6 minute read

Thqnks o We're Ty"qrolc,ndgrowing

t/ t/ t/ satisfuing an industry need in the South acclaimed by nearly 13,000 subscribers in 13 states supported by scores of advertisers including

Ace Saw & Supply

All Woods/Schroeder

American Wood Preseruers Bureau

Arizona Pacific Wood heserving Corp.

Arkla Forest hoducts

B & M Wmd Products. Inc.

Curt Bean Lumber Company

Bwerly Manufacturing Co. Blwins Co., lnc., J.H.

Bohemia. lnc.

Brltt Lumber Co.

Builder Marts of America

California Cascade Industries

C&DLumberCo.

Coastal Lumber Co.

Cole & Associates. Inc..

John T.

Crown Redwmd Co.. Inc.

Dant & Russell, Inc.

Dataline Corporation

Delson Lumber Co.

DMK-Pacific

Dumas Building Products

Advertising/ Marketing

Elco Forest Products

Elder Forat Products

Elder Wood Prcerving Co.

Ensworth Forst Producis

Feather River Moulding

Fields Lumber Company, Walter M.

Fishman and Afhliates, Bill Fountain Lumber Co., Ed

Fullco Lumber Co.

Fullmer Lumbs Co.

G&RLumberCo.

Georgia-Pacific Corporation

GF Company

Global Tile & Wood, lnc.

Great Southem Wood heseruing

Grifiolyn Company, Inc.

Hampton Lumber Sales ldaco Engineering & Equlpment ldacon, Inc.

Intemational Paper

JD Lumber. lnc.

Landry Lumber Sales, Richard

Litrle Lake lnduslris l-ouisiana-Paciffc

Lumbman's Marka Report

Martin For6t Industries

Mary's River Lumber Co.

Masonfte Corporation

McKum Moulding Co.

McCranie Brothas

McKeule Trading Compamy

Mid-South Wod Products

Mid-Stats Wood Prwrc, lnc.

National Home Cenler & Exposltion

Navajo Forest hoducts lndustrles

North American Wholeale

Lumber Association

Norfield Manufacturlng

Oakuod Mmufactuing, Inc.

Ogden Lumber & Milling, Inc,

Orcgm Moddhg & Lmb.r Cr.

Osme Wood Presefling Co.

Pacific Lumber Company

P&MCedarProducis

Port Barre Lumber Industries

Potlatch Corporatifi

Powell Lumber Co.

Produa Sale Co.

Rmtokil. Inc.

Rocklin Foret Products

Setzer Forest Prodkts

Simpcon Timbcr Co.

Snider Lumber hoducrs Co.

Snider lnduris

South Admdc Forer hoducts

South Bay Forcet Prodrrcts

Sunol Foresr hoducts

Terry Distrlbutor, lnc., Walts

Timb€r hoduci Salec Co.

Tlmber Realizatlon Co.

Westem lntcrnrdooal Forest Prodrrts, lnc.

Westem Turnlngs & Stlir Co.

Wlllamene lndutrics. Inc.

Windsor Mill. Inc.

Wlnron Salcr Co.

Wllco Ptoneer

Wholesale Buildnrg Mat€rials Management Co.

YOtUtE 2, Jlo. I

MAJOR NETIIS ANd FEATURES

REDWOOD SPEGIAT ISSUE

South Leads Nation In Housing Starts In 1982

Waferboard Association To Promote Products

Redwood Becomes A Fast Growing ltem In Texas

Soft-Sell & Customer Education Move Redwood

Americans Love Leisure and Redwood Furniture

Redwood Tanks Tame Taste of Full'Bodied Reds

CRA Literature Boosts Sales For Many Dealers

Redwood Siding In All Grades Makes The House

Redwood ls Found In The Popular Playgrounds

New Mill Built To Handle Old Growth Redwood Paint Becomes Big Seller For Home

Publisher David Cutler

Editor Juanita Lowet

Contributing Editors

Dwight Curran. Gage McKinneY

William Lobdell

Art Dircclor Martha Emery

Strff Ar&t Nicola O'Fallon

Cilcnlrtlon Kelly Kendziorski

Building Producs Digest is published monthly at 45q) Campus Dr., Suite 480, Newport Beach, Ca. 9266'0, phone (714) 549-E393 bY Cutler Publishing, lnc. Advertising rates upon requ€st.

ADYERTISING OTTICES

FROM THE NORTHEAST: contact Grylc Ersrry, 35-73A lJ9th St., Flushing, N.Y. ll35t. Cdl (212) '145{()63. FNOM ARXANSAS & Of,I./\HOMA: contact Tinothy J. Ndsoa, Marketing Communications, lnc., 5ll5 S. Vandalia, suite E, Tulsa, Ok. 74135. Cdl (9r8) 496{7?7.

FROM TEXAS. LI)UlSlAllA, MISSI$ SIPPI, VIRGIMA, TENIIESSEE, N. CALIFTORNTA AND (XDGON : contact DrvH Crlhr, 45fl) Car@us Dr., suite 4S0, Novport Bcach, Ca. 92ffi. C l (7r4) 549E393.

FROM THE MIDWEST: contact TYrync VYcstlud, ll09 Willow Lane' Mt. Prospect, n. @56. Cdl (312) 4t7-7377.

FROM SOUTHERN CALIFOR,NIA: contact C.d Yn,205 Occano Dr., lps Angeles, C.a. 9@19. Call (213) 472-3 I I 3 or (714) 5498393.

strBs(RPTroNs

Ch.trgt of Addrcss-Send subscriPtion orders and address changes to Circulation Dept., Building Products Drsesq 4500 Campus Dr., suite 4&), Nerrport Beach, C-a. 92660. lnclude address label from reccnt issue if possible, plus new address and ziP code.

Subscription Rrtes-U.S. and Canada: $2(}one year; t36two years; $SGthree years. Foreign: $30'one year; $52-two yean. Single coPies $2.m. Back copies $3.00 plus shiPping & handling.

BT.JILDING PRODUCTS DIGEST b ot independently-owned publicotion Jor the rctail, whobsale and distibution levels of the lumber and building supply markets in I3 buthem std6.

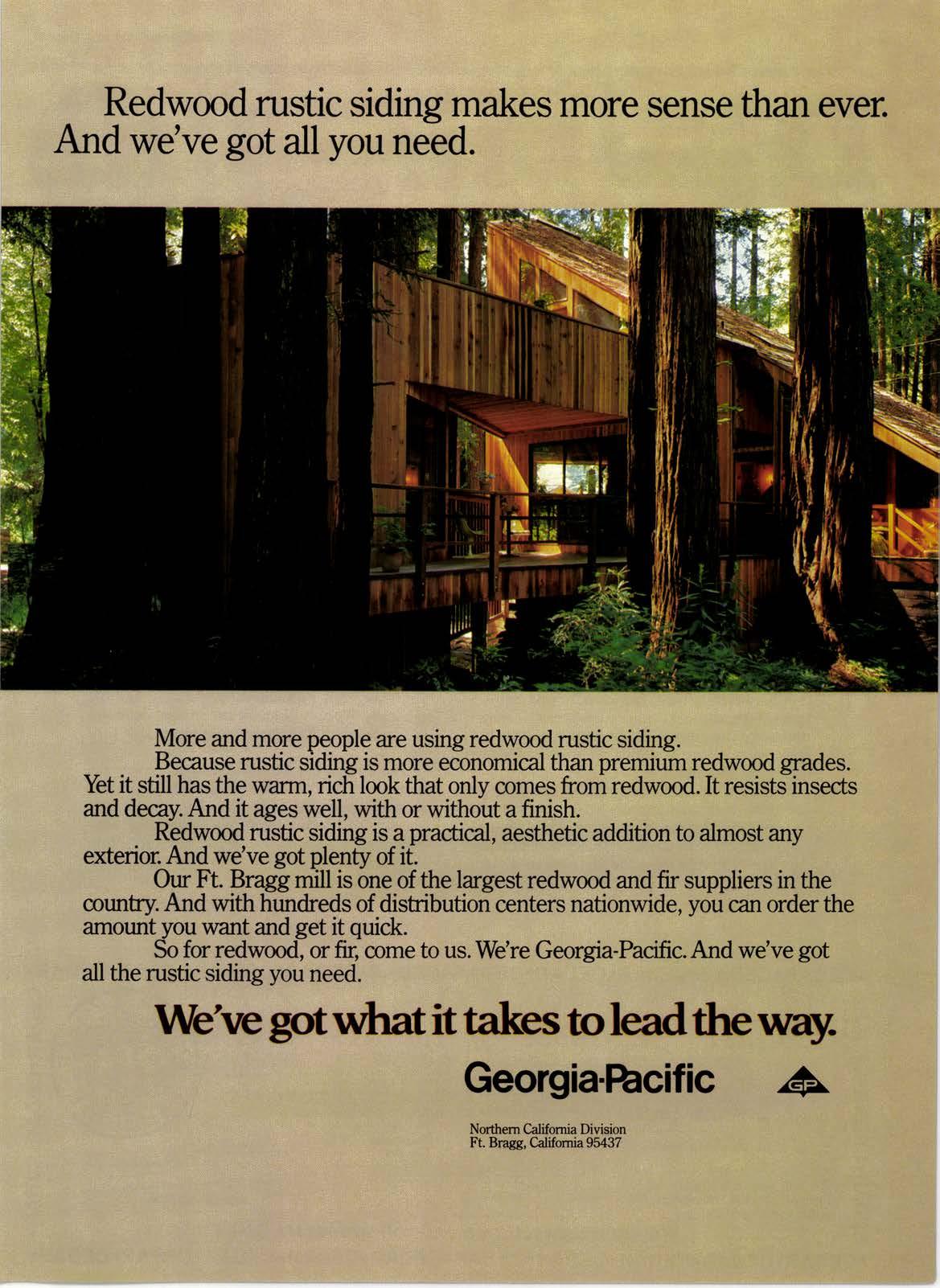

More and more people are using redwood rustic siding. Because rustic siding is more economical than premium redwood grades. Yet it still has the warm, rich look that only comes from redwood. It resistsinsects and decay. And it ages well, with or without a finish.

Redwood rustic siding is a practical, aesthetic addition to almost any exterior. And we've got plenty of it.

Our Ft. Bragg mill is one of the largest redwood and fir suppliers in the county.And with hundreds of disfibution centers nationwide, you can order the amount you want and get it quick.

So for redwood, or fif come to us. We're Georgia-Pacific. And we've got all the rustic siding you need.

DAVID CUTLER publisher

When it's metric time up north

lN THE early 1970s there was a great deal of Italk about the need for the United States to convert from our present standard of measure to the metric system. Despite the flurry of activity and the serious efforts of a number of organizations, nothing much ever came of it. It has now been several years since the last committee met.

Yet, proponents feel the need to convert to metric is still there and cite Canada's announced intention to make the change as an additional reason for the United States to opt for meters over miles. Given the extensive trade between Canada and the U .S.A. , it follows that their conversion will be a strong stimulus for this country to seriously address the question again. If we do not make the conversion to metric, the theory goes, this country stands to lose enormous chunks ofbusiness.

While Canada's major move to metric is set for 1984, their building material suppliers and distributors plan to begin soon with what is called a "soft conversion." This is where the actual size of an item stays the same but its dimen- sions are expressed in both the English and metric measurement. A "hard conversion" where the product is actually changed to a metric size-a 1,200 x 2,400 mm. panel product, for example-is presently seen as a long time off.

As our largest and closest trading partner converts, can this country be too far behind? Historically, Canada has supplied between one quarter and one third of the U.S.'s lumber requirements. This kind of volume is just one more continuing pressure on us to make the change. Whether we actually desire to make the conversion to metric, which promises to be costly, confusing and probably unpopular, is not the question. We may not have any choice. Economic factors may well force the change, like it or not.

The days when we could blithely ignore the fact that 95 9o of the rest of the world is metric are inexorably coming to a close. Last time metric just sort of "went away." We doubt it will happen again. Like it or not, you better start thinking about it.

Charles Dlck

We're manufacturers of cedar products, K.D. or P.A.D.; selected #3 & better, #2 & better common. We can offer selected stock for #3 common price. Try us!

We can ship mixed cars of Ponderosa pine mouldings, solid and fingerloint.

South Leads Housing Starts

The South had 5690 of all housing starts nationwide in 1982 and was the only region to achieve an increase over l98l although it was only a scant 6Vo.

Figures for the past l8 months released by the U.S. Census Bureau show housing starts steadily increasing in the South from 231.3 million units in the second half of l98l to 257.9 million units in first half I982 and 334.4 million units in second half of 1982. The 1982 total was 592.3 million.

The gain of second half 1982 over the same period l98l was 44.6s/o. Second half 1982 gain over first half 1982 was 29.7v/0.

New Waf erboard Associat ion

An advertising program aimed at the builder's market is being undertaken by The Waferboard Association, Atlanta, Ga., to promote its members' products.

"We have an important story to tell," says newly elected association president Robert Thorsen. "In these times of economic concern, we think it's vital that builders be made aware of the dollar savings in using waferboard."

The advertising program will feature the theme "Solid Reasons to Switch to Waferboard." Ads will present the benefits and economics in using waferboard for sub-flooring, wall and roof sheathing, and other structural purposes. The campaign will also introduce the new Association symbol, a stylized "W."

Until now, the Association has served as a purely technical and educational organization, representing nine waferboard manufacturers with combined annual production capacity of 1.5 billion sq. ft.

National Dealers Back M.R.A.

The National Lumber and Building Material Dealers Association is supporting the Mortgage Retirement Account concept introduced last year by Senator John Tower of Texas, placing it high on its priority list for the 1983 session of Congress.

The M.R.A. would be a retirement savings program similar to the Individual Retirement Account program. Wage earners could invest up to $2,000 per year, not to exceed 10090 of earned income, or $4,000 per year for a working couple or $2,250 per couple with one wage earner, on a tax deferred basis for use toward their retirement.

The program would allow the saver to invest I.R.A. funds into a qualified home mortgage, which would be a first mortgage secured by the earner's principal residence. The investment couldbe made in the form of a mortgage prepayment or an initial mortgage down payment. On a regular basis, the saver could use his allowance to "buy down" the principal in order to pay off the loan.

Planned to apply to young couples as well as those near retirement age, the M.R.A. at present is seen as separate from the I.R.A. program although Congress would decide the final details.