49 minute read

CSA and truck tires

from Modern Tire Dealer - February 2012

by EndeavorBusinessMedia-VehicleRepairGroup

It’s time to step up and become your fl eet customers’ solution provider

By Kevin Rohlwing

If you spend any time with fleets, you’ve probably heard about the CSA program, or Compliance, Safety, Accountability. CSA is the new initiative from the Federal Motor Carrier Safety Administration (FMCSA) to measure the on-road safety performance of carriers and drivers. Unlike the old SafeStat system that was based on out-of-service violations, crash reports and certain moving violations, CSA uses data gathered from all roadside inspections to assign a Safety Management System (SMS) score in seven diff erent BASIC areas. BASIC stands for the following Behavior Analysis and Safety Improvement Categories:

• Unsafe driving, which is focused on things like speeding, reckless driving, improper lane change and inatt ention. • Fatigued driving, which centers on hours-of-service violations and incomplete or inaccurate log books. • Driver fi tness, which addresses the lack of training, medical cards or experience. • Controlled substances/alcohol, which covers the use or possession of drugs and/or alcohol including prescription medication. • Vehicle maintenance, which is focused on the inspection criteria outlined by FMCSR Parts 393 and 396. • Cargo-related, which looks at improperly secured, overloaded or spilled cargo. • Crash indicator, which is based on the history that includes frequency and severity.

Th e ultimate goal of CSA, SMS and the BASIC areas is to reduce the number of commercial motor vehicle (CMV) accidents on our nation’s highways. By assigning a score in each BASIC, enforcement offi cials get a much clearer picture of the overall safety performance of the fl eet. Additionally, the drivers are also given an SMS score, and while it cannot be used to revoke a commercial drivers license (CDL), it can have a detrimental eff ect on future employability if the scores are poor.

In a nutshell, there is no place for a defi cient fl eet or driver to hide under CSA, which means both parties have a vested interest in operating vehicles safely.

Each BASIC category includes a series of violations that are assigned a severity rating that ranges from one to 10 with 10 being the most severe. Again, it’s important to recognize that CSA is designed to reduce accidents, so the

FMCSA has determined that the 10-point violations are the most likely to result in a CMV crash. Here are some examples of violations that result in 10 points:

• Reckless driving. • Speeding 15 mph over the posted limit. • Speeding in a construction zone. • Operating a CMV while texting. • Driving aft er being declared out-of-service. • Driver uses or is in possession of drugs. • Release of hazardous material from a package or container. • Package not secured in the vehicle.

As you can see, most of the 10-point violations are directly related to and/or under the control of the driver. Under the old SafeStat system, most of these off enses would not have resulted in any penalties unless there was an accident. With CSA, every moving violation and inspection that takes place on the side of the road or at a weigh station has the potential for serious consequences for the driver/fl eet that is operating a vehicle in an unsafe manner/condition or transporting cargo that is not properly secured.

While the vehicle maintenance BASIC is the only one of the seven categories that is more or less under the direct control of the carrier, drivers are still responsible for conducting the inspections using the criteria in Federal Motor Carrier Safety Regulation (FMCSR) Parts 393, 396 and Appendix G to Subchapter B which covers the Minimum Periodic Inspection Standards for new tires and retreads. For a complete listing of these inspection guidelines, visit the rules and regulations sections of the website www.fmcsa.dot.gov.

Another important point that must be made when

discussing the changes that are associated with CSA is the fact that every vehicle maintenance violation stays with the fl eet for a period of 24 months.

Like I said before, there is no place to hide under this new program, so a fl eet that historically operates poorly maintained equipment has virtually no hope to improve its SMS scores unless it makes signifi cant changes to its maintenance program. And since the SMS score is a percentile that ranks the fl eets in comparison to other carriers of similar size, it will take months (if not years) of clean inspections for a carrier to noticeably reduce its score.

Th e most severe tire violations are assessed eight points because FMCSR has determined that they are more likely to lead to a CMV accident. Th e eight-point violations are as follows:

• Flat tire or fabric exposed. • Ply or belt material exposed. • Tread and/or sidewall separation. • Flat tire and/or audible air leak. • Cut exposing ply and/or belt material. • Steer tire tread depth less than 4/32-inch. • Drive, trailer, dolly tread depth less than 2/32-inch. • Bus tire regrooved/retreaded on front axle.

Unfortunately, neither FMCSR nor CSA specifi cally defi nes any of the violations so one enforcement offi cer’s defi nition of a fl at tire may diff er from another. Th e Commercial Vehicle Safety Alliance (CVSA) is the organization that sets the North American standard out-of-service criteria and they occasionally refer to FMCSA regulations.

Th e 2011 handbook states, “FMCSR code references... are simply recommendations to help inspectors fi nd an appropriate citation.” CVSA does not use the term “fl at tire,” but the handbook does reference FMCSR 393.75(a)(3) which simply says, “No motor vehicle shall be operated on any tire that is fl at or has an audible leak.”

Th e CVSA criteria that refers to this regulation identifi es an out-of-service tire as one that, “has noticeable (e.g. can be heard or felt) leak, or has 50% or less of the maximum infl ation pressure marked on the tire sidewall.”

Making matt ers even more complicated is the fact that this verbiage appears in the CVSA handbook immediately following the 50% rule, “NOTE: Measure tire air pressure only if there is evidence the tire is under-infl ated.”

Of course, the guidelines for evidence of under infl ation are also completely subjective, so an offi cer can pull out the old boot-o-meter and use it to establish probable cause for a pressure check. Th e bott om line is that the generally accepted defi nition of a fl at tire is 50% or less of the maximum infl ation molded on the sidewall regardless of the load being carried.

But the confusion and vague nature surrounding tire violations do not stop with the eight-point fl at tire condition. Here are the three-point tire violations:

• Regrooved tire on front axle. • Tire load weight rating /under-infl ated. • Weight carried exceeds tire load limit. • Tire under-infl ated.

Like fl at tires in the eight-point category, the three-point under-infl ated tires are equally undefi ned. Th is becomes particularly troublesome for fl eets that run infl ation pressures that are lower than the maximum limits molded on the sidewalls of the tires.

Technically, a CMV cannot carry more than 20,000 pounds on an axle and no more than 34,000 pounds on tandem axles.

While there are no exposed sidewall cables on this injury so it cannot be cited for a violation, it should still be submitted for a spot repair.

If this tire develops a sidewall bulge after infl ation, the blue triangle will inform the offi cer that it is the result of a repair so the only question will be whether it is within the 3/8-inch limitation. Without the blue triangle, it is another eight points.

carry 4,300 pounds at 75 psi, which is suffi cient to carry safety hazard. Precure retreaders will have to be more careful

Another issue that must be addressed is the “pencil bulge” that can occur in the sidewall as the result of a puncture repair. While the industry is gett ing closer to releasing guidelines for reinforced shoulder repairs, will commercial tire dealers be creating more problems for their customers when these properly installed repairs result in a small sidewall bulge that the aggressive offi cer defi nes as a sidewall separation? CVSA references 393.75(a)(2) when it identifi es an out-of-service tire as, “Any tire with visually observable bump or knot apparently related to tread or sidewall separation.” Th en the following verbiage appears in the 2011 handbook, “EXCEPTION: A bulge (due to a repair) of up to 3/8-inch (9.5 mm) in height is allowed. Th e bulge may sometimes be identifi ed by a blue triangular label in the immediate vicinity.” Vulcanizing these blue triangles on the sidewall is not commonplace in the truck tire repair industry, but I believe that they are more important than ever now that CSA has changed the rules for drivers and fl eets. Additionally, since the repair technician cannot determine if a puncture repair will result Here is another example of a truck tire that does not appear to be a in a sidewall bulge, the best practice may be to safety violation, but the appearance is severe enough to cause most install blue triangles on both sidewalls in the area law enforcement offi cials to take a closer look. of every repair just in case. Aft er all, a sidewall According to the Tire and Rim Association (TRA ) Yearbook, easy to identify as opposed to a standard “plug and patch” that a 295/75R22.5 Load Range G tire in a dual application can may not be visible to the average person. the maximum allowable weight of 4,250 pounds per tire in Education is the solution a tandem application. Th at same Load Range G tire has a CSA is not necessarily going to change the procedures for maximum load of 5,675 pounds at 110 psi. retreading and repairing tires. But it is already changing the

So using the CVSA and FMCSR defi nitions, a tire would be way that tires and retreads are inspected aft er they are placed unable to support the load below 75 psi and becomes fl at at in service. 55 psi. Change the vehicle to a single axle and the minimum Minor cosmetic issues that were overlooked in the past have infl ation pressure for the maximum load becomes 95 psi while become much more important under the new SMS. the fl at pressure of 55 psi does not change. Confused? You And while FMCSA does not specifi cally defi ne every BASIC, haven’t seen anything yet! the CVSA already has out-of-service defi nitions in place that

In another example, if a cut in the tire or retread does enforcement offi cials have used for years. not visibly expose the ply material but aft er probing the cut Education appears to be the solution and the industry is with an awl the offi cer discovers that steel is still technically doing everything it can to get the word out to drivers and exposed, is that still eight points against the fl eet and driver? the law enforcement community. But the commercial tire This should ultimately result in the increase of spot and dealers and retreaders must also recognize that they play a reinforcement repairs as fl eets att empt to limit the number more important role in helping their fl eet customers comply of tire-related violations. with CSA guidelines.

And does a small void or crack at the edge of the bond line In the past, tires and retreads that were in a marginal condion a precure retread constitute a tread separation? Without tion posed minimal risk to the carrier. specifi c defi nitions of “exposed” or “separation,” it’s reasonNow that the rules have changed and the consequences able to assume that some enforcement officials will just have become more severe, it’s time for dealers and retreaders assess the eight points even though the industry would not to step up to the plate and become solution providers rather consider something that is minor or cosmetic to be a major than just another supplier. ■ bulge associated with a section repair is relatively than ever during fi nal inspection because even the slightest Kevin Rohlwing is senior vice president of training for the Tire imperfection at the bond line may be enough for an offi cer Industry Association (TIA). He can be reached via e-mail at to issue a citation. krohlwing@tireindustry.org.

Leave your store! How SalesMinded dealers make prospecting calls that pay off

By Doug Trenary was using for new tires and service on his cars. First call in November, nothing — the owner wasn’t in, and Trent

Icould never make a bett er teaching point than to off er told me he really wasn’t planning on going back. But some real results — increased sales, profi ts and new Trent got some fresh wind in his sails aft er the December customers with their new dollars — that several retail training meeting. He made a SalesMinded decision and store managers shared with me recently. It happened at started both calling on the phone and calling on that same owner four additional times the following week — and nothing. Th en he got a phone call from the lot owner. His current shop could not turn a car around on the day he needed it to deliver to a customer. But Trent and his store team could — he picked up the car and his service team turned it around and delivered it back in two hours. OK, no big deal, right? Wrong. Th e lot owner was so happy he immediately sent over 20 additional cars for a mix of tires and service — and a whopping grand total of 164 cars in December! Th ink Trent’s call persistence and the performance of his store service team made a diff erence? Check this out: Th e lot owner spent $25,000 in December, and $15,000 of that went to Trent’s store’s bott om line! And that’s not all. Not only is that pace continuing, but the lot owner also gives Trent’s business card to each customer who buys a car and tells Sometimes you have to step up to the plate to spur growth for your business. them Trent’s store is the best when they need tires and service! a training session for one of my independent tire dealer Here are a few more prospecting success stories from customers, a client who has 12 stores. the session. We had completed his fi rst store manager’s training Skip S. also has already opened several new accounts. In session in December, and this was the follow-up session. one of them, he got out of the store and called on a plumbTh e fi rst step of the day was having each store manager ing business that the dealership had used for some work. stand up and present the results of his Personal Action Skip had never met the owner, so he made the sales call. Plan committ ed to in December. At that training session, Net result: $3,000 in service sales on one of the plumbing we focused on issues like leading/empowering your store company’s trucks, and two alignments from two employees team, the power and value of world-class service and of the same company. I suggested to Skip to take a pizza prospecting for new business. lunch over for the whole company, and give out his card Trent W. really never had made any outside sales calls, and maybe some coupons. He’s in the process of sett ing that but got fi red up and made a commitment to do just that up at this writing. Skip’s targets: Th e remaining 11 trucks in December aft er our meeting. He had, however, called in the fl eet and the remaining 13 employees’ personal cars on a used car lot a couple of blocks away in November to and trucks. Prett y powerful prospecting! talk with the owner and do some discovery on who he Mark S. also made some commitments to action at

the December training meeting — and followed through. He sat down and made a prospect list of 10 key companies in the area — all small businesses. Th en he set aside half a day each Wednesday to go out and make sales calls. Th en he did follow-ups, put together tire and service proposals, met with his store service team to discuss his new initiative, and asked each new contact he was able to make for their business.

Mark’s results at this writing since December: $2,800 in new sales from four new accounts — and the commitment to get their repeat business. Here’s the best part: Mark now has a new “accountability partner” — his store team! Th ey eagerly ask him each Wednesday aft er he returns to the store: “How did it go — did you get us any new business?”

Everyone’s excited with the new work, and att itudes and teamwork are completely diff erent. Mark told me he would now never let his team down. Translation: He’s now in the business of making prospecting calls each week that are yielding new, profi table business.

He told me, “I’m not going to sit around anymore and just wait for customers to come in — I’m going out to drive them in!” Powerful. Here are the key SalesMind points to take from these incredible stories, and I’m going to write a follow-up column next month to detail out each important point:

• Make a fresh commitment as a store manager (and the same if you or your team are in wholesale and commercial) to a prospecting/sales call campaign to local businesses/fl eet prospects in your area. • Get your store team empowered to handle the reins when you are out making calls and quit making excuses that “I just have to be in the store.” • Obviously, take your business cards, a pad for notes, and maybe a coupon or special for 10% off an oil change or alignment — or a special deal sheet on new tires. • Start in the morning fi rst thing on your call day to get the calls in — and don’t put it off until 4 p.m. or you’ll never do it! • Prepare the questions in writing you’ll ask those you meet inside the business — how many employees, fl eet cars or

trucks (if they have them), who they use for tires and service, etc. • Ask for the owner — start at the top!

He or she is the one who makes the buying decisions and gives you permission to make a sales presentation to the staff . • Finally, deal with the emotions of prospecting on new businesses. Picture yourself going in to just “visit.”

Visiting people is no big deal. Th at’s bett er than picturing in your mind that you have to make a cold call!

In one way I’m amazed at results like this — but in another, I’m not. Because I know for a fact if you make outside sales calls, somebody will buy. Take a swing at it!

Th e great thing is that your company can get these amazing results, too.

My pledge to you is your sales and profi ts will take a nice jump if you can get yourself or your store managers to just leave the store! ■

Doug Trenary, president of Doug Trenary’s Fast-Track Inc., is an award-winning author, speaker and teacher who has helped companies of multiple sizes, including independent tire dealerships, increase sales and productivity since 1985. His book, Th e SalesMind, focuses on how to establish strong positions with yourself, your buyers — and your time. E-mail Trenary at info@dougtrenary.com or call (404) 262-3339.

Trenary’s book is available for purchase at www.amazon.com.

A Twittering tire dealer – you are kidding, right? Twitter can be a silly waste of time. But, the mere fact that it exists means it can make you money. Here are some things to consider

By Roger McManus

Let’s be honest from the start. You do not care about Twitter. Despite all of those who promote the effi cacy of “social media,” you sort of laugh at the idea of being Tweeted what someone did on their lunch hour. It is laughable, really.

Unless they were thinking about shopping for tires on their lunch hour. Th at might interest you. But, really, how often does that happen — and, who is going to endure 2,000 Tweets to see that one? Well, set that aside for a minute, because it might not be so laughable — or impossible — in a few minutes.

Let’s get back to our cynical reality: You don’t really care a thing about Twitt er itself. Th at is, of course, unless it is a means to an end. And, that “end” is growing your business by whatever means possible.

You have heard how “every business needs to be on Twitt er,” but you have just not ever quite seen how it could work for you. Business people who are not currently actively using Twitt er fall into three categories:

1. Th ey consider it a silly waste of time and have never given it any serious consideration. 2. Th ey tried it and found it a silly waste of time and gave up on it. 3. Or they have an idea it might not be a silly waste of time, but are still trying to fi nd time to learn how to do it eff ectively.

Surprise! It might not be a silly waste of time, aft er all.

I should tell you that I came from the “silly waste of time” camp, myself. But I have become a convert. Let me off er you a few examples of Twitt er conversations I had previously considered “silly wastes of time.” “I love Mexican food!” “My bookkeeper is so far behind! It is driving me crazy.” “Th e family is headed to Arizona next month. What’s there to do besides the Grand Canyon?” “I need a new POS system and I am overwhelmed!” “Response to our last direct mail piece was terrible!” “Chrissie is looking at where to go to college. Th inking about State, but wants something smaller.” “My tires are looking terrible! May not pass inspection.”

All of this “boring stuff ” is personal small talk, randomly distributed to a broad range of people who may or, more likely, may not care one whit about what is being said.

But, if you are the owner of a Mexican restaurant, temp service, travel agency, retail electronics business, local ad agency or the admissions director of a small local college, such “small talk” would not be so boring, would it? And, that last comment about shopping for tires might get you to sit a litt le taller in your chair.

Th e fact is, you can search for these types of messages — even with geographic limitations — to fi nd people in conversation about your specifi c area of interest. And, in modern Internet protocol, it is not considered rude to “butt into” a conversation at any time.

More about ‘small talk’

So many people scoff at Twitt er as a lot of electronic “small talk.” Th at is as opposed to all those serious e-mails people pound out every day, of course. Or, the scholarly messages shared on Facebook. But, the fact is, Twitt er is far more “normal” in human communication than either of those. Take, for example, a typical meeting of friends introducing someone new. Th e conversation might go something like this.

“Hey, Joe. Meet Pete.”

“Hey, Pete. Where do you live?”

“We live over in Pleasant Ridge, not far from the big mall.”

“Oh, Sally and I were over there last month. Th ere was this great litt le Mexican restaurant. Amazing!”

“You must mean Pedro’s. Yeah, we love it there! Did you ever try their sopapillas? Th ey are great!”

“No, we rarely have any room for dessert.”

Not exactly a serious discussion about the state of the world. But, Joe and Pete found some common ground on which to base further discussion. Without that, Joe and Pete meet and pass without connecting at all.

Small talk is how humans interact! It sounds very normal when it happens in the natural fl ow of life. Yet, it feels odd when you are doing it on the Internet. Th at is unless you understand that, by doing it using Twitt er, you get the chance to inject yourself, your personality and your opinions into conversations with people whom you would never otherwise meet. It completely shift s the mind-set about marketing online.

Take the conversation between Joe and Pete a step further. Suppose you were walking by and overheard the conversation about Mexican food. Suppose further, you owned a Mexican restaurant of your own. It would not be totally unheard of to grab a couple of business cards and interject, “Hi, guys, I overheard you talking about one of my favorite subjects. If you are ever in the Kenwood area, drop in to see me. We might get you to start talking about us!”

Making “small talk” on Twitt er is a very highly leveraged way to talk “normally” to thousands of people at one time. Furthermore, it allows you to instantly jump in on conversations relevant to your business!

Pricking up your ears

Spencer is an old dog we rescued from the shelter a few years ago. He likes to sleep on the hassock in front of my chair. He can be completely asleep and some small sound will make his ears pop up. He may not even open his eyes, but his ears are like radar.

Humans do that, too, even if they don’t know it. I lived most of my life in Greensboro, N.C. I live in Las Vegas now. With the tourists and conventioneers in town, every so oft en I will hear “North Carolina” or “Greensboro” or even another North Carolina city. Depending on the situation, of course, I will quite oft en stop and inject myself into the conversation by asking, “Who’s from North Carolina here?” It is a friendly, comfortable way of meeting strangers. Occasionally, these conversations extend themselves into friendships.

If people had been talking about Seatt le, I could have heard them just the same, I just wouldn’t notice. And so it is with Twitt er. Decide what you want to “hear” and go fi nd new friends. Th ey could become customers.

Th ere is much to learn

Th ere is not enough space in this article to teach you how all this works. But there are tons of resources online that will take care of that. Th e point of this article is to clarify why Twitt er can be an important net in which you can catch lots of new customers. It is not all just a silly waste of time.

Amazing fact: You can actually hire “ears”

As I was preparing this article, I was doing a litt le research. It turns out there are actually services that will monitor traffi c on Twitt er and immediately respond on your behalf. Th ey do this locally, regionally or nationally aft er gaining enough information about your business to pull it off .

One tire industry-specifi c source of such “ears” is Wayne Croswell of WECnology LLC (wayne@WECnology.com), another Modern Tire Dealer contributing writer. ■

McManus is author of Entrepreneurial Insanity in the Tire Industry, a recently published book that challenges business owners to examine why they opened their businesses and if they are achieving the personal fr eedom that business ownership was supposed to deliver. It is available at www.EnSanityPress.com or fr om Amazon. You can write to McManus at roger@ensanitypress.com or read more at www.Th eTireBusiness.biz.

Crossfi re service aims to please Replace valve stem sealing grommets when performing TPMS service

SUBJECT VEHICLE: 2005-08 Chrysler Crossfi re. RELEARN PROCEDURE? Yes, directions follow. SPECIAL TOOLS NEEDED? Yes, a Chrysler DRB-III scan tool; a Relearn Magnet (8821).

Th e tire pressure monitoring system (TPMS) on the 2005-08 Chrysler Group LLC Crossfi re utilizes a warning light in the instrument cluster and transmitt ers that are located in the valve stem of each tire. Th e transmitt ers communicate the tire pressure condition to the Universal Garage Door Opener/ tire pressure monitor (TPM) module, which is located in the headliner near the inside rearview mirror.

Th is module has a microprocessor controller that can monitor the transmissions from tire pressure sensors/transmitt ers any time the ignition switch is in the “on” position. If a tire has low air pressure, an indicator light on the instrument cluster is illuminated. Th e TPMS does not determine which tire has a low pressure condition.

Th e TPMS operates by monitoring a radio frequency transmission from the tire pressure sensor/transmitt ers located in each wheel (integrated with the valve stem). When a vehicle reaches a speed of 20 mph, centrifugal force created by the wheels rotating closes a roll switch inside each sensor, powering up the circuitry. To facilitate transmitt ing the radio signal to the module, the valve stem acts as the antenna for the tire pressure sensor/transmitt er.

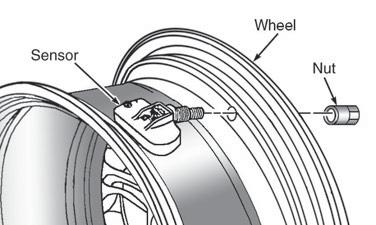

To remove a sensor, follow these steps.

1. Remove the tire and wheel assembly from the vehicle.

Remove the balancing weights from the wheel. Remove the cap from the valve stem. Remove the core from the valve stem. Allow the tire to fully defl ate. CAUTION:

Th e tire pressure sensor must be removed from the wheel and dropped into the tire prior to breaking the bead and demounting the tire. Failure to do this will greatly increase the risk of damaging the sensor when servicing the tire. 2. Remove the nut mounting the valve stem of the tire pressure sensor to the wheel. Drop the sensor into the tire. CAUTION: When breaking the top and bott om bead of the tire off the wheel, care must be used so the bead breaking mechanism on the tire changer does not damage the wheel. Th is includes the surface of the wheel fl ange on the inside of the wheel. 3. Using the tire changer manufacturer’s procedure, fi rst break down

Figure 1

Figure 2

the upper bead of the tire. Th en break down the bott om bead of the tire. CAUTION: When demounting the upper tire bead from the wheel, the proper procedure must be used. Not using the proper procedure will result in damage to the wheel and tire. 4. Demount the upper bead of the tire from the wheel. Th e upper bead must be fully demounted from the wheel to remove the tire pressure sensor from the inside of the tire.

Th e bott om bead of the tire does not need to be removed from the wheel. Pull upward on the tire. Reach inside the tire and remove the tire pressure sensor.

To install a sensor, follow these steps. NOTE: When installing a tire pressure sensor, replace the sealing grommet at the valve stem base before installing the sensor in the wheel. Also, be sure that the surface of the wheel that the grommet seals against is clean and not damaged.

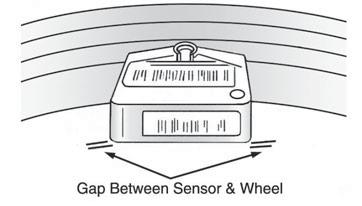

1. Wipe the area clean where the sensor sealing grommet contacts the wheel. Make sure the surface of the wheel is not damaged. NOTE: Once tightened, the gap between the sensor and the wheel must be even on both sides as shown in Figure 2. If the sensor rotates (clockwise), damage to the sensor

Figure 3

can occur when mounting the tire.

Tighten the nut to 35 in.-lbs. (4 N.m). 2. Install the tire pressure sensor on the wheel. See Figure 1. Install the special sensor mounting nut. When tightening the tire pressure sensor nut, hold the sensor so that it does not rotate. 3. Mount the upper bead of the tire on the wheel. Infl ate tire(s) to the proper specifi cation. Install the original or an

OEM replacement valve stem cap on the valve stem. Using a soap solution, check that no air leak is present where the valve stem mounts to the wheel. 4. Balance the tire/wheel assembly, using the correct procedure for using the wheel fl ange mount and stick-on wheel weights. Install the wheel and tire assembly on the vehicle. 5. Register the identifi cation code for the new tire pressure sensor into the

TPMS module. 6. To verify the TPMS functionality, connect the Chrysler DRB-III scan tool to the vehicle. Drive the vehicle at 25 mph for at least two minutes.

While having an assistant monitor the scan tool, verify the operation of all four tire pressure sensors.

To retrain a sensor, follow these steps. WARNING: In the following procedure, Relearn Magnet (8821) is used. Death or serious injury can occur if magnetically sensitive devices are exposed to the retraining magnet used in the TPMS. Magnets can aff ect pacemakers.

NOTE: If a tire is changed (tire rotation), one or more tire pressure sensors fail, or if the TPMS module is replaced, the TPMS needs to relearn tire pressure sensor IDs. To perform this procedure, a Chrysler DRB-III scan tool and a Relearn Magnet (8821) must be used.

1. Connect the Chrysler DRB-III scan tool to the vehicle’s Data Link Connector located beneath the instrument panel, near the steering column. 2. Using the scan tool, access “Chassis

System.” 3. Once in “Chassis System,” select

“Miscellaneous Functions.” 4. Select “Train All Mode” from the menu selections. Select “Yes” to continue. 5. Place Relearn Magnet (8821) over the valve stem for the left front wheel. 6. Each sensor/transmitter will automatically sense the presence of the magnet and begin transmitt ing.

When the tire pressure sensor on each wheel has been programmed, the DRB-III will automatically beep and direct you to the next wheel to be programmed. Move the magnet to each of the remaining wheels as directed by the scan tool. 7. Remove the magnet from the last tire to be programmed (left rear wheel). 8. Once “Training Completed” is displayed, exit the program function screen and use the following to verify

TPMS functionality. a. Verify TPMS module programming is complete by viewing the “Input/

Output Display” selection of the

DRB-III and confi rming the tire pressure sensors are trained. b. Verify TPMS module programming is complete by viewing the

“Sensor Display” selection of the

DRB-III and confi rming the tire pressure sensor pressure readings are accurate. ■

Information for this column comes from Mitchell 1’s ”Tire Pressure Monitoring Systems Guide” for domestic and import vehicles through 2010. Headquartered in Poway, Calif., Mitchell 1 has provided quality repair information solutions to the automotive industry for more than 80 years. For more information, visit www.mitchell1.com.

Focus on industry X-Ice Xi3: White and green North American Michelin dealers get a grip on X-Ice in Quebec

By Bob Bissler

As part of its offi cial launch of the new X-Ice Xi3 winter tire, Michelin North America Inc. brought 350 of its Canadian and U.S. dealers to Quebec, Canada, to test it in tough winter conditions.

The company brought in racing instructor Richard Spenard and his team of professional driving instructors to the Mecaglisse motorsports complex in Quebec’s Laurentian Mountains. Th ere, each day for one week groups were given the opportunity to test the tire against leading competing tires.

Spenard’s team set up courses that included many of the road conditions northern drivers face in the winter: pure ice acceleration and stopping; snow covered driving with cornering; and ice and snow comparison driving on worn (to 4/32-inch) tires.

Dealers were also able to learn all the details of the new tire, and how it was designed to be an improvement of its predecessors, the X-Ice 1 launched in 2004 and the X-Ice 2, launched in 2008.

Th e new X-Ice Xi3 is manufactured using third-generation, winter-grip technology. On ice, the tire delivers 17% stronger grip and stops 7% shorter. On snow, the tire provides 6% bett er traction and stops 3% shorter.

“In developing the X-Ice Xi3, we researched consumers worldwide on what they expect in a winter tire,” says Stephanie Beaudoin, training and development manager for Michelin North America (Canada) Inc. “What we learned is that they want good snow braking, good ice braking and good traction. Th ey also want enduring performance, long mileage and good highway handling. Another big factor: they want the tire to be ‘green.’” In order to meet the green requirement, Michelin engineers designed the tire with the company’s Green X technology. Th e result is a tire that is highly effi cient, with low rolling resistance, for reduced carbon monoxide emissions. Stephanie Beaudoin, training “Longevity is imporand development manager tant for consumers; it’s for Michelin North America one of the top criteria (Canada) Inc., points out the in shopping,” says Ron differences between the XIce Xi3 and its main competitors during a ride and drive Margadonna, Michelin’s senior technical marketing event in Quebec, Canada. manager. “Longevity is

Michelin features four key technologies in the X-Ice Xi3’s tread block: the Cross Z sipe enables stable handling; the Block Edge provides grip on snow and ice; Micro-Pumps absorb water, which improves tread contact; and FleX-Ice, a rubber silica-based compound for enhanced braking.

one of our pillars and we take longevity very seriously. As you look at these tires, others get to the 4/32-inch level of wear much more quickly than the X-Ice 3.”

Michelin says it achieves a higher level of longevity with special tread block technology. Th is includes the Cross Z sipe that enables stable handling and the Block Edge that provides more grip on snow and ice.

In addition, Micro-Pumps absorb water, which improves tread contact. FleX-Ice, a rubber silica-based compound, off ers unsurpassed braking, says Michelin.

Backed by a 40,000-mile limited tread wear warranty, the tire will be available this fall in 33 14- through 18-inch sizes. Michelin adds that the sizes will cover more than 90% of the Canadian and American winter market for cars and mini-vans — with complementary dimensions still available in X-Ice Xi2 tires. ■

Hankook prepares to launch ‘Th e One’ dealer program Meeting attendees are updated on new plants, tires and marketing plans

By Greg Smith

Anew associate dealer program, strong demand and fi ll rate issues highlighted Hankook Tire America Corp.’s annual dealer meeting in Punta Canta, Dominican Republic, in January.

Code named “The One,” Hankook’s associate dealer program is set to launch April 1, with sign-ups taking place during February and March. Hankook executives told

Modern Tire Dealer that planning for this program started in the second quarter of 2011. Details are still being worked out for the program. Dealers were told that accrued co-op funds would be utilized to help provide marketing support at the retail dealer level. Th ere will be three diff erent levels of support, based on sales volume and product pattern sales for associate dealers. Associate dealer incentives for the program will include travel awards and promotional incentives. Distributors will benefi t due to increased brand awareness at the retail store level, inCourtland Michaels told dealers creasing premium product OE placements continue to play sales and being able to utilize and important role in consumers’ brand awareness. motivational tools for the dealers to sell more Hankook tires, Hankook dealers were told. Th e program will have its own website that will allow distributors to monitor their associate dealers’ progress toward goals. Th e site also will feature an online training component and product information. Dealers can receive POS materials as well as use the site’s built-in ad builder.

Executive outlook

Soo Il Lee, company president, summed up the 2011 tire industry when he said, “I believe it was kind of similar to riding a roller coaster last year; up one time and down the next.”

Lee told Hankook dealers that 2011 saw record sales for Hankook Tire America Corp. — $1.2 billion in U.S. and Canada with $1 billion in the U.S. alone — as well as the parent company, Hankook Tire Co. Ltd., totaling sales of nearly $5.9 billion globally. Much of the increase for sales came due to price increases. Lee said unit increases were probably in the 5% range.

For 2012, Hankook is looking to have sales of $1.4 billion in the U.S. and Canada, with U.S. sales being about $1.2 billion.

Despite this success, Lee said “the cost of raw materials skyrocketed throughout 2011, although currently it has stabilized a litt le bit. Tire makers, consequently, could not help but increase their prices, aff ecting consumer demand and subsequently sales volume.

“I admit that last year our fi ll-rate was less than I would have liked, and I would like to apologize for that. In 2012, we will do everything we can; increase our production capacity and allocation to this market, make investments in bigger and better distribution centers, and operate our new back-order system,” Lee told dealers.

Lee continued to express his desire to have “our own factory located in the Americas” which would be an ultimate eff ort to improve Hankook’s service to its customers. No time frame for the plant was mentioned, Lee said a second associate however. Currently, Hankook brand (Aurora is the other) could be launched in the fourth quarter, depending on Chinese tire tariffs. has two new plants under construction, with a total investment for both of about $1.3 billion. Th e Indonesian plant will begin shipping passenger and light truck tires in late 2012. Once fully running in 2014, this plant will produce 5 million tires per year. Hankook has said that 50% of the production will be targeted for North America.

Th e other plant started construction in the fi rst quarter of 2011 and should be completed by 2015. Th e plant, located in China, will produce 11.5 million passenger, truck and bus tires per year when fully operational. All the tires are to be used for Chinese consumption. Th e company believes that this capacity will free up other plants to redirect more product to North America.

Overall, Hankook Tire Co. Ltd. should have a total capacity of 90 million units this year, 93 million next year and a big increase to 103 million units in 2014.

Courtland Michaels, director, corporate accounts, told dealers that original equipment placements continue to play a strong role for enhancing the brand among consumers. In 2011, the company had tires fi tt ed on cars and light trucks that experienced a solid 10.26% increase in market share.

Future plans

Hankook will continue to invest in its marketing communications to build its brand. For 2011, the company increased spending by 75% over 2010 levels. For 2012, there will be a double digit increase, but not near the 75% level, according to Lee.

Th e company is expanding its Major League Baseball home plate signage program to 26 teams, adding the New York Yankees, San Francisco Giants, Seatt le Mariners and Los Angeles Angels for 2012.

“Th ese aggressive and smart marketing investments will not only enhance our brand positioning, but also help your business with Hankook to be more successful,” Lee told dealers.

Lee fi nished his remarks at the meeting by emphasizing Hankook’s core business culture, “relationship and continuity.”

“As you know, the tire business is not a short-term lucrative business like the high-tech electronics or fashion industries. Th is business can only be successful by making long-term continuous eff orts and giving steady and consistent satisfaction to all our partners.

“I believe that the pursuit of a short-lived, quick profi t cannot succeed in our line of business.”

Lee also noted, “Actions speak louder than words... even though there is still a long way for us to reach the level of a top tier tire company, we will do our utmost eff orts to get there, making you, our esteemed partners, successful with us.” ■

Expand and deliver K&M Tire focuses on wholesale growth

By Bob Ulrich

K&M Tire Inc. has 12 warehouses serving 21 states. It needs more to properly service its dealers, says President Ken Langhals.

Th e warehouses are located in Delphos and Toledo, Ohio; Lincoln Park and Grand Rapids, Mich.; Chicago, Ill.; Madison, Wis.; Macon, Ga.; Minneapolis, Minn.; Bismarck, N.D.; Omaha, Neb.; Wichita, Kan.; and Des Moines, Iowa. Th e company plans to open three more in 2012.

“We want to open one in central Nebraska because Omaha is right on the eastern border. We need another one in the Kansas City area because Wichita is probably

200 to 250 miles from Kansas City. For us to really service the Kansas City area, we need something in that area.

“Th e other is in the Fargo, N.D., area. Bismarck to any of our other locations is probably 600 miles. It’s up there by itself. We want something between Minneapolis and Bismarck. North Dakota is really booming with the oil fi elds.”

Langhals says K&M is in talks with three diff erent regional wholesalers. “In 2012, I feel fairly confi dent we will come to an agreement with at least one. We’re looking for opportunities to grow.” More Mr. Tire stores

K&M Tire welcomed 175 of its customers — including Mr. Tire dealers — to Las Vegas, Nev., for its annual dealer trade show. Th e event was held Jan. 19-20, 2012, at Bally’s Las Vegas Hotel & Casino.

Th ere are 278 Mr. Tire franchise dealers in 17 states. Jeff Wallick, program/marketing manager, told the dealers in att endance that K&M plans to increase the number of franchises to 403 by January 2013 through “calculated” growth. Th e keys are to:

• support and recruit a high-caliber, upper echelon dealer base; • maintain exclusivity through a rigid dealer selection process; • implement continuous improvement processes; • build Mr. Tire brand recognition; • build consumer trust through retail excellence; and • create new and stronger vendor partner relationships.

“We’re looking at growing in existing states and hopefully bringing it into new states,” he said. Mr. Tire dealers off er Cooper, Mastercraft , Continental, General and Hankook tires. Bonnie Marlow, assistant program/marketing manager, said K&M is looking at adding brands to the program. K&M is backing the program with a new website and an emphasis on online marketing and branding. “It’s a cornerstone of the program to keep up on the latest trends in the industry,” said Wallick. K&M Tire acquired the Mr. Tire program in 2010 when it purchased Triton Tire & Batt ery from

Universal Cooperatives. ■

Dan Lungrin, station manager for Hi Line Co-op in Elsie, Neb., looks over BKT implement tires (BKT offered $3 off its front and implement tires as part of a K&M trade show special). “Seventy percent of our business is fertilizing. So basically, we’re buying a lot for our own equipment and our customers.”

The g-Force Sport COMP-2 tire The g-Force Sport COMP 2- tire increases BFGoodrich Tires’ coverage in the UHP market to 82%.

Th e BFG Tweets are in

BFGoodrich tests the g-Force Sport COMP-2, asks Twitter followers to comment

Michelin North America Inc. recently launched the BFGoodrich g-Force Sport COMP-2, the newest tire in the BFGoodrich ultra-high performance tire lineup.

At the company’s launch event held at the Auto Club Speedway in Fontana, Calif., tire dealers were invited to put the product through the paces of challenging road course and track conditions. Th ey also were invited to visit the Twitt er website and tweet about it at #BFGComp2.

Twitt er poster CindiLux says, “Just fi nished day #5 of on track driving w/ the new #BFGComp2 tire at Calif Speedway. Amazing NEW tire....wow.”

Poster RikDaddy was so excited he Tweeted he put together his own 14-minute-long in-car video from the #BFGComp2 tire testing event.

“Wet track with #BFGComp2 awesome! Feel sorry for the cones!” tweets gilly1a Craig Gilmour. Tweeter mself_21 Michael Self says, “Awesome day working with @BFGoodrichTires and the #bfgcomp2. Th e tire on a WRX STI is killer!”

While the Tweets are still coming in, the company is preparing for April 1, when the BFGoodrich g-Force Sport COMP-2 will be off ered in 46 sizes ranging from 15 to 20 inches in diameter. It replaces the BFGoodrich g-Force Sport tire.

Th e g-Force Sport COMP-2 lineup includes fi tments for classic and modern muscle cars, sports cars, sports sedans, tuner and imports. An additional 12 sizes will be introduced to the market in September 2012 to off er complete coverage in the ultra-high performance category.

“Th e current BFGoodrich g-Force Sport tread design was reviewed, analyzed and proven to be the optimal design for BFGoodrich Tires’ target consumer, target performances and new advanced ‘COMP-2’ compound,” says Andy Koury, brand category manager for ultra-high performance at BFGoodrich Tires. “While the tread design remains the same, we simplifi ed the sidewall for a ‘racing’ look. It needs to look contemporary and sleek, but not be in the way. Th e new g-Force Sport COMP-2 provides a sleek look and, of course, upgraded performance.”

Th e BFGoodrich g-Force Sport COMP-2 compound and Performance Racing Core (PRC) — developed using many of BFGoodrich Tires’ racing technologies and compounds — resulted in 30% bett er wet grip and 8% bett er dry grip, off ering precise control without sacrifi cing tread life, the company reports. It also off ers optimum dry traction, short braking distance and cornering control in dry conditions.

“Advancements in compounding technologies have enabled us to achieve large improvements in traction in both wet and dry performances,” adds Koury. “We added a high horsepower compound and also upgraded the internal tire suspension to a new level with the Performance Racing Core to make sure all that power could make it to the ground. We strengthened, optimized and evolved the suspension system to increase steering response, rigidity and control to handle the new advanced compound.”

Michelin North America will support the launch with a $50 Mastercard gift card rebate promo that will run April 9 through May 7. ■

To request free product information by phone, call 800-687-1557, enter the extension number listed below, and you will be immediately transferred to the company you want to talk with — it takes only seconds.

To request information online, log on to www. mtdquiklink.com/ plus the corresponding Quik-Link number. You’re just a click away from receiving free information on the new products that interest you.

Advertiser

Bartec USA

BKT Tires, North America

Blackburn’s Hubcap & Wheel Solutions Continental Tire the Americas LLC

Dealer Strategic Planning Inc. EcoExpress Tire Centers Hennessy Industries Inc. Hunter Engineering Company Identifi x

International Marketing Inc./EQUAL Kenda USA

Kumho Tire USA

KYB America LLC

Marangoni Tread North America Inc. Maxxis International—USA

Monroe Shocks & Struts

Nexen Tire America Inc.

NitroFill

Perfect Equipment Inc. Sentaida International Inc.

Sumitomo Tire

Tenneco Inc. (Monroe & Walker) Tire Centers LLC

Tire Centers LLC

Titan International Inc.

VDO TPMS Replacement Parts Yokohama Tire Corporation

800-687-1557 + Page Toll Free Extension

67 12123

10 12105

34

13

33

7

15

61

50-51

49

IBC

5

9

47

27

11

IFC

29

31

25

17

53

36-40

OBC

43

58 12116

12107

12115

12103

12108

12125

12121

12120

12126

12102

12104

12119

12112

12106

12101

12113

12114

12111

12109

12122

12117

12127

12118

12124

Web site

www.mtdquiklink.com/12123 www.mtdquiklink.com/12105 www.mtdquiklink.com/12116 www.mtdquiklink.com/12107 www.mtdquiklink.com/12115 www.mtdquiklink.com/12103 www.mtdquiklink.com/12108 www.mtdquiklink.com/12125 www.mtdquiklink.com/12121 www.mtdquiklink.com/12120 www.mtdquiklink.com/12126 www.mtdquiklink.com/12102 www.mtdquiklink.com/12104 www.mtdquiklink.com/12119 www.mtdquiklink.com/12112 www.mtdquiklink.com/12106 www.mtdquiklink.com/12101 www.mtdquiklink.com/12113 www.mtdquiklink.com/12114 www.mtdquiklink.com/12111 www.mtdquiklink.com/12109 www.mtdquiklink.com/12122 www.mtdquiklink.com/12117 www.mtdquiklink.com/12127 www.mtdquiklink.com/12118 www.mtdquiklink.com/12124 www.mtdquiklink.com/12110

Greed is the reason tire prices are so high

Editor’s note: Aft er reading Editor Bob Ulrich’s November editorial on our website, www.moderntiredealer.com, many readers felt compelled to leave comments. Here is a sample. More Web reader comments will be presented in future issues of MTD.

Dear Editor:

Concerning your November 2011 edito- rial titled “Are tire prices too high? I say yes.””

I agree the price increases have to stop! Th e manufacturers are killing the indepen- dent dealers like myself. (See a list of tire e price increases announced just this year r on www.moderntiredealer.com).

Th e tire makers also have consistently y announced record sales and net profi ts. CEO bonuses will probably refl ect those e profi ts at our and the consumer’s expense.

Profi t is earned, not deserved. Something g is wrong with this picture.

By the way, I have been in the tire business for 39 years, since I was 14 years old. My father, Leroy, and I started our own retail operation June 1, 1987, almost 25 years ago. What a ride it’s been. I grew up in the business and it’s changed so much in the past few years.

It’s almost embarrassing to quote prices on some products these days. It’s a real shame that greed plays such a big part of all industry. Todd Hamilton, Owner Double H Tire Mineral Wells, Texas

Dear Editor:

Concerning your November editorial — you said a mouthful, Bob. Customers are numb and get sticker shock when they are quoted current prices.

One of the screwy things about rebates, etc., is if an independent dealer sells multiple brands like most of us have to just to survive, it can be a nightmare keeping up with what is current at the time. If you are a four- or fi ve-person shop and do not have an offi ce person, it could be a challenge to keep it sorted out. Ed Miller, President Ed’s Tire Factory Medford, Ore.

Dear Editor:

Dealers are facing customers coming in today that are given quotes for tires that consistently range from $850 to $1,200 per set. Most of the people replacing a set of tires haven’t had to do so in a number of years and can’t believe the increase. We are viewed as the bad guy and that we are overcharging the guest. Customers usually revert to dropping to a lesser product, or only putt ing two tires on the vehicle, causing a safety issue. We can’t get water out of a rock, customers can only aff ord what they can aff ord. Another issue is how does the dealer aff ord to inventory these tires? As you have stated, prices have increased by almost 25% in the last few years, and that of course means that our inventory cost has paralleled those increases. With margins gett ing tighter it really constricts cash fl ow. Dealers are starting to reduce premium brands and focus on private brands and lesser fl ag brands. How do we fi x this? It seems to me everyone in this industry agrees there are way too many sizes. If you talk to the tire manufacturers they state this is driven by the auto industry. Well, why can’t there be bett er communication between the two manufacturers to realize it’s gott en out of control and it would benefi t both industries to reel it in? Is there that much diff erence between a 215/55R17 or a 225/50R17?

I think you get my meaning. The only way that I see it changing is when the dealer and the consumer shift purchasing habits and premium brands start losing share of accounts.

If the tire manufacturers can sell a truck tire for $275 each they will, next they will try for $280, and so on until the product doesn’t move. I think they have reached this point but have tried to ride out the recession with the big rebates. It will be interesting to see where this goes. Dennis Knapp, Owner Knapquist LLC Roseville, Minn.

Dear Editor:

Yes, tire prices are too high! Gas is too high, so are prices for shoes, and food, and almost anything you would like to do for recreation is priced too high.

It’s not going to stop until greed is out of the picture. It’s not going to stop until we start doing more for ourselves in this country, which leads us back to that greed thing.

So what do you do? You suck it up and keep paying the higher prices for anything you need in life. Ronnie Lloyd, Owner Colonial Tire and Automotive of Havelock Havelock, N.C.

Join Modern Tire Dealer’s National Advisory Council Each month, Modern Tire Dealer is guided and infl uenced by a select group of readers — members of our National Advisory Council. Th ese members’ opinions are the heart of the monthly Ludwig Report, compiled by well-known industry analyst Saul Ludwig. If you’d like to join this prestigious group, please let us know. We’d love to hear from you. Contact Editor Bob Ulrich at Bob.Ulrich@bobit.com or call (330) 899-2200, ext. 11.