5 minute read

2021: A Year of Change

The word of the year for 2020 was “pivot” and Georgia’s community bankers certainly did just that showcasing flexibility, technology, and personal touch, all while safely serving their customers.

“In my opinion, 2020 will also be remembered as the year of the community banker. During a national time of need, community bankers from across the country answered the call to help inject job saving capital into the small businesses they served,” said John McNair, President

Advertisement

& CEO, Community Bankers Association of Georgia.” Georgia’s community banks led the way making over 93,000 PPP loans which, in turn, saved the jobs of 1 million fellow Georgian’s. Small business owners, politicians and the media alike watched in awe as the nation’s community bankers literally worked night and day for weeks on end to save jobs, livelihoods, and the economy. I am proud to say that your CBA team answered the call as well and worked around the clock to help navigate the PPP process.”

CBA asked several of our bankers and partner firms what they plan to do differently in 2021 as a result of what they learned last year. Many CBA members shared that the bank was well positioned for the pandemic.

“For 2021, we will continue to focus on deepening our relationships with our customers and our communities that we serve. Building loyalty with our customers can be challenging so defining and demonstrating our value proposition will be critical. We will also continue to look for ways to make it easier for people to do business with us. Technology will play a role there for sure. Having options to meet more of our customers banking needs without having to be face-to-face will be a must have in 2021 and beyond,” explained Greg Proffitt, President, Newton Federal Bank, Covington. “Maximizing the bank’s net interest margin (NIM) will be a focal point and will be challenging if the interest rate environment remains similar to what we have experienced in 2020. Lastly, I would say that we will continue to try to

Greg Proffitt

find ways to generate more non-interest President

income since our NIM will be squeezed.”

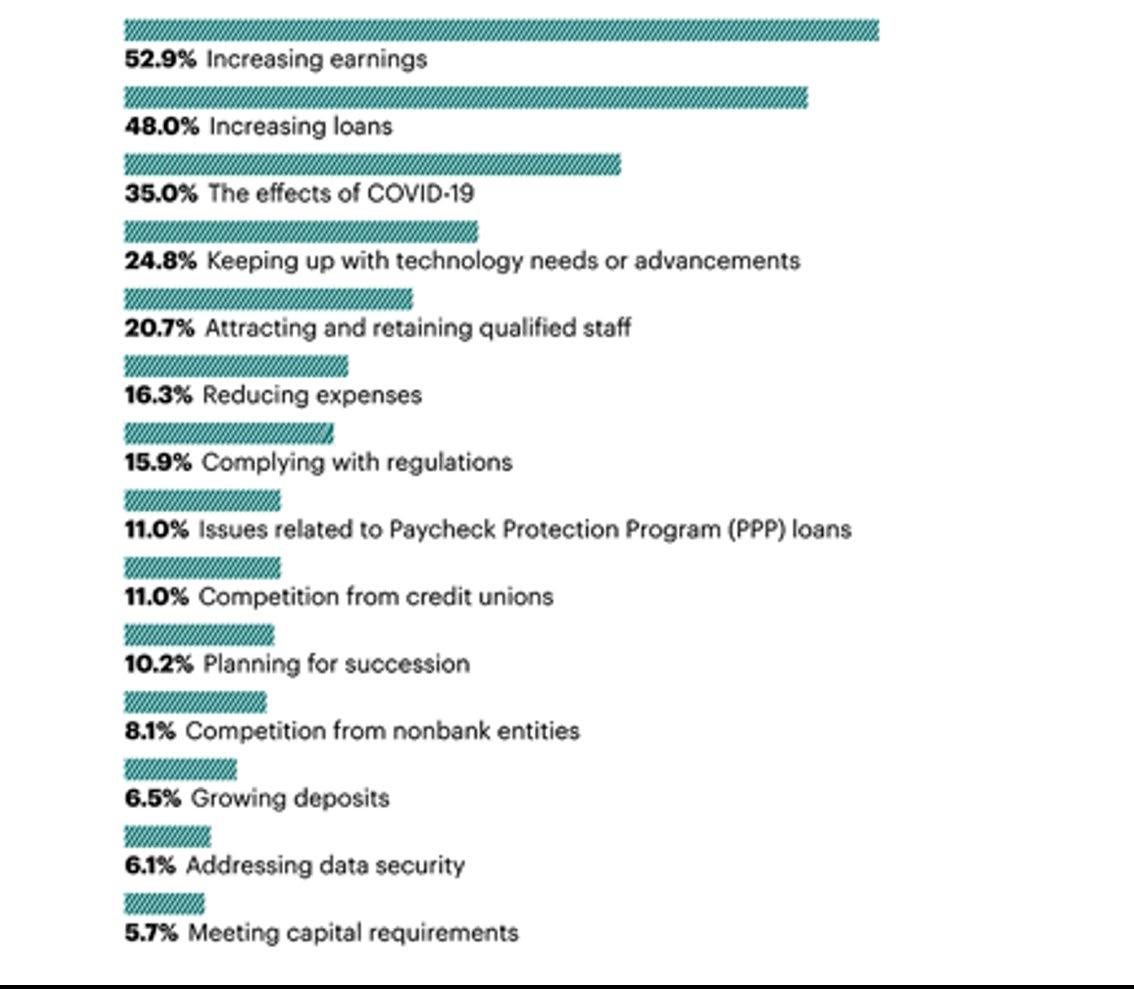

Independent Banker’s annual Community Bank CEO Outlook survey asked bank executives how they plan to move their institutions forward this year. The results of this year’s survey show a different set of challenges—and opportunities—for community bank leaders.

What will be your community bank’s greatest business challenge in 2021?

Correspondent Banking

Fed Funds Management Servis1st Access Online Settlement Services Credit / PCard Program Holding Company Loans Reg O Loans - Stock Loans Participation Loans De Novo & Escrow Services

Tim Finney Vice President - Georgia 478.952.6497 tfinney@servisfirstbank.com

2500 Woodcrest Place Birmingham, AL 35209 855.881.0364 correspondentbanking@servisfirstbank.com

“When COVID permits, I intend to spend more time with our team members and customers. Later in the year, we will plan more companywide gatherings so our employees can get more acquainted with one another. COVID has prevented many of our inter-departmental Mike Sale gatherings and relationship President & CEO building between our employees,” The Commercial Bank commented Mike Sale, President Crawford & CEO, The Commercial Bank, Crawford. “In 2021, we will try to make up for some of this lost time in this arena.

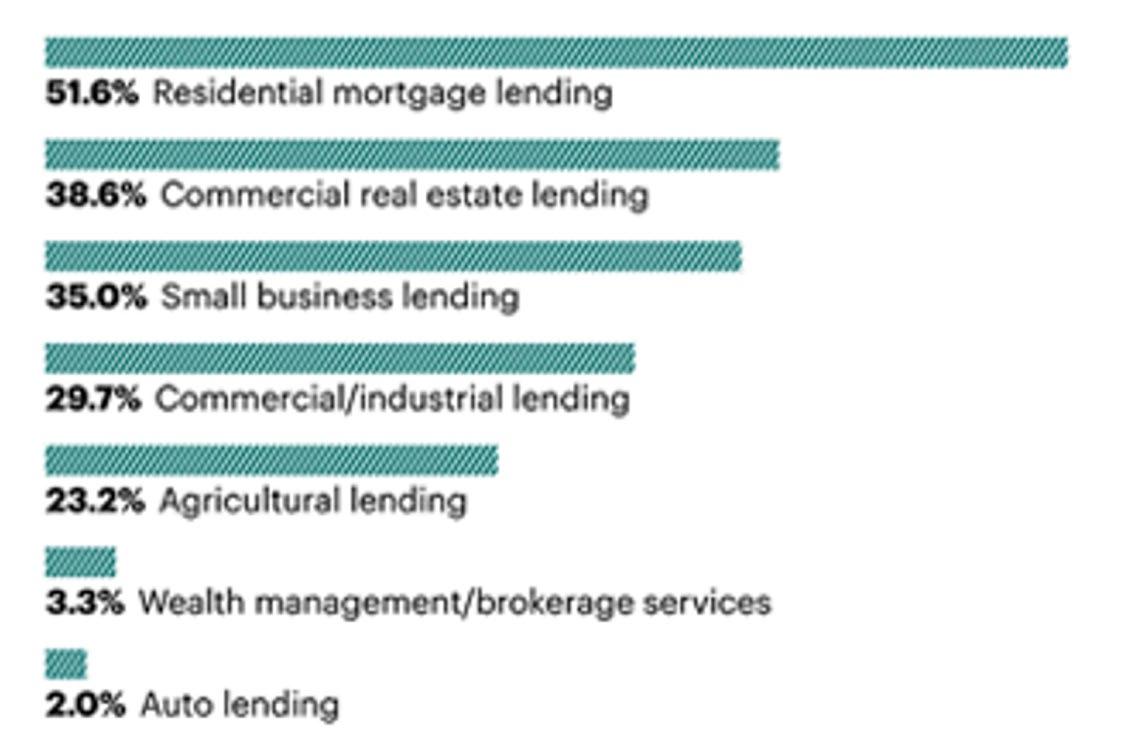

Which of these revenue streams is most likely to drive your community bank’s profitability 2021?

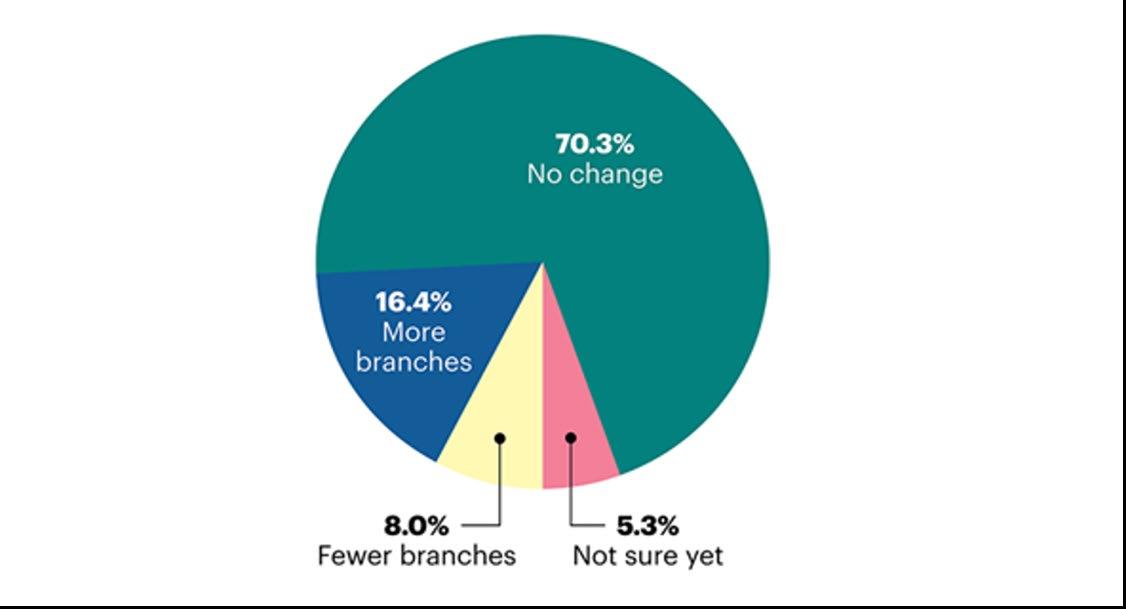

or more brick-and-mortar branches at the end of 2021?

“At our bank, we do not have any major changes for 2021. We are bracing for an income challenge due to the low-rate environment for loans and securities,” shared Doug Nichols, President & CEO, Peoples Bank & Trust in Buford.

Doug Nichols

President & CEO Peoples Bank & Trust Buford

“We did reclose our lobby and are only waiting on existing customers by appointment only. We have had a number of our staff with Covid-19 and presently have four quarantined and one in the hospital. We can’t trace the virus from inside contact with employees and it seems to be with employee contact from outside of the bank. We have about a third of our employees working from home and have a rotation system in place.”

Fowler Williams, President & CEO, Crescent Mortgage Company, Atlanta,

shared his thoughts. “I believe 2021 will be a year where we must continue to adapt. Community Banking has long been a relationship business. We must all

Does your bank anticipate having fewer

find ways to create new relationships and strengthen existing relationships while expecting less face to face interactions that we have become accustom to. The winners are not necessarily going to be the biggest. It will be those who can adapt the best.”

Fowler Williams, AMP, CMB

President & CEO Crescent Mortgage Company Atlanta

Regarding technology, many bankers interviewed said their bank has already invested in new core systems and upgraded digital offerings. Goals for 2021 are ensuring stronger banking relationships in a socially distant world— including online loan applications, account opening and treasury management services.

“Communities across the state are fortunate to have the dedication and commitment of Georgia’s community banks,” said Mr. McNair. “As we move forward in the new year, CBA stands ready to assist our members with first-class professional development, services and of course advocacy efforts. It is an honor to serve you.”

John McNair President & CEO Community Bankers Association of Georgia

Special thanks to Independent Banker Magazine for sharing the 2021 Community Bank CEO Outlook.