6 minute read

Which Is Better, Quotex or Forex? A Comprehensive Comparison

from QUOTEX

If you're new to online trading or looking to switch platforms, you've probably come across Quotex and Forex trading. The question on many traders’ minds is: Which is better, Quotex or Forex?

The short answer is: Forex is better for long-term, professional trading with deeper market access, while Quotex suits beginners looking for fast-paced binary options trading with simplified interfaces and lower capital requirements.

✅ Pocket Option – The best binary options platform in the world

💥 Trade with Pocket Option now: Open An Account or Visit Brokers 👈 100% Bonus for New 💰

However, the right choice depends heavily on your trading goals, experience level, risk tolerance, and strategy. This article dives deep into the real differences between Quotex and Forex so you can make an informed decision.

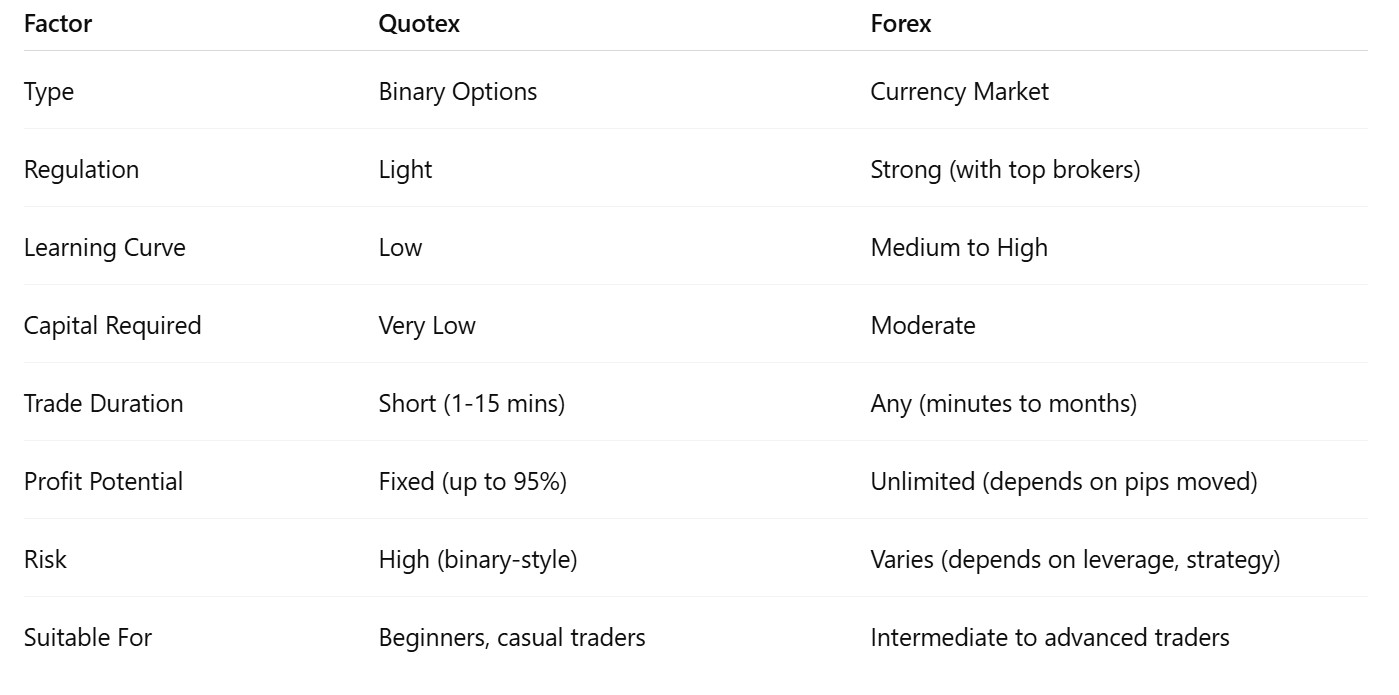

Understanding the Core Differences

Before we compare, it’s important to clarify that Quotex and Forex aren't equal types of platforms. Forex (Foreign Exchange) refers to the global decentralized market where currencies are traded. Meanwhile, Quotex is a digital options broker — a platform that allows users to trade binary options based on short-term price movements.

Let’s break this down:

Forex: You buy and sell currency pairs (e.g., EUR/USD) based on expected price changes. You can hold trades for minutes, days, or months. The profits depend on how far the market moves.

Quotex: You speculate whether an asset's price will go up or down over a fixed time (e.g., 1 minute, 5 minutes). If you're right, you earn a fixed return (usually 70–95%). If you're wrong, you lose your stake.

This fundamental difference shapes the experience, risk, and potential rewards of each.

Quotex: Pros and Cons

✅ Pros of Quotex

Simplicity and Ease of Use

Quotex has a user-friendly interface ideal for beginners. You don’t need to understand complex market mechanics. Just predict price direction.

Low Capital Requirement

You can start trading on Quotex with as little as $10. Trade sizes can be as small as $1.

Fast Results

Trades last from 1 minute to several hours, giving you quick feedback and potential profits.

Fixed Risk and Reward

You know your maximum loss and potential profit before entering a trade. No surprises.

Free Demo Account

Quotex offers a demo account with virtual funds to practice risk-free.

❌ Cons of Quotex

Binary Options Are Risky

Because trades are all-or-nothing, it's easy to lose your entire stake if your prediction is wrong — even by a single pip.

Limited Market Depth

Quotex doesn't offer full market features like order books, leverage control, or variable spreads.

Regulation Concerns

While Quotex is licensed by the IFMRRC (not a major regulatory body), it’s not regulated by top-tier institutions like the FCA or ASIC. That raises questions about transparency and user protection.

Short-Term Trading Can Promote Gambling Behavior

The fast-paced nature can tempt users to overtrade or act on impulse rather than analysis.

Forex: Pros and Cons

✅ Pros of Forex Trading

Access to a Massive Global Market

Forex is the largest financial market in the world with over $7 trillion traded daily. It’s open 24 hours a day, five days a week.

Professional Tools and Analysis

Forex trading gives you access to deep charts, technical indicators, algorithmic strategies, and advanced order types.

Regulated Brokers

Many Forex brokers are regulated by top financial authorities (e.g., FCA, CySEC, NFA), giving more security for your funds.

Scalable Trading Strategies

From scalping to swing and position trading, Forex allows for flexible strategy development over different time frames.

Leverage and Hedging

Forex platforms often allow leverage up to 1:500 (depending on your location), plus the ability to hedge positions for risk management.

💥 Exness - Best Forex Broker: Open An Account or Visit Brokers 🏆

❌ Cons of Forex Trading

Steeper Learning Curve

Understanding how Forex works — including spreads, pips, leverage, and risk management — takes time and effort.

Higher Initial Deposit for Some Brokers

While many brokers offer micro accounts, trading with meaningful returns typically requires a few hundred dollars at minimum.

Market Volatility

Forex markets can be extremely volatile, especially during news releases. Without proper risk management, losses can add up quickly.

Emotional Pressure

Unlike binary options with fixed outcomes, Forex profits and losses vary, which can lead to psychological stress during trades.

Which Platform Suits You Best?

The answer depends on your goals, experience, and risk appetite. Let’s explore different user profiles.

🎯 Quotex is better if:

You’re a beginner who wants to learn trading basics without complex setups.

You prefer quick, fixed-return trades over short timeframes.

You have limited capital to start with.

You’re looking for a simple, visual platform with low barriers to entry.

You’re comfortable with high-risk, high-reward binary options.

🎯 Forex is better if:

You’re a serious or professional trader aiming for long-term growth.

You want to develop real trading strategies based on technical or fundamental analysis.

You care about regulation and security of your funds.

You’re ready to commit time to learn and manage risk effectively.

You seek access to market liquidity, leverage, and custom trade setups.

Risk Management: A Critical Point

Whether you choose Quotex or Forex, risk management is non-negotiable.

On Quotex, it’s easy to get caught in a loop of fast trades that deplete your capital.

On Forex, improper use of leverage can magnify losses quickly.

Both platforms require discipline, emotional control, and a trading plan.

What About Legality?

Quotex is not available in the U.S., Canada, or a few other regions. Always check local regulations before using it.

Forex is legal globally but regulated differently in each country. Top-tier brokers comply with local laws and offer protection like negative balance protection and segregated accounts.

Final Verdict: Quotex vs Forex

To summarize:

If you want fast, gamified trading — try Quotex.

If you’re looking for long-term skill development and flexibility — Forex is the better path.

A Balanced Suggestion: Start With a Demo

No matter your choice, always start with a demo account.

Quotex offers a no-signup demo you can use instantly.

Most Forex brokers offer demo accounts with full access to trading platforms like MetaTrader 4 or 5.

Use these tools to explore the platforms, test strategies, and see which style suits you best — without risking real money.

Final Thoughts

Choosing between Quotex and Forex isn’t about which is objectively better. It’s about what’s better for you. Each has its advantages and risks. Understanding these differences is the key to making the right choice for your financial journey.

If you’re in it for the thrill and speed, Quotex offers an engaging experience. But if you aim to build lasting trading skills with strategic depth, Forex is your arena.

Know your goals. Learn the tools. Master your mind.

That’s how you win — regardless of the platform.

💥 Trade with Pocket Option now: Open An Account or Visit Brokers 👈 100% Bonus for New 💰

Read more: