2 minute read

Oklahoma convention rates an A-OK

OOD associations put on good conventions, a case in point being the Oklahoma Lumbermen's Association annual convention and merchandise mart held recently in Oklahoma City. More than 900 dealers were registered.

Keystone of the 37th annual was the merchandise mart which featured more than 188 exhibits from ll9 firms. It was held at the Myriad Convention Center, adja-

Story at a Glance

Stars, shows and Increased sales featured at Oklahoma Lumbermen's 37th annual . . Glen Haney elected new president . same timelsame place next year: Sept. 7-9.

cent to convention Hq., the Sheraton Century Hotel. Strong floor attendance by the over 2,(XX) registered was reported and sales of $1,812,738.13 generally ran ahead of last year, reflecting an upturn in the state's economy in the east€rn part. Western Oklahoma lags economically due to the continued depressed state of the oil and oil service businesses.

A new slate of officers was elected

(Please turn to page 36)

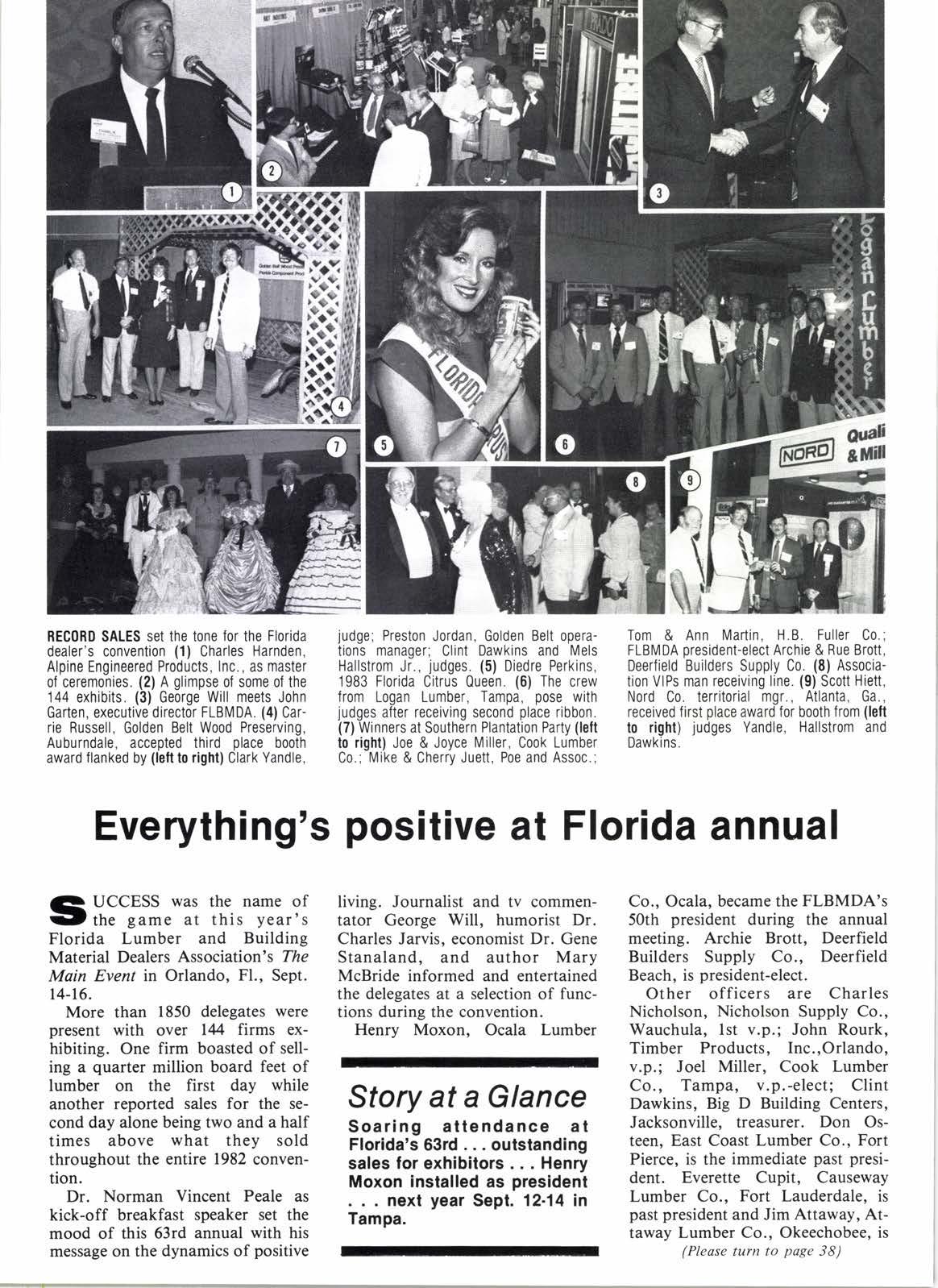

0LA PRESIDEi{T (1) Bud Blakley, Glen Haney. (2) Wes Agee, Mike Summers. (3) Steve Wolfe, Dick Miller, John and Voncille Shipley. (4) Hal Ferguson, Bob Hixson, Larry Jack Horn, Frank Bartrow. (5) Mike Ambrose, Margret & Larry Gilbert, Jim Huff (6) Kathy Sanders, Charles Andrus. (7) Delvin Henry, Shel Gilblom. (8) Lee LeOlair,

Gary Rosebure, Rhea Taylor. (9) Stokely Wischmeier, Charles Huston, Audean Coppedge, Dottie Klotz, Dan Anderson, Dick Jennings. (10) Glenn & Eleanor Yahn, Nalette & Joe Butler. (11) Henry Bockus, Kathy & Gary Horsley. (12) Don Wiard, Chuck Paulette, Ken Rothschopf. (13) Randy & Patti Skinner. Michael. 4. and Lisa. 1 month. (14) John Middleton, Bert Uhlenhake. (15) Paula Moran, Larry Wilson. (16) Jim & Ann Churchill. (17) Ed Day, Hank Bockus, (18) Richard Stuffers, Sonny Ulch, Ron Crosby. (19) Greg & Connie Pannell. (20) Morene Cummings, Tammy & Skipper Blakley.

Avoiding Insurance Problems

Fierce rate competition in insurance underwriting may be signaling a potential problem in the building materials industry. Although substantially reduced premiums appear to be beneficial, the extreme competition is beginning to take its toll. Not all insurance companies are well managed and more than a few are now facing serious financial and cash flow problems, experts warn. Some won't survive and that could spell trouble for policyholders.

Insurance policies represent a promise to pay by the company issuing them, but they are good only if the issuer of the policy has the ability to pay when called upon. One way to check out the stability of an insurance company is by asking the company or its agent for a copy of its current Best's Insurance Report. This report published by the A. M. Best Company, Inc. rates an insurance company by using industry averages. It is available for the asking and is normally free of charge.

R. L. Baker of Lurnbermen's Underwriting Alliance, the nation's largest exclusive insurer of lumber properties, operating out of Boca Raton, Fl., gives the following suggestions of what to look for in the Best's report.

(l) If the company has an A+ rating you can feel secure. Less than an A + rating means that you should check the narrative section of the report to see ifthe rating has recently changed. If it has changed upward (say from B + to A) that's a good sign and indicates that the company is on an upward trend. If the rating has recently changed downward (from A+ to A, A to B+, erc.) it can bean indicator of a bad trend and a need for you to check further.

(2) Check the ratio of Policyholders Surplus to Written Premiums. Most well managed insurance companies try to maintain at least a ratio of $ I of surplus for every $3 of written premiums.

(3) Next check the ratio of Unpaid Loss Reserves to Policyholders surplus. A well managed company normally will have enoughsurplusto offset loss reserves. Be aware that these loss reserves could be understated. If they are, this causes a larger than expected demand on cash flow at the time the claims are closed.

(4) Check the combined loss and (Please turn to page 38)