Studying the elusive yellowfin

Why is there still no fully-farmed yellowfin tuna? p. 10

Rolling with the punches in a time of war

Studying the elusive yellowfin

Why is there still no fully-farmed yellowfin tuna? p. 10

Rolling with the punches in a time of war

Russian fish farmers are braced for the fallout of the war in Ukraine p. 18 PRODUCTION

Ultrasound techniques and technology for salmonid culture

Southeast Asia is definitely feeling the heat from Russia-Ukraine conflict p. 16 p. 24 GENETICS & BREEDING SUPPLY CHAIN

10 Studying the elusive yellowfin

Panama’s Achotines Laboratory is instrumental in understanding tuna aquaculture. But why is there still no fully-farmed yellowfin tuna?

By Liza Mayer

14 Industry receptive to seafood sanctions in Russia

Russia is a small player in aquaculture, but its role in supplying the world with wild-caught seafood could still impact the industry at large.

By Liza Mayer

16 Rolling with the punches in a time of war

Southeast Asia is far from the geographical hotspot, but definitely feeling the heat.

By Ruby Gonzalez

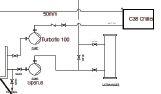

Modbus

VOLUME 23, ISSUE 3 | MAY/JUNE 2022

Reader Service

Print and digital subscription inquiries or changes, please contact Urszula Grzyb, Audience Development Manager

Tel: (416) 510-5180

Fax: (416) 510-6875

Email: ugrzyb@annexbusinessmedia.com

Mail: 111 Gordon Baker Rd., Suite 400, Toronto, ON M2H 3R1

Editor Jean Ko Din jkodin@annexbusinessmedia.com

Associate Editor Maryam Farag mfarag@annexbusinessmedia.com

Contributors Maddi Badiola, Ruby Gonzalez, Ron Hill, Liza Mayer, Catarina Muia

Associate Publisher / Advertising Manager Jeremy Thain jthain@annexbusinessmedia.com +1-250-474-3982

Account Manager Morgen Balch mbalch@annexbusinessmedia.com

Media Designer Svetlana Avrutin savrutin@annexbusinessmedia.com

Group Publisher Todd Humber thumber@annexbusinessmedia.com

COO Scott Jamieson sjamieson@annexbusinessmedia.com

PUBLISHED BY ANNEX BUSINESS MEDIA 105 Donly Drive South, Simcoe, ON N3Y 4N5

Hatchery International is published six times a year by Annex Business Media. The authority for statements and claims made in Hatchery International is the responsibility of the contributors. Reference to named products or technologies does not imply endorsement by the publisher.

Subscription rates (six issues) Canada: $37.00

Within North America: $48.00 CAD

Outside North America: $62.00 CAD

To subscribe visit our website at www.hatcheryinternational.com

PRINTED IN CANADA ISSN 1922-4117

Publications Mail Agreement #PM40065710

RETURN UNDELIVERABLE CANADIAN ADDRESSES TO 111 Gordon Baker Rd., Suite 400, Toronto, ON M2H 3R1

Annex Privacy Officer Privacy@annexbusinessmedia.com Tel: 800-668-2374

The contents of Hatchery International are copyright ©2022 by Annex Business Media and may not be reproduced in whole or part without written consent. Annex Business Media disclaims any warranty as to the accuracy, completeness or currency of the contents of this publication and disclaims all liability in respect of the results of any action taken or not taken in reliance upon information in this publication.

Next Ad Deadline

The advertising deadline for the July/August issue is May 13. Don’t miss the opportunity to be part of this exciting aquaculture publication. For more information, or to reserve space in the next issue, call our advertising department at +1.250.474.3982 jthain@annexbusinessmedia.com

Next Editorial Deadline

The editorial deadline for the July/August issue is May 13. Contact Jean Ko Din at jkodin@annexbusinessmedia.com for details. Material should be submitted electronically with prior arrangement with the editor.

It is a strange time to celebrate my first issue as editor of Hatchery International. There is so much about our industry and the state of global affairs that is just filled with crisis and uncertainty.

Some may see hatcheries as the beginning of the supply chain because that is where the life of the fish begins. But there are supporting industries before and after the fish hatchery that will be affected by the Russia-Ukraine war.

In this issue, we look at this global event from a few different angles and we ask questions about what this is going to do to our global industry. We start with our cover story on how it will affect Russia’s homefront. As Western sanctions continue to compound, supply chains are drying up, and local hatcheries and fish farms are left with few alternatives to keep their operations afloat.

We also talk to leaders in the Western seafood market about their thoughts on more seafood sanctions against Russia. Though they stand to benefit from the import bans, as consumers look to local products, they also know the weight that this foreign policy carries.

In Europe, we think about its dependence on the Russian oil and energy industry. Gas prices are rising worldwide but the continent

JEAN KO DIN

will have to look long and hard at its government regulations to untangle Europe’s gas supply from Russia. Or will this dependence mean that the Western economy will continue to fund the war?

In Asia, the industry braces for the impact of losing Russia as a major trade partner. Vietnam and China’s seafood market will be directly impacted; however, it remains to be seen if the Asian market is agile enough to pivot with the skyrocketing operational costs.

We are only just beginning to see the ripple effects this conflict will have on an industry supply chain that was already limping to recovery from the COVID-19 pandemic.

Still, there remains to be larger fish to fry! Our hatcheries must go on with its work, breeding strong species genetics, developing sustainable operations, producing broodstock and restoring natural populations.

There is also the fact that our industry has an even longer battle to wage against the climate crisis.

These are the topics that I hope to continue pursuing through this publication. And I also look to you, the experts, to bring our attention to innovations and developments. My inbox is always open at jkodin@annexbusinessmedia.com.

New fishmeal facility opens in Myanmar

Scoular, a fishmeal and fish oil merchandiser, recently opened a new fishmeal facility in Myanmar.

The facility hopes to be a hub for high-quality, consistent product and “just-in-time shipment” to Asian feed markets.

“We are excited to expand Scoular’s worldclass fishmeal operations with an additional investment in Asia,” said Adrian Gasparian, Scoular’s managing director for Asia-Pacific. “The facility further expands Scoular’s supply of fishmeal and our ability to produce and deliver high-quality ingredients to our customers around the region.”

The opening of the new facility follows Scoular’s launch in of its Encompass brand in September, which was developed to grow Scoular’s global fishmeal business. The facility itself will play a key role in expanding the U.S.based company’s presence in Asia.

Prior to this most recent effort, Scoular has expanded regional headquarters in Singapore, soybean cleaning and distribution operations in Indonesia, and feedstuffs and grain distribution operations in Indonesia and Myanmar.

Scoular has been involved in the fishmeal market for more than 20 years and works closely with customers to provide fishmeal and fish oil solutions year-round, globally.

Novosibirsk-based hatchery Rybkhoz has started promoting pelchirmuk – a triple hybrid of peled (Coregonus peled), whitefish (Coregonus nasus), and muksun (Coregonus muksun) on the Russian market.

In May of 2021, pelchirmuk successfully passed field trials, showing good gains and breeding potential, said Vladimir Kalgin, director of Rybkhoz. However, so far no solid scientific data is available to support the experimental results, he added.

“It [pelchirmuk] turned out no worse than other whitefishes”, Vladimir Kalgin said. “The growth rate of hybrid fish is higher, it is less picky about the food - it can feed on both zooplankton and bottom crustaceans.”

The new hybrid has some commercial potential. Those who have tried pelchirmuk also said that the fish turned out to be quite tasty.

Following the successful completion of the field trials, Rybkhoz proceeded to stocking several lakes and ponds in Altai Territory with the new fish, Kalgin said, adding that selection of the new hybrid fish is possible, but pelchirmuk is not designed to reproduce independently in natural conditions.

The Russian authorities provided state aid under the pelchirmuk project development.

Rybkhoz is primarily focused on breeding broodstock for commercial purposes. In 2020, Rybkhoz produced 264 million units of broodstock, mainly whitefish – peled, nelma ( Stenodus leucichthys ), muksun, being one of the largest privately-owned hatcheries in Siberia. The company reported that the demand for broodstock increased significantly in this part of the country in the past few years.

“We ship broodstock to our Novosibirsk organizations, as well as to other regions, throughout the country and abroad”, said Kalgin. However, fish farming in Siberia is believed to be in embryo. For instance, the overall production of farmed fish in the Novosibirsk Oblast amounted to only 1,520 tonnes in 2020. The regional authorities embarked on a set of measures aimed at facilitating aquaculture industry development, removing some legal barriers for the business, which is expected to bear some fruits in the coming years.

Specialists in corrosion-resistant, reliable and stable propeller pumps, with high uptime and low energy consumption- for a healthy and sustainable aquaculture.

High fishmeal-fish oil dietary levels may help European sea bass juvenile fight stress

Low fishmeal(FM) to fish oil (FO) ratio in European sea bass juvenile diet may not only affect stress levels but the bottom line, too.

Fish on 10 per cent FM and three percent FO diet, the lowest dose among the dietary levels in a study conducted in Italy showed lower final body weight, weight gain, and specific growth rate compared to the other treatments at the end of the 60-day feeding trial. The moderate reduction in growth performance in the low-level group seemed to be related to the higher feed conversion ratio in its diet.

A study, “Different Fish Meal and Fish Oil Dietary Levels in European Sea Bass: Welfare Implications After Acute Confinement Stress,” sought to provide practical feed management guidelines preceding a stressful episode during farming practices.

Intermediate level group had 20 per cent FM and seven per cent FO and high, 30 per cent FM and 15 per cent FO.

Fish in high-level group indicated better response. “Though the stress exposure caused some systemic physiological alterations in some tissues of fish fed higher FM and FO content, a prompt started to produce some anti-inflammatory molecules as attempt to counteract the stress,” corresponding author, Nicole Francesca Pelusio, explained to Hatchery International. She is a PhD candidate at the University of Bologna.

Feed formulations for European sea bass with very low contents of FM and FO have demonstrated their potentials for commercial use. Another aspect that should be considered though is the susceptibility of the species in to rearing, pre- and post-harvest stress-related factors commercial farm-scale environment. These could stem from handling, sorting fish size, harvest and transportation.

Stress in fish may be managed through procedures such identifying ideal stocking density, monitoring water for nitrate and ammonia levels and biosecurity measures.

Pelusio is an advocate of good feeding strategy. “I strongly believe that a good feeding strategy can contribute to boost and/or sustain fish robustness to stress exposure, matching animal welfare, product quality and famer profit,” she said.

Stress may result in chain reaction that affects the bottom line. “When fish experience a continuously prolonged or intense stress related to farming practices, as response they internally produce some compounds that in case of lack of coping the stress, they can get weaker and easily exposed to disease and in dramatic cases death might occur,” she pointed.

It doesn’t matter if the stress occurs near the tail-end of production, say prior to final harvest. She explained that these stress-induced compounds remain at high contents in the post-mortem body and induce chemical alterations that lead to quality alterations such as meat/fillet gaping, reduction of shelf-life and easiness to spoil faster.

“These facts cause a shorter shelf-life of final product with some and less appealing to consumers which can be translated in important economic losses for the whole chain,” she said.

The published work belongs to the European project, MedAID. – Ruby Gonzalez

BERG-JACOBSEN/NOFIMA

Nofima researchers and partners have announced the development of a promising method to sterilise salmon, which they’ve been working on for several years and further, can document that sterile salmon are just as healthy as fertile salmon.

There’s been a demand for sterile farmed salmon, as this can limit the impact of escaped farmed salmon in rivers; additionally, sterile salmon production will contribute to improved meat quality, less disease, and lower mortality.

To continue developments of this research project and to move into industrial large-scale production of sterile salmon, satisfactory health and growth must continue to be documented, and important production traits have been examined including body growth, smoltification, stress tolerance, salmon lice infestation, and mortality at sea. Scientists documented sterile salmon had no reproductive cells from the embryonic stage to the time of slaughter.

Important production traits have been examined, including body growth, smoltification, stress tolerance, salmon lice infestation and mortality at sea.

The method developed by Nofima scientists blocks a factor that’s required for the development of reproductive cells at the embryotic stage, meaning that the fish never become sexually mature. There are several ways to sterilise salmon, such as triploidization and gene editing. However, triploid salmon have been rejected as an option in Norway due to welfare issues and the use of gene modified salmon in production is still not permitted.

Several fish species may reportedly cease to exist in Belarus since domestic hatcheries fail to ramp up production capacities, while import remains largely restricted.

In particular, Belarusian officials have raised concerns over a sharp decline in the eel (Anguilla anguilla L.) population. As explained by Tatiana Titova, chairman of the fauna and flora protection department at the State Environment-Protection Inspectorate, due to the construction of dams and hydroelectric power stations on the rivers, eel cannot independently reach the water bodies of Belarus.

Until recently, eel broodstock was imported into Belarus, but the supplies were halted by international trade restrictions and sanctions. Eel in Belarus may cease to exist in the coming five to 10 years, if a solution to this problem is not found, the Russian state-owned news outlet Sputnik reported, citing local scientists.

Last time, Belarus purchased eel broodstock in 2008. In order to maintain the population at the current level, the country needs around 1.8 million units of broodstock. Eel population in the country reached its peak in Soviet times, as 100 million units were released annually into the regional water bodies between 1976 and 1980.

Mikhail Chirko, head of the Belarusian National Park Braslavskiey Ozera, said that in 2021 Belarusian authorities entered into negotiations with the UK to source imported eel broodstock. However, no deal has been made so far.

Over the past decades, at least five fish species ceased to exist in Belarus, said Prokhor Zhukov, a local scientist, member of the Belarussian Academy of Science. Currently, the ecologists are primarily concerned over the future of the Baltic salmon (Salmo), the population of which has been seen steadily shrinking over the past few years.

The ecologists called the Belarusian authorities to build new hatcheries to combat the decline in the fish population. They also said that the Belarusian government must prohibit both commercial and recreational fishing of some species for the next few years, and enhance the struggle against poaching. A further decline in the population of some fish species threatens to undermine fish populations in neighbour Lithuania and Baltic salmon population in the Baltic Sea, the ecologists said.

However, the future of the Belarusian recreational campaign remains even more questionable now, as the U.S. and EU have sanctioned Belarus for aiding the Russian invasion, introducing tough financial and trade restrictions on the country.

Utilization of dietary carotenoids for farmed salmon may be optimized by combining algal carotenoid with different oil sources that contain more oleic acid, such as canola, and less saturated fatty acids, such as tallow, according to the article, “Dietary fatty acid composition affects the apparent digestibility of algal carotenoids in diets for Atlantic salmon, Salmo salar.”

“This study continues to demonstrate the utility of algal carotenoids as natural pigment alternatives for farmed salmon, particularly beneficial when combined with different oil sources. The combined impact of feed intake and digestibility on carotenoid utilization from Atlantic salmon diets may demonstrate improved performance and pigmentation in larger scale studies,” said Emily Courtot et al.

Carotenoids, which are fat-soluble, enhance the natural pigmentation of animal flesh. Astaxanthin (Axn) is most commonly used in salmonid. It has “highly variable” digestibility in salmonids, which swings between 20 to and 60 per cent.

Wild salmon have pink flesh because of natural diets containing astaxanthin.

Farmed salmon tend to have light-colored flesh. Supplementation of carotenoids in diet creates the flesh colour the consumers expect.

The authors compared the feed intake, as a measure of diet palatability, and apparent digestibility (AD) of Axn between the two diets containing either synthetic or algal carotenoids, a natural alternative. They also assessed the effect of manipulating dietary lipid sources on Axn digestibility, using commonly available products with different fatty acid compositions, such as canola oil, tallow and poultry oil.

These have significantly different fatty acid composition, which was reflected in the experimental diets.

This experiment contained four diets fed to juvenile Atlantic salmon in tanks for two weeks. All were formulated to contain two oil sources: fish oil at six per cent in addition to 10 per cent complementary lipid source.

“This study showed that neither Axn sources nor dietary lipid sources affected the palatability of the diets. Moreover, algal carotenoids had a higher AD than synthetic carotenoids, which suggested that they may be more efficiently digested by Atlantic salmon,” the authors cited.

The team represented the Commonwealth Scientific and Industrial Research Organization in Australia and the Center for Research on Environmental Ecology and Fish Nutrition of the Ministry of Agriculture, Shanghai Ocean University in China. The article was published on Aquaculture Research

At present, 95 per cent of the aquaculture industry uses synthetic Axn. If market preferences are heeded, however, this share might start contracting as consumers have started showing partiality for natural and more sustainable food products. Naturally-produced Axn also has a trait that could very easily win over the consumers in this cluster. It was recently established that natural astaxanthin may be 20 times more powerful as an antioxidant.

Production costs make algal carotenoids much more expensive than its synthetic counterpart.

– Ruby Gonzalez

Water filtration has never been so easy

The Hydrotech Drum Filter Value series focuses on reduced maintenance, increased component quality and simplified operation – all to give your plant maximum filtration performance at a minimum operational cost.

Contact us!

Panama’s Achotines Laboratory is instrumental to understanding tuna aquaculture. But why is there still no fully-farmed yellowfin tuna? By Liza

Mayer

At the Achotines Laboratory in the Republic of Panama, eight yellowfin tuna broodstock are swimming in a tank measuring 17 metres in diameter and six metres deep. They’re all from local coastal waters, just like the earlier cohorts that have spawned millions of eggs for the laboratory over the last 25 years.

The eight broodstock spawn daily, their eggs ready to be used in experiments to enhance understanding of the early life, history and biology of tropical tunas.

The spawning of yellowfin tuna (Thunnus albacares) in captivity is a big deal. The milestone was reached in October 1996 and to this day, the Inter-American Tropical Tuna

Commission’s research program represents the only sustained spawning of yellowfin tuna in captivity in the world.

“They spawn volitionally,” says Daniel Margulies, program coordinator of the program’s Early Life History Group. “This means we’ve never used any hormonal controls to induce spawning of our yellowfin broodstock. It is

natural spawning controlled mostly by water temperature. The fish are very sensitive to the water temperature as far as their spawning behaviors, and they will spawn nearly daily as long as the water is above 24 C.”

The lab has seen over 5,000 spawning events from 1996 to the present. The broodstock group has been replenished over the years and has fluctuated from five to 44 fish at any time. From these eggs, researchers select certain groups, clean them and place them into hatching tanks in the wet lab where they are randomly distributed in certain replicate tanks for whatever investigation the researchers are interested in conducting.

Knowledge gleaned from these spawning events and succeeding experiments are shared with other research institutions worldwide.

“It’s really spawned a succession of successful collaborative research programs with universities, among them Kindai University in Japan and the University of Miami – all contributing toward a greater understanding of tuna ecology and aquaculture,” says Margulies.

But despite this breakthrough 25 years ago, no yellowfin tuna has been raised fully in captivity. In other words, no eggs from those spawns have grown to be a mature adult and reproduced

“If someone made a concerted effort to focus only on full lifecycle culture of yellowfin tuna, we’d probably be looking at a five- to 10-year time frame for commercial development. It could be less with the proper resources.”

successive generations of yellowfin tuna. This also means that the ahi tuna in the market are either wild catch or a product of ranching.

In contrast, Pacific bluefin (Thunnus orientalis) and the Atlantic bluefin (Thunnus thynnus) have had their life cycle closed in captivity. Researchers at Kindai University closed the life cycle of the Pacific bluefin in June 2002 after 32 years of trying. The life cycle of the Atlantic bluefin was closed in 2016 after 13 years of effort by researchers at the Spanish Institute of Oceanography.

But Margulies says yellowfin lags behind the two bluefins in this department not so much because of the biological challenges inherent in the yellowfin. Rather, it’s more a matter of research priorities.

“There have been various organizations that have looked at yellowfin aquaculture at various times, sort of periodic attempts,” he says. “If someone made a concerted effort to focus only on full lifecycle culture of yellowfin tuna, we’d probably be looking at a five- to 10-year time frame for commercial development. It could be less with the proper resources.”

One reason yellowfin tuna might not be a high priority among other tuna species is it ranks lower in economic value.

“They’re certainly not as high, say per pound, as the bluefin species or bigeye tuna (Thunnus obesus) for example in Japan or in Hawaii, where these tend to draw a higher price per pound. But yellowfin, I would put in a level right below those species and certainly higher than snapper or mahi-mahi or cobia. I would put it at the high end but not as high as bluefin and bigeye tuna.”

Margulies adds that scientists in the Inter-American Tropical Tuna Commission’s research program are confident they can do this type of research on their own or in collaboration with other institutions, but this is currently outside of its mandate.

“Our specific goal is to better understand what is referred to as the ‘pre-recruit’ life stages of yellowfin, that’s the stage before they’re recruited to the fishery in the Eastern Pacific Ocean. And so that age range, specifically for our studies, is from hatch to six months of age. At six months of age, the yellowfin enter the surface fisheries in the Eastern Pacific Ocean,” he explains.

Although the team’s focus is on the ecology of juvenile fish, Margulies says their learnings will be valuable to the aquaculture industry.

“We are mindful that all of our research results can be used by other investigators to

apply it towards tuna aquaculture and greater success with tuna aquaculture,” he says.

For instance, the researchers have found ways to address the cannibalistic nature of juvenile yellowfin – a problem quite common with other pelagic species.

“There are a lot of pelagic species under study globally that have the same problem of cannibalism. When the larvae reach a certain size, they can attack their siblings in culture. There are a number of ways that you can minimize this. We’ve been working on it for really the last 24 years and many of these methods are quite effective at minimizing the cannibalism – everything from having the fish swim against currents, we’ve tried putting

them in raceways so they spend most of their time swimming actively against the current rather than attacking their siblings,” he says.

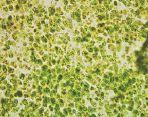

The team found, however, that the most effective method is to keep the fish in socalled “green water” – dense concentrations of unicellular algae that’s used throughout the larval stage.

“This helps in their feeding efficiency because of their visual system. It provides really good contrast for their planktonic prey at very short distances. So when they reach a size of six and a half to seven millimetres and become cannibalistic, we usually maintain those dense green water conditions so that these older larvae actually cannot see their siblings as well, and it just cuts down on the probability of their encounters with their siblings.”

Another challenge to address if the species is to be raised in aquaculture settings is the development of juvenile diets and weaning diets. Nutrition is perhaps the biggest challenge common among pelagic species in aquaculture, he noted.

“We use live planktonic organisms to feed the larvae. We use cultured rotifers, which are small ciliate-like organisms. And we also use the common brine shrimp – artemia. We’ve also collected in the wild zooplankton like copepods, which are the natural prey of larval yellowfin and we fed those in culture, but that’s a difficult thing to maintain (in commercial aquaculture) because it requires a lot of labor and time to go out and collect. And copepod culture itself is fairly challenging. Rotifers and artemia are fairly easy to culture and yes we feed those prey to the early larval stages.”

Within the current scope of the team’s mandate, their next investigation will focus on the early juvenile stages of yellowfin tuna,

Land-based spawning tank measuring 17 m diameter and 6 m depth at Achotines Laboratory

says Margulies. Whereas the early phase of the studies have focused on the species’ first 30 days, the next phase will look at life stages from one to six months of age. But the team may push the envelope further.

“We’d like to get them to probably in the range of 18 months of age because we think that by then, in captivity, they’ll reach reproductive size. In the wild normally they reach reproductive size at about two years of age, 24 months.”

Meanwhile, the industry is watching.

Fertilized yellowfin eggs are collected and hatched for ecological experiments.

Yellowfin post-larva, 11 mm in length and 16 days old

The members of the ELH Group of the IATTC are: Daniel Margulies (Program Coordinator), Vernon Scholey (Achotines Laboratory Director), Yole Buchalla (Assistant Scientist) and Susana Cusatti (Assistant Scientist). The program’s revamp website can be accessed at https:// iattc.org/AchotinesLab/AchotinesDefaultENG.htm

AUGUST 15-18,

St. John’s Convention Centre St. John's, Newfoundland and Labrador,

By Liza Mayer

Russia is a small player in aquaculture but its role in supplying the world with wild-caught seafood could still impact the industry at large.

In 2019, Russia exported 1.9 million tonnes of seafood to overseas markets while 2.7 million tonnes was consumed locally, according to data from Innovation Norway in Moscow. Of the country’s total production of 4.6 million tonnes of seafood in 2019, only 170,000 tonnes came from the country’s 3,000 fish farmers. Around 560,000 tonnes of the total is imported from overseas markets, with salmon as the top import product.

Innovation Norway has since closed all activities in its Moscow office in cooperation of Norway’s move to suspend bilateral innitatives with Russia until further notice.

Players in the seafood industry, like their counterparts in other sectors, are cutting trading ties with Russia since it initiated conflict with Ukraine in February. Norway-based Atlantic salmon producer Cermaq told this publication that it exported salmon to Russia but it has now stopped. The world’s biggest farmed salmon producer, Mowi, said it did not sell any salmon to Russia, and that was the case before the events in Ukraine.

“It is incredibly unfortunate that war is going on in Ukraine right now,” said Ned Bell, an award-winning chef, seafood

advocate, educator and founder of Chefs for Oceans in British Columbia. “We certainly didn’t support Russian seafood prior to this and we certainly won’t be going out of our way to support it.”

Seafood producers in the United States have not been able to sell their produce to Russia since 2014, the year it banned seafood imports from the US and its allies. This is in retaliation against a suite of sanctions against Russia after it invaded the Crimean Peninsula in Ukraine that year.

The current crisis has provided an impetus for US lawmakers to renew calls to ban seafood imports from Russia.

US Senators Dan Sullivan and Lisa Murkowski (both R-Alaska) introduced in February the US-Russian Federation Seafood Reciprocity Act, a legislation that would impose a ban on the import of all Russian seafood products into the United States.

Sullivan decried that Russian seafood exports to the US have grown by 173 per cent since 2013, the year before Russia stopped US seafood products from coming into its borders.

“Most Americans would be astounded to learn that Russia has unfettered access to sell its seafood in the United States at the same time America’s fishermen and seafood processors have zero access to the Russian market,” said Sullivan.

“This is just wrong and hurts our fishermen. For years, I’ve been pressing officials at all levels, from the Oval Office on down, to pursue a seafood trade relationship with Russia based on principles every American can understand — fairness and reciprocity. We don’t have that right now.”

Murkowski hopes that the Congress and the Biden administration will finally agree to equalize the treatment of Alaska’s worldclass seafood. “This is a perfect addition to a package meant to show Russia that undermining and disrupting global norms will not go unpunished,” she said.

US trade industry group, The National Fisheries Institute, supports the move. “The National Fisheries Institute recognizes the need for our nation’s leaders to use a variety of tools to implement effective foreign policy that deters aggression. With the recently announced sanctions, it is likely that imports of Russian seafood could be affected. Senators Sullivan and Murkowski agreed to work together to ensure a bill meets both of their needs. NFI looks forward to seeing what comes from that collaboration,” the association said in an email.

Sebastian Belle, executive director of the Maine Aquaculture Association, noted

“This is just wrong and hurts our fishermen. For years, I’ve been pressing officials at all levels, from the Oval Office on down, to pursue a seafood trade relationship with Russia based on principles every American can understand — fairness and reciprocity. We don’t have that right now.”

that seafood produced in Maine is mostly consumed in the North American market. The crisis could possibly impact European salmon prices and therefore affect “our European colleagues more,” he said.

“There will be an impact possibly on European salmon prices because of the fact that in salmon coming from Norway, and possibly from Scotland, is processed in Ukraine and Poland.” But the upheaval will affect his association members indirectly through fluctuation in exchange rates and fuel prices, he added.

The executive director of the National Aquaculture Association (NAA), Paul Zajicek, says the current conflict and its impact on the seafood trade further strengthens the case for locally produced seafood.

Consumers, he said, are willing to pay the premium for locally grown, fresh seafood because they are confident of their quality attributes – no antibiotics, no other chemicals.

For instance, local shrimp farmers “have developed niche markets to be outside that tidal wave (of imports),” he noted.

But there still may be some seafood from Russia that could end up on consumers plates because of the long-standing problem with seafood traceability, said Chef Bell, who is a partner in the historic Naramata Inn, in Okanagan Lake, BC where he also runs the restaurant.

“There’s no requirement to label the country of origin in imported seafood,” he says. “Labeling and traceability of seafood is a major issue internationally. I know there’s a lot of Russian frozen sockeye salmon that finds Its way into British Columbia and into the retail and food service system. Often it would be labeled as ‘wild salmon’ or ‘wild Pacific salmon,’ and then people wouldn’t really ask any more questions. So, they would be inadvertently supporting salmon that was harvested in Russian waters.”

Southeast Asia may be as far away as a destination could be from the geographical hot spot. But it is definitely feeling the heat. By

Ruby Gonzalez

By the end of 2021, Vietnam has recognized Russia as a potential market for its pangasius exports. Russia imported fish valued at US$32.5 million, up by 72.5 per cent from the year before.

Year 2022, however, delivered reality checks early on. Russia’s January imports were down due to a confluence of factors. Less than a month after the Russian invasion of Ukraine, the Vietnamese Association of Seafood Exporters and Producers said they were suspending exports of pangasius to Russia because of financial sanctions. They

said, however, they still considered Russia as a potential market.

China-Hong Kong is Vietnam’s biggest pangasius export market, with 2021 exports valued at almost $450 million.

From Asia, Vietnam and China are the only big players in seafoods exports to Russia.

As elsewhere, Southeast Asia is feeling the brunt of invasion’s impact on the supply chain level.

The Philippine Department of Agriculture (DA) anticipated early on the reduced global

production and trading of urea, a vital material in fertilizers used in agriculture and aquaculture. Russian production accounts for 18 per cent and Ukraine, four per cent.

The aquaculture industry is under DA’s jurisdiction.

“While the Philippines does not directly import fertilizers from either Russia and Ukraine… their conflict would greatly reduce the volume traded globally,” it cited in a released statement. In March, the DA, through the Fertilizer and Pesticide Authority, said it had been holding bilateral discussions with fertilizer-producing countries, including Indonesia, Malaysia, Qatar and China.

This period coincided with the Philippine government’s approval of the DA’s realignment of funds. The goal is to spearhead projects designed to blunt impacts of the Ukraine crisis.

Malaysia’ Ministry of Agriculture and Food Industries (MAFI) considered alternative measures if the crisis is prolonged. This would include encouraging the use of organic fertilizers to replace chemical fertilizers, according to Malay Mail.

Soaring fuel prices have some governments implementing stop-gap measures to manage inflation. Thailand reduced the excise tax on fuel for three months, starting in February. Indonesia, an oil-producing country, and Malaysia have given subsidies to stabilize fuel prices. And then there are countries where prices are dictated by global supply and demand. The Philippines is among them.

“Even before the conflict, all transport costs increased by 40 per cent,” said Alex Soriano, chairman of the Philippine Milkfish Industry Group, told Hatchery International. A few days after stating this, the Philippine took a hit again with another spate of fuel price hikes.

Milkfish is the Philippines’ most popular species for aquaculture. Local production of fry is so scant that as much as 70 per cent is imported. Indonesia is the biggest source. Since the outbreak of COVID-19 in 2020, no passenger flights have been available, necessitating chartered flights.

The price of milkfish fry increased from $0.13 to as much as $0.28 per piece. This is so steep that demand contracted. Small players who can’t afford the new prices no longer stock their ponds as much or have stopped production all together, he said.

This scenario is being replicated everywhere.

Dr. Emilia Quinitio, a mangrove crab expert, said the Philippines’ traditional export markets for mangrove crabs are far from Ukraine and Russia.

“Even before the conflict of those two countries, people engaged in business, including

“Even before the conflict, all transport costs increased by 40 per cent.... Prices have shot up since COVID.”

those in aquaculture, are already feeling the high cost of operation due to the successive increases in fuel cost. Hence, many partially operated their business only or totally stopped their business operation,” she said.

The drop in production volume in milkfish may be easily assessed by the nightly number of trucks hauling in fresh harvest to Luzon’s major fish ports in Malabon and Navotas in Metro Manila.

“Pre-COVID, there would about be about 18 to 20 trucks carrying 180,000 to 200,000 kilos of milkfish. These days, it is down to 13 trucks at the most with 110,000 to 120,000 kilos,” Soriano said.

Demand has remained unchanged. But bucking the law of supply and demand, the prices have been unchanged, too. “All through these years – from 2020 up to 2022 – the

Join us online October 5, 2022

farm gate price for milkfish has stayed put at P135 ($2.70) to P140 per kilo,” he said.

Producers have no say on the farm gate prices since the inventory is sold at silent auctions, just as it has been for over a hundred years.

With his hand half-cupping a side of his mouth, the buyer would whisper his bid to the auctioneer’s ear. He only has one shot at it and would most probably not always consider the increasing production costs spurred by increase in fuel prices.

“Prices have shot up since COVID: feeds, electricity, spare parts, ice,” Soriano summed up. He is also the chief operations officer at the Tierra Del Norte – Aquaculture Division (TDNAD) which, in addition to milkfish, also grows pompano and siganids.

“We at the company are weathering through this,” he said. Productions costs is commensurate to production output. “If we decrease production, it would mean laying off personnel. We can’t do that.” TNDAD has between 1,600 to 1,800 people working for them.

So far, the company is still doing good. “We get by with a thin margin of profits. But if operation costs increase some more, we will have to find where we could cut expenses,” he said.

Russian fish farmers are braced for the fallout of the war in Ukraine.

Sweeping international sanctions introduced by Western powers against Russia are expected to severely hit the country’s aquaculture and jeopardize local hatcheries and fish farms. In general, the Russian invasion of Ukraine promises dark days for the national economy,

particularly to all segments dependent on foreign equipment and raw materials. The country faces unprecedented financial, trade, and political isolation, and a massive exodus of Western businesses as more than 300 Western brands publicly pulled out from the Russian market.

With the Russian economy now being transferred into a “besieged fortress regime,” almost entirely relying on its own resources, the fish farming industry is braced for dramatic changes, which nobody was prepared for.

Aquafeed is in the spotlight

It is currently unclear how some farms and hatcheries can continue operation, since Russia has a critical dependence on imported aquafeed, according to the Russian government publication Russian Gazette

Russia produces enough fishmeal to meet the domestic demand, but most production capacities are concentrated on the Far East, the country’s key fishing region. Delivering fishmeal to European Russia, where most fish farms are based, is associated with unbearable logistical costs. As a result, most Russian fish meal is exported, while European Russia primarily imports aquafeed.

“We are working with the Finnish [aquafeed] company Raisio,” commented Vladimir Vladimirov, deputy director of the Kala Maryapoyat farm, which breeds rainbow trout (Salmo gairdneri) on the Upper Kuitto and Nyuk lakes in Karelia. “We tried to use some Russian feed but were forced to abandon it, even though it is much cheaper than imported products.”

“The studies conducted by ichthyopathologists showed that on domestic feed trout grows slowly, its health is deteriorating. And quality is our priority,” he added.

It is believed that Russian companies manage to compete with imported products only in the segment of high-energy feed, containing a lot

of protein and fishmeal, said Galina Pavlovich, general director of the Russian Center for the Control of Fish Diseases, adding that in Russia they are produced at three plants in the amount close to only 10,000 per year.

“For comparison, Russia currently imports 100,000 aquafeed per year in this segment”, she added.

Russian demand in aquafeed is estimated at 250,000 tonnes, while production is close to 50,000 tonnes. By 2030, the demand was projected to grow to 375,000 tonnes on the back of major growth of the Russian fish farming production.

Hatcheries in Russia depend on foreign aquafeed even more than fish farms. For instance, Kirill Proskuryakov, head of the Association of salmon (Salmo) hatcheries of the Sakhalin region, reported in late 2021 that all regional salmon hatcheries were dependent on the Danish aquafeed, primarily supplied by one company – Aller Aqua.

Import restrictions imposed, at that time, against European suppliers threatened to disrupt operations of 68 hatcheries in Sakhalin, he said. So far, there is no clarity on how they plan to continue operation under the current circumstances.

Similarly, Russian fish farmers have tough dependence on imported equipment. Some import substitution in this segment took place in the past few years, but the country

still lacks some critical technologies, which were primarily imported from Europe.

Nikolay Belkovsky, director of the Russian fish farming equipment company, Salmo Ru, estimated that some import-replacement on the fish farming equipment has been seen in

•

•

the country over the past few years, but it was associated with complaints from local fish farmers.

“Currently, it is extremely hard to assess the share of imported equipment on the domestic market. I doubt this data even exists. No doubt, the share of the Russian equipment is growing, especially in some product categories,” Belkovsky said.

In some product categories import is dominating the market. These are fish loaders, separators, analytical equipment, and containers for fish transportation, Belkovsky added.

On the other hand, a substantial part of the aerating equipment for ponds and pool farms – way above 50 per cent is produced by Salmo Ru, he said, adding that the equipment for cage farms lately has also been of Russian origin produced by Russian company Luxsol.

According to Belkovsky, all types of drum filters for recirculating aquaculture systems are manufactured in Russia by a Sochi-based company Fishtechno.

Concerns voiced over a lack of commercial broodstock

However, the biggest issue the Russian fish farming industry must be braced for amid international isolation is the lack of broodstock.

A source in the Russian fish farming industry that was not authorized to speak publicly commented that most farms in the Northern basin were expected to stop operation if the supplies of foreign broodstock are suspended. He explained that this problem is particularly relevant for the Atlantic salmon (Salmo salar) industry, which primarily imports smolt from Norway. While some larger players have their production facilities both in Russia and abroad, smaller companies have simply no sources of broodstock, and “are doomed for extinction”, the source said.

“There are practically no hatcheries for industrial aquaculture in Russia,” said Lasar Taufik, general director of the Russian company Kroft Tau, explaining that this is primarily associated with long investment cycles on such projects, which normally range between 10 and 15 years.

“Work with promising aquaculture species has been phased out since the mid-1980s. Few remember that back in the days of the Soviet Union, successful work was carried out on the cultivation of American striped perch (Perea fluviatilis) and river eel (Anguilla Valgaris).

Work on the technology of industrial cultivation of pike perch (Stizostedion canadense) has been stopped. Exotics species like arapaima (Arapaima gigas) and paca (Cuniculus gen.) are forgotten, even though they are one of the most promising freshwater aquaculture species,” Taufik said.

Histidine requirement for Atlantic salmon based on growth and feed efficiency was established by researchers at USDA, casting a new light on its uses.

“The dietary histidine level of North American Atlantic salmon, assessed in terms of growth performance, was met by 0.9 per cent of the diet for smolt growth,” said authors Brian Peterson et al. Their study, “Effects of histidine on growth performance of North American Atlantic salmon” was designed to augment the “lack of information on histidine requirements in Atlantic salmon regarding cataracts and important stages of growth.”

This amino acid is commonly used as a supplement in salmon diet to prevent incidence of cataracts.

“To ensure maximum growth of Atlantic salmon, no single amino acid can be limiting. In the past, the histidine requirement for Atlantic salmon has been measured using reduction in cataract formation and not growth,” they said.

The dietary histidine level of North American Atlantic salmon, assessed in the current study terms of growth performance, was met by 0.9 per cent of the diet for smolt growth.

In the first trial using smolts, fish doubled in weight and had similar feed conversion ratio (FCR) and thermal growth co-efficient (TGC). In the second trial, the fish grew approximately 40 per cent and again had similar FCR and TGC.

Optimizing growth and FCR in Atlantic salmon is spurred by increasing fishmeal costs and consequently, search for alternative proteins and sustainable ingredients. Plant proteins have been identified. Compared to animal proteins, these have reduced content of essential amino acids. This leads to lower protein synthesis, a process involved in making proteins.

A 16-week feeding trial with graded levels of histidine was conducted in a seawater recirculating aquaculture system (RAS). Smolt and juvenile in RAS were fed histidine levels of 0.5, 0.7, 0.9, 1.1, 1.3, and 1.5 per cent. All the experimental diets were formulated to satisfy the nutritional requirements of sub-adult Atlantic salmon.

In the first trial, smolt at about 355 grams grew to around one kilogram, translating to percentage weight gains between 157 and 225 per cent. This didn’t vary much between the dietary groups. At an average FCR of one, this was also what is normally observed in

growth trials and treatments were not significantly different, they said. Examined though visual inspections, cataracts were detected in only one fish out of 50 in the trial.

The second trial, this one for juvenile, used the same levels of histidine and was conducted in a similar manner as the first trial for 16 weeks. Fish started at about 600 grams and grew to approximately 1.1 kilograms. The percent increase was between 35 to 45 per cent. It must be noted that the trial happened winter and with shorter day length and colder average water temperatures.

The FCR was also higher compared to the first trial ranging from 1.1 to 1.3. Diet digestibility for histidine ranged from 93 per cent to 97 per cent. From a total of 50 fish, cataracts were identified in only two from the juvenile trial. “…[T]herefore, we did not detect any cataract formation due to dietary treatment. dietary treatment,” they said. No statistical differences were detected wihtin the second trial based on TGC or FCR.

Previous studies mostly focused on how different levels of histidine affected cataract formation in Atlantic salmon. It was determined that low levels of histidine in diet affected the formation of cataract. Growth difference was not detected.

These studies recommended much higher level of dietary histidine needed to reduce the formation of cataracts in salmon.

– Ruby Gonzalez

Analyzing prices setbacks in the RAS industry due to the Russia-Ukraine war

The entire world is acting in solidarity, donations are tremendous but at the same time, our biggest concern is selfish: how will this war impact our pockets? Basically, which the economic side of all this is. And that is why I feel terrible. My heart and soul are broken. Children,

By Maddi Badiola

women, men… innocent people being killed without any reason. Human corridors being sabotaged. Millions of refugees, the biggest exodus in the last 75 years. Russia is being sanctioned (nearly) everywhere. Global sanctions are being imposed, mainly impacting the innocent populations.

Thousands of companies are moving away from the country, stopping production, imports. The banks are not able to trade internationally and their currency is now valued 40 per cent less than it was two weeks ago. Nevertheless, the major impact is far from being reached. How is this possible? Because Europe (EU and non-EU members) and US are still paying Russia for their gas and thus, financing the war. According to Eurostat and to the International Energy Agency, Europe imports about 40 per cent of its gas, 35 per cent of its crude oil and upwards of 40 per cent of its coal from Russia.

In North America, Russian oil plays a much lesser role in the energy market, but an important one, nonetheless. It accounted for seven per cent of US oil imports in 2021, and three per cent of Canada’s crude oil imports in 2019. So the focus on the critical importance of energy security is again on the table.

This was something that Europe should have been working on years ago, when Germany stopped the Nord Stream 2 pipeline or when eight years ago, the war in Ukraine begun. The eggs should be put in different baskets for balance, rather than relying on one importer, in one source. No matter what, it is a mistake having even one egg depending on a dictator, autocrat.

Energy security is about diversity in supply and giving nations the ability to easily and quickly substitute one supply for another (e.g. substituting gas-fired energy for renewable energy). Obviously, this is not that easy when the a large share of Europe’s gas supply comes

from Russia and new supply is not easily available in the short run.

What if your main operating expenses (OPEX) includes the need of grains? According to Javier Blas, Bloomberg’s commodity expert, grain products are the biggest physical disruption in the commodity market after the outbreak of war. That being said, fish feed prices will undoubtably increase and as such, the final product.

On March 3, a Cargill boat, the “Yasa Jupiter” was hit by a projectile near Odessa (a port in Ukraine); an ultramax bulk carrier normally used to transport commodities such as grain, coal and iron ore. Events like this show that freight rates will increase significantly in the coming years, even more than they have already, due to the new and more distant located markets (e.g. Latin America, Australia or North America). Wheat, corn and barley are exported by Russia and Ukraine where the Black Sea is estrategic. Unfortunately, these have been shut down for business.

And what if your production/company relies on 24/7/365 energy consumption? The solution, or at least the alternative is currently known as green hydrogen. Not even three weeks ago, the governments of the Middle

“This was something that Europe should have been working on years ago, when Germany stopped the Nord Stream 2 pipeline or when eight years ago, the war in Ukraine begun.”

East managed to lower the price of green hydrogen, coming from renewable sources, and make it cheaper than that from gas. According to Bloomberg, the stratospheric rise in the price of natural gas has reached the point where green hydrogen is already cheaper than non-renowables in Europe, the Middle East and Africa and China.

With regards to Recirculating Aquaculture Systems(RAS) industry the concern is real. Energy is the second highest input required for circulating the water (apart from other energy consumptions) and soon, this is going to cause a major problem when making up

the numbers. The energy bill is costing the shut down of some of the industries such as metallurgy, steel and welding companies and this trend is close to pass on other kind of sectors such as aquaculture.

We proudly talk about “decarbonization” and “net zero” energies but we keep on doing nothing. The narrative, the theorical speech, is well known already but we need to act. Solar and wind energy should be impossed, not only for its environmentally-friendly side but also because we would not be under the threaten of one country, one person.

The cost of living is going to increase and the world is going to be different after this war. Unfortunately some are already paying for all of us, and not with money but with lifes.

When money runs before health, human rights, humanity… everything… you realize what a terrible world we have created, what a nonsense world we are leaving to our future.

Maddi Badiola, Ph.D, is a RAS engineer, project manager and co-founder of HTH Full Spectrum, based in Getxo (Basque County, Spain). Her specialties are project management, energy conservation, lifecycle assessments and RAS global sustainability assessments. Email her at mbadiolamillate@gmail.com.

by Ron Hill

The use of ultrasound imaging technology to examine the inside of fish has been available for many years. Sturgeon producers in particular embraced the technology to help with the tricky job of sexing sturgeon.

Useful as the technology is, many farms are reluctant to embrace an expensive unit and do not see the value or how it will improve their bottom line. Despite there being wellmapped techniques and notable benefits for salmonid farms, ultrasounds are used most by large corporations with large brood programs or research institutions.

Though ultrasound units are not for every salmonid farm, any farm holding brood and producing eggs should consider what an ultrasound can do to up their bottom line and smooth their egg production. Ultrasound

units do have a few uses other than sexing and breeding but nothing as impactful.

An ultrasound unit can improve a breeding program in three particularly effective ways:

1. Determining fish sex

First and foremost, an ultrasound unit will let the operator see the eggs within a salmonid. Broodstock Technical Manager Trevor Dawes, who oversees the ultrasound operation at Mowi Canada West, explains, “Sex determination is a simple presence or absence equation, eggs are present- the fish is female, no eggs present- the fish is male.”

Dawes continues, “sexing allows the farmer to create brood groups that maximize the number of females by retaining the minimum number of males, thereby maximizing both space usage and the total eggs the facility can produce. Since Males can be spawned multiple times, only about 20 per cent of our Atlantic salmon brood group need be male.”

Atlantic salmon can be sexed as small as 80 grams. The earlier sexing can be achieved, and males removed the better. By removing extra males early in the production cycle, the expense of feeding and keeping these fish is also removed. Without sexing, a farmer must wait until the onset of maturing and secondary sexual characteristic to sex a salmonid.

If a group of 1000 unsexed fish were held as brood, it is anticipated there would be (approximately) 50 per cent males and 50 per cent females, therefore about 500 of each fish. A brood program only needing 20 per cent of the fish be males, which is 300 extra fish with no value, which have been held for three to four years. By removing those 300 males and replacing them with 300 extra females producing eggs, the value of sexing becomes obvious.

2. Determining spawning time

By using the scanner to measure the length of the gonad, farmers can see how well fish are developing within their brood groups and further group them into early, middle, and late spawners.

Dawes elaborates, “by the time our Atlantic salmon are 3-4.5 kilograms, spawning time can be reasonably determined. Gonad size gives a good relative approximation of development, allowing farmers to sort their brood into subgroups based on the gonad size. Fish found that are severely behind in development, or contain eggs that look damaged/unviable, can be removed from the spawning group as well. These subgroups (early, middle, late) can be subsequently manipulated to control spawning time using lights.”

This control and predictability are a great benefit that allows farms to plan their production with less uncertainty in their schedule and spawn timing, and plan when eggs will be available.

3. Pre-spawning health and viability checks

By scanning the females five months before spawning, egg viability can be determined, and non-viable females can be removed.

“The ultrasound image will show water in the eggs, seen as black rims around the eggs, indicating the fish is reabsorbing their eggs and isn’t viable for breeding. You can also assess the heart and other organs at the same time,” suggested Dawes.

The scanners are user-friendly for a piece of sophisticated technology. The ultrasound scanners are ergonomic and easy to operate. The units are handheld and paired to a smart device that displays the imaging. When the scanner is placed along the side of the fish, it shows an ultrasound image of the internals.

for the size of the fish. How the unit is held determines the quality of the imaging.

“We often are using our units in saltwater. The units are waterproof, but we usually stick them inside a Ziploc bag to keep the saltwater off them. It also is a good biosecurity measure. The cord for the scanner is run up through the jacket of the operator and scanner hangs on the wrist. “

Using the scanner is easy but interpreting the scanner is where the skill and experience of an operator becomes a factor. The operator interprets the image to determine presence of absence of eggs. As the scanner is slid toward the posterior of the fish, the operator notes if eggs are present and where the eggs start and stop to get a gonad length. The unit is held on the left side of the fish, 95 per cent of the time in Atlantic salmon the left is the bigger gonad so for the sake of consistency this is the standard practice.

The scanner is placed on the side of the fish, but the image is not a side view. The scanner reveals a cross section of the fish. It is like you cut through the fish and are looking down it from head to tail.

“Image interpreting takes some time to learn what you are seeing and the subtleties in the differences. After a technician has experience, the scanning and interpreting process takes only five seconds per fish. Being able to see and identify the eggs is the largest focus and is the easiest to pickup, but to notice the black rims of water filled or dying eggs takes an experienced eye. An experienced operator an easily achieve 95 per cent accuracy sexing,” Dawes explained.

Getting the scanner set right a huge factor with ultrasound units. Scanners can show eggs in fish under 100 grams but the depth penetration of the unit must be set properly

Because of its nonobtrusive nature, it is easy to combine ultrasound scanning with other tasks where a fish is being handled. When fish are being moved or split, a subset can be checked quickly with the scanner to monitor development in the group.

Atlantic salmon farmers like Mowi are well funded and have large brood programs, so the CA$8,000 to $12,000 (about US$6,300 to $9,500) price tag is not prohibitive, and the unit will see full time use. Small and midsized farmers can be dissuaded by the price, but ultrasound technology can make a beneficial fiscal impact, especially in the long term. It is adaptable for other salmonid species; the techniques are well mapped, if not widely distributed, and should be considered by any farm holding their own salmonid brood.

Diana Aqua, which is a business unit of Symrise Taste, Nutrition & Health, has announced a name change in an effort to accelerate its aquafeed business development.

The Argentina-based company will now be named Symrise Aqua Feed.

The company was folded into Symrise AG in 2014 and the name change is meant to reflect its new strategy under the Symrise brand.

“This forms a major milestone for the aquaculture division,” said Sylvain Lcladere, general manager of Symrise Aqua Feed.

“Moving from Diana Aqua to Symrise Aqua Feed signifies a confirmation of the willingness by Symrise to continually invest on providing innovative and sustainable solutions to our customers all around the world.”

Symrise is a global supplier of fragrances, flavours, food, nutrition and cosmetic ingredients. Symrise Taste, Nutrition & Health focuses on nutrition solutions for human food, pet food and aquafeed industries. www.aquafeed.symrise.com

BactiQuant has introducer a new product to tackle and prevent fungal contamination in recirculating aquaculture systems (RAS), hatcheries and aquatic feed production.

FungiCount is a new solution designed to provide rapid and reliable fungal detection, even at the earliest stages of fungal growth.

Fungal infection in RAS facilities create a risk for fish welfare and increased mortality in hatcheries. FungiCount can be a tool to detect spores, hyphae and micro fragments. By establishing a baseline and compare against operating routines, users can detect early signs of deviating microbial water quality.

“On Scottish salmon farms alone, losses are at least US$6.5 million per year, which could potentially be avoided,” Tanja C. K. Sørensen, Dept. Manager, QA & Sustainability of Premium Svensk Lax AB, said in a press release.

“This is a prime example as to why monitoring water quality is not a luxury – it really is a necessity.” www.bactiquant.com

Complete feeding solutions for aquatic hatcheries

• Microdiets

• Weaning Diets

• Micro Algae

• Live Feeds

FIAP upgrades its clockwork belt feeder with a professional version.

The Movement Feeder Profi is available in two sizes, three kilograms and five kilograms in capacity. It also has 12-hour and 24-hour movement times.

It is designed to be flexible, without electricity or additional control. The conveyor is tensioned, the housing is filled with the desired amount of feed and the feeder is ready to use.

The automatic drive shaft is made of seawater-resistant aluminum with an integrated conveyor belt. The housing and the cover are weather resistant. The spring-loaded centering pin enables the shaft to be removed and installed in a few steps for easy cleaning and disinfection. www.fiap.com

Scott Foster will be providing Aqualife customer service for the Norway, Sweden, Denmark, Russia and Iceland.

Foster has more than 30 years of experience in the marine industry, including with Golden Sea Produce and Mowi Norway. The newly created position is part of the fish care company’s effort to establish its Nordic team. Aqualife provides fish care and vaccination services in Scotland, Portugal and Norway.

“Scott’s strong technical background will be an enormous asset for Aqualife in the Nordic area. As we continue to thrive in the region, he will have a key role in the development of company strategy and customer support,” said Gordon Jeffrey, owner and chief executive. www.aqualifeservices.com

Want to be featured in Showcase?

Send you company news and press releases to jkodin@annexbusinessmedia.com to be considered in the next issue.

SPAROS introduces two new feeds

SPAROS has launched two new novel feeds for marine fish hatcheries.

ENRico is an all-in-one enrichment for Artemia and Rotifers that has been formulated with a balanced nutritional content for larval development. It is a dry formula rich in DHA and taurine, and has a high protein content and enhanced levels of vitamins and minerals. This feed is specially formulated for Senegalese sole, Turbot, Halibut, Seriolas, Meagre, Seabass, Seabream and Ballan wrasse

WIN Wrasse is a weaning microdiet made for Ballan wrasse larvae. It is formulated with ingredients that are processed by low-shear extrusion and incorporates microencapsulation of water-soluble nutrients. It is optimized for high digestibility, high palatability and low impact on water quality.

“We are pleased to launch these two new products, as a result of SPAROS R&D efforts to provide innovative nutritional solutions that will ultimately support the production of high quality juveniles at marine fish hatcheries and help our customers strive” says Luis Conceição, co-founder and R&D director of SPAROS. www.sparos.pt

Morgen Balch mbalch@annexbusinessmedia.com +1-416-606-6964

MORE THAN 25 YEARS OF MORE THAN 25 YEARS OF SELECTION IN SELECTION IN RAINBOW TROUT RAINBOW TROUT

• HARDY, • HARDY, ADAPTABLE ADAPTABLE STRAINS STRAINS •• DISEASE DISEASE RESISTANCE RESISTANCE

• BEST OF CLASS • BEST OF CLASS GROWTH POTENTIAL GROWTH POTENTIAL

• COMPLETE • COMPLETE TRACEABILITY TRACEABILITY

• 2 STRAINS DESIGNED FOR • 2 STRAINS DESIGNED FOR PORTION SIZE PORTION SIZE AND AND LARGE TROUT LARGE TROUT

•• REGULAR REGULAR PRODUCTION THROUGHOUT PRODUCTION THROUGHOUT THE THE YEAR: YEAR: FEMALE STERILISED ORGANIC FEMALE, STERILISED, ORGANIC Here is our new website ! https://aqualandeorigins.com/ SELECTION FOR SELECTION FOR PREMIUM QUALITY & PREMIUM QUALITY & PERFORMANCE PERFORMANCE

UPCOMING WEBINAR DATES: FEBRUARY 23RD - HATCHERY 101 MAY 2022 JULY 2022 NOVEMBER 2022

Sponsored by UP NEXT!

Be sure to keep an eye out for dates and topics to be announced!

Visit www.hatcheryinternational.com/webinars for more details