16 minute read

Is Pocket Option regulated in South Africa

Is Pocket Option regulated in South Africa? This question resonates with many traders as they navigate the complex world of online trading. In an age where financial markets are increasingly influenced by digital platforms, understanding the regulatory landscape is crucial for ensuring the safety and security of investments. In this article, we will delve into the status of Pocket Option in South Africa, exploring its regulation, or lack thereof, and what that means for traders.

💥Pocket Option👉Open Account or Visit website💥

Is Pocket Option Regulated in South Africa?

The short answer to the question of whether Pocket Option is regulated in South Africa is no. Unfortunately, there is currently no regulatory framework governing Pocket Option specifically within the region. While the platform may be operational and accessible to South African users, it lacks the licenses that would categorize it as a regulated broker under South African law.

Understanding the implications of trading with an unregulated broker like Pocket Option involves recognizing the risks associated with such platforms. Without oversight from a reputable financial authority, traders are left vulnerable to various issues, including fraud, mismanagement of funds, and inadequate customer service.

Regulation serves as a protective measure; it ensures that brokers adhere to certain standards that promote fair trading practices and safeguarding of client funds. The absence of regulation means that traders using Pocket Option in South Africa must exercise heightened caution and carry out extensive research before making any investment decisions.

In the sections that follow, we will explore South Africa's financial regulatory landscape, Pocket Option’s global licensing status, the importance of choosing regulated brokers, the risks present when opting for unregulated platforms, comparisons with other brokers, and investor protection mechanisms available in South Africa.

💥Read more articles👇👇👇

🔸Is Pocket Option a trusted broker

Understanding Financial Regulation in South Africa

Financial regulation in South Africa is managed by several entities, most notably the Financial Sector Conduct Authority (FSCA) and the South African Reserve Bank (SARB). These institutions work to ensure the integrity of financial markets, protect consumers, and maintain economic stability.

South Africa has established regulations that govern various financial services, including banking, insurance, and investment products. However, the online trading space, particularly binary options trading, has been a gray area, leading to confusion among traders.

Role of the FSCA

The FSCA is responsible for overseeing financial markets and ensuring that financial institutions comply with laws and regulations. They aim to promote fair treatment of customers and transparency within the financial sector.

For brokers to operate legally in South Africa, they must obtain a license from the FSCA. This licensing process involves rigorous checks that assess the broker's credibility, financial health, and ability to manage client funds responsibly.

Without a license from the FSCA, brokers cannot offer their services legitimately, leaving traders exposed to potential scams and unethical practices. This makes it all the more important for South African traders to understand the regulatory landscape before engaging with any broker.

Importance of Regulation in Trading

Regulatory frameworks serve as a safety net for traders, offering a certain level of confidence that the broker they are dealing with is legitimate. Regulations dictate how brokers should conduct their operations, thereby fostering a fair trading environment.

When traders know they are working with a regulated broker, they can rest assured that their funds are kept in segregated accounts, reducing the risk of misappropriation. Additionally, there are often compensation schemes in place that provide compensation to clients in case of broker insolvency, further enhancing the trader's financial security.

Current State of Binary Options Regulation

Binary options trading has faced scrutiny globally due to its speculative nature and potential for fraud. In South Africa, while the FSCA has not explicitly banned binary options, it has issued warnings about the risks involved.

As a result, many brokers operating in this arena may not meet the necessary regulatory requirements to offer their services legitimately. This highlights the critical need for traders to be informed about the regulatory status of any broker they intend to use, especially in the binary options market.

💥Pocket Option👉Open Account or Visit website💥

Pocket Option's Licensing and Authorizations: A Global Perspective

Pocket Option operates under the jurisdiction of the International Financial Market Relations Regulation Center (IFMRRC), which is based in the Republic of Seychelles. While this regulatory body does provide some oversight, it is not recognized as a significant authority similar to the FSCA or the UK’s Financial Conduct Authority (FCA).

International Regulatory Frameworks

The IFMRRC offers a degree of regulation but lacks the stringent measures and consumer protections found in other jurisdictions. This presents a challenge for traders seeking reassurance in the legitimacy of their trading platform.

The fact that Pocket Option is licensed by such an entity raises questions about the level of protection offered to its users. Traders should be aware that while some regulatory oversight exists, it may not be sufficient to guarantee their safety in the event of disputes or issues arising.

The Lack of South African Regulation

As previously mentioned, Pocket Option is unregulated in South Africa and does not hold a license from the FSCA. This absence of a domestic regulatory framework leaves South African traders vulnerable to risks commonly associated with unregulated platforms.

Traders engaging with Pocket Option must consider the implications of operating without the added layer of consumer protection that comes with being regulated under South African law. Such considerations are vital in making informed trading decisions.

Implications for Users in South Africa

The implications of trading on an unregulated platform extend beyond mere compliance issues. Traders may face difficulties in accessing support services, resolving disputes, or retrieving funds should problems arise.

Moreover, the lack of stringent regulation can lead to inflated fees, misleading promotional offers, and possible manipulation of trades. Therefore, individuals considering Pocket Option should weigh these factors carefully before committing their resources.

The Importance of Regulated Brokers for South African Traders

Choosing a regulated broker is fundamental for anyone looking to trade online, particularly for South African investors navigating the complexities of foreign trading platforms.

Security of Funds

One of the most compelling reasons to opt for a regulated broker is the security of your funds. Regulated brokers are typically required to keep client funds in segregated accounts, meaning that your money is held separately from the broker’s operating funds.

This separation ensures that even if the broker faces financial difficulties, your funds remain protected. This level of security is paramount for risk-averse investors who wish to safeguard their capital.

Transparent Practices

Regulated brokers are obliged to follow transparent practices in their dealings with clients. They must disclose all relevant information, including fees, commissions, and terms of service.

This transparency creates a fairer trading atmosphere, helping traders make informed decisions. Conversely, unregulated brokers may employ deceptive practices, making it challenging for traders to ascertain the true costs associated with their trades.

Redressal Mechanisms

Another significant benefit of choosing a regulated broker is the access to redressal mechanisms. In cases where a trader feels they have been wronged, regulated brokers provide clear channels through which grievances can be addressed.

These mechanisms may include dispute resolution processes, complaints handling procedures, and compensation schemes, all designed to protect the rights of the trader. Unregulated brokers, on the other hand, often leave clients without recourse in the event of unfair treatment.

Building Trust

Working with a regulated broker helps establish a relationship grounded in trust. Knowing that a broker is accountable to a regulatory authority provides peace of mind, allowing traders to focus on their strategies rather than worrying about the legitimacy of the platform.

Trust is integral in the trading realm, where capital is at stake. Regulated brokers foster an environment where traders feel secure in knowing they are working with professionals who adhere to high ethical standards.

Risks of Trading with Unregulated Brokers in South Africa

Trading with unregulated brokers can expose South African traders to numerous risks that can significantly impact their trading experience.

Fraud and Scams

One of the most alarming risks associated with unregulated brokers is the prevalence of fraud and scams. These platforms may engage in illicit activities, such as refusing withdrawals, manipulating prices, or providing false promises regarding returns.

With no regulatory body overseeing their operations, traders have little recourse if they fall victim to fraudulent practices. As such, it is crucial for traders to conduct thorough research and exercise caution before engaging with any broker.

Lack of Consumer Protection

Unregulated brokers do not offer the same level of consumer protection that regulated brokers do. This absence of oversight means that traders have no guarantees regarding the safekeeping of their funds or the integrity of their trading conditions.

In the event of a dispute, unregulated brokers may ignore complaints or fail to provide adequate resolutions, leaving traders feeling helpless. This lack of accountability can severely undermine the trading experience.

Inadequate Support Services

Customer support is another area where unregulated brokers often fall short. Without the obligation to meet regulatory standards, these brokers may neglect their support services, leading to frustrating experiences for traders seeking assistance.

Effective customer support is essential, particularly for novice traders who may need guidance and answers to their queries. Unregulated brokers may not prioritize this aspect, resulting in delayed or unsatisfactory responses to client concerns.

Poor Trading Conditions

Lastly, unregulated brokers frequently impose unfavorable trading conditions, such as high spreads, hidden fees, and limited trading options. These factors can erode potential profits and impede traders' performance.

Without regulatory oversight, traders have no assurance that the pricing and execution on these platforms are fair and competitive. Consequently, this can lead to negative trading experiences that ultimately deter individuals from participating in the market altogether.

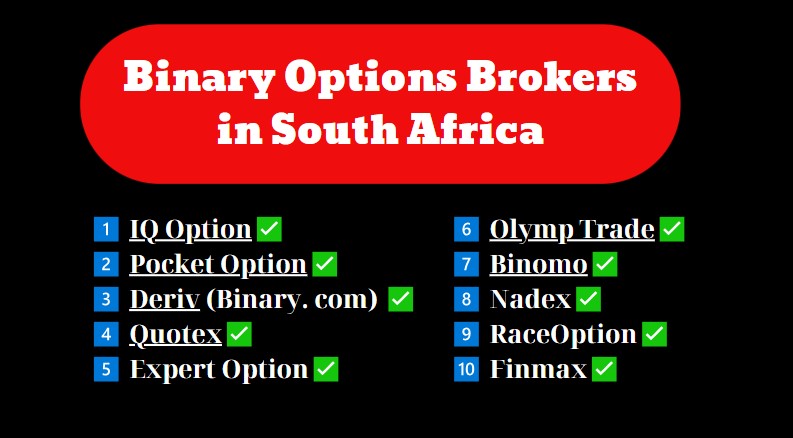

Comparing Pocket Option to Regulated Brokers in South Africa (Quotex, Binomo)

When evaluating Pocket Option in the context of regulated brokers available in South Africa, it is essential to consider alternatives like Quotex and Binomo, both of which claim to operate with a higher level of transparency and oversight.

Quotex: A Regulated Alternative

Quotex is a trading platform that boasts compliance with regulatory standards, offering a range of features designed to enhance the trading experience for users. Its regulation provides a sense of security, assuring traders that their funds are safeguarded.

One notable advantage of Quotex is its commitment to transparency in trading fees and conditions. This enables traders to clearly understand the costs associated with their trades and make informed decisions that align with their trading goals.

Additionally, Quotex offers responsive customer support, ensuring that users receive timely assistance when needed. This level of service is often lacking in unregulated platforms, making Quotex an appealing choice for those prioritizing reliability.

Binomo: Balancing Benefits and Drawbacks

Binomo is another trading platform that has gained traction among South African traders. It operates with a regulated framework and offers various educational resources for traders, making it suitable for both novices and experienced individuals.

Binomo's focus on user experience and support sets it apart from unregulated options. The platform provides tools that help traders improve their skills and knowledge, enabling them to make better-informed trading decisions.

However, it is crucial to note that while Binomo is regulated, traders should still conduct their own due diligence. Even regulated platforms can have limitations, so understanding the specifics of how each broker operates is essential.

Summary of Comparisons

When comparing Pocket Option with regulated brokers like Quotex and Binomo, the differences in security, transparency, and support become evident. While Pocket Option may offer attractive trading conditions, the lack of regulatory oversight poses considerable risks.

For South African traders, opting for a regulated broker not only enhances their trading experience but also mitigates risks associated with fraud and poor service. Thus, understanding the comparative advantages of different trading platforms is imperative in making educated decisions.

Finding Regulated Alternatives for Binary Options Trading in South Africa

In light of the risks presented by unregulated platforms like Pocket Option, finding regulated alternatives for binary options trading is paramount for South African investors.

Researching Reliable Brokers

Thorough research is the first step in identifying regulated binary options brokers in South Africa. Utilizing online resources, forums, and reviews can provide insight into the reputations of various platforms.

Look for brokers with clear regulatory credentials and positive feedback from existing users. Taking the time to read multiple sources can prevent unfortunate experiences and guide you toward reliable options.

Evaluating Features and Services

Once you have identified potential regulated brokers, assessing their features and services is essential. Consider aspects such as ease of use, trading tools, customer support, and educational resources available for traders.

A broker that provides a user-friendly interface, comprehensive educational materials, and responsive customer support can enhance your trading experience significantly. Evaluate these factors against your trading preferences and objectives.

Testing with Demo Accounts

Many regulated brokers offer demo accounts for prospective traders. These accounts allow you to practice trading strategies and familiarize yourself with the platform without risking real money.

Utilizing a demo account is an excellent way to gauge whether a broker aligns with your trading style. This hands-on approach can help you identify platforms that suit your needs effectively, paving the way for successful trading journeys.

⏩Trading on a demo account allows you to practice trading without risking any real money, helping you gain experience before switching to real money trading. 👉👉👉Open an Account link here👈👈 👈

South African Investor Protection and Pocket Option

Investors in South Africa benefit from various forms of protection designed to safeguard their interests. However, when using platforms like Pocket Option, these protections may not apply.

Local Consumer Protections

South Africa offers several investor protection mechanisms, primarily through the regulator FSCA. This authority seeks to promote fair treatment of consumers and maintain the integrity of financial markets.

Protection mechanisms available include compensation schemes and avenues for grievance redressal. These provisions enhance the overall safety of trading in regulated environments, but they are absent when dealing with unregulated brokers like Pocket Option.

Understanding the Limits of Global Regulation

While Pocket Option may be regulated under the IFMRRC, this level of oversight does not equate to the robust protections offered by stricter regulatory bodies. Traders must recognize that relying on global regulations can leave them vulnerable to issues that may arise during their trading activities.

As a South African trader, it is crucial to prioritize platforms that align with local regulatory standards to ensure that your interests are adequately protected.

Implications for Traders Using Pocket Option

Traders utilizing Pocket Option must be aware that they operate outside the protective framework established by South African authorities. In the event of disputes or issues with the platform, traders may find themselves without recourse to effective resolution mechanisms.

This situation underscores the importance of carefully considering the platforms you choose to engage with, particularly when trading high-risk instruments like binary options.

Due Diligence: How to Verify the Legitimacy of Online Brokers

Given the risks associated with trading unregulated brokers, conducting due diligence is essential for verifying the legitimacy of online trading platforms.

Checking Regulatory Credentials

Begin by checking the regulatory credentials of the broker in question. A legitimate broker will prominently display information about their licensing and regulatory authority on their website.

Take the initiative to verify these claims by visiting the official websites of regulatory bodies such as the FSCA or FCA. This verification process will help you confirm whether the broker is indeed authorized to operate in your jurisdiction.

Reading User Reviews and Testimonials

User experiences can provide invaluable insights into a broker’s legitimacy. Searching for reviews or testimonials from current or former clients can reveal potential red flags or highlight positive aspects of the broker.

While individual experiences may vary, consistent patterns in user reviews can offer a clearer picture of the broker's reliability. Be cautious of overly positive reviews that may seem contrived, and look for balanced feedback.

Testing Customer Support

Before committing to a broker, test their customer support services. Reach out with inquiries or requests for assistance to evaluate their responsiveness and willingness to provide support.

Reliable brokers will have a well-established support system in place, ready to address client concerns promptly. If your inquiries go unanswered or take too long to resolve, it is a potential indication that the broker may not be trustworthy.

The Future of Binary Options Regulation in South Africa and its Impact on Pocket Option

As the trading landscape evolves, so does the call for more structured regulations surrounding binary options trading in South Africa. This evolution could have significant implications for platforms like Pocket Option.

Growing Calls for Stricter Regulations

Regulatory bodies, industry experts, and traders alike have raised concerns about the challenges posed by unregulated platforms. Many experts advocate for enhanced regulations that can protect traders while fostering a sustainable trading environment.

Stricter regulations may involve implementing licensing requirements for binary options brokers, ensuring transparency, and establishing consumer protection guidelines. This shift could create a safer trading ecosystem for South African traders.

Potential Impact on Pocket Option

Should the proposed regulations materialize, platforms like Pocket Option may face increased scrutiny and pressure to comply with new rules. This development could either result in Pocket Option adjusting its operations to meet regulatory standards or withdrawing from the South African market altogether.

In either scenario, traders will be affected. Increased regulation may provide a safer trading environment for those engaged in binary options trading, but it might also limit the options available to traders who prefer less regulated platforms like Pocket Option.

Preparing for Change

As a trader, it is vital to stay informed about regulatory developments affecting your trading options. Following news related to trading regulations in South Africa will equip you with the knowledge necessary to navigate these changes effectively.

Being proactive in understanding the evolving regulatory landscape can help you make informed decisions and adapt your trading strategies accordingly.

Conclusion

In conclusion, the question "Is Pocket Option regulated in South Africa?" highlights serious considerations for traders contemplating their choices. The absence of regulation poses significant risks, underscoring the importance of selecting regulated brokers that offer security, transparency, and support.

Throughout this article, we examined various facets of financial regulation in South Africa, explored Pocket Option's licensing status, weighed the pros and cons of engaging with regulated versus unregulated brokers, and underscored the necessity of due diligence.

Ultimately, trading is a venture fraught with uncertainties, and understanding the role of regulation is paramount. By staying informed and opting for platforms that prioritize compliance, South African traders can enhance their chances for success and minimize the inherent risks associated with online trading.

💥Pocket Option👉Open Account or Visit website💥