-Day Upgrades: $5,265

Mansion Global Top Market Tiles

• Available Markets: New York, London & UK, Los

Angeles, Dubai, Miami, Sydney, San Francisco

• 30-Day Static Banner: $575

WSJ Title Unit

Showcase your listing in a fixed position on the WSJ Real Estate front alongside regionally relevant editorial.

• Minimum Spend: $3,250

WSJ Weekly Real Estate Newsletter

Delivered weekly, WSJ showcases aspirational residences from all different regions in the Real Estate Newsletter.

• Open Rate: 19% • Pricing Starts at: $1,500 • Subscribers: 41,000

Mansion Global Daily E-Newsletter

A quick, comprehensive overview of the latest news impacting the global luxury real estate market.

• Open Rate: 39% • Subscribers: 45,000 • Pricing Starts at: $2,375/Month

THE WALL STREET JOURNAL AND MANSION GLOBAL

Mansion Global Homepage Hero

The homepage hero provides premium, full-page visibility and the best opportunity for your listing to reach the most qualified buyer as the first listing on the Mansion Global homepage.

• Static Banner: $2,150/Month • Listings With Video: $2,375/Month

AUDIENCE DEMOGRAPHICS

Unique Visitors 164,000 Click-Through Rate 1.75% Share of Voice 2.5%

THE WALL STREET JOURNAL AND MANSION GLOBAL

Mansion Global New Development Profile

From a property neighborhood profile, video amenities and localized map feature, this feature provides an in-depth look at your new construction project to engaged, HNW buyers.

• Pricing Starts at: $1,250 per month • 3-Month Minimum Buy

Mansion Global Homepage Featured List Module

The homepage featured listing module offers prominent positioning on the Mansion Global homepage and showcases listings regardless of region.

• Pricing Starts at: $1,250 per month

@WSJRealEstate Instagram

Spotlight your brand with a social Instagram post directly on the @WSJRealEstate editorial handle.

• Followers: 154,000 • Price per Post: $1,765 • Price per Story: $1,250

@MansionGlobal Instagram

Leverage Mansion Global’s growing Instagram presence with native Instagram posts that showcase your properties to an active, in-market social media audience.

• Followers: 154,000 • 1 Month of 1 Post a Week: $1,765

Mansion Global WeChat Post

Showcase your listing to an in-market Chinese audience on Manson Global’s WeChat page.

• Price per Post Starts at: $2,353 • 2 Posts Minimum

THE WALL STREET JOURNAL AND MANSION GLOBAL

The Wall Street Journal Mansion Section

• Quarter Pages • Price Based on Region • New York $6,962 • Northeast $7,389 • Wash/Balt $2,556 • Southern $5,250 • Florida $3,110 • Midwest $11,649 • Western $8,492 • So. California $4,783 • No. California $3,541 • Other Regional Rates Available Upon Request

CIRCULATION AND DEMOGRAPHICS

Print 786,294

Affluent Readership 4,143,000

P2JW274000-0-M00100-1--------XA

SKI &MOUNTAIN HOMES

P2JW354000-4-A00100-17FFFF5178F

In theHeights

High-altitude homes takework but the views are worth it M2

HOMES | MARKETS | PEOPLE | REDOS | SALES

MANSION

THE WALL STREETJOURNAL. Courchevel

The French ski town’s real-estate market is hot despiteCovid. M12 Friday, October 1, 2021 | M1

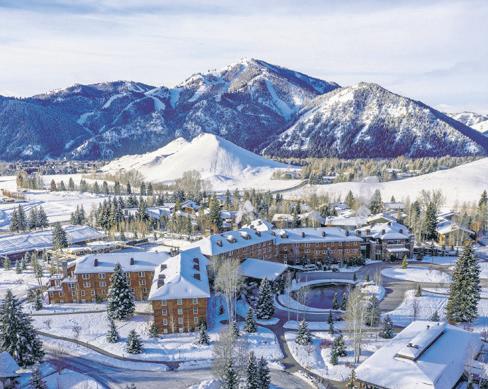

KETCHUM Cost:$4millionLearn howonpage thinkorswim® is morethan atrading platform.It’sanentiretrading experience. B10.

ADVERTISEMENT

BELLEVUE Cost:$1.3million Idaho’s home prices have grown42% in the past two years—twice the national average and the most of all thestates.

ION) (ILL US TR AT YNDMAN KERR YH

Idaho’s

Ski Boom

The stateisattracting awaveofhome buyerswho want smaller resorts, shorter liftlines and amorelaid-back vibe

BY NANCY KEATES

SCHWEITZER MOUNTAIN has 2,900 acres,great snowand stunning lakeviews; it’sIdaho’s largest ski terrain area. Most people have never heardofit. “Wehavenoliftlines.It’s low-key,itisn’t pretentious and there’sastrong sense of community,” says David Thompson, aretired surgeon from Houston who bought aski-in, skiout house therewithviews of Lake Pend Oreille in 2009 for $850,000.

It isn’t easy to gettoSchweitzer—the closest major airport is in Spokane,Wash.,about atwo-hour drive, including asteep road with sharp switchbacks.The two fastest routes from Boise,Idaho’s capital, are10-12 hoursand involvegoing PleaseturntopageM6

HOME) (HIGH-AL TITUDE

But Tina Dicoand Helgi Jonsson managed to do just that with their newvacation home,built on alot wherethe viewismade

AVacation Home in Iceland’sScenic Splendor Acouple built on alot with one of the country’sfamous mountain views,plus ararebit of greenery PUNCH BRIAN THORLA CIUS; MARINO

Tina Dicoand Helgi Jonssonbuilt avacation houselessthan an hour from Reykjavik. BY J.S. MARCUS even morespectacular by a rare bit of greenery. WITH ITSWATERFALLS Less than an hour’s drive and glaciers, Icelandoffers from the couple’smain views that arehardtobeat. PleaseturntopageM4

Tamarack resort presidentScott Turlington is aiming for500,000 skier visits overthe next couple of seasons (upfrom120,000 lastseason),which he acknowledges mightmakehim persona non grataamong some of the currenthomeowners. ‘If Idomyjob properly Iwon’t be the mostpopular person,’hesays.

(T AM AR AC KS KIER) JOURNAL REET ST LL The 71% SUN VALLEY number of sold homes in Augustfroma year wasup earlier. MEIER FO RT HE WA DD TO TA MAR AC KH OME); (2, JOURNAL REET ST LL WA FO RT HE GREEN LE KY RES OR T; LLEY VA N/ SUN MOR TO OPER CO LIFT); RES OR T( SKI Ski Magazine readersvoted comparably shortliftlines;i Sun Valleythe country’s topski resort t’slocated in an arid, high-altitude and in Western North Americ desert-likeenvironment. ain2021, in partbecause of its VA LLEY ADD /S UN TAMARACK Cost:$1.28 million The average sold pricefor ahome in HOMES ); RA YG Tamarack has grown80% overthe past JOURNAL (2, twoyears. ST REET WA LL HE FO RT BORDER GABE P: TO FROM Plentyofroomand yetnone forcompromise. When you’re lookingfor that home away from home,ithelps to have a networkForever Agent℠ whocan truly seeyour vision. See what it means to work withanetwork agent at BerkshireHathawayHS.com For Life Ourfranchise network represents someofthe finestresidences in the United States,Canada,Mexico, Europe,MiddleEast, Indiaand the Bahamas. ©2021BHH Affiliates, LLC. Real Estate Brokerage Services areoffered through the network member franchisees of BHH Affiliates, LLC. Mostfranchisees areindependently owned and operated. BerkshireHathaway HomeServices and the BerkshireHathaway HomeServices symbol areregisteredservicemarksofColumbia InsuranceCompany, aBerkshireHathaway affiliate. Equal Housing Opportunity.

Lastweek: DJIA 35365.44 g **** MONDAY,DECEMBER 20,2021~ VOL. CCLXXVIIINO. 145 WSJ.com605.55 1.7% NASDAQ 15169.68 g 2.9% STOXX600 473.90 g 0.3% 10-YR.TREASURY À 25/32,yield 1.401% OIL $70.86 g $0.81Pandemic Victims AreRemembered Amid NewRestrictions HHHH $5.00 EURO $1.1239 YEN 113.71 Manchin

Is a‘No’ On Big Spending Package

Democrat’s opposition quashes akey plank of Biden’sagenda, spurs apushfor alternatives PRES S GR UBER /A SS OCIA TED MICHAEL VIRUS VIGIL:InVienna, tens offrom Covid-19.New restrictions thousandsgatheredSundayfor amemorial servicefor thewere being adoptedinEurope to combat thespreadofthe 13,000 Austrians Omicron variant. who A8 have died BY MELISSA KORN AND ANDREA FULLER Five months afterKassandra Jones earnedher master’s in public health from NewYorkUniversity in May2019,she still hadn’tlanded ajob in the field. She wasstaringdown asix-figurestudent-loan balanceandhad to payfor rent and food.So she sold her eggs. Again.Ms.Jones firstharvested her eggs beforestarting at NYU in 2017tohelp payfor mov-ing to thecity,she said. She received a$12,500 annual scholarship and relied on$131,000 in federal loans to coverthe rest ofher tuition and expenses.She has given hereggs five times,including to an NYU fertilityclinic,earning $50,000.Now28yearsold,Ms. Jones is workingfreelanceonpublic-health campaigns fornonprofitsmaking about $1,500 amonth,which isn’t covering her living expenses,she It Bah,Humbug!Isn’tChristmas InAustralia, WithoutBeetles i i i Iridescent but aren’t insects used to markseason, swarming liketheyonce did SYDNEY—Americans dreamof awhiteChristmas.InAustralia, manypeopleare hopingforbrown, greenand yellowbeetles. In Yuletides past, swarms ofso-called Christmas beetles,agroup thatincludes about 35different species, would BY MIKE CHERNEY emerge around the holidays,which hit in themiddle ofAustralia’ssummer.Althoughthe beetlesare clumsy fli-ersthatslam intowalls,win-dows,peopleand pets, fanssaythe insects’ iridescent andcolorful carapaces comple-mented the festiveseason.But now, scientistsand evPleaseturntopageA11 WASHINGTON—Sen. JoeManchin (D., W.Va.) said hewould oppose his party’sroughly $2 trillion education,healthcareand climatepackage,likely dooming the centerpieceof President Biden’s economicagenda as currently written. By and Andrew Duehren,Lindsay Wise Michael C. Bender “This is a‘no’onthis legisla-tion,”Mr. Manchinsaid on FoxNews Sunday. “I have tried everything.” Covid-19’s acceleratingspread has hampered opera-tions and slowedsales at somecompanies in amatterofdays, Democrats have spentmonths drafting and revisingthe package, called “Build BackBetter,” to win Mr.Manchin’ssupport,which theyneed topassthe bill through the 50-50Senate. but manysay theyhope pre-cautionsadopted during previous surges will helpthemmo-torthrough this one. Restaurantswereamongbusinesses most immediatelyhit. downtown workers wouldcome back to their offices withthe newyear,”hesaid. “Now,companies aretelling workersto stay home due to Omicron.” Forthe week ended Nov. In his FoxNewsappearanceand in awrittenstatement, Mr.Manchin reiterated many of theconcerns he has expressedabout the bill, including itspos-sible effect on inflation andhowthe cost wascalculated.While Mr. Manchin hasraised those concerns formonths,his statement that hePleaseturntopageA4

By Benjamin Mullin,Emily Glazer and Meghan Bobrowsky Chris Fuselier, owneroftheBlakeStreet Tavern in down-town Denver, said his businesshas fallen sincethe Omicronvariantbegan to be detectedin the area and the city insti-tuted newCovid-19-related re-strictions last month. “We’vehad ahugeslowdownthe pastthree weeks,” he said. Mr.Fuselier said one of hisemployees also caught the vi-rusinrecent days.Heshutdown the barand restaurant’sweekdaylunch servicelastweek.“We were hopeful the Impact Spreads Centralbanksworry surgekeeps prices high............ A2 Covid-19 testsare nowhardtoget........................ A6 Hospitals facedstrainsbeforeOmicron hit......... A6

OmicronChallengesBusinesses

28,U.S.restaurant seatingswere down 4% from 2019 lev-els,according to datafromthewebsiteofreservation serviceOpenTable.Aweek later, theywere down 9% by the samemetrics.The following week,ended Dec.12, seatingsweredown 12%, accordingtothecompany.

NYUTopsRanks—inDebtForGradStudents,Parents “The last 72 hours is reallywhere thingsseem to be esca-lating,” said NewYork restau-rant owner Gabriel Stulman onSaturdaynight, afteraroundPleaseturntopageA8 Pricey Manhattan school leavesmanyfamilies struggling with loans said. She is applying fornew jobs and con-sidering leaving the field. “Thereare defi-nitely momentswherethatnumber justlooms as this tunnel that doesn’t have alight at the end of it,”she said of her debt.“It feels likeI’m kind of trapped.” That feeling is familiar to manyrecentalumni of NYU,which has an ignominiousdistinction. By manymeasures,itistheworstoramong the worstschools for leav-ing families and graduatestudentsdrowningin debt.Manyofits graduate-school alumniearn lowsalaries,despitetheir expensivede-grees. At itscore, thedebt burden among NYUgraduates likeMs. Jones stems from federalPlus loan programs.A number of prestigiousprivateuniversities point families to theGrad Plus and Parent Plus programs tobridgethe gapbetween high prices and mea-gerscholarships. PleaseturntopageA12 Lumber priceshaveshot upagainina rise reminiscent of ayear ago, whenhigh-climbingwood priceswarned of thehinkysupplylines andbroadinflation to come. Futures forJanuarydeliveryended Fridayat$1,089.10 perthousand boardfeet, twicethepricefor aprompt deliveryinmid-November. Cash prices areway up aswell. Pricing serviceRandomLengths said thatits framingcompositeindex, whichtrackson-the-spot sales,has jumped65%sinceOctober,to$915.A$129 gain last week wasthebiggest on record,eclipsing a$124jump in May, when lum-ber prices crested at all-timehighs. Though lumber esoteric markets, is traded in 2-by-4sbe-

LumberPriceSoarsAmidSupplyStrain BY RYAN DEZEMBER Lumber-futures price $2,000 1,500 2021 1,000 2020 500 0 2015-2019 average TRADING DAYS Note:Front-month contracts Source:FactSet came aproxy in the debateover whether inflation wouldfade with distancefromthelockdown. In June,Federal Re-PleaseturntopageA4

per 1,000 boardfeet 1 50 100 150 200 250 to makingaprofit, died in November2020 without awill atthe ageof46. In the last year ofhis life,amid the Covid-19 pan-demic,hestruggled with alco-holand drug use and mental-healthissues,peopleclose tohim have said. He surroundedhimself with an entourageofpeopleinhis Park City, Utah,mansion, where thewalls werecovered with thousands ofstickynotes detailing every-thing from lifemantrastofi-

Climate tougher measures face road.............................. A4 CONTENTS Arts in Review... A15 BusinessNews..... B3 Crossword.............. A16 Heard on Street... B10 Markets...................... B9 Opinion.............. A17-19 nancial deals. Now, the problemsthat con-tributed to his demise arebeinginvoked in acourt battle overhis estate. His family,who standto inherit the estate, and friendsarearguingover who had Mr.Hsieh’sbest interest at heart,and who wasout to use him forhis wealthand connections.His estateisvaluedatmorethan $500 million. Some peopleareclaiming theyare owed mil-PleaseturntopageA6 Morethan ayear afterfor-merZappos.comInc.Chief ExecutiveTonyHsieh diedfrominjuries sustained in amysteri-ous fire,his familyand friendsarefeuding over the entrepre-neur’s estate,including finan-cial claims based on dealsscribbled on stickynotes.Mr.Hsieh, known for pro-moting happiness in the work-place and afun-lovingapproach BY KATHERINE SAYRE ZapposFounder’sFriends,FamilyFeud Over His Estate

Outlook....................... A2 Personal JournalA13-14 Sports........................ A16 Technology............... B4 U.S. News............. A2-8 Weather................... A16 World News........A9-11 s 2021 DowJones &Company,Inc.AllRights Reserved

What’s News

Business&Finance

Lumberpriceshave shot upagaininariseremi-niscentofayearago, whenclimbingwoodpriceswarnedofstrainedsupplylines andbroadinflation tocome. A1 Supply-chain disruptions arethreatening to robsome companiesofholidaysales,leaving them short on pack-aging and transportation at acriticaltimeofyear. B1 Airlineshavebegunplanningforpossibleflightdisruptions as U.S.regulators weighcompetingproposalsforprotecting aircraftfroma new5Gcellular service slatedtogo liveearlynextyear,in-dustryofficialssaid.B1 Bank of Montreal is intalks to buy BNP Paribas’sU.S. unit, Bank of the West,with about 500 branches inthe Midwest and West. B1 Equifax is preparing toadd short-term installment-payment plans to credit reports, amovemeant to givelendersafuller pictureofpeople’sfinancial commitments. B1 “Spider-Man: No WayHome” opened to $253million at the weekend boxoffice, setting apandemicerarecord. B2 YouTube TV and WaltDisney reached adeal to restoreaccesstoDisney-owned channels includingESPN and FX forYouTubeTV subscribers. B6

World-Wide

Sen. Manchin said he would oppose his Democratic Party’s roughly $2trillion education, healthcare and climatepackage,likelydooming the center-pieceofBiden’seconomic agenda as it is currentlywritten. A1, A4 Covid-19’sacceleratingspread is challenging awide spectrum of businesses,including some thathope existingprecautionswill be an adequate defense againstthe disease. A1 Waiting times forCovid-19 tests aregrowingin partsofthe U.S. as concerns over the Omicron variant, newinfectionsand the coming holidaysdriveupdemand. A6 European countries im-posed newrestrictions in an effort to stem the spread of Omicron as atopU.S. health official warnedthat the variant is likely tostrain American hospitalsin the coming weeks. A8 E-subscribers 238,000 Chinese companies arelaying off tens of thou-sands of workersasBei-jing’sregulatoryclamp-downs weigh on the technology, education and property sectors. A10 Chileans elected GabrielBoric,a 35-year-oldformerstudentprotest leaderand congressman, as thecountry’spresident. A9 >

Average HHI $372,943