Feed and Production Continuous

We’ve designed the Morbark ® 3800XL Wood Hog to be the best horizontal grinder on the market. It will dramatically increase your production capacity and operating efficiency, so you can fill your pockets as fast as it fills your trucks.

• More Productive – A larger, more aggressive hammermill and independent drive motors on the feed-wheel and belt-chain result in a continuous feed with higher production, greater fuel efficiency, and a more consistent end product.

• More Convenient – The Morbark Integrated Control System allows you to maximize production and keep the belt full with just an occasional tweak of your thumb. And you can conveniently service the grates and hammers while standing up, with plenty of headroom and space to work.

• More Reliable – The 3800XL is protected from foreign objects by the best solution available: an externally adjustable breakaway torque limiter that releases instantly when overloaded without stalling the engine; this significantly reduces potential damage and decreases downtime.

The Morbark® 3800XL Wood Hog is part of a full line of heavy-duty industrial grinders from the leader in the industry. Learn more about our machines and our extensive product support network at www.morbark.com.

CANADIAN BIOMASS

14 Power play

Nechako uses ORC to convert heat to electricity.

17 Imagery details available biomass

Contractors help the MNR keep track of forest growth.

20 Rising expectations

Rentech continues expansion as mills come online. 22 Moisture measurement

Data gathering and analysis is the key to maximizing value and minimizing processing costs.

Microbiologists manipulate genetics to boost the efficiency of ethanol production.

Beetle-kill business

Fibre constraints tighten near MPB ground zero

Irecently spent a week near Prince George, B.C., where I was visiting several sawmills and pellet plants to see how the industry in the region hardest hit by the mountain pine beetle has adapted 10 years after the forests died. It is difficult to describe the vast forests of dead trees for anyone who hasn’t seen them. In some regions, there may have been up to 20 per cent of living spruce but much of the forests stood dead.

The dead pine had to be treated with care to prevent breakage. Gulbranson, one of the logging contractors that works with L&M Lumber, which shares a site and ownership with Nechako Lumber and Premium Pellet, is using a decking machine to gently pile the lumber before processing. The decker picks up the logs from above, causing less breakage than a skidder pushing the wood into a pile. Even with special treatment, however, I noticed a sizable pile of broken logs.

Even when the logs are carefully harvested, processed and taken to the mill, they aren’t what they used to be. A blue ring around the outside of the log is a telltale sign the log hosted the beetle at one time. Deep checks are also common in the brittle wood that would crack rather than bend in a windstorm. L&M Lumber added an optimizer to spot these defects and to position the logs to find the best solution for each log. Still, recovery isn’t what it used to be – much of the log is now unsalvageable for lumber.

Of course, that means the sawmill is making more sawdust and chips – which is good for companies that depend on sawmill residuals to make pellets or pulp.

But at some point, there won’t be enough value in the logs for the sawmills to bother bringing them in (see Sara Lynn Grady’s article on page 11).

The dead pine trees that stood close to towns, sawmills or accessible roads have mostly been cut down with a new generation of growth pushing up in their place. In areas where the pine has not been removed, they cast shadows over the new growth and slow the forests’ regeneration. Even worse, they provide ideal fuel for forest fires that could be devastating as the new growth burns alongside the old.

The provincial government is tasked with answering the question: how do we keep a healthy and vibrant forest industry in a region where so many of the trees have died?

The solution offered is an interesting one that may provide pellet producers with more clout when seeking a secure source of fibre over the long term. The provincial government introduced a supplemental forest licence meant to encourage the harvesting of the dead pine that is less accessible and this new licence is not available to sawmills.

Harvesting and trucking the dead pine that remains is an expensive option for pellet mills but forest companies have a long tradition of trading log profiles, chips and sawmill residuals to the benefit of the industry as a whole. Supplementary forest licences will provide pellet producers with a seat at the negotiation table.

Volume 14 No. 6

Editor - Amie Silverwood (289) 221-8946 asilverwood@annexweb.com

Associate Editor - Andrew Macklin (905) 713-4358 amacklin@annexweb.com

Contributors - Sara Lynn Grady, Treena Hein, Cam McAlpine , Gordon Murray, Christopher Rees, Dr. Donald L. Smith, and Annie Webb

Editorial Director/Group Publisher - Scott Jamieson (519) 429-3966 ext 244 sjamieson@annexweb.com

Market Production Manager

Josée Crevier Ph: (514) 425-0025 Fax: (514) 425-0068 jcrevier@annexweb.com

National Sales Manager

Ross Anderson Ph: (519) 429-5188 Fax: (519) 429-3094 randerson@annexweb.com

Quebec Sales

Josée Crevier Ph: (514) 425-0025 Fax: (514) 425-0068 jcrevier@annexweb.com

Western Sales Manager Tim Shaddick - tootall1@shaw.ca Ph: (604) 264-1158 Fax: (604) 264-1367

Media Designer - Emily Sun

Canadian Biomass is published six times a year: February, April, June, August, October, and December.

Published and printed by Annex Business Media.

Printed in Canada ISSN 2290-3097

Circulation

Carol Nixon e-mail: cnixon@annexweb.com P.O. Box 51058 Pincourt, QC J7V 9T3

Subscription Rates:

Occasionally, Canadian Biomass magazine will mail information on behalf of industry-related groups whose products and services we believe may be of interest to you. If you prefer not to receive this information, please contact our circulation department in any of the four ways listed above.

No part of the editorial content of this publication may be reprinted without the publisher’s written permission ©2014 Annex Business Media, All rights reserved. Opinions expressed in this magazine are not necessarily those of the editor or publisher. No liability is assumed for errors or omissions. All advertising is subject to the publisher’s approval. Such approval does not imply any endorsement of the products or services advertised. Publisher reserves the right to refuse advertising that does not meet the standards of the publication.

www.canadianbiomassmagazine.ca

BIOMASSupdate

ANDREA KENT APPOINTED CRFA PRESIDENT

The Board of Directors of the Canadian Renewable Fuels Association (CRFA) has appointed Andrea Kent as its new president, following the announcement that W. Scott Thurlow was leaving the position.

“We are extremely pleased that Andrea is growing her role within the CRFA and has accepted this new challenge,” said Scott Lewis, Chairman of the Board of the CRFA.

“Andrea has been an instrumental part of our team over the last several years and her vast knowledge of our industry will serve our membership well. I look forward to Andrea’s leadership helping us ensure that Canada’s renewable fuels industry continues to grow and flourish.”

Prior to her appointment as CRFA president, Andrea Kent held several senior roles

GTI PARTNERS WITH MILLAR WESTERN ON BIOENERGY

Geomembrane Technologies Inc. (GTI) is working with Millar Western Forest Products Ltd. to help harness clean energy from pulp mill wastes as part of an exciting Bioenergy Effluent Project (BEP).

Millar Western is a privately held forest products company that has been in business for more than a century. Its pulp mill in Whitecourt, Alberta, produces 325,000 air-dried metric tonnes (ADMT) of hardwood and softwood bleached-chemi-thermo-mechanical pulp (BCTMP) per year.

GTI’s involvement in the project includes the fabrication and installation of gastight floating membrane covers for three anaerobic digesters that will be central components of the bioenergy facility, as well as the installation of an internal piping and media system. Nearly 30,000 2’ x 2’ x 4’ blocks of corrugated polyvinyl chloride (PVC) media modules are being fabricated and assembled as part of the project.

GTI will fabricate and assemble modular panels with XR-5® top sheet to fit each of the three 126-foot-diameter digesters. Once completed, the covers will float on the pulp process wastewater, creating a seal to capture the biogas produced during anaerobic digestion.

The biogas that GTI’s covers collect will be scrubbed and used to fuel a power island that will generate power and heat, helping to displace fossil fuels in pulp mill processes. The BEP is expected to lower Millar Western’s direct and indirect greenhouse gas emissions by about 40,000 tonnes per year.

Enviva goes public

Enviva Partners LP has announced plans for an Initial Public Offering (IPO) to generate $100 million in revenue.

The largest manufacturer of wood pellets for the global energy market, Enviva will have first right of refusal to acquire

in communications, media relations and issues management, including vice president of communications at the CRFA. Andrea brings with her almost a decade of leadership experience in numerous federal departments and crown corporations.

Ms. Kent’s appointment follows the recent departure of W. Scott Thurlow. “We thank Scott for his service and ded-

ication to the renewable fuels sector in Canada,” said Mr. Lewis. “We wish him every success as he embarks on the next stage of his career.”

B.C. INTRODUCES INNOVATIVE, FLEXIBLE FOREST LICENCE

The B.C. government has created a new type of forest licence that allows emerging, innovative forestry companies to more effectively respond to fluctuations in the supply of wood fibre.

The new supplemental forest licence allows companies to harvest wood only when traditional, business-to-business fibre supplies are reduced. This helps ensure that licence holders – bioenergy companies, pellet producers and secondary manufacturers – have ongoing access to the fibre supply they need to operate.

The new licence also allows the Province to include conditions in licences that encourage the harvesting of less marketable and harder to access wood, helping to make greater use of the existing allowable annual cut.

“The new licence gives companies in B.C. a flexible option that allows them to address temporary supply shortages,” says Gord Murray, executive director of the Wood Pellet Association of Canada. “This is critical for an industry like ours, which has to respond to an ever-growing global market quickly, effectively and reliably. Greater certainty gives us more confidence as we move forward and promote the role of wood pellets in the Canadian and global markets.”

The legislation follows up on a recommendation made by the Special Committee on Timber Supply in its 2012 report, and is consistent with strategies identified in the Province’s 2012 MidTerm Timber Supply Action Plan.

The new licence is not available to sawmills, which traditionally have more stable supplies of wood.

an additional two million tonnes of production capacity from Riverstone/Carlyle.

Currently, Enviva owns five companies in the U.S. southeast with a combined production capacity of 1.7 mil. tonnes.

CGaining momentum

Team of “Bio-Champions” emerges in Ontario Government

By Christopher Rees

anBio and other organisations within the Canadian Bioeconomy Network have long advocated for the reduction of barriers to bioeconomy project implementation resulting from outdated regulations, most of which are at the provincial level.

It is therefore extremely gratifying to see the emergence of a team of bio-champions in Ontario. Kathleen McFadden, ADM, Ontario Ministry of Natural Resources and Forestry outlined how the MNRF is taking a multi-ministry and multi-partner approach to improve the business and policy environment for the use of solid biomass fuels for heat.

The Ontario Provincial Policy Statement’s definition of renewable energy now includes heat and/or cooling, in addition to generating electricity. A Guideline for Control of Air Emissions from Large Wood-Fired Combustors with heat capacities of 3MW or greater has been posted. An interim Guideline for systems less than 3MW has been issued and work continues to refine the guideline. A bioheat “Community of Practice” has been created to foster knowledge about bioheat systems.

The Province is working with others

at the national level to support biomass heat, focussing on the adoption of ISO solid biomass standards for Canada.This was followed up by a meeting and Biomass Heat Facility Tour in the Kingston/ Napanee area at the end of October by twelve representatives from Ontario ministries and a federal government agency, FedNor. The ministries included those responsible for environmental regulations, natural resources and forestry, agriculture and rural affairs, building codes, aboriginal affairs, economic development and education. The tour visited:

The North Addington Education Centre in Cloyne to see a school heated with wood pellets using a system installed by Viessmann Manufacturing. The bio-heat system is a 950kw boiler that will heat 86,000 square feet.

Friendly Fires in Kingston which provides sales and service of residential pellet stoves, wood stoves and pellet boilers.

Forman Farms in Seeley’s Bay with a greenhouse heated by wood/agri pellets produced by a pellet mill on the farm and where biomass crops are grown.

The projects were very interesting but what was even more important was the exchange of views between the project

proponents and the government representatives. The lead question in each case was “how could the Ontario government have helped your project more, and what can we do now?” The project owners were genuinely astonished at how positive the group was in moving forward with suggestions for policy and regulatory improvement. For instance, Forman Farms which had purchased a biomass chipper, wanted to know how the process of permitting could be sped up to allow them to chip “on site” at various locations. While a “mobile permit” for the machine was the answer, it would take up to a year to obtain.

Representatives of the North Addington Education Centre and Viessmann explained how difficult it had been to comply with all the environmental regulations for the project but now that it was complete it would provide hard data from monitoring the systems and then encourage other projects to move forward.

The owner of Friendly Fires was encouraged by the policy that building permits now required CSA-approved wood stoves in Ontario.

Overall, it was an eye-opening day on how to aggressively encourage more bioeconomy projects in Ontario.•

GCanada’s damning reputation

Inaction on climate change will impact pellet industry

By Gordon Murray

lobal wood pellet consumption will be about 24 million tonnes in 2014. More than 80 per cent will be consumed in the European Union (EU) for heat and power generation. Europeans like wood pellets for home heating because they are cheaper than the alternatives – gas, oil, or electricity. And they use wood pellets to replace coal in power generation because pellets are cleaner and can greatly reduce GHG emissions.

It is the EU power sector that has largely enabled the rapid growth of Canada’s wood pellet exports. Since 2009, that growth has been supported by The Renewable Energy Directive. This is the EU law that mandates the increased use of energy from renewable sources, together with energy savings and increased energy efficiency, and the reduction of greenhouse gas emissions to comply with the Kyoto Protocol to the United Nations Framework Convention on Climate Change.

Of course the great irony of this is that Canada – a country with no demonstrated commitment to combating climate change – is benefitting greatly from an EU law mandating reduction of GHG emissions.

We Canadians have to ask ourselves, will Europeans eventually tire of this hy-

pocrisy? Why should the EU continue to improve its GHG emissions performance while Canada continues to emit at a record pace without regard to the negative effects on climate change? Why should EU utilities continue to buy Canadian wood pellets when they can see that Canadian coal power generation (with the notable exception of Ontario) continues unabated?

Consider the differences between Canadian and EU approaches to climate change:

EUROPEAN UNION

Preventing climate change is a strategic priority for the EU. Under the Kyoto Protocol, EU member states committed to reduce their total GHG emissions to 8 per cent below 1990 levels by the period 2008-2012 and were successful in meeting this target.

In 2009, the EU adopted the Renewable Energy Directive, a law requiring a 20 per cent reduction of the EU’s GHG emissions compared to 1990; a 20 per cent share of renewable energy in the EU’s gross final energy consumption; and a 20 per cent increase of the EU’s energy efficiency.

As of 2012, the EU had reduced its GHG emissions by 18 per cent compared to 1990 levels and was close to reaching

its 20 per cent reduction target, eight years ahead of 2020. The EU is also on target to meet it goals of 20 per cent renewable energy and 20 per cent increase in energy efficiency.

On October 14, 2014, the European Council confirmed even more aggressive legally binding targets for 2030. These include: at least 40 per cent less greenhouse gas emissions by 2030, compared to 1990; at least 27 per cent renewable energy; and an energy efficiency increase of at least 27 per cent.

CANADA

The Canadian situation couldn’t be more different than the EU. Like Europe, Canada ratified the Kyoto Protocol in 2002, promising to reduce greenhouse gas emissions to an average of 6 per cent below the 1990 level over the period from 2008 to 2012. However, instead of achieving reductions, Canadian GHG emissions continued to rise to record levels and by 2011 Canada withdrew from the Kyoto Protocol.

Peter Kent, Canada’s environment minister, commented, “Canada produces less than two per cent of global carbon emissions, Kyoto doesn’t require major emit-

ters like China and India to cut the amount of greenhouse gases they produce.” Yet on a per capital basis, Canada and the U.S. each emit a whopping 24 tonnes per capita, compared to China at 6 tonnes and India at 2 tonnes (data source: Netherlands Environmental Assessment Agency).

At the 2009 Climate Change Conference in Copenhagen, the Government of Canada committed to reduce greenhouse gas (GHG) emissions 17 per cent from 2005 levels by 2020. However, Environment Canada’s latest projections show that Canada will again fail to meet its commitment.

On October 7, 2014, Julie Gelfand, Canada’s commissioner of the environment and sustainable development, released a series of environmental performance audits – including one on the federal government’s performance regarding the reduction of greenhouse gas emissions. The audit reported that Canada has made unsatisfactory progress in: putting sufficient measures in place to reduce greenhouse gas emissions; assessing the success of the few measures that are in place co-operating with the provinces and territories; and developing plans to achieve the 2020 Co-

penhagen Accord target of a 17 per cent reduction in emissions below 2005 levels for Canada’s economy as a whole.

The report concludes, “The absence of effective federal planning, including unclear timelines, leaves responsible organizations at all levels without essential information for identifying, directing, and co-ordinating their reduction efforts. It also means that there are no benchmarks against which to monitor and report on progress. For example, industries that may be affected by regulations cannot plan their investments effectively. In our view, the lack of a clear plan and an effective planning process is a particularly significant gap given that Canada is currently projected to miss its 2020 emission reduction target.”

There is little prospect that the Canadian situation will change. On June 9, 2014, Prime Minister Stephen Harper was asked about his approach to climate change. He insisted he won’t be pressured to alter his business-friendly climate-change policies, saying the Conservative government is simply more upfront than leadership in some other countries about its intention to avoid abatement measures that hurt jobs

and economic growth.

“No matter what they say, no country is going to take actions that are going to deliberately destroy jobs and growth in their country. We are just a little more frank about that,” the Prime Minister said.

On October 28, 2014, Germanwatch –a sustainable development advocacy group – reported that Canada is dead last among industrialized nations in a new climate change performance index. Germanwatch said, “Canada still shows no intention on moving forward with climate policy and therefore remains the worst performer of all industrialized countries.”

We are indeed fortunate that European customers continue to demand Canadian wood pellets. After all, in the words of Commissioner Gelfand, “If Canada does not honour its climate change commitments, it cannot expect other countries to honour theirs. If countries fail to reduce their emissions, the large environmental and economic liabilities we will leave our children and our grandchildren [will include] more frequent extreme weather, reduced air quality, rising oceans, and the spread of insect-borne diseases.” •

KAHL Wood Pelleting Plants KAHL Wood Pelleting Plants

OFull speed ahead

Setting the course to a mature biofuels industry

By Dr. Donald L. Smith

wning a home has long been viewed as a rite of passage and a marker of adulthood. If this benchmark is any indication, it looks like the biofuels industry is growing up. Years of research and development in the industry are finally paying off, not only in terms of sophisticated technologies for producing biofuels, but the facilities to house these technologies.

In the past year alone, North America has witnessed the successful launch of several advanced biofuels facilities,

building a commercial facility in Sarnia.

South of the border, several commercial-scale biofuels facilities using waste and residues as feedstock have also recently begun operations: INEOS Bio and New Planet Energy kicked off in 2013 in Florida; POET–DSM launched Project Liberty in Iowa in September 2014; and Abengoa opened the Bioenergy Hugoton Cellulosic Ethanol Facility, the largest cellulosic ethanol facility in the world, in Kansas this year. This activity shows no signs of slowing down: Dupont’s commercial-scale cellulosic ethanol facility is set to open in 2015 in Iowa, and the US Department of Defence has awarded $210 Million to Emerald Biofuels, Fulcrum BioEnergy and Red Rock Bio to build biorefineries that can produce cost-competitive military fuels.

“Interest in valuable bioproducts and bio-based materials has spiked within the cleantech sector and the investment community.”

representing an investment of hundreds of millions of dollars. These integrated biorefineries use diverse feedstocks – primarily waste biomass – and a variety of conversion technologies to produce biofuels and a range of other bioproducts such as animal feed, heat and power.

While U.S.-based operations account for most biofuels facilities in North America, Canada is not far behind. As an example, Quebec-based Enerkem inaugurated Canada’s first commercial-scale municipal waste-to-fuel plant in Edmonton this past June. In collaboration with GreenField Ethanol, Enerkem has also begun construction of a commercial cellulosic ethanol plant in Varennes, Quebec. In Ontario, meanwhile, the green chemistry company BioAmber is in the midst of

Looking beyond biofuels, interest in valuable bioproducts and bio-based materials has spiked within the cleantech sector and the investment community. In fact, these products often help clinch deals with large multinational companies, thus securing important sources of revenue in addition to those derived from biofuel.

All of which is to say: the market is poised for exponential growth.

This is where BioFuelNet comes in. An advanced research network that brings together academia, industry, investment and government, BFN seeks to harness opportunities in biofuels research and address barriers to sustainable biofuels production.

The idea for the Network took shape several years ago, when a small group of university researchers saw the need to unify the disparate components of the

biofuels sector into a network that would help drive development. Intent on avoiding duplication of effort, these thought leaders focused on getting the most out of the existing investments supporting the nascent biofuels industry in Canada. These early efforts culminated in the creation of BioFuelNet Canada (BFN) in 2012. Just two years later, BFN’s network community extends to 142 organizations from both the public and private sectors, including such notable industry partners as Rolls Royce, Ford, Air Canada and FPInnovations.

After a successful first phase of research, BFN is gearing up for a second phase that will target strategic areas such as aviation biofuels and forestry-based biofuels (www.biofuelnet.ca/phase-ii).

The Network will also take a hard look at the barriers to advanced biofuels production, such as policy and availability of suitable feedstock. Also on the agenda: optimizing BFN’s research structure and improving interactions with partners.

Canada stands to benefit from this effort on two important fronts: a greener environment and a healthier workforce. Indeed, the cleantech sector already employs over 41,000 Canadians – more than the pharmaceutical industry – and the 10 projects funded in BFN’s second phase of research could add to this figure. These resources put BioFuelNet in an ideal position to shepherd the biofuels industry into a more mature and productive phase. The ingredients are all there: increasingly cost-effective technology, brand-new facilities, and a groundswell of interest from industry. Stay tuned. •

*The author is grateful for the contributions of Annie Webb, Gabrielle Bauer and Jorin Mamen for the writing of this article.

Beetle-kill conundrum

Pellet manufacturers in B.C. adapt to new fibre.

By Sara Lynn Grady

Themountain pine beetle infestation changed the landscape of forestry in British Columbia, visually, environmentally, and economically. Vast coniferous forests –the ones that aren’t a sea of red – have been reduced to what one forester called “stump farms,” and mills accustomed to a somewhat measured supply of timber have, at times, found themselves trying to drink from a fire hose.

One benefactor of the pine beetle invasion, which has devastated an estimated 18.1 million hectares of lodgepole pine forest in B.C.’s north and central interior, is the pellet industry. Response to this abundant source of raw material for pellet manufacturing has varied, and continues to evolve.

For some, the changes were made in harvesting practices; others have integrated new equipment into their mills; other mills were purpose-built based on the abundance of pine beetle material. Even as mills modify their production methods, the supply of beetle-kill waste may be dwindling, passing its useful lifecycle in manufacturing of any kind. However, the pellet industry is accustomed to riding the waves of construction boom-and-bust, regulatory changes, and environmental factors over which it has little, if any, control. As a relatively nascent member of the forestry sector, all it can do is adapt.

The initial wave of mountain pine beetle harvesting filled lumber yards across the province: annual allowable cuts were increased by the provincial government so that Crown licensees could salvage as much mill-worthy material as possible before it rotted in the forest; approximately 95 per cent of B.C.’s forests belong to the province, with five major companies holding control of the 75 per cent

under long-term tenure agreement. The resulting sawmill residuals were a boon for pellet mills, and these residuals continue to fuel mills across the province.

The second wave of logging saw a shift in harvesting practices, and a change in raw material available to pellet mills. As pine stands died and degraded, licensees became more – or sometimes less – selective about what they cut down, and what they pro-

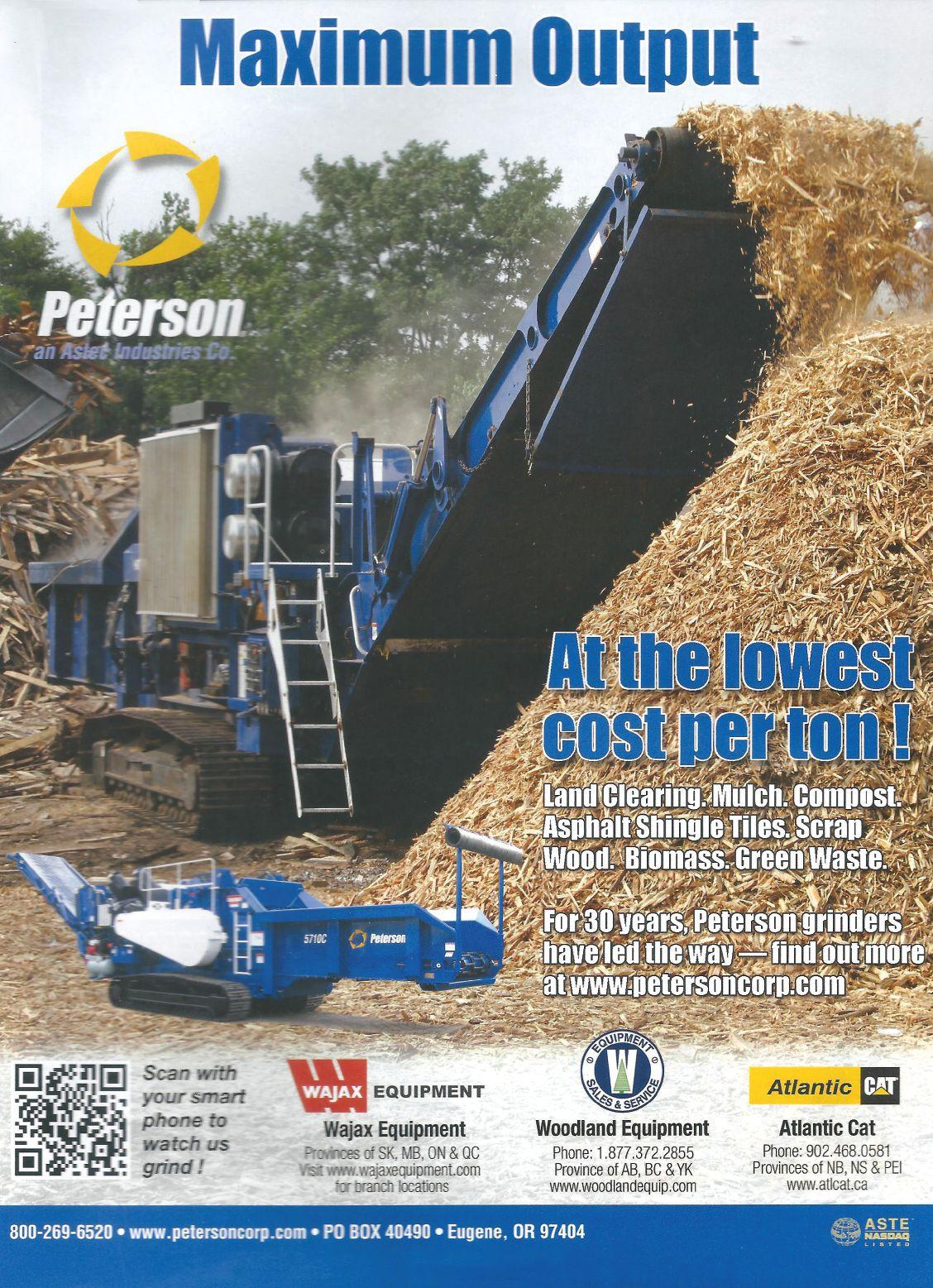

cessed onsite. Pellet mills in the northern interior were no longer receiving chip trucks full of clean bush-grind; instead, they were taking horizontal grinders, like Pinnacle’s Peterson 4710B, to a landing site, grinding the material themselves and trucking it to their plants.

Whether destruction from the pine beetle has met or exceeded projections, the current state of residual supply has the potential to spark a market – and regulatory – challenge that places pulp mills and pellet mills in direct competition for remaining resources. As viable stands of green (still viable as lumber despite pine beetle infestation), red (mostly dead) and grey (completely dead and no use to a sawmill) pine beetle wood diminish within easy reach of logging contractors, the incentive for lumber mills to pay for logging and cartage of an already low-value harvest diminishes as well. Their priority is harvesting sawlogs, and in the remaining stands those are not in abundance. And slash piles, many full of viable pellet material, sit out of range, awaiting burning season rather than a long haul to a pellet mill.

For plants like Pacific Bioenergy in Prince George, situated near pine beetle “Ground Zero,” the focus has been on getting clean material from slash piles. This has meant working more closely with logging contractors and their operators at landings; they are accustomed to pushing everything into a burn pile, scraping up rocks and dirt along with the residuals. It has also necessitated discretion when feeding the waste into a grinder: avoiding the material at the bottom of a residual pile, where most of the foreign debris has built up, reduces wear and tear on the grinder, and a cleaner product

Your global technology process supplier for the biomass industry

ANDRITZ is one of the world’s leading suppliers of technologies, systems, and services relating to advanced industrial equipment for the biomass pelleting industry. We offer single machines for the production of solid and liquid biofuel and waste pellets. We have the ability to manufacture and supply each and every key processing machine in the pellet production line.

Pellet mills have had to work closely with logging contractors to get the cleanest possible material from their operations.

arrives at the mill. By investing in the labour to sort material before grinding, the company can realize nearly four times the lifespan for roll and die wear, saving maintenance and replacement costs.

Similarly, Pinnacle Pellet invests time working with logging contractors to get the cleanest possible material from landings. Once in their Meadowbank (Strathnaver) mill, however, material is passed through a purpose-built General Kinematics De-Stoner, designed in direct response to the abundance of pine beetle material. Using vibrating action and a series of air knives, fibre is separated and cleaned of dirt, metal, stones and any other foreign objects that may have contaminated the bush grind, based on velocity and density.

Some refinements had to be made for the De-Stoner to work effectively with the logging residuals: while pine beetle waste is traditionally bone dry, some would arrive with excess moisture due to the presence of green wood (such as spruce and balsam from higher elevation clearcuts) in the bush grind. The original finger screens tended to clog due to the excess moisture; screens would get wet as green wood passed through, and then get coated with dust from dry beetle wood, creating caked layers that choked the screens. After some experimentation, General Kinematics switched over to rod screens, which had been designed to manage reclamation of construction waste in wet climates like Florida.

Moisture variance has certainly been a factor for mills using pine beetle residuals, but achieving a consistent particle size remains the greatest challenge for efficient pellet production. Brunette Machinery has introduced the BioSizer, purpose-built to manage the wide

service@terrasource.com

variations in species and moisture content, and two of B.C.’s largest mills in the heart of pine beetle country have adopted this new equipment. The standard “hog” mill, operating at 650-750 rpm, has the capability to grind whole logs and sawmill residuals to 3-4” minus dimension. The Brunette BioSizer, used by Pacific Bioenergy and Pinnacle, produces a more consistent, smaller particle ideal for pelletizers – running at 1400 rpm, it generates 1/4” - 3/8” chips that dry more uniformly and efficiently, saving energy and time.

Industry estimates point to another 700 million cubic metres of mountain pine beetle still standing in B.C.’s forests. While northern pellet mills are poised to absorb the residuals from these dead-standing trees, the challenge remains: will the province’s key licensees have the economic will to recover the material so pellet mills can access them? During the initial clearing of pine beetle-kill logging contractors, understandably, harvested the “low hanging fruit” – the stands close to local sawmills and infrastructure. As that radius expands and the returns shrink, pellet mills may have to stand on the sidelines and wait for other motivation, either through market forces or government regulation, before the majors take down the trees.

Equipment manufacturers, like the pellet mills themselves, remain nimble in the face of changing fuel. Having successfully shifted from traditional sources of sawdust and hog fuel to slash piles with varying species, moisture and contaminant content, to processing, albeit infrequently, whole logs, there’s no doubt the biofuel industry will adapt to whatever future fuel becomes available to them. •

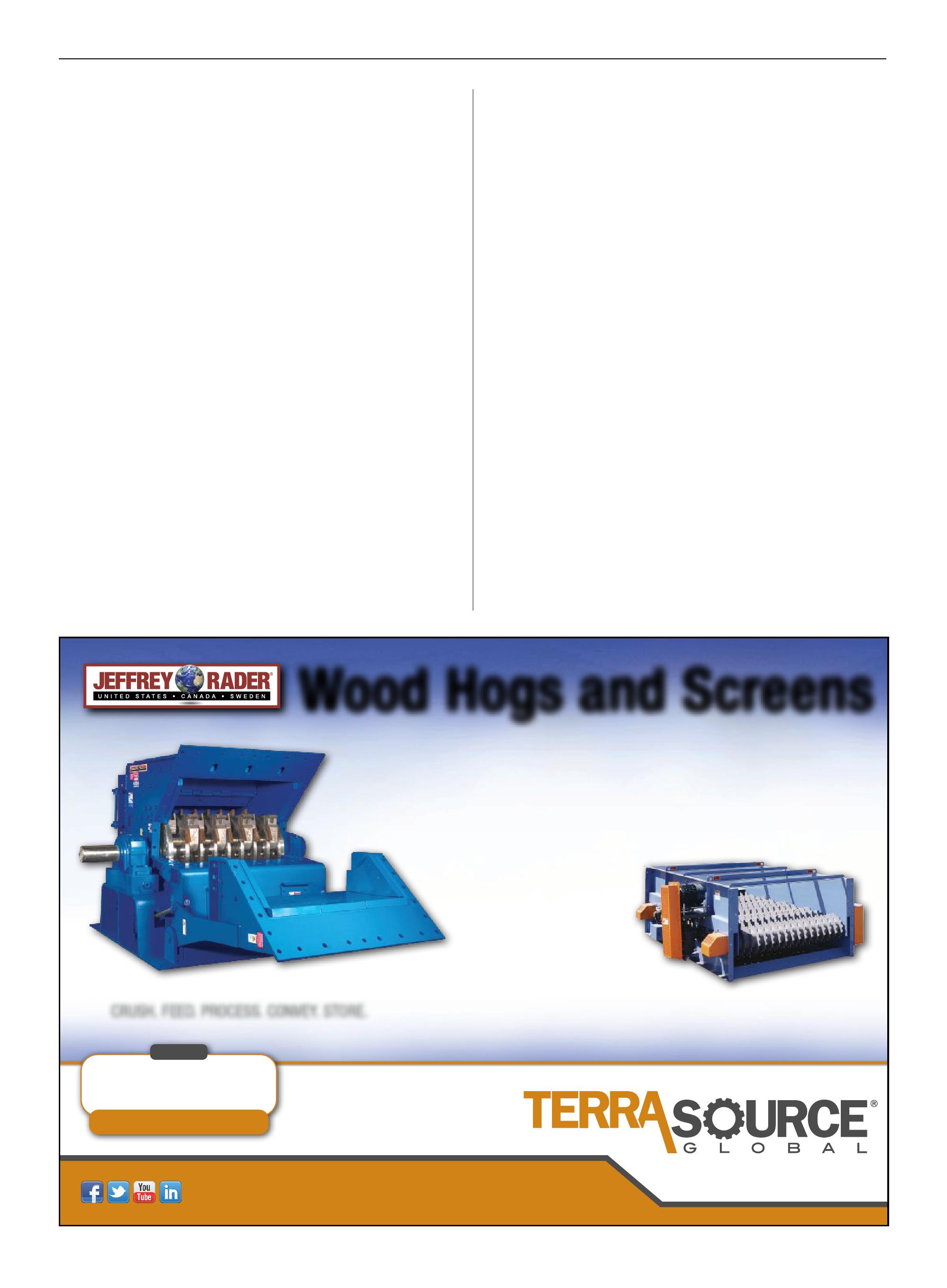

Wood Hogs and Screens

Jeffrey Rader® EZ-Access® Wood Hogs are designed for safe, fast and easy access to hammers, rotors and liners, allowing routine maintenance to be performed safely, easily and with minimal downtime. Our EZ-Access technology even lets operators remove the wood hog’s rotor without moving the feed chute. Plus, our heavy-duty rotor discs allow maximum flexibility of hammer arrangements, up to 3, 4 or 6 rows for premium efficiency on smaller products, while our Duratip® high-alloy hammers with replaceable tips provide increased shredding action and quick change-outs.

Rader® Disc Screens (RDS) are the industry’s #1 scalping screens. When it comes to removing oversize rejects from unscreened wood chips, hog fuel or bark, our RDS is the undisputed workhorse of the industry. With more units in operation than all other suppliers combined, you can depend on us to select the ideal disc profile, interface openings and screen size for maximum screening efficiency.

Power play

Nechako uses ORC to convert heat to electricity

By Andrew Macklin

ForTy

-five years later, Nechako is still using innovation to drive its business forward.

Built in the geographical centre of B.C. in 1969, the Vanderhoof-based business has grown from a simple planer mill to a multi-faceted wood products operation. The planer mill was complemented with a sawmill in 1972 before adding a pellet mill in 1998. Along the way, the company used innovation to spur its growth, becoming the first sawmill in North America to use a Hew Saw for small profile lumber and the first Canadian sawmill to sell stud lumber into the Japanese market.

The construction of the pellet mill, which began at a smaller scale than its current operation, was part of the company’s continuing effort to drive forward through innovation.

“One of the long-term objectives that the company had was full fibre utilization,” explains Alan Fitzpatrick, president of Nechako Green Energy. “One of the steps the shareholders took was to shut down the beehive burner. We then added a pellet plant and a thermal oil system.”

With both systems operational, the company then turned to major upgrades in the sawmill and the new pellet plant. In the mill, significant upgrades were made to optimization equipment on the saw lines, and grade scanning technology was added in the planer mill. The pellet plant saw a substantial increase in capacity, moving from two to four Bliss pellet mills as well as adding a MEC dryer to meet the demands of the increase in production capacity.

The upgrades to both mills continued the driven-by-innovation mantra that had kept Nechako pushing towards full fibre utilization. But at the same time, it created an unanticipated byproduct in abundance: heat. While not a problem for the operation, as ventilation to atmosphere removed the heat to prevent it from becoming an issue, it was a conundrum that needed consideration.

In 2010, after working its way through the heart of the recession, Nechako focused on how to approach using the excess heat as a resource for its operation. The company set an objective to become a more energy-efficient operation, using the heat as a key resource for meeting its goal.

ABOVE: The Organic Rakine Cycle provides approximately 25 per cent of the energy demands of the entire Nechako operation.

After significant due diligence lasting nearly two years, Nechako decided that the best system to invest in was an Organic Rankine Cycle. The ORC uses an organic fluid that vapourizes at a lower temperature than the change from water to steam. The vapour then passes through a turbine to generate electricity. To complete the cycle, the fluid is cooled, condensed and brought back into the beginning of the loop.

Nechako’s research into the ORC technology led them to Italy-based Turboden, one of a handful of global manufacturers of the system.

“Turboden’s technology was the one that best fit what our operation was,” says Fitzpatrick. “The Turboden ORC is a very efficient form of electricity creation.”

GRANT OPPORTUNITIES

In 2010, around the same time that Nechako began its research into what to do with excess heat, the Government of Canada announced the creation of the IFIT program.

The Investments in Forest Industry Transformation program was an initiative of the Ministry of Natural Resources, providing $100 million in non-repayable contributions of up to 50 per cent for capital investment in new technologies over four years. The first and second call combined (Nechako applied during the first call) produced 107 applications from across the country.

Based on the strength of its application and, presumably, the company’s track record of innovation, Nechako was successful in its bid to receive IFIT funding to cover part of the cost of the ac-

quisition, transport and building infrastructure cost of the ORC. The release sent in regards to Nechako’s successful application stated that the technology being incorporated by the company has “significant potential for replication across the industry.” In total, Nechako was given $2.1 million of the budgeted $6.8 million project.

Construction and installation of the ORC began in July of 2012 and was completed in March of 2013. The project was completed both on time and on budget. Day-to-day operation of the ORC involves two staff per shift, who monitor the system’s performance through an electronic tracking system, spitting out real-time data on a computer located in a secondary office adjacent to the ORC.

At current operation levels, the ORC provides approximately 25 per cent of the energy demands of the entire Nechako operation. That’s enough electricity generation to offset most of the energy demands of operating the pellet plant, which produces upwards of 180,000 tonnes of pellets per year.

Monetarily, the cost savings of using the ORC are significant for the operation. Even more so now, as the B.C. Government announced a 15.6 per cent hike in power rates over a two-year period back in November of 2013. That rate could jump even higher if demand continues to rise in the province and the government leans on energy rates to help pay off increasing debt.

In addition to the financial benefits of the installation of the ORC, Nechako is also experiencing a positive bump in its reputation both in the community and in the forestry sector.

“It reinforced our position in the industry as a leader in in-

MOISTURE MEASUREMENT EQUIPMENT

novation and technology,” says Fitzpatrick. “It also raised our profile in the community as a good corporate citizen. It helped the community see that this company is spending money on becoming more energy efficient.”

The investments also sent a clear signal to employees that the company plans to continue its operation in Vanderhoof long into the future. After the impact of the recession a few years ago, that’s welcome news for workers in the forest industry.

“For our employees, I heard a number of times that they were excited that the shareholders were prepared to invest in the operation. That gave the employees the understanding that we’re here for the long haul.”

A BRIGHT FUTURE

Even though Nechako has invested so heavily since 2000, the company continues to identify ways to improve its operation.

According to Fitzpatrick, one of the original company directives still has not been completely met. “We have focused on full fibre utilization at our plant site. Our next opportunities will come from the utilization of our harvesting fibre as well.”

That could lead to an expansion of Nechako’s current operation in the foreseeable future, as well as the potential for new business opportunities.

Fitzpatrick also insists that more work can be done to address the issue of heat on the plant site in an effort to maximize all resources available for energy generation.

“We still have heat that we can use; the ORC does not consume all of the heat. We have a number of different options. We are evaluating all of the different options that we have right now.” •

An expansion created an unanticipated abundance of heat, a resource that could be reused in mill operations.

Imagery details available biomass

Contractors help the MNR keep track of forest growth

By Amie Silverwood

“yellowbirch, yellow birch, balsam fir,” Pat Contant, operation supervisor for Wikwemikong Department of Lands and Natural Resources, is peering through a prism as he calls out the tree species while Steve Willoughby, the manager of Sault Ste. Marie Operations for Terrafact, makes notes in his file.

Terrafact is working with the First Nations group, Wiky as it is commonly called, to plot the forests and unforested areas all over the Algoma district in On-

tario for the Ministry of Natural Resources. Contant and Willoughby are supervisors double-checking calibration plots “cruised” or surveyed by summer forestry student employees. The surveys will be used by photo interpreters to calibrate their understanding of what they see in the ministry’s aerial photos.

In 2008, the Ministry took to the skies to take aerial photos of the lands in the region. Different contractors have bid to take on the job of interpreting those photos – plotting out the forests by tree species, age, height and even soil samples to

help the ministry inform how the province’s land is being managed.

A lab is full of forestry experts in 3D glasses analyzing the photos to determine the details of the forests plotted out in the images. The trees jut out in reds and greens and the photo interpreters can distinguish the species simply by looking at the image of the forest from above. The height is measured by scrolling their cursors up and down. There are tricks to the trade and ground surveys are one of the most important tools the interpreters have to measure the accuracy of their work.

Contant and Willoughby pause to analyze the soil.

PLOTTING BIOMASS

Canadian Biomass met the two-man crew one morning in August to drive about a half hour off the Trans Canada Highway north of Sault Ste. Marie along a well-maintained regional highway that leads to a trove of cottages and a popular local ski hill. Resource roads that have been used for decades of logging branch off these cottage roadways and have become overgrown.

When the 100-year-old paper mill in Sault Ste. Marie shut down, the community’s long-standing history of forestry expertise was left rudderless. But a recent Smart Energy Strategy commissioned by the Sault Ste. Marie Innovation Centre and other community partners has provided reasons to attract biomass businesses to utilize the wood supply from Algoma forests.

“We’re trying to attract new forestry applications to our region. We have wood allocation in the area and we’re looking for new companies, new investment into our wood basket,” explains Jason Naccarato, Vice President of Development for Sault Ste. Marie Innovation Centre.

Detailed maps of the region’s forestry assets are providing the tools his centre is using to attract investment. “The companies we’re talking to now, whether they’re traditional sawmills, advanced biomaterials, or second generation ethanol or anything like that, they’re all asking the same question: ‘What’s your wood like?’ When we can come in and show them the inventory, they get more comfortable and they continue that conversation.”

Terrafact has come up with a new technology that can use super high-resolution aerial imagery and biometrics to track and

Industrial IP Cameras

manage forestry resources. The MNR’s methodology and aerial footage provide a more general overview of the vegetation across the province.

SEEING THE FOREST FOR THE TREES

Accessibility is the largest challenge crews face when surveying a plot of forested land. Roads that were visible when aerial photos were taken in 2008 may not be passable anymore – bridges broken, washed out roads or steep hikes may greet the crews when they follow their GPS to a predetermined site.

Contant chooses a second plot when the first one turns out to be inaccessible. The second plot requires a drive down an old logging road that, despite its disuse, gives way to the truck and takes us right to the predetermined location. Crews are generally two people for safety reasons. They locate the plot using a GPS and a compass tells them which way to walk their straight line.

They start by measuring 10 metres from the first point and the second to tenth points are 20 metres apart. “What we’re going to do is we’re going to do a prism sweep to tally up the trees named by species, and after 10 stations, we’re going to add them all up to see what our lead species will be and our secondary. And then we’ll do three samplings of our lead species and one of our secondary. We’ll do height, age and then we’ll do a soil pit,” explains Contant. The information is then taken to the lab.

IN THE LAB

All of Ontario is broken up into squares called Ontario Base Maps. The imagery taken by the MNR is sent to a lab where photo interpreters are able to create maps that merge the information in the images with the details collected by the cruisers

Pat Contant counts the rings on a core sample of a yellow birch.

like Contant and Willoughby to give an accurate overview of the province’s land.

“The ground work is of critical importance because you use that to calibrate the rest of our calls. Some areas you might have 10 or 15 plots in one map sheet, so that’s great – you have lot of things to go on, but in my case, I don’t have any plots in my area,” explains Ben MacKay, a photo interpreter who has been working with Wikwemikong for two years. There are large areas without any roads and the interpreters don’t have a secondary source with which to verify their work.

Each interpreter is first trained as a cruiser doing surveys to get some experience on the ground. Ben started out as a forest technician with a diploma from Sault College where he learned timber cruising, mensuration skills, some silviculture and dendrology before taking a four-year forest management program from UBC.

Some tree species are easy to identify – white pines tower above the forest with a distinctive star shape when viewed from above – but others require more thought. “North facing, south facing, what type of soils are there, what other species are growing there, has there been disturbances like fire or management in the past, all those will help you make your call and describe your stand in an inventory.”

The interpreters check their work against the field crew’s data. “This orange line is the 200-metre line that you walked,” MacKay tells me. He points to a drop-down menu that has information on when that plot was last harvested or planted. “There’s a whole

bunch of information for that one plot. I can see what date they did it, who the cruisers were, the species composition, and it’s nice when they put in comments as well.”

MacKay’s work joins that of the other photo interpreters in filling out a map of Ontario that can tell where deforestation or wildfire is occurring or be used to monitor the effects of climate change on forests and to develop predictions.

In the Annual Report 2014, the Ministry of Natural Resources explains the importance of gathering this type of data for the forest industry. “The more that is understood about how and why Canada’s forests are changing, the better prepared researchers and forest managers will be in adapting to all the other changes going on: in the forest products Canada turns out, in the global market demand for those products, and in the public expectations about what constitutes good forest stewardship,” the report reads.

The MNR depends on satellite imagery to map out the country’s forests and collaborate with international research partnerships to monitor global forests. But satellite imagery has not made ground- and air-based data collection unnecessary. The ministry must depend on interpreters and “boots on the ground” to verify what the satellites are seeing and provide depth and context to the imagery.

From satellites, to airplanes, and finally to the cruiser crushing the sand between two fingers, a deeper knowledge of our forests provides a comprehensive view of what’s happening in different regions. The applications for the data, however, are in the eye of the beholder. •

The ability to quickly and accurately know the moisture content of a biomass shipment when it arrives for delivery is a key advantage to both buyer and supplier. Insuring accurate agreement on valve and price and the buyers optimisation for burning efficiency deliveries control management and cost optimisation.

Rising expectations

Rentech continues expansion as mills come online

By Andrew Macklin

IT’samazing what can happen in 18 months.

It seems like the anticipation for the opening of Rentech’s pellet production plants in Atikokan, Ont., and Wawa, Ont., has been present for years but, in fact, it has just been 18 months since we learned of the newest player in the Canadian wood pellet industry.

In early May of 2013, the announcement was made that California-based Rentech was purchasing Fulghum Fibres Inc. at a net purchase price of $112 million. The purchase included the Atikokan Renewable Fuels facility in Atikokan, once a particle board processing mill, as well as a former Weyerhauser OSB mill in Wawa. The deal also included logistics agreements with the Port of Quebec and CN Rail.

When the announcement came that both facilities would be converted into wood pellet production plants for domestic and international distribution, it thrust the company, immediately, into the industry spotlight. A solid domestic customer base was already established, as Rentech inherited the OPG Atikokan supply agreement of 45,000 tonnes of wood pellets per year that was originally awarded to Atikokan Renewable Fuels. For international distribution, Rentech wasted little time in establishing a supply contract with Drax in the U.K. once it got the green light to convert the former OSB mill to a pellet plant in November of 2013. Both contracts have led Rentech to pursue full capacity production at both plants as soon as is possible, ultimately producing upwards of 450,000 tonnes of wood pellets per year.

Helping that push to international markets is the logistics chain established through the aforementioned agreements involving CN Rail and the Port of Que-

A year ago, Rentech had little more than an old particle board processing mill and a nice sign in Atikokan, Ont. The plant is currently in its start-up phase.

bec. The agreement with CN Rail will provide affordable transport of pellets from the remote northern Ontario communities to the Port of Quebec since, by car, Atikokan is over 2100km from the port, while the facility in Wawa is just 1500km.

The agreement with the Port itself, and the subsequent partnership formed with Quebec Stevedoring, provides an ideal solution for shipping pellets to Drax and other potential European customers.

The Port of Quebec facility is the largest bulk terminal in Eastern Canada, according to Steve Roberts, Rentech’s managing

director – Canada. Roberts made a presentation at the CanBio conference held in Thunder Bay in September.

During his presentation, he discussed the scale of the port terminal in Quebec City-Wolf’s Cove. As part of the 15-year contract between Rentech and Quebec Stevedoring, who controls the handling facility, Rentech will have access to a dedicated unloading, storage and vessel loading facility once construction is complete. That will include dome storage of an estimate volume of 75,000-80,000 tonnes of wood pellets, and will have a shiploader capacity of 1900MT/hr. The facility will

have the capability of handling Panamax vessels, the largest ship class that Drax is targeting for pellet transport.

OVERCOMING CHALLENGES

Early in 2014, it looked like there was a possibility that Rentech’s plans might get derailed.

A group called Concerned Rentech Shareholders (CRS) delivered a release to the media in late March citing fiscal mismanagement and a lack of desire to address shareholder concerns. The group was launched by two capital partners and, combined, made up one of the largest shareholders.

But less than two weeks later, the company announced a settlement with CRS and, at the same time, introduced a significant new investor in Blackstone’s GSO Capital Partners. The new investment represented an additional $100 million in cash flow as well as $50 in refinancing for borrowing under margin loans.

That capital announcement came within a few hours of the announcement that Rentech had acquired a 280,000m3 wood supply in central Newfoundland, previously allotted to Abitibi-Boawater’s mill in Grand Falls-Windsor. That acquisition has led to reports of several discussions that have taken place with provincial government officials to discuss potential pellet operations in that province. The Newfoundland-Labrador government has already invested more than $10 million into Holson Forest Products pellet plant in Roddickton. However, that plant has been idled due to complications with storage and a lack of port facilities. There was word in May that company officially had met with the St. Anthony Port Authority. St. Anthony is seen as a potential location for the infrastructure needed to support pellet shipments to European customers.

In May, the company also caught the industry by surprise when it announced the acquisition of New England Wood Pellet (NEWP). NEWP is the largest producer of wood pellet for U.S. pellet heating market, operating three pellet facilities with a capacity production of 240,000 tonnes per year. Combined with production from the two Canadian facilities, the addition of NEWP gives Rentech an overall production capacity of over 750,000 tonnes per year.

MOVING FORWARD

In late October, the company officially announced that startup of the Atikokan facility had begun. Within a few weeks following thorough safety inspections, equipment testing and final commissioning, pellet production will commence at the plant.

Coupled with the completion of the pellet plant in Wawa, Rentech will become one of the largest pellet producers in Canada, and one of the few to have

a footprint in both the Canadian and American production market. With most of those pellets already spoken for in the domestic and international markets, and a growing appetite for pellets in Europe, Rentech is poised to continue to establish its footprint in the industry.

In just 18 months, Rentech has moved from a veritable unknown to a potential powerhouse in both the national, and the global, wood pellet industry. •

Moisture measurement

Data gathering and analysis is the key to maximizing value and minimizing processing costs

By Treena Hein

Asthe value of raw feedstocks such as sawdust and finished products such as pellets continues to increase, the importance of streamlining biomass processing has never been greater. Moisture percentage is a huge factor in determining the energy content for a given volume of biomass materials. Knowing precise moisture content is needed at the front end to gauge fair value for raw feedstock, and at various processing steps so that processing energy (heat and electricity) is not being wasted.

To help you determine the value of what’s coming into your plant, increase the quality of your products or improve/accelerate processing activities, we’ve gathered up the latest on the newest moisture meter options. Moisture meter tech for biomass has come a long way over the last few years in terms of reliability, accuracy and speed. It’s been a complex sector for technology

developers, as raw materials can be mixed (bark and sawdust, for example), is often highly compressible, and can possess a highly uneven distribution of moisture.

There are two choices in measuring the moisture content of any biomass material or product: analysing samples or analysing materials continuously as they move along an infeed or processing step. A sampling method that’s still commonly used involves weighing some raw material samples from the truck, drying them over 24 to 48 hours, and then weighing again. While it’s a highly accurate method, there is obviously a big lag time in obtaining results, and those results can only truly be guaranteed for those samples and may not be representative of the entire volume. A quicker and more accurate method for the entire batch is preferable.

“Biomass prices go up and up, and because of that the quality goes down, at least in Europe,” says Theo Coolen. “Mixes

The BLH Moisture Meter from ELECTROMATIC is suitable for wood shavings.

become more and more inhomogeneous, and moisture content is changing from one moment to the other. So sampling and bringing that sample to a laboratory is not fast enough to use the data for process control. The need for online measurement goes up.” Coolen is the managing director at Inadco, a Netherlands-based company that offers moisture sensors for a variety of industries, from potting soil and peat to brick man-

ufacturing, biomass and food. The company is currently looking for distributors in order to enter the North American biomass market. Inadco has developed both an instrument for quick analysis of samples (the Moisturemeter I, which can give a result once every 60 seconds), and a continuous-measurement instrument (the Moisturemeter II). They are both designed for peat and bigger biomass material such woodchips and bark.

Here is the MoistTech IR3000 monitoring the moisture of incoming raw material into plant operations. With hundreds of measurements per second, it monitors material with precise accuracy.

To get a high-quality measurement result through sampling, Inadco stresses that enough samples, and materials in the samples of a representative nature of all of the materials in the batch are needed. The measurement volume must be much bigger than the biggest piece of material in the batch, and the moisture-measuring instrument must have very good bulk density compensation to address the changing compression or flow-properties of the material.

“That was the reason why we developed our own moisture measuring system, the brand-new Moisturemeter II,” explains Coolen. “It needed to have a huge measuring volume, much bigger than any system available on the market.” The need for equipment that could measure bigger particle sizes with more variety in it was rising in Europe, with more and more forest residues being used for feeding combined heat and power plants. “The compression of the product is also a very important factor for the end result

Sustainable Forestry Initiative

Third-party forest certification programs, such as the Sustainable Forestry Initiative® (SFI) have a key role to play in addressing the growing demand for bioenergy feedstocks while ensuring forest conservation values are maintained.

The SFI® forest management standard is based on principles that promote sustainable forest management, including measures to protect water quality, biodiversity, wildlife habitat, species at risk and forests with exceptional conservation value. The SFI program’s unique fibre-sourcing standard promotes responsible forest management on all suppliers’ lands and ensures that controversial sources are avoided. Learn

Inadco has developed both an instrument for quick analysis of samples (the Moisturemeter I, which can give a result once every 60 seconds), and a continuous-measurement instrument (the Moisturemeter II). They are both designed for peat and bigger biomass material such woodchips and bark.

of the measurement,” Coolen adds. (Their moisture meter equipment is used in combination with their long-existing densimeter, which measures compression.)

Brett Linzer agrees that consistency, size and bulk density of wood chips are the biggest challenges in accurately measuring wood chip moisture content. Linzer represents ELECTROMATIC Equipment, which makes Checkline moisture meters. “Two of these challenges are handled by categorizing wood chips in sizes and using certain procedures to fill measuring chambers to compensate for bulk density,” he says. “In addition, our calibration curves are weight-based to achieve the most accurate results.”

To work around the other challenge – wood chip consistency – the company has developed “moisture curves” based on type of material. “Our entire product range can be adjusted to meet the customers’ specifications,” Linzer explains. However, he notes that whenever there is material polluted with other materials, the challenge gets bigger. “If the consistency of this pollution stays the same, the internal moisture can be adapted,” he explains. “Often this is not the case and then it becomes a very difficult. Overall, we keep looking and expanding our product lines to cover as many applications as possible. We use several different types of measurement methods, which all have their advantages and disadvantages depending on the usage. The trick is to find the best solution for that application.”

Checkline offers a wide range of handheld, portable and online instruments with instantaneous readings. Their BM series is

suitable for wood chips, saw dust, pellets, bark, wood shavings and more. The BLL device is suited for wood chip piles, the BP1 for pellets, the BLH for wood shavings and the BLW for round timber and split logs. In terms of fixed installation, Checkline’s BLO System can be installed in various configurations, with the sensors chosen based on the material (wood chips or shavings for example). Linzer says the accuracy that can be achieved in terms of moisture content readings depends on the accuracy of the calibration curve for the material and the consistency of the material that runs over the sensors.

Checkline also recently launched the BMA, a tool specifically for companies that buy large quantities of wood chips and pay per ton. The BMA is an automated meter where a sample bin is filled and placed into the machine by the operator. The system weighs the sample and then starts compressing it to a specific pressure at which the measurement is taken and displayed. As an option, it can also calculate the ATRO ton weight (dry weight per tonne). “Currently, this is the most accurate wood chip moisture content meter available,” Linzer says. “We also offer a wide range of online sensors that can be implemented in augers or on conveyor belts. These systems require support to set them up with the correct moisture curve and sensor type, but once properly configured, they are the most economic and accurate solution around.”

Spektron Biomass also offers a moisture content meter that delivers instant results. The near-infrared (NIR) “Spektron” can be used to measure moisture in

The Spektron from Spektron Biomass can be used to measure moisture in different kind of biomass materials, provided samples of the materials are included in the calibration of the instrument.

different kinds of biomass materials, provided samples of the materials (feedstock or finished products) are included in the calibration of the instrument. Calibration should be done every 6 to 12 months, or as changes occur with materials or the process environment. “The Spektron can also be installed directly above a conveyor belt to analyze moisture in real time,” says company representative Mari-Ann Akerjord. “This makes it possible to measure a complete container of biomass material in real time. The accuracy of single measurements is the same, but the average of a complete container will, of course, be better with an online solution. Which solution is best depends on how the processes are organized.”

The company also offers software, and can integrate the Spektron to any plant’s computer so that results are integrated automatically. “The system includes online production support and reporting from single sample, up to plant and enterprise level,” says Akerjord. “We work in close co-ordination with the production managers to give the best possible and useful results to optimize the processes.” If installed in multiple plants, the devices are connected to a common server and the calibration is upgraded remotely with inputs from all other units, with all units sharing the same calibration.

The IR-3000 is MoistTech’s newest online moisture-measuring instrument, developed for instant, non-contact analysis in the harshest environments. Company President Adrian Fordham says it is insensitive to material variations such as particle size, material height and colour, and provides

continuous, reliable readings without drift or frequent re-calibration. “With hundreds of measurements per second, plant controllers can monitor incoming material with precise accuracy,” Fordham notes.

Drying Technology’s Delta T MC Sensing and Control System solves the three main problems with moisture meter systems by including an exclusive “in-

side-the-dryer” sensor that detects evaporative load changes before they exit the dryer, and makes heat adjustments. The system measures the amount of additional water to be evaporated, and uses an exclusive method for re-calculating the process variable setpoint needed to maintain the target moisture content.

“When these three solutions are combined…the product moisture content variation exiting the dryer is reduced 30 per cent for a single dryer and approaches 51 per cent when two dryers are in series, or two zones of a multi-zoned dryer are controlled individually,” says Drying Technology President John Robinson. “The Delta T eliminates the need to pre-mix incoming biomass, and then makes moisture content determination of the mixture for use in setting the dryer operating conditions.” Robinson says this system also eliminates over-drying and having to add moisture back in (to achieve the desired moisture content for pelletizing for example), and allows production to be increased by adding more feed to bring the hot air temperature back to the maximum limit. •

Photo courtesy of Hung Lee

Better yield from yeast

Microbiologists manipulate genetics to boost the efficiency of ethanol production.

By Annie Webb

Likeall industrial processes, the creation of pulp leaves a residue of waste. To the Canadian forest-products company Tembec, this waste has spawned a sideline business. Long before the current biorefinery craze, Tembec decided to convert the waste into something of value: ethanol (ethyl alcohol), the two-carbon molecule that gives alcoholic beverages their kick and has a wide variety of commercial uses.

Nestled in the rugged Temiscaming region of Quebec, Tembec’s pulp and paper mill incorporates an ethanol production facility, which produces high-purity ethanol from natural wood sugars extracted from the residue of the pulping process.

It wasn’t long before Tembec became a leading supplier of high-grade ethanol to Eastern Canada and the Northern U.S., with customers in a broad swath of industries. It didn’t hurt that the federal government’s Bill C-33, passed in 2008, mandated that ethanol comprise five per cent of gasoline by 2010.

There’s just one problem: the conversion process leaves much to be desired in terms of efficiency – and profitability.

Tembec produces the ethanol from spent sulfite liquor (SSL), a by-product of pulping. Rich in lignin and hemicellulose, compounds extruded from wood chips during the pulping process, SSL retains one ton of lignocellulosic material for every ton of paper fibre produced.

The plant has been using the common baker’s yeast, Saccharomyces cerevisiae, to ferment SSL and produce ethanol. While the yeast does a fine job of converting the hexose sugars in the mix – chiefly glucose and mannose – into ethanol, it falls short

in fermenting pentose sugars such as xylose. If this constraint could be surmounted, the plant could produce as much as 25 per cent more alcohol. As all entrepreneurs know, a 25-per cent difference can make or break a business venture.

Well aware of the problem, microbiologists have been trying to engineer yeast strains capable of fermenting both glucose and xylose to ethanol. Most of them have focused on tinkering with the S. cerevisiae strain to enable it to ferment xylose.

A team of BioFuelNet researchers has taken a different tack: improving the native pentose-fermenting yeasts Scheffersomyces stipitis and Pachysolen tannophilus. While these strains can also ferment hexose sugars, they have several unfortunate properties that limit the efficiency of the process, says team lead Dr. Hung Lee, a professor in the School of Environmental Sciences at the University of Guelph. For one thing, they’re highly sensitive to inhibitory substances in the SSL -- such as acetic acid and furfural – that put the brakes on yeast cell growth and fermentation. The strains are also susceptible to glucose repression, meaning that glucose can prevent the yeast from fermenting the other sugars. Finally, these yeasts have a very low ethanol tolerance, so that even low concentrations of ethanol can stop the fermentation process in its tracks.

“The key challenge is to develop ethanol-producing microorganisms that are tolerant to all the inhibitory compounds generated during the wood-pulping process,” Dr. Lee explains. “The organism must also be able to ferment all the sugars, including pentoses, into ethanol.” (It should be noted that these inhibitory compounds are found not only in the SSL

produced by Tembec, but also in the “lignocellulosic hydrolysates” produced by other companies seeking to convert biomass substrate into fuels or chemicals.)

In hopes of producing such strains, Dr. Lee’s team used simple genetic tools such as random mutagenesis and genome shuffling. They started by testing their genetically-engineered strains on SSL supplied by Tembec. Next, they put the strains to work on lignocellulosic hydrolysates supplied by BP Biofuels, FPInnovations, GreenField Ethanol, Lignol, and Mascoma Canada, among other partners. The effort paid off in spades: “We found that our modified strains ferment the sugars in the hydrolysates more efficiently than the native strains,” says Dr. Lee.

Dr. Lee feels confident that this cutting-edge research has commercial value. “We’ve had very encouraging results in terms of ethanol yield, and some companies have shown strong interest in our inhibitor-tolerant yeast strains,” he says.

Building on this success, the team plans to conduct similar genetic refinements on other pentose-fermenting yeasts. Dr. Lee’s team has also been collaborating with Mount Sinai Hospital in Toronto to sequence the entire genome of the improved yeasts to locate the genes responsible for inhibitor tolerance.

Dr. Lee is the first to admit that the venture might never have seen the light of day without funding from BioFuelNet. Along with financial backing, the organization provided contacts and networking opportunities. “Such connections can make the difference between a project stalling and getting off the ground,” he reflects, “getting the right people working together is how the magic happens.” •

MAIN: - Nicole Harner (PhD student) and Terri Richardson (MSc student) check the status of the fermenting yeast cultures.

BOTTOM LEFT: The research team set out to develop ethanol-producing microorganisms that are more tolerant.

BOTTOM RIGHT: The organism must also produce a better yield.

AIROFLEX RELEASES NEW PORTABLE DUMPER

Airoflex Equipment has announced the addition of the 45 Ton Portable Dumper to its lineup of equipment. Engineered with a rugged design, the 45 Ton Portable Dumper can tackle the most challenging applications with a 10’ x 45’ platform, 45 ton lifting capacity, 63 degree tilt and a two-minute up-cycle time. Designed for simple off-highway movement, it can readily be prepped for over-the-road transport. An electric hydraulic power unit comes with the standard system, and a diesel power unit is also available. Other options include heated/cooled operator booth, hydraulic levelling capabilities, and three-axle transports.

SENSORTECH LAUNCHES NEW MOISTURE ANALYZERS

Sensortech has launched its new NIR 6000 Series moisture measurement analyzers. These analyzers measure moisture in real-time and are ideally suited for on-line biomass applications. The NIR 6000 series include four product line: the 6000

series, 6300 series, 6400 series and 6410 series. NIR 6000 Series: The NIR 6000 Series of On-Line NIR Moisture Analyzers offer precision measurement and moisture control for industrial applications. Sensortech has pioneered industrial applications of moisture measurement technology for over thirty years and the NIR 6000 Series of moisture analyzers packages the latest NIR technology into a sophisticated instrument engineered for durability and precision measurement. It has been designed to provide accurate readings using the molecular structure of your product and to deliver an effective contribution to your process control.

NIR 6300 Series: The IP67 rating of the NIR6300 Series has been developed to withstand severe wash-downs, excessive dust environments, and to protect it against the effects of immersion. Its rugged stainless steel enclosure makes it ideal for harsh environments, high temperatures, and aggressive food grade applications.

NIR 6400 Series: The Explosion Proof Series of NIR moisture analyzers provide an advanced level of protection from hazardous environments and meet the compliance standards of most regulatory bodies. The NIR 6400 Series is accompanied with the appropriate certificates required of the classification including the nameplate indicating the distinct classification for which it has been approved.

NIR 6410 Series: The NIR-6410 is designed for environments where combustible dust is present under normal operating conditions. It is equipped with a pressurization/purging system, is ATEX compliant upon request.

VERMEER LAUNCHES THE TR620 TROMMEL SCREEN