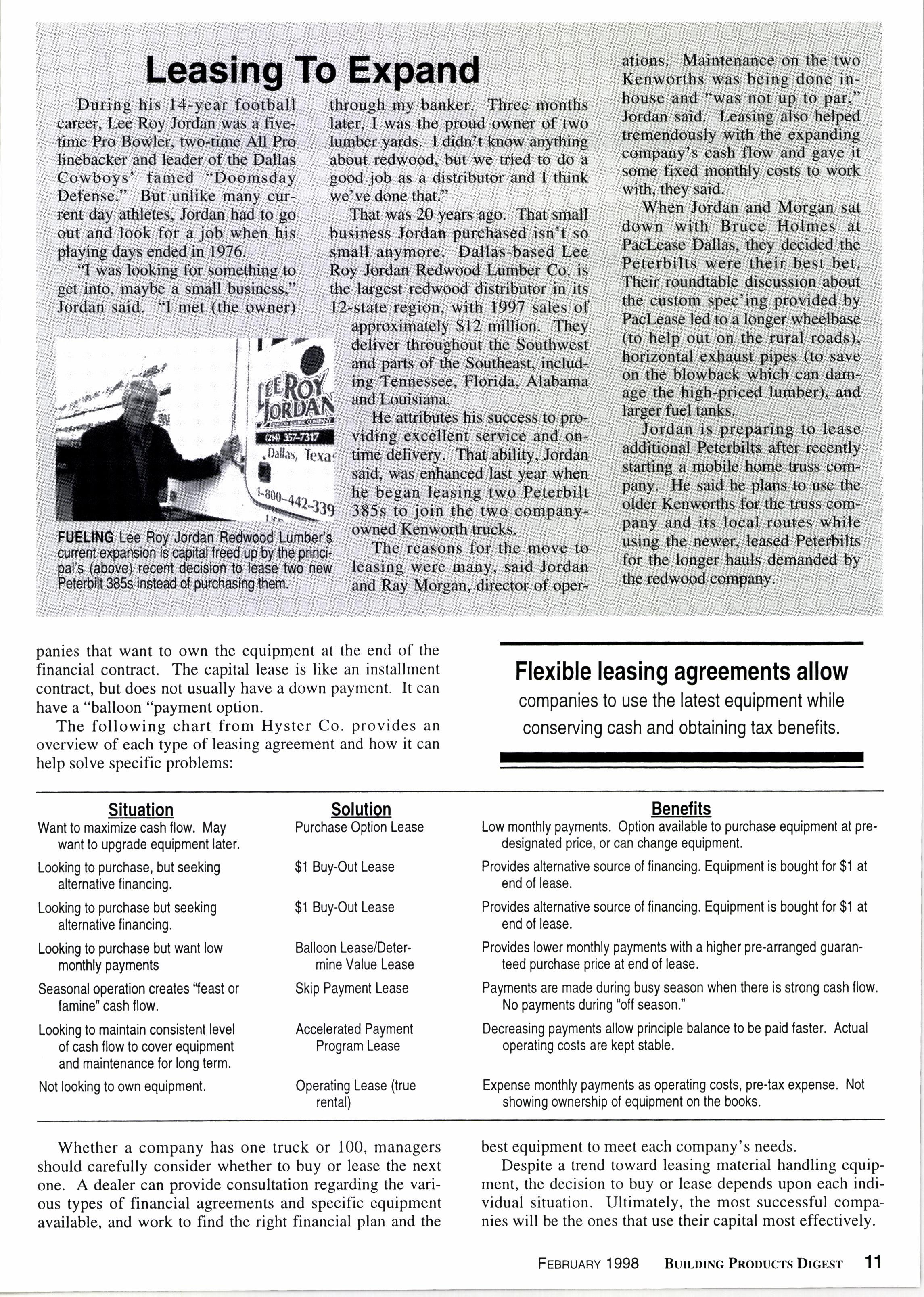

3 minute read

Leasing For lmage

Vehicle image and quality---once an afterthought for most fleets-is fast becoming a primary consideration for many companies, says Jim Ellingson, lease account executive for Paclease, Tacoma, Wa.

"Vehicle image is an intangible for many companies," he explains, "but the benefits of operating premium equipment are critical to private fleets, which are eager to attract and retain top drivers while presenting a superior image of their company and products."

In the wholesale building supply business, few companies on the West Coast are presenting a stronger image than Auburn, Wa.-based PGL Building Products, a division of Huttig Sash & Door, which recently took delivery of 22 Petetbilt 378 and 385 tractors. The vehicles operate from five PGL locations in Washington, Oregon

(l) It offers tax advantages through acceleration of deductions, investment tax credits and asset write-downs.

(2) Leasing conserves capital, eliminating cash outlays.

(3) Leasing may generate replacement of equipmenr ro maintain productivity.

(4) Leasing aids forecasting operational costs.

It is important to understand the different types of leasing in order to maximize the advantages. There are basically two types of leases, an operating lease and a capital lease. An operating lease is typically a convenrional rental contract, where there is no intent to own the equipment. The lessee pays a flat fee to use the equipment. After the lease expires, the lessee returns the equipment. If the user wishes to purchase the truck at the end of the term. the lessor will sell it at "fair market value."

A second type of lease, the capital lease, is used by com- and California.

"Our drivers are the front-line representatives to our customers, so it's critical that they represent PGL Building Products well," said Bill Seth, the company's trucking/warehouse manager. "Over the years, we have always preferred to operate top-of-theJine Peterbilt or Kenworth trucks. What we've learned is that when drivers take pride in the equipment they operate, they are much more likely to ke€p it clean, operate it efficiently and professionally represent the company to our customers. Combined with a striking paint and logo scheme, our trucks are literally rolling billboards for our company."

Seth notes that premium equipment not only results in happier drivers, but it's a big contributor to PGL's safety program. "It stands to reason," he stated, "that a com- fortable vehicle that is easy to operate will result in less driver fatigue. We believe this has contributed to our driver safety record." panies that want to own the equipment at the end of the financial contract. The capital lease is like an installment contract, but does not usually have a down payment. It can have a "balloon "payment option.

The numbers back Seth's conclusion. PGL's fleet includes I I drivers who average more than l7 years with the company, and combined, these I I veterans have driven l4 million safe miles. "It's clear that premium, high-image equipment makes my job much, much easier." he said.

The following chart from Hyster Co. provides an overview of each type of leasing agreement and how it can help solve specific problems:

Situation

Want lo maximize cash llow. May want to upgrade equipment later.

Looking to purchase, but seeking alternative financing.

Looking to purchase but seeking allernative linancing.

Looking to purchase but want low monthly payments

Seasonal ooeration creales'feast or famine" cash llow.

Looking to maintain consistenl level of cash flow lo cover equipment and mainlenance for long term.

Not looking to own equipment.

Solution

Purchase Option Lease

$1 Buy-Out Lease

$1 Buy-Out Lease

Balloon Lease/Delermine Value Lease

Skip Payment Lease

Accelerated Payment Program Lease

Operating Lease (true rental)

Whether a company has one truck or 100, managers should carefully consider whether to buy or lease the next one. A dealer can provide consultation regarding the various types of financial agreements and specific equipment available, and work to find the right financial plan and the

Flexible leasing agreements allow companies to use the latest equipment while conserving cash and obtaining tax benefits.

Benefits

Low monthly payments. Oplion available to purchase equipment at predesignated price, or can change equipment.

Provides alternative source of tinancing. Equipment is bought for $1 at end of lease.

Provides alternative source of financing. Equipment is bought lor $1 at end of lease.

Provides lower monthly payments with a higher pre-ananged guaranteed purchase price at end of lease.

Payments are made during busy season when there is strong cash flow. No payments during -ofl season.' best equipment to meet each company's needs.

Decreasing payments allow principle balance lo be paid faster. Actual operating costs are kept slable.

Expense monthly payments as operating costs, pre-tax expense. Nol showing ownership ol equipment on the books.

Despite a trend toward leasing material handling equipment, the decision to buy or lease depends upon each individual situation. Ultimately, the most successful companies will be the ones that use their capital most effectively.