17 minute read

LEADERSHIP

from Ratchet+Wrench - May 2021

by EndeavorBusinessMedia-VehicleRepairGroup

Tackling the Tough Conversations

BY PAUL HODOWANIC

Communication can be one of the

hardest things we do. It’s often uncomfortable and no matter how wellversed we are at it, we often fail to get our message right.

As a shop owner, having uncomfortable conversations is required, whether you like it or not. Everyone has had an employee that’s shown up late one too many times, isn’t following the sales script, or likes to turn a 30-minute lunch break into an afternoon off.

But for many owners, broaching that conversation is anxiety-inducing, says Maylan Newton, the founder of Educational Seminars Institute, which provides management and personnel coaching to the automotive industry. They’re trying to avoid the situation getting worse or they’re worried if they fire the employee, they’ll hire someone worse.

For Matt Overbeck, owner of Overbeck Auto Services in Cincinnati, Ohio, the process of letting go of a long-term employee was filled with indecision and fear.

A relationship with one of his top employees turned sour after starting out as a major success. Overbeck grappled with the decision for a long time and it hurt his business. It took a lot of coaxing before he finally let the employee go.

So how can you avoid these long, drawnout, painful scenarios? Ratchet+Wrench has your guide to addressing uncomfortable topics with employees that will stop problems in their tracks.

Start small, immediately.

It took Overbeck a long time to finally confront his employee. For much of the employee’s six-year run, things were fine.

Overbeck took over the day-to-day operations of the shop in 2013 after his father’s health took a turn for the worse. He

was never the type of person who liked to be at the front counter working with the customers, so he hired this employee to do it for him.

Immediately revenue climbed and the new employee was a big reason why, Overbeck says.

But as the years passed, Overbeck slowly learned how to run a shop and started to see the limitations of his business. It needed to become more modern, but the employee wasn’t willing.

Slowly the shop’s success dwindled. Then COVID hit and things took a turn for the worse. Not only was the shop faltering, but Overbeck was struggling personally. He was mentally and physically drained. He was gaining weight and he couldn’t sleep.

Don’t let the situation get out of hand like it did for Overbeck.

“Start with lots of little, easy conversations before you ever have to have a big, difficult discussion,” he says reflecting on his situation. It’s what he didn’t do and felt was one of the biggest reasons the situation spiraled.

Overbeck didn’t initially confront the employee about any of the issues that bothered him. That allowed the employee to believe his pattern of behavior was acceptable. He could take off from work early and criticize the shop’s strategies without any thought of repercussions.

Newton sees situations like Overbeck’s all the time. “Most people don’t have that first conversation,” he says. That leads to a pattern of behavior that is hard to break later on.

Newton recommends having a conversation immediately after the first subordinate action. If an employee comes in late, talk to him or her upon arrival. Ask why he or she is late and reiterate your expectations.

If it happens a second time, follow the same process. Ask how you can help him or her be on time. Work with the employee, but don’t change expectations. If you allow him or her to come in 30 minutes late, chances are that in a month, that start time will be missed, too.

“Don’t put your blinders on. When you see stuff you don’t like, talk about it. Don’t let it go,” Overbeck says.

Prioritize consistent conversation.

After Overbeck let the employee go, he brought the rest of his team together to share the news.

“Thank you,” Overbeck recalls his best technician saying.

As a shop owner, if you are feeling the effects of one employee’s actions, there’s a great chance other employees feel the same way. And if the employees are feeling it, the customers are too.

Overbeck thought he had an open line of communication with all of his employees, but this incident made him question it. Nobody said anything. They didn’t feel it was their place.

Newton suggests meeting with every employee once per month for a check-in. Employees can voice their concerns about how things are going and this gives you a natural opportunity to remind them of what they’re doing well and not doing well. Be clear and concise. Make yourself accountable, as well. Create a space where they can be constructive about how you can do better.

It also helps develop a connection between you and your employees. If they feel comfortable with you, they’ll be more likely to bring up issues happening throughout the shop and will feel a greater sense of responsibility to meet all the requirements you set out for them.

“Employees are like relationships,” Newton says. “You need to nurture them with good communication or they'll deteriorate. It has to be consistent.”

Don’t be fearful.

We tolerate missed behavior because of fear, Newton says.

Whether we’re worried about escalating the situation or that we could hire someone worse than what we currently have, that fear holds us back.

Overbeck could barely make it through a day at the shop in the months leading up to the firing. But even as his personal and professional life deteriorated, he was petrified to have an uncomfortable conversation.

It took a webinar call with Shop Fix Academy’s Aaron Stokes, in which another shop owner brought up a similar situation for something to change. That shop owner let go of his employee and saw everything change for the better.

That flipped a switch in Overbeck’s mind. The next day he sat the employee down and let him go.

When Newton is working with clients, the first thing he tells them is that the success of their business does not hinge on one person. Their business is more important than their relationship with one employee or the potential awkwardness that an uncomfortable conversation might induce.

Don’t let the shortcomings of one employee create an environment where others are discouraged or see it as acceptable behavior.

Training for Financial Success

Tips to help your techs save

BY PAUL HODOWANIC

For many of your employees, investing in a 401(k) may be an afterthought. They may have never created a budget, or invested in the stock market, or even checked their credit score.

As shop owners, it can be a valueadded bonus to be a resource to your employees when it comes to their personal finances.

For Brandon Harrell, co-owner of Harrell’s Automotive in Fayetteville, N.C., being an outlet for his employees and their finances has always been important to him. He went to college to become a financial planner and only after he graduated did he decide to come back home and run a shop.

Harrell not only sees it as the right thing to do, but also as an asset for the business.

“I don’t want to be like everybody else. I want a waiting list of people who want to come work for us,” Harrell says. “So we have to create that environment. It’s not just about a place where you can come turn wrenches, it’s got to be the total picture.”

So, what can you do to become a financial resource to your employees?

Provide ample education.

The most important thing you can do to help is educate them, says John Waters, president of Water Business Consulting. Make your employees aware of the benefits that saving or investing can have. Many of your employees aren’t going to come with backgrounds in money management. So the first step in the right direction is making them aware of what is possible.

Harrell has used that financial background to benefit his shop, but also to benefit his employees. Educating them on

how to manage their finances is a big part of his job and one he doesn’t take lightly.

Harrell tries to be a buffer for their success, pushing them in the right direction and getting them in contact with the professionals that will best know how to assist them.

Harrell regularly brings in a representative from a local bank to talk to his employees about different strategies for managing their money. He encourages the employees to ask any questions they have, whether it’s refinancing a mortgage, planning for retirement or how to pay off loans. He also sets up online informational classes through their local bank that his employees can take.

While Harrell admits many of his employees think financial planning is “for the birds,” at the very least it plants a seed in their heads that hopefully they will come back to later on. And for the employees that do use the resources, Harrell has seen the positive impact it has had on them.

Waters finds the “for the birds” mentality to be one of the biggest barriers to overcome with young people in the industry. The idea that they always have time later in life to save is one he tries to crack down on.

Saving, in any amount, should be done as early as possible. The earlier you start, the more time you allow the money to grow interest. It also helps establish a mindset, Waters says. If employees allow themselves to think that there will always be time to save later, the likelihood of them continuing to put it off until it is too late is very high. If they start early, it will become a routine.

It all comes down to education. Commit the energy and time that is needed to teach your employees the basics of personal finance. That will increase the chances that they start saving in their 20s and not their 50s.

Start simple.

There are quick and easy habits to help get your employees up to speed, Waters says. The first is helping them create a budget. This can be a fast and simple way to help employees understand how they are spending their money. It can also show them the small expenses they can cut from their lives that can help them save.

One of the biggest mistakes Waters sees in young employees, in the auto industry and in every industry, is thinking they don't have enough money to start saving. But Waters says practically everyone can find something to save, even if it’s just $50 per month. Creating a budget and tracking expenses is the easiest way to understand that there is room for saving.

Another tip is to support automatic deposits. Whether that’s setting up their 401(k) or simply setting aside money that will go directly into a savings account, if it goes directly into an account rather than manually, it decreases the temptation to spend the money on something else.

Finally, encourage your employees to be curious. There are so many free tools available online to help educate about savings and how to start, Waters says. employees and talk with them about any financial questions they have. With his background coming in finance he’s got lots of knowledge to share, but he’s careful about the ways he does it. Because the last thing he wants is to have it turn back on himself.

“We don’t want to end up with fiduciary responsibility if we give them bad advice. So it’s a fine line you have to walk.”

If the employee needs help creating a budget for his or her family, Harrell is there to help. If they need advice on how to boost their credit score, he’s ready to share his expertise. But if they want advice on different mortgages or what stocks to invest in, that’s when he steps away.

That’s a big reason why Harrell brings in the local bank. He’s a conduit between his employees and bigger financial institutions.

Help with accountability.

Creating a plan is easy. Following through is where it gets hard. That’s why Waters recommends checking up with your employees to see how they are doing with their finances. If you helped create a budget with an employee six months ago, have a follow-up meeting to see if he or she has followed it. If he or she was saving up to buy new tools, check and see his or her progress.

With any goal or plan in life, having someone close to you that you know will hold you accountable is important. It minimizes the temptation to quit because someone will be checking on you. Be that resource for your employees. Help them stay committed to their financial goals.

MAKE T O WIN G WORK

A 20-year towing pro shares how he’s kept his program growing and profitable

BY MEGAN GOSCH

BOB’S MAIN STREET AUTO & TOWING INC.

Owners: Bill and Laurie Rate

Location: 2 locations in West Bend, Wis. Size: 12,500 square feet (combined) Staff: 54 employees (33 fulltime and 21 part-time) (35 are towing employees—16 full-time drivers and 19 part-time drivers) Average Monthly Car Count: 500 (combined) Annual Revenue: $3.6 million (combined)

Take Bill Rate’s word for it: “A tow truck is not a toy, and it’s not a side gig, and it’s not a hobby.”

He sees it time and time again—shop owners who invest in their own truck, only to leave it parked at the shop as they continue to get swept up in day to day shop operations and decline tow calls.

“Those are actually calls we end up taking,” says Rate, coowner of two Bob’s Main Street Auto & Towing locations in West Bend, Wis. He finds many shop owners will add towing programs to their services thinking the move will be a convenient add-on to boost shop profits, but won’t ultimately commit the manpower or strategy to see it through.

“Towing is a scenario where putting more eggs in your basket isn’t a safe bet,” he says. “If you’re going to let your trucks sit, it’s just not worth it, but figuring out how to keep those trucks busy without overwhelming your team is a real Rubik’s cube.”

After more than 20 years in the towing business, Rate has learned what it takes to not only make a towing program work, but turn a profit. How? Strategic staffing and tracking.

THE BACKSTORY

When Rate and his wife Laurie bought their shop in 1980, the business already had a towing program and several functioning, albeit depleted, tow trucks.

With more than 35 repair shops in the area, their customer service helped set them apart from competition and they knew the ability to tow would give them another chance to win customers over.

The Rates traded in their dilapidated models for one reliable truck and slowly grew their fleet—no small investment, considering the trucks can run anywhere from $100,000-$130,000—as well as relationships with independent shops and dealerships, and contracts with local police and club car programs like Geico and AAA.

THE PROBLEM

While there’s no shortage of challenges facing towing programs today—heavy industry regulation, insurance and liability responsibilities, gas mileage, costly equipment and maintenance investments, a shortage of skilled drivers, and a large drop in miles driven are all daily concerns—Rate’s biggest problem was organizing workflow.

Strong client relationships and stable accounts brought in steady business, but the flux and unpredictable nature of the service made it difficult to staff accordingly and avoid passing up profitable calls.

“You can try to make predictions based on the weather, but you don’t know when you’re going to get a call so you’re completely at the mercy of the phone ringing without as many options to shuffle and schedule workflow like you can on the repair side,” says Rate.

THE SOLUTION

“In order to keep your trucks busy at all times, you have to know where they are, their ETA, and have a queue ready to go, with a dedicated scout to keep things on track and a crew of drivers at the ready,” says Rate. “It’s all about running an organized shift. ”

As the shop has built up its fleet of trucks, Rate’s worked diligently to build a deep bench of drivers. He interviews year-round, hands out cards to those he meets with impressive customer service skills, and keeps a constant file of potential new hires at the ready.

He’s also dedicated a member of the team to serve as a dispatcher for all of the shop’s towing calls, and most recently, Rate brought on a designated manager for the towing program to oversee the day to day operations, manage and repair the trucks, and help troubleshoot problems on the go.

Rate has also hired part-time drivers to have at the ready, and restructured the towing staff’s scheduling to allow for staggered starts and give each full time driver one weekday off each week. Homebase, an employee scheduling mobile app, is used now to keep hours and shifts straight.

The team has also streamlined its dispatch and call logging method and cut down their time spent on the phone with a pivot to Beacon Towing software. With the program, the team can receive, accept, manage, and track a tow request digitally through its entire cycle and record the net profit of each call. All of the shop’s trucks are equipped with the software to provide the dispatcher with live updates on their location and status of a tow.

THE AFTERMATH

Today Rate’s trucks are rarely at the shop. “We’ll talk about taking a truck out of rotation and all of a sudden it’s gone. They’re in nearly nonstop motion. I don’t have a spare truck yet,” he says.

Rate now has 16 full-time drivers to operate the shop’s 18 tow trucks and a total of 19 part-time staff ready to jump in and fill gaps when needed.

Real-time tracking through the shop’s software has helped Rate determine if incoming requests can be accepted or will be worth the trip, based on where his trucks are currently located out in the field.

With those tracking tools, the team has honed its workflow for maximum profit. Each morning the drivers depart from the shop and split up to cover a 20-25-mile radius in each direction while the dispatcher accepts and assigns calls to each driver. Rate’s drivers receive assignment alerts and can send notifications to the shop’s team to note when they are enroute, when they’ve arrived at a call and when they have completed a call.

The software has also helped them track the potential profitability of their partnerships with data on the shop’s net gain from each tow, helping Rate and his team set priorities for calls as they come in—a strategy that’s helped boost the shop’s towing profits to nearly $1.2 million (roughly one-third of the shop’s total gross profit).

THE TAKEAWAY

Rate advises approaching every tow truck like you would a bay—owners should be constantly strategizing how to keep them full and in motion.

“Overall you have to be willing to invest the time, money and staff to build a solid program the way you would any other part of the business, because running out on the occasional call is going to bleed you dry fast,” says Rate.

“There are plenty of X-factors, but you have to be ready to commit to those key investments if you want to see a profit.”

TOOLS, TECHNOLOGY & MORE

It’s been a tough year. Since we last published Shop Goods, vehicular repair services were declared essential businesses and a little virus called COVID-19 ravaged the globe.

Some shops persevered. Others folded or faced unimaginable challenges. No matter how successful your business, there are always services and products that can be improved upon that will take your shop to the next level and to help face new challenges with confidence and resolve.

Whether that’s marketing more effectively in your front office, communicating more directly with your customers or making use of the most cutting-edge tools on the shop floor, there’s always an opportunity to improve your bottom line. Ratchet+Wrench’s Shop Goods section has compiled several products to help foster relationships with your vendors, increase clarity with your customers and bolster efficiency, productivity and revenue.

Inside, you’ll find companies that have found strategies to better the industry through their goods and services. Take a look for the tools and technology deemed essential—there’s that word again—for your shop and for your future. TABLE OF CONTENTS

44 AUTOZONE

PROFESSIONAL EDGE

47 KUKUI

ONE LESS TASK CREATES OPPORTUNITIES FOR MORE

49 LEADS NEAR ME

MAXIMUM MARKETING. MINIMAL MANAGING.

51 MITCHELL 1 53 OEC

OEM PART INFORMATION AT YOUR FINGERTIPS

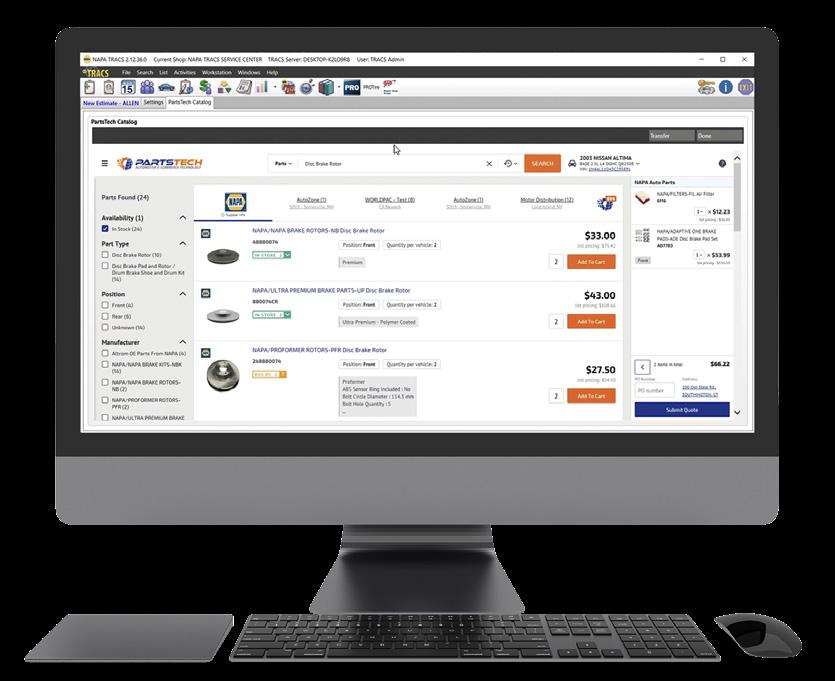

55 NAPA TRACS

EXPANDING THE NAPA TRACS PLATFORM WITH PARTSTECH

57 TECHNET

FIND PEACE OF MIND WITH TECHNET

59 UPSWELL