11 minute read

Is Pocket Broker halal? How to open Pocket Option Islamic account?

Is Pocket Broker halal? How to open Pocket Option Islamic account?

In the world of trading and investment, many individuals are seeking options that align with their ethical and religious beliefs. For Muslims, adhering to the principles of Islamic finance is of utmost importance—this raises the question: Is Pocket Broker halal? How to open Pocket Option Islamic account? In this article, we will explore the essence of halal trading, how to open an Islamic account on Pocket Option, and much more.

👉Open a Pocket Option Account👈

Is Pocket Broker Halal? Understanding Islamic Finance Principles

When discussing whether a broker like Pocket Option can be considered halal, it's essential to understand the foundational principles of Islamic finance. The core tenets revolve around the prohibition of interest (riba), excessive uncertainty (gharar), and investing in haram (forbidden) activities.

The Prohibition of Riba

Interest, or riba, is a key principle that dictates the framework of Islamic finance. According to Islamic law, earning money from interest-bearing loans is not permissible. This means that any trading platform that incorporates interest payments as part of its operations raises red flags for Muslim traders.

Pocket Option's structure and policies must be examined to determine if they comply with these guidelines. If the broker engages in practices that involve riba, it cannot be deemed halal.

Avoiding Gharar: The Uncertainty Factor

Gharar refers to excessive uncertainty and ambiguity in contracts. In trading, this could relate to unclear pricing, hidden fees, or opaque practices that might disadvantage one party. For a broker to be considered legitimate under Islamic principles, all terms should be transparent, ensuring that all parties understand the risks involved.

Conducting thorough research on Pocket Option’s trading conditions allows potential users to see if they can operate without falling into the trap of gharar.

Investing in Halal Activities

A significant aspect of Islamic trading involves ensuring that investments do not fund haram activities. This means that any assets or securities traded must pertain to industries such as alcohol, gambling, or pork—businesses explicitly prohibited by Islamic law.

For Pocket Option to be classified as halal, it must offer instruments and underlying assets that align with these ethical values, enabling Muslim traders to invest confidently.

👉Open a Pocket Option Account👈

How to Open a Pocket Option Islamic Account: Step-by-Step Guide

Opening an Islamic account on Pocket Option may seem daunting, but it is quite straightforward when you follow these simple steps. Once you understand the requirements and process, you can start trading while adhering to Islamic principles.

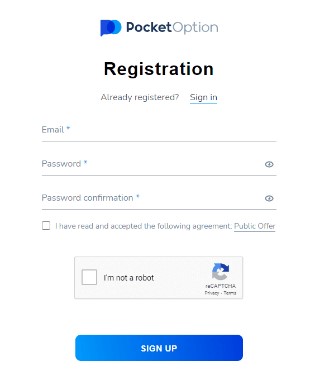

Step 1: Visit Pocket Option’s Website

The first step in opening an Islamic account is to navigate to the official Pocket Option website. It’s crucial to ensure that you are on the legitimate site to avoid scams.

On the homepage, look for the “Sign Up” or “Register” button. Clicking on it will take you to the registration page, where you need to fill out personal details like your name, email address, and phone number.

Step 2: Choosing the Right Account Type

Once you complete the registration form, Pocket Option will provide multiple account types. Ensure you select the Islamic account option, which is usually marked clearly. Read the account specifications, including the absence of interest rates and swap fees, to confirm it meets Islamic standards.

Step 3: Verification Process

After selecting the Islamic account, Pocket Option will require you to verify your identity. This verification typically involves submitting copies of your identification documents, such as a passport or national ID card, and proof of residency.

Completing this step ensures compliance with regulatory standards and helps prevent fraud.

Step 4: Fund Your Account

With your Islamic account now active, you can proceed to fund it using one of the accepted payment methods. Be mindful of transaction fees and choose methods that are convenient for you. Depositing funds will allow you to begin your trading journey with Pocket Option.

The Concept of Halal Trading in Pocket Options

Understanding halal trading requires a broader look at the principles underpinning Islamic finance. It goes beyond merely avoiding interest; it embodies ethical investment practices aligned with Islamic teachings.

Ethical Investment Practices

Halal trading emphasizes the need for socially responsible investing. This means avoiding companies or sectors that promote practices contrary to Islamic beliefs. With Pocket Option, traders are encouraged to engage in ethical trading focused on productive economic activity.

By investing in companies that contribute positively to society, traders can align their financial practices with their faith.

The Role of Transparency in Halal Trading

Transparency is crucial in halal trading. Traders must know the risks and rewards associated with their investments. Pocket Option aims for transparency by providing clear information about its trading conditions, asset classes, and potential risks involved.

When traders possess comprehensive knowledge, they can make informed decisions without succumbing to gharar.

Aligning Goals with Faith

Halal trading also encourages traders to reflect on their intentions behind engaging in financial markets. It promotes the idea that wealth should be created ethically and used for beneficial purposes. Pocket Option provides an avenue for Muslim traders looking to grow their finances while maintaining integrity.

See more:

Is Pocket Option a trusted broker?

Is Pocket Option a regulated broker?

Requirements for an Islamic Trading Account on Pocket Option

Establishing an Islamic trading account on Pocket Option necessitates meeting specific criteria that adhere to Islamic finance principles. These requirements ensure that traders operate within the confines of their beliefs while exploring opportunities in the financial markets.

Personal Information Disclosure

Like most trading platforms, Pocket Option mandates users to disclose personal information during account registration. This includes your name, address, contact details, and date of birth.

Such information aids in creating a secure trading environment while ensuring compliance with local regulations.

Identification Verification

As mentioned earlier, verifying your identity is vital for the establishment of an Islamic account. Submitting identification documents confirms your identity and deters fraudulent activities on the platform.

Ensure that the documents you submit are valid and up-to-date to expedite the verification process.

Account Type Selection

Selecting the Islamic account type is crucial. Thoroughly review the features and benefits attached to the account. Look out for details confirming the absence of swaps and interest, aligning with Islamic principles.

Differences Between Standard and Islamic Accounts in Pocket Option

When considering various accounts, it's essential to recognize the differences between standard and Islamic accounts on Pocket Option. Understanding these distinctions can help traders make more informed choices based on their trading needs and religious beliefs.

Swap-Free Trading Conditions

One of the most significant differences between standard and Islamic accounts is the absence of swap fees charged on positions held overnight. Standard accounts typically incur interest charges, while Islamic accounts are structured to avoid this practice, making them more suitable for Muslim traders.

This structure aligns with Islamic finance principles, allowing traders to hold positions without violating their belief systems.

Additional Features of Islamic Accounts

Islamic accounts often come with additional features designed to accommodate Muslim traders’ needs. These may include tailored educational resources on halal trading practices, access to exclusive market analyses, and dedicated support for Islamic account holders.

Traders should take advantage of these offerings to enhance their experience and knowledge in halal trading.

Risk Management Considerations

Both standard and Islamic accounts come with risk management tools like stop-loss orders and limit orders. However, the way these tools are utilized can differ depending on individual trading strategies and risk tolerance levels.

Utilizing these features effectively allows both types of traders to mitigate risks while pursuing their investment goals.

Benefits of Using Pocket Option for Halal Trading

Choosing the right platform for halal trading is critical for Muslim traders. Pocket Option offers several advantages that can significantly enhance the trading experience for those adhering to Islamic finance principles.

User-Friendly Interface

One of the standout features of Pocket Option is its user-friendly interface. Trading platforms can often seem overwhelming, especially for beginners. Pocket Option simplifies the trading process through intuitive design, enabling traders to focus on making informed decisions rather than navigating complex menus.

A seamless experience fosters confidence, especially for newer traders entering the market with an Islamic account.

Diverse Asset Selection

Pocket Option provides access to a wide variety of assets across different markets, including forex, stocks, commodities, and cryptocurrencies. This diverse selection empowers traders to select halal-compliant investments and diversify their portfolios according to their interests.

Traders can explore various sectors while remaining true to their ethical beliefs, enhancing their chances of success in the market.

Advanced Trading Tools

Equipped with advanced trading tools, Pocket Option enables traders to analyze the markets effectively. These tools include technical indicators, charting capabilities, and other analytical resources that assist in making well-informed trading decisions.

Utilizing these tools can improve trading skills and lead to better outcomes in the long run, ultimately benefiting Muslim traders adhering to halal principles.

Pocket Option's Compliance with Sharia Law

To be considered halal, a trading platform like Pocket Option must comply with Sharia law. Understanding how the platform aligns with these principles can provide insight into its suitability for Muslim traders.

Regular Audits and Transparency

Compliance with Sharia law often involves regular audits and a commitment to transparency. Many brokers work with Islamic scholars or organizations to ensure their operations align with Islamic finance regulations.

Pocket Option’s approach to transparency and compliance may involve disclosing their operational practices, instilling a sense of trust among Islamic traders.

Clear Definitions of Trading Practices

Pocket Option should offer clearly defined trading practices that demonstrate the platform’s alignment with Sharia law. By outlining terms and conditions that avoid riba and gharar, the broker reassures Muslim traders that their financial dealings are compliant.

The clarity surrounding such practices holds paramount importance for establishing a trustworthy relationship between the broker and its clients.

Community Engagement and Feedback

Engagement with the Muslim trading community can also help platforms like Pocket Option refine their services. Soliciting feedback from traders ensures that their needs are met and their concerns addressed, thereby fostering a supportive environment for halal trading.

Regular engagement contributes to continuous improvement in their offerings, ultimately ensuring compliance with Sharia law.

Common Misconceptions About Halal Trading on Pocket Option

Despite growing awareness about halal trading, misconceptions still exist surrounding Islamic finance principles and their application on platforms like Pocket Option. Unpacking these myths can pave the way for a clearer understanding of halal trading.

All Brokers Are Created Equal

One common misconception is assuming that all trading platforms cater equally to Islamic traders. In reality, each broker operates under unique policies and practices. Not every broker offers Islamic accounts or adheres to Sharia compliance.

Thorough research on a broker’s practices is crucial to ensure that trades are conducted within the bounds of Islamic principles.

Halal Trading Means No Risks

Another prevalent myth is that halal trading eliminates all financial risks. While halal trading focuses on ethical investments, it does not guarantee protection from market volatility. Understanding risk management and employing effective strategies is essential for all traders, regardless of their account type.

Islamic Accounts Are Limited in Functionality

Some traders believe that Islamic accounts are less functional than standard accounts. However, many Islamic accounts on reputable trading platforms offer similar functionalities and tools as standard accounts. The only notable difference lies in the absence of swaps and interest.

Recognizing the full potential of Islamic accounts can empower traders to maximize their trading experience.

Customer Testimonials: Experiences with Pocket Option Islamic Account

Customer testimonials provide valuable insight into real-life experiences with Pocket Option’s Islamic account offerings. Positive feedback can reinforce the viability of the platform, while negative reviews serve as warnings to potential traders.

Positive Experiences

Many traders commend Pocket Option for its accessible interface and responsive customer service. Users appreciate the ease of navigation, simplifying the trading process for both beginners and experienced traders alike.

Moreover, traders often express gratitude for the availability of an Islamic account that aligns with their ethical and religious beliefs. The absence of interest fees allows them to trade freely without compromising their faith.

Areas for Improvement

While most feedback leans positive, some traders have voiced concerns regarding withdrawal times and the availability of certain assets. Timely withdrawals are crucial for traders, especially in fast-moving markets where quick access to funds is vital.

Constructive criticism can help Pocket Option refine its services and increase customer satisfaction.

Community Building

Several users highlighted the sense of community fostered by Pocket Option. Engaging with fellow traders through forums or social media groups enhances the learning experience and creates opportunities for collaboration.

Having access to a supportive network strengthens traders' resolve and confidence, particularly for those new to halal trading.

Conclusion: The Viability of Pocket Option for Muslim Traders

In conclusion, the question of "Is Pocket Broker halal? How to open Pocket Option Islamic account?" can be answered affirmatively if the broker's practices align with Islamic finance principles. Pocket Option stands out as a viable platform for Muslim traders, offering a range of benefits tailored to halal trading.

👉Open a Pocket Option Account👈

By focusing on transparency, ethical practices, and community engagement, Pocket Option seeks to meet the unique needs of Muslim traders. Whether you're a novice or an experienced trader, understanding the requirements and nuances of halal trading can empower you to navigate the financial markets confidently while staying true to your beliefs. Embrace the opportunity to engage in ethical trading practices that not only yield financial gains but also align with your faith.

See more: