1 minute read

Hidden Figures

from Q2 2023 Commentary

by bayntree

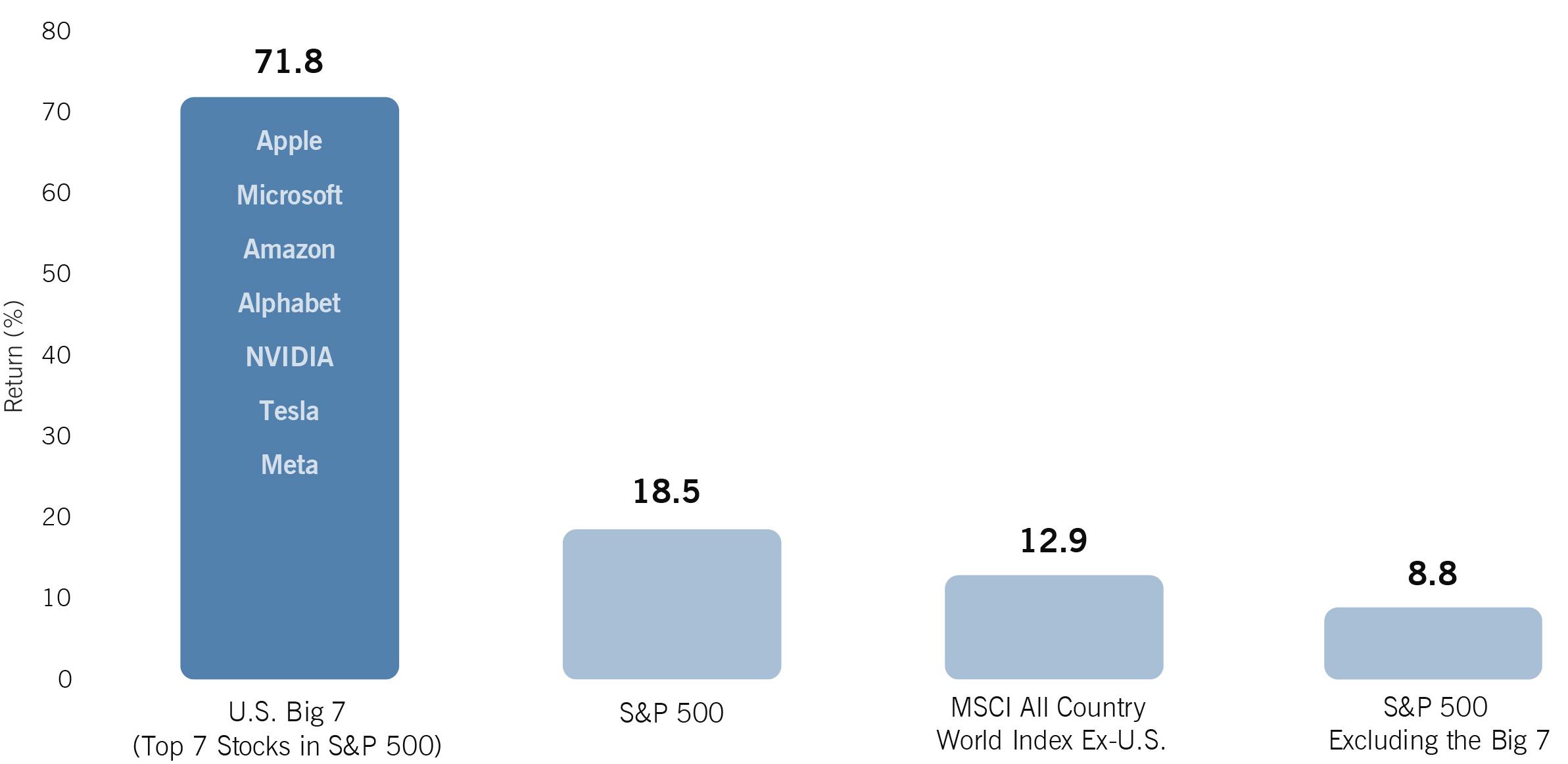

A large portion of the equity rally has been led by only a handful of mega-cap tech stocks, which is quite intriguing given the backdrop of rising interest rates. Normally, such rate increases are considered unfavorable for these longduration assets. This recent market phenomenon certainly raises questions about the sustainability of the rally.

While mega-cap tech stocks flourished, a significant portion of the market, represented by the remaining 493 stocks, failed to see the same success. Some of these companies have even struggled to outperform their international counterparts. This divergence in performance highlights the challenges still faced by many smaller companies in the current environment.

Advertisement

Investors often are concerned when valuations are stretched beyond what their underlying fundamentals may justify, and this rally is no exception. The concentration in the S&P 500 Index has reached alarming levels to where just five stocks account for approximately 25% of the entire index’s value. This marks the highest level since 2020 and surpasses the concentration during the Tech Bubble which was at 18%. The combination of stretched valuations and top heaviness adds an extra layer of risk to the current rally. As these few stocks have propelled the market upwards, any reversal could lead to a downturn, crashing the market as fast as it rallied.