WOOD NETWORK LINKS BUYERS, SELLERS, INVESTORS BIOMASS update

Fibre Connections BC, a new British Columbia provincial government service, will directly link fibre suppliers, manufacturers, and investors to streamline the flow of British Columbia’s wood to its highest value use. Under the new network, fibre inquiries or proposals received anywhere by the government will be directed to 1 of 72 fibre officers based in communities across the province. The officers will triage the requests, provide

information, and bring together buyers, sellers, and investors where applicable. Requests that cannot be filled immediately will be logged and tracked to ensure they are matched with future opportunities.

Fibre Connections BC will work closely with the British Columbia Ministry of Community and Rural Development and resource ministries to ensure that information is coordinated across government and

captures all new investment opportunities.

“Whether you’re a wood pellet producer looking for chips, or a First Nation, municipal government, or community forest license-holder looking for customers, Fibre Connections BC can help get you in touch with the people you need,” says Forests and Range Minister Pat Bell.

A public website will be launched in fall 2010 to support the network.

The AV Nackawic pulp mill in Nackawic, New Brunswick, is receiving $2.37 million from the federal government through the Pulp and Paper Green Transformation Program. Part of the funding will support upgrades to reduce the mill’s water and energy consumption, and part will support the installation of equipment to grind wood pieces for more efficient combustion. The ability to process more wood, along with upgrades to the combustion system, will increase the mill’s annual production of renewable energy by 12,039 GJ/year.

Enviva has signed a long-term wood pellet supply contract with Electrabel, a subsidiary of GDF Suez Group, one of the largest utilities in the world. Under the contract, Enviva will supply 480,000 tonnes/year of wood pellets to Electrabel’s biomass power generating facilities in Belgium. Enviva will supply the wood pellets from its expanding manufacturing base of production facilities in the southeastern United States.

Range Fuels has produced cellulosic methanol from the initial phase of its first commercial cellulosic biofuels plant near Soperton, Georgia, using woody biomass. It will be used to produce biodiesel for various applications, including transportation fuel. Range Fuels plans to begin production of fuel-grade cellulosic ethanol from the plant in the third quarter of 2010, for use in transportation fuel markets. Range Fuels plans to expand the capacity of the plant to 60 million gallons of cellulosic biofuels annually, with construction to begin next summer.

it just makes sense

to keep things simple. That has definitely been the case for Pine Star Logging in Prince George, British Columba, which has gone from a full-scale stump to dump logging operation to a two-man show that produces wood fibre for a major wood pellet production facility.

“We made the switch in 2008,” recalls Keith Brandner, manager of Pine Star, which is owned by Keith’s family and operated by Keith and his brother Neal. “Pacific BioEnergy, which operates a large pellet plant in Prince George, put out RFPs (requests for proposals) for the plant’s fibre supply. We were successful in our bid, so we sold most of our logging gear and invested in a new grinder and loader in late 2008.”

Pine Star was started in 1986 by Keith’s and Neal’s father, Ray Brandner, and the boys grew up logging for Canadian Forest Products Ltd. (Canfor), which has a number of solid wood and pulp and paper operations in the region. At one point, they were harvesting approximately 300,000 cubic metres annually for Canfor. But

with amalgamations and changes with the province’s major licensees, the Brandners had already made a conscious decision to make changes to their business by the fall of 2004, when they sold their contracts and moved to harvesting wood on a small business scale.

“Things were changing in the logging business, and we really saw bioenergy as the beginning of a brand new industry because what was once considered waste now had new value,” explains Keith. “We made this significant investment because we saw a future in bioenergy, and the portability of our operation means we can go wherever we need to and harvest what has previously been left behind on the forest floor.”

INVESTING FOR THE FUTURE

The investment Keith refers to was about $750,000, which bought Pine Star a brand new Bandit Beast 3680 grinder from local dealer Brandt Tractor and a Madill 1800 loader for feeding the grinder. They kept a Caterpillar D6 dozer from their previous operations, which they use for clearing blocks and roads as needed. Log trucks have been replaced by contract chip

trucks, which haul the fibre from the bush to the Pacific BioEnergy plant.

“It’s a really simple operation,” adds Keith. “I run the Bandit and Neal runs the Madill. We produce about 200 ODT (oven dried tonnes) of fibre per day in a 10- to 12-hour shift, and we do that five days a week. And if one of us has to be away for some reason, we have some regular guys that can fill in.”

As for the trucking side of things, Keith says they schedule the trucks at set intervals to minimize waiting time for the truckers in the woods. Pine Star contracts the trucking to Excel Transportation Inc. in Prince George, which has a fleet of 53foot walking-floor trailers. Right now, the brothers are working about an hour from Prince George, so they have six trucks transporting two loads each per day.

Our customers want complete pellet production plants from a single supplier –We have the expertise to deliver turnkey process equipment.

Günter Natus – Sales Director

SOURCING THE GEAR

When it came time to acquire the new gear for Pine Star’s wood fibre operation, they searched for a grinder that could take the sometimes rough conditions faced in British Columbia’s interior, and one that could handle a wide range of input material in terms of size and species. For the loader, they needed a machine with the power, torque, and log handling capacity to feed the Bandit grinder efficiently.

“We have been really happy with the results we have been getting, and our customer is happy with the product, especially the size consistency of the ground fibre, which is essentially hog fuel,” notes Keith. “It’s almost all softwood that we process. There’s a lot of aspen around, but it’s green and the moisture content is high, which means it’s not as good for pellets, so we try to avoid having it in the mix.”

Much of what the Brandners have been processing for the past year is immature beetle-killed wood. They were originally running slash, but in early 2009, they ran a test on some 30-year-old beetlekilled pine that was slated for burning. “It had already been felled and it was going to be burned to make room for young seedlings, so we asked if we could run some on a trial. It worked well for us and, as far as we are concerned, this was a much better way to get some value from it. These were trees that were 30 feet long and less than six inches in diameter. They were too small for the sawmill, but great for us, as processing a whole tree is far more efficient than processing slash.”

LOOKING FORWARD

Keith says there’s no shortage of this type of wood in British Columbia’s central interior and thinks they should have enough raw material to last them for some time. But they’re not the only ones singing the praises of this new business model. “The work Pine Star and Pacific BioEnergy are doing highlights the potential for wood bioenergy in forestry’s future,” said Pat Bell, the province’s minister of forests and range, while touring a Pine Star grinding site. “The forest sector has an important role to play in advancing B.C.’s green energy advantage, and Pine Star is an excellent example of a smaller, local company finding new ways to obtain more value from our forests.”

We ensure our customers excellent plant uptime due to our extensive experience in the construction of large plants, wide process knowledge and high reliability.

Dieffenbacher supplies custom engineered production plants meeting low emission values and with production capacities up to 600.000 t of pellets resulting in a quick return of investment.

Once the fibre gets to Pacific BioEnergy, it is primarily used for pellet production for the plant’s overseas fuel customers. It looks like Pacific BioEnergy will continue to be a long-term customer for Pine Star, as earlier this year, the pellet producer announced a strategic partnership with GDF Suez, a global energy provider based in Europe. The partnership will support a $24-million expansion of Pacific BioEnergy’s current Prince George plant, which will be owned and operated by a new joint venture company.

In addition to its interest in the joint venture, GDF Suez has agreed to purchase 2.5 million tonnes of wood pellets from the plant over the next 10 years. The pellets will replace approximately two million tonnes of coal used at GDF Suez’s electrical generating facilities in Belgium, which the company says will reduce net CO2 emissions by more than four million tonnes.

For Pine Star Logging, simplifying has been a good thing. “With the downturn in the forest industry, it’s been tough for many loggers over the past couple of years, and when we crunched the numbers, this move to biomass just made sense,” explains Keith. “I think there is a huge future in biomass, and we are quite willing to stay the course and see where it leads us. Right now, it makes sense for us to stay small. We are efficient, we can produce a good product, and we can utilize what was once considered waste. •

ast spring, I participated in a field visit organized by the Canadian Forest Service in Ontario. The visit took us from the shores of Lake Superior to White River, with the purpose of looking at experimental trials studying the effects of organic material removal on soil productivity. Trials consisted of sites that had been harvested stem only (tops and branches left on site), whole tree (trees delimbed and branches and tops piled at roadside), or whole tree harvested AND the forest floor scraped by a bulldozer (not for faint-hearted soil ecologists). The stands were about 15 years old.

Ontario’s current guidelines for forest biomass harvesting are among my favourites because they are based on simple and easily observed criteria for identifying sensitive sites: soil depth and soil texture. Thin or coarse sandy soils are considered at highest risk of fertility loss with forest biomass harvesting.

Large areas of Ontario are located on sandy outwash plains and shallow soils and thus would be classified as risky. Forest stands on these types of sites encompass a wide range of productivity. Therefore, a refinement of the criteria seems necessary to better capture the sites at the lowest end of the productivity range, i.e., the really sensitive ones. So, in a joint effort by the Ontario Ministry of Natural Resources, the Canadian Forest Service, and other partners, trials were set up on coarse sandy or shallow soils, as well as other typical Ontario forest sites such as peatlands.

This research in Ontario is linked to a wider initiative called the Long-Term Soil Productivity program. It includes more than 100 experimental sites across the United States and Canada (with some LTSP sites in British Columbia), with trials similar to those in Ontario and covering a broad gradient of species, soils, and climates. This network of trials produces large amounts of ecologi-

cal data and makes for a very powerful and credible analysis of the ecological effects of forest biomass harvesting.

So far, 15 years of post-harvest data show that in slow-growing northern forest stands such as black spruce, scraping the site of all organic material at harvest causes the regenerated trees to grow faster. This is the opposite of what we might expect or want, but occurs because such a treatment improves the microclimate for the seedlings. For example, more sun reaches the ground and warms the soil because there is no organic material cover, and that enhances root growth and produces better tree growth. This is actually in accordance with what we know about the requirements of seedlings in the first stage of stand development: growth is largely driven by the microclimate.

However, fastergrowing stands such as those dominated by jack pine or trembling aspen, or those located in warmer climates, go through this initiation stage much faster. They are usually past this phase by year 15 and are reaching canopy closure; microclimate is a lot less critical for growth, and nutrient availability becomes a more important growth driver. By then, the trees on sites where more organic material was removed (i.e., whole-tree harvest and whole-tree harvest plus forest floor scraping) are starting to show signs of nutrient starvation and slower growth than those on sites that had plenty of organic leftovers (i.e., stem-only harvest).

a widespread catastrophe associated with forest biomass harvesting. However, they do hint that organic material left behind at harvest may play an important role for tree nutrition and growth, but that role may not show up until later in the rotation, once the trees are past the initiation stage. This clearly demonstrates the importance of having a good long-term monitoring network of trials to follow up stands through time and see how they develop after different harvesting treatments. In this case, time is in terms of decades. The LTSP teams in Ontario and British Columbia have obviously understood this for quite a while and are provid-

“By year 15, the trees on sites where more organic material was removed are starting to show signs of nutrient starvation and slower growth than those on sites that had plenty of organic leftovers.”

ing key information for the development of sustainable forest management policies in Canada. Thumbs up!

For more information on the ecological research going on in Ontario about forest biomass harvesting, contact Rob Fleming and Paul Hazlett at the Canadian Forest Service in Sault Ste. Marie, and Dave Morris of the Ontario Ministry of Natural Resources in Thunder Bay. •

Admittedly, the data from Ontario and the rest of the LTSP network do not show

out pellets – briquettes are stealing some of your limelight. As government and private industry explore renewable ways to produce heat and electricity, briquettes are being touted as having important advantages over pellets, such as greater feedstock flexibility and lower production costs. Briquettes have similar heat and density values to pellets and are made in two formats: smaller pucks in a range of diameters, and larger cylindrical or square firelogs.

As with biogas digesters, briquette making has had a long history in Europe, and that’s helping to speed its adoption in North America. Here and in Europe, both pellets and briquettes are being used in home heating, industrial boilers, and district heating and co-generation plants.

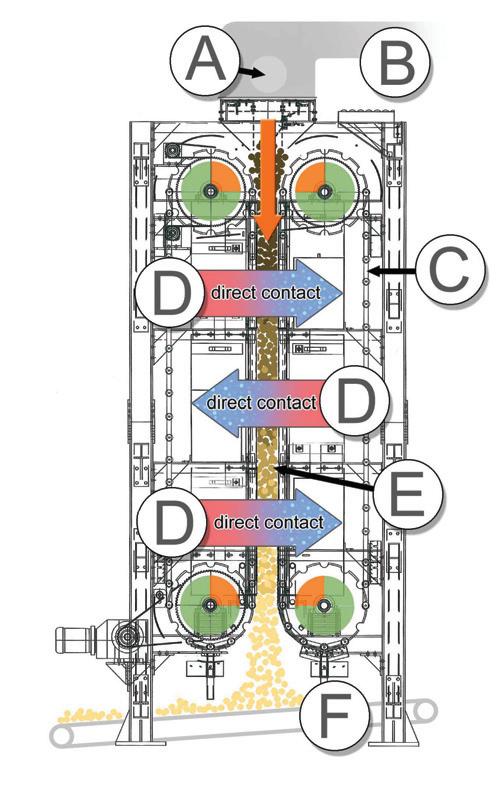

Promoters of briquettes point to their many benefits, such as not requiring materials as finely ground as those needed for pelletization. “Particulate size for briquettes can be larger than for pellets – up to 15 mm – thus requiring less pre-grinding energy,” says Wayne Winkler, president of Vancouver, British Columbia-based Briquetting Systems Inc., the Canadian distributor of Denmark-based CF Nielsen briquetting machines. “Manufacture requires significantly less power consumption, both from a grinding and a pressing view.”

Winkler says that pelletizing fines requires large power-consuming hammermills (typically with outputs of 100 hp/tonne) as well as expensive after-coolers, dust collection systems, and drum-type drying systems, which “are usually fired and have their own fire hazard issues. All this increases both the cost and time to make pellets in comparison to briquettes.” In addition, Winkler says that using dust fines to make pellets is to risk explosions, fires, and respiratory problems. Compared to pellet making, briquette manufacturing also has lower repair and maintenance costs and faster start-up times. “Die replacement in briquetters is a fraction of the pellet die cost,” Winkler notes. “Roll press briquetting is the main technology that has been used for decades to compact high capacities of coal fines into briquetted coal shapes. Wood fuel puck production in most cases will not require expensive hammer-

milling in production.”

Briquettes can also be made from a wider variety of materials that can have much higher moisture contents – up to 15% –compared to those required to make pellets. “A wide array of feedstocks, some that are not pelletable, can be briquetted, including wood, agricultural residue, paper, and mixtures of feedstocks,” says Winkler. Another option for briquetting is torrefied wood, which is green wood that has been reduced to char through mild pyrolysis using high temperatures in a closed environment with little or no oxygen. “Torrefied wood can be ground with coal ball mill pulverizers, and it’s waterproof, so it can be stored outside,” says Winkler. “It also has a higher heat value than wood, but most torrefaction technology is still in the pilot stage.” Some pellet producers have also been considering and testing torrefaction.

Briquettes are at least as easy to handle as pellets in terms of loading and unloading shipping containers at ports. Winkler says drive-through tipping devices have been developed that allow briquettes to be quickly bulk-loaded into containers. They can also be loaded in super-large sacks.

James Brose, president of Kanviromental Corp., a briquetting machine manufacturer in Elmira, Ontario, notes, “It’s also important and very relevant to appreciate the fact that pellets have 15 times the surface area per similar weight than briquettes do. Moisture uptake not only kills the BTU values the pellets left their source with, but additionally increases content shipping weight.”

END-MARKET USES

While residential pellet stoves have made inroads in Canada, briquettes are being used in home heating across many U.S. states.

Indeed, the customers of Cleveland, Ohiobased RUF US Inc. (the North American distributor for Germany-based RUF briquetters) are producing briquettes mainly for residential heating. The rectangular (6 x 2.5 x 3-inch) briquettes can be used in any wood-burning appliance, says RUF US president Greg Tucholski, and are available to customers in many mid-U.S. states through retail outlets in bags or by bulk delivery at USD $250–350 per tonne. “Customers are using two to three tonnes a winter,” he observes. “Briquettes produce much less ash and provide a cleaner, more consistent and longer burn than wood. Customers like the convenience and cleanliness of the product and the fact that they last longer during the night than firewood.” Tucholski says the feedstock is mostly kiln-dried residuals from wood product manufacturers and sawmills. He’s sold about 50 machines so far and expects to sell 20 to 30 more in the next 12 months.

In Mont Joli, Quebec, Bois BSL Énergie Inc. has been producing “SmartLogs” since 2006 for home heating, which the company claims produce almost 35% more heat than firewood. “Our sales have increased from 2006 to 2009, but are stable since then, having reached a maximum level in a saturated

market,” says Jacynthe Rodrigue, Bois BSL energy division sales manager. The company lists Rona, Kent, Millwork Home Centres, and other stores in Quebec and Ontario – along with one U.S. distributor – as sales outlets.

Bois BSL uses an in-house CF Nielsen briquetter to process hardwood sawdust from its flooring manufacturing operation. CF Nielsen briquetters are also available in two other versions – containerized

(semi-portable) and a large silo format with feedstock fed via airhandling or conveyor to an upper floor with sweep-auger feeding to presses on a lower floor. “Both these formats negate the need for a building,” Winkler notes.

Other companies, such as Brenlo Custom Wood Mouldings in Mississauga, Ontario, are marketing briquettes to greenhouse operators. Brenlo started making pucks using a CF Nielsen machine in August 2009. “We have multiple greenhouse customers, but with natural gas prices decreasing, it’s been a challenge on the return on investment side,” says Overton Smith, Brenlo’s head of research and development and commercial development. “We’re managing our prices based on customer demand.” Smith expects that cost return on the machine will be reached in about two more years, but is optimistic about demand. “We expect that natural gas prices will go up again,” he notes. “Our briquettes are very popular. They produce very high BTUs – over 8100 per pound – because they’re made from kilndried wood byproduct, and produce almost no ash.”

However, the natural gas price drop has meant the greenhouse market has completely dried up for Sauder Moulding & Millwork in Ferndale, Washington. Its CF Neilson briquetter is currently idle. “We sold a container about five months ago to a greenhouse,” says spokesperson Ryan Hammer, “but we’re now back to selling our (hemlock) sawdust directly to local farms.”

The Quatsino First Nation Economic Development Corporation (QFNEDC) in Coal Harbour on Vancouver Island, British Columbia, is planning to serve the greenhouse industry as well as feed boiler systems in commercial and industrial buildings. It will be making briquette pucks and some “niche market” firelogs with byproduct from its cedar shake operation, which uses hemlock, red cedar, red alder, and balsam fir. “We’re planning to start within six months, pending funding for the project,” says QFNEDC general manager David Schmidt. The project also involves consultants and other specialists. Quatsino decided on briquettes instead of pellets because they’re “cost effective and the market is better,” says Schmidt. “The competition in the pellet market is fierce and, without going overseas, hard to get into.” He adds that hemlock doesn’t make very good pellets.

Some wood product manufacturers are briquetting residuals to feed their own boilers. “There’s a misconception that briquettes cannot be broken up to fit in boilers designed for dust or pellets, but it can be done easily,” says Irvon Weber, Kanviromental’s chief technology officer. Winkler notes that CF Nielsen is developing a puck quartering system for boiler use. At West Fraser’s Westpine mediumdensity fibreboard plant in Quesnel, British Columbia, they “occasionally briquette sander dust when too much has built up,” says plant manager Dave Berg. “We burn the dust in our thermal oil system, but when there’s too much for us to handle, we briquette it and truck it to our Quesnel pulp mill for use in their boiler. It’s much easier to transport briquettes than dust.” Berg figures cost-return was reached about a year after getting the CF Nielsen briquetter two years ago, and adds that there’s been recent talk of purchasing briquetters at other West Fraser operations.

POWER GENERATION ABROAD

While the short-term export outlook to Europe for both pellets and briquettes has recently taken a hit, mostly due to the Euro’s plunge in value, several companies are actively shipping or making large-scale plans to ship densified fuel overseas for power generation.

The long-term market potential is huge. A recent study by

cost has gone down, and some power plants have switched to that from coal, which has gone up in price,” he notes. “They won’t sign long-term contracts with fixed prices (for biomass).”

Kern also observes that there’s only a small market for home heating in the eastern U.S. states because of the mild winters, and that coal is “still king” for power generation there. Carolina Pacific’s trademarked ROCette briquettes are made using a proprietary process that involves Di Più (Italy) and CF Nielsen equipment. “It’s an impact press, rather than a die, with continuous extrusion,” says Kern. ROCettes deliver over 8,000 BTU/pound, and are made from a combination of logged pine and residuals from local furniture and moulding operations.

German energy consultant ecoprog and the Fraunhofer Umsicht research institute predicts that new wood-fired power plants in the United Kingdom and France will see biomass capacity in those countries grow 50% by 2013. New biomass power plants have also been built recently in Scandinavia, Germany, and Austria. Scandinavian countries will continue to have the biggest use of biomass, due to their relatively large timber resources in comparison to other European countries. A further 130 plants are being built all over Europe and the United Kingdom, which will bring the expected number of plants to 1050 and biomass generating capacity to 10,000 MW by 2013.

Carolina Pacific in Charleston, South Carolina, shipped its first load of briquettes to Sweden in March. President John Kern says they will ship another 50,000 tonnes this year and 100,000 to 250,000 tonnes next year. “Germany, Belgium, Netherlands, Denmark, and other Scandinavian countries are good markets,” he says. “They want to build plants and make long-term agreements.” England, however, is another story. Kern notes that the failure of that country’s energy subsidy regime has made it very difficult to predict prices. “Natural gas

Not everyone is shipping briquettes. RWE Innogy, the renewable energy arm of German-based energy giant RWE, plans to ship pellets to Europe from a 20-million plant they are building in Georgia, USA, in partnership with Sweden’s BMC Management AB. By 2011, the plant will produce 750,000 tonnes/year of pellets for use in European biomass power and co-generation coal plants. When asked why they chose pellets, RWE spokesperson Heinz Vinkenflügel said, “The experiences of co-firing biomass in European power stations are based on using pellets. Pellets are the most traded biomass in the world and

… at present, there are not enough longterm experiences with briquettes to prove the … theoretical advantages."

Pacific Briquetters Inc. in Mission, British Columbia, (a subsidiary of Vancouver-based Carbon Friendly Solutions Inc.) would like to be producing briquettes for U.S. and European power plants, but has put plans for that on hold for now. Carbon Friendly Solutions CEO Mike Young says, “We had been in discussions with energy companies in the Scandinavian region to purchase briquettes in the 125/tonne range. However, with the sudden drop in the euro, there is almost a 30% decline in profit, making it no longer profitable. Basically, our cost to produce briquettes is approximately CAD $90/tonne FOB (free on board) our mill. Shipping costs overseas are in the CAD $50 to 60/tonne range, so you can see the margins were already going to be tight.” Young says they’d ideally like to sell and ship within North America, “but to the best of my knowledge, the market is not there yet.” In the meantime, Pacific Briquetters is going forward with developing its wood waste and recycling facility in Mission, and Young says they can easily move into briquette production as demand increases.

DOMESTIC POWER

For North American utilities to effectively use briquettes, Winkler advises them to investigate the best technical features of biofired European plants and tweak the design to suit local markets. “This could involve cofiring with biomass and natural gas, which has already been done in Sweden,” he says. “Demand for fuel briquettes is large, as there are more than 600 coal-fired plants in North America, many in the 600-MW range, which equates to approximately one million tons/year of coal per plant. If 5–10% of it is exchanged for biomass fuels, it equates to millions of tons of required biomass. Coalfired power plants can use their own stationary grinders to grind briquettes.”

Brose says it’s a misconception that briquettes are too big to use in power plants. “The coal must be ground up anyway, so briquettes are fine,” he notes. Since drying is needed for briquetting however, Brose notes that combined heat and power systems that have been developed in Europe are a smart move. “Electricity is produced from the briquettes and the waste heat dries the biomass that goes into the briquettes, which eases costs significantly,” he notes.

Kanviromental’s BioKrush briquetter was developed using the staff’s long expertise in densifying scrap metal from the automotive industry and is designed for industrial settings where large throughput is required. “There are already small-throughput European machines available, so we’ve focused on what we call ‘central briquetting,’” says Brose. “This means one of our units would briquette feedstocks like sawdust and chips, purpose-grown crops, or paper waste leftover from recycling operations at (capacities

of) one, five, and eight tonnes/hour.” The company has some machines in stock but plans to produce them on a made-to-order basis. Director of sales Gary Cruickshank says the company may choose to find partners to jump-start electricity production from briquettes, but that the company’s focus is briquetter manufacturing. “It’s a relatively new industry to Canada,” he notes, “but Ontario Power Generation and others are very interested.”

To supply a local co-fired coal plant as

well as local boilers, Ernst Conservation Seeds in Meadville, Pennsylvania, expects to have a commercial briquetting operation (pucks and firelogs made from switchgrass) up and running by spring 2011. “It will in-

clude storage for the switchgrass, a dehydration system that will use waste from our feed mill, and a pellet mill to produce pellets for anything that doesn’t have an eight-inch auger,” says Ernst biomass manager Dan

Arnett. Since purchasing a CF Nielsen briquetter in February 2008, the company has been running tests at a coal plant, a greenhouse, and a school with a biomass boiler.

As someone who has watched the densified fuel market closely for a long time – and is admittedly enthusiastic about briquettes –Winkler still remains guarded. Until Canada and the United States have a carbon tax and regulatory framework in place, he says, expansion of the densified biofuel market will remain difficult, whether that involves pellets or briquettes. “In terms of export, we’re at the mercy of low currency exchange rates, fluctuating shipping rates, as well as European utility buyers working together to set prices,” he concludes. “At the same time, we must fight the perception here in North America that fossil fuels are cheap, when in reality they are not. Even at the best of times, margins are narrow in biofuels, but we must not allow other countries to commandeer our future.” •

he wood pellet business is hazardous.

Dock workers have unknowingly entered loaded ship holds and perished from carbon monoxide emitted by wood pellets. Many times, rainwater has leaked into a storage silo, causing the pellets to selfheat and eventually burst into catastrophic fire. Workers trying to extinguish the fire then cut holes in the side of the silo, only to cause explosions, injuries, and deaths. The pellet manufacturing process creates highly explosive wood dust. Consequently, there have been numerous incidents of fires and explosions set off by a spark from the friction between moving parts, a flame from a welding torch, or the heat from a drum dryer. Such incidents happen too frequently, not only in Canada, but in pellet plants around the world. Every incident is investigated and explained, yet they continue to occur.

Canadian insurance companies have recently told the pellet industry that its performance must improve or else pellet plants will no longer be insurable. Without insurance, pellet producers will lose the ability to be financed or operate. More importantly, injuries and loss of life are unacceptable. Occupational health and safety is a critical issue demanding immediate attention. Although there are pellet producers who have excellent safety records, the frequency of incidents by those who do not taints the reputations of everyone. Pellet producers must create an industry-wide culture in which the health and safety of workers is an overriding priority.

The Wood Pellet Association of Canada (WPAC) is taking action. Together with the British Columbia Forest Safety Council (BCFSC), it is developing an industry-wide safety program consisting of: (1) a handbook of best practices for pellet industry health and safety; (2) a safety audit protocol based on the best practices handbook; and (3) a safety certification brand (SAFE Certified).

The best practices handbook is being developed in consultation with WPAC members and will consist of safety guidelines for construction, operation, and maintenance of pellet plants. It will include references to occupational health and safety legislation, regulations, and the requirements of safety authorities such as the National Fire Protection Association, the EU ATEX Directives, and others.

Each WPAC member company will have the opportunity to become SAFE Certified by undergoing an initial comprehensive safety audit by a qualified third-party auditor to ensure compliance with the best practices handbook and then periodic subsequent maintenance audits to ensure ongoing compliance.

Although most provinces have their own forest industry health and safety association, WPAC intends to try to reach an agreement with each province to have BCFSC act as the health and safety association for all Canadian pellet plants to maintain a consistent safety standard for the entire wood pellet industry in Canada. Most provincial workers’ compensation boards have certificate of recognition programs whereby certified members of an approved health and safety association – such as BCFSC – receive significant rebates (i.e., 10%) of their workers’ compensation fees.

erating safely. This means rebates on premiums and reduced rates.

• Insurance companies will gain confidence that future incidents will be reduced. Hence, they will continue to provide coverage and refrain from unusual rate increases.

• European utility customers, who must increasingly demonstrate that they are purchasing from sources that are both green and ethical in the treatment of workers, will gain confidence in the companies.

• Good (certified) performers’ reputations will no longer be tainted by the poor

“Although there are pellet producers who have excellent safety records, the frequency of incidents by those who do not taints the reputations of everyone.”

safety performance of poor (non-certified) performers.

The certification process is designed to provide several advantages to participants: • Employees will have a safer working environment.

• Workers’ compensation boards will gain confidence that the companies are op-

Canadian pellet producers are currently struggling as a result of an oversupplied European market, declining prices, and unfavourable foreign exchange rates. It is tempting in such times to cut back and wait before starting any new initiatives. However, this is one initiative that can’t wait and must be pursued with maximum effort. Fatalities and accidents are preventable, and we are all responsible. •

Arsenault drives around the country with the future of the pellet industry in the back of his SUV. The vice-president of Energex Pellet Fuel Inc.’s Quebec operations keeps a 40-pound bag of torrefied pellets in his backseat, ready to show potential clients, politicians, or travelling biomass journalists what he, and many in the industry, feels to be the next generation of solid biomass fuels. The coal-like wood pellets are among several hundred pounds of pellets made in a pilot plant at the company’s facility in Lac-Mégantic, Quebec, near the border with rural Maine.

“There’s lots of talk about torrefied pellets, especially among academics,” the easytalking industry veteran says from the plant parking lot. “But how many of us are driving around with 40-pound samples in their trucks? How many companies have made hundreds of pounds in a process that can be scaled up in a hurry? Maybe just us.”

That’s a fair point. There’s lots of talk around this dense, water-resistant solid biomass fuel, but little in the way of actual production. The Wood Pellet Association of Canada (WPAC) has a subcommittee looking at torrefaction technologies under the experienced eye of Len Fox, recently

retired from Premium Pellets in Vanderhoof, British Columbia. Yet the initiative was launched just this past spring and is still in the engineering and feasibility stage. Some plants in Europe are making torrefied pellets, but there too, the process is in its infancy. That leaves Arsenault and his in-house process.

HARD WINTER

Energex is a true pellet pioneer, having helped introduce the product to such current biomass giants as Sweden (see sidebar on page 21). Its current flagship plant in Lac-Mégantic was built by petroleum giant Shell in 1982 in response to the 1970s oil crisis. Designed to serve the industrial bulk market in the eastern United States, it ran as a Shell facility until 1993, when a group of private investors took it over. At that time, a few changes were made, including the addition of a bagging line and the move to sawmill residuals, allowing the plant to target the growing residential heating market.

In 2000, the owners merged two U.S. pellet facilities into one larger facility in Mifflinton, Pennsylvania. That facility has since been modernized and expanded, finishing an upgrade in 2007. That same

year, a green energy venture capital company out of Pennsylvania called DFJ Element acquired the majority of the company and has run the two plants since. The Lac-Mégantic and Mifflinton plants have annual capacities of 120,000 and 100,000 tonnes respectively. Both have similar horsepower, Arsenault explains, but the U.S. facility deals with hardwood. Either way, that makes the company a major player in the North American pellet sector.

Today, 95% of the Quebec plant’s production goes to the U.S. residential heating market, which, at times, can be a volatile place to do business.

“In the winter of 2008–2009, we couldn’t keep up. We almost ran out of supply, so our raw material costs went up and we took new sources like wood chips to add to our sawmill residues. Pellet costs went up as well, but with heating oil where it was, that was not a problem. Last summer, we stockpiled a lot of raw material to avoid running into shortfalls, but by

November of 2009 we hit a wall. There was too much product out there, the winter was warm, and heating oil much cheaper, and we had to shut down production for much of the winter to balance things out.”

That harsh reality gave Arsenault time to accelerate a couple of projects. For starters, the collapse of the North American pellet market in November 2009 shocked more than just Energex. Few in the industry saw it coming. Yet looking back, Arsenault has uncovered a set of parameters that would have helped predict the collapse, had the industry known the signs.

“There are a number of factors, but it comes down to the price differential between heating oil and wood pellets at the end of the heating season. As homeowners, we look at our heating costs at the end of the year and either say, ‘I’ve got to do something about this,’ or not. In the summer of 2008, that difference was large enough to cause many homeowners to do something about it, and we had a great season in 2008–2009. We were so busy trying to keep up and raising prices that we didn’t realize what was happening. We were in the midst of a recession, heating oil prices had dropped dramatically, and pellet prices had gone up. The differential had vanished. Sales in the spring were still good because people were responding to a perceived shortage, so we didn’t notice the wall until we hit it hard in November.”

In fact, heating oil prices per litre (according to Statistics Canada) hit $1.29 in Montreal in July 2008, creating that massive gap. Just one year and a recession later, pricing had dropped to just over 71 cents/litre. This past July, heating oil prices in Montreal had climbed back to almost 87 cents/litre, setting the industry up for a better season this coming winter, or at least that’s what Arsenault is predicting.

“We’ll be able to test it out this year, but it seems that a heating oil price of at least 75 to 80 cents/litre, and thus a 15% differential, is a key factor. There are others— another really mild winter will hurt—but we’re expecting that demand will be significantly better this year. There is a lot of inventory out there, so pricing may not be great, but at least demand will be there.”

GENERATING A FUTURE

Predicting poor markets is one thing; responding is another. That’s where Arsenault’s second project comes into play. Energex took

advantage of its slow winter to push its pellet torrefaction development into high gear.

“It’s a question of necessity,” Arsenault explains. “It’s hard to invest in new technology and market development in ugly markets, but we can’t afford to wait, either as a company or an industry. Things like developing the market for residential heating are great, but it will take a long time to add any significant volumes. Let’s say we double it over the next 10 years to 120,000 tonnes in this area, there are

two problems. We’re only adding 60,000 tonnes when more capacity than that has come into the market in Canada in the past year alone. And we’re taking 10 years to do it. We can’t survive another 10 years like this. We need to create a bang in the market, not a whimper.”

For a faster and larger bang, Arsenault and his colleagues at WPAC are targeting the coal-fired power generating industry in Canada. We’re a hydro-rich nation, but parts of the country still burn a lot of coal to meet

Quality pellets, guaranteed. For perfect pellets the entire production system must work together flawlessly. Buhler enables total process control by providing a complete process design package and key equipment for drying, grinding, pelleting, cooling, bagging and loading. This, combined with Buhler’s integrated automation system, unrivaled after sales support and training provides a seamless solution, guaranteed.

Buhler Inc., 13105 12th Ave N., Plymouth, MN 55441, T 763-847-9900 buhler.minneapolis@buhlergroup.com, www.buhlergroup.com

The solution behind the solution.

peak demand. The country burns some 58 million tonnes of coal, with 51 million of it being used to generate power, chiefly in Alberta, Ontario, and Nova Scotia.

“You can see the attraction. If we can just achieve a 5% co-firing rate, we’d be creating a market for more pellets than are currently produced across all of Canada, just for this. That’s the kind of stability you need to grow this sector. And there is interest among Ontario Power Generation (OPG), and we’re starting to see interest among other utilities in other provinces.”

Arsenault and WPAC have been actively encouraging this issue as well, meeting with senate committees, federal ministry staff, provincial ministers, and, this fall, presenting at a power generator conference in Calgary, Alberta. It’s encouraging, but Arsenault cautions that the industry will need the right product to seal the deal.

“Wood pellets are a great solid fuel, but they have limitations. These utilities have large, open-air storage, which is fine with coal. Pellets on the other hand react poorly to water; 90% of my claims on the residential

SPC

Sweden Power Chippers AB

market are for moisture, and we ship those in bags. They don’t necessarily grind well using the utility’s equipment, and the energy content is much lower. Anything we can do to solve those problems makes us a better supplier and makes the decision for these power generators easier. That’s where torrefied pellets come in.”

Energex has developed a process to torrefy its own pellets that fits its existing production process without adding significant costs. Starting out in the company’s quality control lab, the process has moved to a small pilot plant that is filling 40-pound bags and, according to Arsenault, is ready to ramp up over the next year to production scale.

MARKET IRONIES

Energex’ John Arsenault likes to tell a short tale to highlight the ironies of a pellet pioneer nation like Canada in desperate need of a market.

“In the early 1990s, Sweden enacted a carbon tax to reduce the nation’s dependence on fossil fuels. It’s a dreaded concept here, but the results are interesting. The power generators looked around for alternatives to avoid paying the tax and came across the idea of wood pellets.”

There were no wood pellet producers in Sweden making the volumes needed for industrial trials, so the generators imported pellets for a co-firing trial, which was a success. They then approached local sawmills, encouraging them to produce pellets from sawmill residuals, creating the industry from scratch. With further government incentives, a residential heating market also grew.

“Now Sweden burns more renewable fuels than fossil fuels, a stunning success in less than 20 years, and they are now the largest consumer and producer of wood pellets. The irony? Those first loads of pellets for the co-firing test came from this plant. We shipped two loads of 5,000 tonnes each in 1991 to help get the whole thing started, and we still can’t find a market here!”

“It’s an in-house process we’ve been playing with over the past few years, but this past winter gave us the time to ensure we had a process that could be scaled up. And that’s what we need to do. As part of its investigative process, OPG, along with some American power generators, has contracted the Centre for Energy Advancement through Technical Innovation (CEATI) to test the merits of torrefied pellets as a renewable fuel. We’ve supplied a 40-pound bag for lab tests and will soon ramp up to larger samples.”

Arsenault expects to send a 50-tonne sample in the fall, hopefully followed by a 5,000-tonne sample in the early spring of 2011. “And we have others interested to hear about that first 5,000-tonne shipment. That’ll give them proof it can be done on a larger scale, making it a credible fuel supply.”

Arsenault is confident that the new fuel can be made cost effectively on an industrial scale. The goal is to have 100% of the plant’s production leave in torrefied form, and he stresses that this is possible in large part because the process was designed from a pellet producer’s perspective. For starters, the gas created in the torrefaction process will be reused in the plant’s burner, thus limiting the effect on the plant’s energy balance.