6 minute read

What is the Difference Between Forex and Quotex?

If you're new to online trading, you’ve probably come across both Forex and Quotex. At first glance, they might seem similar—they both involve predicting price movements in the financial markets. However, Forex trading and trading on Quotex are fundamentally different in how they operate, the risk involved, strategies used, and even in their legal standing in some countries.

✅ Pocket Option – The best binary options platform in the world

💥 Trade with Pocket Option now: Open An Account or Visit Brokers 👈 100% Bonus for New 💰

Let’s dive straight into the core differences between Forex and Quotex, so you can understand what each platform or trading type offers, and which one might be right for your financial goals.

1. What is Forex?

Forex (short for foreign exchange) is the world’s largest financial market where currencies are bought and sold against each other. It operates 24 hours a day, five days a week, with a daily trading volume exceeding $6.6 trillion (according to the BIS 2019 report). Traders profit by speculating on the price differences between currency pairs like EUR/USD, GBP/JPY, or USD/CAD.

Key Features of Forex:

Real-time price fluctuations

Leverage and margin trading

Requires technical and fundamental analysis

High liquidity

Traded through brokers using platforms like MetaTrader 4/5

2. What is Quotex?

Quotex is a binary options broker. It offers a simplified form of trading where users predict whether an asset's price will go up or down within a fixed period of time—this can be 1 minute, 5 minutes, 15 minutes, etc. If the prediction is correct, the trader earns a fixed return (usually up to 95%). If wrong, they lose their investment.

Quotex doesn’t offer traditional Forex trading. Instead, it provides digital options on currency pairs, stocks, indices, and cryptocurrencies.

Key Features of Quotex:

Fixed profit/loss

Fast expiration times

User-friendly interface

No complex charts or analysis needed

Low entry point (as low as $10 deposit)

3. Core Difference: Trading Mechanism

This is the biggest difference between Forex and Quotex.

Forex trading involves buying and selling currency pairs in a dynamic market. You can open and close trades anytime, and your profit or loss depends on how much the market moves in your favor.

Quotex involves predicting the direction of price movement over a short period. You’re not buying or selling actual currencies—you’re betting on whether the price will be higher or lower than your entry point at a specific time.

Think of it this way:

In Forex, you trade the market.

In Quotex, you bet on market direction.

4. Profit Model: Variable vs. Fixed Returns

Forex profits are unlimited in theory. The more the market moves in your favor, the more you earn. However, losses can also grow significantly.

Quotex profits are fixed. You know in advance how much you’ll earn or lose. For example, if you invest $10 in a trade with a 90% return, you’ll earn $9 if you're correct—or lose the full $10 if you're wrong.

This makes Quotex simpler for beginners but also riskier if you trade emotionally or without a strategy.

5. Leverage and Margin

Forex brokers offer leverage, allowing you to trade with more money than you actually have. For example, with 1:100 leverage, a $100 account can control $10,000 in currency.

Quotex does not use leverage. You only risk the money you put into a trade. This can reduce the risk of account wipeout but also limits profit potential.

💥 Exness - Best Forex Broker: Open An Account or Visit Brokers 🏆

6. Trading Platforms and Tools

Forex is usually traded on advanced platforms like MetaTrader 4, MetaTrader 5, or cTrader, which offer technical indicators, Expert Advisors (EAs), and algorithmic trading.

Quotex provides a proprietary web-based platform. It’s visually clean and ideal for short-term trades but lacks the depth of professional tools and analysis available in Forex platforms.

7. Market Scope and Asset Types

Forex focuses on currency pairs like EUR/USD, USD/JPY, and GBP/USD.

Quotex offers digital options on currencies, cryptocurrencies, commodities, and indices. However, you're not actually trading the assets—just predicting their short-term direction.

8. Timeframes and Trade Duration

Forex traders can hold positions for seconds, minutes, hours, days, or even weeks. This allows for scalping, day trading, swing trading, or position trading.

Quotex trades have fixed expiration times, usually from 1 to 60 minutes. It’s entirely short-term, which adds intensity but also limits long-term strategy use.

9. Regulation and Legality

Forex brokers are regulated by financial authorities like:

FCA (UK)

NFA (USA)

ASIC (Australia)

CySEC (Cyprus)

These regulatory bodies ensure transparency, security, and fairness.

Quotex, however, operates in a regulatory gray area. It is not licensed by top-tier regulators, though it claims registration under the IFMRRC, which is not considered a major authority. As a result, Quotex may not be legal in some countries, including the USA, Canada, and parts of the EU.

Always check local laws before using platforms like Quotex.

10. Risk and Transparency

Forex trading risks come from market volatility, leverage, and emotional trading. However, Forex brokers are often required to segregate client funds and disclose risks.

Quotex risk lies in the "all or nothing" payout model. You either win or lose your full investment. Also, since it’s not regulated by major authorities, issues like price manipulation or unfair practices are possible on some platforms.

11. Learning Curve

Forex trading has a steeper learning curve. You need to understand charts, indicators, macroeconomic news, and risk management. But once mastered, it allows for deeper strategic development.

Quotex trading is easy to start—you just pick an asset, time, direction, and amount. However, it’s also easier to lose money fast because of the temptation of quick profits and fast-paced decisions.

12. Who Should Use Forex vs. Quotex?

Choose Forex if:

You want to trade professionally

You're interested in macroeconomics and technical analysis

You want control over trade duration

You're looking for a regulated, long-term platform

Choose Quotex if:

You prefer a simple interface

You want fast, fixed-return trading

You're a beginner exploring trading

You're okay with short-term, high-risk trading

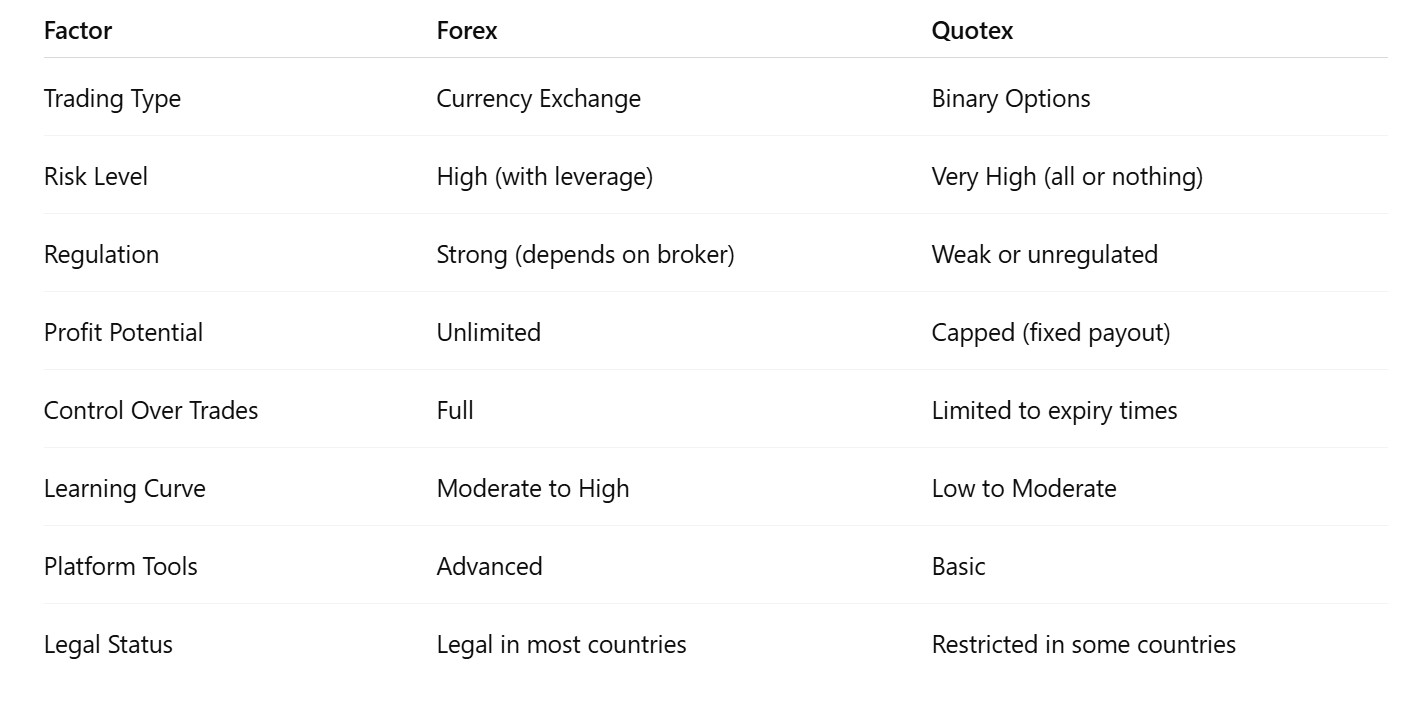

Final Verdict: Forex vs. Quotex

Conclusion

Forex and Quotex are not the same. While both involve price speculation, Forex is a traditional, globally regulated market with high potential and complexity. Quotex, on the other hand, is a simplified binary options platform offering fast-paced, fixed-return trading.

If you're just starting out and want to experiment with a small amount of money, Quotex might be a good intro. But for long-term growth, deeper strategy development, and transparency, Forex is the better choice—as long as you trade responsibly.

Whichever you choose, remember: trading involves risk. Never invest money you can't afford to lose, and always educate yourself before entering the market.

💥 Trade with Pocket Option now: Open An Account or Visit Brokers 👈 100% Bonus for New 💰

Read more: