FAST, FRIENDLY, FLEXIBLE FINANCING

Learn How Beacon’s Equipment Expertise Can Help Build the Perfect Financing Plan for Your Business

Learn How Beacon’s Equipment Expertise Can Help Build the Perfect Financing Plan for Your Business

Since 1990, Beacon Funding has been providing best in class equipment financing solutions for US businesses, just like yours. By specializing in niche equipment financing and partnering with industry equipment leaders, we can customize a financing plan that fits your needs.

What Makes Us a Trusted

• A+ reputation with Better Business Bureau

• Expert financing consultants

• On Glassdoor, 91% recommended Beacon

• 94% approve of Beacon’s CEO

• $1 billion in equipment financing

• 27,300+ deals approved

What sets us apart:

• 100% financing available

• 24-48 hour turnaround

• Competitive payment programs

• Strong vendor relationships

• Dedication to customer service

• Strong client and vendor reviews

We want your business to succeed, and you can count on Beacon Funding to guide you through the equipment financing process.

Conserve your cash for times when you need it most.

Avoid the rising cost of money, and lock in a low monthly payment.

We look at details other funding sources don’t consider, so your new business can get financing.

We finance a wide range of used equipment and trucks from both vendors and private party sellers. If you are in the process of looking for used equipment, we recommend starting at equipused.com.

Small businesses are the backbone of the US economy. That’s why we are dedicated to providing fast and friendly equipment financing. Businesses all over the country rely on Beacon Funding to help them achieve faster, affordable growth.

Most competitive option for your new business to acquire equipment.

Save bank borrowing options to support ongoing cash flow needs.

By establishing credit with Beacon, it will be easier to acquire your next piece of equipment.

Acquire equipment today without being subject to this year’s capital budget restrictions.

We recognize that not all businesses are the same. leasing programs are designed to ensure that you get the loan you need. Our flexible credit approval process means most companies will qualify for affordable tow truck financing. Need help finding a new truck? Check out what our partners at towtrucklocator.com and towforce.com have to

Are

Mention it when you apply with us! Beacon Funding can leverage your provider history to get you approved faster. Qualified roadside service providers also can earn up to $300 for each tow truck financed!

Pump up your business today by adding a new (or used) pumper or Beacon’s flexible financing plans make it possible to get exactly the truck you need without breaking the bank. Check out what our partners at pumper.com have to offer! We’re ready to get creative and develop a plan that works for your

Boom truck, bucket truck, utility truck, crane truck, cherry pickerwhatever you call it, we’ve got your back. Beacon Funding is here to provide boom truck financing to those who’ve been in the industry for years or just recently decided to get into business. Get your loan in as little as 24-48 hours.

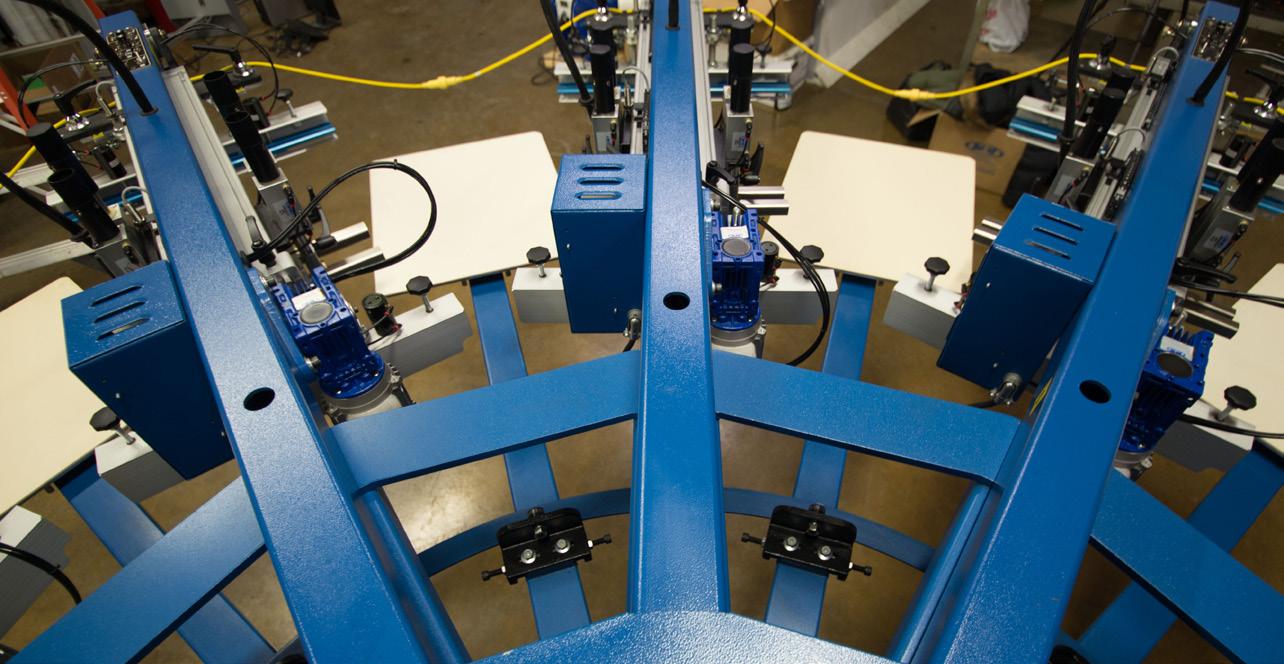

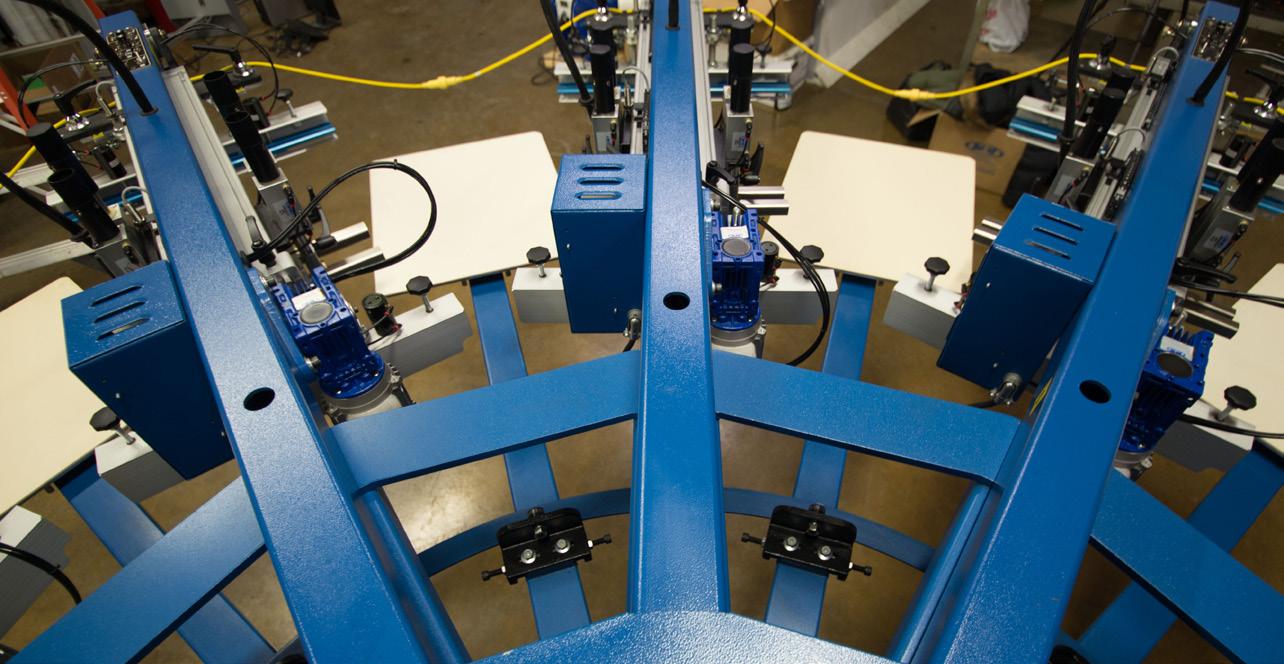

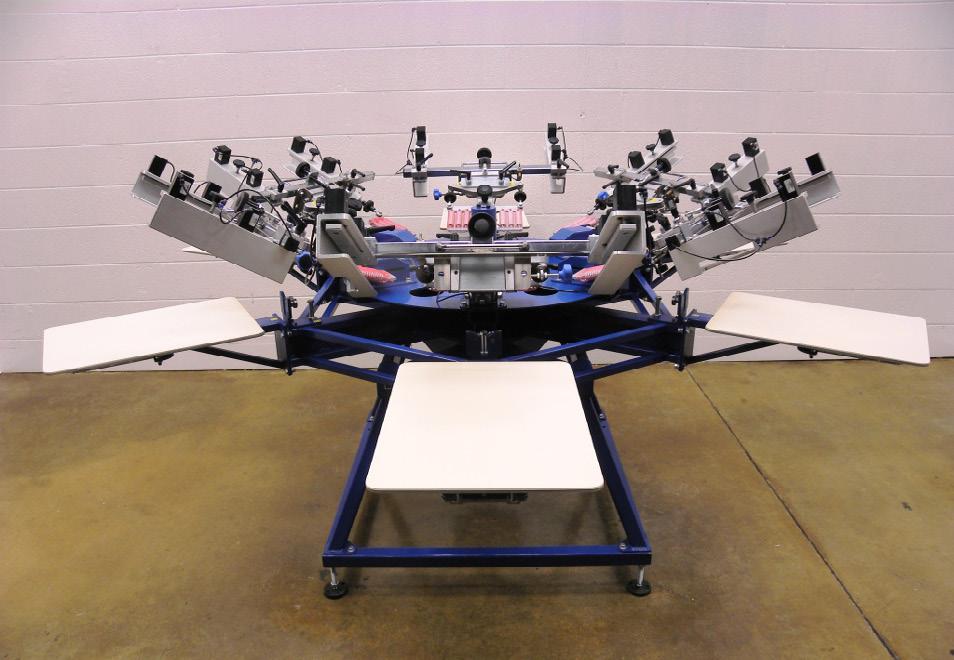

Beacon Funding helps small businesses get the screen printing equipment they need though our fast and flexible financing options. Whether you need manual or automatic screen presses or folding and packaging machines, Beacon can help you finance it.

An additional single-head or multi-head embroiderery machine can make a big impact in your business’ productivity. Crank out more designs than ever before with more machines – and Beacon can help you afford it. We have a variety of financing options that can be customized towork for you and your business.

Afford the landscaping trucks or equipment your business needs to reach new heights with our flexible financing programs. Big or small, new or used we’re ready to help you fit it into your budget with low monthly payments.

Our Lease-to-Own Program is similar to a capital lease, and is an ideal option for those businesses that prefer long-term ownership of their equipment. You simply make low monthly payments over the agreed-upon life of your lease. Once you’ve reached the end of your lease, and you’ve paid it off, you’ll own your equipment. That’s it! It really is that simple.

If a lease doesn’t suit your business, an Equipment Financing Agreement could be a good alternative for you. For some businesses, the EFA insurance, title, and tax processes might be easier. Talk to a financing consultant to see if an EFA is right for your business.

Traditional lenders often disregard a young business. With our deep understanding of equipment, we’re more than willing to provide financing to a start-up business looking to invest in the equipment we know and love. To approve more young businesses, we consider various factors such as personal pay history, collateral value, and industry experience.

Our Pre-Approval Program allows you to apply for financing prior to picking the actual equipment. With no cost and no commitment - a pre-approval is a great way to learn what equipment you can afford! Simply fill out our quick application online to get started! Learn your maximum lease amount and terms, monthly payment estimate, whether any down payment is required, end-of-lease options, and more.

Qualify for a loan of up to 60-90% of the value of your equipment. Receive funds in 3-5 business days! Sell your equipment to Beacon Funding and let us lease it back over a period of time. You get the cash from the sale to use for a variety of business needs, while retaining the use of your equipment. Then you reclaim ownership at the end of the lease term.

Apply today and you may qualify for up to 8%* of your annual revenue and receive funds the very same day you apply. No equipment leasing or financing agreement is necessary for this type of loan. You can then use your working capital loan for a variety of needs, anything from equipment soft costs, warranties, or payroll shortages.

Beacon attends industry trade shows across the United States to offer businesses one-on-one equipment financing guidance. Are you curious about what financing options are available to your business? Come and meet us at our next tradeshow and get your answers in person.

See what shows we will be attending in your area by visiting us at: Beaconfunding.com/events

Our financing reps are some of the friendliest and most knowledgeable people around. They attend shows because they want to answer your questions and learn how to help your business.

As you are researching the latest equipment at a local tradeshow, remember that Beacon Funding can help you afford the newest technology for a low monthly payment. Since we have funded thousands of equipment transactions, we may be able to connect you with some of the industry’s best equipment sales organizations and representatives at the show.

We make applying easy by offering multiple ways to apply: online, by phone, and in person. Get help with your application by visiting our booth. We’ll walk you through the application process and answer questions you have along the way.

Visit our booth and get entered to win free prizes. Whether it is a Yeti cooler, Amazon gift card or the latest Beacon swag, we love to give away fun gifts and prizes to our valued business clients and prospects.

A variety of customers come to us with different equipment needs and business dreams. It’s our job to help turn those dreams into reality with equipment financing. Read some standout stories below or watch full videos online at beaconfunding.com/testimonials.

We wouldn’t have been able to do most of the jobs we do without the new equipment we financed, the sign boom truck. It’s the Rolls Royce of the sign industry.

-CHRIS WICKS, GLOBAL SIGN & AWNING

Having the equipment on the floor and paying for it in increments is worth a lot more than just upfront cash, a big expenditure, and a hole in your balance sheet.

-BRYAN HUBER, ICON SCREENING, INC

We would not have been able to create a new revenue stream if we hadn’t made those improvements by purchasing this equipment and working with Beacon Funding.

-ELIJAH TAYLOR, LEA COUNTY SEPTIC

After being rejected by other lenders, my consultant at Beacon Funding figured out how to do it all. I’m able to provide a better service for my customers, and take on a whole new genre of work.

-DAVE SANDEL, SANDEL CRANES

Beacon Funding helped me get my new Hirsch embroidery machine fast and at an affordable monthly payment for my in-home business. they came through when no other lenders would.

-SYDNEY ALLEN, STORYBOOK BLANKIE, LLC

Financing helped us grow. We have newer, more reliable equipment. We are able to take on bigger jobs; go on more runs; fill the customers’ needs. No need to worry about break downs.

-ALLAN BENIEN, BRETT’S TOWING & REPAIR

1

Apply online in minutes at beaconfunding.com/apply-now

You can also apply via:

Phone: (847) 897-2499

Email: sales@beaconfunding.com

Our process is 100% digital. Securely share your bank statements online in seconds using DecisionLogic®. 2

During a call, we’ll discuss your equipment financing goals to build the right plan for your situation. 3

If you’re approved, we’ll send over your agreement through DocuSign®. Accept and sign with the click of a button! 4

Once it arrives, let us know! After you have provided us with a verbal confirmation, you’re all set and the vendor gets paid! 5

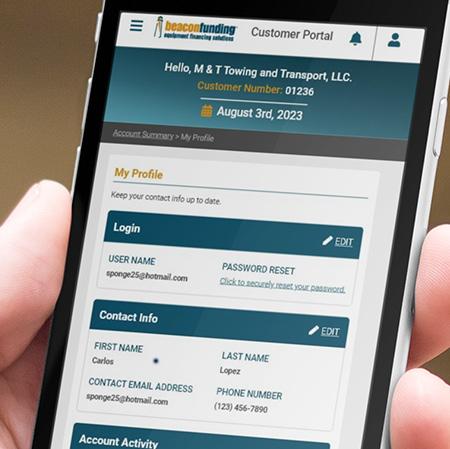

Manage your account all in one place! Login to easily view your current charges, statements, and securely pay past due payments.

Safe & Secure

Customer information is encrypted & protected.

Convenient

Access it from your computer, tablet, or mobile phone.