By Neil Sutton

Westminster, Colo.-based 3xLOGIC has acquired the access control product lines of infinias in order to round out its Cloud-based security solution.

The deal closed on Feb. 27 and all major moves, including personnel, were completed by March 2, according to 3xLOGIC. Wayne Jared, president of infinias, joins 3xLOGIC as vice-president of engineering and the company’s total headcount is now 120. Financial terms of the deal were not disclosed.

ty solution. The missing piece in our portfolio was access control,” he says.

After surveying the market, the company identified infinias as an acquisition target and approached Observint Technologies, owned by Carlyle Group, to arrange a sale.

3xLOGIC’s focus is using intelligent video systems to drive business intelligence information, according to company CEO Matthew Kushner. A little more than a year ago, the company “mapped out what our business ambitions are in this market: to build a fully Cloud-based integrated securi-

Observint bought infinias in September 2012 and says it has doubled the business since then. “After almost seven months of discussions, they agreed to carve out infinias from the Observint group,” says Kushner.

In future, 3xLOGIC will be able to offer its own VIGIL branded solutions integrated with the infinias product line either as an on-premise server-based integration or as a Cloud-based solution.

“What really got us attracted to the infinias product was the investment the Carlyle Group made into their Cloud-based initiative,” says

Tyco is one of the latest companies to join Internet of Things standards body the Thread Group in a sponsor-level role.

The Thread Group was established last year with seven founding companies — Nest Labs, Yale Security, ARM, Big Ass Fans, Freescale Semiconductor, Samsung Electronics, and Silicon Labs — as a means to promote the adoption of its Thread protocol, an IP-based wireless mesh network to connect compatible devices in the home. Overall membership has since swelled to more than 80 companies. Tyco will take a seat on the board along with the founding members and another newcomer, Somfy, a France-based home control products company.

“We’re always looking at Tyco to leverage different technologies that are out there in the market, keeping our eye on them and seeing which ones align with our strategy. We think Thread has a good alignment with our strategy because it looks at open standards and leverages some of the existing technologies that are out there to bring unified adoption of the Internet of Things to reality,” explains Tim Myers, senior product manager for Tyco Security Group. “That’s the biggest reason why Tyco has jumped in at the sponsor level.”

Kushner. “Infinias has their own Cloud-based infrastructure that mimics what we have built — the same fundamental Cloud-based architecture approach but on an access control discipline versus a video discipline. We will blend these two products together.”

Kushner says 3xLOGIC will maintain the infinias branding, which he says is strong in several vertical markets including K-12 education and multi-tenant environments, the hallmark of which is “one or two doors of access control, one or two cameras, but thousands of locations,” he says. “They are exceptional at that, and they will pull 3xLOGIC through that market.”

3xLOGIC will also leverage infinias’ existing channel partnerships. The company’s go-to-market strategy emphasizes a hybrid approach, selling direct to dealers, but also going through major distributors.

“We’re going to respect the distribution model infinias has. We’re not changing anything there,” says

He adds that Tyco waited until now to join the group because “a lot of it is understanding what we see of the formation of the group and the direction that that standard is going to take and how it’s going to progress with a certain industry.”

Currently, Tyco’s participation in Thread will be limited to its Security Group, says Myers. “All product divisions [within Tyco] are always looking into new technologies but specifically with this, Tyco Security Products is taking the lead.”

“Specifically with this, Tyco Security Products is taking the lead.”

—Tim Myers,Tyco

Thread Group president and Nest Lab’s technical product marketing manager Chris Boross told SP&T News last fall that the first half of 2015 would be devoting to helping companies test and certify products on the Thread protocol and we should see Thread-compatible products enter the market later in the year.

“The Thread wireless technology will be released this summer and addresses the networking layer. There are many existing application layers targeted for IoT that could potentially complement Thread,” says Myers.

“We believe there’s an opportunity for us to substantially grow our business in Canada with the combined offering and a stronger, focused push. We see Canada as a growth market.”

— Matthew Kushner, 3xLOGIC

Kushner. “We’re going to take advantage of the good relationships they have with their distribution partners and start expanding our reach in the market.”

Kushner estimates that approximately 10-15 per cent of 3xLOGIC’s business comes from Canada. But there is considerable room to increase that, he says.

“We believe there’s an opportunity for us to substantially grow our business in Canada with the combined offering and a stronger, focused push. We see Canada as a growth market.”

Kushner says 3xLOGIC is primarily a Cloud-based company, and will continue to grow its business on that platform. Its key market is retail, using multiple data points (such as people counting, dwell time and transactional data) to generate business intelligence information.

“The speed at which we can collect the data, splice the data and put the data in a dashboard in front of the operator is achieved with a level of efficiency. We can’t find any better way of doing it than taking that data and dropping it into the Cloud, run it through it the business intelligence engine then re-present it to the operator in a very [visual] fashion so they can make a quick, informed decision,” he says.

Kushner acknowledges, however, that Cloud is still a new concept in the minds of many, and education is required to convince some of its advantages. “There is apprehension,” he says. “I remind folks, you’re either a company that is offering service solutions in the Cloud, or you’re a Cloud that is ultimately going to lose your grip on the market.”

Sielox, a New Jersey firm mainly known for its access control solutions, is trying to establish a larger presence in Canada by hiring two manufacturer’s representative firms up here.

Sielox already has a major presence in Calgary in the K-12 market and some marquee customers in Toronto, mostly large retailers, but CEO Karen Evans feels there is ample opportunity to expand the company’s reach.

Earlier this year, Evans selected Toronto-based Connsec Products (Connected Security Products Inc.), run by Brian Hachey, to represent the company in Ontario, Quebec and the Maritimes. From Manitoba to British Columbia, Sielox will be represented by Andy Grewal of IAVI Canada.

there and have something that’s really different? I took a slightly different approach,” she says. “I decided to think a little bit outside the box and looked at rep firms that may dabble in the security space but played heavily in the sound and paging business.”

Both firms will carry Sielox’s Pinnacle software solution as well its Class (Crisis Lockdown Alert System) product.

Evans says she was drawn to those companies since they have knowledge and expertise outside of traditional physical security systems.

“When I first started looking at the Canadian market, I thought . . . How am I going to play up

The ZigBee Alliance and the Thread Group announced they are collaborating to enable the ZigBee Cluster Library to run over Thread networks. The ZigBee Cluster Library standardizes application level functionality for a variety of devices used in smart homes and other markets. Thread is a wireless

networking protocol that can support multiple low-bandwidth, IP-based application protocols to provide secure networks, connectivity and low power in the home. “By agreeing to work together, ZigBee and Thread are taking a big step towards reducing fragmentation in the industry,” says Chris Boross, president of the Thread Group and technical product marketing manager, Nest, in a prepared statement. “Thread is designed to work with and support

For Evans, Canada is practically a green field opportunity. The largest potential, she says, is with customers with 10-20 doors or less.

“Our push is really going to be small to mid-range and ultimately grow to the big systems,” she says.

But what’s piqued the interest of the new Sielox reps is the Class system. “That’s why we wanted to partner up with Sielox,” says Hachey, owner of Connsec. “We knew they had a card access system, but this Class system was icing on the cake. It’s not something we’re seeing a lot of other manufacturers offer, but there’s definitely demand for that type of product in the marketplace.”

Grewal agrees. While it isn’t well known in Canada, there’s “definite interest from dealers who have been introduced to the product.”

— Neil Sutton

Kaba Access and Data Systems Americas has appointed Andreas Dahms as Canada country sales manager for electronic access control, including both Kaba and Keyscan products.

Dahms has more than 25 years experience in the security industry. He got his start as an apprentice locksmith while attending college to earn a Certified General Accounting designation before going on to operate his own locksmith company. Dahms has also worked for Chubb Lock & Safe, managing its operations in B.C.

Since 2006, Dahms has worked with Keyscan as its Western Canada regional sales manager.

“We are pleased to promote Andreas to this new role,” says Steve Dentinger, vice-president of sales and marketing and site manager, Kaba Toronto, in a statement. “His dedication, vast experience, savvy sales skills and track record of proven success position him well to manage and continue to grow Kaba EAC brands across Canada.”

Kaba acquired Whitby, Ont.-based Keyscan in November 2014.

many different application layer protocols, and we look forward to working with ZigBee to create a combined solution for the connected home.”

Zwipe has joined the aptiQ Alliance Program, a collaborative group of global companies that support Allegion’s aptiQ smart card technology. Zwipe can now provide aptiQ customers with biometric authorization using their presently installed aptiQ card readers. aptiQ users will be able to authenticate themselves directly on the Zwipe biometric card without adding a biometric reader to existing aptiQ multi-technology card reader systems. “Using the Zwipe Access biometric card is yet another way that Allegion is bringing multi-factor verification and authorization to its large cus-

tomer base,” says Kim Humborstad, CEO of Zwipe, in a statement.

Brivo has been acquired for US$50 million by Dean Drako, president and CEO of Eagle Eye Networks. An integrated solution combining Brivo OnAir Cloud-based access control with Eagle Eye Networks’ Cloud security camera system will be made available by Brivo as an initial step with sales expected to begin in July. The solution will include: video verification of door events, with natively viewable and searchable video; and door event visibility in video — Brivo OnAir door events will appear within the Eagle Eye Security Camera VMS. Brivo’s Cloud-based access control system currently services more than six million users and more than 100,000

access points. Drako is also the founder of Barracuda Networks.

The Z-Wave Alliance has announced that SmartThings has become a member of its Board of Directors. SmartThings is an open platform designed to offer end users smart home convenience. The system is controlled via a mobile app and can communicate with more than 150 devices. SmartThings was acquired by Samsung in August 2014. “The incredible growth they’ve experienced in just over two years — culminating in their purchase by Samsung — is a testament to their understanding of the smart home market,” says Z-Wave Alliance chairman Mark Walters in a statement.

SBy Victor Harding

Some of you will know that I do M&A work for both fire and security companies.

Given that both sectors are calling on the exact same customer and are doing security related work, it is odd that more companies don’t try to do both. Wouldn’t the customer like to deal with one less supplier? Wouldn’t they also feel safer if they knew that the person doing their camera and burglary work understands their fire system as well?

As an example, I had lunch recently with the owner of a very well-established, GTA based fire services company. This company did all the things that well-established fire companies do — testing and inspection of fire alarm installations, installing new alarm panels, servicing fire extinguishers and emergency lighting, fire suppression systems and servicing of sprinkler installations. They were making good money and were, by anybody’s standards, a success story in the fire industry.

But they did no electronic security — no installation of burglar alarms, no access control and no camera work. Amazingly enough, I don’t think this fire company had ever tried to do security work, despite

the fact that most of their technicians would probably not require certification to do security work and their company was well ensconced with many big, blue-chip fire clients who might well have given them an opportunity to quote on the security part of their business.

On the other side, very few alarm and integration companies do any fire business despite the fact that they have security commercial customers that by law need fire work done. Secondly, fire companies tend to generate lots of cash, something that many alarm companies are often short of. Their fire inspection revenue can be as “sticky” as the RMR of an alarm account base. Also most of the work of fire companies is mandated by law. It has to be done. For most security companies today at least 40 per cent of their customer base is commercial. Why would they not think about offering them fire services? An account that is taking two services from one supplier is likely to be “stickier” or less likely to cancel.

On the other hand, fire companies would benefit from more of the steady, high margin monitoring revenue that security companies have.

TBy Richard McMullen

There are no big barriers to entry to either one of these sectors. Sure to do fire work, technicians have to be trained but the certification process is not that lengthy, difficult or expensive. Going the other way fire technicians need no certification to do security work. Both fire and security work is similar on the technical side. Selling security service probably requires more training and experience but again nothing impossible to get a handle on.

The largest companies in both sectors in Canada and the U.S., Tyco and Chubb Edwards, are testament that it must make some sense to combine these two sectors. The distribution companies like Tri-Ed and ADI also sell both fire and security equipment.

Yet on the installation end these two sectors function almost totally separately. The owners and their salesmen and technicians don’t know their counterparts in the other sector. I think all of this is to the detriment of both sectors.

Victor Harding is the principal of Harding Security Services (www.hardingsecurity.ca).

Security projects can be puzzles, but you can see the whole picture if you have all the pieces

oday’s consumers want cost-effective, non-proprietary and efficient solutions. They also want the benefits of an integrated system. Some of the most beneficial applications include having a single software application to search, maintain and produce reports. Detailed audit and transaction reports offer efficient investigative tools, simple audit reporting, and seamlessly connected alarm, access and video evidence along a single timeline. This integrated timeline accurately pieces together details of an event in a single package.

Today, integration of alarm, video and access control has become more popular as technology blends what were once separate disciplines. Integrated telephone entry systems that connect access control systems to manage tenant and guest access in apartments, condominiums and commercial buildings help facilitate a single software to manage users. Building operators benefit from having one software application to learn, manage and maintain. A new tenant can simply be enrolled in

one software application. Removing a tenant can be done at one point as well. This reduces the chance for neglecting to remove them from the directory and allowing unauthorized access.

Virtual alarm keypads, managing alarm inputs and having active maps are efficient management options once reserved for large campus security applications. Many integrators now offer complete solutions that include full service alarm, video surveillance and access control applications within a single suite of software.

Integrating video surveillance applications can also benefit the end user. Video is no longer simple situational awareness or after the fact evidence.

Open source technology platforms offer a series of advantages. Video analytics and integration can provide real-time awareness and reporting of critical events and situations. More importantly, these features offer benefits to extend the return on your security investment. Having access to real time information and reporting features increase security and effectiveness.

We are fortunate to have so many integration options from leading manufacturers. Connecting video, intercom, alarm, access control and a host of other applications has never been easier. Taking advantage of these technology offerings requires continual education and learning. Maintaining the skillsets required to offer, sell and service these systems is vital to our success.

But, as we all know, not all systems can work together in a seamless environment. This allows all of the security stakeholders to collaborate on the best solution.

Defining the desired outcomes in a clear scope of work can only benefit all involved. Knowing what you want to achieve by an integrated security solution will improve your security system and provide security benefits for years to come. Seek out the advice and counsel of a security professional to help choose the right solution for your application.

Richard McMullen is partner, security solutions, FCi (www.fci. ca), and national president of CANASA (www.canasa.org).

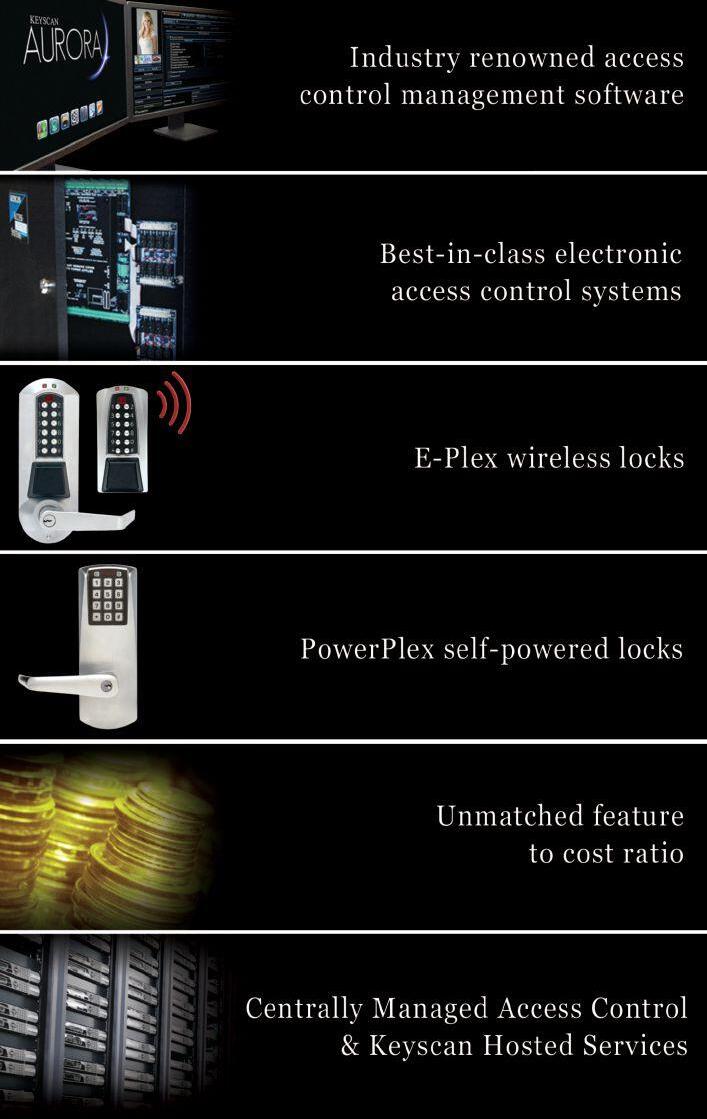

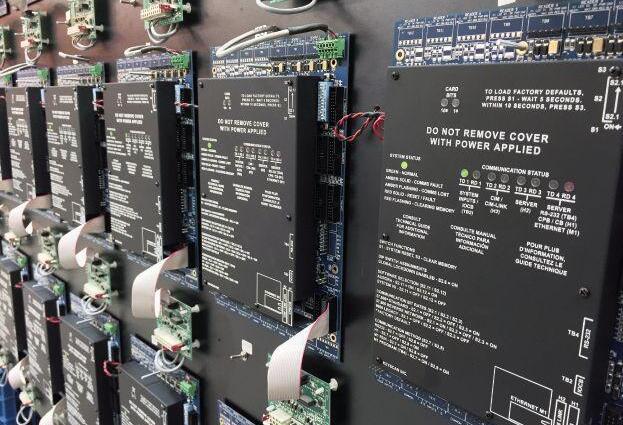

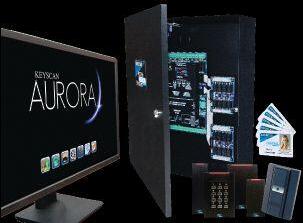

Since Keyscan became a member of the Kaba Group in October 2014, it's not only our look that has changed. Keyscan access control system now plays a key product role for Kaba Access and Data Systems - Americas. This provides dealers, integrators and endusers access to a more complete range of electronic access control

s

wireless and stand-alone locks and Keyscan access control systems.

“

c

commercial sector” said Michael Kincaid, COO Kaba Access & Data Systems (ADS) - Americas. “In accordance with our acquisition priorities this purchase adds an adjacent product group to our Access and Data Systems business.”

Aurora software plays a lead role in the integration

A full year has now passed and many wonder what is next. At ASIS 2015 in Anaheim we showed a glimpse of the future The Keyscan Aurora access control management software and its inaugural integration with Kaba’s E-Plex line of wireless locks sets. This is the first of many integration steps to come With its comprehensive design, Keyscan Aurora was the choice for becoming the base software for integrating Keyscan and Kaba’s products lines together

Saflok and RezShield hotel and m

products soon to be available “ T

Kaba’s access control portfolio in North America,” said James

Kaba Electronic Access Control (EAC) “In addition to its line

o

multi-housing and lodging lock p

K

control solutions as well This provides even more opportunities for integrators and security dealers ”

In April 2015, the industry was rattled again with the merger announcement of Dorma and Kaba and completed on September 1 to form dorma+kaba. dorma+kaba Group thus becomes one of the top 3 companies in the world for security and access solutions, with total sales of more than CHF 2 billion (EUR 1 9 billion) and more than 16,000 employees in around 50 countries.

In the Summer of 2015, the Kaba Electronic Access Control (EAC) sales team was announced Headed by Steve Dentinger, Kaba has created and integrated its electronic access control sales team. Staff from Kaba and Keyscan came together in the newly aligned North American sales organization for electronic access control. T

provided tremendous organization coverage for the Americas It essentially brings Keyscan access control innovation together with Kaba’s PowerPlex, E-Plex electronic and E-Plex wireless lock product line up that creates a full end-to-end solution for security and access control

It was further announced that Kaba Electronic Access Control administration, technical support and EAC Canada sales will be based in Whitby, Ontario, Canada. Kaba EAC United States sales staff and technical support for Kaba’s electronic lock products will be based out of Kaba’s ADS Americas office in Winston-Salem, NC

See how Kaba EAC solutions can solve all of your access control challenges, contact us today 1 888 539 7226

B u i l d i n g E n d - t o - E n d A c c e s s

C o n t r o l S o l u t i o n s - G e t f i t !

Kaba’s electronic access control systems fit our customers’ specific needs for security, organizational efficiency and operational convenience

Our solutions include the innovative network appliance-based Keyscan access control system It remains best-in-class and provides unmatched feature-to-price ratio combined with system scalability and flexibilit y With multiple integration options, it continues to be a an industry-leading access control system.

Kaba’s E-Plex wireless and electronic locks and PowerPlex stand-alone selfpowering lock also offer advanced functionality, features and flexibility and are a perfect complements to the Keyscan system in virtually any environment

Together, our access control systems will support any access control deploy ment, regardless of project size or scope – Kaba Electronic Access Control fits your needs

Kaba Access & Data Systems - Americas 888 539 7226

kaba-adsamericas com

Expect to see trends that were gathering steam in 2014 to push ahead full force this year — industry consolidation, mobile credentials, RMR opportunities, cyber security and much more

by Linda Johnson

Work is often a race against the clock, about meeting daily or weekly goals. Now and then, it’s important to stop and try and take in the longer view.

At the start of this new year, SP&T News turns to financial and industry analysts — whose business is the longer view — to look ahead to the changes they see shaping the security industry through 2015 and beyond and to share their insights into the economics, technologies and other forces driving these changes.

Across their comments run several themes. One frequently sounded note is

the continued movement towards managed services and the Cloud, along with the concomitant expansion of RMR. They envision a changing competitive landscape and the emergence of new geographical markets, as well as other new opportunities. And, not surprisingly, given the frequency and prominence of cyber attacks, they point to the growing awareness of the urgency for better logical security.

Their answers suggest some new directions but also the not-so-new advice that investing in customers and building long-term relationships makes good business sense — not just for 2015, but well beyond.

Blake Kozak

senior analyst, security and building technology

IHS,

IEnglewood, Colo.

n access control, I think mobile credentials are going to start to evolve.

market is evolving into: How are you going to use role-based security to integrate VMS with logical and physical access control systems and mobile phone apps and really adopting that technology aspect?

Lastly, technology is getting closer to the edge. People are utilizing the Cloud a lot more with access control as a service.

A lot of manufacturers are coming out with their own systems. HID has their gesture technology, and Allegion has a product called Engage. It seems today almost all manufacturers have some form of mobile application for their systems. In hardened security environments, people will get used to using applications, and it could expand into commercial real estate or other types of end-user industries. So you find hotels using it.

In the residential market, you’re seeing a lot of growth in mobile applications in remote access. So these more personal ways of using the solution could drive the market forward for other parts of the industry.

Services and RMR are also going to become more important over the next 12 months, especially as part of it becomes a bit of a commodity. A lot of integrators and manufacturers are going to look for ways to differentiate.

Electronic locks are a mega-trend, so we will continue to see wireless access control. The cost per door comes down due to the lower cost of installation and less system hardware on the door. You’re going to see more of these electronic locks that don’t necessarily require power supply and all the wiring. What’s going to be interesting is how systems begin to integrate. Integration has been around for a long time, but now everybody’s starting to embrace it.

It’s about integrating logical and physical access control, using role-based access control. So we’re moving beyond the idea of just talking about trends being hardware, like biometrics or smart cards. The

principal market analyst

IHS, Englewood, Colo.

One trend is HDcctv, which seems to be growing in popularity. The prices for HDcctv equipment have fallen, and users are increasingly adopting that in place of standard analogue video surveillance equipment. And, from a technology viewpoint, H.265 is likely to become a much more common compression standard in 2015.

We’ve also seen Chinese vendor growth. Video surveillance vendors from China have entered the market in Europe and America and have a growing share in recent years. We expect that to continue.

A really topical trend is body-

Education will see a lot of growth across North America, but also in Europe. Utilities and energy is the other big one. You have continued investment in infrastructure: in Brazil and Mexico, for example. Health care will continue to expand. Commercial, too, is a big growth area: a lot of facility managers are centralizing their access control. It’s also a good opportunity for hosted and managed access control.

I think new entrants will help the market evolve. It’s interesting that many of these players are shifting to a retail format. I think there will some consolidation, perhaps in 2016. There are dozens upon dozens of players offering electronic locks and video systems. How are you going to bring that together? Because many of these new entrants utilize similar platforms, whether it be iControl or another offering. It should be an interesting 12 months.

“In access control, I think mobile credentials are going to start to evolve.”

— Blake Kozak, IHS

principal, Sandra Jones and Company, Chardon, Ohio

Wewill continue to attract non-traditional market participants that will disrupt the existing channels and redefine how technology and services go to market.

In regard to these new entrants, I think a high

worn cameras. They are receiving a bit more press and attention, particularly in the U.S. I think sales of the equipment are likely to start to take off.

For so many years now, the use of network video surveillance equipment has been growing, and that’s likely to continue. Within that, certain categories of products are particularly popular, such as 360 degree cameras. And 4K cameras are receiving a lot of attention; they’re likely to start shipping in volume.

tide raises all ships. But I also believe we need to pay attention to customers again. We’ve tolerated attrition in the marketplace. I think we’ve been reluctant, once the sale’s been made, to sometimes go back to the customer.

Dealers and integrators will put a much greater emphasis on keeping existing customers, delighting them with new services and focusing on selling them more and being more of a value-added provider than just a seller of security.

In the next few years I think we’ll be relying more and more on Cloud-based services. We’ll also be seeing stronger identity requirements to protect big data. We’ll also see growth in analytics: it’s about taking information and moving it from lots of data to actionable intelligence in real time.

We’re continuing to see investment interest, by both private equity as well as strategic buyers. There’s still a lot of money out there looking for a home in security, and while our industry fluctuates with the economy, we’re more resilient than most markets. So we are still attractive. As a consumer or as a business owner, security is in the news every single day, and that awareness and new risks help people think about: Should they be buying our services?

“There’s still a lot of money out there looking for a home in security.”

— Sandra Jones, Sandra Jones and Company

partner and national leader, cyber risk services, Deloitte Canada, Toronto, Ont.

Over the last couple of years there have been regular breaches, and one of the things we’ve seen is that security — in particular cyber security — is top of mind for executives.

Then, there are certain verticals and geographic markets that are likely to grow. Video surveillance in China has been growing quickly. China is a large country with a large population, and the ratio of cameras per head is still much lower in China than it is elsewhere. So there’s lots of room for growth there.

I believe there’s going to be a heightened awareness across all industries. And, at no particular point in time will things slow down. The key is that organizations must continue to be pro-active and vigilant when it comes to cyber security. That means a number of things. One is making sure they have the processes in place to practically manage information security and, in particular, cyber threats. The second is to continue to enhance their technology capabilities to proactively identify specific threats, in particular malware and

patterns. Thirdly, it comes down to a fully integrated monitoring ability, which means ensuring they are actively looking for new, emerging and evolving threats. So cyber-threat intelligence gathering is going to be critical.

Enhancing your threat monitoring ability requires resources and a team of individuals. So many organizations will look to third parties to provide that level of security operations.

“Cyber-threat intelligence gathering is going to be critical.”

— Nick Galletto, Deloitte Canada

senior vice-president, security alarm group, Bank of America Merrill Lynch, Chicago, Ill.

We see continued expansion of additional forms of RMR, from home automation and PERS [personal emergency response system] in residential to video and access control in commercial.

It is vital that security alarm companies stay on top of the key metrics of creation cost multiples, margins and attrition and work closely with their banks to ensure that adequate financing is available to fund these growth efforts.

We also see growing familiarity and acceptance of the newer forms of RMR, both in the bank and capital markets.

“It is vital that security alarm companies stay on top of the key metrics.”

— David Stang, Bank ofAmerica Merrill Lynch

market analyst, access control, fire and security IHS, Englewood, Colo.

of the biggest things coming down the line in 2015 is the announcement by the TSA and European Civil Aviation Conference (ECAC) to move forward on a risk-based approach to security.

This is an intelligence-driven screening program where passengers submit data. Passengers in the U.S. can submit to the precheck program, and the TSA will give them a security level, low or high threat, based on the information they’ve provided. (In the U.S., it’s a bit easier because we don’t have the restrictions they have in the EU on collecting personal data.)

Risk-based screening will drive for the checkpoints the purchase of newer technologies, like advanced imagery technology.

Currently, there’s not a lot of integration at checkpoints and hold baggage (baggage in the hold

of an aircraft). But risk-based screening is looking to integrate these systems, particularly hold baggage, where they would use bag-tag readers and new explosive detection units. At the CT scanners, this would allow them to do image analysis, as well as atomic number analysis of products in the bag, so they can tell, for example, if an item is a homemade explosive or there’s no threat at all.

The ultimate goal is to link passengers with their baggage from the time they enter the airport to the time they leave their destination airport. The bags you check on the plane would be tied to you. And information, such as where you’re going, layovers, how many people you’re travelling with — all that would be accessible by security personnel.

“The ultimate goal is to link passengers with their baggage.”

— Jared Bickenbach, IHS

managing director, security lending group Capital Source, Los Angeles, Calif.

the commercial side, we continue to see the trend toward managed services.

Chris Peterson president and owner Vector Firm, Orlando, Fla.

The technology for some of the hosted and managed services regarding access control has been there for three or four years, but I see some of the security integrators being trained now and are learning how to sell it.

They’re building the right sales teams, the right sales methodologies, and they’re holding their sales people accountable for selling some of these solutions — primarily access control, but also some video.

The integration companies doing the enterprise installa-

tions are starting to figure out that their client base needs to be educated on hosted and managed solutions. Their client base needs to understand the pros and cons of having someone else host their data. And integrators are figuring out how to sell these recurring-revenue services. Those are the three key ingredients. The sales people now have the tools and the training; management is holding them accountable and paying them properly; and third, the end-user clients are being educated, rather than just sold to.

So, I think there will be an uptick on this in 2015, but we’re not going to see real traction until 2017-18.

“Their client base needs to understand the pros and cons of having someone else host their data.”

— Chris Peterson,Vector Firm

More people are taking products that used to be bought standalone and are buying them now as part of an integrated service package, which is allowing security alarm companies to have more meaningful relationships with their customers. So where someone in the past would have just purchased, and an alarm company would have installed, an access or video system, now there are many more services that the installing companies are able to provide around those systems, whether it’s helping manage the access control system on an ongoing basis or providing video monitoring or analytics that are allowing the dealer to generate more ongoing revenue from that customer. We’ll continue to see that trend materialize over the next 12 months. On the residential side, we continue to see more and more uptake in the connected home and additional services being bundled or added on to the traditional security panel. The RMR will continue to increase as the adoption of those products increases.

“We continue to see more and more uptake in the connected home.”

—Will Schmidt, Capital Source

By Mitchell Kane

The evolution of standards developed by organizations such as ONVIF and the Physical Security Interoperability Alliance (PSIA) has led to promises of increased interoperability between video surveillance and access control systems.

However, the integration of these two critical components remains, for the most part, something that has to be customized for each individual project.

In addition, while both video and access control management systems typically deliver the same basic type of functionality, their architectures and hierarchies as to where and how information is routed can vary significantly depending on the customer. For example, does the end user want all of the alarms generated by the video management system to be managed by the access control/alarm management system, or should they reside strictly in the VMS?

The challenge for systems integrators is to find a balance between the needs and wants of their clients while helping them understand the limitations of their technology solutions.

Anyone who has been around the security industry for any length of time is familiar with what many people refer to as the “CSI Effect,” in which end users have unrealistic expectations about what they can accomplish with the latest and greatest technology. The role of systems integrators, in many ways, is to go beyond the technology installation itself, and act as a trusted advisor to their end user clients to help temper these types of expectations. This level of honesty not only builds goodwill between the two parties but also fosters a relationship that could extend well beyond a single project.

Perhaps one of the most common obstacles facing systems integrators today is being able to perform all of the necessary upgrades on video and access systems at a customer site each time a manufacturer releases a new software version or desired product feature with

minimal site disruption. Once you complete integration, integrators are bound to provide ongoing support, and performing tasks such as regression testing can be somewhat of a challenge. In some cases, vendors will roll out a feature that interferes with a user interface or complicates how an access control platform is tied into a video system and vice versa. To be a systems integrator that’s known for dependability and customer support, you have to be prepared to have a lifetime commitment to your customized installations.

Traditionally, the overwhelming majority of requests have come from end users who already have an access control system in place and want to tie it into a new or existing video platform. Oftentimes, end-users who want these integrations can’t describe, from a functional standpoint or to what degree, how they want those platforms integrated.

Increasingly, end users want the ability to add a forensic element to access control transactions. Aside from the audit trail functionality provided by most access systems, end users are turning to video to aid them in real time, as well as in post-event analysis. The ability to see who may have been hovering around a door 30 seconds before an unauthorized entry or being able to run a report of when and where a credential has been used with accompanying video footage of each incident can be invaluable assets.

One common misstep is failing to properly synchronize the date and time in the interfaced systems. For example, imagine a transit agency in a metropolitan area has cameras focused on turnstiles, through which hundreds of people walk within a 30-second timeframe. If the transaction history is off by as little as one second when security personnel are reviewing the video, the person of interest they are seeking will not be associated with the transaction. If access and video systems are not synced to a common reference time source, collected data can become completely useless. Another item that may be overlooked is maintaining the network security of the cameras and access panels. In many cases, those policies are not adhered

to and default manufacturer passwords are left in place, leaving cameras and other devices open and vulnerable to online threats.

There is no denying the prominent role that VMS solutions now play in the systems integration process. When it comes to access control, there are usually a finite number of doors that need to be secured. But with cameras, the possibilities are nearly limitless. There is a tremendous need for video in every vertical market.

Although some may have expected the advent of physical security information management (PSIM) software to have a much broader impact on the industry by now, the fact is that many of these platforms’ actual capabilities are oversold. As a result, they still remain a small portion of the overall market when it comes to systems integration.

Considering customer expectations, integrators need to take advantage of the myriad educational opportunities and certification classes presented to them on a regular basis. Systems integrators can attend onsite training classes to help them understand what a system can and cannot do. When an end user makes a request, they can subsequently take that knowledge and be able to explain what can realistically be achieved. At the end of the day, an integrator has to work within the capabilities and limitations of the technology platforms they have been tasked with integrating. While some requests may seem logical, the reality is they may not all be feasible. End users often want a magic button that can accomplish everything on their wish list and integrators need to interpret the needs of their clients and be able to deliver a system that works as it was intended while paving the way for future scalability and advancements.

Mitchell Kane is the general manager of Vanderbilt Industries (www.vanderbiltindustries.com).

By Minu Youngkin

In the 19th century, fingerprints had very little significance in solving a crime.

Because there was no way to link someone’s identity to the imprint left behind from their finger, law enforcement relied heavily on other forms of evidence. That changed in 1892 when breakthroughs were made with biometrics, a science using unique human characteristics to identify individuals. In that year, investigators used fingerprints to uncover new details that led to the first successful conviction leveraging biometrics.

This same technology helped to further define the new field of biometrics and transformed not only crime scene investigations, but the way we keep facilities secure.

Today, some view biometrics as a system reserved only for highly-advanced facilities. Aided by Hollywood, biometrics is seen as something for those tasked with impossible missions or state-of-the-art scientific laboratories to overcome, but in reality, biometric security is much more attainable and practical than ever.

One of the first biometrics solutions — a mechanical hand reader — operated using physical springs and gears to identify an individual’s hand. But as is the case for most fledgling technologies, biometrics further developed as technological advancements were uncovered over time. These advancements led to modern biometrics, where low-powered LEDs and cameras work in conjunction to identify an individual through hand geometry.

The use of biometrics expanded outside the law enforcement and government community in the late 1970s when two-dimensional hand recognition was utilized at the University of Georgia. The school used a biometrics system to improve safety and prevent students from taking advantage of unlimited meal plans. Since then, biometric technology has advanced even further and been adapted in many ways. Some other applications include:

Iris Recognition: Iris recognition is contactless and uses mathematical pattern-recognition techniques on video images of an individual’s eyes. The iris — which is the colored ring around the pupil — is unique to each individual; even the pattern of one eye is different from another. Used often in government buildings, iris readers tend to be more expensive than fingerprint and hand geometry, and must be installed and used at specific heights.

Facial Recognition: Facial recognition is priced similarly to iris recognition and most often used in banking, labs and clean environments due to its accuracy. As the name implies, facial recognition uses the most

Since fingerprints became useful identifiers for humans, the technology hasn’t stopped changing

obvious identifier — the human face. This system takes a digital image of an individual’s face and verifies their identity by analyzing and comparing patterns. This form of biometric technology has become popular because it is non-intrusive. Identification can be done from two feet away or more and requires virtually no action by users. The major facial recognition downfall is the affect lighting can have on readings and reliability.

Vein Authentication: When it comes to computer logins, point-of-sale (POS) authentication and physical access control, vein authentication is the best advanced biometric solution. Vein authentication captures the vascular patterns of an individual’s hand through a combination of infrared light reflected by hemoglobin and a special camera, and stores an image as personal identification data. Similar to irises, vein patterns are extremely unique to each individual, making the false acceptance rate close to zero. Another huge advantage is that cuts and cracked or rough skin poses no threat to biometric readers since veins are internal.

The use of biometric security was initially used in national research labs and nuclear power plants to protect national secrets and dangerous materials because of its security impact.

As the years progressed, biometric experts came to realize how practical and effective these technologies could be in a workplace where processing thousands of identities is the norm.

Mechanical locks with keys, electronic locks with readers, proximity cards, smart cards and biometrics, among others, are all access control solutions in today’s world. Each has its advantages and disadvantages, but their level of security can be measured by:

Things you have: Things you have is the physical objects in your possession that allow access into a facility, such as metal keys or proximity cards. This is the most basic level of security, and with it comes the lowest and least reliable level because keys can be lost easily and tenants run the risk of key duplication. Anyone can enter a facility with generic keys or cards, and once they gain access without further verification or identification, security is compromised.

Things you know: Things you know is the makeup of

passwords and PIN numbers for an enhanced level of security. Passwords and PIN numbers are intended to be kept solely inside an individual’s memory, offering a higher level of security than things you have. You can’t physically misplace a password or PIN number, but you are susceptible to human error, such as forgetting a complicated combination of letters and numbers. Things you are: This brings us full circle to the benefits of biometrics, the most advanced way to keep facilities secure and occupants safe. This level refers to biometric identification, which plays an important role in security and is an ideal option for companies that require employees to display a badge that proves their identity for entry. Biometrics offers the utmost security because there is no easy or practical way to replicate an individual’s unique physical feature for authorization.

Although biometric identification benefits outweigh its hindrances, implementing a new system comes with drawbacks.

Over-monitoring is one of the biggest concerns with biometric security. The ability to track where an individual is at all times is, not surprisingly, threatening to people’s perception of their privacy.

This component of biometrics is important and can cause distrust among workers if they do not fully understand why and how biometric technology is being added to your security plan.

Biometrics solutions collect information that makes a person unique to allow or deny access, which is a sticking point to some who believe this is a violation of their rights. User acceptance can be challenging and resistance is discouraging. The best way to overcome this barrier is to fully educate all users on how implementing biometric technology enhances security in the office and has the potential to make everyday tasks easier.

Before implementing a biometric system, check all privacy and other biometric and data collection laws that apply in your area. Be sure to notify all employees of the company’s intent to use biometric technology in writing, including what an employee can do if they have questions or concerns. In addition, assure employees that alternative accommodations for issues based on disability, religious beliefs, or other qualifications covered by the law will be handled accordingly.

Resistance to emerging technology is common, and biometric security is no exception. However, once a system is implemented, employees are likely to understand the multiple advantages it provides both them and their workplace.

Minu Youngkin is the integrator marketing manager for Allegion (www.allegion.com).

Understanding wireless access control can enable integrators to tackle a variety of projects

By Scott Lindley

If you are an integrator who appreciates the growing importance of electronic access control (EAC), a part of your learning curve should include understanding wireless access control.

That’s because the majority of all EAC systems being installed today, new or retrofit, are employing wireless for a very simple reason. These solutions let you and your customer enjoy a different benefit set when compared to more traditional hardwired systems and often without the cost.

With no holes to drill, trenches to dig, wire to pull and minimal installation disturbance to the customer, the implementation of a wireless system may be faster and less expensive than a wired system. And, in many retrofit situations such as in older buildings, there may be no alternative. Plus, wireless systems work with the majority of access control product brands.

Instead of spending money on labour, which is normally contracted out, your customer will be able to buy more product from you with the same budget. Or, if you are in a bid sale, the wireless solution will have a much lower cost than a wired alternative. The bottom line is that wireless systems use less hardware and install up to 10 times faster.

Another positive for the integrator who sells wireless solutions is that these systems allow you to protect openings beyond doors. You now can provide access control for exit devices, gates and even elevators, all controlled by your choice of access control management system. With such systems, your customer can continue to use their present contactless cards for all access points, whether entering the parking lot, the building or the elevator to the seventh floor at a price lower than wired systems and less than using off-line, standalone systems.

Contrary to what many will tell you, no line of sight is needed. Wireless RF signals can penetrate cinder block walls, plasterboard walls, brick walls and many other non-metallic materials for simplified system designs and implementations. They are secure, with many making use of AES encryption. They work on wood and metal doors, both exterior and interior, as well as glass, monitored and scheduled doors, gates and elevators.

Wireless systems typically operate up to 200 feet between the door and the panel interface module (PIM) for indoor applications. For outdoor applications, like vehicle and pedestrian gate access, wireless links can often bridge up to 1,000 feet, eliminating costly trenching. Thus, wireless systems are ideal for garages, parking lots, across city streets and other outdoor areas that the customer may want to access using the same contactless credentials they employ at the front door. They are especially cost effective for controlling gates around a facility. And, they are the natural choice for temporary system installations.

Don’t forget to add the elevators to your bid list. They are a perfect candidate for extending the access control system. Traveling cables are routinely included when installed, yet they may be unable to reliably transport access control data from the cab to the elevator controller. Since elevator shafts provide an unforgiving environment for electrical signals, often being the culprit that creates data corrupting noise which pollutes card reader data lines. This can lead to the system providing inconsistent performance, which may actually worsen over time as cable shielding decays due to continual movement.

With a wireless solution, you can eliminate the need for data lines in elevators. In fact, they can thrive

For long range access control, a receiver and transmitter will provide read ranges up to 200 feet

in this challenging installation environment and provide consistent, reliable data transport that doesn’t wear out. As a result, you may have the opportunity to save your customers thousands of dollars per elevator.

“It is often a big jump for your customer, as well as yourself, when moving to a networked EAC wireless solution.”

In Canada, there are two major wireless technologies used in access control systems to send information from/to the door to/from the system computer which runs the access control software: 900 MHz and WiFi. In the first, a 900 MHz communication module, along with the card reader is installed to a PIM (panel interface module) and, from there, onto a hardwired source network.

The second is 2.4 GHz/802.11 WiFi, in which communication goes from the card reader or sensor directly to a WiFi antenna and onto a network.

If lockdown is a major need, be aware. Usually, with WiFi, access control decisions are downloaded by the host into the lock five to six times per day versus five to six times per hour with 900 MHz solutions. Also, signal propagation and strength through building walls is stronger for 900 MHz signals versus the shorter wavelengths of 2.4 GHz signals. Typically, if a 2.4 GHz system is installed in a building, additional WiFi antennas will likely be needed to support an equal number of wireless locks or sensors. In WiFi systems, this can mean additional installation costs by assuring antennas have closer proximity to the readers to ensure reliable operation. In addition, independent WiFi locks require unique IP addresses. Thus, there is greater involvement with the IT department and, all too often, extra internal fees get charged for each IP address. With 900 MHz solutions, a single IP address manages 16 or more doors or opening.

With the 900 MHz solution, the entire access control system knows when someone is at the door. The reader captures information such as request to exit, door position and card data and sends it to the host immediately in real-time. The access control management system makes a decision to unlock the door or not. Since WiFi cannot afford to use all that power, decisions are made solely at the door. Any updates, such as the change or termination of a person’s access

rights, may not have yet reached that door before the ex-employee does.

With advanced transmitters and high sensitivity receivers providing optimal coverage throughout an area, today’s wireless access control is nothing short of robust. Moreover, 900 MHz technology, which sends the same data over many frequencies simultaneously, makes wireless redundant and extremely reliable. Wireless solutions also have a built-in red alert. They’re supervised by a signal called a Heartbeat. If for some reason the Heartbeat signal is interrupted, a warning signal is generated.

In most cases, the integrator uses interchangeable contactless proximity or smart card readers to migrate from standalone, offline locking to a networked access control system by installing a 900 MHz communication module. After linking the reader to a PIM, perhaps via a range extending repeater, the user is able to initiate emergency lock/unlock commands throughout the facility when needed and change access rights from a central location.

To clarify the role of wireless in access control, some people classify the use of contactless credentials as wireless. In case you happen upon this, this is what they are talking about: 125 kHz, 13.56 MHz, 433 MHz, NFC and Bluetooth. Let’s quickly look at each, just so you are prepared.

125 kHz: This is what the primary contactless credential used in access control systems, the proximity card, uses to transmit information from the card to the reader.

13.56 MHz: In the last decade, proximity cards have been augmented by the smart card which uses 13.56 MHz technology. This provides two-way communication, sending information to the reader and, then, the reader sending information back to update the card.

433 MHz: All of a sudden, there has been great interest in long-range reading which uses 433 MHz technology. It can be installed as a complement to either a proximity or smart card system.

NFC: Near Field Communications is a short range technology to let people use their smartphones just like a contactless card in conjunction with the reader. To enter, a user opens the access control app and taps their phone to the smart reader on the wall in the same way that they would present their contactless ID badge.

Bluetooth: This technology is often considered a wireless competitor to NFC technology as it is also commonly found on smartphones. In operation, the user will typically open an app, select the door to open and then push the “unlock” button. Bluetooth supports ranges up to 300 feet, making it a long range technology.

It is often a big jump for your customer, as well as yourself, when moving from a mechanical locking system to a networked EAC wireless solution. Remember to keep it simple. You do not need to undertake the complete upgrade all at once. Space it out, getting more and more comfortable with each installation. Your communication module manufacturer can be of great help in guiding you.

Scott Lindley the president of Farpointe Data, a DORMA Group company (www.farpointedata.com).

Kaba’s leading-edge Keyscan access control hardware and software innovations remain best-in-class and, as a result, over 65,000 Keyscan systems are actively used around the world. With the Keyscan systems now complementing Kaba’s electronic, stand-alone and wireless lock product lines we are, more than ever, well-positioned to provide innovative and fully integrated solutions in the electronic access control marketplace.

Keyscan’s full line of feature-rich 1, 2, 4 and 8-reader door and elevator floor access control units provides bestin-class access control solutions for all new installations or system upgrades. Our access control units can all be mixed and matched and networked to any LAN/WAN to satisfy all new system requirements. You can also simplify an upgrade of aged access control hardware while, in many cases, re-using existing cabling, readers and credentials.

www.keyscan.ca

Keyscan Aurora is the new benchmark access control management software. It provides a new level of efficiency and integration options regardless of your system size or complexity. From a single-door entry-level application to a multi-site enterprise with system integrations and thousands of doors to be secured, Keyscan Aurora access control management software is optimized to outperform expectations. With VMS integration, web interface and other multiple add-on modules for enhanced functionality, Keyscan Aurora delivers a whole new experience in access control.

www.keyscan.ca/English/Aurora.html

Kaba’s flexible and scalable Wireless Access Control System provides two-way communication from an E-Plex Lock or Stand-Alone Controller to a centrally located computer. A simple, easy-to-install USB Option allows users to install up to 100 locks without wires, conduit runs, access panels, or network drops. This system also scales up to 10,000 locks using a TCP/IP connection. Kaba’s Wireless System eliminates visiting doors for updates, provides real-time functionality of events, and allows the management of both online and stand-alone locks. Fast data transfer, long battery life, and mesh redundancy make this system an efficient, low cost access control solution.

www.keyscan.ca

Keyscan Hosted Services (KHS) takes Centrally Managed Access Control (CMAC) to a new cost-saving level. With KHS, dealers can create a CMAC business model offering RMR-based managed access control services. Your clients’ access control software and data is hosted on Keyscan’s secure server infrastructure and you can avoid the upfront expense attributed to implementing a central host service. It helps you refine a business model in ways that will build lasting and intrinsic value to your organization. www.keyscan.ca/English/KHS.html

CMAC offers access control convenience allowing users to manage their system “through the cloud” from any internet-enabled PC or mobile device, at any time, from any location. Dealers and integrators can leverage CMAC and offer customers access control as a service while eliminating much of the cost of infrastructure typically required for access control. It brings the benefits of electronic access control to a whole new group of customers that may not have considered it an option.

www.keyscan.ca/English/CMAC.html

PowerPlex is a self-powered, eco-friendly electronic lock with NEW “No-pump Technology”—wake the lock up by pressing the first button of the code. PowerPlex is easy to install, use, and maintain. It requires no wires or batteries, just pure Kaba power. PowerPlex offers the flexibility of programming at the lock or via computer using optional software. The lock is BHMA Grade 1 Certified, ROHS (Restriction of Hazardous Substances) and ADA compliant. Other programmable features include, passage, lockout, tamper shutdown, and service codes. PowerPlex is as reliable as a mechanical pushbutton lock with all the features and benefits of an electronic lock.

www.keyscan.ca

Keyscan Aurora Web interface allows you to manage your Keyscan access control system from any web-enabled computer, laptop, tablet or mobile phone. Perform updates and maintenance tasks using the Aurora Web Client’s available functions from the comfort of wherever you may be located. The Aurora Web interface is an add-on software module used in conjunction with Keyscan Aurora access control management software. Use Aurora Web interface for access to People, Sites, Status and Report portals of your access control software. It is the ideal solution for those who need, or want, true mobility and remote access.

www.keyscan.ca/English/AuroraModules.html

The Door Angel is hung over the deadbolt knob, requiring no installation. When someone tries to turn the deadbolt from the outside, the device will push against the doorjamb or a restrictor. This prevents the deadbolt from turning, the slide from retracting, and the door from opening, so it is effective against both key bumping forced entry and unwanted access by those with a home key. The device is designed to fit over a deadbolt that locks in any position, including vertical, horizontal, or 45-degree angle. It can be installed without the use of any tools. www.lokabolt.com

The SV-32 appliance comes pre-installed with Genetec’s open platform security system, Security Center, allowing end-users to deploy their choice of a unified security solution, or a standalone access control or video surveillance system. Designed to secure any site requiring up to 32 cameras, or up to 100 readers, the SV-32 supports a wide range of IP cameras and provides native integration with a variety of IP-ready door controllers and electronic locks. When deployed as a unified system, the SV32 provides a consolidated view and control of video and access control activities with monitoring, alarm management, and reporting tools. www.genetec.com

Using a deeply embedded victor unifying client, victor Unified SiteServer takes a holistic video approach of managing and monitoring access control, video, and intrusion from one database. The victor Unified Client is a new client choice which can be run in parallel with existing C•CURE 9000 client choices. The victor Unified SiteServer is pre-installed with all the software needed to manage and monitor the various activities related to access control, video and intrusion. www.swhouse.com

Kevo Plus extends the Kevo platform by enabling remote access capabilities and enhanced features to Kwikset’s Bluetooth smart lock, Kevo. Kevo Plus establishes a direct, online connectivity to Kevo, letting users lock and unlock their door with their smartphone. Kevo Plus features include: remote locking and unlocking; unlimited anytime and scheduled eKeys; and real-time activity monitoring. Upon upgrading their Kevo account to Kevo Plus, users will receive a free Bluetooth-enabled gateway that enables real time updates and remote functionality. www.kwikset.com

The IX Series is a network-based, all-in-one communication and security control system. Features include video identification, emergency call queuing, ONVIF video streaming, and paging. The system can remotely unlock doors or broadcast information quickly to multiple stations using either the standard master station or the new IX Series mobile device application. The IX Series allows buildings, parking facilities, and large campuses to reduce costs and improve staff efficiency by controlling security needs from a central location. www.aiphone.com

The CX-00 Series Value Line strikes are designed for light duty applications, where an economical fail secure, 8V - 16V AC/DC strike is required. Applications include retrofit installations in small multi-unit apartment buildings utilizing intercom systems. They can be used on wood, metal or aluminum frame doors and are fully reversible for right or left hand doors. They come complete with integrated faceplate for use with centre line cylindrical or mortise locksets. www.camdencontrols.com

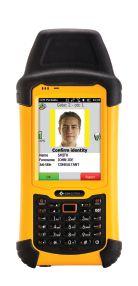

The new S3040 portable reader is a lightweight and rugged hand-held card-reading device for roaming security. Key features include card swipe and visual verification of cardholder photograph and high-resolution 3.5” sunlight readable display. Stored cardholder photographs are displayed on the reader along with name, date of birth and job title, allowing for additional visual verification. The reader can store up to 200,000 cardholders and includes mustering, occupancy, roaming and random check modes. The S3040 portable reader connects to host via encrypted Wi-Fi or USB Ethernet hub and supports 125kHz Proximity, MiFare or DESFire CSN, iClass/iClass SE and PicoPass.

www.cemsys.com

The QID (Quick Intruder Deadbolt) classroom lock functions as a classroom function lock for everyday use but features the ability to instantly deadbolt a classroom door with the push of a single red button. With one press, the person closest to the door can instantly activate both the deadbolt and the lever handle lock. A visual indicator lets the teacher know that the door is secured by the QID deadbolt and the outside lever is locked.

www.securitech.com

Dortronics Systems

Suggested for use in hospitals, schools and industrial facilities, and with a variety of door or access systems, the 6510-S35 features a single pull action to provide instant egress and alarm activation in the event of an emergency situation. The 6510 COV plastic cover discourages improper activation while providing moisture protection during washdown operations. Designed with dual SPDT switches, one set of contacts breaks the lock power when activated and a second set of contacts allows connection to an alarm or access control system. All models are available in three colours and custom text availability.

www.dortronics.com

Talkaphone

This compact video door entry station features a new design and IP66 weather rating for tough environments. The embedded wide-angle megapixel camera is ONVIF compliant and offers a clear view of the caller. It works with major video management system (VMS) vendors and offers deployment flexibility to higher education institutions, healthcare and corporate facilities, and other institutions where it is necessary to retain video evidence. The speaker and microphone components coupled with a proprietary audio enhancement algorithm offer sound clarity. The compact video door entry station is also SIP compliant. www.talkaphone.com

The CHERRY JK-A0100EU smart card keyboard is designed to control logical access to networks in order to maintain a secure user base. This keyboard is suited for regulated industries such as government, finance and health care. It requires the secondary authentication of a Smart Card before allowing access to the connected system. In addition to the smart-chipset card reader, the keyboard supports secure PIN entry. The PC/SC smart card reader is CCID and EMV Level 1 approved, and is also compatible with reading and writing ISO 7816-compliant smart cards. The keyboard features a thin profile and weighs 1.85 lbs.

www.cherrycorp.com

The ABLOY PROTEC2 CLIQ key includes features like LED indication on both sides and a reversible key. Other benefits include the ability to store more audit trails, program up to 3,500 locks or lock groups into the key. The battery allows clock and time features to last up to a decade while space inside the key has been reserved for a Radio Frequency Identification (RFID) tag. The PROTEC2 CLIQ ecylinder also includes new technology developed to help the user better manage contacts and, if necessary, reset electronically or mechanically for increased security.

www.abloy.ca

Korea Technology and Communications

KEES, an iris recognition door lock powered by SRI’s Iris on the Move (IOM) technology, has been developed for the residential security market. The door lock combines iris biometrics with a push-pull handle for keyless access, eliminating the need to fumble for keys, enter a PIN or put down the groceries. Traditional keypad-only door locks may recognize what has happened (i.e., a PIN code was entered), but do not confirm individual identity. The KEES lock brings iris biometrics to multi-unit residential properties and apartment buildings. Additional features for the KEES lock system will also be available in the future.

www.ktncusa.com

BioCam300 is an HD IP access control camera that combines long-range facial recognition, video surveillance and time and attendance, in a single device. It can operate standalone (no computer nor panel needed) for quick and easy installations requiring no special wiring, and can also be tied into any existing third-party access control panel having Wiegand input. BioCam300 embedded facial recognition technology unlocks a door once authorized us ers walk within 12 feet of its camera. Its built-in infra-red illuminators ensure accurate face rec ognition, even in low-light conditions. www.zkaccess.com

The KeyWatcher Touch key control system supports C•CURE 9000 Security and Event Management System from Software House with the Stratus everRun Redundancy Solutions. The KeyWatcher Touch system was successfully put through a set of defined tests at Tyco in Westford, Mass. These tests focused on integration interoperability, security and performance between the systems. Morse Watchmans is the first partner to be tested with the new everRun Enterprise 7.2 (2-Node system).

www.morsewatchmans.com

The Dual Technology Proximity Card Reader (WAR-EH0) can interface with a wide range of electronic access control systems by complying with the Wiegand communication protocol. These readers can be ordered to support several EM and HID compatible proximity card and tag technologies. This dual-application product has advanced reader features for wide compatibility with different controller types including multiple RFID card transmission formats, LED and Buzzer control. This Proximity reader is rugged and weather-resistant. Blue backlit LED assist operation in low or no light conditions.

www.watchnetinc.com

3M

The 3M CR5400 Double-Sided ID1 Reader gives businesses a way to verify and authenticate driver’s licences, municipal ID cards, insurance cards, and more. Users drop in an ID and the reader checks it in less than four seconds, reading the front and back simultaneously to compare the printed region, barcodes and magnetic stripe data. Colour-coded LED lights give the user a real-time response — a green light means the ID is valid. Once the card is read, the reader automatically ejects it. In addition to basic dual-side verification, the CR5400 reader is also available with optional software which checks government-issued IDs against a database to verify authenticity. The reader also has an optional cradle for RFID and magnetic stripe data reading.

www.3M.com/IdentityManagement

HID Mobile Access enables a smart phone and other mobile devices to securely open a door or gate. This solution enables new iCLASS SE or multiCLASS SE readers to activate with a close range “tap” of a smartphone, or from a distance with HID Global’s patented “Twist and Go” gesture technology. HID Mobile Access supports both Android and iOS operating systems. The solution is powered by HID Global’s Seos technology. www.hidglobal.com

Guardian vandal-resistant and Gibraltar bullet-resistant contactless proximity card readers are suggested for installations where more durability is required than with a standard proximity reader. They are in use at schools, universities, correctional institutions, housing authorities, factories, hospitals and other locales where RFID proximity and smart card readers may be subjected to stress.

www.farpointedata.com

The Pinnacle Access Control Platform is a solution for Small-to-Medium Business (SMB) applications with 1 to 20 doors. Pinnacle’s access control capabilities are complemented by numerous third party integrations without additional ongoing license fees. These include a smart elevator interface, a one-card campus solution, visitor management and video surveillance integration, and more. www.sielox.com

Schlage NDE wireless locks with ENGAGE technology streamline the transition from mechanical keys to electronic credentials. Using wireless technology, the ENGAGE platform allows users to gain access to interior offices, common areas and other sensitive places by using mobile credentials on compatible smart phones or by using their existing building ID cards. For basic applications, the ENGAGE apps provide the freedom to manage locks, add or delete credentials and view lock history from anywhere. Schlage NDE wireless locks with ENGAGE technology are designed to fit into a standard cylindrical door prep. www.allegion.ca

Scott Sieracki recently took the reins of Vancouver-based Viscount Systems, replacing Dennis Raefield, who stepped down but will maintain his position on the board.

Sieracki, who was previously vice-president of sales, sees his role as one of “disruptive” change, helping to push the company’s IP access control products further into the market.

Security may not be the fastest moving market in terms of technology transition, but IP video has stepped to the forefront in recent years, in some ways blazing the trail for other IP security technologies. SP&T News recently spoke with Sieracki about this trend, as well as its recent wins with the U.S. Government and how its relationships with end users are evolving.

sP&t news: What are your initial thoughts about your new role as CEO?

scott sieracki: The board’s got a lot of confidence and a lot of support for me in this role. Our visions align. We’re going to march ahead and try to continue with the disruptive technology that we have with our access products and keep the revenue numbers headed north and see where we are six months from now.

We’ve got our legacy business, which is our telephone entry technology. We’ve been in that space somewhere since 1969 when we peeled off of Telus. [Editor’s Note: Viscount was an R&D affiliate of Telus from 1969 to 1997.] That business, for all intents and purposes, has remained fairly steady. The technology hasn’t changed a lot, but we did launch a new technology platform for one of our Enterphone devices last year and really brought it to market this year — and it’s picking up some good traction.

But the big investment and focus for us has been on our IP-centric access control architecture, which has been in the product suite for, I would say, five years. We really started working hard on evolving the story and the platform when we got introduced to the U.S. Government, Citizenship and Immigration Services, about three years ago. They adopted us as their new go-forward standard within that division of the Department of Homeland Security. We spent a lot of time maturing the product, aligning it with the HSPD12 initiatives and requirements around FICAM (Federal Identity, Credential

By Neil Sutton

and Access Management). We essentially secured our position with CIS, continued the massive expansion of all the new facilities that they’re building or moving into to accommodate President Obama’s initiative for Citizenship and Immigration.

“It’s not always the big enterprises that jump on this right away.”

sP&t news: What is your go-to-market strategy?