8 minute read

Modifying down child and spousal support obligation after a divorce

Barrister’s Corner

DIVORCED parties are sometimes ordered to pay child support and spousal support in the divorce judgment. The support orders are generally based on the parties’ financial situation and custody arrangements at the time of the settlement or trial. However, what if your income decreases after the divorce or what if your spouse’s income increases after the divorce due to a promotion or a better paying job? Do you have the right to modify your support obligation?

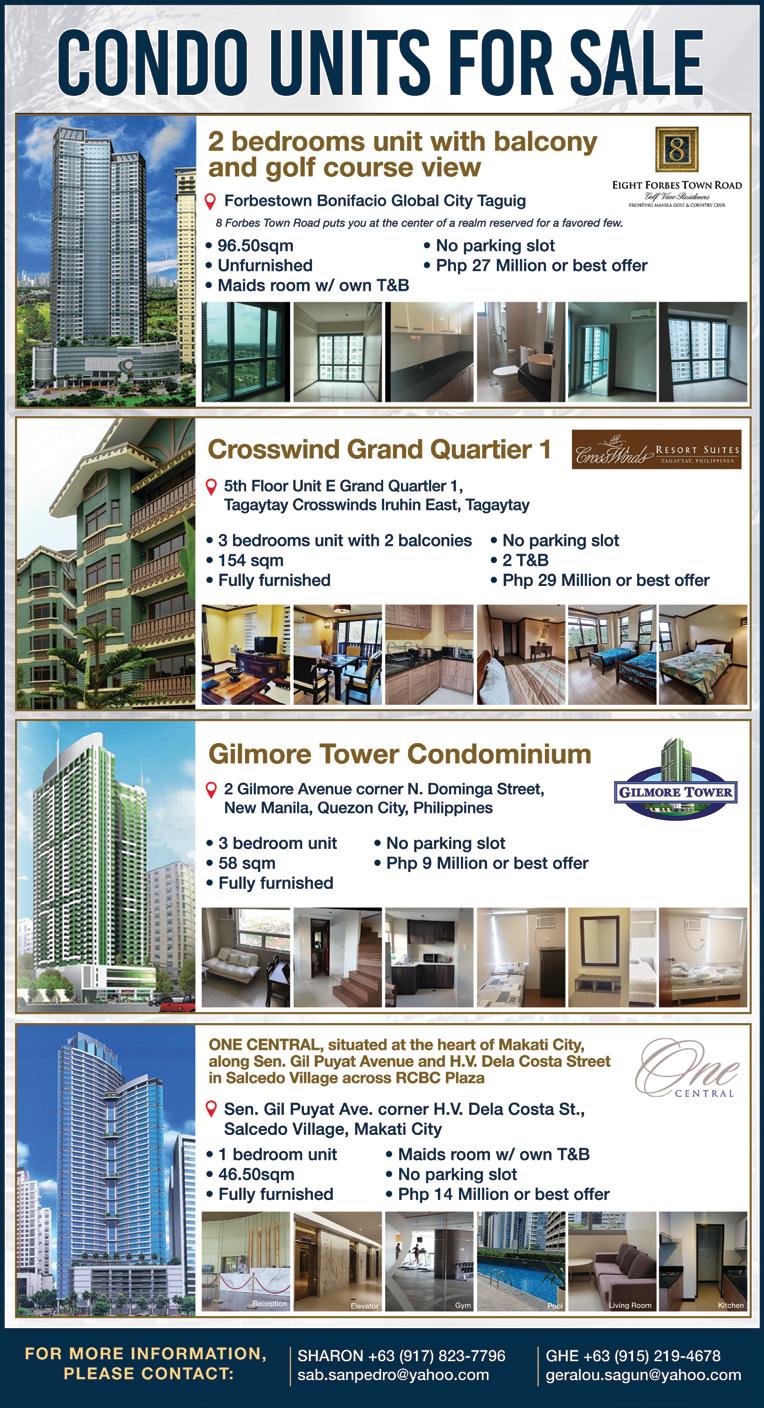

Advertisement

If your income has gone down substantially from the time that the child or spousal support determination, you may be able to file a modification of your support obligation. Losing a job or having less income constitutes a material change of circumstances that would allow the court to modify down your support obligations.

Child support in California is based on guideline formula.

One of the factors that is considered in the guideline formula is your gross income. Usually the court would look at several months or even an average of the last 12 months income. If your average income has decreased, you may be able to modify your child support to a lower amount. Bear in mind that there are other factors that come in the equation such as the amount of actual timeshare you spend with your child and the income of the other parent. If the other parent’s income has gone down, this may adversely affect your child support obligation.

Spousal support may also be modified unless you stipulated in a divorce judgment that it is non modifiable. However, spousal support are usually calculated differently than guideline. The court will look at other factors in deciding whether to modify this. Those factors are listed in family code section 4320.

If you are unemployed, the other party may be expected to try to impute income on you. However in light of the recent cases in California, they would have to prove that you had the ability and the opportunity to obtain employment.

If your income has gone down or your spouse’s income has increased as a result of a new job, a promotion, or you got laid off or hours cut, it may be possible to modify both your child support and spousal support obligation. Without modifying the order, the current order will continue to be in

What is the purpose of bankruptcy law?

effect and the same amount will accrue regardless of whether your income declined or your spouse income increased. It is important to file a post judgment request for order to modify support as soon as your financial situation changes.

* * * Please note that this article is not legal advice and is not intended as legal advice. The article is intended to provide only general, non-specific legal information. This article is not intended to cover all the issues related to the topic discussed. The specific facts that apply to your matter may make the outcome different than would be anticipated by you. This article does create any attorney client relationship between you and the Law Offices of Kenneth U. Reyes, APLC This article is not a solicitation.

* * * Attorney Kenneth Ursua Reyes is a Certified Family Law Specialist. He was President of the Philippine American Bar Association. He is a member of both the Family law section and Immigration law section of the Los Angeles County Bar Association. He is a graduate of Southwestern University Law School in Los Angeles and California State University, San Bernardino School of Business Administration. He has extensive CPA experience prior to law practice. LAW OFFICES OF KENNETH REYES, APLC. is located at 3699 Wilshire Blvd., Suite 747, Los Angeles, CA, 90010. Tel. (213) 388-1611 or e-mail kenneth@kenreyeslaw.com or visit our website at Kenreyeslaw.com. (Advertising Supplement)

Debt Relief

Atty. LAwrence yAng

THE highest profile cases of bankruptcy filings are Walt Disney, Milton Hershey, Orange County, a certain Catholic diocese in the USA that was hit by the child molestation cases, the bankruptcy filings of the Trump companies during the 90s wiping out billions of debt, Toys R Us, Hertz car rentals, among many others.

A distinction can be made between individual bankruptcies as in the person Walt Disney, and the person Milton Hershey who both filed personal Chapter 7 cases, with Mr. Disney filing twice, and Mr. Hershey filing Chapter 7 once, before their businesses became wildly successful and making them both billionaires subsequently, and entity or business filings as in Orange County, the Catholic church dioceses, Hertz car rentals, and the Trump companies.

Why did the Constitution of the United States specifically authorize congress to enact bankruptcy law?

The United States Supreme Court has time and again stated that the primary policy of bankruptcy law is to give consumer debtors a “fresh start” by discharging their debt.

In the case of businesses, the policy is almost the same; that is, the purpose of bankruptcy law is to give the business a chance to start again by discharging their debt. Of course in the case of businesses, the owners of the business, the stockholders bear the brunt of the loss after creditors are paid under a bankruptcy liquidation or reorganization. In the case of Hertz — which already had financial problems before the pandemic struck, due to its large debt of $19B that it was having a hard time paying — had its stock price drop from about $100 in 2014, to $15 just before the pandemic hit in late 2019, and dropping rock bottom to $1 when it filed for bankruptcy reorganization in the middle of 2020. So, stockholders who did not sell at the peak in 2014, saw their shares of the company drop to almost zero when it filed for bankruptcy.

Because the court approved its bankruptcy reorganization plan, the company exited bankruptcy in late 2021. So those who bought at $1 have already been rewarded with a six times return on the investment of $1 that is now $6. Certainly, the plan would pay something to creditors but not $19B, most likely a portion of that, maybe 20%. Hertz came out of bankruptcy as a much lighter company with very manageable debt and become a productive business again, able to bring in good profits as travel business continue to recover with the virus totally under control.

The “fresh start” is accomplished by allowing debtors to keep most if not all their assets through a system of exemptions provided by federal or state law, while discharge all debts, which are dischargeable. A debt is dischargeable in bankruptcy if it is not excepted from discharge. If it is not excepted, then it is discharged.

The exceptions to discharge are limited and clearly stated in the bankruptcy code. For example, a debt obtained by fraud is not dischargeable. So if you obtained a credit line of $1M from the bank by falsely claiming that your business sells $10M a year and it is later discovered that the sales figure is grossly inflated — as proven by the significant absence of the necessary inventory in the warehouse stated in the financial statements submitted to the bank when applying for the loan — then that credit line of $1M is not dischargeable because of fraud.

Another example is a debt owed because you killed someone because of your negligence. You made an illegal U turn, which caused an accident that killed someone. The deceased left a wife and two kids who sued you the death of her husband and their father. They were able to get a judgment against you for $3M. That $3M judgment is not dischargeble. Or, let’s say you’re the pilot who flew the helicopter that crashed and killed Kobe and his daughter. There is a judgment against you for $10M. That judgment is not dischargeable.

All debts are dischargeable unless excepted. Thus, if you owe $280,000 of credit cards and $5M of bank loans that you guaranteed for your business, all of that $5.280M is dischargeable when you file Chapter 7. How do you get a fresh start? Let’s say you own a house in LA with equity of $400,000, a retirement account of $500,000, two nice cars which you are still paying for, all the furniture in your house (assuming these are normal stuff, not like a concert piano worth $100,000), you get to keep all of these assets while getting rid of all of your debt of $5.280M.

So you get to keep all your assets, which are worth $900,000 while you wipe out all of your unsecured debt of $5.280M. That’s how you get a fresh start in life. Let’s say your income as an executive is $90,000 a year, you still keep that income which is protected by law so your creditors can’t touch it. You still keep your two cars as long as you keep on making the car payments on time. You get a fresh start because you don’t have to worry about the $5.280M of creditors hounding you day and night, suing you and threatening to put a lien on your house and garnish your wages.

You just flush the $5.280M of debt down the drain and don’t have to worry about them anymore for the rest of your life, but you still own your house, your retirement account, your furniture, your cars, just about all of what you own, including your salary. Isn’t that great? It sure is.

In other countries, you lose everything when you declare bankruptcy. Here in the good old USA, you get a “fresh start,” without accumulated debt and keep most if not everything you own. It’s the best bankruptcy law in the planet that favors debtors over creditors, just so debtors can have a “fresh start” in life without accumulated and debilitating debt. It’s literally a resurrection after financial death, a new life with all your assets intact without debt. What more can anybody ask for?

Just ask Walt Disney and Milton Hershey. Mr. Disney filed for Chapter 7 twice then his Disney business became a global success making him a billionaire. Mr. Hershey filed once, then his business became the biggest global chocolate business making him a billionaire. Bankruptcy law in the USA is a blessing indeed!

Without it, we won’t have Disneyland to go to, and we won’t have Hershey chocolate bars to enjoy. Both these business were made possible and came to fruition because of bankruptcy law. And the next time you rent a car from Hertz, you can thank bankruptcy law for its resurrection.

If you have too much debt and need relief, please set an appointment to see me. I will analyze your case personally.

* recommend. Our celebrity endorser, veteran actress Hilda Koronel is in her 60s now yet she looks amazing like in she’s in her 50s. We applied the 10-years-younger protocol on her and one of the treatment we used is the Sculptra treatment. You would notice the texture of her skin is more contoured and natural looking. She has been one of our faithful supporters and a true epitome of one who ages gracefully in all aspects. miskinmedspa. *

* * Disclaimer: None of the foregoing is considered legal advice for anyone. Each case is different. There is no absolutely no attorney client relationship established by reading this article.

* * * Lawrence Bautista Yang specializes in Bankruptcy, Business, Real Estate and Civil Litigation and has successfully represented more than five thousand clients in California. Please call Angie, Barbara or Jess at (626) 2841142 for an appointment at 20274 Carrey Road, Walnut, CA 91789 or 1000 S. Fremont Ave., Mailstop 58, Building A-10 South Suite 10042, Alhambra, CA 91803.

To our readers, you are more than welcome to our iSkin location if you are in LA area; and if you happen to be in the Inland Empire and Orange County, we have MiSkin Spa for you self-love and self-pampering needs.

For more information go to iskinbeverlyhills.com.

Visit iSkin Med Spa and MiSkin MedSpa for a free consultation. iSkin is located at 8665 Wiltshire Blvd penthouse Beverly Hills,90211 or call 424-382-1002.