5 minute read

How to Get Approved for a Loan Online in the Philippines?

from Best Loan PH

How to Get Approved for a Loan Online in the Philippines?

In today’s fast-paced financial landscape, the ability to secure an online legit loan in the Philippines can be the difference between overcoming a financial hurdle or facing prolonged stress. Whether you're a freelancer, a seasoned trader, or someone managing a household, knowing how to get approved for a legit loan online is a skill that pays off—literally.

As someone who has personally navigated the digital loan application landscape and tested various platforms, I can tell you: approval doesn’t come from luck. It comes from preparation, knowing the right apps, and understanding what lenders are really looking for.

In this comprehensive guide, I’ll walk you through everything you need to know—from choosing the right legit loan apps to presenting a compelling application. 💰

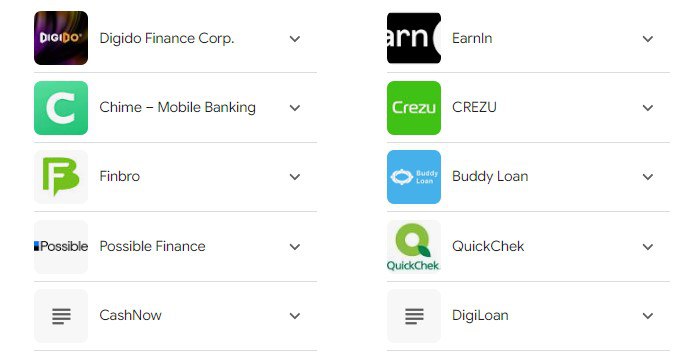

Best loan app Philippines

Why You Should Apply for a Legit Loan Online in the Philippines

The rise of legit online loan apps has revolutionized the lending landscape in the Philippines. No more standing in long queues or being rejected by traditional banks for not having a credit history.

Here are some reasons why this method is increasingly popular:

💲 Speed: Most apps process and disburse loans within 24-48 hours.

Accessibility: Open to freelancers, online workers, and even those with no credit history.

Paperless convenience: All you need is your phone and a valid ID.

Transparency: Most platforms clearly display their terms, interest rates, and repayment periods.

But here’s the catch: not all loan apps are made equal. And not all of them are legit loan apps with low interest.

What Is a Legit Online Loan?

A legit online loan refers to a loan offered by a government-registered or SEC-licensed provider in the Philippines. These apps comply with data privacy laws, disclose all costs upfront, and offer customer service support.

To qualify as legit, a provider should:

Be registered with the Securities and Exchange Commission (SEC)

Offer clear, non-predatory interest rates

Provide easy-to-understand terms and repayment options

Be featured in trusted publications like Legit Online Loan Apps in the Philippines

How to Get Approved for a Legit Loan Online

Let’s dive into the exact steps I’ve used and recommend:

Step 1: Choose the Right Platform

Do your homework. Not all apps are equally efficient or affordable.

Start with proven platforms like:

Step 2: Prepare the Right Documents

Legit loan apps generally require:

Valid government-issued ID (UMID, SSS, Driver’s License, etc.)

Proof of income (Payslip, bank statement, GCash screenshots)

Active mobile number and email

Selfie or face verification

Step 3: Build Your Credit Profile

💰 Here’s a secret most users overlook: your behavior on one platform often affects your approval on others. Pay back loans on time. Even small loans help build your digital credit reputation.

Step 4: Only Borrow What You Can Repay

Never max out your borrowing limit unless absolutely necessary. Always keep your debt-to-income ratio below 30%.

Step 5: Watch Out for Hidden Fees

Even the most legit loan online with low interest apps may charge service fees or penalties for late payments. Read the terms and FAQs before signing up.

Top Legit Loan Apps in the Philippines You Can Trust

Let’s explore some of the most reputable and efficient platforms available today. These apps are frequently used by traders and professionals alike.

1. Digido

💲 Interest: 0% for first-time users; 11.9% monthly after

Loan amount: ₱500 - ₱25,000

Loan term: 7 to 180 days

Approval time: As fast as 5 minutes

Pros: Fully automated, no human intervention, fast approval

2. Finbro

💲 Interest: Around 5% monthly

Loan amount: ₱5000 - ₱50,000

Loan term: 1 to 12 months

Approval time: Within 24 hours

Pros: Accepts applicants with no credit history

3. Kviku

💲 Interest: 0% first loan, 12% monthly after

Loan amount: ₱500 - ₲25,000

Loan term: 60 - 180 days

Approval time: Instant in-app decision

Pros: Fast disbursement, low documentation

4. Cashspace

💲 Interest: Starts at 0%, up to 12% monthly

Loan amount: Up to ₱25,000

Loan term: 91 to 120 days

Approval time: Within minutes

Pros: Compares multiple lenders instantly

5. MoneyCat

💲 Interest: ~10% monthly

Loan amount: ₱100 - ₱20,000

Loan term: 91 to 180 days

Approval time: 24 hours or less

Pros: Friendly for repeat borrowers

Common Mistakes That Lead to Loan Rejection

Avoid these pitfalls:

Using inconsistent information across apps

Uploading blurry documents

Applying to too many apps at once (can flag you as high-risk)

Ignoring repayment schedules or terms

FAQs About Getting a Legit Loan Online in the Philippines

What is a legit online loan?A legit online loan is one offered by an SEC-registered platform with fair interest rates and transparent policies.

How can I get approved fast?Choose apps with automatic systems, prepare your documents, and start small to build trust.

Are there legit loan apps for unemployed individuals?Yes, some platforms like Finbro and Cashspace may approve loans based on alternative proofs like remittance or GCash activity.

Which app offers the lowest interest rates?Apps like Digido and Kviku offer 0% for first-time users, making them ideal for short-term borrowing.

Can I apply without a payslip?Yes, especially on apps like MoneyCat or LoanOnline where alternative income proofs are accepted.

Is online loan disbursement instant?Some apps offer real-time approval and fund transfer within minutes.

What if I can’t repay on time?Most apps offer grace periods or re-loan options but be wary of accumulating interest or penalties.

How to avoid fake loan apps?Stick to platforms reviewed on trusted sites like Legit Online Loan Apps in the Philippines.

Can I get more than one loan at a time?Yes, but it may affect your credit rating and future approvals.

Are these apps secure?SEC-registered apps follow Philippine Data Privacy Laws and use encryption to protect user data.

Final Thoughts

💰 In today’s digital age, access to credit is literally at your fingertips. By using only legit loan apps, being proactive, and applying strategically, you significantly improve your chances of approval. Avoid fly-by-night apps and prioritize transparency, speed, and reputation.

Remember, the smartest borrowers don’t just get approved—they get approved on their terms. Now that you know the steps, it’s time to take action and apply through a legit online loan app that fits your needs.