1 minute read

OnlineGroceryTrends

OnlineGroceryTrends 3keytakeawaysforsuppliers

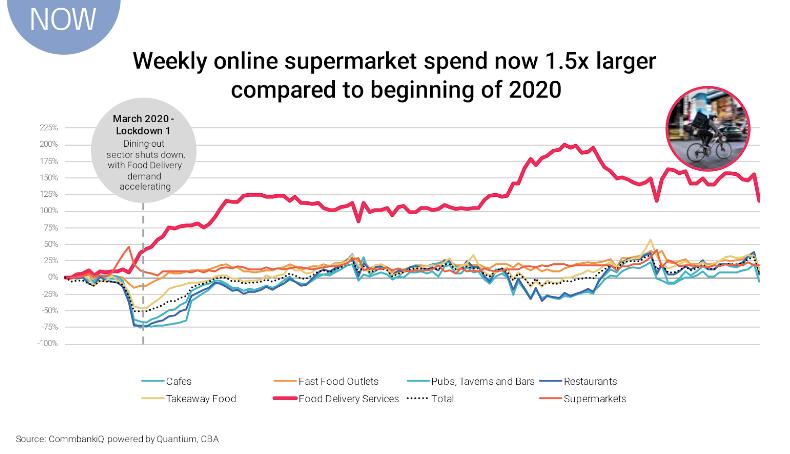

Online supermarket spend is now two and a half times larger than before the pandemic. And the shift online is by no means finished, with online grocery penetration in Australia (18%) still only half that of the US (36%). In some countries nearly 50% of all grocery shopping occurs online. In a recent presentation to AFGC’s Food and Grocery 2022 event, Quantium CEO Adam Driussi identified some of the lifelong habits being formed by new online grocery shoppers. Here’s what they mean for your business.

1

Shoppingbehaviourinthevirtualaisleishardertoshift

When customers transition online they become simultaneously more loyal to both the retailer and the brands in that category. This ‘stickier’ environment has significant implications for customer acquisition, justifying greater investment to attract high-value shoppers. It also presents challenges to both trial and conversion for new product development, giving in-store an ongoing and important role in omni-channel routes to market.

“Dry-freshomnis”shopperswillhelpdrivethenextgenerationofgrowth

Dry goods categories already over-index online, with customers valuing the convenience of having bulky items regularly delivered to their home while still preferring to choose their own fruit and vegetables in-store. We expect “dry-fresh shoppers” to form an increasingly larger portion of new omni-channel customers, which will boost demand for larger-format dry goods SKUs whilst driving traffic to smaller, more convenient stores (such as Woolworths Metros) that specialise in fresh foods.

3

Valuecheckersdemandare-thinkofpromotions

For a core group of savvy digital shoppers, price comparability is key, and large variances between on-promotion and standard pricing is concerning. For these shoppers, loyalty is best grown through targeted offers on the products that most motivate them, using data that tells us what they want, when they want it and the value they find attractive. In terms of normal promotional activity, our data suggests that this group prefers smaller bandwidth, longer offer period pricing changes like Woolworths’ recent price drop campaign to less regular, deeper discounting. EDITION8 I JULY2022 14