5 minute read

LEGISLATIVE WRAP UP

from Building Insight June 2019

by BIAW

LEGISLATIVE SESSION WRAP UP

B I A W S U C C E S S E S

BIAW PRIORITY BILLS PASSED

CONDO LIABILITY REFORM—SB 5334

This bill helps revise overreaching condo warranty liability from the 90s, which will allow for new condo construction in Washington state. It’s not a silver bullet to the housing crisis in our state, but it is another option for consumers seeking a path to affordable homeownership, by increasing supply and options for families of all sizes and incomes.

URBAN CAPACITY—HB 1923

This bill encourages cities to choose from a menu of “get to yes” options on projects. Options include up zones, cluster lot development, form-based codes and planned actions, among others. Newly adopted ordinances would be protected from appeal. In addition, the bill provides transportation SEPA appeals protection for individual projects that are consistent with the underlying transportation plan.

HARMFUL BILLS KILLED by BIAW

CONTRACTOR LIABILITY—HB 1395

This legislation would have made general contractors liable for benefits, contributions, and payroll of subcontractors’ employees.

WHISTLEBLOWER CLAIMS—HB 1965

Trial lawyers pushed for a qui tam bill that would have allowed anyone to sue and recover damages as a whistleblower.

MORE STRINGENT ENERGY CODES—HB 1257/SB 5293

Legislation would have allowed local governments to increase energy codes, creating a patchwork of new pricey rules across the state and adding unnecessary costs to the price of a home.

SESSION IS OVER

Governor Inslee has signed the last of bills from one of the worst sessions for the business community in decades. We’ve prepared a final wrap up, with some wins, with many of the harmful bills we killed, we’ll see again next year.

ENVIRONMENTAL JUSTICE—HB 1109

A task force was tucked into the budget requiring the study of the impact of development on minority communities. BIAW will work with the governor’s office with regard to the mission and makeup of this committee to ensure our industry is represented. A similar, more problematic bill (SB 5489), passed the House and Senate in different forms but the chambers were unable to reach a compromise.

WHALE-WASHED—HB 1579

“An act relating to implementing recommendations of the southern resident killer whale task force related to increasing Chinook abundance.”

This whale-washed bill has been around for years, but add in a reference to an orca and it passes. The requirement that the Department of Fish and Wildlife issue a hydraulic project approval (HPA) within 45 days for single-family bulkhead projects was repealed.

This means WDFW can now deny an HPA application even when the project has been approved by a local

See OVER on page 13 //

TAX INCREASES AHEAD

The greatest disappointment of the session, however, was the majority party’s approach to taxes and spending. Despite the state receiving $6.2 billion in new revenue–a 17 percent increase—House and Senate Democrats decided this was the year to double down on dramatic spending increases.

The business community was not spared and was hit with corresponding tax increases. In the end, the legislature passed 11 tax and revenue bills raising $2.6 billion in new, additional taxes over the next two years, $7.9 billion over the next four years, and more than $26 billion over the next 10 years.

What didn’t make the tax hike cut? The proposed capital gains tax. Ruled by the IRS and multiple courts as an income tax, unconstitutional in the state of Washington, lawmakers failed to pass it. However, millions of dollars have been allocated to the Department of Revenue for the implementation of new taxes, as well as to study ways to make Washington state’s tax code more “fair.”

// OVER from page 12 jurisdiction and is compliant with their shoreline master plan.

STALLED BILL

SHORT PLATS — SB 5008

Generally, short subdivisions remain defined as the division of land into four or fewer lots. Under SB 5008, jurisdictions not planning under the Growth Management Act (GMA) may now, by local ordinance, increase the number of lots, tracts or parcels to nine.

Jurisdictions planning under the GMA may create short subdivisions of up to nine lots, tracts or parcels, and, by ordinance, increase the number to 24 within a Urban Growth Area (UGA). Unfortunately, this bill did not pass this year, but BIAW will continue to work with lawmakers on this issue next session.

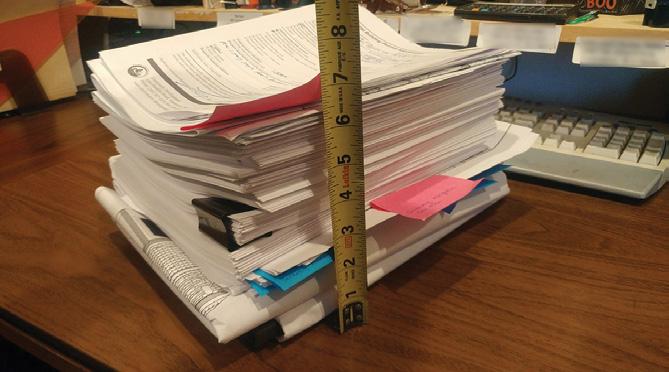

HOUSING COSTS ON THE RISE

TAX INCREASES = $23 BILLION OVER 10-YEAR PERIOD

Taxes (*All figures in millions) Bill

Payroll Tax for Long-Term Care HB 1087 Levy Lid Lift — Property Tax SB 5313 B&O Tax Increase — Services HB 2158 Graduated Real Estate Excise Tax SB 5998 MTCA (hazardous substance) SB 5993

TOTAL 2-Year 4-Year 10-Year

---- $2,090 $8,930 $1,422 $2,976 $8,661 $380 $945 $3,009 $244 $598 $1,884 $165 $361 $1,075

$2,211 $6,970 $23,559

Source: Washington State Office of Financial Management 10 Year Tax & Fee Costs Analysis

B&O TAX INCREASE—HB 2158

The home building industry was not immune to the legislature’s B&O tax increase. Lawmakers voted to impose a 20 percent surcharge on current rates for income from services and other activities of select businesses. Businesses taxed include architecture, engineering, insurance, telecommunications, interior/industrial design, insurance agents, legal agents, accounting, and more.

GRADUATED REET—SB 5998

The Real Estate Excise Tax (REET) structure was restructured. BIAW attempted to work with lawmakers and educate them about the complexity of greenfield projects and how parcels are divided and sold, but to no avail. The new REET rates take effect Jan. 1, 2020. Current REET is 1.28%.

Transaction Amount Rate

Up to $500,000 1.10% $500,000 - $1.5 M 1.25% $1.5 M - $3.0 M 2.75% $3.0 M and Above 3.0%

LEVY LID LIFT—SB 5313

The legislature also unraveled the McCleary fix, the K12 lawsuit requiring the state to fund basic education to address local educational inequalities. Unfortunately, on the last day of session, lawmakers passed the “levy lid lift” bill that will allow districts to raise local school levies. The state should expect to find themselves in a McCleary-type lawsuit once those levies are bargained into teacher salaries, only this time it’ll be even more expensive.