4 minute read

Younger Adults Seek a Different Buying Experience for Life Insurance

SEPTEMBER IS LIFE INSURANCE MONTH

Younger Adults Seek a Different Buying Experience for Life Insurance

Many prefer to buy online rather than work with a financial professional; others will research before going to a pro

While younger adults are less likely to own life insurance than the general population, a new study shows nearly half of Gen Z adults and Millennials say they plan to buy life insurance this year. How they say they want to purchase suggests the insurance industry will need to pivot to meet the expectations of these consumers. (Gen Z are born 1997-2012, 11-26 year old's; Millennials are born 198196, 27-42 year old's).

According to results from the 2023 Insurance Barometer Study, conducted jointly by LIMRA and Life Happens, more younger adults say they would prefer to buy life insurance online than work with a financial professional. While interest in online buying has been growing over the past decade, this is the first time the preference to buy online was the top choice.

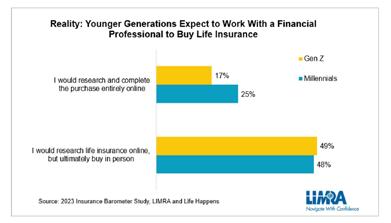

While younger consumers are attracted to the convenience and ease of buying online, they also recognize the value of working with a financial professional. Nearly half of Gen Z and Millennials say they expect to research online for life insurance but work with a financial professional to ultimately purchase coverage. Why? For most people, buying life insurance is an important decision — one where they don’t want to make a mistake. Four in

10 Gen Z and Millennials express little confidence in their knowledge about life insurance and more than a quarter say they haven’t purchased coverage because they don’t know what to buy or how much they need. Working with a financial professional can help answer these questions and ensure they are getting the life insurance coverage appropriate for their needs and goals.

“No doubt, younger generations are living online — on average, younger adults report spending at least five hours on their devices every day,” said Alison Salka, Ph.D., senior vice president and head of LIMRA Research. “While they want to research online, they recognize they may not be particularly knowledgeable about life insurance, so they want to talk to an expert when they make the final decision to purchase coverage because it involves the financial security of their loved ones.”

Younger generations turn to social media for financial advice and information

Unlike older generations, the study reveals that younger people are most likely to turn to social media platforms like YouTube, TikTok and Instagram rather than financial company websites to get financial advice and information. To them, social media equals the internet. According to the study, 81% of Gen Z and 75% of Millennials turn to social media for discussion, advice, and information regarding financial topics, compared with just 48% of Gen X consumers and 27% of Baby Boomers. As a result, it is even more important for life insurance carriers and financial professionals to effectively leverage social media to engage, educate, and sell to younger consumers.

“The industry needs to realize, it’s not just the platforms we use that need to change — we need to adapt our messages and images to reflect the reality of these younger generations who are more racially and ethnically diverse than prior generations,” said John Carroll, senior vice president, head of Life & Annuities, LIMRA and LOMA. “We also need to tackle the challenge of combining the digital experience with access to human advice to meet these younger people where they are with the information and advice they want and need.”

LIMRA research continues to demonstrate the importance of the Help Protect Our Families campaign’s mission to improve Americans’ future financial security by reducing the life insurance coverage gap in the United States. With more than 100 million uninsured and underinsured American adults, it is critical that the industry innovate to meet consumers, particularly young adults, where they are.

• Learn more about the findings and insights, by watching Unlocking the Future: Empowering Gen Z & Millennials to Secure Their Future.

• Learn more about Millennials’ life insurance buying preferences by visiting Millennials Are Serious About Life Insurance.

“The industry needs to realize, it’s not just the platforms we use that need to change — we need to adapt our messages and images to reflect the reality of these younger generations who are more racially and ethnically diverse than prior generations.

John Carroll, senior vice president, head of Life & Annuities, LIMRA and LOMA

To find a SME for Life Insurance, contact

The Collaboration Center @ 657-229-2849