6 minute read

Is Your Dealership at Risk?

Is Your Dealership at Risk for a Credit Card and Cybersecurity Breach?

DANNY TIMMINS, CISSP

Advertisement

Today’s auto dealerships have raised the bar when it comes to prioritizing customer convenience and elevating the shopping experience. Whether it’s on-site coffee and snack bars, pick-up and drop-off concierge service or extended test drives, dealerships are constantly vying to stand out from each other in the competition for market share.

When it comes to research and shopping for new vehicles, sophisticated websites are also vastly more functional than they were just a few years ago. Dealers can now show new or used car inventory in real time and even allow customers to pre-fill loan applications or place deposits on vehicles before they even set foot in a showroom.

While convenient, the continuing integration of customer and financial systems also means more third parties are able to interact with both the customer’s personal information and valuable payment card data—and that increases the risk of a data breach.

Know where you’re vulnerable While newer technologies have ways of deflecting cyber fraud and theft, third-party or supply chain attacks are more widespread than ever as cyber criminals acquire more sophisticated tools and techniques to sidestep enterprise security.

Dealerships’ IT departments and outsourced IT third parties must be even more vigilant about protecting customers’ personal data.

Cheers to the 100th Anniversary of the Vancouver Auto Show. Drinks are on us!

MNP is proud to be the Beverage Sponsor of the 2020 Unveiled Autoshow Gala on March 25, 2020. As business advisors to more than 140 auto dealerships in B.C., MNP understands the specific demands and opportunities of the automotive industry. Let us help you to increase your profitability while mitigating your risks in this increasingly challenging market.

To learn how we can help you deliver performance - drive results and more success, contact Chris Schaufele today at chris.schaufele@mnp.ca or 604.536.7614

Chris Schaufele, CPA, CA

Partner, Automotive & Assurance Services MNP Surrey

Dan Lock, CPA, CA

Partner, Automotive & Assurance Services MNP Port Moody

Ryan Gorder, CPA, CA

Partner, Automotive & Assurance Services MNP Port Moody

What else is at risk? In addition to e-commerce transactions, your dealership has numerous payment touchpoints with clients, such as multiple credit card terminals in the business office, service department and sales department.

Customer Relationship Management tools (CRMs) and Dealership Management Systems (DMSs) such as DealerSocket and CDK contain highly sensitive customer data and each could potentially lead to a costly breach. With the risk to personal financial information, organizational data and your company’s reputation, you need to trust that each of those systems is as secure as possible.

What should you be aware of?

Payment Card Industry Data Security Standard (PCI DSS) Are you PCI compliant? PCI DSS requirements are intended to ensure any organization that processes, stores or transmits credit card information protects customers’ card data against fraud through robust payment security. The PCI Security Standards Council can impose fines and stop businesses which fail to meet the standards from processing payments.

Canada’s Personal Information Protection and Electronic Documents Act (PIPEDA) PIPEDA is the federal privacy law which sets out rules for how businesses must handle personal information. Failing to meet these rigorous standards can result in severe fines of up to $100,000 per offence.

Growing Risk of Civil Litigation and Reputation Harm Businesses must also weigh the risk and potential consequences of increased lawsuits and class action claims resulting from breaches. Not only do these have significant financial costs, but the reputation damage could also be difficult, if not impossible, to recover from.

How MNP can help MNP has more than 20 years of cyber security experience and possesses the practical insight, certifications and know-how to help your dealership with any of these challenges. Our team is PCI certified by the PCI Security Standards Council as an Authorized Scanning Vendor (PCI ASV) and Qualified Security Assessor (QSA)—among numerous other industry-specific designations.

Protect your customers, protect your operations, protect your revenue—beginning today.

Danny Timmins, CISSP, is the National Cyber Security Leader at national accounting, tax and business consulting firm, MNP. He has more than 20 years of experience developing effective, client-focused digital security solutions for a wide range of clients and industries. To learn more, you can reach him at danny.timmins@mnp.ca

LEARN STUFF AND GET REWARDED.

SiriusXM has launched an incentive-based program that is a quick, entertaining and easy way to learn about our service and how to amplify your customers’ experience. Go to sxmdealer.ca/training today to register. With the completion of each module, you will get 90 days of streaming on the SiriusXM app. There’s always something good on!

DRIVING INSIGHTS | Win the Trade Today and a Customer for Tomorrow

DREW HARDEN, MANAGER, RESEARCH & INSIGHTS AT CARFAX CANADA

Have you ever heard of someone winning a deal and losing a customer at the same time? Winning a trade today is great, but the business of selling cars and getting great trades is quickly becoming more competitive. So how can you create a trade-in process that not only wins deals today, but makes that customer excited to come back next time?

Canadians don’t love the trade-in process Among Canadian used-car buyers who traded in a vehicle, only 64 per cent said their trade-in experience was good or excellent; this is just barely better than their feelings about the negotiation process, which is rated as the worst part of buying a used vehicle. Improving the trade-in process so it wins cars and creates an excellent experience will not only help you sell more today, it will help bring in more customers tomorrow through referrals, reviews and repeat business.

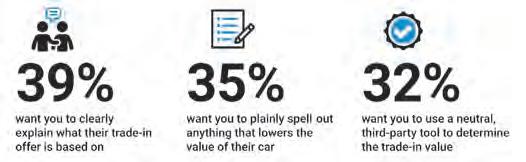

What used car buyers wish you would do Improving the trade-in process is all about justifying how your price was determined, then doubling down on that justification. We asked used-car buyers, including those who didn’t consider a trade, how the experience could be improved in the future. Thirty-nine per cent of buyers told us they want you to clearly explain what their trade-in offer is based on (e.g., auction values, comparable sales), while 35 per cent want you to plainly spell out anything that lowers the value of their car (e.g., tires need to be replaced,

want you to clearly explain what their trade-in offer is based on want you to plainly spell out anything that lowers the value of their car

want you to use a neutral, third-party tool to determine the trade-in value

dents need to be fixed). Finally, 32 per cent want some external validation and would like to see you use a neutral, third-party tool to generate the trade-in value, to help reinforce your offer.

Justifying your offer is time well spent By justifying trade-in offers, you can create a process that keeps customers coming back. Not only do customers want this going forward, it’s already working for dealers who are doing it now. Used-car buyers who go through a trade-in process today that includes a vehicle history report, a valuation tool from a third-party service, and/or the sales person showing comparable vehicles, are more satisfied with the trade-in process than average.

More leads. More trades. More inventory.

The CARFAX Canada Vehicle Trade-in Widget provides realistic trade-in values from a trusted third-party, helping drive quality leads from your website to your dealership.

Learn more at go.carfax.ca/leads

Start Over

Français

2016 Ford Escape Titanium typically trades for:

$14,764

If you want to consider trading in, <Dealership Name> values your car at:

(Average Trade-In Price)

(Average Tax Savings)

$19,129

$16,593 $2,157

* $18,750

* This is not an offer to purchase your vehicle. All values are provided by CARFAX Canada from actual transactions of vehicles just like yours. Final trade-in value adjustments will be made by the dealership after an inspection of your vehicle including an assessment of current condition, previous history, and odometer readings.