16 minute read

Norfield givesyou the fastest double end trim saw on the market today!

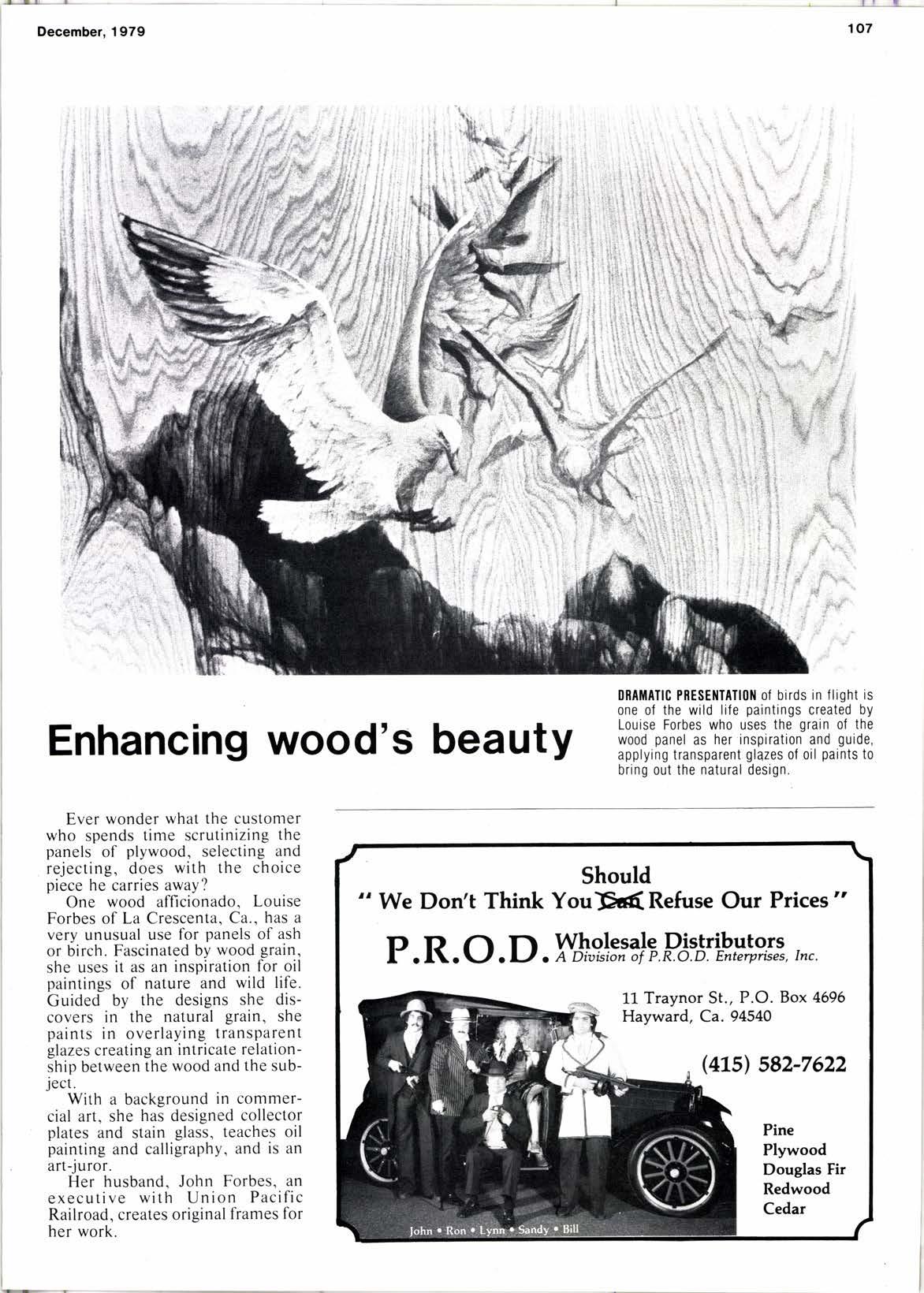

See us at the NAHB SHOW! Booth 2080, Las Vegas, NV, Jan. 18'21, 1980

IF

YOU'RE LOOKING FOR A

look first to the leader. NORFIELD'S Model 1020 double end trim saw is the fastest, safestmost versatile casing and brick mould cutter available. lt's hopper fed and tully automatic. The 1020 cuts up to 30 pieces of pine and other softwoods per minute. lt's engineered for high pedormance and minimum maintenance. Optional features like kerfing and iamb dadoing caoabilities make the Model 1020 the most flexible double end trim saw made.

Double End Trim Saw

NORFIELD Manufactures a complete line of precision pre-hung door making machinery. Two decades in the business have brought about the standards by which all pre-hung door machinery is measured. Our engineering experlise is reflected in every unit we manufacIUre.

Call or write for details on our full line of cosl efficient pre-hung door machinery. NORFIELD Manufactu ring

(Continued from page 12) growing demand for its products with a limited supply of wood?

The long-term solution lies in intensive management of privatelyowned forest land and proper utilization of our national forest by the federal government.

The short-term answer is better utilization of available resources.

One positive development has been composite plywood, which has a core of reconstituted wood sandwiched between face and back veneers. One composite mill has been operating in the Pacific Northwest for several years and a second will open in the South early next year.

The need to maximize resource utilization was acknowledged by the APA board of trustees several months ago when they approved a new definition of "Structural-Use Panel Products." Their action means qualified panels can now meet APA performance standards whether they are made of all veneer, composite layup or unveneered construction.

Unveneered structural panel products will not replace plywood. They are an evolution, not a revolution, that will allow us to keep pace with the world's growing demand for structural wood panels.

The need to stretch our supply of timber is also one of the reasons APA is in the process of developing performance standards for its members: products.

Performance standards are based on tests that determine a product's ability to perform in a specific application. If the product meets the standard, composition of the panel is irrelevant.

Members are already producing their first performance-rated product, Sturd-I-Floor, which is designed specifically for singlelayer residential floor applications. Each Sturd-I-Floor panel carries a span rating showing the maximum recommended spacing of floor joists as determined by extensive tests at the APA Research Center in Tacoma. Wa.

The Technical Services Division is now in the process of developing a performance standard for plywood sheathing. Similar standards for siding and concrete forming are planned in the future.

Producing members are also striving to maintain the high quality of products bearing the APA gradetrademark. The voluntary "Certified lnspector" quality assurance program, introduced just a year ago, has already been adopted by nearly 600/o of our metnbers. Combined, CI mills now account for about 700/o of our plywood production.

Participating mills report a pro- perly conducted CI program can significantly improve overall product quality.

The future looks good for the plywood industry for a number of reasons: the market outlook in the 1980s is extremely promising. Timber supply is a problem, but the industry is making great progress to improve its utilization of wood and to more intensively manage forests.

THE ECONOMY & HOUSING

(Continued from page 13) prool"' real assets abates, easing the pressure on this comPonent of builders' costs. The prices of raw materials and labor services should also grow at slower rates and be more predictable over the life of a project. The cost of construction financing should be reduced commensurately as the inflation premium is gradually wrung out of interest rates.

On the demand side, reduced mortage credit costs should expand the number of qualifying purchasers for residential properties. Combined with the rapid family formation anticipated through the 1980s, demand for single family homes should be particularly strong. Steady prices and a healthy business environment should stimulate business investment, translating into amplified demand for commercial and industrial properties as well.

The wild card in the deck of future policies is, of course, energy prices. Continued increases in petroleum prices constrain our ability to fight inflation without loss of employment and output. However, there is a linkage between energy prices and our own policies. A less inflation-prone American economy would give strength to the weakened dollar and this, in turn, would diminish the need for OPEC members to raise energy prices to ofset the decline in the dollar value of their income from oil. based on actual, recently-completed projects in the major categories: single-family residential, multi-family residential, vacation homes, commercial/institutional, interiors and remodeling/restoration.

In conclusion, the 1980 s could be a very strong decade for the economy and the construction industry. The critical variable is our willingness to endure a weakened economy in 1980 without fueling future inflation with overly stimulative government policies.

This year's program. just completed, was entered by 218 architectural firms from 42 states across the country and two Canadian Provinces. Thus the architect, a highlyregarded influence in the use of shingles and shakes, evidences his continUing interest in these Products in significant numbers.

Cedar Shingles

(Continued from

& SHAKES

pase 14) constructlon contlnues to grow.

Tangible evidence of the strong interest in and application of cedar shingles and shakes on all types of projects resulted from the bureau's 1979 Architectural Awards Program. Biennially conducted with the American Institute of Architects, this design competition is l|hen sending in a change ol address please include zip code on both old and new addresses and either the old label or the inlbrmation.liom it. Thanks!

The strength of this industry can also be measured in the high level of membership in the Red Cedar Shingle & Handsplit Shake Bureau. At the present time there are a record 525 mill members from throughout the manufacturing area of Washington, British Columbia, Oregon and Idaho.

Opportunity In Crisis

(Continued from page 1 I ) everyone earning a living in the construction business.

While the purpose of the actions ofthe Federal Reserve Board are to halt speculation and to bring down the excessive monetary growth, the results are proving damaging to users of building materials. Some of the problem may be overreaction by the financial community but in any event the problem is with us.

It is now up to the individual dealer to make the most of the crisis-opportunity. He must do everything practical to help the local home builder get through his period of cash flow problems. At the same time, the dealer must use all avenues of promotion, must move right in to tell the home owner how to conserve energy, how to add that extra room. how to make his living space more efficient, more attractive.

The home owner needs to be reminded that money spent for home improvement is an investment toward future financial gain.

There is a crisis time ahead, a hurdle the industry must face. Beyond that hurdle, however. is growth. Need is certainly not declining. Housing is not just a home, it is an investment. When the pent up demand jumps the hurdle, the industry will overcome the sluggish start of the eighties and enjoy a healthy, stable business increase.

THE PARTY'S OVER

(Continued from page 9) ing industry prepare for a little less exuberant times. At the national level, over the next 4 years, we expect only 5 million new jobs while population is climbing 7 million. Real production may go up 80h. less than half the rate of the last 4 years. Consumer prices will still be climbing about 300/u. 1980 will carry most of the burden for the reduced activity.

Housing starts will not top 1.5 million units next year and total less than 7 million for the next 4year cycle. Government expenditures will continue to grow faster than most businessmen would like because of defense and education costs. While interest rates will surely nlove down from current levels, some sectors, such as mortage loan and savings rates, will remain higher than their normal

The Merchant Magazine relationship with other rates during this coming cyclical period.

These national results will mask the continued relative strength of general business and home building in the western United States. Toward mid-1980, as interest rates settle back from the terrible levels of late 1979, western construction activities should improve from depressed first half levels. Even so, the incidence of modular homes, mobile homes, and smaller, planned-unit developments will increase faster than the standard. detached, single-family home.

To sum up, most current economic data would support a case for a restrained first half in 1980 followed by a gradual, and much more manageable improvement in the second half of the year. On balance, the longer-run view is particularly optimistic for construction opportunities in theWest compared to other sections of the countrv. The current financial squeeze will probably halt the speculative increases in real estate prices that we have recently experienced.

In many ways it is probably just 4s well that the Federal Reserve has "taken the punch bowl away" just when the party was about to get out of hand.

Pressure Treated Lumber

(Continued from page 16) ated lumber move through western plants in 1980.

There are other areas that will have a bearing upon the use ofpressure treated wood.

For one, we expect that the All Weather Wood Foundation will come in for much greater usage in the years ahead as builders discover its practicality and cost efficiency.

This is the residential foundation system that utilizes treated lumber and plywood with no concrete or masonry required for that foundation. Up until recently, the AWWF has experienced its heaviest use in the Midwest, but its popularity is increasing throughout the nation. Now, there are 40,000 such foundations in use. And western builders are getting the message that pressure treated wood does the job.

In addition, higher interest on housing will work to encourage homeowners to expand or to improve the livability of their present homes by adding a deck, outdoor patio, or other touches that increase value.

Basically, the Western Wood Preservers Institute has a rather simple story to tell. we feel that pressure treated lumber does the job better for less. It is cost-efficient as compared with higher-priced species; it has remarkable durability, and it is a dependable source.

And that's why we believe that pressure-treated wood will carve itself a good chunk of the western lumber market in 1980. . by making itself useful to builder and homeowner alike.

Plan For Sales Obiective

Write out a specific objective for each sales call with a definite goal, not a general make-a-sale aim. Detail an individualized program for each call - exact percentage increase, opening trial order, or demonstration of a new product. For optimum motivation, reread the written objective just before making the call.

SPECIALIZING IN PINE AND FIR PRODUCTS FOR THE INDUSTRIAL AND RETAIL MARKETS.

INDUSTRY/WORLD FACTORS

(Continued from page 32) the not too distant future but I can't even guess what prescription might be used to cure the sickness. -

The really important event of 1980 is the election. On the Democrat side the country will be treated to a slugging match between Kennedy, who has an impregnable power base in Massachusetts, who is the darling of the media, the Man of Chappaquiddick, the Man of Harvard (how many Harvard's do you know of who were expelled for cheating?) Man about Washington (at least he isn't gay), the dove who would cut our defense spending so we can have more welfare and socialized medicine as President. Kennedy with the leftists and liberals on his side will move with a politician's sense of direction toward the center in an effort to enlist wider support. He will be tough.

Carter, with the immense power of the Presidency, will be tough. Carter has the advantase of not having to create a new iriage since his political genius moves him in atl directions at once. While no one in his right mind could describe Carter as a conservative, he comes off somewhat to the right of Kennedy.

The Republican nominee will be Ronald Reagan. Voters will have a clear cut choice in the coming election. Reagan is a clean, decent. ethicalman which would put him in sharp contrast with Kennedv but not with Carter. Reagan has a widely recognized conservative philosophy which can't be changed or softened. Reagan does not believe in appeas- ing and strengthening communist states. Reagan strongly believes in the free enterprise system. He not only believes in reduction of government-he dramatically demonstrated he could implement his views while serving as governor of California.

O

In a Reagan-Carter showdown there is no defending the Carter energy policies.

_ Increasingly we depend on lbreign oil. Increasingly we are hostage to OPEC to supply the energy which sustains our industry and our way of life.

Think if you will of a far more serious oil embargo. Imagine the establishment of Soviet control of Iran. Suppose the almost insoluble problems of the mid East (Palestine for example) were to ignite another war. Suppose the Strait of Hormuz was blocked by international sabotage. Suppose the Soviet Union was successful in penetrating and controlling one of our major sup- pliers either on the Arabian Sea or Nigeria, for example.

Responding to this ominous scenario Carter rose to the occasion by creating a new Department of Energy which adds 15 to 20 billion to our budget-15 to 20,000 new

Planing Mill, Inc.

We have fractional sizes, 1x4 to 4xG up to 100 inches long. We also stock heavy 4 foot and Q foot (35.miilion per year) of western wood, Doigtal hard- woods. We will ship by box and by flat rail, or by truck. federal employees and not a nickel's worth of new energy. An additional problem, not a solution.

Carter has done little on working to develop our four or five thousand year supply of coal. We have hanrpered and restricted (one way or another) the discovery and development of domestic oil and gas reserves.

If anyone thinks Carter has done anything to counter the thrust of nukewits who have harassed and impeded the development of nuclear energy he knows something that I don't.

Nuclear power is safe. lt is desperately needed for our American needs and even more desperately needed in the undeveloped world which is critically short of energy.

As these words are written (thanks to Fondas and Browns and Kennedys) the Carter administration is moving more in the direction of decreasing nuclear power production than increasing it.

Carter promised to eliminate budget deficits, to reduce the size and role of government. I don't hear anyone connected with Carter talking about a balanced budget. Washington is not shrinking.

The Carter record in foreign policy is appalling. Here he has Republican company. Neither Nixon nor Ford had an Andrew Young but they did have detente with the Soviet Unionl they did play footsie with Pekingt they did turn their back on Taiwan. Chile, Rhodesia and South Africa.

Moscow has made impressive gains in Africa, Yemen, Afghanistan, Cuba, Panama, Nicaragua, Viet Nam. and Cambodia. While Moscow is training and supplying terrorists operating in Palestine, Northern Ireland. Latin and South America, we are shoveling food, credit, technology and detente back to Moscow in return. Like trying to smother a fire with gasoline.

We desperately need leadershiP if this country hopes to survive.

Salt II is a good example of where we are today. The treaty does not reduce military power. It does confer a position of permanent military inferiority on the United States. it is not verifiable, it will be broken with impunity (like every other treaty we have ever had with the Soviets) by the Russians at a time of their convenience. Our retired military IeadershiP is unanimous in condemning the treaty as dangerous and foolhardy.

The worst part of the treaty is the impression that the Russians share our desire for world peace and security and that by the acceptance of the treaty we are moving together toward the objective.

In 1923 Hitler wrote a book which described his program and his dedication to that program. No one believed him.

Marx. Lenin. Stalin, Khrushchev and Brezhnev have all done the same thing for the Communist take over of the world. Anyone not agreeing is an enemy. Moscow has to take one step back now and then in order to take two steps forward but there has been no deviation from this repeatedly stressed goal. Nor can there be.

The Russian people sooner or later will destroy the Communist dictatorship from within -unless freedom can be snuffed out all over the world.

In December 1979 there is no prospect of any significant leadership to counter this deadly menace to our survival.

The Presidency, the State Department and the United Nations are heedless.

Congress? Hardly.

Thanks to people like the Senior Senator from Oregon the Senate Internal Security Committee is long gone. Ditto the House Unamerican (Continued on next page)

MARY's RIVER LUMBER CO.

(Continued from previous page)

Activities Committee. These committees both made mistakes but they publicized Communist procedures and objectives-not only here in the United States but over the world.

Academia? Forget it. There are few anti-Communists in our universities, this is neither a stylish nor profitable posture. Much careerhealthier is to take stern positions against Chile or South Africa or perhaps point out deviations from democracy in the Republic of China.

The American press, the ,Ncu' York Timas, Washin.qton Post, San Francisco Chronicle, all view the world with the same liberal myopia. The lessons of Cuba. Viet Nanr. Cambodia, Chile are not for thent. Also toss in the television nredium. Certainly not universally true but as a broad generalization -true. The Reoders Digcst, Human Events, The lt'/ational Revieu', fortunately are the other side of the coin

American business? Perhaps our least promising source of anti-Communism or enlightenment. Try to visualize The Bank of America. IBM, Occidental Petroleum. Control Data. General Motors as antiConrmunists? Having trouble with this concept? So do I.

While we are on the subiect of weak reeds, we have handcuffed the FBI and emasculated the CIA. Both of these organizations were in the front line of Communist opposition.

The Soviets are not only preparing for nuclear war but they believe they can n'il a nuclear war.

With our assumption of mutual annihilation. we have no anti-missle defenses, no shelter program, no survival plans for the unthinkable-nuclear war.

We have time left for several reasons. The Russians are achieving so many of their goals without a war that they really don't need one now. Both the Russians and our country are on the threshold of startling advances in weaponry which could make our Dresent system obsolete. lf they -perfect these weapons first they (at least theoretically) could either face us down or greatly reduce retaliatory damage to themselves.

Our only hope for both peace and survival is strength and the national resolve which will make it unmistakably clear to the Russians they cannot achieve their objectives by force. Any other course will leave us either Red or Dead if not by the end of the 80's, certainly by the advent ofthe 2lst Century.

Our time is short to change directions in this country. My hope is that Reagan will be given this herculean task. Should we put a Kennedy or Carter or Baker in the White House in 1980, it won't matter nruch in the span ofjust a few years about building, or inflation or timber availability.

My advice in this eventuality is: teach your children to speak Russian-they will need it.

Prop. 2 Guts Interest Rates

With the passage of Prop. 2 in California, the mortgage bankers are back in business and the mortgage rates show signs of falllng.

Prior to the election. the bankers who raise money from investors, often out of state, were restricted by the l0{1, usury ceiling which did not apply to home mortgages. l'scc The Mercha nt, N ot'., I 9 7 9,p. J//Now with no lid, they are free to raise funds for new loans as well as buy and sell mortgages.

Their actions are felt by many to be responsible for the slight drop in mortgage rates with the big lenders making across the board cuts.

SLOWER GROWTH TILL MID.YEAR

(Continued from Page 17)

(b) ttreir issuing of large certificates of depositst and (c) their increased access to the secondarY market. Demand for housing has also continued strong, despite recordhigh mortgage rates and raPid increases in home prices. This demand has been bolstered by the large number of individuals currently in the prime home-buying age bracket, by a high rate of new household formation, and perhaps most importantly, by the widespread investment in housing as a hedge against inflation.

Forces Influencing Sale ProffiE-T980--

Favorable Factors: r Tax cut likely, including faster depreciation. o No severe strains on capacity. o Significant backlogs in certain industries. o Further good growth Potential for exports. o Nogeneral, widesPread disruPtions from strikes anticiPated.

Restraining Factors: o Low rate of economic growth for total Year. o More stringent Price guidelines. o High and rising cost of energy. o High financing costs. o Sizable rise in unit labor costs. o Reduction in inventory profI ts.

Net Results in 1980: o Business sales expected to be up 8.5%r, versus gains of 1l(7' to l3()l' in each of the previous four years.

. Corporate Profits after taxes are forecasted to post only a meager rise of 3.60ft. down from increases ranging from 130lr to 3l0l' in prior four years.

The result of these factors is likely to be a significantly milder decline in housing in the Present cycle as compared with the 1913-75 experience, when housing starts plunged 430h.ln the present period, the decrease in housing starts between 1978 and 1980 is anticiPated to amount to about one-half that magnitude.

Housing starts in the U.S. are forcast to total 1.6 million units in 1980. a decline of 135,000 units or about 8(l' from 1979. The tendencY of rent increases to trail the general rate of inflation and the existence or fear of rent control in certain parts of the country will cause the primary decline of home building to occur in the multi-family segment. Although rapidly rising land prices are inducing manY home buyers to opt for condominiums, the single-family home remains the rrreferred form of housing. As a result. while multi-family starts are projected to slide by more than l7V' in 1980, starts of single-family units are predicted to be down bY a much smaller 3(xl. accounting for nearly J2ih of the total.

In California, home construction willdecline in the first half of 1980, but is likely to accelerate in the second half of the year, resulting in housing starts of 190,000 units' 15.000- units less than in 1919. Sinsle-unit construction will accou-nt for 130.000 units or 6801, of the total. while multiple units will decline to 60.000. a 20rh reduction from 1979. Home builders will be careful in their planning, avoiding large buildups in unsold homes.

Ttre increase in the Price of homes in California which has accelerated by a more than 20()l, annual rate in the past three years, will moderate considerably in 1980. The tight money markets and the skyrocketing mortgage rates are likely to make the sale ol existing homes a buyer's market during the first half oi 1980.

The outlook for the home improvement industry, led bY the do-it-yourself segment. is much brighter than that of new residential construction. It will maintain its growth rate as it has done in the past several years.

In summary, the outlook for 1980 is for a slow and declining first half. then a modest recoverY in the second half of the year. The strong demand for housing and housing improvements will continue despite continuing high costs. The currently high mortgage rates however. should dampen housing construction and real estate sales durins the first half of 1980.