8 minute read

Top 10 best prop firms forex Trading India

When it comes to forex trading, prop firms offer incredible opportunities for traders to maximize their potential. In this article, we will unveil the Top 10 best prop firms for forex trading in India. These firms provide funding and resources to traders looking to elevate their trading strategies without risking their own capital. From established names like FTMO to emerging players such as The Funded Trader and True Forex Funds, we will analyze each firm’s features, pros, cons, and ultimately, our opinion. By the end of this article, you will have a clearer understanding of which prop firm could be the best fit for your trading journey in India.

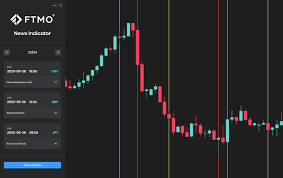

1. FTMO

Introduction

FTMO is one of the most recognized proprietary trading firms globally, and its reputation extends to Indian traders seeking funding opportunities. Known for its structured evaluation process, FTMO stands as a beacon for serious forex traders.

Features

Evaluation Process: FTMO has a two-step evaluation consisting of a Challenge and a Verification phase.

Profit Split: Traders can earn up to 90% of the profits.

Trading Instruments: A wide array of instruments including stocks, commodities, and indices.

Educational Resources: FTMO provides ample resources including webinars, articles, and performance coaching.

Pros

High profit-sharing percentage.

Well-structured evaluation system.

Comprehensive educational support.

Cons

Evaluation fees can be relatively high.

Strict loss limits during the evaluation process.

Opinion

FTMO stands out as a premier choice for traders due to its comprehensive evaluation process and generous profit split. However, the initial investment may deter some beginners. Overall, FTMO cultivates a serious trading environment that encourages growth and discipline.

2. TheFundedTrader

Introduction

Another favorable option in the realm of proprietary trading firms is TheFundedTrader. This firm stands out for its user-friendly approach and transparent policies.

Features

Flexible Plans: Multiple funding options tailored to different trader profiles.

No Evaluation Required: Upon signing up, traders get access to funds right away.

Profit Split: Up to 75% profit share depending on the plan chosen.

Community Support: Engaged community offering mentorship and guidance.

Pros

Immediate access to capital.

Lower entry costs compared to other firms.

Supportive community environment.

Cons

Profit sharing is lower than some competitors.

Limited educational resources compared to giants like FTMO.

Opinion

TheFundedTrader is an excellent choice for those who want to bypass lengthy evaluations and dive straight into trading. Its flexible plans make it accessible for traders with different skill levels, although the profit-sharing ratio leaves room for improvement.

3. The Forex Funder

Introduction

The Forex Funder has gained popularity among aspiring traders in India due to its straightforward approach and user-centric policies.

Features

Fast Onboarding: Quick registration process with easy access to funded accounts.

High Leverage: Offers competitive leverage options making it attractive for scalpers.

Profit Split: Up to 85% profit share available based on performance.

Flexible Trading Strategies: Traders are allowed to use various strategies including scalping and hedging.

Pros

Fast onboarding and approval processes.

High leverage options are beneficial for aggressive traders.

Flexibility in trading strategies employed.

Cons

Limited educational material and resources.

Customer service could be more responsive.

Opinion

The Forex Funder presents a solid option for traders looking for flexibility and speed. While its customer service may need improvement, its fast onboarding process and competitive profit splits make it appealing for many traders.

4. True Forex Funds

Introduction

True Forex Funds is a newer addition to the prop trading landscape but has quickly made a name for itself with its unique offerings.

Features

Unlimited Evaluation Attempts: Traders can retry the evaluation process as many times as needed.

Profit Share: Offers an impressive profit share of 90%.

User-Friendly Interface: Easy to navigate platform suited for both novice and seasoned traders.

Diverse Trading Styles Allowed: Supports various trading styles and strategies.

Pros

Very high profit-sharing potential.

Unlimited retries for the evaluation program.

User-centric platform design enhances usability.

Cons

Still establishing a reputation compared to older firms.

Limited geographical presence might affect support availability.

Opinion

True Forex Funds is proving to be an intriguing option for traders who appreciate a high-profit share and the chance to retry the evaluation. As a relatively new player, its long-term reliability remains to be seen, but it shows promise for those willing to explore its offerings.

5. Maverick FX

Introduction

Maverick FX offers a unique blend of education and funding, focusing on developing traders into professionals through rigorous training programs.

Features

Comprehensive Training Programs: Detailed programs aimed at improving trading skills.

Profit Split: A competitive profit share model, rewarding consistent performers.

Mentorship Opportunities: Access to experienced traders for guidance and insights.

Pros

Strong emphasis on trader education.

Personalized mentorship can accelerate learning.

Good profit-sharing structure.

Cons

Training programs may require additional investment.

Higher performance standards may intimidate new traders.

Opinion

Maverick FX is ideal for those who value education alongside trading. It fosters a supportive environment while offering robust funding options, making it a great choice for dedicated learners.

6. City Traders Imperium (CTI)

Introduction

City Traders Imperium caters primarily to the UK market but is also gaining traction among Indian traders. Their focus is on cultivating successful partnerships with traders.

Features

Unique Funding Models: Offers various funding levels based on trader experience.

Profit Split: Competitive profit-sharing up to 80%.

Additional Resources: Provides tools and resources to enhance trading performance.

Pros

Tailored funding models to suit different needs.

Emphasis on trader development through additional resources.

Cons

May have geographical restrictions impacting support.

The application process can be lengthy.

Opinion

City Traders Imperium is a solid option for those seeking personalized trading experiences and additional developmental resources. Although the application process can be cumbersome, the tailored approach makes it worth considering.

7. TopstepFX

Introduction

TopstepFX is an extension of the well-known TopstepTrader, focusing exclusively on forex trading. It has built a reputable brand among traders looking for reliable funding options.

Features

Evaluation Process: Similar to FTMO, with a combination of trials before funding.

Profit Share: A lucrative profit-sharing plan that rewards top performers.

Risk Management Guidance: Offers guidelines to help traders manage risk effectively.

Pros

Established brand with a focus on forex.

Performance-oriented funding structure.

Educational resources to aid in decision-making.

Cons

Initial evaluation process may take time.

Fees associated with challenges might not appeal to all.

Opinion

TopstepFX is a trustworthy option for forex traders seeking funding. Their established framework and dedicated resources ensure a supportive environment, although the evaluation process can dissuade some traders from participating.

8. Apex Trader Funding

Introduction

Apex Trader Funding has emerged as a prominent player in the prop trading industry, especially among forex traders. They emphasize scalable trading opportunities.

Features

Scalable Funding Options: Traders can scale their accounts as they prove success.

Profit Split: Profits shared up to 90%.

Training and Resources: Provides educational material to assist traders in becoming more effective.

Pros

Scalable funding allows for growth potential.

High profit-sharing capability for successful traders.

Training helps improve trading efficiency.

Cons

Newer firm may lack the stability of established competitors.

Some traders prefer fixed funding amounts over scaling.

Opinion

Apex Trader Funding is a commendable choice for forex traders aiming to develop and scale their trading careers. However, being a newer player, there may be uncertainties regarding its durability in the long term.

9. FTUK

Introduction

FTUK is another prominent firm catering to the forex trading community. With a mission to empower traders, FTUK has designed several features aimed at easing the funding process.

Features

Simple Onboarding Process: Streamlined registration and verification procedures.

Profit Split: Generous profit sharing, rewarding traders for their efforts.

Diverse Product Range: Availability of multiple trading products beyond forex.

Pros

Efficient onboarding can attract new traders rapidly.

Diverse product offerings broaden trading possibilities.

Cons

Limited educational resources compared to larger firms.

Less recognition in the market compared to industry leaders.

Opinion

FTUK's efficient operations make it appealing to new traders. However, its limited educational resources mean that traders looking for extensive training might need to look elsewhere.

10. Blue Sky Forex

Introduction

Blue Sky Forex rounds off our list and focuses heavily on creating a community-driven trading environment. The firm emphasizes collaboration and learning among its traders.

Features

Community Forums: Promotes interaction and sharing among traders.

Profit Split: Fair profit-sharing model that motivates performance.

Workshops and Seminars: Regular events to foster learning and development.

Pros

Strong sense of community encourages knowledge sharing.

Regular workshops help build skills.

Cons

Profit-sharing may not be as high as other firms.

Community-driven nature might not suit everyone.

Opinion

Blue Sky Forex is an excellent fit for traders who thrive in community settings. While the profit-sharing model is somewhat lower, the collaborative culture and learning opportunities make it valuable for new traders.

FAQs

What is a prop firm in forex trading?

Prop firms provide capital to traders to trade financial instruments like forex. Traders can keep a portion of the profits while minimizing personal risk.

How do I choose the right prop firm for me?

Consider factors such as profit-sharing ratios, evaluation processes, fees, and additional educational resources offered by each firm.

Are there any fees associated with joining prop firms?

Yes, many prop firms charge evaluation or subscription fees as part of their onboarding process.

Can I work with multiple prop firms simultaneously?

Yes, many traders opt to affiliate with multiple prop firms to diversify their trading opportunities, but it's essential to review each firm's policies.

What happens if I lose money trading with a prop firm?

Generally, traders are only responsible for adhering to the loss limits set by the firm, meaning they do not incur losses beyond the predetermined amount.

Conclusion

In summary, the Top 10 best prop firms for forex trading in India present a multitude of options for traders at various stages of their careers. Whether you're drawn to the rigorous evaluation process of FTMO or the immediate access to funds from TheFundedTrader, each firm has unique strengths and weaknesses. Doing your due diligence can help you determine which prop firm aligns best with your trading goals. As the trading landscape continues to evolve, these firms are poised to play vital roles in fostering talent and offering substantial opportunities for success in forex trading.