4 minute read

Q3 Economic Outlook

Inflation and rental costs decline, housing inventory challenges remain

by Noah Blanton President, Oregon Direct Operations, WFG National Title Insurance Company

INFLATION & INTEREST RATES

No recession (yet), and rates are rising

No recession, technical or otherwise, is yet apparent in the US economy. Instead, we find ourselves in the strange environment of falling inflation and rising borrowing costs.

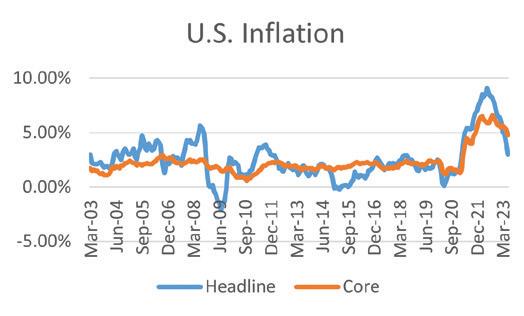

Inflation fell to an annualized rate of 3% in June, an anticipated and unsurprising result. Interest rates have not yet followed due to core inflation remaining close to 5%. (See Figure 1)

Supply chain and pandemic-related inflation (transitory) has largely been driven out of the economy. What remains is “sticky” inflation, so-called core inflation, pertaining to services and money supply. When the Fed does pause, expect the elevated rate to persist for 12-24 months before we enter a lowering cycle.

The more relevant influence on mortgage rates is the yield on the 10-year treasury, up nearly 80 basic points (bps) from lows earlier in the year and holding above 4%.

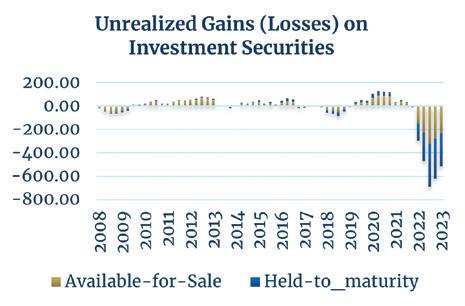

Watch this indicator for the direction of mortgage rates. Along with elevated treasuries and stubborn inflation, the banking system remains under substantial pressure. The speed at which interest rates rose from historic lows has created significant risk for financial institutions. Banks are managing the largest unrealized losses on record, creating an environment of fragile stability. (See Figure 2)

There is little incentive to lend at lower rates in the current climate, even if it increases transaction velocity and market share. Expect additional consolidation and failures in the system before rates come down significantly.

SUPPLY-SIDE

Low rates cast a long shadow

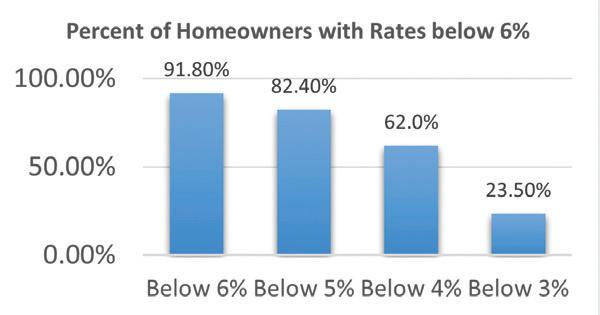

The higher the 30-year mortgage rates, the greater the supply and inventory imbalance. Sellers with rates less than half the average rate today have little incentive to sell. The inventory issue has not improved over the last quarter, becoming more acute in most markets driven by the continued increase and volatility of 30-year mortgage rates. At

this writing, the 30-year mortgage rate average is 6.9%. With 92% of existing homeowners having a rate below 6%, no significant increase in inventory is anticipated from the existing housing stock. The upside to low inventory is stable or rising prices. (See Figure 3)

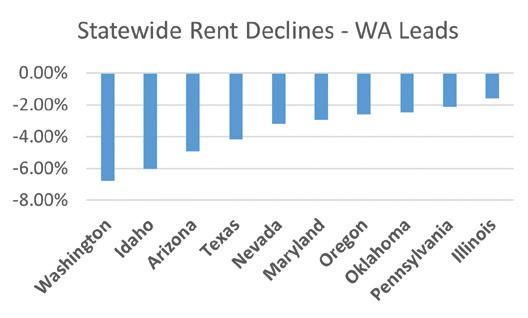

However, we are beginning to see the impact of supply impacting Multi-Family Residential rental rates, with Washington leading the nation in deflating rents. Moreover, Seattle and Portland’s metro areas (including SW Washington) lead declines in both states with -13.5% and -9.5% growth, respectively. (See Figure 4) Potential buyers leaving multifamily units are encouraged to stay in housing that is getting less expensive versus buying, which continues to become more expensive. New construction will face competition for first-time buyers from landlords offering lower monthly payments.

Figure 4

DEMAND-SIDE

Jobs are everything!

The West Coast depends more on China than other parts of the country, which helps and hurts depending on the cycle. Employment and a growing population are the base of all demand for housing.

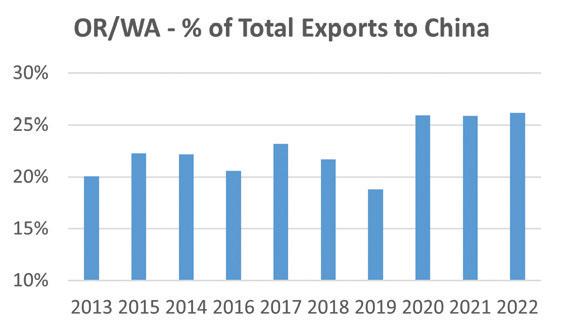

Western states are the United States’ largest trade partners with China, impacting our economies as China grows at varying paces. China has been responsible for over a quarter of all Oregon and Washington exports for the last three years. (See Figure 5) Exports concentrated around computers, computer chips, agriculture and transportation (Intel, Boeing and grain).

Chinese growth is now slowing, impacting employment and job growth in the West. From a demand perspective, it is an area to watch closely, regardless of constrained supply.

However, the total number employed in Washington state has continued to grow thus far, outpacing both Oregon and California and is now above prepandemic levels after flat growth in 2022. (See Figure 6) That’s a positive for the housing market!

The Building Industry Association of Washington has teamed up with WFG National Title Insurance Company’s Noah Blanton to offer quarterly economic outlooks to assist members in making decisions for their businesses. Contact him for more information at (503) 431-8506 or nblanton@wfgtitle.com