20 minute read

How does a Pocket Broker work? Pocket Option trading

Understanding Pocket Option and its Brokerage ModelTo fully grasp how a pocket broker operates, it’s crucial to first comprehend the mechanics of Pocket Option itself. This platform has gained traction among traders due to its user-friendly interface and innovative features that cater to both novice and experienced investors.What is Pocket Option?Pocket Option is an online trading platform that specializes in binary options. The appeal of Pocket Option lies in its simplicity and accessibility, allowing users to trade a variety of assets such as stocks, currencies, commodities, and cryptocurrencies. The platform provides traders with opportunities to profit from market fluctuations while employing various strategies tailored to individual risk tolerances.The rise of Pocket Option can be attributed to its intuitive design and advanced analytics tools, enabling traders to make informed decisions. The platform also promotes social trading, where users can follow successful traders and replicate their strategies, making it particularly attractive for beginners.Understanding how a pocket broker works in the realm of Pocket Option trading is essential for traders looking to optimize their experience and improve their chances of success. In this article, we will delve into various facets of pocket brokers and their intricate relationship with Pocket Option trading.Understanding Pocket Option and its Brokerage Model

Understanding how a pocket broker works in the realm of Pocket Option trading is essential for traders looking to optimize their experience and improve their chances of success. In this article, we will delve into various facets of pocket brokers and their intricate relationship with Pocket Option trading.

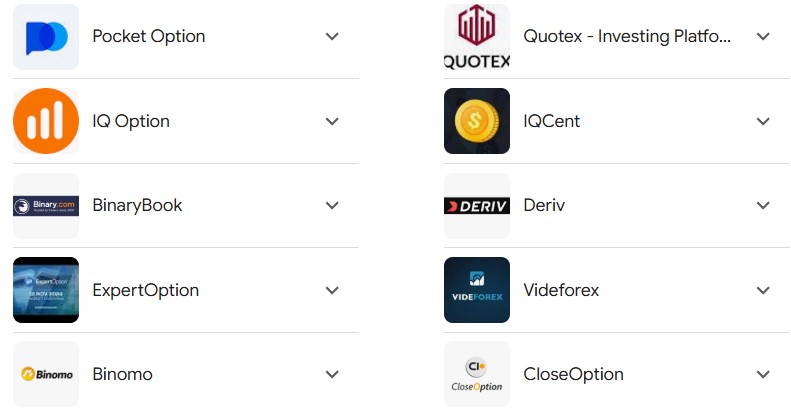

Top binary option trading brokers

Understanding Pocket Option and its Brokerage Model

To fully grasp how a pocket broker operates, it’s crucial to first comprehend the mechanics of Pocket Option itself. This platform has gained traction among traders due to its user-friendly interface and innovative features that cater to both novice and experienced investors.

💥Pocket Option👉Open Account or Visit website💥

What is Pocket Option?

Pocket Option is an online trading platform that specializes in binary options. The appeal of Pocket Option lies in its simplicity and accessibility, allowing users to trade a variety of assets such as stocks, currencies, commodities, and cryptocurrencies. The platform provides traders with opportunities to profit from market fluctuations while employing various strategies tailored to individual risk tolerances.

The rise of Pocket Option can be attributed to its intuitive design and advanced analytics tools, enabling traders to make informed decisions. The platform also promotes social trading, where users can follow successful traders and replicate their strategies, making it particularly attractive for beginners.

The Role of Brokers in Pocket Option

Brokers play a pivotal role within the Pocket Option ecosystem. They serve as intermediaries between the trader and the financial markets, facilitating transactions and providing access to trading instruments. The relationship between traders and brokers can significantly impact the overall trading experience, influencing factors such as execution speed, fees, and available resources.

In terms of brokerage models, Pocket Option utilizes various types of brokers, including pocket brokers. These specialized brokers focus on enhancing the trading experience by offering personalized services, technological support, and educational resources tailored to individual trader needs.

💥Pocket Option👉Open Account or Visit website💥

Types of Brokers Available on Pocket Option

Understanding the different types of brokers associated with Pocket Option is vital for traders. While traditional brokers may offer comprehensive services, pocket brokers are typically more specialized, focusing on specific niches tailored to the Pocket Option platform.

Market Makers: Market makers provide liquidity by taking the opposite side of a trader's position. They often set the spreads and can impact execution prices. Traders should be cautious, as some market makers may have conflicts of interest.

ECN Brokers: Electronic Communication Network (ECN) brokers connect traders directly with liquidity providers, offering tighter spreads and faster execution times. However, they may charge higher fees than other broker types.

Pocket Brokers: As previously mentioned, pocket brokers offer targeted services specifically for Pocket Option trading. They may assist with account management, strategy development, and educational resources, elevating the trading experience for their clients.

In conclusion, the understanding of Pocket Option and its brokerage model lays the foundation for exploring how pocket brokers operate within this dynamic trading environment.

How Pocket Brokers Facilitate Pocket Option Trading

Pocket brokers are designed to streamline the trading process for individuals utilizing the Pocket Option platform. By acting as essential facilitators, these brokers enhance the overall trading experience, helping users navigate the complexities of the market.

Personalized Support and Guidance

One of the key advantages of engaging with a pocket broker is the personalized support they offer. Unlike traditional brokers, who may operate on a larger scale, pocket brokers tend to work closely with each client to understand their unique trading goals and preferences.

This individualized approach ensures that traders receive tailored advice, whether they are just starting or seeking to refine their existing strategies. Pocket brokers can help identify potential trading opportunities based on a trader's profile, leading to more informed decision-making.

Furthermore, they can assist with technical analysis, guiding traders on how to interpret market signals and develop actionable strategies. This level of support is invaluable for those who prefer a hands-on approach to trading.

Access to Advanced Tools and Resources

Another significant advantage of using pocket brokers is their ability to provide access to advanced trading tools and resources. Many pocket brokers offer proprietary technology solutions designed to enhance trading efficiency.

These tools might include:

Advanced charting software

Real-time market data feeds

Algorithmic trading systems

By equipping traders with sophisticated tools, pocket brokers empower them to analyze the market effectively and execute trades confidently. Additionally, many brokers offer educational resources, webinars, and tutorials, further enriching the trader's knowledge base.

Streamlined Account Management

Managing funds and accounts can be cumbersome for traders, especially those involved in multiple trades daily. Pocket brokers simplify this process by offering streamlined account management services.

Traders can benefit from timely updates regarding their account balances, trade execution statuses, and market conditions. Moreover, pocket brokers often assist with fund transfers, ensuring that deposits and withdrawals are processed efficiently and securely.

In summary, pocket brokers play a crucial role in facilitating Pocket Option trading by offering personalized support, access to advanced tools, and streamlined account management services.

Key Features and Benefits of Using a Pocket Broker

When engaging in Pocket Option trading, selecting the right broker can dramatically influence your experience and profitability. Pocket brokers come equipped with features designed to enhance the trading journey.

User-Friendly Platforms

Pocket Option broker often utilize user-friendly platforms that prioritize ease of navigation and functionality. A straightforward interface allows traders to quickly execute trades, monitor positions, and analyze market trends without getting overwhelmed by complex features.

This aspect is particularly beneficial for novice traders who may not be accustomed to navigating trading platforms. A simple layout eliminates distractions and enables users to focus on developing their trading strategies.

Competitive Fees and Commission Structures

Another significant benefit of working with pocket brokers is their transparent fee structures. Many pocket brokers aim to attract traders by minimizing commission rates and offering competitive spreads.

Understanding cost structures is critical for traders, as fees can significantly impact overall profits. Pocket brokers often disclose all relevant information upfront, empowering traders to make informed choices about their trading costs.

Moreover, some brokers may offer commission-free trading options for specific asset classes or during promotional periods. Such incentives are enticing for traders looking to maximize profits without incurring excessive costs.

Enhanced Risk Management Strategies

Risk management is paramount when trading, and pocket brokers often assist traders in implementing effective risk mitigation strategies. These may include setting stop-loss orders, utilizing take-profit levels, and diversifying portfolios across multiple asset classes.

Pocket brokers may also provide valuable insights into market volatility and risk exposure, helping traders adjust their strategies accordingly. By emphasizing risk management, pocket brokers contribute to long-term trading success and sustainability.

In conclusion, the key features and benefits of using a pocket broker include user-friendly platforms, competitive fee structures, and enhanced risk management strategies. These elements collectively create a conducive environment for successful Pocket Option trading.

Step-by-Step Guide: Connecting with a Pocket Broker for Pocket Option

Establishing a connection with a pocket broker is critical for optimizing your trading experience on Pocket Option. Here’s a step-by-step guide to help you navigate this process seamlessly.

Research and Identify Potential Pocket Brokers

Before diving into Pocket Option trading, it’s vital to conduct thorough research to identify potential pocket brokers. Begin by reading reviews and testimonials from other traders who have utilized their services.

Look for brokers that demonstrate a strong track record, reliable customer service, and a transparent fee structure. Additionally, consider their expertise in Pocket Option trading and the range of services they offer. Creating a shortlist of potential brokers will help you streamline your selection process.

Open an Account with Your Chosen Pocket Broker

Once you've identified a suitable pocket broker, the next step involves opening an account. This typically entails filling out an online registration form, which requires basic personal information, including your name, email address, and phone number.

Some brokers may require additional documentation for verification purposes, such as a government-issued ID or proof of residence. Ensuring you provide accurate information during this stage is critical, as discrepancies may lead to delays in account approval.

After submitting your application, you will receive instructions regarding the next steps. Follow these instructions carefully to ensure a smooth onboarding process.

💥Pocket Option👉Open Account or Visit website💥

Fund Your Trading Account

With your account successfully opened, the next step is to fund it. Most pocket brokers offer multiple funding options, including bank transfers, credit/debit cards, and e-wallets.

Choose the funding method that best suits your needs and transfer the desired amount into your trading account. It’s important to factor in any deposit fees that may apply, as well as the processing time associated with your chosen funding method.

Once your funds are deposited, confirm that the balance reflects accurately in your account before proceeding to trade.

Start Trading on Pocket Option

Now that your account is funded and ready for action, you can begin trading on Pocket Option. Familiarize yourself with the platform’s features, including charting tools, asset categories, and trading options.

Pocket brokers often provide educational resources, so take advantage of these materials to enhance your trading skills. Whether you're opting for short-term trades or longer-term strategies, approach your trading with diligence and patience.

In conclusion, connecting with a pocket broker for Pocket Option trading involves extensive research, account setup, funding, and ultimately engaging in the trading process. Following these steps will lay the groundwork for a successful trading journey.

Comparing Different Pocket Brokers: Fees, Services, and Reliability

As the demand for pocket brokers continues to grow, it's essential for traders to effectively compare different options to ensure they select the right partner for their Pocket Option trading endeavors.

Analyzing Fee Structures

One of the most critical aspects to evaluate when comparing pocket brokers is their fee structures. These can vary significantly among different brokers, impacting your overall profitability.

Consider the following when analyzing fees:

Commission Rates: Examine the commission charged per trade. Some pocket brokers may offer lower commissions but impose wider spreads, while others may have fixed commissions.

Deposit and Withdrawal Fees: Investigate any fees associated with depositing and withdrawing funds from your trading account. Transparent brokers typically disclose this information upfront.

Inactivity Fees: Be mindful of inactivity fees that may apply if you haven’t traded in a while. Such charges can erode your account balance over time.

By carefully evaluating these components, you can determine which pocket broker offers the most favorable fee structure for your trading style.

Assessing Available Services

Beyond fee structures, it's crucial to assess the range of services offered by different pocket brokers. Consider the following services that may enhance your trading experience:

Educational Resources: Look for brokers that offer robust educational materials, including webinars, tutorials, and market analysis reports. Comprehensive education can empower you to make more informed trading decisions.

Trading Tools: Evaluate the quality and availability of trading tools provided by each broker. Advanced charting, indicators, and algorithmic trading systems can significantly aid in executing successful trades.

Customer Support: Reliable customer support is essential for addressing queries and concerns. Compare the responsiveness and availability of customer support channels offered by different pocket brokers.

By considering these services, you can select a broker that aligns with your trading objectives and requirements.

Evaluating Broker Reliability

Reliability is a crucial factor when choosing a pocket broker for Pocket Option trading. A trustworthy broker enhances your trading experience and reduces potential risks.

To assess a broker's reliability, look for:

Regulatory Compliance: Ensure that the broker adheres to applicable regulations and is authorized to operate in your jurisdiction. Regulatory oversight adds a layer of protection for your funds.

User Reviews: Reading user reviews and testimonials can provide insight into the broker's reputation. Look for feedback related to trade execution speed, withdrawal processes, and customer service experiences.

Transparency: A reliable pocket broker should be transparent about their operations, including fee structures, terms and conditions, and potential conflicts of interest.

By evaluating these aspects, you can confidently choose a pocket broker that demonstrates reliability and trustworthiness.

In conclusion, comparing different pocket brokers involves analyzing fee structures, assessing available services, and evaluating reliability. Taking the time to conduct thorough comparisons will ultimately lead to a more informed choice for your Pocket Option trading journey.

Risks and Considerations When Using a Pocket Broker for Pocket Option

While pocket brokers offer numerous advantages for traders engaged in Pocket Option trading, it's essential to be aware of the associated risks and considerations. Understanding these factors will equip you to make more informed decisions and minimize potential pitfalls.

Market Volatility and Risks

The financial markets are inherently volatile, and trading in binary options carries a level of risk that requires careful consideration. While pocket brokers can provide valuable insights and guidance, traders should remain conscious of market fluctuations that can adversely affect their positions.

It’s vital to recognize that while pocket brokers help mitigate risks through education and support, the ultimate responsibility for trading decisions rests with the individual trader. Developing a solid risk management strategy is essential for protecting your investment capital.

Dependence on Broker Performance

Engaging with a pocket broker means entrusting them with certain aspects of your trading experience. This dependency can present challenges, particularly if the broker fails to deliver on promised services or experiences technical difficulties.

Traders must remain vigilant and monitor their broker's performance regularly. Ensure you maintain open lines of communication with your pocket broker and stay informed about any developments that may affect your trading activities.

Potential Conflicts of Interest

As with any trading environment, pocket brokers may encounter potential conflicts of interest. For instance, if a broker is incentivized to promote specific trading products, their recommendations could be biased toward maximizing their own profits rather than prioritizing client interests.

To mitigate this risk, traders should engage in independent research and analysis to verify the information and recommendations provided by their brokers. Strive to cultivate a balanced perspective that incorporates both broker insights and personal analysis.

In summary, while using a pocket broker for Pocket Option trading can enhance the trading experience, traders must remain cognizant of market volatility, dependence on broker performance, and potential conflicts of interest.

Regulation and Security: Choosing a Reputable Pocket Broker

Regulation and security are paramount concerns for traders engaging in Pocket Option trading. Selecting a reputable pocket broker involves ensuring compliance with regulatory standards that safeguard your investments.

Importance of Regulatory Oversight

When selecting a pocket broker, one of the foremost considerations is whether the broker is regulated by a recognized authority. Regulatory bodies impose strict guidelines on brokers to ensure transparency, fairness, and protection for traders.

Choosing a regulated broker provides several advantages:

Safety of Funds: Regulated brokers are required to maintain segregated accounts, safeguarding client funds and reducing the risk of misappropriation.

Fair Trading Practices: Regulatory oversight helps prevent unethical practices, such as price manipulation or unfair trade execution, ensuring a level playing field for all traders.

Dispute Resolution: If issues arise, regulated brokers typically have established procedures for dispute resolution, offering clients recourse in the event of disputes.

Traders should research regulatory bodies relevant to their jurisdiction, such as the Financial Conduct Authority (FCA), the Commodity Futures Trading Commission (CFTC), and the European Securities and Markets Authority (ESMA).

Assessing Security Protocols

In addition to regulatory compliance, assessing the security protocols employed by pocket brokers is crucial for safeguarding your personal and financial information.

Consider the following security measures when evaluating potential brokers:

Encryption Technology: Look for brokers that employ encryption protocols for data transmission and storage, ensuring that your sensitive information remains protected from unauthorized access.

Two-Factor Authentication: Two-factor authentication adds an extra layer of security to your account, requiring not only a password but also a secondary verification method.

Regular Audits: Reputable brokers often undergo regular audits to assess their operational integrity and adherence to industry standards.

By scrutinizing the security measures employed by pocket brokers, you can make a more informed decision regarding the safety of your trading activity.

Verifying Broker Reputation

Finally, researching the reputation of potential pocket brokers is fundamental to ensuring a secure trading experience. Utilize resources such as trading forums, review websites, and industry publications to gather insights on broker performance and reliability.

Look for brokers with a proven track record, positive user reviews, and a commitment to transparency. Engaging with reputable brokers fosters trust and confidence, allowing you to concentrate on honing your trading skills.

In summary, when choosing a reputable pocket broker for Pocket Option trading, prioritize regulatory oversight, security protocols, and broker reputation. This diligence will ultimately lead to a more secure and rewarding trading experience.

Optimizing Your Trading Strategy with the Help of a Pocket Broker

Developing a successful trading strategy is essential for maximizing profitability in Pocket Option trading. Pocket brokers can significantly enhance the effectiveness of your strategy through personalized support and expert guidance.

Identifying Your Trading Goals

The first step toward optimizing your trading strategy is identifying your unique trading goals. Everyone approaches trading with different objectives, whether it's generating passive income, achieving long-term growth, or engaging in short-term speculation.

Engaging with a pocket broker can help clarify your objectives and align your trading strategy accordingly. By articulating your goals, you can work with your broker to tailor a plan that encompasses risk tolerance, asset classes, and preferred trading styles.

Analyzing Market Conditions

The ability to analyze market conditions is paramount for successful trading. Pocket brokers can offer valuable insights into market trends, economic indicators, and emerging opportunities that can inform your trading decisions.

Utilizing advanced analytical tools provided by pocket brokers allows you to analyze historical data, assess price movements, and identify key patterns. By incorporating both technical and fundamental analysis into your strategy, you can create a well-rounded approach that enhances your chances of success.

Implementing Risk Management Techniques

An effective trading strategy incorporates risk management techniques to protect your capital and minimize losses. Pocket brokers offer tools and guidance on implementing sound risk management practices.

Some common risk management techniques include:

Setting Stop-Loss Orders: Designating a predetermined exit point can help limit potential losses on trades.

Diversifying Your Portfolio: Allocating funds across multiple asset classes reduces the risk associated with overexposure to any single position.

Maintaining a Trading Journal: Keeping detailed records of your trades enables you to analyze your performance and identify areas for improvement.

By integrating these risk management techniques into your trading strategy, you bolster your resilience in the face of market uncertainties.

In conclusion, optimizing your trading strategy with the help of a pocket broker involves identifying your goals, analyzing market conditions, and implementing effective risk management techniques. Collaborative efforts with your broker can enhance your overall trading proficiency.

Case Studies: Successful Traders Using Pocket Brokers for Pocket Option

Examining real-life case studies of traders who have leveraged pocket brokers for Pocket Option trading can provide valuable insights into effective strategies and best practices.

Case Study 1: The Novice Trader

Meet Sarah, a novice trader who had little prior experience with financial markets. After conducting extensive research, she chose a pocket broker specializing in Pocket Option trading.

Upon opening her account, Sarah received personalized assistance from her broker, who helped her identify her trading objectives and develop a tailored strategy. The broker provided access to educational resources, enabling Sarah to learn about market fundamentals and trading techniques.

With her broker's support, Sarah implemented a disciplined approach to trading, utilizing risk management techniques. Over time, she became more confident in her abilities and began achieving consistent profits.

Sarah's success illustrates how engaging with a pocket broker can empower novice traders to develop effective strategies and reach their trading goals.

Case Study 2: The Experienced Trader

John, an experienced trader, faced challenges maintaining consistent profitability in an increasingly competitive market. Seeking to refine his approach, he turned to a pocket broker known for providing advanced analytical tools and personalized support.

Collaborating closely with his broker, John analyzed market trends and refined his trading strategies. His broker helped him implement automated trading solutions, ensuring that he capitalized on opportunities even when he was away from the screen.

As a result of this collaboration, John witnessed a marked improvement in his trading results. By leveraging the resources and expertise of his pocket broker, he regained his edge in the market.

This case study highlights how even seasoned traders can benefit from the insights and tools offered by pocket brokers, thus enhancing their overall trading performance.

Lessons Learned from Successful Traders

The stories of Sarah and John emphasize several key takeaways for traders considering pocket brokers:

Tailored Support: Personalized assistance from pocket brokers can significantly enhance traders' abilities to achieve their goals.

Access to Resources: Traders should leverage educational resources and analytical tools provided by their brokers to inform their trading decisions.

Continuous Improvement: Maintaining an adaptable mindset and regularly refining strategies based on market conditions are essential for sustained success.

In summary, the experiences of successful traders utilizing pocket brokers for Pocket Option trading illustrate the value of personalized support, access to resources, and continuous improvement in achieving trading success.

The Future of Pocket Brokers and their Role in Pocket Option Trading

As the trading landscape continues to evolve, the role of pocket brokers in Pocket Option trading is poised for transformation. Emerging technologies and changing market dynamics will likely shape the future of how traders interact with brokers.

Technological Advancements

Advancements in technology are already beginning to redefine the relationship between traders and pocket brokers. The integration of artificial intelligence (AI) and machine learning is expected to revolutionize trading strategies, enabling brokers to offer personalized recommendations based on real-time data analysis.

For instance, AI-powered advisory platforms can analyze vast amounts of market data in seconds, providing traders with actionable insights and improving decision-making processes. This level of sophistication will empower traders to better navigate market complexities, resulting in improved trading outcomes.

Increasing Competition

As more traders enter the financial markets, competition among pocket brokers is likely to intensify. This competitive landscape will compel brokers to innovate and differentiate themselves by offering unique services, competitive pricing structures, and enhanced user experiences.

Traders can expect to see improved platform functionalities, expanded asset offerings, and greater emphasis on customer support as brokers strive to attract and retain clients. Consequently, traders will benefit from this increased competition, leading to better overall trading experiences.

Evolving Regulations

The regulatory environment surrounding trading continues to evolve in response to market developments. New regulations aimed at protecting traders and promoting fair practices will influence the operations of pocket brokers.

Traders should anticipate changes in compliance requirements and adapt their strategies accordingly. Pocket brokers that prioritize regulatory compliance and transparency will likely emerge as trusted partners for traders seeking stability and security.

In conclusion, the future of pocket brokers in Pocket Option trading will be shaped by technological advancements, increasing competition, and evolving regulations. Traders must remain adaptable and informed to capitalize on these changes for their benefit.

Conclusion

Understanding how a pocket broker works in conjunction with Pocket Option trading is essential for traders aiming to optimize their trading experience. From personalized support and advanced tools to risk management strategies, pocket brokers play a significant role in enhancing trading outcomes.

By thoroughly researching potential brokers, considering regulatory compliance, and leveraging available resources, traders can establish successful partnerships that foster growth and profitability. The future of pocket brokers is bright, with technological advancements and increasing competition paving the way for even more innovative services and experiences.

Ultimately, traders who engage actively with pocket brokers can navigate the complexities of the market more effectively, leading to achievement and success in their Pocket Option trading endeavors.

💥Pocket Option👉Open Account or Visit website💥