6 minute read

Research - There’s no business like the car business

There is simply no business like the car business. In Australia there are over 50 brands that offer passenger vehicles. The comparison site finder.com.au currently lists 56. Within these brands, there are at least 500 models – or more, depending on what you count as a model.

In addition, within models there are different vehicle grades, and these grades are significant differences in the product. If we assume an average of 2 grades per model, that means around 1000 products to select from. For the consumer, this is a dazzling and sometimes bewildering amount of choice, and that’s not even including colours and other optional features.

Advertisement

Finder.com.au currently lists 56 car brands operating in Australia.

Competitive intensity The phrase “the world’s most competitive car market” is often used to describe the Australian market, with its 56 or so brands for a population of just under 27 million people. Compare the USA, a car-obsessed nation for sure, with less brands available (finder.com currently lists 43) for a population of some 330 million.

So, in terms of competitive intensity, the Australian car market is remarkable. To survive and prosper as one of the companies selling to the consumer, you need to be a very good marketer indeed. The competition in the new car market is even more intensive than the ‘FMCG’ (fast-moving consumer goods) categories. As an example, let’s take yoghurt, a very crowded and competitive grocery category. The Woolworths site lists 41 yoghurt brands with 363 products (which basically means flavours). Versus the Aussie new car market with 56 brands and over 1000 products. FMCG used to be seen as the top of the marketing tree. It was considered the most advanced marketing there was. Ambitious marketers wanted FMCG experience on their resume and a name like P&G or Unilever or Nestle on their resume. Nowadays, things have changed in FMCG, with long lag times for new products to reach the shelves, less scope for innovation, the dominance in Australia of two retailers, diminishing budgets, and the rise of generics. The room to move in FMCG is limited, at least in comparison to the auto market.

Auto marketing is top of the tree I’d argue that auto marketing is king of the jungle now. Why? Because it encompasses just about every aspect of modern marketing practice and is rapidly evolving. Let’s consider the 4Ps of the marketing mix and take our yoghurt example as a proxy for FMCG. Yes, I know there are 7Ps now; but let’s stick with the original 4Ps; i.e. product, price, place and promotion. a) Product • From what I can see, recent yoghurt product development includes: More Greek style varieties, probiotics, handy pouches for kids, thick & creamy varieties and high protein. Add vanilla bean if you want to boost the list -

I certainly like it!

• Compare the revolution that is happening in automotive:

Electric vehicles on the rise, with OEMs changing their whole line-ups; and other power trains like hydrogen fuel cell coming. Multiple new active safety features are now pouring down, not just trickling down, from luxury design.

High tech convenience features like heads-up display, multi-media with touch screens, GPS. The list could go on and on; it’s a race that is transforming the car from a transport device to a lifestyle technology tool.

Yoghurt, one example of a crowded, competitive FMCG category

The author finds some notable product innovation in his own fridge.

b) Price • I suppose with yoghurt you can have normal price, a discount, an expiry date clearance, cheaper per gram for multi-packs and larger packs, and ‘choose any 5 for $x’.

Not sure what else there is to play with. • Whereas in automotive we are dealing with more complexity, including manufacturer cash-backs, dealer offers, discounted extra features, capped price servicing, runouts, leasing, and guaranteed future value schemes.

On top of these pricing options is the issue that making money is more the province of parts & accessories and service. Hence, the initial product sale is almost a loss-leader to introduce the consumer to an on-going relationship. c) Place • We get our packaged yoghurt at supermarkets, convenience stores, direct-to-home food boxes, some fast-food chains, and a few greengrocers. Plus, they now make me do my own scanning, neatly outsourcing the checkout labour and trying to sell it to me as convenience.

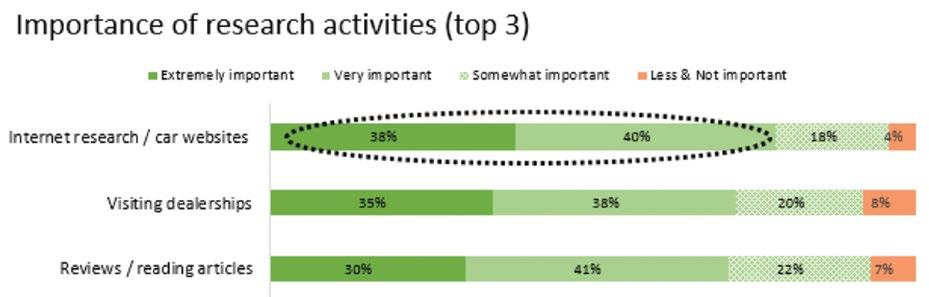

• We buy cars at dealerships. Hold on, it’s not quite that simple. Dealerships have been improving both service and physical environment for several years. There are better amenities, and also much investment in technology such as video displays, touch screens and i-pads to improve the customer experience. • Other types of dealer presence are becoming more common, such as boutique-style stores in city centres and pop-up stores. On the near horizon is the shift to completely online purchasing, i.e. without an in-person interaction at a dealership. Research now finds around 5% of new car buyers saying they’d ‘definitely’ be likely to buy completely online, with a further 19% expressing interest with a ‘probably’ response. d) Promotion • ‘Promotion’ in a broad sense includes selling, advertising, sales promotion, and PR. I suppose the main change for yoghurt would be online and social media; although I can’t remember seeing anything online. TV advertising remains in place as a significant lever, but it’s hard to argue that much has changed overall in promoting grocery goods. I wait to be corrected by someone more knowledgeable. • The revolution in automotive could hardly be more profound. The internet is key for consumer research and decision-making. Online now dominates the near and in-market consumer, and its influence is on par with dealerships. OEMs have invested heavily in the digital experience and their websites are at the cutting edge; with 360° views, fly-throughs, and e-brochures just a few of the innovations. The race is on; and brands are experimenting with virtual and augmented reality, to try make the online experience as close as possible to the in-person visit. It’s like no business I know

In my long career, first as a brand marketer and then as a researcher, I’ve been involved in a myriad of other categories and brands; e.g. banking & finance, packaged food and drink, health & beauty, fast food, telco, technology, retail, etc. But… No other business I know is changing at the rate of automotive, and it’s right at the top of the marketing tree. To be successful, you need to be up-to-speed right across the marketing mix; and then to understand the business implications of any move. If you’re part of the 3,000 dealerships or 55 auto brands in Australia, you’re fighting hard for a share of the approximately 1 million new cars sold each year. It’s challenging, that’s for sure - but I reckon it beats working in FMCG. Jerry Berowne is Director of FF2. Nov. 2021

Internet research is extremely or very important for 78% of car intenders.

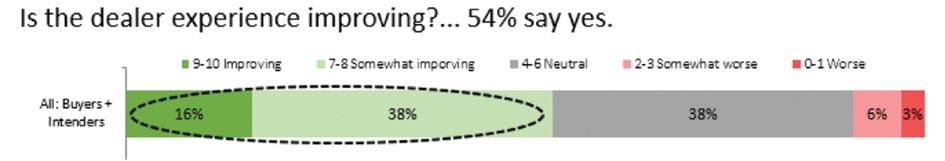

Research for CAMS shows that over 50% of consumers believe the experience is improving.