32 minute read

History Repeating Itself

It’s all just a little bit of history repeating

It’s all just a little bit of history repeating… this catchy song by Shirley Bassey is the most apt introduction to this article. In the building and construction industry, history is repeating right before our eyes. On 25 July 2022 the newly elected Albanese Labor Government wound the 2016 Building Code back to its “bare legal minimum’’ and by doing so took its first steps towards its promised abolition of the Australian Building and Construction Commission (ABCC). The history of the ABCC stretches back to 2001 and the Cole Royal Commission, and prior to that there is a history stretching back till at least the early 1980s all of which shows that the building and construction is unique and as such needs a specialist regulator. The ABCC exists to enforce laws under the Fair Work Act 2009 (Fair Work Act) and the Building and Construction Industry (Improving Productivity) Act 2016 (BCIIP Act). The BCIIP Act makes provision for a Building Code. This is the Code that contractors were bound by when they applied for Commonwealth work. It is this Code which has been stripped back to its “bare legal minimum.” On 25 July 2022, the Albanese Government registered a legislative instrument called the Code for the Tendering and Performance of Building Work Amendment Instrument 2022 (the Amended Code). This was the document by which the 2016 Building Code was stripped back to the “bare legal minimum”. Both the Fair Work Act and the BCIIP Act are still in full effect and people are still bound by these laws. But the key point here is that the Code has been effectively hollowed out, and this hollowing out means that the regulator loses their ability to impact the industry. So whilst there is technically still a regulator, the practical result of this legal manoeuvre is that the regulator cannot now drive effective change in the industry. In short, the code bound the industry to a higher standard of behaviour. Now the Code has been gutted, there is nothing to stop poor behaviour re-emerging. The situation is not much different from a riot in a big city. The laws are still in full effect, but when there is no police around to enforce them, people will smash and grab, knowing they can get away with it. University of Adelaide law professor Andrew Stewart recently noted that the extent of law breaking in the building and construction sector “…is arguably greater than any other sector” the professor however went on to state that “[t]o the extent that conduct is directed against large employers that have the resources to go to court then arguably there’s no reason for [a regulator] to be directing scarce resources there.” It is naive to suggest that companies can now take legal action on their own behalf to enforce the Fair Work Act and the BCIIP Act. Law enforcement is a job for an independent

regulator. The CFMEU has been fined over $16 million by the ABCC since 2016. It is pure fantasy to think that any one business, no matter how well resourced, can take on the CFMEU without risking consequences. The simple fact is that the building and construction industry is unique, and it needs a tough regulator. Without one, lawless behavior will return. The ALP used to agree with this basic premise. In 2007 the then Federal shadow Industrial Relations Minister Julia Gillard warned building unions that there would always be ‘a tough cop on the beat’ under a Labor Government. In a National Press Club speech in May 2007, Gillard reassured business:

“I am from the political party that deregistered the BLF. That happened in Victoria under the

Cain Labor government. Any suggestion that

Labor’s track history isn’t one of insisting on tough compliance is a suggestion that simply doesn’t pass the test of analysis…” In April 2022 the High Court of Australia in the landmark Pattinson case stated that “the CFMEU’s continuing defiance … indicates that it regards penalties previously imposed as ‘an acceptable cost of doing business”. Since the ABCC was reinstated in December 2016, it has had an astonishing success rate as a regulator. Its actions have resulted in over $17 million in penalties. $16 million of which have been against the CFMEU alone. This is an extraordinary statistic. Master Builders still hopes that more sensible thinking prevails and that there is a regulator in some fashion or other for the construction industry. So that we don’t have to repeat the sad tale of lawlessness once again in the industry, followed by a royal commission, followed by a call for a regulator. However, if the ABCC is to be abolished, this is a good opportunity to have a brief look at the history of the regulator and indeed, why we have a specialist regulator in this industry at all.

History repeating

The idea of specialist regulator for building and construction is not new. Lawless behavior, particularly from construction unions had been on the Australian radar since at least the late 1940s. The ABCC as it exists today was established by the Building and Construction Industry (Improving Productivity) Act 2016 (the BCIIP Act) on 2 December 2016 however, the history of the agency stretches back to the 2001 Cole Royal Commission into the building and construction industry. In fact, a similar regulator, called the Building Industry Task Force (BITF) was established in NSW following the recommendations of the Gyles Royal Commission into the NSW Building industry in the early 1990s. In 1974 the forerunner to the CFMEU, the Builders Laborer’s Federation (BLF) was deregistered as a federal organisation before being re-registered some two years later based on undertakings about future industrial behavior. Following the 1982 Winneke Royal Commission Report (which saw the federal secretary and Victorian state secretary of the BLF, Norm Gallagher come to face corruption charges) a further effort was made to deregister the BLF. The newly elected Hawke Federal Government and the ALP Cain-led Victorian governments withdrew from the deregistration proceedings in 1983, again based on undertakings (given to the Federal Court) about future conduct. The undertakings however were not honored and on 14 April 1986 the BLF was deregistered federally and the state branches of the BLF in NSW and VIC were deregistered at the same time. When introducing the deregistration legislation into the House of Representatives in August 1985, PM Hawke stated: “The BLF’s complete disdain for the law, their frequent resort to practices of thuggery and physical coercion have no place in our society. The BLF has forfeited any claim it might otherwise have had either on the community at large or on the trade union movement”.

1992 — The Gyles Royal Commission

In 1992 there was a Royal Commission into Productivity in the Building Industry in New South Wales conducted by Roger Vincent Gyles, a former Judge of the Federal Court and the NSW Supreme Court. Gyles publicly observed that;

“Observance of the law and law enforcement in general play very little part in the industry. The law of the jungle prevails.

The culture is pragmatic and unprincipled. The ethos is to catch and to kill your own…

Once it becomes acceptable to break, bend, evade or ignore the law and ethical responsibilities, there is no shortage of ways and means to do so.” Gyles noted that industrial relations was overwhelmingly the most important issue and the union’s conduct and philosophy the fundamental cause of the industry’s problems. He recommended the government deregister the Builders Workers Industrial Union (BWIU)

(now the CFMEU) in both the state and federal jurisdictions, and his Commission’s BITF pursue cases and recommended changes to the law. Gyles made 63 recommendations to the NSW Government, of which all but two were adopted. One of the recommendations was to “commence deregistration proceedings against the CFMEU”. These proceedings however did not commence. In return for not proceeding with deregistration, the CFMEU entered in a ‘Deed of Agreement’ with the NSW Government. The Deed (dated 16 March 1994) set out a clear Code of Conduct of behavior for the union and its officials. The Deed was signed by both State and National officers of the CFMEU, the secretary of the Labor Council of NSW, and the NSW Minister for Industrial Relations. Following Gyles recommendations came the NSW Code of Practice for the Construction Industry (1996), then the Commonwealth, State and Territory governments through the Australian Procurement and Construction Council (APCC) introduced a National Code of Practice for the Construction Industry in 1997. It is interesting to note with a change to a Labor NSW Government led by Bob Carr in 1995, the Building Industry Task Force was disbanded almost immediately.

2001 — The Cole Royal Commission

By August 2001 unlawful behavior was again rife in the industry and the Cole Royal Commission was established to enquire into unlawful practices in the ...the key point industry. is that the ability In March 2003, Commissioner Cole of the regulator to enforce good tabled his final report and found that that the building behaviour has and construction industry was been crippled. characterised by a widespread disregard for the law, and that existing regulatory bodies had insufficient powers and resources to enforce the law. The reasons for this lawless behavior are numerous but the contracting nature of the industry, the large cash flows, and the opportunity for construction unions to gain wealth far beyond mere union dues by exercising leverage through industrial unrest and the abuse of right of entry powers, all seem to play a part. Cole stated that; “These findings demonstrate an industry which departs from the standards of

commercial and industrial conduct exhibited in the rest of the Australian economy.

They mark the industry as singular. They indicate an urgent need for structural and cultural reform. At the heart of the findings is lawlessness…” The final report had 212 recommendations, the great majority about changes to federal workplace relations legislation governing the building and construction industry. Cole also proposed an Australian Building and Construction Commission (ABCC) to monitor illegal behavior by unions. In short, the Cole Royal Commission recommended the establishment of an independent commission to monitor conduct in the building and construction industry. In October 2002, an interim body, the Building Industry Taskforce, was established. It became a permanent national taskforce in March 2004. On 1 October 2005, Under PM John Howard the Office of the Australian Building and Construction Commissioner was established. On 1 June 2012, Under Prime Minister Gillard, the Fair Work Building and Construction replaced the Office of the Australian Building and Construction Commissioner as the building industry regulator. On 30 January 2013, Then Minister for Employment and Workplace Relations Bill Shorten announced a new Building Code 2013 would take effect on 1 February 2013. The Building Code 2013 outlined a range of requirements designed to promote lawful behavior within the industry, regrettably however, from MBA’s perspective, the 2013 Code lacked sufficient sanctions to force change within the industry.

2015 — The Heydon Royal Commission

The Heydon Royal Commission was broader in scope than simply the building and construction industry and was concerned with Trade Union governance and corruption. Lasting approximately 21 months, the Commission hosted 155 days of public hearings, 46 days of private hearings, received evidence from over 500 individual witnesses and was completed on time and under budget. The Royal Commission revealed allegations involving multiple examples of bribery, extortion and blackmail in the nation’s construction industry. The report listed 79 recommendations to improve the governance of registered organizations, to improve the management of construction worksites across the country, and to make unions more transparent and accountable to their members. Foremost among these recommendations was the reinstatement of the ABCC. On 2 July 2016 the entire nation watched the outcome of the double dissolution election, an election called by the Turnbull Government, largely based on its promise to re-instate the ABCC with greater power. On 2 December 2016, the Australian Building and Construction Commission (ABCC) commenced operations, established by the Building and Construction Industry (Improving Productivity) Act 2016. Since December 2016 nationally, the CFMMEU and its representatives have had some $16 million in penalties imposed for repeated breaches of the law. In addition to the astonishing fines, the legal activity of the ABCC has meant that the Federal Court of Australia has made many judgments which may help to uphold lawful behavior in the construction industry into the future. However, in the absence of a powerful regulator such as the ABCC, this law will not be properly enforced. As a direct result of the ABCC, the High Court of Australia has confirmed that any person can, and should, be fined the maximum for flagrant law breaking in an industrial context but again, without a powerful public regulator the law will not easily be enforced. In April 2022 Independent consultant Ernst & Young handed down a report (commissioned by the MBA Australia) which analysed the impacts to Australia’s economy from the abolition of the ABCC. The headline being that abolishing the ABCC could cost the Australian economy around $47 billion. The Building and Construction Industry is in many ways the canary in the coalmine of the Australian economy. The industry is critical to economic confidence and investment in areas as diverse as employment, home ownership and venture capital. A few facts tell an important story: • The Building and Construction Industry employs nearly 1.2 million Australians. • The Building and Construction Industry is the single largest provider of direct employment in Australia. • The Building and Construction Industry provides more opportunities to small business than any other sector of the economy. • The Building and Construction Industry employs more Apprentices and Trainees than any other sector.

Summary

When people talk about History, we often hear the old saying; ‘’Those who cannot remember the past are condemned to repeat it.” The history in our industry is clear. Unlawful behavior is an ever-present risk within the building and construction industry – without a powerful and independent regulator, lawless behavior is likely to return.

Are You Balancing Work and the Books? Are You Able to Pay Staff and Bills? Are You Stressed Chasing Payments? Are You Feeling Family or Lifestyle Pressures?

28 Years Experience Knowledge of the Law Over $20M Paid

With passion for the job and compassion for clients, Subbie Assist is a creative problem solver with strong writing ability and communication skills. Subbie Assist has the willingness to listen with healthy scepticism and perseverance to get the job done — giving you YOUR LIFE BACK!

It’s up to you to take the fi rst step ~ it can be done swiftly!

Getting your life back start with one simple phone call 0400 221 360

Master Builders NSW Top 50 Industry Luncheon

NSW Government announces Building Commissioner will stay on

The Hon. Victor Dominello MP.

On Friday, 26 August 2022, Master Builders Association of NSW presented the Top 50 Builders Luncheon at Royal Randwick with special guests, the Hon. Victor Dominello MP, Minister for Customer Service and Digital Government, Small Business and Fair Trading and David Chandler OAM, NSW Building Commissioner.

Addressing nearly 200 people at a sold-out event, Minister Dominello outlined the digital transformation across NSW Government services and what it meant for the Building and Construction industry. The Minister has driven a number of significant reforms impacting the Building and Construction industry, including overhauling the state’s strata title laws, the rollout of the e-Planning portal, the establishment of the Strata Portal and e-Construction platforms and the e-Regulation initiative. The Australian newspaper recently recognised the Minister as one of the nation’s Top 100 Innovators. In addition, Minister Dominello announced that the NSW Building Commissioner has withdrawn his resignation and Mr Chandler will remain in his role until August 2023. “Mr Chandler is a highly respected industry leader, and his commitment to the year ahead ensures we will maintain momentum in lifting customer confidence across residential building and construction in NSW,” Minister Dominello said. “He has made significant contributions to building industry reform in this State, and I am happy the work can continue under his leadership.” “In the year ahead, the focus will be on continued advocacy for industry change to deliver key projects, including Project Remediate and a new initiative known as Project Intervene, where we are working with the strata community to help rectify serious defects in existing buildings.” Minister Dominello said Mr Chandler would work closely with Property Services Commissioner John Minns to progress industry reform across the strata sector. “This will be an important collaboration as the journey of establishing buildings transitions into what happens after they are built. Close engagement with strata communities, building managers and other service providers will inform the key areas we need to address,” Mr Dominello said. Mr Chandler will move forward with industry and consumers to advance ongoing and additional building reforms. This will include progressing Construct NSW, which focuses on six areas of industry reform: regulation, ratings, education, contracts, digital tools and data and research. In Mr Chandler’s first public remarks addressing industry leaders, his U-turn in the role, he said his decision followed almost four weeks of “Victor’s arm-twisting”. Mr Chandler explained why he felt the need to extract himself from overseeing the state’s beleaguered construction industry. “Frankly, the situation is that I’m not an elected member of parliament,” Mr Chandler said at the Master Builders NSW event. “And when a bureaucrat feels as though the work that you’re trying to do is probably tougher than it needs to be, then a bureaucrat has got to make the decision as to whether that place suits them or not. That’s the only decision that’s happened here.”

David Chandler OAM, NSW Building Commissioner, with Master Builders NSW Executive Director Brian Seidler.

Builder Professionalism Award presented by Brad Walters and Alexandra Shaw, received by Mark Monk on behalf of Helm.

The Commissioner joked that he was headed for the physio after Minister Dominello twisted his arm into staying until August 2023. In his presentation, Mr Chandler discussed the significance of building industry reforms over the last three years and the long-term impact this will have on rebuilding public confidence and our pride in our industry. In addition, Mr Chandler said he was pleased to continue the work the industry had achieved. “Much has been achieved in the past two years, but there is still more to be done to establish NSW’s residential building and construction market as the most trusted and customercentric in the country. I am looking forward to continuing the work we have started,” Mr Chandler said. The NSW Building Commissioner will continue focusing on key projects, including the removal of dangerous flammable cladding from highrise buildings and working with the strata community to rectify serious building defects. The Luncheon also heard from industry partner EQUAFAX, who outlined the services offered by the companies operating as a rating agency. EQUAFAX specialises in developing ratings models and contributes to public sector reviews and Government enquiries on insolvency in the construction industry. EQUAFAX has been instrumental in the development of the independent construction industry rating tool (iCIRT). Alexandra Shaw, Strategic Enterprise Director, presented a number of iCIRT industry awards: • The Builder Transparency Award, received by

Fabrizio Perilli on behalf of TOGA • Builder Professionalism Award, received by

Mark Monk on behalf of Helm, and • Builder Governance, received by Ray Millar from North Construction & Building Pty Ltd. Congratulations to all award recipients! The Top 50 Builders Luncheon would not have been possible without the generous support of our major partner, Equifax Australia. The 2022 Building Degree Graduate of the Year Award winners were also announced at the event. These awards are open to all New South Wales graduates. The Awards were introduced by the Sydney Division of the Master Builders to encourage the next generation of building professionals, and proudly sponsored by CBUS. Representing the 2022 Building Degree Graduate Awards Sponsor, CBUS SUPER, Jessica Weston, Senior Employer Engagement Manager, presented the awards to the winners. 1st place: Brittany Wells from FDC Construction & Fitout

Brittany has been employed with FDC since 2018 and is currently employed as a Contract

Administrator.

In April, Brittany completed her Bachelor of

Construction Management at Western Sydney

University with Honours and was awarded the

University Medal.

Brittany now has responsibility for the Hilltop

Precinct Separable Portion of the Oakhill

College Innovation Hub project, including cost control, forecasting and procurement. 2nd Place: David Sidra from Construction Consultants

David began training with Construction

Consultants in 2017 and graduated with a

Bachelor of Construction Management from

Western Sydney University.

During his time with Construction Consultants,

David successfully mitigated the risk of project delays, has exceeded budgets, and managed successfully interpreting and administering the head contract and subcontract agreements. 3rd Place: Nathan Wood from Erilyan Pty Ltd

Nathan commenced his training with Erilyan in 2014 and completed his Bachelor of

Construction Management with Honours this year from the University of Newcastle.

He achieved this whilst also managing up to 50 subcontractors on regional sites. His role as Site Manager included the demolition and construction of The Cardiac Catheterisation Laboratory and Intensive Care development, The IVF Laboratory and Consulting Suite upgrade and refurbishment at Dudley Private Hospital in Orange NSW.

The MBA acknowledges the winners and nominees for the 2022 Awards. MBA also thanks this year’s judges, Bill Stavrinos from Richard Crookes Constructions and Stephen Flannery from Fugen Constructions, for their time and expertise in interviewing all our nominees. We are grateful for their efforts to ensure the awards are possible. We also thank CBUS for their continued support of these Awards.

MASTER BUILDERS FINANCIAL SERVICES

The Team at Master Builders Financial Services has extensive experience in the Banking and Finance Sector. We specialise in Asset and Equipment finance for the building and construction industry. Supported by our Home loan and Business lending specialists, we have the expertise to create structured finance packages to suit business and personal needs of our MBA members. Ogarit Kelley – Manager, Financial Services, has been with the MBA since 2011. Ogarit has been supporting members, their families, and colleagues with all facets of lending, finance and industry updates and requirements in an ever so changing market. Mick Brazel – Mortgage & Business Lending Specialist brings a wealth of knowledge and expertise to the financial services team. Mick specialises in SME lending with the ability to tailor suitable lending advice.

Financial Services available:

CAR SEARCH

Our MBA Car Buying Service can help members save on vehicle purchases. This unbiased service ensures the correct MBA discounting is applied and maximise the value of your trade-in. Enjoy significant fleet savings on new and demo vehicle purchases through a reputable and reliable network.

VEHICLE AND EQUIPMENT FINANCE

A hassle free, personalised service with a range of tax effective finance options. We work with various lenders to secure the best rates in the market and structure your finance in a way that best suits your business and personal needs. Our financial packages can help you purchase: • Cars, utes and 4WDs, • Trucks and trailers, • Printing and cutting machinery, • Excavators, IT equipment and forklifts If you are a small to medium sized business, the Instant Asset Write-Off could be a great way to acquire capital assets and obtain an immediate tax deduction. You can write off 100% of assets that cost up to $150,000, for businesses with less than $500 million turnover. This has been extended until June 30, 2023.To take advantage of this offer some of the items that you could look at purchasing include cars, vans, utes, bobcats, plant, and machinery.

MORTGAGES

We can assist members with Residential Home loans and Investment Mortgages across a vast platform of lenders. We work closely with you to ensure the appropriate product is in place to support your individual requirements. Business Lending — Commercial Property, Term Loans, Secured/Unsecured short-term funding. If you are looking to buy your own commercial premises, secure a line of credit or consider alternative short term cash flow solutions. We have several options available that may be suitable. Self-Managed Super Fund (SMSF) loans for residential investment and commercial property may also be a consideration, as you work towards your long-term retirement goals.

If you would like further information please contact Ogarit and the team for a hassle-free finance solution on 1300 760 366 or 0414 919 194 or okelley@mbansw.asn.au

Member Services

Meet our team —

Back Row from left: Paul Love, Clare Mayhew, Debralee Scarselletta, Jessica Martin Front Row: Emma Day, Graham McGuiggan, Verity Michell, and Peter Sahyoun

The Member Services Team is the go-to department for all member enquiries — we assist members to connect with the right service department, member benefits or assistance with member discounts.

Our team also arrange certificates of service, publishe member information brochures, assist members with change of details on their membership and login assistance for our website. The team also assist enquiries for: • Find a Master Builder advertising • Refer a Mate • Division Information Night invitations • Member voting – Division and Council of

Management • Service Awards – Division Gold Medal,

Honorary etc. • Member discounts and rewards program • CPD seminars and advice • Building Business Start up Kit – Guidance for members changing their business structure • Sponsorship opportunities for suppliers • Marketing materials for members – eg: MBA logos, Vehicle stickers, etc. Paul Love – Membership Coordinator Paul has more than 20 years’ industry experience. His key role is to recruit new members, assist member enquiries and support division members throughout the metropolitan area. Clare Mayhew – Member Engagement Representative Clare has been in our department for four years and spends most of her time assisting member enquiries and contacting members to check in on and provide updates of our service offering. Debralee Scarselletta – Administration Coordinator Debralee has been heading up our admin team for just over four years, is an accomplished administrator that supports our team throughout the state and is always willing to take on new challenges with enthusiasm. Jessica Martin – Membership Officer Jess has been with us now for three years and has progressed her career and experience in a noticeably short time. Her new role is to recruit members, assist member enquiries and support division members throughout the metropolitan area. Emma Day – Administration Assistant Emma is a recent addition to our team, her role is assisting enquiries and maintaining our member CRM database. Within a short period of time Emma has demonstrated her skill set in administration and customer service. Graham McGuiggan – Manager Member Services Department Graham has over 14 years’ service and prior to joining the Master Builders Association, has held Senior Management roles with Repco, Tradelink and BOC Gases. Overall, Graham has more than 30 years’ experience within the building and construction industry. Verity Michell – Marketing and Sales Support Verity has recently joined our team and her experience in marketing is already being demonstrated. Verity’s customer service focus is also a welcomed addition to our team. Peter Sahyoun – Division Coordinator Peter joined our team in early May and his prime responsibility is to work closely with our division committees throughout the state. This role requires someone with a high focus on operational processes, technology, customer service and sales acumen.

AHRCA MEMBERSHIP PROMOTES CONFIDENCE

AHRCA NSW membership includes complementary Master Builders Association membership. AHRCA is affiliated with MBA NSW and adheres to the MBA NSW Code of Fair Business Practice and Code of Ethics.

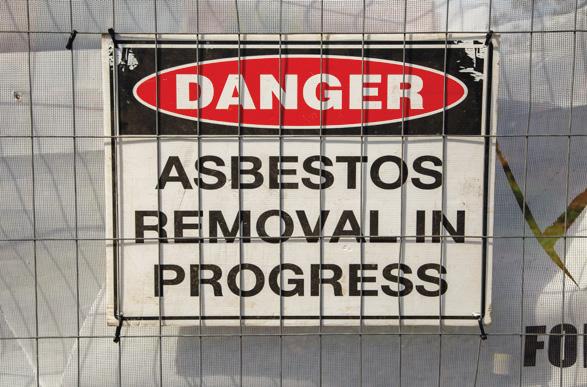

AHRCA actively promotes the dangers, risks and safe management of asbestos and HAZMAT products. We raise industry standards and professionalism presenting a responsible and ethical image of our members among clients, industry, government, media and the general public.

AHRCA provides significant benefits to our members. We are synonymous with industry best practice in asbestos and HAZMAT removal. Through our commitment to compliance and our affiliations, AHRCA presents a respected and ethical image to promote confidence in our members as industry leaders. Membership benefits include: • Alignment with the respected AHRCA brand and our affiliates including the Master Builders

Association; • Representation in government and industry on issues that impact our industry, workers and the community; • Safety updates and the provision of essential information on Work Health & Safety and regulatory changes; • A members forum to discuss issues on asbestos and HAZMAT removal or treatment; • Assistance and support should difficulties arise including access to Industrial Relations advice and advocacy when required; • Access to legal advice on contracts; and, • Significant savings on annual business expenses including insurances and vehicles.* *Visit our website for details.

INDUSTRY LEADERS

For over 30 years, members of the Asbestos and HAZMAT Removal Contractors Association (AHRCA) have protected Australians and the environment from asbestos and hazardous material risks. AHRCA represents New South Wales industry leaders from the asbestos abatement industry including asbestos removal contractors, consultants, equipment suppliers, education and training institutions and other industry related organisations. To ensure the highest quality standards, we promote compliance and ethical best practice in international and Australian Standards, Occupational Health and Safety, and Environmental Management Codes of Practice for asbestos and other materials hazardous to human health.

COLLABORATION & CONSULTATION

AHRCA collaborates and consults with leading industry and government representatives providing best practice expertise. With the shared goal of preventing diseases caused from exposure to asbestos fibres and other hazardous materials commonly found in the Australian domestic and commercial construction and demolition industries; AHRCA is closely affiliated with building industry bodies, trades and construction education facilities, government regulators, advocates and health and research organisations to consistently promote improved health and safety for workers and the wider community.

COMMITMENT TO QUALITY & COMPLIANCE

As the peak industry body for asbestos and HAZMAT removal in Australia, we are committed to ethical best practice and compliance in Safety and Environmental Systems and Work, Health and Safety regulations in the identification, treatment, removal and disposal of asbestos and other hazardous materials including silica, lead, synthetic mineral fibres (SMF), polychlorinated biphenyls (PCB’s) and treated timbers.

COMMITMENT TO HEALTH & SAFETY

With over 4,000 Australian lives lost to asbestos-related diseases annually, AHRCA is committed to promoting best practice in safe sampling, containment, management, removal and disposal of asbestos and best practice in the management and removal of other HAZMAT materials.

ASBESTOS

Asbestos is a naturally-occurring fibrous silicate mineral. Once considered a versatile material because of it’s ability to withstand heat, erosion and decay, and with fire and water resistant properties; asbestos was used in the manufacture of around 3000 products worldwide, most commonly in the construction, car manufacturing and textile industries. Although asbestos was banned in Australia in 2003, legacy asbestos-containing materials remain in older residential and commercial structures. If disturbed, asbestos fibres could be released into the air and inhaled, which poses a health risk to workers and the community.

HAZMAT

AHRCA members also specialise in the removal of many hazardous materials capable of posing health risks if they are not adequately maintained or if they are disturbed during renovation or demolition. These materials include lead paints; Polychlorinated Biphenyl

(PCB); Synthetic Mineral Fibre (SMF) typically used in thermal and acoustic insulation and reinforcing agents; and silica dust, commonly referred to as respirable particles generated in workplaces through mechanical processes involving manufactured stone, concrete and the like.

The AHRCA promotes industry best practice, quality management systems and adherence to government Regulations and Codes of Practice. We deliver excellence in asbestos and HAZMAT removal to benefit the Australian community and Industry.

For a list of AHRCA members or for information on how to become a valued member of the AHRCA visit our website ahrcansw.asn.au or email us at email@ahrcansw.asn.au

ahrcansw.asn.au

Keeping Industry informed whilst promoting Safety & Compliance since 1991

Don’t let mould put your project on hold!

Mould is a serious concern for builders. It results in costly delays while waiting for structures to dry and cleaning the mould further adds to the time and cost. Siniat’s Interhome is a popular separating wall system suitable for duplexes and townhouses, and is well-known for its ease of installation.

Interhome can now offer mould resistance.

By incorporating Siniat’s mould resistant Intershield in the central fire barrier, and mould resistant Multishield in the lamination of the barrier, mould does not have to put your project on hold.

Siniat. Let’s build better together.

siniat.com.au

Shining a light on ‘off-the-books’ payments

Dodgy contractors trying to keep income ‘off-the-books’ and businesses helping them do so are being put on notice as the Australian Taxation Office (ATO) continues to shine a light on shadow economy behaviour. Paying cash in hand to avoid paying tax is a significant part of the shadow economy. However, the taxable payment reporting system (TPRS) allows the ATO to investigate this conduct. Around $350 billion in payments made to 950,000 contractors were reported to the ATO in the last financial year. The ATO expects more than 270,000 businesses to complete a taxable payment annual report (TPAR) for the current 2021-22 year. TPRS obligations apply to businesses in the building and construction industry, as well as businesses that provide cleaning, courier, road freight, information technology and security, investigation, or surveillance services and have paid subcontractors in relation to these services. The ATO is reminding these businesses that they will have had to lodge a TPAR with the ATO by 28 August setting out payments to their contractors. ATO Assistant Commissioner Peter Holt said the TPAR is just one tool in the ATO’s toolbelt, helping crack down on $11 billion a year in missing taxes and keeping things fair for those businesses and contractors doing the right thing. “The ATO has sophisticated data and analytics to identify businesses that fail to lodge a TPAR,” Mr Holt said. “Not reporting payments to contractors may be seen as a red flag and will prompt closer scrutiny from the ATO on your own affairs as well as those of your contractors. “Trying to ‘help out’ your contractors by not disclosing their payments is a great way of bringing attention on yourself.” The TPAR was introduced in 2012 to level the playing field and ensure businesses in the building and construction industry reported their income and paid their fair share of tax. The ATO uses information reported on the TPAR to make sure that businesses are complying with their tax obligations, for example, reporting the correct amount of income, lodging business activity statements (BAS) and income tax returns, paying the right amount of tax, being registered for GST if required, and using a valid Australian business number (ABN). “We know most small businesses do the right thing, however there are some contractors out there who deliberately don’t report or under-report their income, making it unfair for honest businesses,” Mr Holt said. “Businesses and tax professionals can view the data the ATO receives about their business, like taxable payments reported under the TPRS, as a reported transaction in ATO Online platforms. “Our new reported transactions services can help businesses and their tax professionals to view their data to make it easier to meet tax obligations.” Mr Holt also reminds sole traders any payments reported to the ATO through TPRS will be pre-filled in their tax return at tax time. “If you’re a sole trader, any payments you received as a contractor that were reported in a TPAR will be available as a pre-fill information report into your tax return. “Whether you lodge your tax return yourself or through an agent, just remember to double check the pre-fill information is complete and correct before lodging, especially as not all your income may have been reported to us previously.” The ATO is reminding businesses and tax professionals who are lodging on behalf of their clients to contact the ATO if they need additional time to lodge their TPAR. More information and resources to help businesses and their advisers work out if they need to lodge, how to lodge, and what to report is available at ato.gov.au/TPAR

NEW INSURANCE REQUIREMENTS

New Insurance Requirements from 1 July 2023

On and from 1 July 2023 a registered building practitioner under the Design and Building Practitioners Act 2020 (the Act) will need to be adequately insured to perform building work. Registered building practitioners will need to ensure that they are adequately insured for any work referred to in a compliance declaration given on and from 1 July 2023. This will include any work done before that date relating to that declaration. Section 24(1) of the Act states: (1) A registered building practitioner must not — a) Provide a building compliance declaration to do related building work, or b) Hold out that the practitioner is adequately insured with respect to the provision of the declaration or doing the work, unless the practitioner is adequately insured with respect to the declaration and work. Clause 75 of the Design and Building Practitioners Regulation 2021 states: (1) For the purposes of section 24(2)(a) of the

Act, a registered building practitioner must be indemnified under an insurance policy, whether a professional indemnity policy or otherwise, that complies with this clause. (2) An insurance policy must, in the reasonable opinion of the registered building practitioner concerned, provide for an adequate level of indemnity for the liability that could be incurred by the practitioner during the practitioner’s work. (3) In determining whether a policy provides for an adequate level of indemnity, the practitioner must consider the following matters: a) the nature and risks associated with the work typically carried out by the practitioner, b) the volume of the work typically carried out by the practitioner, c) the length of time that the practitioner has been registered, d) a reasonable estimate of claims that could be brought against the practitioner based on paragraphs (a)–(c), e) the financial capacity of the practitioner, f) any limits, exceptions, exclusions, terms, or conditions of the policy We recommend that you consult with your insurance broker. Otherwise, you can contact Master Builders Insurance Brokers for further questions.