LOOKAHEAD 2026

BHP says Jansen lessons key to cost control

POTASH | Americas head explains $1.7B budget overrun

BY FRÉDÉRIC TOMESCO

BHP (NYSE, LSE, ASX: BHP)

wants to use lessons from its maiden foray into potash production to ensure that a subsequent expansion of the facility is completed at or under budget.

The world’s biggest miner in July disclosed a $1.7-billion (C$2.38-billion) cost overrun in the development of its Jansen potash mine in Saskatchewan as it pushed first production back by six months to mid2027.

The project’s first stage – known as Jansen 1 – is now expected to cost as much as $7.4 billion, up from a previous target of $5.7 billion. Capital expenditures for a second stage, whose entry into service was delayed by two years to 2031, are still pegged at $4.9 billion, though the amount is under review.

Located about 140 km east of Saskatoon, Jansen is crucial to BHP’s ambitions of building a significant footprint in potash – a new commodity for the mining behemoth. The investment, the largest in Saskatchewan’s history, is part of an effort by BHP to shift its portfolio away from steelmaking materials and towards what executives call “future-facing commodities” such as copper and potash. About 65% of BHP’s capital will be invested in these sectors over the medium term, the company said this year.

“We’ve had a lot of learnings from Jansen 1 in terms of what drove those cost pressures,” Brandon Craig, BHP’s president for the Americas, told The Northern Miner by phone. “We want to take all of that and apply what we understand about Jansen 1 to Jansen 2.”

Modules

Greater use of modular construction will be key to BHP’s efficiency ambitions for the project’s second stage, Craig said by phone in November. He likens the process to building a structure with Lego blocks, adding that BHP’s assembly facility in Edmonton will play a key role.

“The more you can push into the module, the less work you have to do on the site itself,” he said. “If you can pre-fit out in a factory a very large amount of the project build and transport it to the site, where you use very large cranes to erect that module, all you have to do is bolt it on site. The less you pre-fit out, the more labour hours you have to consume on the site itself.”

BHP is aiming to disclose an updated capital estimate for Jansen’s second stage by June 30, the executive said. While a two-year

“We want to take [what we learned] and apply what we understand about Jansen 1 to Jansen 2.”

BRANDON CRAIG PRESIDENT FOR THE AMERICAS, BHP

postponement will probably result in higher costs, some savings could still materialize, he stressed.

“We want to do the work first to make sure we have a degree of confidence in the accuracy,” he said. “The team is working quite hard at understanding how we can really improve the productivity. Whether

that’s sufficient to offset the inflationary effects, we will see.”

Major producer

Stage 1 of Jansen is almost threequarters complete, while Stage 2 is 13% done, BHP said Oct. 21. Once fully ramped up, Jansen will become one of the world’s largest potash mines, producing about 8.5 million tonnes of the fertilizer annually – equivalent to about 10% of global supply.

Crews reached a key milestone in August with the installation of a new 50-metre-tall steel headframe –the equivalent of a 16-storey building. Most of the steel was made in Canada before being shipped to the mine site.

With major steel construction almost done, focus will now

Toro® LH518iB Battery-electric loader

This state-of-the-art BEV loader is designed specifically for underground mining operations. Equipped with an optimal battery chemistry, the fastest battery swap on the market and a high-power electric driveline, this loader is your gateway to sustainable mining.

Toro® LH518iB Safer. Stronger. Smarter.

Runners start the World’s Deepest Marathon 1.1 km underground in Boliden’s Garpenberg zinc mine in Sweden in October. See story on p. 10.

CREDIT: SAM MCELWEE/BECOMING X

n Glencore smelter

Glencore and Quebec denied a Reuters report citing unnamed sources that the company was planning to shut down its Horne smelter in the province – Canada’s largest copper-metal producing plant – due to steep environmental upgrades and operational costs.

Horne, in the city of Rouyn-Noranda, processes concentrates to make copper anodes. Another Glencore facility, the Canadian Copper Refinery (CCR) in Montreal East, turns them into cathodes.

“Glencore is not currently considering the closure of the Horne Smelter or the CCR refinery,” a company spokesperson told Reuters Nov. 4.

Smelters globally are facing significant “financial, regulatory and operational pressure,” and Glencore’s smelters in Canada are not exempt from this, the spokesperson added. “The Horne smelter is not about to close its doors,” a spokesperson for Quebec Premier François Legault told The Canadian Press. While no production figures have been published for Horne and CCR, industry sources cited by Reuters have pegged their annual output at more than 300,000 tonnes. Much of the copper metal production goes to the United States, a net importer.

On whether the Reuters sources were trying to prod government levels to fund the smelter, veteran mining investor John Ing told The Northern Miner: “Why are we subsidizing battery plants with public money, when we should be building up processing capacity. Public money finances exploration, building mines – why not processing?”

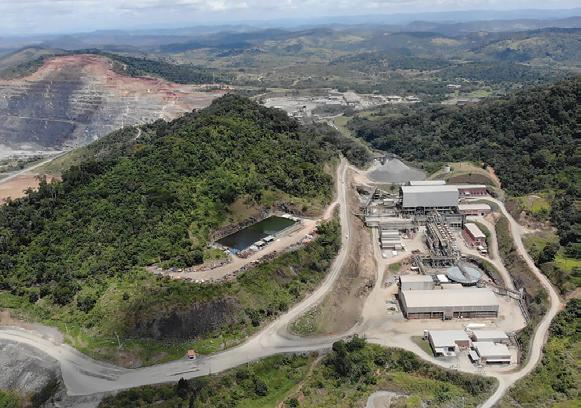

n Tailings failings

One-third of mines around the world operated by two dozen leading companies don’t fully meet industry standards for tailings management, a new report found.

The findings are contained in a report produced by the London-based International Council on Mining and Metals, which analyzed 836 facilities to see whether they complied with the Global Industry Standard on Tailings Management.

The council and United Nations agencies established the standard in 2020 to encourage miners on tailings performance after a dam burst a year earlier on Vale’s Feijão iron ore operation, killing 270 people downstream in the world’s worst mining disaster in recent decades.

While a newfound focus on critical minerals in Western countries is helping the industry’s image, tailings disasters contributed greatly to anti-mining sentiment in recent decades and remain a cornerstone of environmental complaints.

A review by The Northern Miner of disclosures from the council’s 26 members found many majors – such as China’s MMG, Glencore, BHP, French uranium miner Orano and Anglo American – still have several mines that don’t meet the standard.

n Barrick reviews

Barrick Mining has begun a review of operations to curtail unplanned downtime and improve worker safety as the Canadian miner shifts its focus to North America.

Toronto-based Barrick is to report on the work in February, interim CEO Mark Hill said Nov. 10. Barrick wants

to better plan maintenance and eliminate “unexpected surprises” such as a recent roaster failure at the Carlin complex in Nevada, which caused the company to lose seven days of production at the end of the third quarter, he said.

Hill, who replaced Mark Bristow in late September following the longtime CEO’s surprise departure, gave no update on a replacement, deflected a question on the fate of the de facto nationalized Loulo-Gounkoto mine in Mali and said new investment would target Fourmile in Nevada.

Barrick is investigating how two workers died at its underground mines in the most recent quarter – one at Goldrush in Nevada, and another one at Bulyanhulu in Tanzania.

n China ‘REE-lents’

China agreed to suspend a planned expansion of export controls on rare earth elements (REE) for a year after U.S. President Donald Trump struck a broad trade deal with Chinese counterpart Xi Jinping.

Trump agreed to lower tariffs on Chinese goods from 57% to 47%, Reuters reported. In exchange, Beijing will “work diligently” with the U.S. to stop fentanyl shipments and buy U.S. agricultural products such as sorghum and soybeans. China, which puts out most global rare earth production, set export restrictions in April then expanded them in October. China then lifted a nearly year-long ban on exports of gallium, germanium and antimony to the U.S., but said it would still restrict all mineral exports for military applications. The bans were imposed in retaliation for U.S. export controls on high-bandwidth memory chips into China towards the end of the Biden administration.

BY NORTHERN MINER STAFF

GLOBAL MINING NEWS • SINCE 1915 www.northernminer.com

PRESIDENT THE NORTHERN MINER GROUP: Anthony Vaccaro, CFA, MBA avaccaro@northernminer.com

EDITOR-IN-CHIEF: Colin McClelland cmcclelland@northernminer.com

COPY EDITOR AND PRODUCTION EDITOR: Blair McBride bmcbride@northernminer.com

SENIOR STAFF WRITER: Frédéric Tomesco ftomesco@northernminer.com

WESTERN EDITOR: Henry Lazenby hlazenby@northernminer.com

PODCAST HOST: Adrian Pocobelli apocobelli@northernminer.com

ADVERTISING: Robert Hertzman (416) 898-6654 rhertzman@northernminer.com

Kathleen Plamondon (514) 917-5284 kplamondon@northernminer.com

Michael Winter (416) 510-6772 mwinter@northernminer.com

SUBSCRIPTION SALES/ APPOINTMENT NOTICES/ CAREER ADS

George Agelopoulos (416) 510-5104 (Toll free) 1-888-502-3456, ext. 43702 gagelopoulos@northernminer.com

PRODUCTION MANAGER: Jessica Jubb (416) 510-5213 jjubb@northernminer.com

CIRCULATION/CUSTOMER SERVICE: (416) 510-6789 | 1-888-502-3456 northernminer2@northernminer.com

REPUBLISHING: (416) 510-6768 jmonteiro@northernminergroup.com

ADDRESS: Toronto Head Office

69 Yonge St, Toronto, ON M5E 1K3 (416) 510-6789 tnm@northernminer.com

SUBSCRIPTION RATES: Canada:

C$130.00 one year; 5% G.S.T. to CDN orders.

U.S.A.:

opinion

EDITORIAL

Banner year

BY COLIN McCLELLAND

If it hasn’t been clear since “critical minerals” entered the popular lexicon in 2022, it sure is now: We’re living in one of the greatest periods to be part of mining. Find me a politician anywhere, even on some Pacific atoll, who isn’t talking about mining and metals, and I’ll show you someone zoned out.

Even remote island nations want energy-transition metals mined if they help keep rising seas at bay.

Countries and miners alike are racing to secure supply of copper, nickel, lithium and uranium. Canada’s industry, for example, is under pressure to step up in mining or risk losing ground to other jurisdictions. The West is hell-bent on reducing its reliance on China.

Rare earths became a rallying cry in 2025 as the Asian giant first weaponized the 17 elements, then appeared to come to somewhat of a truce with the U.S. The Trump administration took an equity stake in the rare earths producer MP Materials before steering it towards a deal with Saudi Arabia. The U.S. also invested for 5% of Lithium Americas, making government stakes in miners a new norm from a deal-making White House.

Carney just passed a federal budget through Parliament that gives more money to mining than, well, ever. Pierre Gratton of the Mining Association of Canada can’t believe it. (See page 34.) The prime minister is following through on promises to move large mining and infrastructure projects to fast-tracking.

However, there is criticism this could be just another layer for projects to endure, and they still must be determined to be in “the national interest” before speedier measures take effect.

Trade, security

Trump and Carney are casting the new boosterism in terms of trade and national security. Hardly a day goes by without the Donald or his administration making a critical minerals deal with some nation or other: Saudi Arabia, Australia, Japan, Ukraine, Malaysia, Thailand, Kazakhstan.

Even when Trump flies off on a whim against conventional economic theory, mining seems to win. His global tariff policies made gold the biggest metals story this year – and likely since the late ’70s, when roaring inflation and oil price shocks rattled the world.

The spot price of gold has risen 56% this year, setting record highs over $4,000 an ounce. It’s second only to when gold surged more than 250% from 1978 to 1980 as investors fled to anything that looked solid.

One of our top-read stories this year online was out of the Beaver Creek conference in Colorado, where Frank Giustra talked about how investors want physical gold – not gold on paper. Another was on the potential IPO for an obscure gold producer from Uzbekistan, the stateowned Navoi, which is actually the fourth-largest gold producer in the world. Investors are still hungry for gold, and forecasters say it could hit $5,000 an oz. next year. (See page 35.)

Copper

Copper was also in the spotlight this year with America’s 50% tariffs on imports triggering record prices for the red metal in July. They subsided after details emerged the duties were for products, not raw material. But the plumbing and wiring metal, a proxy indicator for the economy, looks good for next year.

Chile’s Codelco, the world’s largest copper producer, has lifted its 2026 premiums on top of the London Metal Exchange price to record levels, signalling tight availability of refined copper. And China Daily, the state-owned English-language newspaper, reports the government is exploring options to support the country’s ailing property sector.

Nuclear energy is booming again. See page 42 for a comparison with the Cold War in another part of our archive series this year looking back from the Miner’s 110th anniversary.

Artificial intelligence had another big year, helping support stock market gains. It also offers advances in exploration to co-ordinate reams of data, and likewise efficiencies in processing. AI also means more demand for copper wiring, semiconductors sparkling with rare earths, and uranium to feed the proposed small modular reactors to power the new data centres required.

Research

We’ve begun to use AI in stories for the Miner. It’s most useful as a research tool. It can be trained, but, like a child, needs a watchful eye on it all the time, lest it make up quotes or garble figures. On the whole, it’s a plus for our team, helping transcribe interviews and dig into reports.

We’re doing more with less as we cover the globe from the head office in Toronto while taking advantage of Northern Miner Group staff or stringers in Vancouver, Montreal, Nova Scotia, Europe and Australia. Videos and podcasts are expanding as well as our social media reach.

As we wrap up another year, some of you may be reading this in London where we’re staging our most successful International Metals Symposium yet, with several hundred delegates and presentations by Rick Rule, Rob McEwen and Mark Cutifani, among others.

We’re riding high after a great year for mining with strong momentum heading into 2026.

Merry Christmas and Happy New Year! TNM

COMMENTARY

Awakening the Argentine giant

BY JAMES COOPER

What place holds the highest probability for a new world-class discovery?

As an Australia-based geologist and investor, I tend to look in my own backyard first, which is the home bias effect. But the thing is, thanks to decades of a supportive mining environment, well-trained staff, and advanced exploration methods, the prospect of discovering another giant deposit in Australia is fading.

Don’t get me wrong, there could still be potential in remote outback locations, like the Tanami.

But compared to places like West Africa, where high-grade gold can still be found close to surface, Australia’s giant discovery potential is diminishing.

Then there’s Canada. Like Australia, Canada has been heavily explored thanks to its supportive governance and skilled labour force. It has also lost its discovery potential.

But like Australia, there are still some remote frontiers – especially in the far north – that hold discovery potential.

But if you want to stack the odds firmly in your favour and pick a place with the highest potential for a major discovery, look no further than Argentina!

Land of the giants Argentina sits as one of the best places for explorers and their shareholders. And there are a few reasons why that’s the case.

To understand the potential here, you must look at its neighbour, Chile and what it has achieved in its mining industry over the last several decades.

Chile is the world’s largest copper-producing nation. That’s enabled it to remain one of the wealthiest nations in South America. Its economy feeds off its vast copper exports, thanks to discoveries made 30, sometimes 50 years ago. It holds mega-copper projects that have left a legacy of long-term production.

But across the border, Argentina’s copper output has gone from modest to virtually nil. So, is there less copper in Argentina or is something else happening here?

The critical thing to realize here is that the same geological system hosting giant porphyry copper-gold deposits in Chile crosses into Argentina. South America’s ‘porphyry copper belt’ straddles the border between Argentina and Chile.

Yet only one country has realized this potential over the last several decades.

Here’s the opportunity

A lack of copper mining in Argentina has nothing to do with geology and all to do with politics.

Mega-mining projects take up to 20 years to develop and remain in production for decades. These mines leave a legacy for the mining companies that own them and for the host country. It’s why political stability is essential for developing giant copper mines.

And that’s the key element that’s been missing in Argentina. Thanks to decades of hostile business conditions and economic chaos, the miners haven’t ventured into Argentina. And that’s why the country holds a vast untapped wilderness of geological potential.

Geology ignores borders The key point is that the same geological setting that hosts giant copper porphyry deposits in Chile also exists in Argentina. And that’s why for geologists, Argentina represents Chile, perhaps 50 or 60 years ago, when discoveries were far larger and higher grade. So, why should investors start taking notice? In case you’re not familiar, Argentina has been experiencing a tidal wave of reform since its new president, Javier Milei, swept into power in 2023. Milei implemented a series of austerity measures, including slashing energy and transportation subsidies, laying off tens of thousands of government workers, freezing public infrastructure projects and imposing wage and pension freezes below inflation. While it has been controversial, inflation has plummeted since Milei took office. Bonds have also rallied while Argentina’s country-risk index, a measure of the risk of default, is at its lowest point in five years.

Milei also secured a political victory in late October, extending his ability to push reforms and encourage investment. And clearly, he’s moving the dial on the country’s mining investment.

Late last year, the world’s biggest miner, BHP, announced a multi-billion-dollar takeover deal for Filo Mining, a stock I recommended to my readership group back in 2023. Meanwhile, Glencore is weighing two significant copper developments in the country that would require about $13.5 billion in investments. Barrick, Lundin Mining, and Rio Tinto are other big names starting to build a presence in the country.

For geologists, Argentina is the Chile of 50 years ago.

Open for business

So, what happens when modern exploration techniques are used on ground that’s barely been explored. Major discoveries happen. And that’s what’s happening in Argentina. TNM

James Cooper is a geologist based in Australia who runs the commodities investment service Diggers and Drillers. You can also follow him on X @JCooperGeo.

Discoveries, ore sorting could lift Spanish Mountain

BY NORTHERN MINER STAFF

Spanish Mountain Gold (TSXV: SPA; US‑OTC: SPAUF) is betting recent in pit, near surface high grade discoveries of 1 gram gold per tonne and higher, coupled with ore sorting can raise mill head grades, scale output and front‑load cash flow at its namesake project in British Columbia’s Cariboo district.

The company has launched particle and bulk sorting programs while a 9 10,000 metre drill campaign, with over 60% of drilling completed and pending assays, seeks to better define higher‑grade areas inside a proposed main pit shell. Spanish Mountain has already released the targeted higher grade results cut in the new Orca Fault discovery area with the program’s first four holes in press releases on Nov. 3 and 17.

Eleven more holes in this area have been drilled pending assays.

The site sits about 555 km north of Vancouver, near the community of Likely, with year‑round access. It’s in the same district where Osisko Development (TSXV: ODV; NYSE: ODV) is advancing the $890 million capex Cariboo gold project to construction and Artemis Gold (TSXV: ARTG) recently achieved commercial production at its Blackwater mine.

“We are extremely encouraged with the progress of our two pronged strategy to improve head grade to the proposed mill,” President and CEO Peter Mah said.

“Firstly, our recent drill programs have demonstrated huge potential to discover new, continuous in pit high grade,” Mah said. “Secondly, preconcentrating mineralization essentially moves more gold through the process plant, which together, these two initiatives could dramatically uplift processed grades, gold production and overall project economics.”

Project advantages

Investors who prioritize early cash generation and smaller footprints may find ore sorting especially important, as it removes waste before the mill and could have an even greater impact if infill drilling continues to link higher grade structures in the near surface mine plan.

If the Orca Fault area infill drilling keeps mapping contiguous higher‑grade corridors inside the pit, the combined effect could improve the first decade of operations, according to Mah, where value is most sensitive. The pending trove of drill assays and the results from ore sorting are to show whether the company can improve the project’s math as it works towards making a development decision by 2027.

Head grade

Spanish Mountain is running two complementary test work streams.

ABH Engineering is leading a particle‑scale program following past amenability work that indicated the deposit responds to X‑ray transmission sorting –tested to lift mill feed grades and gold produced.

In parallel, OrePortal is conducting a bulk sorting desktop study that examines ore heterogeneity and sensor options such as XRF and prompt gamma

neutron activation analysis for shovel or belt applications at the front end.

“The logic is simple,” Mah said, “reject dilution and low‑grade material early, send a richer feed to the plant and tail fewer tonnes.”

Overall, the work will estimate capital and operating costs and model the impact on project value relative to the current study, the executive said. Both streams target next‑stage engineering decisions as the company advances towards a feasibility study. It is currently in the request for proposal competitive bidding process and is expected to be awarded in the first quarter of next year.

Infrastructure supports the approach. A proposed 230‑kV/~60‑MW grid interconnection is in the second stage of BC Hydro’s system‑impact process. Sorting that trims haulage, reduces energy and tailings volumes would stack on these advantages.

Connecting the dots

The first two drill holes delivered broad, near‑surface intervals: 112 metres grading 0.77 gram gold per tonne starting at 84 metres in hole 25‑DH‑1292, including 35.8 metres of 1.18 grams gold. Drill hole 25‑DH‑1293 returned 102 metres grading 0.64 gram gold from 94 metres, including 20.25 metres at 1.28 grams gold.

“ The logic is simple: reject dilution and low‑grade material early, send a richer feed to the plant and tail fewer tonnes.”

CEO

The results confirmed continuity beyond 25 metres between closely spaced holes and reinforced a preferred drilling orientation (about 120° azimuth) to properly intersect vein sets, Mah said.

Split tubes

The wider land package still teases upside. That includes a 0.75‑metre interval at 719.26 grams gold per tonne in the K Zone which was contained in a broader mineralized interval of 139 metres at 4.18 grams gold per tonne within 200 metres of surface and previously classified as waste.

This hole, the new Phoenix deposit and most of the 2025 drilling have not been included in the current resource estimate and economic study. It’s a reminder of the system’s ability to locally concentrate metal even within previously proposed mining limits. It supports growth and scalable production, begging the question of how high can the bar be raised, according to Mah.

PEA baseline

Spanish Mountain’s July preliminary economic assessment – prepared by a consortium led by Ausenco – re‑envisions the project at larger scale than the 2021 pre‑feasibility, extending mine life to 24.5 years and raising throughput to 26,000 tonnes per day.

It projects 3 million oz. of

payable gold over the mine life, with 203,000 oz. averaged in the first five years, 122,000 oz. annually over the life, and a waste‑to‑resource strip ratio of 2:1. The all in sustaining cost is estimated at US$1,338 per oz. and US$1,024 in the first five years. Recoveries average 89%.

The PEA envisions an open‑pit mine processing 26,000 tonnes per day with a base‑case after‑tax net present value (at a 5% discount rate) of $1 billion (US$710,000), an internal rate of return (IRR) of 18% and initial capital of $1.25 billion, using a gold price of US$2,450 an ounce.

At a spot gold price of US$3,900 an oz., the NPV and IRR improve to $3.2 billion and 41% with a payback of 1.7 years. This excludes the potential upsides of higher grades, ore sorting and Phoenix mentioned earlier. The flowsheet is conventional –grinding, gravity, flotation and carbon‑in‑leach – and features a move to filtered dry‑stack tailings and integrated water management.

The environmental design is a notable pivot, according to Mah. The plan adopts filtered dry‑stack tailings and a small, lined cell for any potentially acid‑generating fraction. It will also reuse all of process water with capture, treatment and discharge to provincial standards – aimed at reducing mine‑impacted runoff

and avoiding discharges near nearby parkland.

The Main deposit hosts 292.1 million measured and indicated tonnes grading 0.44 gram gold per tonne for 4.16 million oz. of contained metal. The inaugural Phoenix estimate adds 25.4 million inferred tonnes grading 0.44 gram for 357,000 oz. However, Phoenix isn’t in the current economics, setting up a clear avenue for future inclusion as drill confidence improves and ore sorting is tested.

“Importantly, besides adding high grade mineralization, the study identified pre‑concentration among one of the most promising levers to enhance value at the next stage,” Mah stressed.

Catalysts

Management’s near‑term plan is to complete the ongoing drilling, finish the sorting workstreams and refresh the PEA to include sorting and higher‑grade domains before starting a feasibility study.

Mah points to “PEA upside” scenarios – specifically sensor‑based sorting to uplift mill head grade and possible inclusion of the Orca Fault area and Phoenix once resource confidence is higher – alongside a program of engineering and power‑line work. The company says it is advancing toward feasibility studies with a build decision targeted for 2027.

Engagement with First Nations and communities – which shaped the tailings and water plan –continues alongside baseline work, Mah said.

“We have the ounces, the jurisdiction and the infrastructure,” the CEO said. “Now it’s about proving we can build a mine the Cariboo can be proud of.”

The preceding Joint Venture Article is PROMOTED CONTENT sponsored by Spanish Mountain Gold and produced in co-operation with The Northern Miner. Visit: https://spanishmountaingold.com for more information.

PRODUCTION MILESTONES TO WATCH IN 2026

By Blair McBride

As 2025 comes to a close, The Northern Miner looks ahead to 12 projects across North America on track to reach mining milestones in 2026. From precious and critical metals mines across the vastness of Canada to uranium mines further south in the U.S., the milestones cover the start of production, commercial production, production restarts and ramp ups to nameplate capacity.

ARTEMIS GOLD

BLACKWATER PHASE 1A | BRITISH COLUMBIA, CANADA

Plant expansion to 8 million tonnes per year by Q4 2026.

B2GOLD

GOOSE MINE | NUNAVUT, CANADA

Ramp up to nameplate capacity of 250,000 oz. of gold in early to mid-2026.

SASKATCHEWAN, CANADA

Commercial production scheduled for mid-2026.

COEUR MINING/ NEW GOLD

NEW AFTON C-ZONE

BRITISH COLUMBIA, CANADA

Ramping up to nameplate capacity of more than 14,500 tonnes per day by 2026.

BUNKER HILL MINING

BUNKER HILL

Restart targeted for first half of 2026.

RIO TINTO

KENNECOTT NORTH RIM SKARN | UTAH, USA

Production start expected in Q1 2026.

AGNICO EAGLE MINES

ODYSSEY / EAST GOULDIE | QUÉBEC, CANADA

Initial production from East Gouldie in second half of 2026.

WEST RED LAKE GOLD MINES

MADSEN MINE (RESTART) | ONTARIO, CANADA

Commercial production targeted for early 2026.

Northern

UR-ENERGY

SHIRLEY BASIN | WYOMING, USA

First uranium production in early 2026.

ALAMOS GOLD

ISLAND GOLD PHASE 3+ | ONTARIO, CANADA

Expansion completion enabling nameplate capacity of 2,400 tonnes per day in second half of 2026.

ENCORE ENERGY / BOSS ENERGY JV

ALTA MESA | TEXAS, USA

Nameplate capacity is expected to be reached in early 2026, with 1.5 million lb. of uranium oxide per year.

Mic’d Up JV Q&A

Terronera in production as Endeavour aims at ‘30 by 30’

BY HENRY LAZENBY

ENAME: Dan Dickson

TITLE: CEO

COMPANY: Endeavour Silver

ndeavour Silver (TSX: EDR; NYSE: EXK) has started commercial production at Terronera in Jalisco, Mexico, a step CEO Dan Dickson says anchors its “30 by 30” plan – 30 million silver-equivalent oz. a year by 2030. Terronera’s wide, shallow vein and strong gold by-product credits are central to the plan. The orebody is slated to produce 4 million oz. silver and 38,000 oz. gold a year over a decade. Dickson expects Terronera to deliver about $100$200 million (C$140-C$280 million) in annual free cash flow at current prices.

What comes next is scale. Endeavour is also advancing Pitarrilla in Durango, targeting a feasibility study by midnext year, to help bridge to the 30-million-oz. goal. In April, Endeavour added its first Peru operation with the Kolpa polymetallic mine with about 5 million silver-equivalent oz. a year (about 40% silver).

As part of our new Mic’d Up series, The Northern Miner’s Western Editor, Henry Lazenby, sat down with Dickson at the company’s Vancouver head office to unpack the growth story.

Henry Lazenby: You’ve been operating in Mexico for about 20 years and just declared commercial production at Terronera, the latest mine you’ve built. What, if anything, did you change at Endeavour to make sure this build worked from day one?

Dan Dickson: Our capabilities for operating mines haven’t fundamentally changed, but over the last couple of years we brought more engineering and construction expertise in-house to deliver Terronera. Geologically and operationally, Terronera is similar to Guanaceví and Bolañitos – underground epithermal vein systems. The values that made us successful in Mexico – especially earning and maintaining social licence in the small towns where we operate –are the same values we brought to Terronera.

That helped us get through a long permitting arc, from early work in 2013 to declaring commercial production in 2025. The formula remains: deliver the plan and work together to keep moving the company forward.

HL: If a new hire shadowed you for a week, what might surprise them about your management style?

DD: First, they’d probably be underwhelmed by the glamour. I spend a lot of time on the phone with different groups. What might surprise them is how much I focus on working with people, not having people work for me. We’re all pulling on the same rope. I

“Over the next 12 months, priority one is Terronera: consistently hitting tonnes, grades and recoveries. After that, make sure the cost profile aligns

with expectations — recognizing

we’ve

all gone through an inflationary period since

2021 —

sharesholders

so

Terronera

expect.”

— DAN DICKSON , CEO, ENDEAVOUR SILVER

delivers the cash flow we and

try to roll up my sleeves like the person beside me.

As a management team we treat each other with respect. That extends to safety – our program is called “Te cuido” (“I care for you”), meaning you look out for the person next to you so everyone works safely and gets home safely. If you care for the person who reports to you, they’ll care for the person beside them; it waterfalls through the organization.

HL: Endeavour says it’s “silver‑first.” Where does that show up in planning, marketing and social engagement?

DD: It shows up first in what we choose to own. Our mandate is to be a senior silver producer, and about 60% of our revenue today comes from silver. When we look at exploration or acquisitions, we want silver to be the predominant metal in the revenue mix.

Once you have the mine and the resource, the planning and concentrate sales aren’t so different from a gold or copper company – there are scale differences and plant nuances –but the strategy starts with silver.

HL: Can you give an example of how this silver‑first thinking influences decisions?

DD: The primary-silver space is small. There are a handful of senior silver producers globally and fewer midsized names; most silver comes as a by-product from gold or base-metals mines. Shareholders buy Endeavour

because they want silver exposure. If someone thinks silver is going lower, it doesn’t make sense to invest in a silver company. So when we evaluate projects, we prioritize those where silver leads the revenue line – that’s how Terronera and Guanaceví/ Bolañitos fit, and it’s how we weigh new opportunities.

HL: You recently acquired an operating asset outside Mexico. Tell us more about Kolpa.

DD: In May we acquired Minera Kolpa in Peru – our first operating asset outside of Mexico, though we’ve long held properties in Nevada and Chile. The previous owners grew it from roughly 600 t/d to around 2,000 t/d. For us, Kolpa contributes around 5 million silver-equivalent ounces per year, with a metals mix that’s about 40% silver and the balance lead, zinc and copper by-products. Primary silver mines are rare; Peru is one of the world’s top jurisdictions for silver, so Kolpa made sense as the next step and a platform for more growth there.

HL: Place Terronera in context. How does it change the portfolio?

DD: Terronera is a game-changer. When we sanctioned construction in April 2023, we expected it to double our production and halve our cost profile. The deposit averages roughly 5.5 metres in thickness across a defined 10-year reserve life; we expect to be there 15–25 years with ongoing exploration. It’s rich in silver and gold.

At today’s prices, the gold covers operating and sustaining costs plus exploration, so the silver is effectively free on a cash-flow basis. Depending on the year, Terronera can generate about $100–$200 million in free cash flow. It takes us from two mature, higher-cost assets we purchased inexpensively and turned around, to a lower-cost, longer-life producer with growth ahead.

HL: You also have another big lever – Pitarrilla. How does that bolt onto the story?

DD: Pitarrilla (acquired from SSR Mining, which found it in 2002) is one of the world’s largest undeveloped silver deposits. Many people remember the 2012 feasibility study on a large open pit, but there was also a 2009 study on an underground operation. We’re advancing the underground case. We already hold permits for an underground mine and a plant, and we’re working on permits for the tailings facility. Our plan is to deliver a feasibility study by mid-2026 and then be in a position to make a construction decision. With today’s prices it’s easy to see the case, but we’ll remain disciplined and follow the study and permitting.

HL: What will it take to achieve “30 by 30”?

DD: It’s the combination: Terronera ramping up through higher-grade stopes; steady contributions from Guanaceví

and Bolañitos; Kolpa running at scale; and Pitarrilla coming in later in the decade if studies and permits land as planned. That path supports our ambition of 30 million silver-equivalent ounces by 2030.

HL: Where do you want the company to be in the next 12 months to five years?

DD: Over the next 12 months, priority one is Terronera: consistently hitting tonnes, grades and recoveries. After that, make sure the cost profile aligns with expectations – recognizing we’ve all gone through an inflationary period since 2021 – so Terronera delivers the cash flow we and shareholders expect.

Then it’s about what’s behind Terronera. If Terronera is doing what it should, the next focus is Pitarrilla – keeping studies, development and permitting on track so we can move to a construction decision after the feasibility work targeted for mid-2026. That sets us up for the 30-by-30 goal.

HL: That was Dan Dickson, the CEO of Endeavour Silver. Thank you for having me.

DD: Thanks for coming in.

The preceding Joint Venture Article is PROMOTED CONTENT sponsored by Endeavour Silver and produced in co-operation with The Northern Miner. Visit: www.edrsilver.com for more information.

sitevisit

Revival Gold shows ‘exploration sizzle’

IDAHO | Firm targets 160,000 oz. a year from two assets

BY HENRY LAZENBY BOISE, Idaho

An underground discov-

ery hunt in central Idaho

could shuffle Revival Gold’s

(TSXV: RVG; US-OTC: RVLGF) development queue, CEO Hugh Agro said last month on a site visit.

The underground potential at Beartrack-Arnett in Idaho is shaping up as a possible third project in Revival Gold’s portfolio after the open-pit heap-leach restart at Mercur in Utah and the initial aboveground stage at Beartrack-Arnett.

“If we can demonstrate continuity of those higher-grade shoots at depth, that could change the order of operations at Beartrack-Arnett,” CEO Hugh Agro told The Northern Miner during a blustery Fall day at the project.

Mercur is to be developed first with the open pit at Beartrack-Arnett second. But Revival has started a 3,900-metre drilling program at Beartrack-Arnett, just west of Salmon and about 300 km northeast of Boise via US-93 over the Sawtooth Range. The plan is to step out holes south to the covered Sharkey target and return to deep holes at Joss. Prior intercepts here outlined broad zones of multi-gram gold. A fourth

rig has been moved to this site.

The move sparks “exploration sizzle” to complement the company’s dual-track heap-leach development work, Paradigm Capital mining analyst Don Blyth flagged in a note Oct. 29.

Tier one

The combined platform gives investors a pathway to production of roughly 160,000 oz. a year from two U.S. assets in a tier one jurisdiction. Majors and mid-tiers are taking note, CEO Agro said.

Revival Gold has become a timely U.S. gold developer to watch as money returns to the sector with bullion near record high prices. Australia-based private equity firm EMR Capital with 12% of Revival and Dundee Sustainable Technologies (CSE: DST) holding 6% show the miner’s backing. Agro said the market has “turned 180 degrees” for U.S. gold developers.

At 66¢ apiece in Toronto near press time, shares in Revival have more than doubled this year, like most gold companies benefiting from the yellow metal’s rise. It has a market capitalization of $180 million (US$128 million).

The enhanced exploration focus comes as Idaho’s regulatory tide

Novel Metallurgical Processes for the Mining Industry

https://dundeetechnologies.com/home info@dundeetechnologies.com

is turning. Perpetua Resources’ (Nasdaq, TSX: PPTA) Stibnite mine just started construction. It’s the first large gold project in the state to do so in decades. Meanwhile, Integra Resources’ (TSXV: ITR; NYSE-A: ITRG) DeLamar project is moving ahead with its environmental review. Investors are keeping a close eye on Idaho, Agro said.

Hidden core?

Revival bets that an orogenic system hosting 4.6 million oz. across 5 km of strike to depths of roughly 750 metres hides a deeper, higher-margin core. The resource base gives a district-scale feel. Beartrack-Arnett hosts 86.2 million tonnes at 0.87 gram gold per tonne for 2.4 million oz. gold in the measured and indicated categories and another 50.7 million inferred tonnes at 1.34 grams gold for 2.2 million ounces, according to a 2023 prefeasibility study.

Key risks remain. Targets south of Joss are blind under Tertiary cover, and geophysics images a post-mineral fault, not ore. The task is to hit narrow sulphide shoots in a braided shear and prove continuity at mineable widths. Deep holes are costly and winter slows drilling; a 2022 wildfire already forced an early halt. Metallurgy for arsenopyrite-rich sulphides, though encouraging, still needs pilot work, permits and offtaker buy-in.

Mercur – a brownfields Carlinstyle past-producer just southwest of Salt Lake City – could be restarted by 2029, according to Velocity Trade Capital analyst Paul O’Brien. It would average roughly 95,000 oz. a year at all-in sustaining costs

of about $1,400 per oz. over 10 years, based on Revival’s March preliminary economic assessment. The company still trades below peer averages on financial ratios concerning its resources, O’Brien said, suggesting the market is undervaluing Revival.

Geology counts

The Beartrack-Arnett heap-leach phase is a modest start to what Revival hopes will be a much bigger prize. In the core shed, Chief Geologist Dan Pace examined an assay from Joss. It displayed yellow-jacket quartzites and quartz-arsenopyrite vein swarms.

“The first objective is the structure,” Pace said. “Hit it, follow it, then find the shoots.”

The high-grade pulses often appeared as brittle overprints on a ductile mylonitic fabric. He described it as classic orogenic architecture. It’s a braided shear corridor along the Panther Creek structure. Mineralization shifts from the east to the west side of the main fault as it moves north through the historic South, Mason-Dixon and North pits.

That thesis is why the Sharkey holes matter; under the Leesburg Basin conglomerates, the team says the structural corridor may continue another 5-6 km south. Much of the higher-grade, underground-amenable material sits at Joss and Sharkey is the covered extension Revival has been waiting to test.

Metallurgy

Meanwhile, Revival shared positive results from Dundee Sustainable in August. They tested the GlassLock process to sequester arsenic

on a Joss flotation concentrate. This concentrate had about 50 grams gold per tonne but also contained high levels of the toxic mineral arsenopyrite. After GlassLock, the concentrate ran 66.1 grams gold with arsenic cut to 0.19% – a 99% reduction – with no measurable loss of gold and the arsenic held safely in glass.

Agro pitched the outcome as a potential pathway to a direct-tosmelter product from a second-stage underground operation, should drilling firm up scale. Dundee Sustainable boss Jonathan Goodman called his firm’s role “one of the key attractions” in taking a stake in Revival earlier this year.

Infrastructure-rich

From the old adsorption-desorption recovery plant – still standing and serviceable with minor upgrades – one can trace the story in infrastructure. A 69-kV line drops off the ridge; lined leach pads and solution ponds terrace the valley floor; a modern water-treatment building and substation sit beside a spacious core facility former operator Yamana Gold built in 2013.

In the 1990s, pre-Yamana-takeover Meridian Gold produced about 600,000 oz. from heap-leach oxides. Tossing in historical placer take, roughly 1 million oz. have come out of these gulches. The pads are now reclaimed, grassed and popular with elk. The reclamation job was unusually tidy for an operation of this vintage, Agro noted.

The 2023 prefeasibility study scoped an initial heap-leach restart at about 65,300 oz. per year over eight years for $109 million in initial capital expenditures and it did not include an underground component.

Pace says Joss, conceptually, could support around 1.5 million oz. at five to six grams per tonne if the fault-bend and cross-structure model continues to map and drill as expected. It’s a target he stresses will require much more drilling.

“Walk before we run,” Agro said. “But if we hit, we’re ready to sprint.” TNM

indepth

Sahel faces widening security threats, analysts say

GEOPOLITICS | West Africa coastal

states could be next

BY COLIN MCCLELLAND

Despite military governments across West Africa, the region’s security situation is worsening as insurgents flush with kidnapping ransoms and illegal mining profits threaten fuel supplies and road networks, according to an expert with 18 years of experience in the region.

While miners and diplomats used to be able to authoritatively state the Islamic war was isolated in the Sahel’s north, far away from their operations, that’s no longer the case, says Liam Morrissey, CEO of MS Risk. He advises a slew of majors, explorers, contractors, investors and insurers across Africa and other global hotspots.

Dubai reportedly paid $50 million in October for the release of two United Arab Emiratis – held by Jama’at Nusrat al-Islam wal-Muslimin (Group for the Support of Islam and Muslims), commonly referred to by its acronym JNIM. They were kidnapped in southern Mali, apparently trying to buy artisanal or illegally mined gold.

“This is supercharging al Qaeda or JNIM because they are used to having kidnap cases run for three to five years and finish for a ransom of between $2 million and $6 million,” Morrissey, who’s worked on more than 800 hostage releases, said by phone from the U.K. where he’s based.

“Now, all of a sudden, in a space of six weeks, they appear to have got $50 million and that’s a lot of bribes, that buys a lot of ammunition and equipment. It sparks copycat attacks. We’re going to risk having bandits and ordinary criminals going out to target expats to try to upsell them.”

Not targeting majors

Even so, the insurgents are not directly targeting majors operating in the region. They couldn’t run a large mine, don’t want to disturb large employers and are more interested in carving out territory from governments where they can operate smuggling routes, Morrissey says. They want to control hundreds of millions of dollars in illegal mining from the region’s circa 3 million people drawn to the activity by record gold prices.

Rebels even apologized after an attack this year on one gold miner’s convoy because they thought it was a Mali government operation, according to company and other security sources who spoke on condition of anonymity.

Producers such as Endeavour Mining (LSE, TSX: EDV; US-OTC: EDVMF), B2Gold (TSX: BTO; NYSE-A: BTG), West African Resources (ASX: WAF; US-OTC: WFRSF), Orezone Gold (TSXV: ORE) and Iamgold (TSX: IMG; NYSE: IAG) are drawn to the region in search of higher grades and lower labour costs than conventional jurisdictions such as Canada and Australia.

But over the past decade security expenses have ballooned as coups installed juntas in Burkina Faso, Mali and Niger – among the world’s poorest countries despite their mineral wealth. They asserted indepen-

dence by kicking out troops from the UN and colonial ruler France, and struggled to counter Islamic extremists penetrating from the north.

Alliance

The trio abandoned the Economic Community of West African States to avoid pro-democracy sanctions, formed the Alliance of Sahel States and turned to Russian mercenaries for support. The shift from the West has opened opportunities for JNIM to expand along coastal states such as Ghana, Togo, Benin and Ivory Coast which could be a significant development for 2026, according to Morrissey and the Sydney-based Institute for Economics and Peace.

“They’re all in serious risk right now,” said Morrissey, who served as a Lt. Col. in the Canadian and British armies. “How we’ll know is when we see terrorist attacks in those countries. It might start small and be assassinations or kidnappings inside the borders, but the worstcase scenario will be a shopping centre attack or a hotel attack in the capital cities.”

[Insurgents] want to control hundreds of millions of dollars in illegal mining from the region’s 3 million people drawn to the activity by record gold prices.

in its 2025 Global Terrorism Index issued in March.

The country hosts Endeavour’s Houndé and Mana gold mines, Iamgold’s Essakane, Orezone’s Bomboré, and West African Resources’ Sanbrado.

Uranium

Niger recorded the largest increase in terrorism deaths globally last year, nearly doubling to 930, reversing previous improvements from 2022 when it had the second-largest improvement, according to the terrorism index.

The landlocked country, the world’s seventh largest uranium producer, has attracted Global Atomic (TSX: GLO; US-OTC: GLATF) advancing the high-grade Dasa project and GoviEx Uranium (TSXV: GXU; US-OTC: GVXXF) with its Madaouela project.

“Niger highlights how fragile progress in reducing terrorism deaths can be,” the institute said, noting it could mean improvements in Burkina Faso are “transitory”.

While insurgents have established their strongest regional presence in Burkina Faso after a better supported military in Mali pushed out terrorists, the institute reports one positive trend.

“Although Burkina Faso remains the most affected country, both deaths and attacks declined, falling by 21% and 57% respectively, however the country is still responsible for a fifth of all terrorism deaths globally,” the institute says

Morrissey says. The fuel crisis triggered school closings and strained food supplies which instilled widespread fear.

“They’re blowing up the first bowser and they’re filming that and they’re putting it on social media, and then they’re hijacking the rest,” the analyst said. “That’s gas for them, and with the excess that they don’t need, they’re selling that into the black market and so you’ve got profiteering.”

And like drug dealers, they’re cutting the contraband with other liquid, probably water, so in extreme cases 600 litres of fuel becomes 1,000 litres of something that can’t be trusted and most likely can’t be used without draining, separating and filtering.

“To be fair to the government, they are running operations to try to bring fuel in securely, and I think they have brought in a few hundred

“The Sahel remains the global epicentre of terrorism, accounting for over half of all terrorism-related deaths in 2024 with the number of countries affected increasing,” according to the index.

Fuel crisis

Insurgents in Mali have declared a renewed economic war this year on the capital, Bamako, increasing attacks on fuel supplies trucked in from neighbouring Côte d’Ivoire and Senegal so that diesel on the black market can sell for $7 a litre,

tankers successfully,” Morrissey says. “But the propaganda war is being lost. And so there’s a public fever around this.”

Mali has reached new mining code agreements with Allied Gold (TSX: AAUC), B2Gold and Resolute Mining (ASX: RSG). But the junta seized the Loulo-Gounkoto complex from Barrick Mining (TSX: ABX; NYSE: B) after the miner insisted its long-standing conventions remained binding and filed for arbitration at the World Bank’s International Centre for Settlement of Investment Disputes.

China

Other issues to consider concern China’s growing presence in the region, the analyst says. The Asian giant’s quest for minerals across the region is still small compared with the number of Canadian and Australian companies, but it can be a commercial threat.

Following weeks of increasingly fraught talks with the Malian government over a new mining code and tax settlements, Leo Lithium sold its 40% stake in the Goulamina lithium project to Ganfeng Lithium in May 2024 for about $343 million. Leo had spent years and tens of millions of dollars helping advance the project from study stage into construction.

Whatever the project, a good relationship with locals is paramount for success, and security.

“The local inhabitants do not often distinguish between foreigners,” Morrissey said. “It means if one company creates local tensions then this will impact others who are unrelated and who appear at a later time. It can mean having a security peril that is far more potent than is first realized, and demands strong community engagement to identify and mitigate responsibly.”

indepth

Deepest marathon on Earth tests runners and miners

SWEDEN | Diverse group aims to set World Record

BY BLAIR MCBRIDE

It was hot, damp and utterly dark, the kind of darkness that swallows sound. A line of headlamps bobbed through the tunnels of Boliden’s Garpenberg zinc mine more than a kilometre underground, the air thick with humidity and the faint tang of diesel and dust.

This wasn’t a shift change but the start of the World’s Deepest Marathon on Oct. 25, when 55 runners from 18 countries traced a 2-km stretch of tunnel back and forth to reach the full 42 km. The racers, including some of the most senior executives in the mining industry, Boliden staff, part-time runners and seasoned ultra-marathoners, competed down in the tunnels of Boliden’s zinc mine, 180 km northwest of Stockholm.

“You’d run to the end and then you’d turn around and come back and we did that 11 times,” Henrietta Newman, a consultant with the World Gold Council told The Northern Miner in a video interview from London in late October. “There was music at the start and finish point. [And] other than our head [lamps], it was complete darkness.”

Organized by education company BecomingX, the International Council on Mining and Metals (ICMM) and Boliden, the event is poised to set Guinness World Records for the deepest marathon and the deepest underground marathon distance run, pending final verification.

The run was also aimed at raising more than $1 million for the BecomingX Foundation to support disadvantaged students in Africa, and for dog welfare initiatives through U.K.-based Wild at Heart Foundation.

From tunnel to tunnel Newman, who has run in several half-marathons and a full marathon in London in 2021, began training for the underground race about eight weeks before it by increasing her weekly distances. It helped that she could do some practice runs in tunnels while on holiday in Spain, where several roads inside tunnels go through the Sierra Madre mountains.

Her running coach also joined her for an “informal marathon” through the Combe Down Tunnel near Bath, U.K., one of the country’s longest non-ventilated tunnels.

“Every year there’s a race where people have to run it 200 times, and it’s something like 1.2 km [long],” she said. “It’s an extreme challenge that people do, but that was quite good preparation actually running in that tunnel.”

Go down and run

Once at the Garpenberg site, the runners were taken by elevator down to 1,120 metres

Fifty-five runners from 18 countries, including Henrietta Newman from the U.K. (right) ran in the underground marathon more than 1 km deep in Boliden’s Garpenberg zinc mine in Sweden. SAM MCELWEE/ BECOMING X AND HENRIETTA NEWMAN

below sea level and then driven by truck to the race area.

“And that’s probably the craziest thing because it was a working mine,” Newman said. “You could see these giant trucks full of stuff, and then there we are just in our fourby-four, kind of weaving into the mine.”

For safety reasons, some items of personal protective equipment were mandatory for all runners, including helmets.

“I was a bit worried about wearing a hard hat…But I almost didn’t even notice it,” Newman said. “They’re super light climbing ones. One person had to run with a Go Pro on their helmet for the actual world record, to authenticate how far we’d run.”

Boots weren’t needed. The organizers graded the floor of the tunnel and removed large rocks, so it was more like a smooth gravel road and participants could wear running shoes.

Humid but supported

Temperature-wise, it was humid, and Newman estimates it was 24C, but she got used to it. Organizers said the air in the mine contains 30% more oxygen than in the atmosphere.

“When you were going up [the incline]

Lundin laces up

Among the mining executives who joined the event was Lundin Mining (TSX: LUN) CEO Jack Lundin.

“It was actually my first marathon, and potentially my last marathon,” he told Northern Miner podcast host Adrian Pocobelli.

there was no movement of air, but coming down you’d get these occasional puffs and it was so nice. That was perhaps oxygenated air,” Newman said.

Refreshment stations at each end of the tunnel kept marathoners hydrated, and the support staff were diligent with logistics, including helping runners whose headlamps malfunctioned.

No easy feat

With the run itself, Newman stayed in the “middle of the pack” for most of it and the 12-metre wide tunnel provided more than enough space for people to pass each other.

But the stuffy and dark conditions took their toll on some runners, even the top finisher, whom Newman said finished 50 minutes slower than his personal best for a marathon.

While Newman said, laughing, that she wouldn’t do the race again, she does recommend it as a way to bond with people through a unique experience.

“There were people from different walks of life,” Newman said. “There were two young runners, and one of them…it was her first marathon, and I ran with her for a little bit. It was tough for her. She did it. And at the end, three South African runners who were super runners, they all went and did the lap with her, and it was just such a nice moment.” TNM

Even though the mining veteran is a marathon rookie, he had few concerns about the air quality, temperature and logistics of the event.

“With Boliden and the ICMM that were putting it on and Becoming X…We were in good hands. The operating standard for Boliden is top notch as well. It was more just about like, ‘Okay, we got to run a marathon 1.1 kilometres below sea level, 1.3 kilometres below surface, in the dark, with a headlamp on. How do I mentally prepare for this environment that I’m going to be in?”

Lundin, who at around age 35 is one of the industry’s youngest leaders, was initially invited to join the marathon by Boliden CEO Mikael Staffas in February. But “I respectfully declined,” he said.

ICMM CEO Rohitesh “Ro” Dhawan then approached Lundin, saying it would be really good if he could join it. Lundin noted that one of ICMM and Boliden’s goals in organizing the event was to show that mining today is much more modern than most people realize, such that running a marathon inside one is possible and safe.

“I just said, ‘Fine, let’s go for it.’ It sounds like something that I’m crazy enough to try anyway,” Lundin said. “I was just worried about the training because it takes a lot of time to prepare the body for a marathon. But we made it happen.”

The humid conditions during the race meant that Lundin, like all runners, had to make sure he was fuelling properly and drinking enough water and electrolytes, which was hard to manage, he said.

“[We] got through that and overall I was really pleased that I came out without any injuries, and was still smiling at the end of it. That made it all worth it.”

Reflecting on whether the marathon experience has changed his perception of underground mining, Lundin suggested he might feel differently once the blisters on his feet have cleared up and he’s more recovered.

“It was unique for sure,” he said. “I’m happy to be contributing to something that can show the world that mining is much different today than it was 100 years ago, and it continues to get better.”

indepth

Election thrusts right-winger to runoff

CHILE | Kast expected to beat leftist Jara

BY TOM AZZOPARDI

Astrong showing by pro-business candidates in Chilean elections Nov. 16 bodes well for the resurgence of mining investment in the world’s largest copper producer.

Although conservative hardliner José Antonio Kast took just less than 24% of the vote, almost three percentage points behind leftist former labour minister Jeannette Jara, he is expected to win a Dec. 14 runoff by a landslide, picking up votes from rival candidates, according to the latest polls.

“If you just add up the votes for the right, Kast has a very significant base of support for the second round,” Hernán Campos, a political scientist at the Diego Portales University in Santiago, said the day after the ballot.

Kast has campaigned on attracting more investment by slashing corporate tax rates, regulation and public spending, while reintroducing guarantees for foreign investors to shield them from future tax and regulatory changes. He has promised an emergency administration to deploy troops against rising crime and illegal immigration, which voters say are their most important issues.

Right-wing parties, including Kast’s Republicanos, also performed well in elections to Congress which would make it easier for Kast to push through his reform program.

Mandatory vote

The ballot is notable as the first where voting is compulsory. It comes after six years of political uncertainty as majors BHP (NYSE, LSE, ASX: BHP), Freeport-McMoRan (NYSE: FCX) and Teck Resources (TSX: TECK.A,TSX: TECK.B; NYSE: TECK) plan to invest billions of dollars. Copper and gold prices are near record levels and demand for lithium is expected to surge.

“Today we’re a land of opportunities in mining,” said Mirco Hilgers, a mining partner at Baker McKenzie’s law offices in Santiago.

Kast’s challenge is now to unite enough votes from rival campaigns to win this month’s runoff. Centre-right veteran Evelyn Matthei and nationalist libertarian Johannes Kaiser quickly endorsed him. Each received around 13% of the votes counted, putting Kast very close to the 50% mark. But the main prize will be the backing of Franco Parisi, a maverick populist who surprised pollsters to finish third with almost 20% of the vote.

“These [voters] are people who are not ideologically defined but are concerned about law and order and the economy, and Kast resonates best with these demands,” Campos noted.

On the campaign trail, Kast has downplayed his conservative views on social values issues like abortion and same-sex marriage which turned off some voters four years ago in a runoff against Boric.

Jara

Polls suggest that Jara, current president Gabriel Boric’s successor on the ballot since winning the left’s primary last June, is likely to

“These [voters] are concerned about law and order and the economy, and Kast resonates best with these demands.”

HERNAN CAMPOS POLITICAL SCIENTIST, DIEGO PORTALES UNIVERSITY

struggle in the second round. Campaigning on raising the minimum wage and stronger labour laws, she has been unable to distance herself from the current government and attract votes beyond its core supporters.

“Jara failed to get 30% as many expected and she was the only significant leftwinger running so she has not got much room to grow in December,” Campos said.

Boric, who cannot seek immediate re-election, won a surprise landslide four years ago. As Chile’s most leftwing leader in half a century, the former student organizer had promised to tear up the constitution, dismantle the private pension system, ramp up taxes on mining and the very rich and “bury neoliberalism.”

However, his ambitious plans have been stymied by a lack of congressional support and changing public sentiment.

Less than a year later, voters overwhelmingly rejected a constitution which would have weakened property rights and beefed up environmental protection. Lawmakers blocked a major tax hike while a punitive mining royalty was significantly watered down.

As voters’ concern turned to more bread-and-butter issues such as crime, jobs and the cost of living, Boric’s administration has strived to prove its credentials with investors. It slashed red tape in Chile’s labyrinthine permitting system and signed new trade deals with the European Union, United Arab Emirates and the Trans-Pacific Partnership.

“We’re finally sobering up after the party,” said Maria Paz Pulgar, mining partner at Santiago law firm Guerrero, of Chile’s volte-face.

Investment

The completion of major projects such as Teck’s Quebrada Blanca and Gold Fields’ (NYSE, JSX: GFI) Salares Norte and the approval of a $3-billion expansion of Anglo American’s (LSE: AAL) Los Bronces mine showed that, despite recent instability, Chile is a destina-

nationalization, has proved a boon. State partnerships with Rio Tinto (NYSE, LSE, ASX: RIO) and SQM (NYSE: SQM) are set to unlock investments which could double production of the mineral within a decade. Although questioned during the election campaign, China’s recent approval of the Codelco-SQM tie-up means that “it is a done deal,” Pulgar said.

Projects

A Kast win Dec. 14 should be good news for a slew of new mining projects advancing towards construction.

Claims fees

Another reform promises to boost mineral exploration which has waned over the last decade. In 2021, to finance a new universal pension, Boric’s predecessor boosted claims fees.

tion where mining is still welcome.

“The current government has really changed the rhetoric around permitting,” said Hayden Locke, CEO of Marimaca Copper (TSX: MARI, ASX: MC2), which obtained an environmental licence in November for its namesake $587-million capex project.

As conditions have stabilized, investment has poured in. BHP plans to invest up to $14 billion to bolster production at Escondida, the world’s biggest copper mine, and reopen its shuttered Cerro Colorado mine while Freeport-McMoRan is eyeing an $8-billion expansion of its El Abra joint venture with state copper firm Codelco.

“Now they’ve run out of money, they realize the importance of mining,” said Manuel Viera, president of Chile’s Chamber of Mines.

Even Boric’s National Lithium Strategy, once feared as a veiled

After obtaining an environmental licence in November, Marimaca Copper is aiming to start construction of its project in northern Chile by the end of next year. The solvent extraction-electrowinning operation could be producing 50,000 tonnes of copper cathode annually by the end of the decade.

Shareholders, including Greenstone Resources, Assore and Mitsubishi, are raring to go. “It’s very rare in my career, but financing is not my biggest concern,” Marimaca’s Locke said.

Hot Chili (ASX: HCH) is another company aiming to reach production by 2030. Exploiting three deposits in the Atacama Desert, its Costa Fuego would produce 100,000 tonnes of copper mostly as concentrate for export.

“We see the new government providing a tailwind for the mining industry,” Hot Chili Executive Vice-President Jose Ignacio Silva said.

The move has shaken up Chile’s sleepy market in mining property under which mining companies and individuals could sit on huge areas for decades for minimal fees and no work requirements. Firms like BHP, Codelco and SQM managed portfolios the size of small countries, cutting off much of Chile from newcomers keen to explore.

With fees now set to quadruple every four years unless companies can show efforts to develop the claim, many landholders are selling off giant packages of the Atacama Desert and the Andes Mountains, sparking an unprecedented fire sale in mineral property.

“I’ve been in this industry 20 years and never seen anything like it,” Baker McKenzie’s Hilgers said. “Chile’s becoming attractive again for mineral exploration.”

Not everyone is pleased. Small mining companies say the exponential rise in fees amounts to expropriation of assets which are key to their future development. Some have taken legal action to block the move, Marco Zavala of law firm Guerrero said.

The issue could become a major test of the next president’s willingness to stand up to vested interests in order to realize Chile’s mineral potential. TNM

projectupdates

Prairie builds DLE plant

LITHIUM | Plant to be largest in North America

BY MINING.COM STAFF

Australia’s Prairie Lithium (ASX: PL9) has kicked off construction in Saskatchewan of what it says will be the largest direct lithium extraction (DLE) facility in North America.

Prairie’s plant would have a total of four commercial-scale DLE columns, with an anticipated arrival date in April, the company said Nov. 4. The successful testing of one commercial-scale column in Arkansas over the past 18 months, combined with the high-quality brine from its lithium project, supports confidence in the technology’s performance and scalability, Prairie said.

“The construction on our lithium extraction facility at Pad #1 is a strong step forward on our critical path to production,” Prairie Lithium managing director Paul Lloyd said in the release. “The groundwork we are laying now will host what we believe will be the largest known direct lithium extraction facility in North America.”

Lithium brine Prairie is among the few lithium brine developers in Canada to bring their projects to an advanced stage, including E3 Lithium

(TSXV: ETL; US-OTC: EEMMF), Volt Lithium (TSXV: VLT) and LithiumBank Resources (TSXV: LBNK; US-OTC: LBNKF) in neighbouring Alberta.

For now, a Standard Lithium (TSXV: SLI) plant in Arkansas is believed to be the biggest DLE facility in North America. In March 2024, the Canadian company successfully installed and commissioned the Li-Pro lithium selective sorption commercial-scale unit supplied by Koch Technology Solutions (now Aquatech).

Pad #1 build Prairie’s Pad #1 foundation is expected to be completed in early 2026 with building construction to follow. The application to connect the wells and plant at Pad #1 to grid power has also been submitted to SaskPower.

Prairie plans to use conventional oil and gas drilling and completion methods to access lithium-rich brine from aquifers about 2.3 km underground.

The property comprises over 1,396 sq. km of subsurface permits in the Duperow Formation. It contains an estimated 4.6 million tonnes of lithium carbonate-equivalent in measured and indicated resources. TNM

Rio halts Jadar

LITHIUM | Serbian permit woes

Rio Tinto (NYSE, LSE, ASX: RIO) plans to pause its development of the long-delayed Jadar lithium project in Serbia to cut costs and shift focus elsewhere, Bloomberg reported on Nov. 13.

The Anglo-Australian miner intends to place the nearly $3-billion lithium project into care and maintenance after the government approvals process produced little progress, Bloomberg said. It cited an internal memo that it later confirmed with a company spokesperson.

Rio Tinto didn’t immediately respond to a Northern Miner Group request for comment.

The move essentially ends Rio’s two-decade-long quest to tap into one of the world’s largest lithium resources. Rio had estimated that Jadar could produce 58,000 tonnes of refined battery-grade lithium carbonate per year, as soon as 2027. It’s considered a main EU project to develop battery metals and expected to meet a chunk of its lithium demand.

Uncertainty

Since its initial discovery in 2004, the Jadar project has faced numerous regulatory setbacks, political uncertainty and opposition. Rio’s licence was taken away in January 2022 over environmental concerns, and despite regaining it two and a half years later, permits barely moved.

In June, the Rio Tinto raised its cost estimates for Jadar to $2.95 billion from $2.4 billion. It reflectscosts to meet “European Union environmental and human rights standards,” Jadar’s managing director said then

The Jadar halt is the latest cost-cutting move under new CEO Simon Trott, who has pledged to simplify operations.

Shares in Rio Tinto traded for A$132.59 apiece in Sydney before press time, valuing the company at A$48.9 billion (US$31.8 billion). TNM

Smackover sets high grade for brine

LITHIUM | Franklin combines mining with oil and gas know-how

BY HENRY LAZENBY

Smackover Lithium, a joint venture between Standard Lithium (TSXV, NYSE-A: SLI) and Norway state oil company Equinor (NYSE: EQNR), says it has North America’s highest lithium-in-brine grades in the first inferred resource for the Franklin project in northeast Texas.

The project has 0.61 cubic km of brine averaging 668 milligrams per litre lithium for 2.16 million tonnes lithium carbonate-equivalent, according to a Nov. 5 release. It also includes 15.4 million tonnes of potash (as potassium chloride) –newly added to the U.S. Geological Survey’s draft critical minerals list – and 2.64 million tonnes of bromide, the company said.

“This initial project definition marks a key step toward the ultimate goal of reaching production of over 100,000 tonnes per year of lithium chemicals in Texas through multiple phases,” Standard Lithium, which operates the 55:45% JV, said in the release.

The resource for a project combining mining with oil and gas know-how comes as other similar partnerships plumb reservoirs in the huge Smackover, a limestone formation stretching from Texas through Louisiana, southern Arkansas, Mississippi, Alabama and into the Florida Panhandle. ExxonMobil (NYSE: XOM) has discussed initial output as early as 2027, while Albemarle (NYSE: ALB) and Standard Lithium have also expanded positions in Arkansas.

Standard Lithium shares rose 2.2% to C$4.64 in Toronto on Nov. 5 and another 11% to C$5.16 near press time. The shares have more than doubled this year for a market

Two additional East Texas projects could, if developed, roughly triple the JV’s portfolio in the state.

capitalization of about C$1.23 billion ($880 million).

Next steps

Work at Franklin now turns to appraisal drilling, re-entering three shut-in wells and refining models of the Upper and Middle Smackover aquifers to support a preliminary feasibility study.

Key risks include financing amid lithium-price volatility, scaling DLE to a reliable commercial production, power access, and harmonizing royalties and leases across multiple owners. The company also needs offtakers for lithium and its potash and bromide co-products will also be a hurdle to markets.

Smackover rising Franklin, about 400 km northeast of Austin near Mount Vernon, spans roughly 323.8 sq. km (80,000 acres), with more than 186 sq. km leased to support the resource. The project also hosts a previously measured 806 mg per litre brine at the Pine Forest-1 well.

Two additional East Texas projects being advanced could, if developed, roughly triple the JV’s portfolio in the state. Royalty and lease terms in Texas differ from Arkansas and will be a key input to project economics.

While the U.S. Geological Survey and Arkansas officials last year outlined multi-million-tonne lithium potential in Smackover brines, the battery metal fell 8% year-on-year through mid-October before firming into November.

Fastmarkets assessed China battery-grade lithium carbonate at ¥72,500–73,000 per tonne (just over $10,100) on Oct. 10, a yearlow. The price climbed to $11,475 per tonne near press time, according to the Wall Street Journal. It’s still far below the November 2022 peak at around $88,500 per tonne.

DLE tech

Smackover developments plan to use direct lithium extraction (DLE), which pumps brine to the surface, captures and purifies lithium, and re-injects the leftover brine. DLE can shorten production cycles from months to hours compared with conventional evaporation ponds, and reduce land footprint, though unit costs may be higher.

Standard Lithium plans to leverage operating data from its El Dorado, Ark., demonstration plant and learnings from the South West Arkansas project.

Others leaning on DLE include Occidental Petroleum (NYSE: OXY) and Berkshire Hathaway Energy, which are trialling geothermal-brine lithium at California’s Salton Sea. E3 Lithium (TSXV: ETL) is advancing DLE on Alberta brines, and SQM (NYSE: SQM) has reported high recovery rates in Chilean trials.

On the funding front, the U.S. Department of Energy has indicated it is considering investment of up to $225 million for Standard Lithium’s South West Arkansas project. TNM

Maritime pours first gold

NEWFOUNDLAND | $292M takeover closes

BY BLAIR MCBRIDE

Maritime Resources poured first gold at its Hammerdown project in northwest Newfoundland in November, the first time the mine has produced yellow metal since 2004. Shares gained.

The pour comes from stockpiled material at Hammerdown and was processed at Maritime’s nearby Pine Cove mill. It caps off a year of construction and commissioning work at the mine, located near the town of Baie Verte.

“Bringing the Pine Cove mill back into operation after two years of care and maintenance, completing all project permitting and seeing the first gold poured from Hammerdown is the result of a tremendous effort by our team and the support of our shareholders, local communities and the province,” Maritime President and CEO Garett Macdonald said in a Nov. 12 release.

M&A momentum

The milestone came just a day before New Found Gold (TSXV: NFG; NYSE-A: NFGC) announced